FIMA Daily Insight

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE January 8, 2013 Stocks on ZSE traded higher today. CROBEX increased 0.24% to ZSE STOCK MARKET 1,808.40 pts while blue chip CROBEX10 gained 0.21% to 1,010.86 pts. CROBEX Last 1.808,4 Regular stock turnover amounted to HRK 14.4 million. % daily 0,24% Integrated telecom HT (HTRA CZ) topped the liquidity board collecting % YTD 3,91% HRK 4.3 million in turnover. The price increased 0.9% to HRK 210.70. CROBEX10 last 1010,9 Fertilizers producer Petrokemija (PTKMRA CZ) also came to focus again % daily 0,21% with HRK 1.5 million in turnover while price gained 5.5% to HRK 240.0. % YTD 4,05% Petrokemija was in investors’ focus few months ago, after speculations on Government selling its share of 1.7 million shares (50.6% of capital). Stock Turnov er (HRK m) 14,37 A few days ago Mladen Pejnović, head of the State Office for State Total MCAP (HRK bn) 194,39 Property Management confirmed government’s plans to privatize Source: w w w .zse.hr Petrokemija. Auto-parts producer AD Plastik (ADPLRA CZ) came to focus trading in -4,0% -2,0% 0,0% 2,0% 4,0% 6,0% blocks. The price advanced 1% to HRK 115.99 on HRK 1.3 million in PTKM-R-A ATPL-R-A turnover. AD Plastik currently trades at P/E=7.7, P/S=0.7 and DDJH-R-A P/Bv=0.7. VPIK-R-A LKPC-R-A Tobacco and tourism Adris group preferred share (ADRSPA CZ) was VIRO-R-A KORF-R-A also in investors’ focus with HRK 0.7 million in turnover while price KNZM-R-A slipped 1.3% to HRK 262.20. -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE March 16, 2012 Croatian equities recorded an upward movement today; CROBEX ZSE STOCK MARKET gained 0.74% to 1,844.03 pts while blue chip CROBEX10 accelerated CROBEX Last 1.844,0 0.41% to 1,008.60 pts. Total turnover of the day reached HRK 30.4 % daily 0,74% million. % YTD 5,97% Integrated telecom operator HT (HTRA CZ) topped the liquidity board CROBEX10 last 1008,6 as usual with HRK 5.6 million in turnover and increasing 0.49% to HRK % daily 0,41% 216.05. % YTD 3,32% Construction engineering company Ingra (INGRRA CZ) followed Stock Turnov er (HRK m) 30,44 collecting HRK 2.3 million in turnover and advancing 2.9% to HRK 8.40. Total MCAP (HRK bn) 187,00 Frozen foods producer Ledo (LEDORA CZ) came to focus with HRK 2.1 Source: w w w .zse.hr million in turnover while price accelerated 2.33% to HRK 6,049.97. Other companies from Agrokor concern were among better performers today. Agricultural producer Vupik (VPIKRA CZ) and kiosk chain Tisak -10,0% -5,0% 0,0% 5,0% 10,0% 15,0% 20,0% (TISKRA CZ) increased 4.59% and 4.53%, respectively, largest RIVP-R-A domestic retail chain Konzum (KNZMRA CZ) accelerated 5.76% to HRK DLKV-R-A KNZM-R-A 165.99 while food producer Belje (BLJERA CZ) declined 1.98% to HRK LKRI-R-A 89.20. ATPL-R-A INGR-R-A Heavy constructor Viadukt (VDKTRA CZ) rocketed 30.32% to HRK 245 THNK-R-A DDJH-R-A after company informed investors about new contract signed in total PTKM-R-A worth HRK 516 million, related to construction of Zagreb airport. -

