Logistics M&A Industry Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

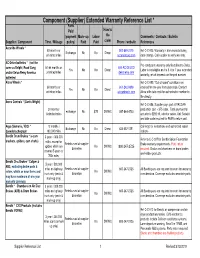

Component (Supplier) Extended Warranty Reference List *

Component (Supplier) Extended Warranty Reference List * Parts Paid How to (payment Mark- up Labor file Comments / Contacts / Bulletin Supplier / Component Time / Mileage policy) Paid Paid claim Phone / website References Accuride Wheels * 60 months or 800-869-2275 Ref C-C-005. Warranty is from manufacturing Exchange No No Direct unlimited miles accuridecorp.com date (stamp). Call supplier to verify warranty. AC-Delco batteries * (not the Pro-rated parts warranty only filed direct to Delco. same as Delphi, Road Gang 60-84 months or 800-AC-DELCO Yes No No Direct Labor is not eligible on the 5, 6 or 7 year extended and/or Delco Remy America unlimited miles delcoremy.com warranty, which depends on the part number. batteries) Alcoa Wheels * Ref C-C-099. "Out of round" conditions are 60 months or 800-242-9898 covered for one year from date code. Contact Yes No No Direct unlimited miles alcoawheels.com Alcoa with date code for authorization number to file directly. Arens Controls * (Curtis Wright) Ref C-C-056. Supplier pays part at PACCAR 24 months/ production cost + $75 labor. Total payment for exchange No $75 DWWC 847-844-4703 Unlimited miles actuator is $292.19, selector varies. Unit Serial # and date code required for RMA to return part. Argo (Siemen's, VDO) * 12 months / Call Argo for instructions and authorized repair Exchange No No Direct 425-557-1391 Speedo/tachograph 100,000 miles stations. Bendix Drum Brakes * (s-cam 3 years / 300,000 Refer to C-C-007 for Bendix Spicer Foundation brackets, spiders, cam shafts) miles, except for Reimbursed at supplier Brake warranty requirements. -

Upsteamstermaga

upsWINTER 2009 TEAMSTTEAMSTA Magazine for Teamsters at United Parcel Service EERR We Want to Hear from You Ready, Set, Go Union! Local 597 Sponsors The UPS Teamster magazine Member’s Stock Car focuses as much as possible Electing Obama on individual Teamsters UPS Teamsters Get Out the Vote working in the parcel industry, but there are plenty of untold stories about you. The only way we can know about them is if you let us know. resting If you have an inte ur job or as story relating to yo e-mail a Teamster, please [email protected] UPSTeamsterMaga or write to: azine UPS Teamster Mag N.W. 25 Louisiana Ave. 0001 UPS Freight Washington, D.C. 2 Members Reap Benefits Teamster Contract Valued by New Members IN THIS ISSUE WINTER 09 FROM THE GENERAL PRESIDENT DIRECTOR’S MESSAGE JAMES P. HOFFA KEN HALL SUCCESS! UPS Freight Milestone his past November, our I am proud to count more country witnessed history than 12,600 UPS Freight Twhen Barack Obama was drivers and dockworkers in elected 44th president of the 42 states as fellow Teamsters. United States. A friend of the There are countless stories 23 Teamsters and strong ally to out there of workers who 2 organized labor, Obama brings were fired or punished the hope and promise of a for their union activity at bright future to all working Overnite. Yet they stuck with families in America. us and never gave up. His victory, however, would I am proud we were able to not have been possible without negotiate a great contract for help and support from our these workers that provides members, including UPS and job security in these uncertain UPS Freight workers. -

MC-116200 United Parcel Service, Inc. (An Ohio Corporation)

