Press Release Ecostar Goel Properties

Total Page:16

File Type:pdf, Size:1020Kb

Load more

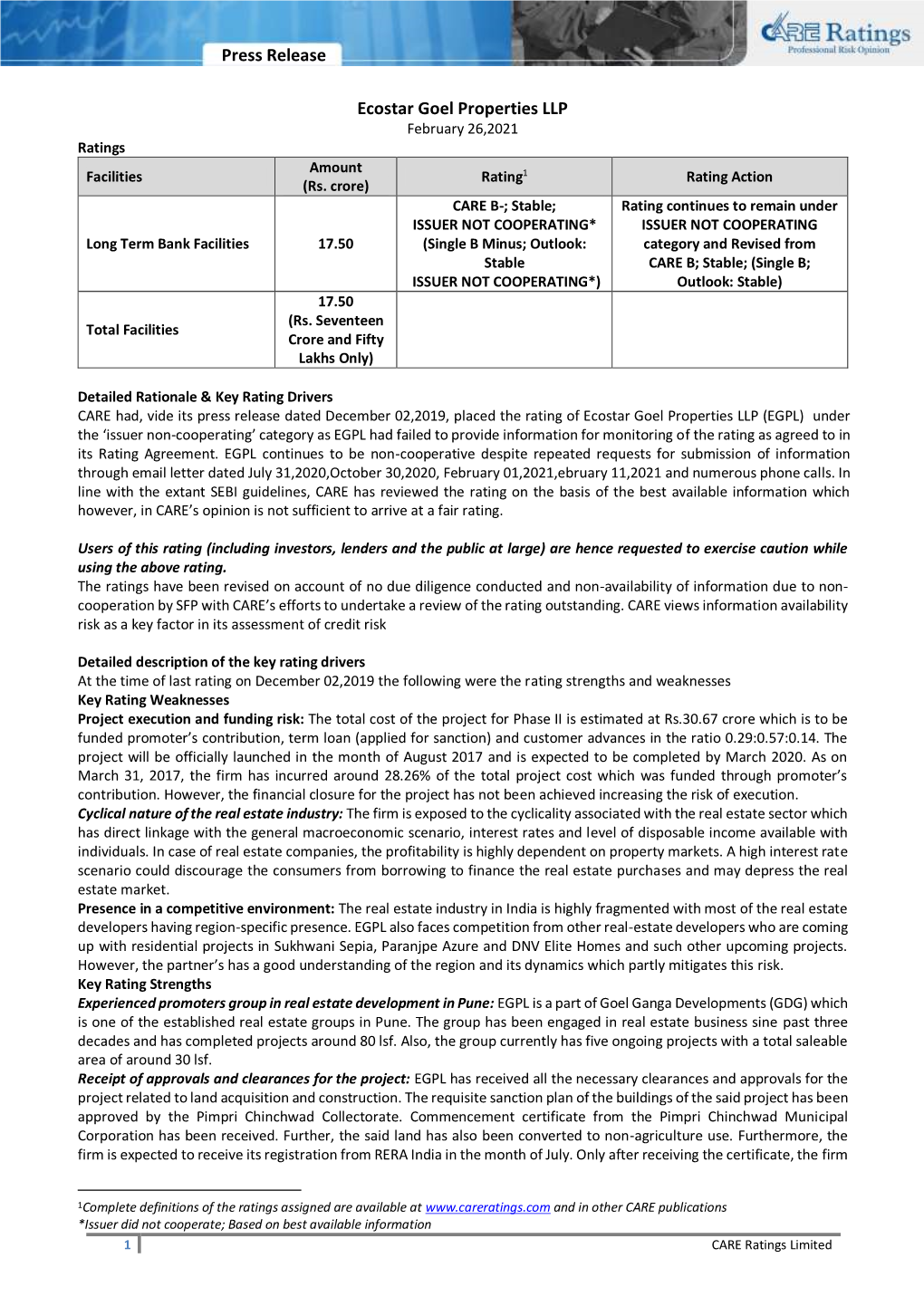

Recommended publications

-

Administrative Map

Darumbare Chandkhed ´ 1 0.5 0 1 Jambe km Tathavade (CT) Nere Administrative Map Kusgaon P.m. Kasarsai Gram Panchayat : Mann Block : Mulashi Marunji District : Pune State : Maharashtra Legend Rihe Tathavade (CT) GP Boundary Village Boundary Man World Street Map Data Source : SOI,NIC,Esri Bhegadewadi Map composed by : RS & GIS Div, NIC Chande Nande Sources: Esri, HERE, DeLorme, USGS, Intermap, increment P Corp., NRCAN, Esri Japan, METI, Esri China (Hong Kong), Esri (Thailand), TomTom, MapmyIndia, © OpenStreetMap contributors, and the GIS User Community Mulkhed Lavale Karjat 4 2 0 4 km ´ Khalapur Khed Khed Mawal No. Of Households Haveli Block : Mulshi District : Pune State : Maharashtra Sudhagad Mann Legend Mulshi Pune City Block Boundary GP Boundary Village Boundary Urban_area Village Boundary(No. Of Households) Data Not Available Roha 1 - 500 Haveli 501 - 1000 1001 - 5074 Mangaon Velhe Bhor Data Source : SOI,NIC,Esri Map composed by : RS & GIS Div, NIC Mahad Karjat 4 2 0 4 km ´ Khalapur Khed Khed Mawal Total Persons Haveli Block : Mulshi District : Pune State : Maharashtra Sudhagad Mann Legend Mulshi Pune City Block Boundary GP Boundary Village Boundary Urban_area Village Boundary(Total Persons) Data Not Available Roha 1 - 1500 Haveli 1501 - 3000 3001 - 23448 Mangaon Velhe Bhor Data Source : SOI,NIC,Esri Map composed by : RS & GIS Div, NIC Mahad Karjat 4 2 0 4 km ´ Khalapur Khed Khed Mawal Total Population Male Haveli Block : Mulshi District : Pune State : Maharashtra Sudhagad Mann Legend Mulshi Pune City Block Boundary GP Boundary Village -

