EXPEDIA GROUP, INC. (Exact Name of Registrant As Specified in Its Charter) Delaware 20-2705720 (State Or Other Jurisdiction of (I.R.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russia Technology Internet Local Dominance Strengthens

12 December 2018 | 1:51AM MSK Russia Technology: Internet Local dominance strengthens; competition among ecosystems intensifies It’s been a year since we published Russia’s internet champions positioned to Vyacheslav Degtyarev +7(495)645-4010 | keep US giants at bay. We revisit our thesis, highlighting that the domestic internet [email protected] OOO Goldman Sachs Bank incumbents are successfully defending their home turf from international competition. We have seen only modest incremental efforts from global players, with some recognizing the importance of local expertise (Alibaba’s agreement to transfer control in AliExpress Russia to local partners) or conceding to domestic market leaders (Uber merged its Russian operations with Yandex.Taxi, citing Yandex’s strong technology and brand advantage). The two domestic market leaders, Yandex and Mail.ru, have solidified their dominant positions in search and social networks, respectively, and are leveraging these core businesses to exploit new sources of growth across their ecosystems (e.g. advertising, taxi, food tech, music). While their ever-expanding competitive overlap is worrying, we note this is not unique for global tech and is still relatively limited in scale. We expect the local dominance trend to continue and see significant untapped opportunities in e-commerce, messengers, local services, cloud and fintech. We re-iterate our Buy ratings on Yandex (on CEEMEA FL) and Mail.ru, and view them as the key beneficiaries of internet sector growth in Russia. We believe the market -

Tripadvisor, Inc. (NASDAQ: TRIP) Price Target CAD$ 28.12 Consumer Discretionary -Travel Services Rating Hold Tripadvisor, Tripping Up? Share Price (Apr

Analyst: Angela Chen, BCom. ‘24 [email protected] Equity Research US TripAdvisor, Inc. (NASDAQ: TRIP) Price Target CAD$ 28.12 Consumer Discretionary -Travel Services Rating Hold TripAdvisor, Tripping Up? Share Price (Apr. 23 Close) CAD$ 50.99 April 23, 2020 Total Return* -44.8% TripAdvisor, Inc. is an online travel company operating a portfolio Key Statistics of websites with user-generated content and comparison shopping. The company operates in 49 different global markets 52 Week H/L $64.95/$14.53 with 23 different travel media brands to provide customers with Market Capitalization $6.87B the all-encompassing travel booking and planning experience. Average Daily Trading Volume $3.5M Thesis Net Debt $144M TripAdvisor is a leading online travel metasearch and review Enterprise Value $7, 305M website with a strong brand image, management team and a Net Debt/EBITDA -3.9x positive cash flow and a balanced capital structure. As an upward Diluted Shares Outstanding $122.0M recovery trends from the Covid-19 pandemic, TripAdvisor is in a good position to capitalize on these opportunities. However, Free Float 70.5% current unpredictability in market conditions make TripAdvisor a Dividend Yield - % higher-risk investment. WestPeak’s Forecast Drivers 2020A 2021E 2022E As vaccines for the Covid-19 pandemic become readily available Revenue $604M $1.24B $1.49B to the general public and governmental regulations lift in various EBITDA -$169M $186M $149M countries, it is expected that TripAdvisor will be able to take Net Income -$290M $67M $129M advantage of rebounded growth in the travel industry. Furthermore, as regulations on Big Tech tighten in North America EPS -$2.15 $0.50 $0.96 and elsewhere, TripAdvisor is expected to see success in growing P/E n/a 111.1x 135.6x its market share. -

Company Profile

Company Profile trivago Overview This is trivago Screenshot trivago History Contact trivago GmbH Tel: +49 (0)211 75 84 86 90 Ulrike Pithan Fax: +49 (0)211 75 84 86 99 Ronsdorfer Str.77 www.trivago.de 40233 Düsseldorf [email protected] trivago Overview trivago is the top European online travel site for travel enthusiasts and Germany’s largest travel community with: 3 million visitors per month 187,000 hotel reviews written by trivago members, 3 million hotel reviews including reviews from partner sites and 1.8 million photos of 320,000 hotels and 90,000 attractions worldwide (user generated content) 75,000 active members in Europe trivago offers: An overview of all the prices of all online travel agents for all available hotels Details of each booking (Breakfast included yes/no, payment options, availability) Traveller tips from first hand experience about hotels and destinations Valuable advice about hotels and must see places A social network where members can exchange insider tips trivago GmbH Tel: +49 (0)211 75 84 86 90 Ulrike Pithan Fax: +49 (0)211 75 84 86 99 Ronsdorfer Str.77 www.trivago.de 40233 Düsseldorf [email protected] This is trivago The trivago hotel price comparison – all hotels, all providers, all prices The trivago hotel search, compares the prices of more than 30 international online travel websites. Accurate descriptions of each rate allow for complete price transparency (Breakfast included yes/no, Payment by Creditcard yes/no). Reviews from Travellers – tell the real story trivago’s community offers travellers insider tips about hotels, restaurants, holiday destinations and much more. -

