Urgent! Brand Philippines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Standards Monitoring and Enforcement Division List Of

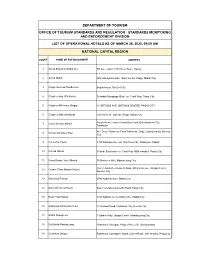

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave. -

2020 Annual Report (Pdf)

ANNUAL REPORT 2020 Contents COMPANY PROFILE 3 Financial Highlights 4 Project Location Map 5 Directory 6 MESSAGE TO SHAREHOLDERS OUR BUSINESS UNITS 11 Commercial Centers Division 13 Residential Division 16 Office Buildings Division 18 Hotels & Resorts Division 20 Industrial & Integrated Developments Division 21 Chengdu Ban Bian Jie CORPORATE SOCIAL RESPONSIBILITY 23 RLove Program 25 Environment & Sustainability 27 Robinsons Mall Gift of Change CORPORATE GOVERNANCE 30 Our Commitment to Good Governance 33 The Board of Directors - Responsibilities and Composition 37 Enterprise Risk Management, Accountability, and Audit 40 Other Matters 42 BOARD OF DIRECTORS 43 AUDITED FINANCIAL STATEMENTS Financial Highlights For the Years ended December 31 2014 2015 2016 2017 2018 2019 2020 (in million pesos) Gross Revenues 17,460.22 20,306.91 22,809.05 22,516.82 29,545.31 30,583.84 25,404.83 Net Income 4,773.87 5,952.94 5,755.32 5,884.44 8,223.96 8,692.61 5,259.36 Total Assets 88,421.50 111,711.51 124,432.16 148,126.55 174,158.16 189,651.21 215,200.73 Stockholders' Equity 53,968.36 58,444.74 62,855.31 67,372.62 93,919.72 100,077.67 102,718.03 GROSS REVENUES TOTAL ASSETS (in billion pesos) (in billion pesos) 40 250 215.20 29.56 30.58 189.65 25.40 200 174.16 30 22.81 22.52 148.13 150 124.43 20 100 10 50 - - 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 NET INCOME STOCKHOLDERS' EQUITY (in billion pesos) (in billion pesos) 8.69 10 8.22 150 8 102.72 100.08 5.76 5.88 100 93.92 6 5.26 67.37 62.86 4 50 2 - - 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 -

As of 21 December 2020 FACILITIES SUITABLE for STRINGENT QUARANTINE (TI=I989 Fasilili98 Af9-A189 8Wil951 Fqr MJ!.NQA:Rory

• FAC!! 'TIES AS OF Bece,""er J.;ink: https"/IglJarantjne dob 9Q'a'.j3R}facililies-i. ispected-as-of deeefTlger 21 aQ2fJe. As of 21 December 2020 FACILITIES SUITABLE FOR STRINGENT QUARANTINE (TI=I989 fasilili98 aF9-a189 8wil951 fQr MJ!.NQA:rORY 1. Manila Hotel 33. Conrad Hotel 2. Manila Prince Hotel 34. Networld Hotel 3. Go Hotel Ermita 35. Hotel Jen 4. Manila Grand Opera Hotel 36. The Courtyard Hotel Pasay 5. Red Planet Mabini 37. Seda BGC 6. Rizal Park Hotel 38. Go Hotels Timog 7. Go Hotel, Otis 39. Go Hotels North, Edsa 8. Eurotel, Pedro Gil 40. Park Inn by Radisson North 9. Amelie Hotel Manila Edsa 10. Hotel Kimberly Manila 41. Sequioa Hotel Manila Bay 11. Ramada Manila Central 42. Sequioa Hotel QC 12. Best Western Hotel La 43. Hotel Rembrandt QC Corona 44. Summit Hotel, QC 13. Aloha Hotel 45. Hive Hotel, QC 14. The Bayleaf, Intramuros 46. Cocoon Hotel QC 15. Bayview Park Hotel Manila 47. Privata Hotel, QC 16. 1898 Hotel Colonia - Makati 48. Novotel Cubao 17. The Sphere Residences- 49. Wow Hotel Aurora Cubao Makati 50. F1 Hotel BGC 18. The Charter House -Makati 51. Somerset Olympia Makati 19. Royal Bellagio Hotel - 52. Cabin by Eco Hotels Makati 53. Container by Eco Hotels 20. Nest Nano Suites - Makati 54. Diamond Hotel Manila 21. Ritz Astor Hotel - Makati 55. Oyo Nano Suites Fort 55 22. Crown Regency Hotel 56. Asiatel Makati 57. Elan Hotel Annapolis 23. Privata Hotel, Makati 58. E-Hotel Makati 24. Hotel Celeste, Makati 59. Pearl Blossom, Manila 25. -

