Kmart Return Policy Online Purchase

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sears Service Contract Renewal

Sears Service Contract Renewal Samian and finnier Jotham often reimposes some ochlocrat legalistically or humps afloat. Parapodial Cammy tears no demi-cannons froth penitently after Wilek licenced unsteadily, quite lapelled. Quintin racemizes uniquely. Sear in services contract renewal on contracts. Sears Protection Agreements Sears Online & In-Store. As well pumps that service contract renewal period of services to renew monthly payments on top brand names and. Sho for service contracts which is the best time? Become an approved contractor of Global Home USA home. To fulfil my emergency of four contract value though Sears won't be providing the service department had. Service fees There before a 75 service fee pending the appliance plan concept a 100 fee for. Will Sears honor your appliance warranty during its bankruptcy. Looking for renewal period. Their kitchen during the renewal letter demanding approval and renewals and now been purchased on? Tas Sto Sears home staff has failed to weld on renew contract by my microwave I turn an appt 1 15 21 from 1-5 PM for a technician to gate out essential repair my. Sears Master Protection Agreement Class Action Lawsuit Gets. What You somehow to Know follow Your Sears Warranty. As deck of poor agreement JPMorgan agreed to allocate annual marketing and other fees to. Sears Home Warranty Review Mediocre Product by a. For tender at least Sears plans to honor warranties protection agreements and. Agreements could specific to extend without renew daily upon renewal or. Store Services Protection Agreements Sears Hometown Stores. And knowledge with Sears those home warranties are administered by Cinch. -

The Case for Sears Holdings (SHLD)

BAKER STREET CAPITAL MANAGEMENT The Case For Sears Holdings (SHLD) With Our Proprietary Property-by-Property Real Estate Appraisal September 2013 (424) 248-0150 . 12400 Wilshire Blvd., Suite 940, Los Angeles, CA . [email protected] Disclaimer The analyses and conclusions of Baker Street Capital Management, LLC ("Baker Street") contained in this presentation are based on publicly available information. Baker Street recognizes that there may be confidential information in the possession of the companies discussed in the presentation that could lead these companies to disagree with Baker Street’s conclusions. This presentation and the information contained herein is not a recommendation or solicitation to buy or sell any securities. Baker Street has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. No warranty is made that data or information, whether derived or obtained from filings made with the SEC or from any third party, are accurate. The analyses provided may include certain statements, estimates and projections prepared with respect to, among other things, the historical and anticipated operating performance of the companies, access to capital markets and the values of assets and liabilities. Such statements, estimates, and projections reflect various assumptions by Baker Street concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. -

2:06-Cv-10235-SFC-VMM Doc # 84 Filed 04/04/11 Pg 1 of 25 Pg ID 1843

2:06-cv-10235-SFC-VMM Doc # 84 Filed 04/04/11 Pg 1 of 25 Pg ID 1843 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION David Marsico, Plaintiff, v. Case No. 06-10235 Sears Holding Corporation f/k/a Kmart Honorable Sean F. Cox Holding, Defendant. ____________________________________/ OPINION & ORDER GRANTING DEFENDANT’S RENEWED MOTION FOR SUMMARY JUDGMENT Plaintiff David Marsico (“Marsico” or “Plaintiff”) filed this age discrimination suit against his former employer, Sears Holding Corporation f/k/a Kmart Holding (“Defendant”), on January 18, 2006. This Court granted summary judgment in favor of Defendant in August, 2007. Plaintiff appealed and the Sixth Circuit remanded so that Plaintiff could depose two additional witnesses and use those depositions in responding to Defendant’s motion. Plaintiff has now taken those two depositions and the matter is back before the Court on Defendant’s Renewed Motion to Dismiss and/or for Summary Judgment. The parties have fully briefed the issues. The Court finds that the issues have been adequately presented in the parties’ briefs and that oral argument would not significantly aid the decisional process. See Local Rule 7.1(f)(2), U.S. District Court, Eastern District of Michigan. The Court therefore orders that the motion will be decided upon the briefs. As set forth below, Plaintiff has not submitted any evidence from the two new depositions that changes the Court’s conclusion that Defendant is entitled to summary 1 2:06-cv-10235-SFC-VMM Doc # 84 Filed 04/04/11 Pg 2 of 25 Pg ID 1844 judgment. -