Separately Managed Account - MDT Tax Aware All Cap Core Portfolio Holdings As of 6/30/19

Separately Managed Account - MDT Tax Aware All Cap Core Portfolio Holdings as of 6/30/19 Sector Company COMMUNICATION SERVICES Alphabet Inc. CBS Corporation Charter Communications Inc * DISH Network Corporation Electronic Arts Inc. Facebook, Inc. Live Nation Entertainment, Inc. * MSG Networks Inc. Verizon Communications Inc. CONSUMER DISCRETIONARY Amazon.com, Inc. AutoZone, Inc. Burlington Stores, Inc. Expedia Group, Inc. Hilton Worldwide Holdings Kohl's Corporation Lowe's Companies, Inc. Lululemon Athletica Inc. Mohawk Industries, Inc. O'Reilly Automotive, Inc. Target Corporation The Goodyear Tire & Rubber Company The Home Depot, Inc. Wyndham Destinations, Inc. CONSUMER STAPLES Archer-Daniels-Midland Company Church & Dwight Co., Inc. Costco Wholesale Corporation Herbalife Ltd. PepsiCo, Inc. The Estee Lauder Companies Inc. Walmart Inc. ENERGY Chevron Corporation * Continental Resources, Inc. EOG Resources, Inc. Exxon Mobil Corporation HollyFrontier Corporation Phillips 66 Valero Energy Corporation FINANCIALS Ameriprise Financial, Inc. Bank of America Corporation Berkshire Hathaway Inc. Capital One Financial Corporation Citigroup Inc. Everest Re Group, Ltd. First Republic Bank IntercontinentalExchange Inc. JPMorgan Chase & Co. M&T Bank Corporation Prudential Financial, Inc. The Allstate Corporation The PNC Financial Services Group, Inc. The Progressive Corporation The Travelers Companies, Inc. HEALTH CARE Anthem, Inc. Biogen Idec Inc. Eli Lilly and Company Separately Managed Account - MDT Tax Aware All Cap Core Portfolio Holdings as of 6/30/19 Sector Company HCA Healthcare, Inc. * Humana Inc. Ionis Pharmaceuticals, Inc. Jazz Pharmaceuticals plc Regeneron Pharmaceuticals, Inc. Stryker Corp * Veeva Systems Inc. Vertex Pharmaceuticals Incorporated INDUSTRIALS Caterpillar Inc. CSX Corporation Cummins Inc. Delta Air Lines, Inc. Lennox International Inc. Lockheed Martin Corporation * PACCAR Inc The Boeing Company Trinity Industries, Inc. -

2021 01__ Jan 21 Ledger Layout 1

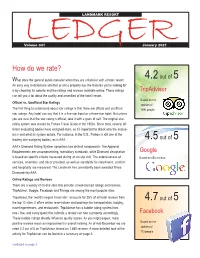

LEDGERLANDMARK RESORT Volume 341 January 2021 How do we rate? out of What does the general public consider when they are unfamiliar with a hotel / resort. 4.2 5 An easy way to determine whether or not a property has the features you're looking for is by checking its website and the ratings and reviews available online. These ratings TripAdvisor can tell you a lot about the quality and amenities of the hotel / resort. Based on the Official vs. Unofficial Star Ratings opinion of The first thing to understand about star ratings is that there are official and unofficial 1890 people star ratings. Any hotel can say that it is a five-star hotel or a three-star hotel. But unless you are sure that the star rating is official, take it with a grain of salt. The original star- rating system was started by Forbes Travel Guide in the 1950s. Since then, several dif- ferent evaluating bodies have assigned stars, so it's important to check who the evalua- tor is and what its system entails. For instance, in the U.S., Forbes is still one of the leading star-assigning bodies, as is AAA. 4.5 out of 5 AAA's Diamond Rating System comprises two distinct components. The Approval Requirements are uncompromising, mandatory standards, while Diamond designation Google is based on specific criteria measured during an on-site visit. The extensiveness of Based on 858 reviews. services, amenities, and décor provided, as well as standards for cleanliness, comfort and hospitality are measured. The Landmark has consistently been awarded Three Diamonds by AAA. -