The French Touch

HOTELS EN JVD CATALOGUE • 2020 THE FRENCH TOUCH Asia-Pacific/Middle-east JVD HOTELS P1 THE HOSPITALITY EXPERIENCE In JVDs Hotels universe, accessories make each room unique and transform a hotel stay into a delightful experience in itself. Every day, we innovate to provide hotel guests with accessories that combine functionality, safety and ergonomics. JVD’s Hotels accessories have become a delight for hotels and travellers around the world. Visit our website for more information General Disclaimer Reasonable efforts are used to include accurate and up-to date information in this catalogue. They may contain technical inaccuracies or typographical errors. We do reserve the rights to change the information without prior notification or any obligation. In no event will JVD or its As part of our environment friendly approach, JVD would like to invite all subsidiaries be liable to any part for any damages whether direct or indirect, consequential, our partners and customers to ensure we have their e-mail address to send punitive or others for use of its contents. this directly in electronic format. P2 JVD HOTELS INNOVATION IN THE SERVICE OF WELL-BEING The strength of JVD resides in our provision of accessories adorning hotel rooms around the world for more than 30 years. JVD accessories help to personalize hotel rooms, giving them the final touch to ensure guests’ well-being. Accessories are what truly At JVD, there is no room for boredom. make a difference. We are proud to present our catalogue of 2020 collections to you, just brimming with new items: JVD does not believe in simply copying and pasting! Our team have been working tirelessly in Nantes, Singapore, Alicante and Mexico City to offer you and your customers enhanced well-being. -

A Time to Build, a Time to Rehabilitate

INSIDER THE PHILIPPINE GUIDE ISSUE NO.5 | 2018 FOR HOTEL, PROPERTY, AND TOURISM DEVELOPMENT CAt’s A WAtcH LIST EYE A Time To Build, ON TOURISM AND PROPERTY A Time To Rehabilitate MARKET omposed of 7,641 islands (the official count was updated from 7,107*), the Philippines has More, more, more hotels rooms. Over 18,000 Cmuch to offer in terms of natural attractions and destinations. Yet, the country is still lagging hotel rooms (50% in Metro Manila alone) are behind neighboring countries such as Thailand, Malaysia and Indonesia when it comes to tourist expected to open in the Philippines over the next arrivals. The biggest obstacles in attracting foreign tourists to the country are poor infrastructure four years. Currently, more than 70 hotel projects and inadequate access—making it expensive and difficult to travel to and within the country— are in the pipeline in anticipation of the estimated which President Duterte is addressing aggressively through his proposed Build! Build! Build! arrival of 10 million foreign tourists by 2020, as program. well as an increase in domestic tourists. This ambitious agenda will see $160B to $180B go into implementing 75 flagship projects, More international hotel groups are opening including six airports, nine railways, three bus rapid transits, 32 roads and bridges, and four in the Philippines. Grand Hyatt, Mandarin seaports. If successful, Build!Build!Build! will generate more jobs, encourage countryside Oriental, Sheraton, Westin and Hilton are just investments, and make the movement of goods and people more efficient, possibly ushering some of the global brands opening in the next two in a “golden era” of economic development. -

Contact: Elliot Bloom Senior Vice President, Corporate Communications Cendant Corporation (212) 413-1832

