Tender Documents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Water Supply Flow Diagram Catalogue

WATER SUPPLY FLOW DIAGRAM CATALOGUE Municipalities of Gujarat V02, 2012-13 URBAN MANAGEMENT CENTRE III Floor, AUDA Building, Usmanpura Ashram Road, Ahmedabad, Gujarat Tel: 079 27546403 Email: [email protected] ; www.umcasia.org Urban Management Centre (UMC) Performance Assessment System (PAS) The Urban Management Centre (UMC) is a not-for-profit PAS, a five-year action research project, has been organization based in Ahmedabad, Gujarat, working initiated by CEPT University with funding from the Bill towards professionalizing urban management in India and and Melinda Gates Foundation. PAS aims to develop South Asia. UMC provides technical assistance and better information on water and sanitation support to Indian state local government associations and performance at the local level to be used to improve implements programs that work towards improvement in the financial viability, quality and reliability of services. cities by partnering with city governments. It will use performance indicators and benchmarks on UMC builds and enhances the capacity of city water and sanitation services in all the 400-plus urban governments by providing much-needed expertise and areas of Gujarat and Maharashtra. UMC and the All ready access to innovations on good governance India Institute of Local Self Governance are CEPT’s implemented in India and abroad. UMC is a legacy project partners in Gujarat and Maharashtra, organization of International City/County Management respectively. Association (ICMA) and hence is also known as ICMA- South Asia. More details are available on www.pas.org.in. www.umcasia.org ABOUT THIS CATALOGUE This catalogue displays graphical flow diagrams of water supply network of 159 municipalities of Gujarat. -

One Time ODF+ & ODF++ Updated.Xlsx

ODF++ Certified: 958 State Number of ULB Certified Andaman and Nicobar 1 Andhra Pradesh 7 Chandigarh 1 Chhattisgarh 169 Delhi 3 Gujarat 111 Haryana 14 Himachal Pradesh 2 Jharkhand 3 Karnataka 2 Madhya Pradesh 296 Maharashtra 213 Odisha 21 Punjab 66 Rajasthan 6 Telangana 9 Uttar Pradesh 31 Uttarakhand 3 Grand Total 958 ULB Census Code State District ULB 804041 Andaman and Nicobar South Andaman Port Blair 802947 Andhra Pradesh Visakhapatnam Greater Visakhapatnam 802969 Andhra Pradesh Krishna Vijaywada 803014 Andhra Pradesh Chittoor Tirupati 802988 Andhra Pradesh Prakasam Ongole 802982 Andhra Pradesh Guntur Tenali 802940 Andhra Pradesh Srikakulam Rajam 802952 Andhra Pradesh East Godavari Rajahmundry 800286 Chandigarh Chandigarh Chandigarh 801911 Chhattisgarh Koria Baikunthpur_C 801912 Chhattisgarh Koria Manendergarh 801913 Chhattisgarh Koria Khongapani 801914 Chhattisgarh Koria Jhagrakhand 801915 Chhattisgarh Koria Nai ledri 801916 Chhattisgarh Koria Chirimiri 801918 Chhattisgarh Balrampur Balrampur_C 801919 Chhattisgarh Balrampur Wadrafnagar 801921 Chhattisgarh Surajpur Jarhi 801922 Chhattisgarh Balrampur Kusmi 801926 Chhattisgarh Surajpur Premnagar 801927 Chhattisgarh Sarguja Ambikapur 801928 Chhattisgarh Kathua Lakhanpur_C 801929 Chhattisgarh Balrampur Rajpur_C 801930 Chhattisgarh Sarguja Sitapur_CH 801932 Chhattisgarh JashpurNagar Jashpur 801934 Chhattisgarh JashpurNagar Kotba 801936 Chhattisgarh Raigarh Lailunga 801937 Chhattisgarh Raigarh Gharghora 801939 Chhattisgarh Raigarh Raigarh 801941 Chhattisgarh Raigarh Kharsia 801944 Chhattisgarh -