Raiffeisen Weekly Report, Nr. 38/2017

Raiffeisen Weekly Report Number 38 October 16th, 2017 Leaning on exports, the economy is growing Number of overnights stays On Tuesday the national statistical office delivered tourism figures for August (Jan – Aug) which showed expected growth of tourist arrivals and overnight stays (6.1%yoy 80 and 5.4%yoy respectively). The share of foreign tourists in the overnight stays 70 amounted 94.4%. Cumulatively, during the first eight months, the number of over- night stays was 72.5 million (+11.8% more than in the same period last year). 60 For the whole 2016 total number of overnight stays stood at 77.8mn. It is very mn 50 certain that, with data for September, this year will officially be a new record 40 tourist season. Although the strength of tourism helped Croatia remain on the 30 path of 3%yoy real growth, it also increased the sensitivity to potential downturns in tourism. As long as Croatia is perceived as a safe destination, it will retain its 20 attractive destination status. Under such circumstances, the budget picture will 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 look more favourable due to the stronger revenue inflow, especially VAT. Sources: CBS, Economic RESEARCH/RBA On the other side foreign trade activities in terms of import and export of goods remained subdued although the latest data pointed to a slight rise. In the period CPI, PPI, yoy from January to July, foreign trade deficit widened to EUR 4.9bn (+9.3%yoy). In 4 the same period, exports growth at 15.7%yoy compared to imports growth of 2 13.2%yoy resulted in coverage of imports by exports at 61.7% (+1.4pp). -

Market Commentary Portfolio Performance Vs Benchmark

Feb. FKHR1 Monthly Fund Update 2016 Market Commentary Following the publication of Q4 results, the share price jumped by 7.06% in one day. Viadukt operated with a net profit of HRK 3.2m in After a tumultuous start of the year, February brought on a reversal 2015, but this is still 36% less profit compared to the previous year. of trends in most of our largest holdings. This is in line with the rest Revenue fell by 9.1%, which is the consequence of an overall of European and global markets, which reached a bottom in mid- reduction in total investment in the Republic of Croatia, from which February, only to recover by the end of the month. The Croatian Viadukt achieves 99% of its total revenue. However, the growth in market started this recovery even sooner, having reached its lowest share price after the announcement of financial results might have point during January. However during February, the benchmark been due to the optimistic expectations for the rest of the year. The CROBEX index stayed mostly at the same level from the start of the construction industry expects a slight recovery and increased month, with only slight fluctuations. In the meantime, our fund investment from contracting authorities. managed to achieve a return of almost 4% MoM, beating the A third position that we want to emphasize is Đuro Đaković Holding market by a large margin. (ĐĐ). After having an amazing January, on the 15th and 19th of The most important contributor was our largest holding, the Adris February it was announced that Đuro Đaković signed contracts with Group, with common stock growing by over 10%. -

Pregled Podataka O Planovima Gospodarenja Otpadom

PREGLED PODATAKA O PLANOVIMA GOSPODARENJA OTPADOM SVIBANJ 2011. Pregled podataka o planovima gospodarenja otpadom Zagreb, svibanj 2011. PREGLED PODATAKA O PLANOVIMA GOSPODARENJA OTPADOM Svibanj 2011. Pregled podataka o planovima gospodarenja otpadom Zagreb, svibanj 2011. SADRFAJ SAFETAK. ................................................................................................................... .- 2 - I UVOD. .......................................................................................................................... .- 3 - 1.1. PLAN GOSPODARENJA OTPADOM – PRAVNA OSNOVA ........................................................................... 4 1.1.1. PLANOVI FUPANIJA, GRADOVA I OPĆINA .................................................................................................... 4 1.1.2.PLANOVI PROIZVOĐAČA OTPADA ................................................................................................................ 5 II PLANOVI I IZVJEEĆA O PROVEDBI/IZVREENJU PLANOVA FUPANIJA, GRADOVA I OPĆINA. .................................................................................................. .- 6 - 2.1. PREGLED BROJA FUPANIJA, GRADOVA I OPĆINA KOJE SU IZRADILI PLAN GOSPODARENJA OTPADOM I IZVJEEĆE O PROVEDBI/IZVREENJU PLANA GOSPODARENJA OTPADOM .................... 6 III PLANOVI PROIZVOĐAČA I/ILI POSJEDNIKA OTPADA. ........................................ .- 9 - 3.1. PREGLED BROJA PRAVNIH SUBJEKATA/TVRTKI KOJI SU IZRADILI PLAN GOSPODARENJA OTPADOM U RH ................................................................................................................................................. -