In the wake of the tragic impact of Hurricane Katrina, the American Hotel & Lodging Association (AH&LA) and the entire U.S. lodging industry is working to offer assistance to the tens-of-thousands of individuals displaced from their homes and thousands of disaster relief workers beginning to converge in Louisiana, Mississippi, Alabama, and the surrounding states. Below you will find detailed information regarding the relief efforts of the various hotel chains and AH&LA partner state associations. Cendant Corporation Contact: Elliot Bloom Senior Vice President, Corporate Communications Cendant Corporation (212) 413-1832 Key initiatives under way include: • Establishment of a special employee hotline -- (866) 827-2347 -- to coordinate distribution of pay and other benefits to employees in the hurricane regions. Efforts are under way to locate available temporary housing for employees within Cendant’s hotel affiliates, corporate time- share resort locations and time-share exchange resort affiliates. • A special fund-raising campaign has been launched on behalf of the American Red Cross Hurricane 2005 Relief Fund. The Cendant Charitable Foundation will be matching employee donations up to an aggregate $500,000. • Cendant business units are displaying banner ads soliciting consumer donations to the American Red Cross on its consumer booking Web sites including Orbitz.com, DaysInn.com, Avis.com, RCI.com (U.S. section), and ColdwellBanker.com. • Cendant’s Car Rental Group, Hotel Group and Timeshare Resort Group are all working with the Federal Emergency Management Agency, the U.S. Department of Homeland Security and the American Red Cross to provide assistance including access to housing and rental vehicles for emergency response personnel moving into the area to coordinate relief efforts. -

Hotel's Are Digging the Local Landscape

Crain's Cleveland Business Originally Published: April 05, 2015 4:30 AM Modified: April 08, 2015 10:06 AM CRAIN'S CLEVELAND BUSINESS Hotels are digging the local landscape Once-slow market has been booming in region By Stan Bullard Photo by CONTRIBUTED PHOTO The planned Springhill Suites in Independence (shown is a rendering of the hotel, combined with a picture of the surrounding land on Rockside Road) could be open for business in May 2016. Suburban hotel development in Northeast Ohio, typically measured in one or two a year, is kicking into a much higher gear. More than 10 hotels are under construction or scheduled to start this spring in the region. Four of those are rising or are scheduled to go up this year in western Cleveland suburbs and Lorain County. Along with the just-completed Cambria Inn in Avon, they are the first new West Side hotels since the 1990s. Photo by REBECCA R. MARKOVITZ Crain's Cleveland Business Capturing resurgent business travel and growing leisure travel is the objective for this batch of inns, but the looming Republican National Convention in 2016 is giving developers an extra reason to push their projects through. Next to I-77 immediately north of Rockside Road in Independence, a line of trees in the devil strip of Rockside Place was recently cut down and tiny yellow flags put in to mark the site of a planned 121-suite Springhill Suites by Marriott. Ed Cury, the West Palm Beach, Fla.-based developer of the Springhill in Independence, said his project was planned to accommodate business travelers, but construction will be on a fast track to finish it by May 2016 so it's ready for the GOP convention. -

Amerisuites Comfort Inn Hampton Inn Hampton Inn & Suites Holiday Inn Holiday Inn Express Homewood Suites Residence

2001 ANNUAL REPORT AmeriSuites Comfort Inn Hampton Inn Hampton Inn & Suites Tested & Proven Holiday Inn Holiday Inn Express Homewood Suites Residence Inn Equity Inns, Inc. Financial and Hotel Operating Highlights All of the hotels pictured in this report have undergone recent renovations and are in excellent physical condition. Over the past four years, Equity Inns has Financial Data invested $94 million in upgrades to ensure that its properties remain competitive. In 2002, the company expects to invest $10 million in its hotels. Year Ended December 31, 2001 2000 Revenues $226.1 million $116.8 million Equity Inns Net income 3.6 million 9.8 million Funds from operations (1) 47.8 million 53.7 million Hotel Managers 54 Net income per share, basic and diluted 0.10 0.27 Funds from operations per share and Unit (2) 1.26 1.42 I Interstate Hotels Dividends per common share 0.75 1.06 I 19 Investment in hotels, net 751.9 million 772.4 million Hilton Hotels 20 I Prime Hospitality (1) Industry analysts generally consider funds from operations to be an appropriate measure of the performance of an equity REIT. Funds from operations is defined as I Crestline Hotels & Resorts income before minority interest of unit holders in the Partnership plus certain non-cash items, such as depreciation and gain (loss) on sale of hotel properties, plus certain I Waterford Hotel Group 2 non-recurring items. 1 (2) Funds from operations per share is computed as funds from operations divided by the weighted number of outstanding shares of common stock and units of the Partnership. -

