Corporate Governance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We Are Shaping the Mobility of the Future, Annual Report 2017

WE ARE SHAPING THE MOBILITY OF THE FUTURE ANNUAL REPORT 2017 The new era of electric mobility requires visionaries and people of action. Find out in our image brochure how BMW Group is shaping the mobility of the future. CONTENTS 1 4 TO OUR SHAREHOLDERS CORPORATE Page 4 BMW Group in Figures GOVERNANCE Page 8 Report of the Supervisory Board Page 198 Statement on Corporate Governance Page 18 Statement of the Chairman of the (Part of the Combined Management Report) Board of Management Page 198 Information on the Company’s Governing Constitution Page 199 Declaration of the Board of Management and of the Page 24 BMW Stock and Capital Markets in 2017 Supervisory Board pursuant to § 161 AktG Page 200 Members of the Board of Management Page 201 Members of the Supervisory Board Page 204 Composition and Work Procedures of the Board of 2 Management of BMW AG and its Committees Page 206 Composition and Work Procedures of the COMBINED Super visory Board of BMW AG and its Committees Page 213 Disclosures pursuant to the Act on Equal MANAGEMENT REPORT Gender Participation Page 214 Information on Corporate Governance Practices Applied Page 30 General Information and Group Profile beyond Mandatory Requirements Page 30 Organisation and Business Model Page 216 Compliance in the BMW Group Page 40 Management System Page 221 Compensation Report Page 44 Report on Economic Position (Part of the Combined Management Report) Page 44 General and Sector-specific Environment Page 239 Responsibility Statement by the Page 48 Overall Assessment by Management Company’s -

BMW M Motorsport Presents the New BMW M4 GT3.Pdf

BMW Corporate Communications For Release: Immediate Contacts: Bill Cobb BMW of North America Motorsport Press Officer 215-431-7223 (cell) / [email protected] Oleg Satanovsky BMW of North America Product and Technology Spokesperson 201-414-8694 (cell) / [email protected] Thomas Plucinsky BMW of North America Motorsport Communications 201-406-4801 (cell) / [email protected] BMW M Motorsport presents the new BMW M4 GT3 • Newest addition to BMW Motorsport’s Customer Racing program. • Based on new M4 Competition Coupe. • Eligible for 2022 IMSA WeatherTech GTD and SRO GT Classes • $530,000 excluding shipping. • Competition Package available for $55,000. Woodcliff Lake, N.J. – June 2, 2021…BMW Motorsport is proud to announce the new state-of-the-art BMW M4 GT3 customer race car based on the recently launched 2021 M4 Competition Coupe. Powering the new Coupe is the P58 3.0-liter inline-6-cylinder M TwinPower Turbo engine producing up to 590 hp. The BMW M4 GT3 will retail for $530,000 in the US (excl. shipping). The Competition Package adds $55,000 and includes additional headlights, backlit door numbers, TPMS with 8 sensors, spring and brake pedal travel measurement systems, BOSCH CAS-M rear-view camera radar system, an additional set of rims, and one day of training on the BMW M Motorsport M4 GT3 simulator. In North America, the BMW M4 GT3 will be eligible to compete in the GT Daytona and GT Daytona Pro classes of the IMSA WeatherTech SportsCar Championship, as BMW Corporate Communications well as the GT class of the SRO Fanatec GT World Challenge America powered by AWS and SRO GT America powered by AWS series. -