Quarterly Financial Report I-Xii 2016

QUARTERLY FINANCIAL REPORT I-XII 2016 QUARTERLY FINANCIAL REPORT OF THE GROUP ĐURO ĐAKOVIĆ AND COMPANY ĐURO ĐAKOVIĆ GROUP PLC. I - XII 2016 QUARTERLY FINANCIAL REPORT OF THE GROUP ĐURO ĐAKOVIĆ AND COMPANY ĐURO ĐAKOVIĆ GROUP PLC. I - XII 2016 On behalf of the Management Board Tomislav Mazal, President of the Management Board Marko Bogdanović Member of the Management Board In Slavonski Brod, 30 January 2017 2 QUARTERLY FINANCIAL REPORT I-XII 2016 Construction of the biomass cogeneration plant BE-TO Sisak Foto: HEP d.d. 3 Content I MANAGEMENT REPORT 4 1. Introduction 8 1.1. General information about the Company and the Group 8 1.2. Management 9 1.3. Supervisory Committee 9 1.4. Share capital and ownership structure of Đuro Đaković Group Plc. 9 2. Description of products and services 12 2.1. Defence 12 2.2. Transport 12 2.3. Industry and Energetics 12 3. Operation of group Đuro Đaković January-December 2016 14 4. Significant events in the 4th quarter 2016 17 5. Significant events following the end of the 4th quarter 18 6. Share 19 7. Expectations in 2017 20 8. Other matters 22 8.1. Product and production development 22 8.2. Exposure to risks and risk management 22 8.3. Human resources 22 8.4. Quality, environment, health and safety, energy 22 4 QUARTERLY FINANCIAL REPORT I-XII 2016 Construction of crude oil storage tanks II ANALYSIS OF OPERATING RESULTS OF 24 ĐURO ĐAKOVIĆ GROUP Plc. AND MEMBERS OF GROUP ĐĐ 1. Key indicators 28 2. Revenue structure 31 3. Cash flow 33 4. -

FIMA Daily Insight

CROATIA | SLOVENIA | ROMANIA | BULGARIA FIMA Daily Insight June 19, 2017 CROATIA BENCHMARKS DAILY CHANGES % Croatian equities closed higher on Friday with both indices increasing; CROBEX increased 0.11% to 0,73% 1,857.87 pts and blue chip CROBEX 10 increased 0.10% to 1,107.93 pts. Regular stock turnover amounted to HRK 4.86 million. (Positive) Croatian oil and gas company INA (INARA CZ) topped the liquidity board collecting HRK 3.2 million in 0,21% turnover and its price decreased 0.78% to HRK 3,175.00. 0,11% Adris’ (ADRSRA CZ) insurance company Croatia osiguranje (CROSRA CZ) finished with restructuring process and stopped negative trends. In the period Jan-Apr, Croatia osiguranje increased net profit by 61% yoy. For 2017, Management board expects GWP to increase by 4% yoy and net profit to reach HRK 226 mln. Insurance market in Croatia has been showing improvements, therefore in May, insurance -0,25% companies recorded total gross premiums in the amount of HRK 4.14 bln, which was an increase of CROBEX SBI BET SOFIX 2.24% yoy. Non life insurance premiums grew by 2.93% yoy to HRK 2.85 bln, while life insurance premiums increased by 0.75% to HRK 1.28% yoy. (Positive) BENCHMARKS 3Y CHARTS This year Podravka (PODRRA CZ) marked again a great success on international quality evaluation and received 18 Superior Taste Awards, the most distinguished world award in food segment. All the 140 products that were being evaluated, were rewarded, which is Podravka's greatest success since it started participating on this competition and confirmation of excellence in the categories in which they 120 have been competing. -

FIMA Daily Insight

FIMA Daily Insight Wednesday, March 18, 2015 Croatia Croatian equities closed lower yesterday with both indices decreasing; CROBEX decreased 0.35% to 1,745.30 pts and blue chip CROBEX 10 declined 0.52% to 1,012.93 pts. Regular ZAGREB STOCK EXCHANGE stock turnover amounted to HRK 6.05 million. (Negative) CROBEX Last 1.745,30 Integrated telecom operator HT (HTRA CZ) topped the liquidity board collecting HRK 1.6 million daily -0,35 in turnover and its price decreased 0.43% to HRK 162.80. YTD -0,01% According to the article published in today´s newspaper Poslovni dnevnik, Podravka CROBEX10 Last 1.012,93 (ZSE:PODR-R-A) is considering share capital increase in the amount EUR 100 mln. The aim of daily -0,52 the share capital increase is to collect funds for new investments; for the acquisition of Zito and for the construction of new Belupo facilities. Podravka said yesterday that formal decision YTD 0,57% on share capital increase is not yet made. According to the media, share capital increase Stock Turnover (EUR m) 0,79 should be complete by the end of the July this year. Share capital increase will be carried out MkCap(%of GDP) 56,91% through Zagreb Stock Exchange and Warsaw Stock Exchange. Podravka will issue new shares and the nominal price will be probably HRK 200 per share. (Positive) Source:www.zse.hr Croatian builder Viadukt [ZSE:VDKT-R-A] said on Tuesday it has signed a EUR 15.7 mln road construction contract with state-owned motorway operator Hrvatske Autoceste (HAC). -