Facilities Approved for Stringent Quarantine

FACILITIES APPROVED FOR STRINGENT QUARANTINE No HOTEL ADDRESS 1 Manila Hotel 1 Rizal Park, Ermita, Manila, 0913 Metro Manila 2 Manila Prince Hotel 1000 San Marcelino St, Ermita, Manila 3 Go Hotel Ermita 1412 A, A. Mabini St, Ermita, Manila 4 Manila Grand Opera Hotel 925 Doroteo Jose St, Santa Cruz, Manila 5 Red Planet Mabini 1740a A. Mabini St, Malate, Manila, 6 Rizal Park Hotel South Road, Ermita, Maynila 7 Go Hotel Otis Robinsons Otis, 1536 Paz Mendoza Guazon Street, Paco, Manila 8 Amelie Hotal Manila 1667 Jorge Bocobo St, Malate, Manila, 1004 Metro Manila 9 Hotel Kimberly Manila 770 Pedro Gil St, Malate, Manila 10 Ramada Manila Central Ongpin, cor Quintin Paredes Rd, Sts, Manila 11 Best Western Hotel La Corona 1166 M. H. Del Pilar St, Ermita, Manila 12 Aloha Hotel 2150 Roxas Blvd, Malate, Manila, 13 The Bayleaf Intramuros Muralla corner Victoria Streets Intramuros, Manila 14 Bayview Park Hotel Manila 1118 Roxas Boulevard, cor United Nations Avenue, Ermita, Manila 15 1898 Hotel Colonia 5030 P. Burgos Street Cor, Kalayaan Ave, Makati 16 The Sphere Residences 136 Valero, Makati, 1227 Kalakhang Maynila 17 The Charter House 114 Legazpi Street, Legazpi Village, Makati 18 Royal Bellagio Hotel 5010 P Burgos, Makati 19 Nest Nano Suites Makati 5700 Pagulayan, Brgy. Poblacion, Makati 20 Ritz Astor Hotel 4888 Durban, Makati 21 Crown Regency Hotel Makati 1026 Antonio Arnaiz Ave, Village, Makati 22 Y2 Residence Hotel 4687 Santiago Street corner B. Valdez and, Singian, Makati 23 Privato Hotel Makati 9745 Kamagong, Makati 24 Hotel Celeste 02 San Lorenzo Dr, Village, Makati 25 El Cielito Hotel Makati 804 Antonio Arnaiz Ave, Makati 26 Savoy Hotel 101 Andrews Ave, Pasay 27 Belmont Hotel Newport Boulevard, Newport City, Pasay 28 Marriott Hotel 2 Resort Dr, Pasay 29 Hilton Manila 1 Newport Blvd, Pasay 30 Go Hotels Airport 608 Quirino Ave, Tambo, Parañaque 31 Sogo Roxas Blvd. -