United Parcel Service, Inc. (a New York corporation) MC-116200 United Parcel Service, Inc. (an Ohio corporation) MC-115495 United Parcel Service Canada Ltd. MC-186275 GENERAL TARIFF CONTAINING THE CLASSIFICATIONS, RULES AND PRACTICES FOR THE TRANSPORTATION OF PROPERTY In Individual Shipments of Packages or Articles Not Exceeding 150 Pounds per piece nor exceeding 108 inches in Length, or 165 Inches in Length and Girth combined, except as provided in Item 1030 of Tariff, via all Motor and Substituted Service Between Points and Places in the United States. Certain other classifications, rules and practices may apply as provided in the shipper's contract. For Reference to Governing Publications see Item 400 of Tariff EFFECTIVE: January 3, 2005 Issued By: OFFICE OF GENERAL COUNSEL UNITED PARCEL SERVICE, INC. 55 Glenlake Parkway NE Atlanta, Georgia 30328 Permanent Address: Permanent Address: Permanent Address: United Parcel Service, Inc. United Parcel Service Canada Ltd. United Parcel Service, Inc. (a New York corporation) 6285 Northam Drive, Suite 400 (an Ohio corporation) 55 Glenlake Parkway, NE Mississauga, Ontario 55 Glenlake Parkway, NE Atlanta, Georgia 30328 Canada L4V IX5 Atlanta, Georgia 30328 RULES AND OTHER PROVISIONS WHICH GOVERN THE TRANSPORTATION OF PROPERTY TABLE OF CONTENTS SUBJECT ITEM PAGE List of Participating Carriers 3 Governing Publications 400 3 Supplemental Corrections or Successive Issues 420 4 Firearms and Ammunition 425 4 Measurement of Combined Length and Girth 435 5 Packaging 437 5 Refusal of Service 440 5 Right -

United States Court of Appeals

RECOMMENDED FOR PUBLICATION Pursuant to Sixth Circuit I.O.P. 32.1(b) File Name: 20a0025p.06 UNITED STATES COURT OF APPEALS FOR THE SIXTH CIRCUIT JOE SOLO; BLEACHTECH LLC, and all others similarly ┐ situated, │ │ Plaintiffs-Appellees, │ > No. 17-2244 v. │ │ │ UNITED PARCEL SERVICE CO., │ Defendant-Appellant. │ ┘ Appeal from the United States District Court for the Eastern District of Michigan at Detroit. No. 2:14-cv-12719—Denise Page Hood, Chief District Judge. Decided and Filed: January 23, 2020 Before: STRANCH, DONALD, and LIPEZ, Circuit Judges.* _________________ COUNSEL ON BRIEF: Jill M. Wheaton, DYKEMA GOSSETT PLLC, Ann Arbor, Michigan, Deanne E. Maynard, Joseph R. Palmore, Bryan J. Leitch, MORRISON & FOERSTER LLP, Washington, D.C., for Appellant. Andrew J. McGuiness, ANDREW J. MCGUINNESS, ESQ., Ann Arbor, Michigan, Daniel R. Karon, KARON LLC, Cleveland, Ohio, Sanford P. Dumain, MILBERG LLP, New York, New York, for Appellees. *The Honorable Kermit V. Lipez, Circuit Judge for the United States Court of Appeals for the First Circuit, sitting by designation. No. 17-2244 Solo, et al. v. United Parcel Service Co. Page 2 _________________ OPINION _________________ JANE B. STRANCH, Circuit Judge. Plaintiffs Joe Solo and BleachTech LLC sued Defendant United Parcel Service Co. (UPS) in July 2014 alleging that it had systematically overcharged customers for insurance on their shipments. The first time this case was appealed, we held that the contract governing the shipments was “at least ambiguous” as to the contested charge, Solo v. UPS Co., 819 F.3d 788, 796 (6th Cir. 2016), and reversed the order granting UPS’s motion to dismiss. -

T'fj ·Laifit .-Of:Thfn~Le~ -•Fqtllpt:\C&-- ·

., ..... ~\. ,. j NRL.Bc'ActtnmRiffl?DifedprlsSt1e$·,·__ s.f ry. Is:-- O.ff -to ' t'fJ ·laifit_.-of:tHfn~le~ -•fqtllpt:\C&-- ·. r'"··' -~ .. '· . 1 . - ·I ,, 01,~,: 1?~cembe:r: 2s: 1956 Roy G ;:-Hof~nia~n:, {i.cting re·gional ,, Somebo<ty QI1Ctf ~aid, ''the 9nl'y thing YOll 'ca.11 be sure of is change," and that 1'emark <i11Jr~eto~: of ~he 20th_ J:~gi~n ?f.tlrn ,:~at.i~.~al T.~b?r. Relati_ons J certainly applies, t& _the ,Calif. ~:Nev.-Utah Weather situation arid construction industry as \ve ~:oafd m -~an Fr~nqs~o; 1ss!1ed a comp}a.1nt ~gamst HensleJ' I i)1ov'e,. Jnto t0.g·new yea.1~ of 1957. · J&qmpment Co.; Inc. and: .Hensley Thietal ;I'rr.atin~ Co., Inc., an I If ,ve·_ sa;f it'i~ )lry- on·e of . the 1 --- ----- -"·--·-- ·- ·--·--·--- p!ffiliated company, lJpoii qharges· file<l' by Local No. 3. and at !· ~011gest ~iy st~ll,:/ on 1;eco1·d~th~n · _$ siune «fane ilismisse<l netitions fol' the electiofr fiH~l by} oy th0 tun~ '.'11s , go~s t9 pr?SS a!ltl ·. ·, : , ·. • : . • · ,· . · • · · , y ou get it,. tnere ·. ~v 11J 1i1·oha.bly be tllf:lSe tvvo q:nnpames. I . ' . ' . .' ~ I floo<ls'-everJ'.,:here. At : lill)''c rate The· complafot._ issu!),d aft1=r in- i !}aig·n,, aga!llS> that Company ~nd , that's how sh e . stands as of the ·e~ti.gat-ion. of -th e fads by tlie rep~···I ,mply '.n g ,that the u_mL.'U)l~ll lauor ; se_c;o nci t,;eei~ ,. -

