Samsung Electronics Co., Ltd. and Subsidiaries NOTES to INTERIM

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interbrand-Best-Korean-Brands-2015

Contents 02 Introduction 04 The future of business is personal 06 The Age of You: key questions answered 10 Best Korea Brands 2015 Top50 46 Best Korea Brands 2015 Analysis 54 Authors & Contributors 1 engage customers and generate genuine result, each of us will become our own 2015 will provide the insights you need value for the business. marketplace or “Mecosystem.” to drive your organization forward—and Introduction new inspiration to push creative thought The need to create brand experiences In our report, Jez Frampton, Global CEO Jihun Moon and innovation in these changing times. that are seamless and more holistic has of Interbrand, will elaborate on this new been precipitated by sector convergence era, which we at Interbrand refer to as Congratulations to all of Korea’s Best The origin of the term “branding” was and the rise of Big Data. Harnessing the the “Age of You”—the move from brand Global Brands—in particular those whose lit¬erally to burn one’s name onto prop- potential of Big Data isn’t just for tech as monologue, to brand as dialogue, leadership skills have earned them a erty as a crude mark of ownership. But companies anymore—it offers huge to brand as a communal experience, to place among the nation’s top brands. it’s only in our relatively recent history opportunities for all brands. By collecting brand as a truly personal and curated ex- that branding has become recognized as To your continued success, and analyzing customer data and honing perience created around each and every a business discipline. -

Samsung Electronics Co., Ltd. and Its Subsidiaries NOTES to INTERIM

Samsung Electronics Co., Ltd. and its Subsidiaries NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS 1. General Information 1.1 Company Overview Samsung Electronics Co., Ltd. (“SEC”) was incorporated under the laws of the Republic of Korea in 1969 and listed its shares on the Korea Stock Exchange in 1975. SEC and its subsidiaries (collectively referred to as the “Company”) operate four business divisions: Consumer Electronics (“CE”), Information technology & Mobile communications (“IM”), Device Solutions (“DS”) and Harman. The CE division includes digital TVs, monitors, air conditioners and refrigerators and the IM division includes mobile phones, communication systems, and computers. The DS division includes products such as Memory, Foundry and System LSI in the semiconductor business (“Semiconductor”), and LCD and OLED panels in the display business (“DP”). The Harman division includes connected car systems, audio and visual products, enterprise automation solutions and connected services. The Company is domiciled in the Republic of Korea and the address of its registered office is Suwon, the Republic of Korea. These interim consolidated financial statements have been prepared in accordance with Korean International Financial Reporting Standards (“Korean IFRS”) 1110, Consolidated Financial Statements. SEC, as the controlling company, consolidates its 256 subsidiaries including Samsung Display and Samsung Electronics America. The Company also applies the equity method of accounting for its 41 associates, including Samsung Electro-Mechanics. -

South Korea Product Profiles Download the Report

Market opportunities for Queensland agribusiness from FTA with South Korea FINAL REPORT 1 Executive summary Background Australia recently signed Free Trade Agreements (FTAs) with China (June 2015), Japan (July 2014) and South Korea (April 2014). These agreements substantially reduce or remove tariffs on a range of Australian food and agribusiness export products including beef, grains, horticulture, seafood and processed foods, which together represent a large share of Queensland’s total agricultural production and exports. Deloitte Access Economics has been engaged by Trade & Investment Queensland (TIQ) and the Queensland Department of Agriculture and Fisheries (DAF) to identify opportunities and barriers within Queensland agribusiness sectors arising from the FTAs. The project has been undertaken in two stages. Stage 1 highlighted the commodities which showed the most promise for increased trade and investment between China, Japan and South Korea. These commodities were identified through analysis of tariff reductions, Queensland production, exports, consumption trends and major competitors as well as consultation with Queensland agribusiness stakeholders. Stage 2 (this report) profiles these identified commodities in more detail to identify any non-tariff barriers, supply chain constraints, market operation and their Strengths, Weaknesses, Opportunities and Threats (SWOT). This profiling was informed through further consultation with Queensland Government, industry associations, traders and selected in-market contacts in China, Japan -