List of Kaushalya Vardhan Kendra with Attach ITI

List of Kaushalya Vardhan Kendra with attach ITI No. District Taluka Name of KVK Attached ITI 1 Ahmedabad Ahmedabad City Ghatlodiya (P.H) Kubernagar 2 Ahmedabad Ahmedabad City Vastrapur (P.H) Saraspur 3 Ahmedabad Bavala Bagodara Bavala 4 Ahmedabad Bavala Durgi Bavala 5 Ahmedabad Bavala Kavitha Bavala 6 Ahmedabad Bavala Shiyal Bavala 7 Ahmedabad Daskroi Bareja Saraspur 8 Ahmedabad Daskroi Bopal (Godhavi) Sarkhej 9 Ahmedabad Daskroi Kuha Maninagr 10 Ahmedabad Detroj DetrojRampura Rampura Detroj DetrojRampura 11 Ahmedabad Dhandhuka Rojka Dhandhuka 12 Ahmedabad Dholka Badarkha Dholka 13 Ahmedabad Dholka Koth Thaltej (Women) 14 Ahmedabad Mandal Trent Mandal 15 Ahmedabad Sanad Mankol Sanad 16 Ahmedabad Sanad Virochannagar Sanad 17 Ahmedabad Viramgam Shahpur Viramgam 18 Aravali Bayad Ambaliyara Bayad 19 Aravali Bayad Demai Bayad 20 Aravali Bhiloda Kishan gadh Bhiloda 21 Aravali Bhiloda Torada Bhiloda 22 Aravali Dhansura Akrund vadagam 23 Aravali Malpur Aniyor Malpur 24 Aravali Malpur Ubharan Malpur 25 Aravali Meghraj Panchal Meghraj 1 No. District Taluka Name of KVK Attached ITI 26 Aravali Modasa Limbhoi Modasa 27 Aravali Modasa Sardoi Modasa 28 Banaskantha Amirgadh Iqbalgadh Amirgadh 29 Banaskantha Amirgadh virampur Amirgadh 30 Banaskantha Bhabhar Kuvala Bhabhar 31 Banaskantha Bhabhar Mitha Bhabhar 32 Banaskantha Danta Danta Kumbhariya 33 Banaskantha Danta Hadad Kumbhariya 34 Banaskantha Danta Navavas Kumbhariya 35 Banaskantha Dantiwada Panthawada Dantiwada 36 Banaskantha Deesa Agthala Deesa 37 Banaskantha Deesa Bhadath Deesa 38 Banaskantha -

Detials of Working Kaushalya Vardhan Kendra Sr.No

Detials of Working Kaushalya Vardhan Kendra Sr.No. Name of Region District Taluka Name of KVK Name of Attached ITI 1 AHMEDABAD AHMEDABAD DHOLKA GANGAD DHOLKA 2 AHMEDABAD AHMEDABAD DHOLKA KOTH DHOLKA 3 AHMEDABAD AHMEDABAD MANDAL TRENT MANDAL 4 AHMEDABAD AHMEDABAD A'BAD CITY BAPUNAGAR MANINAGAR 5 AHMEDABAD AHMEDABAD DASCROI BAREJA SARASPUR 6 AHMEDABAD AHMEDABAD A'BAD CITY VASTRAPUR(PH) SARASPUR 7 AHMEDABAD AHMEDABAD DHOLKA BADARKHA THALTEJ(M) 8 AHMEDABAD ARAVALLI BAYAD AMBALIYARA BAYAD 9 AHMEDABAD ARAVALLI BAYAD DEMAI BAYAD 10 AHMEDABAD ARAVALLI BHILODA KISHANGADH BHILODA 11 AHMEDABAD ARAVALLI BHILODA SHAMLAJI KUTIR BHILODA 12 AHMEDABAD ARAVALLI MODASA MUSLIM GHANCHI SAMAJ MODASA 13 AHMEDABAD ARAVALLI DHANSURA AKRUND DHANSURA 14 AHMEDABAD ARAVALLI MALPUR ANIYOR MALPUR 15 AHMEDABAD ARAVALLI MALPUR UBHRAN MALPUR 16 AHMEDABAD ARAVALLI MEGHARJ PANCHAL MEGHRAJ 17 AHMEDABAD ARAVALLI MODASA LIMBHOI MODASA 18 AHMEDABAD ARAVALLI MODASA TINTOI MODASA 19 AHMEDABAD BANASKANTHA AMIRGADH VIRAMPUR AMIRGADH 20 AHMEDABAD BANASKANTHA BHABHAR KUVALA BHABHAR 21 AHMEDABAD BANASKANTHA BHABHAR MITHA BHABHAR 22 AHMEDABAD BANASKANTHA KANKREJ THARA BHABHAR 23 AHMEDABAD BANASKANTHA DEESA ASEDA(LAKHANI) DEESA 24 AHMEDABAD BANASKANTHA DEESA BHILADI(MALAGADH) DEESA 25 AHMEDABAD BANASKANTHA DEESA JHERDA DEESA 26 AHMEDABAD BANASKANTHA DEODAR CHIBHADA DEODAR 27 AHMEDABAD BANASKANTHA DEODAR RANTILA DEODAR 28 AHMEDABAD BANASKANTHA KANKREJ KAMBOI HARIJ 29 AHMEDABAD BANASKANTHA DANTA HADAD KUMBHARIYA 30 AHMEDABAD BANASKANTHA DANTA NAVAVAS KUMBHARIYA 31 AHMEDABAD BANASKANTHA -

