Declaration of Kurt Schnaubelt in Support of First Day Motions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BAKERS SQUARE (Corporate | Chicago MSA) 7409 Kingery Highway Willowbrook, IL 60527 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING BAKERS SQUARE (Corporate | Chicago MSA) 7409 Kingery Highway Willowbrook, IL 60527 TABLE OF CONTENTS TABLE OF CONTENTS I. Executive Profile II. Location Overview III. Market & Tenant Overview Executive Summary Photographs Demographic Report Investment Highlights Aerial Market Overview Property Overview Site Plan Tenant Overview Map NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant net leased Bakers Square located in SUMMARY: Willowbrook, Illinois within the Chicago MSA. -

Normal UI Decision Form

IOWA WORKFORCE DEVELOPMENT Appeal Number: 04A-UI-10334-ET Unemployment Insurance Appeals Section OC 04-04-04 R 02 1000 East Grand—Des Moines, Iowa 50319 Claimant: Respondent (6) DECISION OF THE ADMINISTRATIVE LAW JUDGE 68-0157 (7-97) – 3091078 - EI This Decision Shall Become Final, unless within fifteen (15) days from the date below, you or any interested party appeal to the Employment Appeal Board by submitting either a signed letter or a signed written Notice of Appeal, directly to the Employment Appeal Board, 2nd Floor— Lucas Building, Des Moines, Iowa 50319. JUSTINE SHRIVER 815½ CRAWFORD AVENUE The appeal period will be extended to the next business day if the last day to appeal falls on a weekend or a legal AMES IA 50010 holiday. STATE CLEARLY 1. The name, address and social security number of the claimant. 2. A reference to the decision from which the appeal is taken. VILLAGE INN/BAKERS SQUARE 3. That an appeal from such decision is being made and VICORP RESTAURANT such appeal is signed. C /O EMPLOYERS UNITY INC 4. The grounds upon which such appeal is based. P O BOX 749 YOU MAY REPRESENT yourself in this appeal or you may ARVADA CO 80006 obtain a lawyer or other interested party to do so provided there is no expense to Workforce Development. If you wish to be represented by a lawyer, you may obtain the services of either a private attorney or one whose services are paid for with public funds. It is important that you file your claim as directed, while this appeal is pending, to protect your continuing right to benefits. -

10293 Big Bend Road Riverview, FL

VILLAGE INN 10293 Big Bend Road Riverview, FL ACTUAL PROPERTY VILLAGE INN | RIVERVIEW, FLORIDA ON MARKET: VILLAGE INN IN RIVERVIEW, FLORIDA ACTUAL PROPERTY INVESTMENT HIGHLIGHTS Village Inn in Riverview, FL Adjacent to Newly Constructed Aldi, Walmart and Sam’s Club LOCATED 13 MILES SOUTH OF TAMPA Adjacent to 264 Unit Multi-Family Development Simmons Loop Long Term Triple Net Lease (NNN) ACROSS FROM $12 MILLION BIG BEND ROAD RETAIL DEVELOPMENT ZERO LANDLORD RESPONSIBILITIES Strong Performing Location Strong Local Demographics CONSISTENTLY ACHIEVING PERCENTAGE RENT BREAKPOINT AVERAGE HOUSEHOLD INCOME GREATER THAN $91,000 WITHIN A 3 MILE RADIUS Landlord Collects 7% of Sales in Excess of 2 Million Strong Growth Market MOST RECENT FULL LEASE YEAR LANDLORD COLLECTED MORE THAN $20,000 RESIDENT POPULATION INCREASED 44% WITHIN A 5 MILE RADIUS SINCE 2010 Strong Retail Corridor Ideally Located on Big Bend Rd MORE THAN 650,000 SF OF RETAIL SPACE WITHIN A 1 MILE RADIUS MORE THAN 33,000 VEHICLES PER DAY (VPD) Hedge Against Inflation Significant Capital Commitment to the Area 6.5% RENT INCREASES EVERY 5 YEARS MORE THAN $100 MILLION IN PLANNED COMMERCIAL DEVELOPMENT IN RIVERVIEW 2 This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. VILLAGE INN | RIVERVIEW, FLORIDA 10293 BIG BEND ROAD FINANCIAL -