MAHARASHTRA Not Mention PN-34

SL Name of Company/Person Address Telephone No City/Tow Ratnagiri 1 SHRI MOHAMMED AYUB KADWAI SANGAMESHWAR SANGAM A MULLA SHWAR 2 SHRI PRAFULLA H 2232, NR SAI MANDIR RATNAGI NACHANKAR PARTAVANE RATNAGIRI RI 3 SHRI ALI ISMAIL SOLKAR 124, ISMAIL MANZIL KARLA BARAGHAR KARLA RATNAGI 4 SHRI DILIP S JADHAV VERVALI BDK LANJA LANJA 5 SHRI RAVINDRA S MALGUND RATNAGIRI MALGUN CHITALE D 6 SHRI SAMEER S NARKAR SATVALI LANJA LANJA 7 SHRI. S V DESHMUKH BAZARPETH LANJA LANJA 8 SHRI RAJESH T NAIK HATKHAMBA RATNAGIRI HATKHA MBA 9 SHRI MANESH N KONDAYE RAJAPUR RAJAPUR 10 SHRI BHARAT S JADHAV DHAULAVALI RAJAPUR RAJAPUR 11 SHRI RAJESH M ADAKE PHANSOP RATNAGIRI RATNAGI 12 SAU FARIDA R KAZI 2050, RAJAPURKAR COLONY RATNAGI UDYAMNAGAR RATNAGIRI RI 13 SHRI S D PENDASE & SHRI DHAMANI SANGAM M M SANGAM SANGAMESHWAR EHSWAR 14 SHRI ABDULLA Y 418, RAJIWADA RATNAGIRI RATNAGI TANDEL RI 15 SHRI PRAKASH D SANGAMESHWAR SANGAM KOLWANKAR RATNAGIRI EHSWAR 16 SHRI SAGAR A PATIL DEVALE RATNAGIRI SANGAM ESHWAR 17 SHRI VIKAS V NARKAR AGARWADI LANJA LANJA 18 SHRI KISHOR S PAWAR NANAR RAJAPUR RAJAPUR 19 SHRI ANANT T MAVALANGE PAWAS PAWAS 20 SHRI DILWAR P GODAD 4110, PATHANWADI KILLA RATNAGI RATNAGIRI RI 21 SHRI JAYENDRA M DEVRUKH RATNAGIRI DEVRUK MANGALE H 22 SHRI MANSOOR A KAZI HALIMA MANZIL RAJAPUR MADILWADA RAJAPUR RATNAGI 23 SHRI SIKANDAR Y BEG KONDIVARE SANGAM SANGAMESHWAR ESHWAR 24 SHRI NIZAM MOHD KARLA RATNAGIRI RATNAGI 25 SMT KOMAL K CHAVAN BHAMBED LANJA LANJA 26 SHRI AKBAR K KALAMBASTE KASBA SANGAM DASURKAR ESHWAR 27 SHRI ILYAS MOHD FAKIR GUMBAD SAITVADA RATNAGI 28 SHRI -