![Gujarat Databook, Part-1 [2012-13]](https://docslib.b-cdn.net/cover/0138/gujarat-databook-part-1-2012-13-2070138.webp)

Gujarat Databook, Part-1 [2012-13]

Annual Performance Assessment Report of Urban Water supply and Sanitation - Gujarat Databook, Part-1 [2012-13] CEPT University July 2014 DATABOOK PART - 1 State Profile Dhanera Tharad Palanpur Thara Radhanpur Idar Harij Rapar Mehsana Modasa Bhachau Bhuj Kadi Viramgam Gandhidham Maliyamiyana Jhalod Dhrangadhra Mandavi Dahod Dholka DevagadhBariya Dhrol Savri Halol Okha Chotila Sikka Dhandhuka Khambhat ChhotaUdaipur Rajkot Dwarka Khambhaliya Kalavad Baravala Dabhoi Karjan Jamraval Gondal Gadhda Rajpipla Upleta Jetpur Ankleshwar Visavadar Savarkundla Talaja Mahuva Tarsadi Jafrabad Kodinar Una Vapi Umargam About Tableau maps: www.tableausoftware.com/mapdata Overall Performance All Sectors State Level Aggregation of Indicator Values for 2012-13 Harij Gandhidham Mandavi Dhrol Chotila Dwarka Rajpipla Ankleshwar Tarsadi Kodinar About Tableau maps: www.tableausoftware.com/mapdata Umargam Water supply indicators Maximum Minimun Mean Median Mode Mean Count Coverage of water supply connections 100.0 0.0 73.0 74.5 75.9 165.0 Coverage of water supply connections in slums 100.0 0.0 53.1 59.9 0.0 143.0 Per capita available of water at consumer end 288.0 12.4 88.5 83.1 107.1 165.0 Extent of metering of water connections 2.7 0.0 0.0 0.0 0.0 166.0 Extent of Non Revenue Water 55.3 1.1 19.9 18.4 10.0 158.0 Continuity of water supply 9.0 0.1 1.3 1.0 1.0 165.0 Efficiency in redressal of customer complaints (WS) 100.0 39.4 92.5 98.2 100.0 165.0 Quality of water supplied 100.0 0.0 96.4 100.0 100.0 161.0 Cost recovery in water supply services 249.4 5.1 68.6 56.7 -