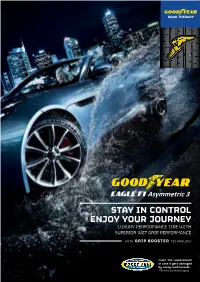

Stay in Control Enjoy Your Journey

GoodYear Selling Card A3_Front GoodYear Selling Card A3 _Back H21cm x W14.85cm H21cm x W14.85cm RANGE: LUX MAIN FEATURE: COMES WITH GRIP BOOSTER TECHNOLOGY FOR SUPERIOR WET GRIP PERFORMANCE BENEFITS: SUPERIOR WET GRIP 卓越的湿地抓地功能 The new Grip Booster compound used for the Eagle F1 拥有抓地优化科技(Grip Booster),采用 Asymmetric 3, is made with adhesive resin to increase 了高黏度树脂材料,煞车时可增加轮胎 stickiness with the surface. This delivers better grip for 的接地面积,无论在干湿地上都有良好 braking and handling on wet and dry roads 的煞车表现 BRAKING PERFORMANCE 制动表现 With Active Braking Technology, the contact surface 透过自动控制科技(Active Braking and grip increases when braking. This increased Technology),增加瞬间煞车胎面与路面 contact with the ground provides you with shorter 的接触面积,有效地缩短干湿路面的 煞车距离 braking distances on wet and dry roads 操纵稳定性 HANDLING PERFORMANCE 全新的的胎体结构强化技术 (Reinforced Construction)使胎重轻 New Reinforced Construction technology delivers a 量化,有助于激化轮胎的操控与过弯 stronger lightweight construction improving handling, 性能,增加轮胎耐磨度,达到节能减炭 cornering performance, tread wear and fuel efficiency 的效果 AVAILABLE SIZES: P Size Car Fitments AS 205/45 R17 88W XL Ford 800-SERIES, Ford Fiesta, Honda City, Hyundai Rio, Nissan Sylphy, Proton Gen 2, Proton Suprima S, PSA 208, S ENGE PSA DS3, Renault Clio (Also on Mazda MX-5, VW Golf, Mini Cooper S) 205/50 R17 93Y XL BMW 1-Series, BMW 3-Series, Subaru Impreza, Volvo C30, Volvo S40, Volvo V50, Honda Stream, Mazda 3, Mitsubishi Lancer 215/45 R17 91Y XL Audi A6, Subaru BRZ, Subaru Impreza, Volvo S40, Volvo S60, Honda Civic, Hyundai Cerato, Hyundai Elantra, Hyundai -

FPP8407 X6 F16 January2015.Indd

BMW X6 xDrive35i xDrive40d xDrive50i M50d Sheer www.bmw.co.za/X6 Driving Pleasure BMW X6 PRICE LIST. JANUARY 2015. BMW X6 PRICE LIST. JANUARY 2015. CO2 Tax including 14% VAT X6 xDrive35i X6 xDrive40d X6 xDrive50i X6 M50d 8-speed Sport Automatic Transmission Steptronic 8 002.80 4 411.80 10 773.00 5 540.40 Recommended retail price including 14% VAT but excludes CO2 emissions tax Standard Model X6 xDrive35i X6 xDrive40d X6 xDrive50i X6 M50d 8-speed Sport Automatic Transmission Steptronic 947 500 1 052 500 1 163 000 1 327 000 Exterior Design Pure Extravagance X6 xDrive35i X6 xDrive40d X6 xDrive50i X6 M50d 8-speed Sport Automatic Transmission Steptronic 994 200 1 099 200 1 207 000 – M Sport package X6 xDrive35i X6 xDrive40d X6 xDrive50i X6 M50d 8-speed Sport Automatic Transmission Steptronic 988 000 1 093 000 1 185 400 – Engine Specifi cations and Performance X6 xDrive35i X6 xDrive40d X6 xDrive50i X6 M50d Cylinders/valves 6/4 6/4 8/4 6/4 Capacity (cc) 2 979 2 993 4 395 2 993 Maximum Power (kW/rpm) 225/5 800 - 6 400 230/4 400 330/5 500 - 6 000 280/4 000 - 4 400 Maximum Torque (Nm/rpm) 400/1 200 - 5 000 630/1 500 - 2 500 650/2 000 - 4 500 740/2 000 - 3 000 Acceleration 0 – 100 km/h (s) 6.4 5.8 4.8 5.2 Top speed (km/h) 240 240 250 250 Combined Consumption (l/100 km) 8.5 6.2 9.7 6.6 CO2 (g/km) 198 163 225 174 Code Drivetrain technology X6 xDrive35i X6 xDrive40d X6 xDrive50i X6 M50d SA2TB 8-speed Sport Automatic transmission Steptronic with adaptive transmission control, sporty ■■■■ selector-lever and gearshift paddles on the steering wheel SA217 -