Curriculum Vitae

Curriculum Vitae Mohammed Omair BVSc & AH (Mum.) Flat No.24, B-Wing, 2nd Floor, Sarfaraz Nagar, Aurangabad, Maharashtra (India). Pin - 431001 E-mail: [email protected] Mob.: +91 - 9594 8959 13 Personal Details Date of Birth: 6 December 1995 Nationality: Indian Passport Details: PP No. S-6852528, issued at Mumbai, India on 17 Aug. 2018, valid till 16 Aug. 2028 A passionate, enthusiastic person with interest in development & welfare of Livestock sector, making it focus of my career planning to grow & become a Research Scientist. Education Maharashtra Animal & Fisheries Sciences University, Nagpur, India Bachelor of Veterinary Science & Animal Husbandry in First Division, July 2018 Bombay Veterinary College, Mumbai, Maharashtra, India (AVMA listed) OGPA: 7.93 (0 - 10 scale) (highest individual marks in Veterinary Medicine, Surgery & Radiology, Pathology, Nutrition & LPM) Maharashtra State Board of Secondary & Higher Secondary Education, Pune, India Higher Secondary School Certificate (+2, Class 12) in th Distinction, Feb 2013 Maulana Azad College, Aurangabad, Maharashtra, India 77.17% (highest individual marks, 80% in Biology) Maharashtra State Board of Secondary & Higher Secondary Education, Pune, India Secondary School Certificate (Class 10) in th Distinction, March 2011 Little Flower High School, Aurangabad, Maharashtra, India 92.55 % (highest individual marks, 93 % in Sci. & Tech. & 98% in Mathematics) Computer Skills: MS-Office (Word, Excel, Power Point) Email, Web & social skills. Optical character recognition (OCR). Acquired statistical knowledge to work on various data sets using SPSS software. Internship Experience 15 Jan 2018 - 14 July 2018 (6 Months) a) Institute of Veterinary Biological Products (IVBP), Aundh, Pune Summary: gained knowledge about a part of production process of chemical reagents & economically important bacterial & viral vaccines (Clostridium sp., Anthrax, FMD, Rabies, MD, ND). -

Ffir*Rfi, Got Irext Strr+ Qerpift=[ Yrflr5.{Ur, Gut6ftilr Uift, F4{D?Frfr HOSPITAL MISE ALTOT MENT of IEMDES IVIR on 6-04-2021PUN - Dtstrtc'l