Properties for Sale

For Sale Summary Report Alsip Industrial: 2 Properties For Sale PORTFOLIO FOR SALE DETAILS Portfolio Name Alsip Industrial Price $4,800,000 # of Properties 2 Price/SF $91.19 Total Size 52,635 SF On Market 700 Days Total Land Area 782,733.00 AC Last Updated Dec 3, 2020 Industrial Properties 1 Status Active Retail Properties 1 Sale Type Investment or Owner User PROPERTIES Address City State Property Type Rating Size % Leased 1 4601 W 120th St Alsip IL Industrial 25,000 SF 2 12055 S Cicero Ave Alsip IL Retail 27,635 SF SALE NOTES Two industrial properties inclusive of a +/- 15,000 sf fully leased office and industrial facility and a +/- 25,000 sf vacant office and industrial facility. Additionally there is a small cell tower operation on site paying ground rent. 19.1 acres measuring 413’ by 2015’ Entire asphalt paved site is fully secured by perimeter fencing, manned guard house and lighting. Enterprise Car Rental . +/- 15,000 SF on approximately 17 acres Copyrighted report licensed to CoStar Group 1/12/2021 Page 1 For Sale Summary Report Alsip Industrial: 2 Properties For Sale Crown Castle . Cell Tower Vacant . +/- 25,000 SF on approximately 2.09 acres Cell tower ground lease in place Coveted location with national companies including Home Depot, LA Fitness, Sherwin Williams Dollar Tree and others in adjacent proximity. Copyrighted report licensed to CoStar Group 1/12/2021 Page 2 For Sale Summary Report Alsip Industrial: 2 Properties For Sale 4601 W 120th St 12055 S Cicero Ave Alsip, IL 60803 Alsip, IL 60803 Copyrighted report licensed to -

Northwest Indiana Merriville/Schererville/Hobart

Northwest Indiana Merriville/Schererville/Hobart La Carreta Mexican Restaurant & Bar 269-275 W. Lincoln Hwy., Merrillville, IN 46410 House of Kobe 8101 Broadway, Merrillville, IN 46410 Portillo's 555 E 81st Ave, Merrillville, IN 46410 Old Chicago Pizza & Pasta 740 E 81st Ave, Merrillville, IN 46410 Gino's Steakhouse 600 E 81st Ave, Merrillville, IN 46410 Asparagus 7876 Broadway, Merrillville, IN 46410 Aladdin Pita 3750 W 80th Ln, Merrillville, IN 46410 Jelly Pancake House 399 East 81st Ave, Merrillville, IN 46410 Abuelo's Mexican Food Embassy 8255 Georgia St, Merrillville, IN 46410 Outback Steakhouse 8117 Georgia St, Merrillville, IN 46410 Catch 22 500 E 81st Ave, Merrillville, IN 46410 BC Osaka 2999 E Lincoln Hwy, Merrillville, IN 46410 Philly Steak and Lemonade 2024 W 81st Ave, Merrillville, IN 46410 T.J. Maloney's Authentic Irish Pub 800 E 81st Ave, Merrillville, IN 46410 Bar Louie 8239 Georgia St, Merrillville, IN 46410 Taste of India 761 E 81st Ave, Merrillville, IN 46410 Joe's Crab Shack 2757 E 80th Ave, Merrillville, IN 46410 Cooper's Hawk Winery & Restaurant 2120 Southlake Mall #500, Merrillville, IN 46410 Chipotle Mexican Grill 1948 Southlake Mall, Merrillville, IN 46410 Gamba Ristorante 455 E 84th Dr, Merrillville, IN 46410 Olive Garden 1900 Southlake Mall, Merrillville, IN 46410 Cracker Barrel 6200 Opportunity Ln, Merrillville, IN 46410 Villa Del Sol Mexican Restaurant 2225 W. Lincoln Highway, Merrillville, IN 46410 Red Robin Gourmet Burgers 2465 Southlake Mall, Merrillville, IN 46410 Taco Depot 1491 E 82nd Ave, Merrillville, -

Village Inn Parent Approved for $20M Ch

Portfolio Media. Inc. | 111 West 19th Street, 5th floor | New York, NY 10011 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | [email protected] Village Inn Parent Approved For $20M Ch. 11 Loan By Vince Sullivan Law360, Wilmington, Del. (February 24, 2020, 2:42 PM EST) -- The parent company of restaurant chains Village Inn and Bakers Square received final approval for a $20 million Chapter 11 loan Monday in Delaware after negotiations with unsecured creditors yielded a consensual order. During the hearing, American Blue Ribbon Holdings LLC attorney Jonathan M. Weiss of KTBS Law LLP said the hard work of the parties including the debtor, its post-petition lenders, the Office of the United States Trustee and the recently formed official committee of unsecured creditors had resulted in a deal that allowed the financing motion to go forward without dispute. “The fact that we are here consensually this morning is a credit to all parties in the courtroom,” Weiss told the court. The negotiations among the case stakeholders resulted in two major amendments to the final debtor- in-possession financing order, Weiss explained. The DIP collateral package was changed to carve out causes of action owned by the debtor related to avoidance actions for prepetition transactions, and a $75,000 budget was added to fund the unsecured creditors committee’s investigation of prepetition transactions and the debtor’s intercompany cash management system. Committee attorney James S. Carr of Kelley Drye & Warren LLP said upon formation in early February, the committee began discussions with the debtor and DIP lender Cannae Holdings to learn about that cash system. -