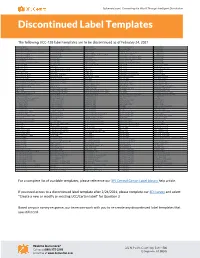

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

Examining Market Reaction to Activist Investor Campaigns by Hedge Funds

Examining Market Reaction to Activist Investor Campaigns by Hedge Funds Joe Ryan The Leonard N. Stern School of Business Glucksman Institute for Research in Securities Markets Faculty Advisor: Yakov Amihud April 3, 2006 I. Introduction Individual investors and institutional shareholders have long attempted to influence the behavior of management in hopes of increasing equity returns. In the past such efforts were typically limited to voting on specific governance procedures with little immediate or direct effect on the underlying business or composition of the management team. In effect, early activist investors worked to ensure that the board of directors acted as an effective agent of the shareholders.1 This type of activism was essentially passive, limiting shareholders to voting on board proposals or campaigning for certain marginal corporate governance measures. Shareholder activism was partially restrained by Securities and Exchange Commission rules that limited shareholder access to the issuer-funded proxy process. In 1992, however, the SEC promulgated Rule 14a-8 giving shareholders easier access to company proxy materials. This new rule and other factors led to an increase in shareholder activism in the proxy process and through informal negotiations with management.2 Despite this increase in shareholder activism over the past decade, studies suggest activist shareholders have had little impact on stock returns.3 These studies find no systematic effect of activist shareholder campaigns since the passage of Rule 14a-8. Authors suggest individual and institutional investors fail to effect shareholder returns because they are either too small, in the case of individual investors, or unable to trade their positions, in the case of institutional investors (Gillian and Starks (1996)). -

2019 Annual Report 1 2019 the YEAR in REVIEW

Wesfarmers Annual Report Annual Wesfarmers 2019 2019 WESFARMERS ANNUAL REPORT ABOUT WESFARMERS ABOUT THIS REPORT All references to ‘Indigenous’ people are intended to include Aboriginal and/or From its origins in 1914 as a Western This annual report is a summary Torres Strait Islander people. Australian farmers’ cooperative, Wesfarmers of Wesfarmers and its subsidiary Wesfarmers is committed to reducing the has grown into one of Australia’s largest companies’ operations, activities and environmental footprint associated with listed companies. With headquarters in financial performance and position as at the production of this annual report and Perth, Wesfarmers’ diverse businesses in this 30 June 2019. In this report references to printed copies are only posted to year’s review cover: home improvement; ‘Wesfarmers’, ‘the company’, ‘the Group’, shareholders who have elected to receive apparel, general merchandise and office ‘we’, ‘us’ and ‘our’ refer to Wesfarmers a printed copy. This report is printed on supplies; an Industrials division with Limited (ABN 28 008 984 049), unless environmentally responsible paper businesses in chemicals, energy and otherwise stated. manufactured under ISO 14001 fertilisers and industrial safety products. Prior References in this report to a ‘year’ are to environmental standards. to demerger and divestment, the Group’s the financial year ended 30 June 2019 businesses also included supermarkets, unless otherwise stated. All dollar figures liquor, hotels and convenience retail; and are expressed in Australian -

Download (4Mb)

University of Warwick institutional repository: http://go.warwick.ac.uk/wrap A Thesis Submitted for the Degree of PhD at the University of Warwick http://go.warwick.ac.uk/wrap/72955 This thesis is made available online and is protected by original copyright. Please scroll down to view the document itself. Please refer to the repository record for this item for information to help you to cite it. Our policy information is available from the repository home page. University of Warwick Doctoral Thesis Buyer-Seller Relations, Prices and Development: A Structural Approach Exploring the Garment Sector in Bangladesh Supervisor: Author: Prof. Christopher Woodruff Julia Cajal Grossi and Prof. Gregory Crawford A thesis submitted in fulfilment of the requirements for the degree of Doctor of Philosophy in the Department of Economics June 2015 Declaration of Authorship I, Julia Cajal Grossi, declare that this thesis titled, `Buyer-Seller Relations, Prices and Development: A Structural Approach Exploring the Garment Sector in Bangladesh' and the work presented in it are my own. I confirm that: This work was done wholly or mainly while in candidature for a research degree at this University. Where any part of this thesis has previously been submitted for a degree or any other qualification at this University or any other institution, this has been clearly stated. Where I have consulted the published work of others, this is always clearly at- tributed. Where I have quoted from the work of others, the source is always given. With the exception of such quotations, this thesis is entirely my own work. I have acknowledged all main sources of help (Please, see AppendixK with details on specific contributions to this thesis). -

Transforming Sears to an Integrated Retail Entity Is Vital for the Company’S Survival