x'.fq.6, .r+. en lhtfue-q qffilr ! e/Q o q q ffiElql,Frq,got ffrt*,. ?Q/x/qoqq qfitqffi fuEq :- Hftrtr{ ifuE-qT qreqrc{r-{f,. liqrt '- l) qr. sTr{ffi , Bl=r H si}qq urTlvq *'+ qiq*oqr.m.qlfqerJHfisqtr q, q. qfrq{H/q. 1- R k{is- q/x/R o R t) qr qrqffie qr mreffim e+rtvr *. fe.HT. ien.q /ffi /qst /tott.kqi6 q\/x/RoRt. i) qT *lqidqmslfr qr qrqffie entvr m. fq.mr. /en.q /ffi /q\er /totq.kim U/x/QoRq. x) ur.o1g6, sr=r.r eiiqq wnaq qtffif, qr F. .No. Remdesivir nr 4/ $' 202t/08 frqim qi/x/Ro?l e+re k{i6. Rq/x/?oRt n-S gri ffi srw Art'er Hnr+{ tffi Fru1?1-q F-orq eraq Hi-q-d-qT qffi s-{u-{Trd sTrA-f,1 GG. ilft {GiRrd +ii{s eit qurqqhr q E{tfoqm 3Tr*@T lffi ertwr gwd-Et-{ 1q-n ei++q{ HGFra. tq-gfiselr idErH rTrsfli FR+d ffi--@T qr+ qrq q;sq qr*o qt{IEkT qi"kflEt Req qwrr ilE}.ffi e-snql tffi , ztarzrd, wq{ Elw{ rT6t qrfr qerf,r Frulrei+ wrnr-{ q qr$q' m qirt fuH sTrt {Eiiqn *t+s FrutT-f,qirt vflqT et}qq {rar qTw q'-FT ndffirqt Fione-qrqr d'er t-g r{ v& mmn* qrfrrsrrd e vrPr$f, q-ffiti qrs.F ffi {K{ q-rui qFi[{s' qTt qurc-d-qt qktsmr swi qrger Bgirt eftqqi \Fl.q fuf,{q v<t qTM tfiisrs Eq-frn q eil-s*tq / atsfi wro +-wti ent *tfue-t q a{ko{refiqd o.rq uruntfrdr$T Tdr{' yqr: aml'q fur, rcmrrwnfuor, qrrqrfufi, rr6Eit, +*q, urqkflq, t.nf+ors, srq E[ oitqtl q$nff{, qfr€{ FFTrfi FdPdq enenr<iqr orRr*,rff e offi mffi ro z*^qtewr*d *qoqd fqtw qt. -

GIPE-184793.Pdf

•. ... / SUMMARY OF THE REPORT OF THE REGIONAL PLAN FOR PUNE METROPOLIT~ REGION 1970-1991 I. INTRODUCTION Why Regional Planning ? . ~~ ' Prior to independence the chief functions of the city of Pone were administrative, military, educatiO!ial- and cultural. It was a city made great by political stalwarts, thinkers and dedicated workers like Gopal Krishna Gokhale, Lokmanya Tilak, Agarkar, Maharshi Karve and Mahatma Phule. It was a city which had acquired its name because of such educational and research institutions like the Deccan College, Fergusson College, S. P. College, the Pone Engineering College, Bhandarkar Oriental Research Institution and Bharat Itihas Sanshodhak Mandai. It was a lovable city up the ghats with a beautiful setting of hills and mountains surrounding it and with a salburious climate all the year round. A seat of the Peshwas in the past it also became a favourite with the English who established military cantonments in its environs, who made it the summer capital for the Governor and also a second administrative capital of the State by the location of several departmental head offices in the city. The post independence decades witnessed the commencement of a new industrial era in the develop ment of Pune-Bombay was getting over concentrated and new industries were seeking out an alternative location for them. Pone was in many respects a natural alternative, being away and yet not too far away from the Capital; and being equipped with all the necessary infrastructure, development of industrial area in the eastern part, at Hadapsar as also the development of large industrial area by Maharashtra, Industrial Development Corporation in the Pimpri-Chinchwad complex on the Bombay-Pone Rail Road corridor at the very apparture time attracted many industries to Pone since I 960 onwards. -