Q3 2015 Transportation & Logistics

TRANSPORTATION & LOGISTICS Q3 2015 CONTACTS STATE OF THE TRANSPORATION M&A MARKET Experts continue to view the Transportation & Logistics industry as a measure of the health of the Len Batsevitsky overall economy and thus far, 2015 has been a strong year for providers of commercial Director transport. The industry has been aided by significantly lower oil prices, increased personal (617) 619-3365 [email protected] consumption, expanded manufacturing and the continued rise of e-commerce as a viable retail channel. As a result, many transportation companies are experiencing improved financial Daniel Schultz performance which, coupled with a robust middle market M&A environment, has led to a Director of Business Development significant increase in deal activity. Furthermore, the industry’s high fragmentation will serve to (617) 619-3368 increase M&A activity as companies look to consolidate, increasing their efficiency through scale. [email protected] Overall, 2015 is shaping up to be a strong M&A year for the Transportation & Logistics industry Matthew Person because thus far through Q4, there have been 104 transactions. If that pace continues Associate (617) 619-3322 throughout the rest of calendar year, we could see nearly 140 M&A transactions during 2015, [email protected] which would near the record breaking high of 144 transactions in 2012. Transportation and Logistics Transactions 160 144 140 113 120 108 108 104 100 80 80 60 40 20 0 BOSTON 2010 2011 2012 2013 2014 YTD CHICAGO 9/30/2015 Sources: Capital IQ and Capstone Partners LLC research LONDON LOS ANGELES In addition, valuations have remained stable over the past several years with recent transaction PHILADELPHIA multiples for asset-light logistics businesses generally north of 8x LTM EBITDA, while traditional SAN DIEGO asset-heavy freight carriers (primarily in the trucking sub-industry) have traded at a range of 5x to 7x. -

Decision and Order

U.S. Department of Labor Office of Administrative Law Judges 800 K Street, NW, Suite 400-N Washington, DC 20001-8002 (202) 693-7300 (202) 693-7365 (FAX) Issue Date: 15 November 2013 In the matter of TIMOTHY J. BISHOP, Complainant v. CASE NO. 2013-STA-00004 UNITED PARCEL SERVICE, Respondent Appearances: Paul Taylor, Esquire For the Complainant Mark Jacobs, Esquire For the Respondent Before: DANIEL F. SOLOMON Administrative Law Judge DECISION AND ORDER This proceeding arises from a claim brought under the employee protection provisions of the Surface Transportation Assistance Act (“STAA”), 49 U.S.C. § 31105, filed by Timothy Bishop (“Complainant”) against United Parcel Service (“Respondent”). Appellate jurisdiction in this matter lies with the 8th Circuit Court of Appeals. PROCEDURAL HISTORY On July 29, 2011 Complainant filed a complaint against Respondent alleging that Respondent had discharged him in violation of the employee protection provisions of the STAA. The Secretary of Labor issued Preliminary Findings and an Order on October 12, 2012. Complainant filed objections to the Secretary’s Findings and Order on October 18, 2012. A hearing was held in St. Louis, MO on June 5, 2013. ALJ Exhibit (“AX”) 1; Joint Exhibits (“JX”) 1-9; Complainant’s Exhibits (“CX”) 2 and 6-13, and Respondent’s Exhibits (“RX”) 103, 108, 113, 115, and 124 were admitted into evidence. Tr. 6, 13, 154, 159, 161, 164- 167, 227. At the hearing the following witnesses provided testimony: Allen Worthy, Frank Fogerty III, Rick Meierotto, Bernard Alton White, Daryl Leonard Bradshaw, Rhonda Bishop, Complainant, and Derrick Sizemore. STIPULATIONS Complainant and Respondent stipulated to the following: 1. -