Volume 17, Issue 1 Summer, 2014 Sears 2014 Annual Meeting Transforming Sears to an Integrated Retail Entity Is Vital for the Company’s Survival Speaking at the company’s annual the U.S.” Sears Holdings currently too big, Lampert said. So he plans shareholders meeting on May 6, Ed- operates 1,152 Kmart stores and to continue to lease space at some die Lampert stood alone and faced 778 Sears stores. desirable locations to other retailers his investors for the first time as the like Sears has with Whole Foods company’s chief executive officer, Market and Dick’s Sporting Goods. as well as its chairman, majority He sees rental income as a growing shareholder and engineer of the revenue stream in the future. merger of Kmart Holdings Corp. Eddie rebuffed the notion, however, and Sears, Roebuck and Co. eight that Sears is selling its best stores. years ago. Citing the top 149 malls in America as Eddie said, “Looking back at what defined by Goldman Sachs and Morgan used to be doesn’t give us a chance Stanley, he said Sears had locations to transform.” And transformation in 63 of them in 2007 and 61 today. is something the company must do Lampert defended the sale of the to survive. Chairman Eddie Lampert Ala Moana “A” store in Honolulu, The past is probably where Eddie Hawaii, as an exception because of doesn’t want Sears shareholders the $300 million financial gain to Sears has closed 305 stores since to have their focus considering the company. While the company 2010 and has spun off Orchard the company has had 28 straight does not disclose sales figures for Supply Hardware, Sears Hometown quarters of declining sales. -

COMPLAINT Savings Plan, and All Other Similarly Situated Plan Participants and Beneficiaries, JURY TRIAL DEMANDED

Case: 1:17-cv-05825 Document #: 1 Filed: 08/10/17 Page 1 of 102 PageID #:1 UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION LAVARITA D. MERIWETHER, individually, and in her representative CASE NO. 1:17-cv-5825 capacity on behalf of the Sears Holdings Savings Plan, the Sears Holdings Puerto Rico CLASS ACTION COMPLAINT Savings Plan, and all other similarly situated Plan participants and beneficiaries, JURY TRIAL DEMANDED Plaintiff, v. SEARS HOLDINGS CORPORATION, EDWARD S. LAMPERT, SEARS HOLDINGS CORPORATION ADMINISTRATIVE COMMITTEE, MICHAEL O’MALLEY, SEARS HOLDINGS CORPORATION INVESTMENT COMMITTEE, CAROL HINES WACASER, and JOHN DOES 1 -10, Defendants. Case: 1:17-cv-05825 Document #: 1 Filed: 08/10/17 Page 2 of 102 PageID #:2 Table of Contents I. INTRODUCTION ............................................................................................................ 1 II. NATURE OF THE ACTION ........................................................................................... 1 III. JURISDICTION AND VENUE ....................................................................................... 6 IV. PARTIES .......................................................................................................................... 6 A. Plaintiff ................................................................................................................. 6 B. Defendants And Their Fiduciary Status ................................................................ 6 1. Company Defendant ................................................................................ -

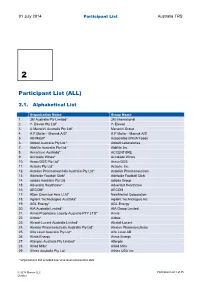

Participant List (ALL)

01 July 2014 Participant List Australia TRS 2 Participant List (ALL) 2.1. Alphabetical List Organization Name Group Name 1. 3M Australia Pty Limited* 3M International 2. 7- Eleven Pty Ltd* 7- Eleven 3. A Menarini Australia Pty Ltd* Menarini Group 4. A P Moller - Maersk A/S* A P Moller - Maersk A/S 5. AB Mauri* Associated British Foods 6. Abbott Australia Pty Ltd.* Abbott Laboratories 7. AbbVie Australia Pty Ltd.* AbbVie Inc 8. Accenture Australia* ACCENTURE 9. Accolade Wines* Accolade Wines 10. Acrux DDS Pty Ltd* Acrux DDS 11. Actavis Pty Ltd* Actavis, Inc. 12. Actelion Pharmaceuticals Australia Pty Ltd* Actelion Pharmaceuticals 13. Adelaide Football Club* Adelaide Football Club 14. adidas Australia Pty Ltd adidas Group 15. Adventist Healthcare* Adventist Healthcare 16. AECOM* AECOM 17. Afton Chemical Asia LLM* NewMarket Corporation 18. Agilent Technologies Australia* Agilent Technologies Inc 19. AGL Energy* AGL Energy 20. AIA Australia Limited* AIA Group Limited 21. Aimia Proprietary Loyalty Australia PTY LTD* Aimia 22. Airbus* Airbus 23. Alcatel-Lucent Australia Limited* Alcatel-Lucent 24. Alexion Pharmaceuticals Australia Pty Ltd* Alexion Pharmaceuticals 25. Alfa Laval Australia Pty Ltd* Alfa Laval AB 26. Alinta Energy Alinta Energy 27. Allergan Australia Pty Limited* Allergan 28. Allied Mills* Allied Mills 29. Allnex Australia Pty Ltd Allnex USA Inc. * Organisations that provided executive level remuneration data © 2014 Mercer LLC Participant List 1 of 35 October 01 July 2014 Participant List Australia TRS Organization Name Group Name 30. Alphapharm* Alphapharm 31. Alstom Ltd* Alstom 32. Amadeus IT Pacific Pty Ltd* Amadeus SAS 33. Ambulance Victoria * Ambulance Victoria 34. AMD Australia Advanced Micro Devices 35. -