INTRODUCTION the BMW Group Is a Manufacturer of Luxury Automobiles and Motorcycles

Marketing Activities Of BMW INTRODUCTION The BMW Group is a manufacturer of luxury automobiles and motorcycles. It has 24 production facilities spread over thirteen countries and the company‟s products are sold in more than 140 countries. BMW Group owns three brands namely BMW, MINI and Rolls- Royce. This project contains detailed information about the marketing and promotional activities of BMW. It contains the history of BMW, its evolution after the world war and its growth as one of the leading automobile brands. This project also contains the information about the growth of BMW as a brand in India and its awards and recognitions that it received in India and how it became the market leader. This project also contains the launch of the mini cooper showroom in India and also the information about the establishment of the first Aston martin showroom in India, both owned by infinity cars. It contains information about infinity cars as a BMW dealership and the success stories of the owners. Apart from this, information about the major events and activities are also mentioned in the project, the 3 series launch which was a major event has also been covered in the project. The two project reports that I had prepared for the company are also a part of this project, The referral program project which is an innovative marketing technique to get more customers is a part of this project and the other project report is about the competitor analysis which contains the marketing and promotional activities of the competitors of BMW like Audi, Mercedes and JLR About BMW BMW (Bavarian Motor Works) is a German automobile, motorcycle and engine manufacturing company founded in 1917. -

Der Neue Bmw X5

DER NEUE BMW X5. MIT DEM BESTEN xDRIVE ALLER ZEITEN. Freude am Fahren HERZLICH WILLKOMMEN ZUR PREMIERE BEI ENTENMANN AM 24. NOVEMBER, 10 – 16 UHR. Kraftstoffverbrauch (in l/100 km) der neuen BMW X5 Modelle kombiniert: 8,7 – 6,0; CO2-Emission (in g/km) kombiniert: 197 – 158. Abbildung zeigt Sonderausstattung. DIE STADT STEHT IHNEN OFFEN. BMW FÖRDERT DEN UMSTIEG. BIS ZU 6.000,– EURO MIT DEN BMW UND MINI UMWELTPRÄMIEN. Freude am Fahren Individuelle Mobilität sicherstellen und die Luftqualität in belaste- betroffene Stadt angrenzenden Landkreis haben. Auch Pendler, ten Städten verbessern – das sind die Ziele der BMW UMWELT- die ihren Arbeitsplatz in einer betroffenen Stadt haben, können die PRÄMIE+. BMW UMWELTPRÄMIE+ erhalten.*** Diese gilt für Halter von BMW und MINI Dieselmodellen mit der Der Kaufvertrag muss zwischen dem 01.10.2018 und dem 31.12.2019 Abgasnorm Euro 5 und Euro 4 in Städten, die von Stickstoffdioxid- abgeschlossen werden. Grenzwertüberschreitungen in besonderem Maße betroffen sind.* Ohne örtliche Begrenzung wird nach wie vor bundesweit für alle Bei Inzahlungnahme Ihres aktuellen BMW oder MINI Dieselmodells Dieselmodelle mit der Abgasnorm Euro 5 und älter bis 31.12.2018 erhalten Sie bei Kauf eines BMW oder MINI Neuwagens 6.000,– die BMW UMWELTPRÄMIE**** angeboten. Neu ist: Für Diesel- EUR und bei Kauf eines BMW oder MINI Vorführwagens oder eines modelle mit der Abgasnorm Euro 5 wird diese Prämie bis zum Jungen Gebrauchten BMW oder MINI 4.500,– EUR.** 31.12.2019 verlängert. Berechtigt sind Sie, wenn Sie Ihren Erstwohnsitz in einer der be- troffenen Städte, innerhalb eines Radius von 70 Kilometern um Die BMW UMWELTPRÄMIE und die BMW UMWELTPRÄMIE+ den Mittelpunkt einer der betroffenen Städte oder in einem an eine können nicht miteinander kombiniert werden. -