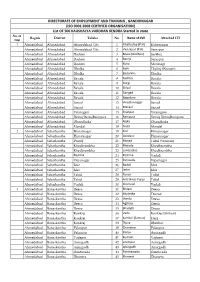

List of 500 KAUSHALYA VARDHAN KENDRA Started in State No

DIRECTORATE OF EMPLOYMENT AND TRAINING , GANDHINAGAR (ISO 9001:2008 CERTIFIED ORGANISATION) List OF 500 KAUSHALYA VARDHAN KENDRA Started in state No. of Region District Taluka No. Name of KVK Attached ITI Dist 1 Ahmedabad Ahmedabad Ahmedabad City 1 Ghatlodiya (P.H) Kubernagar Ahmedabad Ahmedabad Ahmedabad City 2 Vastrapur (P.H) Saraspur Ahmedabad Ahmedabad Daskroi 3 Bopal (Godhavi) Sarkhej Ahmedabad Ahmedabad Daskroi 4 Bareja Saraspur Ahmedabad Ahmedabad Daskroi 5 Kuha Maninagr Ahmedabad Ahmedabad Dholka 6 Koth Thaltej (Women) Ahmedabad Ahmedabad Dholka 7 Badarkha Dholka Ahmedabad Ahmedabad Bavala 8 Kavitha Bavala Ahmedabad Ahmedabad Bavala 9 Durgi Bavala Ahmedabad Ahmedabad Bavala 10 Shiyal Bavala Ahmedabad Ahmedabad Bavala 11 Gangad Bavala Ahmedabad Ahmedabad Bavala 12 Bagodara Bavala Ahmedabad Ahmedabad Sanad 13 Virochannagar Sanad Ahmedabad Ahmedabad Sanad 14 Mankol Sanad Ahmedabad Ahmedabad Viramgam 15 Shahpur Viramgam Ahmedabad Ahmedabad Detroj DetrojRampura 16 Rampura Detroj DetrojRampura Ahmedabad Ahmedabad Dhandhuka 17 Rojka Dhandhuka Ahmedabad Ahmedabad Mandal 18 Trent Mandal 2 Ahmedabad Sabarkantha Himatnagar 19 Illol Himatnagar Ahmedabad Sabarkantha Himatnagar 20 Akodara Himatnagar Ahmedabad Sabarkantha Prantij 21 Moyad Talod (Woman) Ahmedabad Sabarkantha Khedbrambha 22 Matoda Khedbrambha Ahmedabad Sabarkantha Khedbrambha 23 Lambadiya Khedbrambha Ahmedabad Sabarkantha Poshina 24 Poshina Vadali Ahmedabad Sabarkantha Vijaynagar 25 Parosada Vijaynagar Ahmedabad Sabarkantha Idar 26 Badoli Idar Ahmedabad Sabarkantha Idar 27 Jadar -

U Rba N Devro P Mer, )T'llltiln, O R R, N, De Pa Rtm E Nt Sachiva Lay Ga Ndh Inaga R .\ Dated

U rba n Devro p mer, )T'llltiln, o r r, n, De pa rtm e nt Sachiva lay Ga ndh inaga r .\ Dated: . +, . "lrft l119 ;UJARAi FIRE No: GH/V/ 28 of 2016/AGN /1.0/20j"683a6/v:- In exercise of the powers PRFVFNTION conferred by section 9 of the Gujarat Fire prevention and Life safety AND LIFE Mesaures Act, 2013 (Guj. 11 of 201,3), the Government of Gujarat hereby SAFETY divide the fire regions as specified in column (2) into fire division with their MEASURES headquarters as specified in colunrn (3) and (4) respectively of the scheduted ACT,2013 to this notification, .appended and defines the limits of such division as specified in column (5) of the said Schedule. SCHEDULE sr.No jNameofthe jwam@ liry!"S_s_qf,!be.f_Le*o!-o-r_s-ien_ fire region fire division of rhe I I I fire i Name of the (1) t Q) Ga ndhi nagar i. Ahmedabad Urban j Rhmedabad Development authoritv ii. Bareja Nagarpalika iii .Viramgam Nagarpalika iv. Dhandhuka Nagarp.alika v. Sanand Nagarpalika vi. Dholka Nagarpalika vii. Bavaia Nagarpalika viii. Bopal-Ghuma i. Gandhinagar Urban Gandhinagar Development authority ii. GIFT Urban Development a uth ority iii Dahegam Nagarpalika iv. Manasa Nagarpalika v. Pethapur Nagarpalika vi. Kalol Nagarpalika i. Thasara Nagarpalika ii. Chakalasi Nagarpalika iii Kanajari Nagarpalika iv. Mahudha Nagarpalika v. Kapadvanj Nagarpalika vi,Kheda Nagarpalika vii.Dakor Nagarpalika viii.Nadiadvr,r.rYoutcrtl NagarpalikattdE,dt pa I i j ix.Mhemdavad Nagarpalika x. Katha la I Xleaeq t i LI _l __.,[ ka Himatanagar |trm*r I i.ttimatanagar Urban Sabarkantha Development authority ii. -