Stoxx® All Europe Total Market Index

TOTAL MARKET INDICES 1 STOXX® ALL EUROPE TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX All Europe Total Market Index 13,768.8 10,453.0 7.2 1.7 250.9 0.0 2.4 0.0 3.0 STOXX Global Total Market Index 54,569.6 44,271.7 6.1 1.3 618.0 0.0 1.4 0.0 3.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX All Europe Total Market Index 0.3 2.0 18.1 43.3 55.0 3.8 3.0 17.7 12.4 8.9 STOXX Global Total Market Index 2.3 7.7 21.7 49.4 78.4 30.7 11.5 21.2 13.9 11.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX All Europe Total Market Index 11.0 11.2 11.6 19.9 21.1 -1.0 0.3 1.3 0.6 0.4 STOXX Global Total Market Index 8.2 7.9 8.1 12.8 22.5 1.1 1.4 2.3 1.0 0.5 Index to benchmark Correlation Tracking error (%) STOXX All Europe Total Market Index 0.9 0.9 0.9 0.9 0.9 5.8 6.1 6.3 10.0 10.2 Index to benchmark Beta Annualized information ratio STOXX All Europe Total Market Index 1.2 1.2 1.2 1.4 1.3 -3.5 -1.3 -0.6 -0.0 -0.2 1 For information on data calculation, please refer to STOXX calculation reference guide. -

FIMA Daily Insight

FIMA Daily Insight Monday, December 14, 2015 Croatia Croatian equities closed lower yesterday with both indices decreasing; CROBEX decreased 0.8% to 1,659.99 pts and blue chip CROBEX 10 declined 1.04% to 984.97 pts. Regular stock turnover ZAGREB STOCK EXCHANGE amounted to HRK 9.00 million. (Negative) CROBEX Last 1.659,99 Tourism company Valamar Riviera (RIVPRA CZ) topped the liquidity board collecting HRK 1.6 million in daily -0,80% turnover and its price increased 0.25% to HRK 23.66. YTD -4,90% Croatian diversified conglomerate Djuro Djakovic Holding (ZSE: DDJH-R-A) said one of its units has CROBEX10 Last 984,97 signed as part of a consortium a contract for part of the works on a bridge linking the Adriatic island of daily -1,04% Ciovo with the mainland. The HRK 11.83 mln agreement was signed by a consortium of Djuro Djakovic YTD -2,20% Industrijska Rjesenja and local builder Viadukt. (Positive) Stock Turnover (EUR m) 1,11 Croatia's state asset management office, DUUDI extended the deadline for filing expressions of interest by Feb 8, 2016 in a project for the redevelopment into a tourist complex of the former MUZIL MkCap(%of GDP) 56,91% military site, nears the Adriatic town of Pula. (Neutral) Source:www.zse.hr Croatian shipping company Jadroplov (ZSE: JDPL-R-A) terminated agreements with local shipyard 3. Maj Brodogradiliste (ZSE: 3MAJ-R-A) for the construction of vessels. The contracts were terminated on December 7. (Negative) LJUBLJANA STOCK EXCHANGE SBI TOP Last 682,93 The number of issued building permits in October decreased 2% compared to October 2014, according to data provided by the Croatian national statistical office (DZS). -