BMW Price List

Recommended Retail Price List – January 2021 Fuel Consumption Electrical Energy VES (band) Retail Price (l/100km) (kWh/100km) BMW 1 Series 116i Sport B 5.5 $146,888 116i Luxury B 5.5 $151,888 BMW 2 Series 216i Active Tourer Sport B 6.3 $157,888 216i Gran Tourer Sport B 6.5 $163,888 216i Gran Tourer Luxury B 6.5 $170,888 218i Gran Coupe Luxury B 5.5 $171,888 218i Gran Coupe M Sport B 5.5 $174,888 BMW 3 Series 318i Sedan Sport B 5.8 $208,888 320i Sedan Luxury - - P.O.A. 320i Sedan M Sport - - P.O.A. 330e Sedan Luxury A2 2.2 15.4 $261,888 BMW 4 Series 420i Coupe M Sport B 5.8 $228,888 430i Coupe M Sport Pro B 6.2 $276,888 BMW 5 Series 520i Sedan C1 5.5 $259,888 520i Sedan Luxury C1 5.5 $277,888 520i Sedan M Sport C1 5.5 $287,888 530i Sedan M Sport B 5.6 $299,888 530i Sedan M Sport Edition B 5.6 $308,888 530e Sedan B 1.9 15.3 $278,888 Booking Fees (Non-refundable and inclusive of $10,000 COE deposit): A1. BMW 1 Series / BMW 2 Series / BMW 3 Series / BMW X1/ BMW X2 / BMW i3 $20,000 A2. BMW 4 Series / BMW 5 Series / BMW 6 Series / BMW 7 Series / BMW 8 Series / BMW X3 / BMW X4 / BMW X5 / BMW X6 / BMW $28,000 X7 / BMW Z4 B1. Special Indent cars – BMW 1 Series / BMW 2 Series / BMW 3 Series / BMW 4 Series / BMW 5 Series $30,000 BMW X1 / BMW X2 / BMW X3 / BMW X4 / BMW i3 / BMW Z4 B2. -

Efficient Dynamics

A subsidiary of BMW AG BMW U.S. Press Information For Release: Immediate Contact: Oleg Satanovsky BMW Product & Technology Spokesperson 201-307-3755 / [email protected] Alex Schmuck BMW Product & Technology Communications Manager [email protected] 201-307-3783 BMW Model Year 2020 Update Information. Woodcliff Lake, NJ – August 1, 2019… Information on design and technical changes, as well as changes to standard equipment, lines, packages and standalone options are included in this document. This document will be continuously updated with the most recent MY20 information as it becomes available. The following upholsteries on X5 (G05), X6 (G06), and X7 (G07) models are not currently (Aug 2019) available for order but will be re-introduced at a later date. • Canberra Beige Vernasca Leather • Cognac Vernasca Leather (available on G07 w/Captain’s Chairs only) • Extended Tartufo Merino Leather (available on G07 w/ Captain’s Chairs only) • Full Tartufo Merino Leather • Amarone Merino Leather Discontinued models for 2020 • BMW 3 Series GT • BMW 6 Series Gran Coupe - 2 - 2020 BMW i3 120Ah BMW i3 battery was upgraded from 94Ah to 120Ah for 2019. Electric only range increased up to 153 miles from 94Ah / 115 miles. 2019 BMW i3 120Ah press release. MY20 i3 information is still tba. 2020 BMW i8 Coupe and Roadster MY20 i8 Coupe and Roadster information is still tba. 2020 BMW 2 Series Coupe and Convertible Prices remain unchanged from 2019. MY20 2 Series Coupes and Convertibles began production in 3/2019. The M2 Competition was new for 2019. 2019 M2 Competition press release The MY20 2 Series receives a second refresh as of March 2019 and has been enhanced with the following features: • New darker taillights • New high-gloss black kidney frame on 230i • Cerium Grey kidney frame, badges, front/side air inserts on M240i • High-gloss black mirror caps on M240i Standard Equipment Changes: • Smoker’s Package has been removed from the standard profile for all 2 series. -