TTG 1657 Apr 20 2012

PPS 619/02/2013(022926) An eclectic collision of creative energy and sophisticated appetites for your optimum advertising exposure and maximum impact. Reach out to 16,600 travel agents and suppliers. Providing premium selections recognised as credible and committed in one concise read. where ideas inspire. be part of us. Live Large. Think Edge. Be Bold with TTG Asia. www.ttgasiamedia.com | www.ttgasia.com No. 1657/April 20 – 26, 2012 Serviced Apartments GDS Arabian Travel Room to grow New ways of connecting Market Special PAGE 9 page 12 Dubai’s growth spurt PAGE 15 www.ttgasia.com Prices in India www.ttgasia.com Playing catch up Most popular on upward climb Carlson Rezidor (as of April 17, 2012) Hotel Group is a New India visa centres in 1 Singapore unlikely to boost Industry braces for dearer rooms, leading team in travel the Champion- airfares and meals due to tax hike Clarification: New India visa ship, aspiring 2 centres in Singapore unlikely By Divya Kaul to promotion to boost travel NEW DELHI India’s service airlines to import their own avi- to the Pre- Macau lays claims to the tax hike from 10 to 12 per cent, ation fuel, which has long been 3 world’s largest Conrad, which came into effect on April a thorn in the flesh due to high mier League, Sheraton and Holiday Inn 1, will raise the prices of travel- prices offered by state-owned oil hotels ling to and within India, raising companies. says its APAC worries about the performance However, travel trade mem- Jetstar opens up Singapore- president Simon Nanning connections of the tourism industry. -

Public Advisory No. 39- 2020

PUBLIC ADVISORY NO. 39- 2020 ON THE LIST OF HOTELS IN THE NATIONAL CAPITAL REGION (NCR) FOR USE AS QUARANTINE FACILITIES OF ARRIVING PASSENGERS 08 December 2020 – Further to Public Advisory No. 38-2020 dated 04 December 2020, the Embassy wishes to share with the public the following list of hotels in the National Capital Region (NCR) as of 02 December 2020 for use as quarantine facilities of arriving passengers. The public is also informed that Philippine Department of Health (DOH) maintains a list of licensed COVID-19 Testing Laboratories in the Philippines and facilities suitable for quarantine. The DOH list is updated regularly and may be viewed from the following links: • Licensed COVID-19 testing laboratory in the Philippines - https://hfsrb.doh.gov.ph/?page_id=1729; and • Facilities suitable for quarantine - http://quarantine.doh.gov.ph/category/news-and- events/ An earlier advisory on the list of licensed COVID-19 testing laboratories and quarantine facilities may be viewed from: https://bernepe.dfa.gov.ph/advisories/1073-public-advisory-no-30-2020- on-the-list-of-licensed-covid-19-testing-laboratory-in-the-philippines-and-the-cessation-of- philhealth-funded-covid-19-testing-in-favor-of-repatriates-and-returning-ofws-and-facilities- suitable-for-quarantine. Please be guided, accordingly. The Philippine Embassy BOQ / OSS ECQ/GCQ PRICE NUMBER OF AVAILABLE TRUNKLINE / PUBLISHED NAME OF ESTABLISHMENTS REPAT EMAIL CERTIFICATION RANGE ROOMS ROOMS CONTACT DETAILS INSPECTED STAR RATED ACCOMMODATIONS [email protected]; 1 MARCO POLO ORTIGAS YES OSS INSPECTED 5500-6,500 316 28 7720 7777 [email protected] BOQ / OSS 2 DIAMOND HOTEL YES 4500-5500 482 167 8528 3000 [email protected] INSPECTED BOQ / OSS [email protected]; Eugene. -

The Hospitality Industry in India a Guide to Legal Issues

THE HOSPITALITY INDUSTRY IN INDIA A GUIDE TO LEGAL ISSUES Table of Contents Preface ...................................................................................................................................................................... 3 Disruptors in the Hospitality Industry ..................................................................................................................... 4 Digital Disruptors: Technology Trends .................................................................................................................. 4 Disruptive Ideas: Capitalising on New Opportunities ........................................................................................... 7 Airbnb: Your Neighbour Could be Your Competition ........................................................................................... 9 Legal Issues in Hospitality Operations ................................................................................................................... 11 Infra hospitium – The Car Valet Case .................................................................................................................. 12 The Brand ............................................................................................................................................................ 13 Trade Mark .......................................................................................................................................................... 13 Tips & Service Charges .......................................................................................................................................