ITI LIST.Xlsx

LIST OF GOVERNMENT/GRANT‐IN‐AID/SELF FINANCE ITI WITH ITI CODE IN GUJARAT STATE (ADMISSION‐2020) DISTRICT TALUKA ITI TYPE ITI NAME ITI CODE Ahmedabad Ahmadabad City Government Gota‐Ranip 173 Ahmedabad Ahmadabad City Government Kubernagar 101 Ahmedabad Ahmadabad City Government Mahila Iti Maninagar(Vastral) 171 Ahmedabad Ahmadabad City Government Maninagar 134 Ahmedabad Ahmadabad City Government Saraspur 109 Ahmedabad Ahmadabad City Grant In Aid Blind People Association ‐ Vastrapur 527 Ahmedabad Ahmadabad City Grant In Aid Deaf & Dumb ‐ Navrangpura 533 Ahmedabad Ahmadabad City Grant In Aid Nava Naroda 538 Ahmedabad Ahmadabad City Grant In Aid Physically Handicapped ‐ Gomtipur 550 Ahmedabad Ahmadabad City Grant In Aid Samarpan ‐ Motera 549 Ahmedabad Ahmadabad City Grant In Aid Shahibaug (Mahila) 518 Ahmedabad Ahmadabad City Grant In Aid Sola 524 Ahmedabad Ahmadabad City Self Finance Ahmedabad Cantonment Board 5211 Ahmedabad Ahmadabad City Self Finance Ashirvad Research Foundation 5257 Ahmedabad Ahmadabad City Self Finance B M Institute Of Mental Health 5250 Ahmedabad Ahmadabad City Self Finance City High School, Ahmedabad 5002 Ahmedabad Ahmadabad City Self Finance Computer Vasana, Ahmedabad 5089 Ahmedabad Ahmadabad City Self Finance Deaf & Dumb, Navrangpura 5010 Ahmedabad Ahmadabad City Self Finance Gujarat Vidyapith Sf‐ Shahibaug 5013 Ahmedabad Ahmadabad City Self Finance Hariom, Ahmedabad 5080 Ahmedabad Ahmadabad City Self Finance Indo German, Ahmedabad 5006 Ahmedabad Ahmadabad City Self Finance Medi Planet Manav Sanvedana, Maninagar -

Water Supply Flow Diagram Catalogue

WATER SUPPLY FLOW DIAGRAM CATALOGUE Municipalities of Gujarat V02, 2012-13 URBAN MANAGEMENT CENTRE III Floor, AUDA Building, Usmanpura Ashram Road, Ahmedabad, Gujarat Tel: 079 27546403 Email: [email protected] ; www.umcasia.org Urban Management Centre (UMC) Performance Assessment System (PAS) The Urban Management Centre (UMC) is a not-for-profit PAS, a five-year action research project, has been organization based in Ahmedabad, Gujarat, working initiated by CEPT University with funding from the Bill towards professionalizing urban management in India and and Melinda Gates Foundation. PAS aims to develop South Asia. UMC provides technical assistance and better information on water and sanitation support to Indian state local government associations and performance at the local level to be used to improve implements programs that work towards improvement in the financial viability, quality and reliability of services. cities by partnering with city governments. It will use performance indicators and benchmarks on UMC builds and enhances the capacity of city water and sanitation services in all the 400-plus urban governments by providing much-needed expertise and areas of Gujarat and Maharashtra. UMC and the All ready access to innovations on good governance India Institute of Local Self Governance are CEPT’s implemented in India and abroad. UMC is a legacy project partners in Gujarat and Maharashtra, organization of International City/County Management respectively. Association (ICMA) and hence is also known as ICMA- South Asia. More details are available on www.pas.org.in. www.umcasia.org ABOUT THIS CATALOGUE This catalogue displays graphical flow diagrams of water supply network of 159 municipalities of Gujarat. -