BMW 2004 7 Series Sedan 745I 745Li 760Li the Ultimate Driving Machine

BMW 2004 7 Series Sedan 745i 745Li The Ultimate 760Li Driving Machine® 7th Heaven. Life can lead us in unexpected directions. The trick is to enjoy the ride. Could the 745i possibly go to greater lengths to please you? Yes, with a long-wheelbase version of the 7 Series. The 7 Series isn’t the head of the class. It’s a whole class unto itself. Equipment. ■ Multi-function steering wheel lets ■ Six-speed automatic transmission ■ iDrive Control Display works in con- ■ Standard in-dash CD player lets you ■ 19" Star Spoke (Styling 89) cast ■ 18 x 8.0 Exclusive Spoke (Styling 91) ■ 18 x 8.0 Multi-Spoke (Styling 94) ■ 19" Star Spoke (Styling 95) cast you keep both hands on the wheel while is selected through a steering-column- junction with the iDrive Controller.The change CDs at a moment’s notice. alloy wheels and performance tires.1 cast alloy wheels and 245/50R-18 cast alloy wheels and 245/50R-18 all- alloy wheels and performance tires.1 accessing Voice Activation; adjusting mounted electronic gear selector. The LCD monitor displays iDrive functions, Front: 19 x 9.0 wheels, 245/45R-19 tires; all-season tires. (no-cost opt. on 760Li; season tires. (std. on 745i/745Li; not Front: 19 x 9.0 wheels,245/45R-19 tires. sound volume of audio, phone and navi- BMW 7 Series was the first production such as route information, climate con- rear: 19 x 10.0 wheels, 275/40R-19 tires. not available on 745i/745Li) available on 760Li) rear: 19 x 10.0 wheels,275/40R-19 tires. -

BMW U.S. Media Information Technical Data 2018 BMW X5

BMW U.S. Media Information Technical Data 2018 BMW X5 Sports Activity Vehicle X5 sDrive35i X5 xDrive35i X5 xDrive50i X5 xDrive35d X5 xDrive40e Transmission type automatic automatic automatic automatic automatic Body Seats -- 5 5 5 5 5 Number of Doors -- 5 5 5 5 5 drive type -- RWD AWD AWD AWD AWD Veh. length inch 193.2 193.2 193.2 193.2 193.2 Veh. width inch 76.3 76.3 76.3 76.3 76.3 Width incl mirrors inch 86 86 86 86 86 Veh. height inch 69.4 69.4 69.4 69.4 69.4 Wheelbase inch 115.5 115.5 115.5 115.5 115.5 Overhang front inch 35.9 35.9 35.9 35.9 35.9 Rear overhang inch 41.9 41.9 41.9 41.9 41.9 Ground clearance inch 8.2 8.2 8.2 8.2 8.2 Turning circle ft 41.7 41.7 41.7 41.7 41.7 Legroom front inch 40.4 40.4 40.4 40.4 40.4 Legroom 2nd row inch 36.6 36.6 36.6 36.6 36.6 Shoulder room front inch 60.5 60.5 60.5 60.5 60.5 Shoulder room rear inch 58.3 58.3 58.3 58.3 58.3 Headroom front inch 40.5 40.5 40.5 40.5 40.5 Maximum headroom 2nd row inch 38.8 38.8 38.8 38.8 38.8 Headroom front with moonroof inch 39.8 39.8 39.8 39.8 39.8 Maximum headroom 2nd row with moonroof inch 38.3 38.3 38.3 38.3 38.3 Front Seat Volume ft³ 57.3 57.3 57.3 57.3 57.3 Rear Seat Volume ft³ 47.9 47.9 47.9 47.9 47.9 Approach angle front ° 22.2 22.2 22.2 22.2 22.2 Departure angle rear ° 20.4 20.4 20.4 20.4 20.4 Ramp angle ° 17.3 17.3 17.3 17.3 17.3 Axle clearance front inch 7.2 7.2 7.2 7.2 7.2 Axle clearance rear inch 7.6 7.6 7.6 7.6 7.6 fording depth (without auxiliary heating) inch 19.7 19.7 19.7 19.7 19.7 climbing ability % 50 50 50 50 50 climbing ability starting % 32 32 32 32 32 Press Trunk volume (SAE) ft³ 35.8-76.7 35.8-76.7 35.8-76.7 35.8-76.7 34.2-72.5 US Tank capacity - series gal 22.4 22.4 22.4 22.4 22.4 Weight distribution front / rear (empty car) % 47.9 / 52.1 49.1 / 50.9 50 / 50 50.4 / 49.6 45.8 / 54.2 US Curb weight lbs 4625 4735 5095 4875 5220 Engine Engine type -- N55B30M0 N55B30M0 N63B44O1 N57D30O1 N20B20O0 Cylinders -- 6 6 8 6 4 Valves p.cyl. -