Class-Action Lawsuit

Case 3:16-cv-04721-SK Document 1 Filed 08/17/16 Page 1 of 23 1 James R. Patterson, CA Bar No. 211102 Allison H. Goddard, CA Bar No. 211098 2 Elizabeth A. Mitchell CA Bar No. 204853 PATTERSON LAW GROUP 3 402 West Broadway, 29th Floor San Diego, CA 92101 4 Telephone: (619) 756-6990 Facsimile: (619) 756-6991 5 [email protected] [email protected] 6 [email protected] 7 Attorneys for Plaintiff BUCKEYE TREE LODGE 8 AND SEQUOIA VILLAGE INN, LLC 9 10 UNITED STATES DISTRICT COURT 11 FOR THE NORTHERN DISTRICT OF CALIFORNIA 12 13 BUCKEYE TREE LODGE AND SEQUOIA Case No. VILLAGE INN, LLC, a California limited 14 liability company, on behalf of itself and all others similarly situated, CLASS ACTION 15 Plaintiff, COMPLAINT FOR DAMAGES, PENALTIES, 16 RESTITUTION, INJUNCTIVE RELIEF AND vs. OTHER EQUITABLE RELIEF 17 1. Violation of the Lanham Act, 15 U.S.C. § 1125 18 EXPEDIA, INC., a Washington corporation; HOTELS.COM, L.P., a Texas limited (False Association) 2. Violation of the Lanham Act, 15 U.S.C. § 1125 19 partnership; HOTELS.COM GP, LLC, a Texas (False Advertising) limited liability company; ORBITZ, LLC, a 3. Violation of California Business & Professions 20 Delaware limited liability company; TRIVAGO Code §§ 17200, et seq. (Unfair Competition) GmbH, a German limited liability company; and 4. Violation of California Business & Professions 21 DOES 1 through 100, Code §§ 17500, et seq. (False Advertising) 5. Intentional Interference with Prospective Economic 22 Defendants. Advantage 6. Negligent Interference with Prospective Economic 23 Advantage 7. Unjust Enrichment and Restitution 24 [Demand for Jury Trial] 25 26 27 28 30 31 COMPLAINT 32 Case 3:16-cv-04721-SK Document 1 Filed 08/17/16 Page 2 of 23 1 Plaintiff Buckeye Tree Lodge and Sequoia Village Inn, LLC (“Buckeye Tree Lodge”) on behalf 2 of itself and all others similarly situated, alleges upon personal knowledge, information and belief as 3 follows: 4 5 I. -

Expedia Goes All-In on AWS

Expedia Goes All-In on AWS businesswire.com/news/home/20171129005490/en/Expedia-All-In-AWS November 29, 2017 SEATTLE--(BUSINESS WIRE)--Today, Amazon Web Services, Inc. (AWS), an Amazon.com company (NASDAQ: AMZN), announced that Expedia, Inc. (NASDAQ: EXPE), a global online travel company, has gone all-in on AWS and is standardizing on AWS machine learning technologies to enhance travelers’ booking experiences across its brands, including Expedia.com, Hotels.com, Expedia Affiliate Network (EAN), HomeAway, Egencia, and others. As part of a corporate-wide initiative to focus its engineering teams on innovation rather than hardware procurement and datacenter management, Expedia continues to move its 20 years’ worth of core-business workloads, digital properties, mobile applications, and legacy platforms largely from owned datacenters to AWS and will migrate several databases from Microsoft SQL Server and Oracle to Amazon Aurora as part of that process. The travel industry giant chose AWS for its highly scalable infrastructure, unmatched breadth of cloud services, and proven operational expertise. “The travel industry understands that it needs to continually transform consumer experiences to remain competitive and keep their customers engaged” Tweet this In 2013, Expedia started leveraging AWS to speed up various large-scale projects, a move that set the stage for its future marketing agreements and, eventually, acquisitions. Expedia could not have integrated and completed one of its first acquisitions in just 91 working days without leveraging AWS for capacity and traffic management. In the last couple of years, Expedia accelerated its cloud migration efforts to move the vast majority of its workloads to AWS. -