Short Form Catalogue 2011

Short form catalogue 2011 TM Always On WiFi Short description Nanoradio AB has developed the smallest and most power NRG831 - 802.11b/g/n single chip System in Package efficient Wi-Fi solutions in the world, for battery operated mobile (SiP) for Mobile Devices devices like: The NRG831 is 802.11b/g/n compliant Wireless LAN System-in- Mobile phones, VoIP phones, tablets (MID), multimedia devices Package (SiP) solution. This ultra-low power circuit is optimized for (Mobile gaming terminals, portable multimedia players, digital use in mobile phones and supports full coexistence with Bluetooth cameras, positioning devices and E-book readers) and headsets. chips. Wi-Fi Certifications including 802.11b/g/n, WPA. WPA2, Nanoradio AB is now broadening its offerings by developing WMM. UMA support. solutions including further connectivity features, e.g. Bluetooth. NRG800 - Combo WLAN 802.11b/g/Bluetooth single chip The Nanoradio solutions are offered as Wi-Fi chipset or as System-in-Package (SiP) for mobile devices. complete modules from our global module partners. The NRG800 is a complete Wireless LAN/ Bluetooth© Combo System- in-Package (SiP) Solution for Mobile devices. The NRG800 delivers a PRODUCTS complete and fully tested implementation of 802.11b/g and Bluetooth NRX600 - 802.11 b/g true one chip (COB) functionality. Best WiFi/BT coexistence on the market. High performance 802.11 b/g true one chip for direct PCB NRG850 - Combo WLAN 802.11b/g/n/Bluetooth single mounting, designed to handle the 802.11 b/g standards. This ultra chip System-in-Package (SiP) for mobile devices. low power chip is optimized for use in battery operated The NRG850 is a complete Wireless LAN/Bluetooth© Combo mobile devices, due to one chip power System-in-Package (SiP) Solution for Mobile devices. -

Interim Consolidated Financial Statements of Samsung Electronics Co., Ltd

INTERIM CONSOLIDATED FINANCIAL STATEMENTS OF SAMSUNG ELECTRONICS CO., LTD. AND ITS SUBSIDIARIES INDEX TO FINANCIAL STATEMENTS Page Independent Auditors’ Review Report 1-2 Inteim Consolidated Statements of Financial Position 3-5 Inteim Consolidated Statements of Profit or Loss 6 Inteim Consolidated Statements of Comprehensive Income 7 Inteim Consolidated Statements of Changes in Equity 8-11 Inteim Consolidated Statements of Cash Flows 12-13 Notes to the Inteim Consolidated Financial Statements 14 Deloitte Anjin LLC 9F., One IFC, 10, Gukjegeumyung-ro, Youngdeungpo-gu, Seoul 07326, Korea Tel: +82 (2) 6676 1000 Fax: +82 (2) 6674 2114 www.deloitteanjin.co.kr Independent Auditors’ Review Report [English Translation of Independent Auditors’ Report Originally Issued in Korean on November 13th, 2020] To the Shareholders and the Board of Directors of Samsung Electronics Co., Ltd.: Reviewed Financial Statements We have reviewed the accompanying interim consolidated financial statements of Samsung Electronics Co., Ltd. and its subsidiaries. The interim consolidated financial statements consist of the consolidated statement of financial position as of September 30, 2020, and the related consolidated statements of profit or loss and comprehensive income for the three-month and the nine-month period ended September 30, 2020, changes in equity and cash flows for the nine-month period ended September 30, 2020, all expressed in Korean won, and a summary of significant accounting policies and other explanatory information. Management’s Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of these interim consolidated financial statements in accordance with Korean International Financial Reporting Standards (“K-IFRS”) No. 1034 Interim Financial Reporting, and for such internal control as management determines is necessary to enable the preparation of interim consolidated financial statements that are free from material misstatement, whether due to fraud or error. -