United Parcel Service-Federal Express-National Labor Relations

United Parcel Service-Federal Express-National Labor Relations Act-Railway Labor Act-Union Employee-Independent Contractor- FedEx-Current Developments of the Legal Status of FedEx Workers- and the Trend of Employers Classifying Employees as Independent Contractors Richard Trotter University of Baltimore UPS and FedEx are both package delivery services, however UPS workers are considered employees under the National Labor Relations Act and are represented by the Teamsters Union. FedEx, which began as an air delivery service is under the jurisdiction of the Railway Labor Act. In recent years, FedEx management has restructured its relationships with its workers in such a way as to classify them as independent contractors. Legislative actions on both the state and federal level have sought to impose stricter scrutiny on employers classifying their employees as independent contractors. INTRODUCTION The National Labor Relations Act (NLRA) was originally enacted in 1935. Since its original enactment the law has been amended twice, in 1947 with the enactment of the Taft-Hartley Act and again in 1959 with the enactment of the Landrum-Griffin Act. The basic philosophic underpinnings of the law is that it protects a worker’s right to organize into labor Unions, and once organized workers can seek to be represented by a union through the election process administered by the NLRB. Once a union is chosen, the employer has a duty to engage in collective bargaining with the union elected by the employees. In 1926 the Railway Labor Act was enacted originally to govern labor relations in the railway industry. The purpose behind the law was to ensure the smooth running of the railroads without labor disruptions particularly in times of war or other national crisis. -

Transportation & Logistics M&A Update September 2015

www.peakstone.com Transportation & Logistics M&A Update September 2015 Transportation & Logistics Industry Update | September 2015 Transportation & Logistics M&A Update . U.S. transportation & logistics M&A continues to see strong activity. Year-to-date 2015 transaction volume of 93 deals is on pace to surpass 2014 deal volume of 99 transactions. For the year-to-date 2015 period, strategic buyers accounted for 87% of the transportation & logistics M&A transactions with financial buyers making up the difference. During 2014, strategic buyers accounted for approximately 81% of the transactions. Asset-light transport and logistics companies are trading at premium valuations compared to the S&P 500. Many larger, publicly traded transportation and logistics companies have been very active in pursuing acquisitions. Notable publicly announced 2015 transactions: o XPO Logistics entered into a definitive agreement to acquire Con-way for approximately $3.5 billion. o United Parcel Service acquired Coyote Logistics for approximately $1.8 billion. o Apax Partners acquired Quality Distribution for approximately $780 million. o Echo Global Logistics acquired Command Transportation for approximately $410 million. 1 Transportation & Logistics Industry Update | September 2015 Transportation & Logistics – M&A Market Overview U.S. Transportation & Logistics Transactions by Buyer Type U.S. Transportation & Logistics Transaction Multiples 160 12 10.1x 140 10 8.6x 32 8.3x 120 NM NM 7.6x 8 7.0x 100 6.7x 25 23 18 19 12 80 6 16 16 60 106 4 40 79 81 83 80 81 64 -