Environmental Clearance to SEIAA

Environment department, Room No. 217, 2nd floor, Mantralaya, Annexe, Mumbai- 400 032. Date:February 27, 2020 To, M/s. Paranjape Schemes (Construction) Ltd. at S. No. 84/1B, 84/2B, 84/3B, 85/4 at Village- Tathavade, Taluka – Mulshi, Dist.- Pune, State- Maharashtra. Environment Clearance for Application for Amendment in Environment Clearance of Proposed Residential Subject: and Commercial project “Azure” at S. No. 84/1B, 84/2B, 84/3B, 85/4 at Village- Tathavade, Taluka – Mulshi, Dist.- Pune, State- Maharashtra by M/s. Paranjape Schemes (Construction) Ltd. Sir, This has reference to your communication on the above mentioned subject. The proposal was considered as per the EIA Notification - 2006, by the State Level Expert Appraisal Committee-III, Maharashtra in its 93rd meeting and recommend the project for prior environmental clearance to SEIAA. Information submitted by you has been considered by State Level Environment Impact Assessment Authority in its 186th meetings. 2. It is noted that the proposal is considered by SEAC-III under screening category 8(a) B2 Category as per EIA Notification 2006. Brief Information of the project submitted by you is as below :- Proposed Residential and Commercial project “Azure” at S. No. 84/1B, 84/2B, 84/3B, 85/4 at 1.Name of Project Village- Tathavade, Taluka – Mulshi, Dist.- Pune, State- Maharashtra by M/s. Paranjape Schemes (Construction) Ltd. 2.Type of institution Private 3.Name of Project Proponent M/s. Paranjape Schemes (Construction) Ltd. 4.Name of Consultant Mahabal Enviro Engineers Pvt. Ltd. Thane 5.Type of project Residential and Commercial project. 6.New project/expansion in existing project/modernization/diversification Amendment in existing project in existing project 7.If expansion/diversification, whether environmental clearance Yes, we have received Environment Clearance from Government of Maharashtra vide file no. -

Pune Cdap.Pdf

PREFACE The process of planned economic development in India began with the launching of the First Five Year Plan in 1951 and currently India is in the 12th Five Year Plan (2012-13 to 2016- 2017). The main objective of policy makers is to promote growth with social justice. During the Eleventh Plan period, the agricultural sector experienced a miniscule growth rate of 3.64 per cent per annum. Indian agriculture is presently at cross roads and one of the major challenges is to reverse deceleration in agricultural growth rates so as to successfully achieve a higher broad based growth. In view of the above, a special Additional Central Assistance Scheme -Rashtriya Krishi Vikas Yojna (RKVY) which is a State Plan scheme administered by the Union Ministry of Agriculture was conceived. The main purpose of the scheme is to supplement state specific strategies with a view to rejuvenate agriculture. The pattern of funding under this scheme is 100 percent Central grant. In order to avail of funds under RKVY, each district is entrusted with the task of preparing a comprehensive district agricultural plan. Accordingly, this plan was prepared for Pune district. The Plan revealed that the city has suitable infrastructure and conducive climate for high value agriculture. Floriculture is also coming up in a big way. Similarly dairy development and poultry have huge potential in the district. As the city is close to Mumbai and well connected by road, rail and air to other major cities there is a ready market available for consumption of agricultural goods, processed goods, dairy and poultry products. -

Pimpri Chinchwad Municipal Corporation Pimpri - 411 018 Maharashtra

S ystem of A ssisting R esidents A nd T ourists through H elpline I nformation 1 System of Assisting Residents And Tourists through Helpline Information SARATHI (English) Pimpri Chinchwad Municipal Corporation Pimpri - 411 018 Maharashtra SARATHI Pimpri Chinchwad Municipal Corporation, Pimpri - 411 018 2 S ystem of A ssisting R esidents A nd T ourists through H elpline I nformation Pimpri Chinchwad Municipal Corporation - Ward wise Map - Ward Municipal Corporation Pimpri Chinchwad SARATHI Pimpri Chinchwad Municipal Corporation, Pimpri - 411 018 S ystem of A ssisting R esidents A nd T ourists through H elpline I nformation 3 New Ways... Pimpri Chinchwad Municipal Corporation is committed to provide basic amenities and ensure the welfare of its citizens. The rapid growth of the city is a big challenge to meet this objective. Many people are usually not aware of the functioning and activities of various departments of the corporation as well as the procedures for submitting applications. The administration also has to spend a lot of time in answering queries and providing information. SARATHI is an initiative which provides this information in the form of Frequently Asked Questions (FAQs) through multiple channels i.e. book, PROLOGUE website, mobile app, e-book & pdf book. In addition an interactive platform in the form of a helpline has been started to answer the queries, aid grievance redressal and guide the citizens when needed. SARATHI will enable the citizens of Pimpri Chinchwad to seek information easily which will save their precious time. I am sure SARATHI will play a key role in empowering the citizens for taking decisions and actions for their own welfare. -