¼Khíkeþ Slkíkk Ãkkxeo

BHARATIYA JANATA PARTY – GUJARAT STATE ASSEMBLY ELECTION - 2017 MEMBER OF LEGISLATIVE ASSEMBLY OF 14TH GUJARAT ASSEMBLY - 2017 Assembly Seat Sr. Dist/City Details NAME & ADDRESS CONTACT NO. & EMAIL No. Name 1. Valsad 178 Dharampur Shri Arvindbhai Patel (Dhodiya) Mo. 9825143156 (ST) Dadri Faliyu, At. Po. Kakadkuva, [email protected] Ta. Dharmpur, Dist. Valsad 2. 179 Valsad Shri Bharatbhai Kikubhai Patel Ph : (02632) 248541 (R), 253388 (O) C/o. Anjani Enterprise, Mo. 9638335951 Shop No. 4, Shopping Centre No. 3, [email protected] Stadium Road, Valsad – 396 001 3. 180 Pardi Shri Kanubhai Mohanlal Desai Ph : (0260) 2400783 404/4, Sankalp Society, Gunjan Road, Mo. 9909994444 G.I.D.C. Vapi, [email protected] Ta. Pardi, Dist. Valsad 4. 182 Umargam (ST) Shri Ramanbhai Nanubhai Patkar Ph : (0260) 2585226 At. Po. Ghodipoda (Maroli), Mo. 9825108101 Ta. Umargam, Dist. Valsad [email protected] 5. Navsari 174 Jalalpore Shri Rameshbhai C. Patel (R.C.) Mo. 9978215151, 9978405924 Methiya Faliya, [email protected] At. Po. Aat, Ta. Jalalpore, Dist. Navsari - 396403 6. 175 Navsari Shri Piyushbhai Dinkarbhai Desai Ph : (02637) 258090 (R) C-2, Ambicanagar Society, Mo. 9428367444 Dargah Road, Lunsi Kui Road, [email protected] Navsari. 7. 176 Gandevi (ST) Shri Nareshbhai Maganbhai Patel Ph : (02634) 243616 Patel Faliya, Opp. Gram Panchayat, Mo. 9427129711, 9978263453 At. Po. Rumla, Ta. Chikhali, [email protected], Dist. Navsar [email protected] 8. Surat City 159 Surat East Shri Arvindbhai Shantilal Rana Mo. 9925011019 3/672-A. Navapura Karva Road, [email protected] Choksi Bazar, Surat. 9. 160 Surat North Shri Kantibhai H. Ballar (Patel) Mo. -

One Time ODF+ & ODF++ Updated.Xlsx

ODF++ Certified: 778 State Number of ULB Certified Andaman and Nicobar 1 Andhra Pradesh 4 Chandigarh 1 Chhattisgarh 168 Delhi 2 Gujarat 76 Haryana 14 Himachal Pradesh 1 Jharkhand 2 Karnataka 2 Madhya Pradesh 214 Maharashtra 183 Odisha 11 Punjab 59 Rajasthan 6 Telangana 6 Uttar Pradesh 26 Uttarakhand 2 Grand Total 778 ULB Census Code State District ULB 804041 Andaman and Nicobar South Andaman Port Blair 802947 Andhra Pradesh Visakhapatnam Greater Visakhapatnam 802969 Andhra Pradesh Krishna Vijaywada 803014 Andhra Pradesh Chittoor Tirupati 802988 Andhra Pradesh Prakasam Ongole 800286 Chandigarh Chandigarh Chandigarh 801911 Chhattisgarh Koria Baikunthpur_C 801912 Chhattisgarh Koria Manendergarh 801913 Chhattisgarh Koria Khongapani 801914 Chhattisgarh Koria Jhagrakhand 801915 Chhattisgarh Koria Nai ledri 801916 Chhattisgarh Koria Chirimiri 801918 Chhattisgarh Balrampur Balrampur_C 801919 Chhattisgarh Balrampur Wadrafnagar 801921 Chhattisgarh Surajpur Jarhi 801922 Chhattisgarh Balrampur Kusmi 801926 Chhattisgarh Surajpur Premnagar 801927 Chhattisgarh Sarguja Ambikapur 801928 Chhattisgarh Kathua Lakhanpur_C 801929 Chhattisgarh Balrampur Rajpur_C 801930 Chhattisgarh Sarguja Sitapur_CH 801932 Chhattisgarh JashpurNagar Jashpur 801934 Chhattisgarh JashpurNagar Kotba 801936 Chhattisgarh Raigarh Lailunga 801937 Chhattisgarh Raigarh Gharghora 801939 Chhattisgarh Raigarh Raigarh 801941 Chhattisgarh Raigarh Kharsia 801944 Chhattisgarh Raigarh Baramkela 801945 Chhattisgarh Korba Katghora 801948 Chhattisgarh Korba Pali_C 801949 Chhattisgarh Korba Korba -