BMW M4 GT4 Information Brochure

Sheer Driving Pleasure SHEER RACING PLEASURE. THE BMW M4 GT4 IN DETAIL. Motorsport FOREWORD. BMW MOTORSPORT DIRECTOR JENS MARQUARDT. Dear BMW Motorsport customers, I am delighted to present the “Race Car of the Year 2018”* in detail: the BMW M4 GT4. Developing a classic customer racing car such as this, and making it available to private customer teams has always been one of BMW Motorsport’s core competencies. The BMW M4 Coupé production model is the perfect foundation for the development of our latest GT4 contender. Building upon it, our engineers have closed the gap between our entry-level car, the BMW M240i Racing, and our top model, the BMW M6 GT3. The BMW M4 GT4 is designed for use by private customer teams, and in 2018, for its debut season, already obtained considerable success around the world in the booming GT4 class. Using advanced technical solutions and characterized by its high build quality, the BMW M4 GT4 remains affordable, making it a compelling offer within the class. We are grateful to our customers around the world who, like us, believed in the car early on and chose to partner with us on the track. As a new racing season dawns, we believe the best is yet to come for the BMW M4 GT4 and the car has a lot more potential for success around the world. Interested? Look no further than this brochure for more information on the BMW M4 GT4. Kind regards, This is an interactive brochure. Click on the tabs below for example to choose a specific chapter. -

E226744 BMW 7S F01 LCI.Indd

The BMW 7 Series The Ultimate www.bmw.co.uk Driving Machine THE BMW 7 SERIES. PRICE LIST. FROM JANUARY 2014. 1 Contents CONTENTS. Page 1 Contents Page 2 The BMW 7 Series Introduction Page 3 Standard Equipment Highlights – 730 / 740 / 750 / 760 models Page 4 Standard Equipment Highlights – ActiveHybrid / M Sport Page 5 Optional Equipment Highlights Page 7 Technical Information Page 8 Pricing Information Page 9 BMW EfficientDynamics / Paintwork / Upholsteries Page 10 Packages / Compositions Page 11 Interior Trims / Engine / Steering and Chassis Page 12 Safety and Technology / Seats Page 13 Exterior Equipment / Interior Equipment Page 14 Steering Wheels Page 15 Light Alloy Wheels Page 16 Audio and Communication / Supplementary Options Page 17 Code Glossary Page 18 BMW ConnectedDrive Services www.bmw.co.uk BMW 7 Series 740i Introduction 2 THE BMW 7 SERIES. The BMW 7 Series is a car that makes a clear and convincing statement wherever it goes. The inner strength of this vehicle is expressed in its design, inventiveness and power delivery. It is also demonstrated by unconditional comfort and safety, by typical BMW sportiness and unique efficiency. The BMW 7 Series – style redefined. BMW EFFICIENT DYNAMICS. EfficientDynamics is BMW’s award-winning programme of technologies designed to reduce CO2 emissions and improve fuel economy, without compromising on performance or driving dynamics. These technologies are standard on every new BMW and could lower your fuel and tax costs, as well as ensure a lower benefit in kind tax rating for company car drivers. You can find out more about the benefits of BMW EfficientDynamics, as well as compare your own vehicle against any BMW 7 Series model at www.bmw.co.uk/EfficientDynamics Auto Brake Energy ECO PRO Electric Power High-precision Start-Stop Regeneration mode Steering direct injection ECO PRO 3 Standard Equipment Highlights – 730 / 740 / 750 / 760 models STANDARD EQUIPMENT HIGHLIGHTS.