JSPM's Jayawant Institute of Management Studies Tathawade, Pune-33 Add-On Courselist

Print JSPM's Jayawant Institute of Management Studies Tathawade, Pune-33 Add-On CourseList Add-On Course: BCC2017-18 Business Communication Course Resource Person: Western Academy, Pune Duration: 34 Hrs Sr. No. Participant Name Participant Class 1 YADAV SHUBHAM HANMANTU MBA-I 2 SANGOKAR VISHAL VISHNU MBA-I 3 PRIYANKA SHARAD PATIL MBA-I 4 RAMTEKE SHUBHAM DHANRAJ MBA-I 5 NISHANT PRADIP FUKATE MBA-I 6 PRAVIN PRAKASH HANWATE MBA-I 7 PINKU SANJAY MANE MBA-I 8 KOHALE ANTIMA ASHOKRAO MBA-I 9 SWAPNIL DADASAHEB SAWANT MBA-I 10 PRIYA PURI MBA-I 11 AKASH KISHOR RANVEER MBA-I 12 SAYALI RAM SUPEKAR MBA-I 13 SNEHA WASUDEO REKDE MBA-I 14 ANITA RAMASHREY YADAV MBA-I 15 VIKAS KAILASH BHISE MBA-I 16 IMRAN RUKMODDIN FAKIR MBA-I 17 AJINKYA PRADIP SURADKAR MBA-I 18 AJAY MAHADEORAO PETHE MBA-I 19 TEJAS GANESH NIMHAN MBA-I 20 NIKHIL RAJENDRA GORANE MBA-I 21 PRERANA TANAJI BHOSALE MBA-I 22 UDAYKUMAR SITARAM WAGH MBA-I 23 ANJALI SIDDHARTH KAMBLE MBA-I 24 PRASHANT DNYANESHWAR BARBATE MBA-I 25 AKSHAY NILAKANTH KAMBALE MBA-I 26 SHARAD DADASAHEB RUPANWAR MBA-I 27 SHITAL RAJENDRA NARAJE MBA-I 28 PRATIMA ANAND BANSODE MBA-I 29 POLE KALINDA RAOSAHEB MBA-I 30 RAVINDRA GORAKSHNATH SONAWANE MBA-I 31 NILESH MAHADEV VIJAYKAR MBA-I 32 GANESH MADHAV JARARE MBA-I 33 PRAVIN BAJIRAO JARARE MBA-I 34 BHAGYASHRI ADINATH MARKAD MBA-I 35 PATHAK AKSHAY HEMANT MBA-I 36 DEEPIKA NARAYANRAO RAMTEKE MBA-I 37 RUPA SHARANAPPA HIREMANI MBA-I 38 ASHWINI ASHOK GHONGADE MBA-I 39 ROHIT DATTATRAYA CHAVAN MBA-I 40 KAILASH KESHAV KANHULE MBA-I 41 PRIYANKA VIJAY KAMBLE MBA-I 42 PARESH ISHWAR LOHAR -