Copyrighted Material

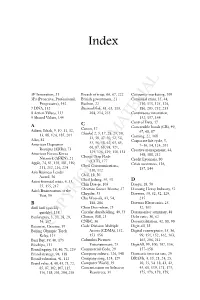

Index 3P Innovation, 31 Breach of trust, 66, 67, 222 Consumer marketing, 109 3Ps (Proactive, Professional, British government, 21 Continual crisis, 35, 44, Progressive), 142 Buchon, 22 110, 113, 125, 126, 7 DNA, 132 BusinessWeek, 43, 63, 113, 186, 205, 232, 233 8 Action Values, 133 204, 214, 235 Continuous innovation, 9 Shared Values, 144 132, 137, 144 Control Data, 17 A C Canon, 17 Convertible bonds (CB), 49, Adizes, Ichak, 9, 10, 11, 12, 67, 68, 87 13, 88, 124, 185, 201 Chaebol, 2, 5, 17, 28, 29, 30, 32, 38, 47–50, 52, 54, Corning, 22, 168 Aibo, 81 Corporate life cycle, 5, American Depositor 55, 56, 58, 62, 63, 65, 66, 67, 68, 94, 121, 7–16, 34, 124, 201 Receipts (ADRs), 73 Creative management, 44, American Forces Korea 124, 126, 129, 130, 131 Charge Trap Flash 148, 188, 212 Network (AFKN), 21 Credit Lyonnais, 80 Apple, 74, 83, 158, 181, 189, (CTF), 177 Cheil Communications, Crisis awareness, 136, 211, 212, 216, 224 137, 144 Asia Business Leader 110, 112 Award, 36 Cheil, 18, 50 Asian financial crisis, 6, 33, Cheil Jedang, 50, 53 D 55, 155, 217 Chin Dae-je, 103 Daegu, 18, 50 Asia’s Businessman of the Christian Science Monitor, 27 Daesung Heavy Industry, 52 Year, 36 Chrysler, 53 Daewoo, 30, 32, 52, 129, Chu Woo-sik, 43, 54, 215 B 188, 206 Daewoo Electronics, 25, Balli balli (quickly Chun Doo-whan, 23 32, 101 quickly), 138 Circular shareholding, 49, 53 Datamonitor summary, 48 Bankruptcy, 3, 20, 28, 29, Clinton, Bill, 21 Debt ratio, 30, 62 54, 107 CNBC, 36 Decentralization, 42, 88, 90 Bateman, Graeme,COPYRIGHTED 39 Code Division Multiple -

Nanoradio at a Glance

Nanoradio at a glance 1 © Nanoradio 2010 Confidential Nanoradio - Geographic Reach Headquarters: Kista, Sweden Sales Office in Lund NA: Agent Korea: Seoul China: Shanghai Japan: Tokyo Patras, Greece Taiwan: Taipei Development office Sales & Customer support office 2 © Nanoradio 2010 Confidential Nanoradio - Major Progress During the Last 12 Months 15 major mobile phone manufactures have selected Nanoradio, and growing 5 Global TOP10 mobile players, including Samsung, selected the Nanoradio Solution #1 Japanese vendor Sharp leading ODM’s and OEM’s in China and Taiwan Nanoradio also selected for MIDs VoIP phones Wi-Fi headsets DSC Photo frames Volumes increasing fast 350% 2008->2009 350% 2009->2010 Leading wafer and back-end partners Ported on major operating systems and platforms, increasing the addressable market to 70% 3 © Nanoradio 2010 Confidential Nanoradio - Wi-Fi Design Wins Samsung Haier P250 (2008) Q1 (2010) P270 (2008) N8 (2010) GT-M5650 (2010) K-Touch GT-M5650u (2010) W606 (2010) GT-B7722 (2010) Coolpad GT-B7722u (2010) W711(2010) GT-B7732 (2010) Huawei GT-B7722i (2011) T8301(2011) W6370 (VoIP phone) (2010) Acer Sharp beTouch E120 (2010) 940SH (2009) beTouch E130 (2010) 941SH (2009) 943SH (2010) 944SH (2010) 945SH (2010) 945SH-G (2010) 002SH (2010) 004SH (2011) 4 © Nanoradio 2010 Confidential Nanoradio - Other Applications Selected by World’s largest Camera ODM for Wi-Fi products Major SIM card Top headset player selected brand, launching NRX600 for SIM + World’s first Wi-Fi Wi-Fi cards headset China’s largest Close cooperation SD-card player with a leading selected NRX600 video chip for Flash + Wi-Fi provider cards WiFi partner by China’s largest application processor suppliers. -