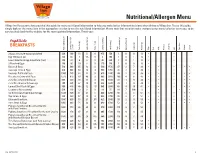

Nutritional/Allergen Menu

VillageInn.com Nutritional/Allergen Menu Village Inn Restaurants has provided this guide for menu nutritional information to help you make better informed decisions when dining at Village Inn. To use this guide, simply look for the menu item in the appropriate section to see the nutritional information. Please note that we often make changes to our menu to better serve you, so be sure to check back to the website for the most updated information. Thank you! brightside BREAKFASTS Total calories (cal) Total fat Calories from cal) (fat (g) Fat Total (g) Fat Saturated (g) Fat Trans (mg) Cholesterol (mg) Sodium Total (g) carbohydrate (g) Fiber Dietary (g) Sugars (g) Protein Eggs Fish Milk Peanuts Shellfish Soy Nuts Tree Wheat Gluten 2 Eggs, any style except poached 220 160 18 5 0 475 150 1 0 0 13 • • Egg Whites (4 oz) 120 60 7 1.5 0 0 190 1 0 1 12 • • Low-Cholesterol Egg Substitute (4 oz) 140 80 9 2 0 95 320 1 0 1 13 • • 2 Poached Eggs 140 90 10 3 0 370 140 1 0 0 13 • Bacon & Eggs 710 400 45 12 0 530 1570 47 2 7 29 • • • • • Sausage Links & Eggs 920 560 63 18 .5 590 1950 48 2 8 39 • • • • Sausage Patties & Eggs 1090 740 82 28 0 615 2290 49 2 9 36 • • • • • Biscuits & Gravy with Eggs 1520 910 102 40 0 600 3910 100 4 6 45 • • • • • 2-2-2 Breakfast with Bacon 600 340 38 11 0 555 1030 38 1 9 24 • • • • • 2-2-2 Breakfast with Sausage 700 420 47 14 0 585 1220 39 1 9 29 • • • • • Corned Beef Hash & Eggs 850 410 46 12 1.5 565 2380 65 4 10 41 • • • • • Cranberry Nut Oatmeal 510 110 12 3 0 10 75 89 7 896 13 • • • 1/2 lb Chicken-Fried Steak & Eggs 1330 -

Bakers Square Restaurant & Bakery

Bakers Square Restaurant & Bakery EXCLUSIVE NET - LEASE OFFERING Representative Photo OFFERING 4839 W 111th St, Alsip, IL 60803 MEMORANDUM CONFIDENTIALITY AND DISCLAIMER Marcus & Millichap hereby advises all prospective some properties, including newly-constructed facilities or for the subject property, the future projected financial purchasers of Net Leased property as follows: newly-acquired locations, may be set based on a tenant’s performance of the property, the size and square footage projected sales with little or no record of actual of the property and improvements, the presence or The information contained in this Marketing Brochure has performance, or comparable rents for the area. Returns absence of contaminating substances, PCB’s or asbestos, been obtained from sources we believe to be reliable. are not guaranteed; the tenant and any guarantors may the compliance with State and Federal regulations, the However, Marcus & Millichap has not and will not verify fail to pay the lease rent or property taxes, or may fail to physical condition of the improvements thereon, or the any of this information, nor has Marcus & Millichap comply with other material terms of the lease; cash flow financial condition or business prospects of any tenant, or conducted any investigation regarding these matters. may be interrupted in part or in whole due to market, any tenant’s plans or intentions to continue its occupancy Marcus & Millichap makes no guarantee, warranty or economic, environmental or other conditions. Regardless of the subject property. The information contained in this representation whatsoever about the accuracy or of tenant history and lease guarantees, Buyer is Marketing Brochure has been obtained from sources we completeness of any information provided. -

Fidelity National Financial, Inc. and J. Alexander's Corporation Announce Completion of Merger