Village Map Taluka: Haveli District: Pune

Village Map Taluka: Haveli District: Pune Khed !( Shirur Mawal Dehu (CT) MalinagarVitthal Nagar Dehu Road (CB) µ 4.5 2.25 0 4.5 9 13.5 Borhadewadi km Tulapur Fulgaon Pimpri Chinchwad (M Corp.) Wadhu Kh. Nirgudi Tathavade (CT) Perane Location Index Bhawadi Loni-kand Burkegaon Dongargaon Sangavi Sandas District Index Nandurbar Pimpale Saudagar Bakori Pimpri Sandas Bhandara Pimpale Gurav Nhavi Sandas Dhule Amravati Nagpur Gondiya Wagholi (CT) Jalgaon Shiraswadi Akola Wardha Kesnand Buldana Nashik Washim Chandrapur Gawdewadi (N.V.) Shindewadi Yavatmal Awhalwadi Murkutenagar (N.V.) Palghar Aurangabad Wade Bolhai Jalna Gadchiroli Taleranwadi Ashtapur Hingoli Thane Ahmednagar Parbhani Mumbai Suburban Nanded Bid Manjari Kh. Sashte Hingangaon Mumbai Biwari Pune Sunarwadi Pashan Raigarh Bidar Pune City HAVELI Latur Mulshi !( Osmanabad !( !. !( Bhawarapur Khamgaon Tek Kolwadi Naigaon Satara Solapur Theur Peth Tilekarwadi Ratnagiri Daund Sangli Koregaon Mul Peth Maharashtra State Kolhapur Kadamwak Wasti Uruli Kanchan Sindhudurg Shewalwadi Kunjirwadi Sortapwadi Dharwad Fursungi Khadewadi Taluka Index Loni-kalbhor MokarwadiAhire Shindwane Uruli-dewachi Tarade Junnar Wanjalewadi Alandi Mhatobachi Bhagatwadi Bahuli Autadwadi Handewadi Ambegaon Agalambe Walati Kudaje Wadki Holkarwadi Ramoshiwadi Katavadi Gujar Nimbalkarwadi Khed JambhulwadiMangadewadi Wadachiwadi Khadakwadi Mawal Gorhe Bk. Shirur Mandvi Bk. Nandoshi Sangarun Mandvi Kh. Gorhe Kh. Haveli Kolewadi Bhilarewadi Donaje Khanapur Sanas Nagar Mulshi Pune City Jambhali Malkhed Haveli Manekhadi Daund Thoptewadi Gogalwadi Legend Ghera Sinhagad Tanaji Nagar Velhe Purandhar Wardade Sambarewadi Nigade Mose !( Taluka Head Quarter Bhor Baramati Gaud Dara Khamgaon Mawal Indapur Awasare NagarArvi Ambee Mordhari Railway Kondhanpur Ramnagar Mordari !( Mogarwadi Shiwapur Express Highway Kalyan District: Pune Rahatwade Khed National Highway Purandhar State Highway Village maps from Land Record Department, GoM. -

Traffic Branch,Pimpri Chinchwad. (Drunk and Drive Cases) 01-01-2019 to 31-01-2019