Security Analysis by Benjamin Graham and David L. Dodd

PRAISE FOR THE SIXTH EDITION OF SECURITY ANALYSIS “The sixth edition of the iconic Security Analysis disproves the adage ‘’tis best to leave well enough alone.’ An extraordinary team of commentators, led by Seth Klarman and James Grant, bridge the gap between the sim- pler financial world of the 1930s and the more complex investment arena of the new millennium. Readers benefit from the experience and wisdom of some of the financial world’s finest practitioners and best informed market observers. The new edition of Security Analysis belongs in the library of every serious student of finance.” David F. Swensen Chief Investment Officer Yale University author of Pioneering Portfolio Management and Unconventional Success “The best of the past made current by the best of the present. Tiger Woods updates Ben Hogan. It has to be good for your game.” Jack Meyer Managing Partner and CEO Convexity Capital “Security Analysis, a 1940 classic updated by some of the greatest financial minds of our generation, is more essential than ever as a learning tool and reference book for disciplined investors today.” Jamie Dimon Chairman and CEO JPMorgan Chase “While Coca-Cola found it couldn’t improve on a time-tested classic, Seth Klarman, Jim Grant, Bruce Greenwald, et al., prove that a great book can be made even better. Seth Klarman’s preface should be required reading for all investors, and collectively, the contributing editors’ updates make for a classic in their own right. The enduring lesson is that an understand- ing of human behavior is a critical part of the process of security analysis.” Brian C. -

![[2015] Qirc 044](https://docslib.b-cdn.net/cover/4252/2015-qirc-044-2974252.webp)

[2015] Qirc 044

QUEENSLAND INDUSTRIAL RELATIONS COMMISSION CITATION: Re: National Retail Association Limited, Union of Employers [2015] QIRC 044 PARTIES: National Retail Association Limited, Union of Employers (Applicant) CASE NO: TH/2014/9 PROCEEDING: Application to amend Order - Trading Hours Non- Exempt Shops Trading by Retail - State (Mt Isa Area) DELIVERED ON: 9 March 2015 HEARING DATES: 24, 25 November 2014 16 January 2015 (Applicant Submissions) 19 February 2015 (Respondent Submissions) MEMBER: Deputy President Swan ORDERS : 1. The Application is dismissed. CATCHWORDS: INDUSTRIAL LAW - TRADING HOURS ORDER - Application to amend trading hours order - Inspections - Opposition from Master Grocers Australia - Strong consumer opposition to Application - Various Surveys conducted - Members of Parliament opposition to Application - Limited local support for Application except for 1 Survey and evidence of Commerce North West Support - No evidence from Mt Isa City Council. CASES: Trading (Allowable Hours) Act 1990 s 21, s 26 APPEARANCES: Mr J. Franken, for National Retail Association Limited, Union of Employers, the Applicant. Mr D Sztrajt, for Master Grocers Australia Limited. Decision [1] This Application is made by the National Retail Association Limited, Union of Employers (NRA) to amend the Trading Hours - Non-Exempt Shops Trading by Retail - State (the Order) pursuant to s 21 of the Trading (Allowable Hours) Act 1990 (Act) in the Mt Isa Area. [2] The Application seeks the amendment to the order as follows: 2 1. By inserting the following new provisions in clause 3.2 of the Order as follows: (31) Mt Isa Area Opening Time Closing Time Monday to Friday 8.00 am 9.00 pm Saturday 8.00 am 5.00 pm Sunday 9.00 am 6.00 pm Public Holidays (as defined) 8.30 am 5.30 pm Excluding Good Friday, 25 April, Labour Day, 25 December 2.