Can Company 013230

PLEASE CONFIRM CSIP ELIGIBILITY ON THE DEALER SITE WITH THE "CSIP ELIGIBILITY COMPANIES" CAN COMPANY 013230 . Muller Inc 022147 110 Sand Campany 014916 1994 Steel Factory Corporation 005004 3 M Company 022447 3d Company Inc. 020170 4 Fun Limousine 021504 412 Motoring Llc 021417 4l Equipment Leasing Llc 022310 5 Star Auto Contruction Inc/Certified Collision Center 019764 5 Star Refrigeration & Ac, Inc. 021821 79411 Usa Inc. 022480 7-Eleven Inc. 024086 7g Distributing Llc 019408 908 Equipment (Dtf) 024335 A & B Business Equipment 022190 A & E Mechanical Inc. 010468 A & E Stores, Inc 018519 A & R Food Service 018553 A & Z Pharmaceutical Llc 005010 A A A - Corp. Only 022494 A A Electric Inc. 022751 A Action Plumbing Inc. 009218 A B C Contracting Co Inc 015111 A B C Parts Intl Inc. 018881 A Blair Enterprises Inc 019044 A Calarusso & Son Inc 020079 A Confidential Transportation, Inc. 022525 A D S Environmental Inc. 005049 A E P Industries 022983 A Folino Contruction Inc. 005054 A G F A Corporation 013841 A J Perri Inc 010814 A La Mode Inc 024394 A Life Style Services Inc. 023059 A Limousine Service Inc. 020129 A M Castle & Company 007372 A O N Corporation 007741 A O Smith Water Products 019513 A One Exterminators Inc 015788 A P S Security Inc 005207 A T & T Corp 022926 A Taste Of Excellence 015051 A Tech Concrete Co. 021962 A Total Plumbing Llc 012763 A V R Realty Company 023788 A Wainer Llc 016424 A&A Company/Shore Point 017173 A&A Limousines Inc 020687 A&A Maintenance Enterprise Inc 023422 A&H Nyc Limo / A&H American Limo 018432 A&M Supernova Pc 019403 A&M Transport ( Dtf) 016689 A. -

Wall Street Journal Article

Amazon, in Threat to UPS, Tries Its Own Deliveries; An Alternative to Shippers Like FedEx and UPS, New Service Could Deliver Goods the Same Day as Purchased Bensinger, Greg . Wall Street Journal (Online) ; New York, N.Y. [New York, N.Y]24 Apr 2014: n/a. ProQuest document link ABSTRACT The move is a shot across the bow of United Parcel Service Inc., FedEx Corp. and the U.S. Postal Service, which now deliver the majority of Amazon packages. Customer-service representatives and former employees say those codes designate Amazon's in-house delivery network. FULL TEXT The future of Amazon.com Inc. is hiding in plain sight in a San Francisco parking lot. Adjacent to recently closed Candlestick Park, Amazon is testing its own delivery network for the "last mile," the final leg of a package's journey to consumers' doorsteps. Trucks loaded with Amazon packages and driven by Amazon-supervised contractors leave for addresses around San Francisco. Similar efforts are under way in Los Angeles and New York. Delivering its own packages will give Amazon, stung by Christmas shipping delays, more control over the shopping experience. It can also help contain shipping expenses, which have grown as a percentage of sales each year since 2009, according to securities filings. On Thursday, Amazon reported another quarter of skimpy profit even as sales increased 23% to $19.74 billion. Shipping costs rose 31%, and it also spent on cloud computing and new initiatives. The company reported a first- quarter profit of $108 million, compared with $82 million a year earlier. -

02-22-2017 Board Meeting Agenda

Orange County Sanitation District Wednesday, February 22, 2017 Regular Meeting of the 6:00 P.M. BOARD OF DIRECTORS Board Room 10844 Ellis Avenue Fountain Valley, CA 92708 (714) 593-7433 AGENDA CALL TO ORDER INVOCATION AND PLEDGE OF ALLEGIANCE (Denise Barnes, City of Anaheim) ROLL CALL (Clerk of the Board) 1. RECEIVE AND FILE MINUTE EXCERPTS OF MEMBER AGENCIES RELATING TO APPOINTMENTS TO THE ORANGE COUNTY SANITATION DISTRICT BOARD OF DIRECTORS (Clerk of the Board) CITY/AGENCY DIRECTOR ALTERNATE DIR. City of Fullerton Greg Sebourn Jesus Silva City of Santa Ana Sal Tinajero David Benavides City of Newport Beach Scott Peotter Brad Avery (amended) DECLARATION OF QUORUM (Clerk of the Board) PUBLIC COMMENTS: If you wish to address the Board of Directors on any item, please complete a Speaker’s Form (located at the table outside of the Board Room) and submit it to the Clerk of the Board or notify the Clerk of the Board the item number on which you wish to speak. Speakers will be recognized by the Chairperson and are requested to limit comments to three minutes. SPECIAL PRESENTATIONS: • Employee Service Award(s) • CSDA Transparency Certificate REPORTS: The Chair and the General Manager may present verbal reports on miscellaneous matters of general interest to the Directors. These reports are for information only and require no action by the Directors. 02/22/2017 OCSD Board of Directors’ Agenda Page 1 of 8 CONSENT CALENDAR: Consent Calendar Items are considered to be routine and will be enacted, by the Board of Directors, after one motion, without discussion.