Traffic Branch,Pimpri Chinchwad. (Drunk And Drive Cases) 01-01-2019 To 31-01-2019 NO. DIVISION NAME ADDRESS SECTION DATE TIME PLACE VEHICLE NO 1 SANGVI CHETAN SANJAY DEVAKE BHOSARI, PUNE 184,185, 3(1)181 01-01-2019 0.2 KOKANE CHOWK MH20 DG 6714 2 SANGVI SHESHRAO VITOBA GAIKWAAD RAHATANI, PUNE 184,185, 3(1)181 16-01-2019 20.3 TAPAKIR CHOWK MH 14 AA 3022 3 SANGVI VITTHAL MAHADEV SANAP KALEWADI PUNE 184,185, 3(1)181 17/01/2019 20.00 RAHATNI FATA MH 14 GQ 6121 4 SANGVI DYANESHWAR RAMLING NAVALE RAHATANI, PUNE 184,185, 3(1)181 25/01/2019 10.50 M.M.CHOWK MH 14 BQ 1090 5 SANGVI GANGADHAR MARUTI GOTMUKALE VADHANA PUNE 184,185, 3(1)181 30/01/2019 19.00 RAHATNI FATA MH 14 AY 6126 6 SANGVI TUKARAM GANGADHAR WAKADE THERGAON PUNE 184,185, 3(1)181 30/01/2019 19.40 RAHATNI FATA MH 11 N 8717 jalasa nhotel ambika pan 184, 185, 3(1)/181, 7 Hinjawadi Ashish Viraprakasah Grag 06-01-2019 19:15 wakad naka MH 14 B 3589 stol waked 158/177 aaman transport surya 184, 185, 3(1)/181, 8 Hinjawadi Premjit kumar rajadhan yadhav hospital bhaji mandai 08-01-2019 20:45 shivaji chouk MH 14 EM 6251 158/177 chakan kondadibag, nanded city 184, 185, 3(1)/181, 9 Hinjawadi Vinod dnyaneshwar shinde ingavale complex tel-haveli, 10-01-2019 21:55 wakad nanka MH 12 LX 8014 158/177 pune kaspate wasti pcmc shale 10 Hinjawadi Dipak raju raut mage mane pandhari nivas 184, 185, 130/177 10-01-2019 20:16 jambhulakar jim MH 11 BG 1733 wakad taramax chouk, c/o- Mahesh gayakawad 11 Hinjawadi Namadev tayappa dandugale 184, 185, 3(1)/181, 16-01-2019 20:00 surya aandarapas MH 14 BU 0890 ajantanagar -

Pune Region Geographical Area * T Koregaon Kh

73°40'0"E 73°45'0"E 73°50'0"E 73°55'0"E 74°0'0"E H PUNE REGION GEOGRAPHICAL AREA * T KOREGAON KH. E # P S D * PUNE CITY TALUKA,PIMPRI-CHINCHWAD MUNICIPAL CORPORATION, R PIMPRI KH. A HINJEWADI,TALEGAON-DABHADE,CHAKAN AREA COVER IN THIS MAP. # W GONAVADI O # T NASIK MIDC WATER TREATMENT PLANT AHMEDNAGAR ! ROHAKAL BHAMBOLI GM PLANTS # ð # #WASULI #VARALE ðRAS GROUP OF COMPANIES THERMAX CA-17 GHANWAT INDUSTRIAL PARK CA-16 L&T m CA-15 ð CA-19 NA BEARINGS INDIAð ! CA-14 CA-18 CA-12 CA-13 ð AMBETHAN CA-20 CA-11 NH-50 CA-01 CA-10 CA-09 JCB INDIA # CA-02 CA-03 CA-06 PUNE ¤£ CA-04 ð MUMBAI CA-05 CA-08 CA-07 o ± l TALEGAON MIDC AREA #KHARABWADI AISHWARA ANGAN SHIVAM RESIDENCYõ KISHOR MOTORS õ ð Q SAVARDARI SHOLAPUR AMBI SATARA # MTS INDIA CHAKAN (CT) # o MEDANKARWADI (N.V.) #NANOLI TARF CHAKAN #SUDUMBRE ! l #!. HYUNDAI MOTORS VICTORS GASKETSo AUTOMAG INDIA Total Population within the Geographical Area as per Census 2001 ð CHAKAN FORT ð CA-17 ð @ ! 40.05 Lacs(Approx.) Total Geographical Area (Sq.KMs) No. Charge Areas L'OREAL INDIA KADACHIWADI (N.V.) NANEKARWADI (N.V.)VISHAL GARDEN ð õ # 1053 20 VARALE COGEME PEECISION PARTS MAHALUNGE LNGALE # # BAJAJõ AUTO EAGLE AGRO VARALE I ð MAHALUNGE Charge Areas Identification Important location within N SUDUMBARE ð D ð KEIHIN FIE INDIA PVT. LTD# VOLKSWAGEN PLANT R # A VARROCð EXAHUST SYSTEM LTD. CA-01 Pashan Lake 18°45'0"N CA-16 ð YA ð N I SSK AUTOMOTIVE CA-02 Raj Bhawan VEDGAON RLYSTN.