Samsung Electronics Co., Ltd. and Its Subsidiaries NOTES

Samsung Electronics Co., Ltd. and its Subsidiaries NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS 1. General Information 1.1 Company Overview Samsung Electronics Co., Ltd. (“SEC”) was incorporated under the laws of the Republic of Korea in 1969 and listed its shares on the Korea Stock Exchange in 1975. SEC and its subsidiaries (collectively referred to as the “Company”) operate four business divisions: Consumer Electronics (“CE”), Information technology & Mobile communications (“IM”), Device Solutions (“DS”) and Harman. The CE division includes digital TVs, monitors, air conditioners and refrigerators and the IM division includes mobile phones, communication systems, and computers. The DS division includes products such as Memory, Foundry and System LSI in the semiconductor business (“Semiconductor”), and LCD and OLED panels in the display business (“DP”). The Harman division includes connected car systems, audio and visual products, enterprise automation solutions and connected services. The Company is domiciled in the Republic of Korea and the address of its registered office is Suwon, the Republic of Korea. These interim consolidated financial statements have been prepared in accordance with Korean International Financial Reporting Standards (“Korean IFRS”) 1110, Consolidated Financial Statements. SEC, as the controlling company, consolidates its 252 subsidiaries including Samsung Display and Samsung Electronics America. The Company also applies the equity method of accounting for its 46 associates and joint ventures, including -

Cafeteria Services VISION

No. 1 food supply distributor IR Material(2012) 0 Vision & Holding Structure Summary The SYSCO of Asia, No.1 domestic food supply distributor and leader in the paradigm shift of cafeteria services VISION To become the sole leader in the domestic food supply distribution market in terms of scale and capability, and become the Sysco of Asia through globalization "2016 sales of W5tn, OP W150bn" History Holding Structure . 1988, established Samil Agriculture Fishery(material processing) . 1996, transferred to CJ CJ affiliation Other . 10,798,900 outstanding shares . 1999, began food supply distrubution . Market cap W270bn ITC + corporate (Dec 31, 2011 standard) . 2001, listed on Kosdaq 11.1% . 2007, received first HACCP for hospital catering . 2009, selected as hygiene inspection institution by KFDA . 2010, opened largest domestic distribution center (Icheon) Treasury shares 7.3% 1 Business Structure(Food supply distribution) Overview Leading the food supply distribution market with its simplified process via direct-sourcing from the producer and thorough health control, No.1 domestic food supply distributor with the best SCM and products in the industry CJ Agency Freshway (wholesale) Dining • 317 Sales personnel Maker • 109 MD personnel Cafeteria Affiliates • 20,000+ SKU Producer/ • 9 distribution centers Food Global • 39 food safety center processing personnel Dining Cafeteria Food processing • SamCheongGak • STX Catering • CJ Foodvill • Pizza Hut • Kuksundang • CJ CJ • Pho Mein • Harim • Saempyo • Beer Cabin • Dongyang Magic • Samlip Foods • Bon Juk 2 Business Structure(Cafeteria) Overview Secured various clients in businesses, hospitals, colleges with endless R&D for tastier and healthier food CJ Freshway Business/ Public Menu development & Hygiene & safety Customer satisfaction cooking Hospitals . -