October 29, 2012 Fidelity National Financial, Inc. and J. Alexander's Corporation Announce Completion of Merger Jacksonville, Fla. and Nashville, Tenn., October 29, 2012 -- Fidelity National Financial, Inc. (NYSE:FNF) ("FNF") and J. Alexander's Corporation (NASDAQ: JAX) ("J. Alexander's") announced today the successful completion of the merger of FNF's indirect wholly-owned subsidiary, New Athena Merger Sub, Inc. ("Merger Sub"), with and into J. Alexander's. At the effective time of the merger, each share of J. Alexander's common stock outstanding immediately prior to the effective time of the merger that was not accepted for payment pursuant to Merger Sub's tender offer for J. Alexander's common stock (other than shares held by J. Alexander's or Merger Sub, which shares were cancelled without any conversion) converted into the right to receive the same $14.50 per share in cash, without interest and less any applicable withholding taxes, that was paid in the tender offer. On October 29, 2012, J. Alexander's common stock ceased to be traded on the Nasdaq Global Market. About FNF Fidelity National Financial, Inc. (NYSE:FNF), is a leading provider of title insurance, mortgage services and restaurant and other diversified services. FNF is the nation's largest title insurance company through its title insurance underwriters - Fidelity National Title, Chicago Title, Commonwealth Land Title and Alamo Title - that collectively issue more title insurance policies than any other title company in the United States. FNF also owns a 55% stake in American Blue Ribbon Holdings, a restaurant owner and operator of the O'Charley's, Ninety Nine Restaurant, Max & Erma's, Village Inn, Bakers Square and Stoney River Legendary Steaks concepts. -

The Sweet Smell of Success Lingers Over Orlando at the 2008 Great American Pie Festival Sponsored by Crisco®

American Pie Council Newsletter www.piecouncil.org Spring 2008 THE SWEET SMELL OF SUCCESS LINGERS OVER ORLANDO AT THE 2008 GREAT AMERICAN PIE FESTIVAL SPONSORED BY CRISCO® More than 25,000 Pie Lovers and Pie Bakers United in Weekend of Competition, Family Fun and Of Course, Pie Eating It was a pie-lovers dream come true. For one weekend, April 19-20, thousands of pie lovers, pie bakers, celebrity chefs and vendors of all things pie-related converged in the idyllic town of Celebration, Fla., just outside Orlando, to celebrate a love affair with what is arguably America’s most beloved dessert, pie. The 2008 Great American Pie Festival sponsored by Crisco® was the most successful in the event’s 14-year-history, with more than 25,000 pie lovers in attendance and a record- setting 50,000 slices in the Never-Ending Pie Buffet, which was sponsored by a smorgasbord of local, regional and national commercial bakeries, restaurants and markets. The Food Network added an exciting presence at the pie baking championship and throughout the weekend festival, as film crews captured the thrills, spills and chills of every competition and event to compile into a special program which will air at a later date. Danielle Nettuno, 2008 Junior Chef Division Winner, with Celebrity Chef Jon Ashton Among pie-eating contests, baking demonstrations, vendor exhibits, games and live entertainment, the highlight of the festival was the announcement of the winners of the APC Crisco® National Pie Championships. Held annually since 1995, the National Pie Championships offer participants the opportunity to test their pies against other top bakers nationwide. -

United States Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported): July 30, 2021 BBQ HOLDINGS, INC. (Exact name of registrant as specified in its charter) Minnesota 001-39053 83-4222776 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) (Address of principal executive offices) (Zip Code) 12701 Whitewater Drive, Suite 100, Minnetonka, MN 55343 (952) 294-1300 (Registrant’s telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $0.01 par value BBQ The Nasdaq Global Market Indicated by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

RG Group Holdco, LLC in Their Sale of $13.5 MILLION Village Inn and Bakers Square to BBQ Holdings, Inc

Investment Banking Update July 30, 2021 Stephens served as exclusive advisor to RG Group Holdco, LLC in their sale of $13.5 MILLION Village Inn and Bakers Square to BBQ Holdings, Inc. Transaction Details • On July 30, 2021, BBQ Holdings, Inc., (“BBQ”) the multi-brand restaurant company behind fan- favorite restaurant concepts such as Famous Dave’s and Granite City Food & Brewery, announced it has completed the acquisition of Village Inn, a family restaurant concept with 21 company-owned restaurants and 114 franchised restaurants, and Bakers Square, a pie and comfort food concept with 12 company-owned restaurants. HAS BEEN ACQUIRED BY • “I am elated to welcome the Village Inn and Bakers Square teams into the family, Village Inn and Bakers Square are wonderful additions that will only strengthen our portfolio of restaurants and support center teams. I want to thank the franchise partners, restaurant teams, and leadership who have worked tirelessly to build these concepts into the brands they are today. I’m eager to begin forging a new growth path for both concepts. I know I speak for everyone at BBQ Holdings when I say we can’t wait to get to work doing so.” ― Jeff Crivello, BBQ Holdings’ CEO According to the Press Release Village Inn and Bakers Square Since 1958, guests have visited Village Inn because they can enjoy great-tasting food and extra-friendly service in a clean and comfortable family-friendly environment. Their breakfast heritage remains made-from-scratch buttermilk pancakes, eggs cooked any-style and a pot of hot coffee on every table.