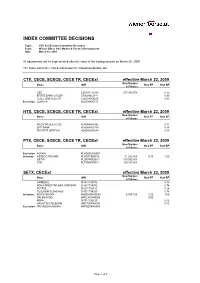

CEE CIS Committee Decision

INDEX COMMITTEE DECISIONS Topic: CEE & CIS Index Committee Decisions From: Wiener Börse AG / Market & Product Development Date: March 18, 2009 All adjustments will be implemented after the close of the trading session on March 20, 2009 The Index Committee has decided upon the following adjustments: CTX, CECE, SCECE, CECE TR, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares CEZ CZ0005112300 537.989.759 0,32 ERSTE BANK GROUP AT0000652011 0,90 TELEFONICA O2 CR CZ0009093209 0,97 Exclusion ZENTIVA NL0000405173 HTX, CECE, SCECE, CECE TR, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares MAGYAR OLAJ GAZI HU0000068952 0,71 OTP BANK HU0000061726 0,95 RICHTER GEDEON HU0000067624 0,95 PTX, CECE, SCECE, CECE TR, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares Exclusion AGORA PLAGORA00067 Inclusion ASSECO POLAND PLSOFTB00016 71.292.980 0,75 1,00 GETIN PLGSPR000014 710.930.354 TVN PLTVN0000017 169.159.984 SETX, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares GORENJE SI0031104076 0,78 NOVA KREDITNA BKA. MARIBOR SI0021104052 0,78 PETROL SI0031102153 0,78 TELEKOM SLOVENIJE SI0031104290 0,78 Inclusion ADRIS GRUPA HRADRSPA0009 6.784.100 1,00 1,00 DALEKOVOD HRDLKVRA0006 0,50 KRKA SI0031102120 0,42 HRVATSKI TELEKOM HRHT00RA0005 0,73 Exclusion PRIVREDNA BANKA HRPBZ0RA0004 Page 1 of 5 NTX effective March 23, 2009 New Number Name ISIN New FF New RF of Shares ANDRITZ AT0000730007 0,99 Exclusion BANCA TRANSILVANIA ROTLVAACNOR1 ERSTE GROUP BANK AT0000652011 0,99 OMV AG AT0000743059 0,99 RAIFFEISEN INTERNATIONAL AT0000606306 0,99 Exclusion CENTRAL EUROP. -

CROBEX® and Crobextr® CROBEX10® and Crobex10tr

September 8th, 2020 CROBEX® and CROBEXtr® ISIN Trading Issuer Free float Number of Weighting code factor listed shares factor 1 HRADPLRA0006 ADPL AD PLASTIK d.d. 70% 4.199.584 1,00000000 2 HRADRSPA0009 ADRS2 ADRIS GRUPA d.d. 95% 6.784.100 0,36528752 3 HRARNTRA0004 ARNT Arena Hospitality Group dd 50% 5.128.721 1,00000000 4 HRATGRRA0003 ATGR ATLANTIC GRUPA d.d. 45% 3.334.300 0,48953990 5 HRATPLRA0008 ATPL ATLANTSKA PLOVIDBA d.d. 85% 1.395.520 1,00000000 6 HRDDJHRA0007 DDJH ĐURO ĐAKOVIC GRUPA d.d. 50% 10.153.230 1,00000000 7 HRDLKVRA0006 DLKV Dalekovod, d.d. 40% 24.719.305 1,00000000 8 HRERNTRA0000 ERNT ERICSSON NIKOLA TESLA d.d. 55% 1.331.650 0,98709462 9 HRHT00RA0005 HT HT d.d. 45% 80.766.229 0,15037086 10 HRIGH0RA0006 IGH INSTITUT IGH d.d. 50% 613.709 1,00000000 11 HRINGRRA0001 INGR INGRA d.d. 95% 13.545.200 1,00000000 12 HRKOEIRA0009 KOEI KONČAR d.d. 100% 2.572.119 0,59493974 13 HRKRASRA0008 KRAS KRAŠ d.d. 12% 1.498.621 1,00000000 14 HROPTERA0001 OPTE OT-OPTIMA TELEKOM d.d. 40% 69.443.264 1,00000000 15 HRPODRRA0004 PODR PODRAVKA d.d. 85% 7.120.003 0,35950401 16 HRRIVPRA0000 RIVP Valamar Riviera d.d. 55% 126.027.542 0,55422898 17 HRSAPNRA0007 SAPN Saponia d.d. 13% 658.564 1,00000000 18 HRTPNGRA0000 TPNG TANKERSKA NEXT GENERATION 50% 8.733.345 1,00000000 19 HRZABARA0009 ZABA Zagrebačka banka d.d. 4% 320.241.955 1,00000000 CROBEX10® and CROBEX10tr® ISIN Trading Issuer Free float Number of Weighting code factor listed shares factor 1 HRADPLRA0006 ADPL AD PLASTIK d.d.