1 AHMEDABAD 1 Bareja 2 Barvala 2 ANAND 3 Sojitra 4 Anklav 3

SJMMSVY NEW NAGAR SEVA SADAN BUILDING TO BE CONSTRUCTED SR.NO. DIST. S.NO. NAME OF MUNI. 1 2 3 4 1 AHMEDABAD 1 Bareja 2 Barvala 2 ANAND 3 Sojitra 4 Anklav 3 KHEDA 5 Thasra 6 Dakor 7 Kanjari 4 DAHOD 8 Devgadhbariya 5 SABARKANTHA 9 Parntij 10 Bayad 6 SURENDRANAGAR 11 Chotila 12 Patadi 7 JUNAGADH 13 Sutrapada 14 Bantava 15 Chorvad 16 Talala 8 BHAVNAGAR 17 Vallbhipur 9 TAPI 18 Songadh 10 RAJKOT 19 Bhayavadar 20 Maliya-Miyana 11 NAVSARI 21 Gandevi 12 VADODARA 22 Savali 13 VALSAD 23 Umargam 24 Dharmpur 14 SURAT 25 Kanakpur-Kansad 15 GANDHINAGAR 26 Pethpur 16 PATAN 27 Chanasma 28 Harij 17 MEHASANA 29 Kheralu 30 Vijapur 18 JAMNAGAR 31 Kalavad 32 Bhanvad 33 Dhrol 34 Jam-Jodhpur 35 Sikka 36 Jam-raval 19 PORBANDAR 37 Kutiyana 20 AMRELI 38 Chalala 39 Lathi 40 Babara 21 BANSKANTHA 41 Thara 42 Bhabhar D:\Mahesh\Website\Tab Wise\SJMMSVY\Seva Sadan--new1 sadan 1/10/2013 GMFB COMPONENT - V UDP - 56 SJMMSVY - Administrative Approval & Grant Paid - NAGAR SEVA SADAN ` IN LACS PAYMENT TO N.P. FROM AA by DOM Office GMFB SR.NO. NAME OF N.P. ORDER PAYMENT ORDER TS OF ` DATE recommended DATE ` 1 2 3 4 5 6 7 NEW SEVA SADAN 1 TO 42 Muni. Of 21 14.9.10 - 2000.00 23.9.10 1890.00 42 Dist. -- Jamjodhpur 19.10.11 - 3.70 12.11.11 3.70 43 KHEDA 25.11.11 88.00 50.00 9.12.11 50.00 44 GARIYADHAR 12.11.11 --- 45.00 13.12.11 45.00 45 KODINAR 17.3.12 68.69 50.00 28.3.12 50.00 46 Jetpur-Navagadh 29.8.12 181.52 100.00 7.9.12 100.00 47 Mahuva 10.9.12 516.91 75.00 12.9.12 75.0000 48 Okha 10.9.12 68.12 68.1216 12.9.12 68.1216 49 Shehra 10.9.12 49.99 49.9986 12.9.12 49.9986 TOTAL