THE NEXT PHASE the NEXT PHASE Samsung Annual Report 2003

Samsung Annual Report 2003 THE NEXT PHASE THE NEXT PHASE Samsung Annual Report 2003 THE NEXT PHASE MOTIVATION To understand where we’re going, it helps to take a look at what’s driving us there. 9 COLLABORATION Successful companies no longer always go it alone. 23 EXPECTATION Customers are all about expectations. 35 DEMONSTRATION It is important to demonstrate that our standards, values and goals are indeed real. 44 COMPUTATION 61 All Samsung products and services mentioned in this publication are the property of Samsung. ORGANIZATION Published by Samsung in coordination with Cheil Communications Inc. The power of Samsung as a brand is tied Printed by Samsung Moonwha Printing Co., Seoul, Korea to the strength of its organizations. Written by Denis Jakuc 65 Principal Photography by Ashton Worthington Created by The Corporate Agenda: www.corporateagenda.com TEN YEARS AGO, Samsung launched its New Management initiative, with the ultimate goal of becoming one of the world’s premier companies. 1993 June Samsung adopts New Management initiative 1994 1995 1996 February January January January July Chairman Kun-Hee Lee holds Japanese headquarters opens Samsung opens headquarters Samsung Electronics begins Samsung Everland opens Carribean electronics products comparison in USA, Europe and China mass production of 64Mb DRAMs Bay, world’s first indoor and outdoor and evaluation conference July water park in Los Angeles, California, USA Samsung Corporation is the February March first Korean company to reach Samsung Electronics completes Samsung Electronics -

Global Attractions Attendance Report COVER: © Disneyland at Disneyland Resort®, Anaheim, CA, U.S

2015 2015 Global Attractions Attendance Report COVER: © Disneyland at Disneyland Resort®, Anaheim, CA, U.S. CREDITS TEA/AECOM 2015 Theme Index and Museum Index: The Global Attractions Attendance Report Publisher: Themed Entertainment Association (TEA) Research: Economics practice at AECOM Editor: Judith Rubin Publication team: Tsz Yin (Gigi) Au, Beth Chang, Linda Cheu, Bethanie Finney, Kathleen LaClair, Jodie Lock, Sarah Linford, Erik Miller, Jennie Nevin, Margreet Papamichael, Jeff Pincus, John Robinett, Judith Rubin, Brian Sands, Will Selby, Matt Timmins, Feliz Ventura, Chris Yoshii ©2016 TEA/AECOM. All rights reserved. CONTACTS For further information about the contents of this report and about the Economics practice at AECOM, contact the following: John Robinett Chris Yoshii Senior Vice President, Americas Vice President, Asia-Pacific [email protected] [email protected] T +1 213 593 8785 T +852 3922 9000 Brian Sands, AICP Margreet Papamichael Vice President, Americas Director, EMEA [email protected] [email protected] T +1 202 821 7281 T +44 20 3009 2283 Linda Cheu aecom.com/economics Vice President, Americas [email protected] T +1 415 955 2928 For information about TEA (Themed Entertainment Association): Judith Rubin Jennie Nevin TEA Publications, PR & Social Media TEA Chief Operating Officer [email protected] [email protected] T +1 314 853 5210 T +1 818 843 8497 teaconnect.org 2015 2015 The definitive annual attendance study for the themed entertainment and museum industries. Published by the Themed Entertainment Association (TEA) and the Economics practice at AECOM. Global Attractions Attendance Report 3 CONTENTS THE BIG PICTURE 6 2015 THEME INDEX 22 The Americas 22 Asia-Pacific 42 Europe, Middle East and Africa (EMEA) 52 © Aquaventure Water Park, Dubai, U.A.E. -

Interim Business Report for the Quarter Ended September 30, 2014

SAMSUNG ELECTRONICS Co., Ltd. Interim Business Report For the quarter ended September 30, 2014 Note about forward-looking statements Certain statements in the document, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our financial reports available on our website. Samsung Electronics 2014 Interim Business Report 1 / 152 Table of Contents Certification ........................................................................................................................................................................... 3 I. Corporate Overview .................................................................................................................................................... 4 II. Businesses Overview ................................................................................................................................................ 20 III. Management Discussion and Analysis ...................................................................................................................