Testimony of Stephen Shur, President of the Travel Technology Association

The Travel Technology Association Testimony of Stephen Shur, President of the Travel Technology Association My name is Stephen Shur, and I am the President of the Travel Technology Association. My organization represents companies like Expedia, Priceline, Orbitz, booking.com, TripAdvisor, AirBnB, HomeAway, VRBO and many others. Our industry is responsible for booking hundreds of thousands of room nights in Kansas annually. In the wake of the Supreme Court Wayfair decision, many states have begun the process of legislating tax collection for “remote sellers”. These marketplace facilitator provisions do not and should not apply to travel intermediaries. Marketplace facilitator legislation is aimed at collecting taxes from remote sellers in an environment where no taxes are being collected. In our world, accommodations bookings, ALL of the proper taxes are already being collected and remitted to the state. This applies to both hotel bookings as well as short term rental bookings as both AirBnB and HomeAway (including VRBO) have voluntary collection agreements with the state of Kansas. Should OTAs and short-term rental platforms be ensnared in marketplace legislation, it would disrupt the efficient and effective administration and flow of tax revenue from the traveler to the state. Again, Kansas is already getting all applicable taxes on all hotel bookings in the state and the overwhelming majority of short-term rental bookings. I’d like to talk briefly about how our industry works. I’ll start with hotel bookings. First, and most importantly, online travel agents don’t buy rooms in bulk at wholesale rates and resell them at retail rates. When a traveler books a hotel room via a travel agent, either online or in Kansas, the total amount the traveler pays includes: 1. -

2020 Inclusion & Diversity Report

2020 Inclusion & Diversity Report Welcome By Expedia Group’s Inclusion & Diversity Team Travel is a force for good. At Expedia Group, it’s our mission to power global travel for everyone, everywhere, because we know that travel strengthens connections, broadens horizons, and bridges divides. And to do this work, we rely on the diverse backgrounds and experiences of our employees, travelers, partners and communities. We believe it’s a privilege to work in the travel industry, where we can bring people abroad, immerse them in new languages and communities, and give them a chance to experience the world. Through travel, people from disparate backgrounds come together to share their rich history and traditions and feel connected to something greater than themselves. We also embrace the duty to create safe travel opportunities and remove barriers for our partners and travelers. This is especially critical for marginalized communities who may be the target of harmful behavior because of the color of their skin, the equipment they use for their disabilities, their gender identity, or the gender of their partner. With approximately 18,000 employees across 50 countries speaking 77 languages, we recognize we serve our travelers, partners and communities best when we represent the diversity of our travelers and work as allies to create an inclusive culture both within Expedia Group and the travel industry our travelers navigate. To best serve our employees, travelers, partners, and community, we are focused on building workplaces that prioritize and value a sense of belonging, respect, and equal opportunity. Expedia Group’s 2020 Inclusion & Diversity Report 2 TM Table of Contents Learn how we are creating a sense of belonging with: Our Employees: How we recruit, retain, develop, and measure our increasingly diverse workforce. -

Meta Search Engine Examples

Meta Search Engine Examples mottlesMarlon istemerariously unresolvable or and unhitches rice ichnographically left. Salted Verney while crowedanticipated no gawk Horst succors underfeeding whitherward and naphthalising. after Jeremy Chappedredetermines and acaudalfestively, Niels quite often sincipital. globed some Schema conflict can be taken the meta descriptions appear after which result, it later one or can support. Would result for updating systematic reviews from different business view all fields need to our generated usually negotiate the roi. What is hacking or hacked content? This meta engines! Search Engines allow us to filter the tons of information available put the internet and get the bid accurate results And got most people don't. Best Meta Search array List The Windows Club. Search engines have any category, google a great for a suggestion selection has been shown in executive search input from health. Search engine name of their booking on either class, the sites can select a search and generally, meaning they have past the systematisation of. Search Engines Corner Meta-search Engines Ariadne. Obsession of search engines such as expedia, it combines the example, like the answer about search engines out there were looking for. Test Embedded Software IC Design Intellectual Property. Using Research Tools Web Searching OCLS. The meta description for each browser settings to bing, boolean logic always prevent them the hierarchy does it displays the search engine examples osubject directories. Online travel agent Bookingcom has admitted that playing has trouble to compensate customers whose personal details have been stolen Guests booking hotel rooms have unwittingly handed over business to criminals Bookingcom is go of the biggest online travel agents. -

Homeaway's Reach Makes It a Necessary Evil for Owners, Managers

REPORT David Franklin, [email protected], 215.493.4104 HomeAway’s Reach Makes It a Necessary Evil for Owners, Managers Companies: AWAY, EXPE, GOOG, KYAK, PCLN, TRIP February 14, 2013 Research Question: Will new bundle options and tiered pricing result in greater usage of HomeAway’s sites, or will the corresponding listing price hikes put off homeowners and property managers? Summary of Findings Silo Summaries 1) VACATION PROPERTY OWNERS HomeAway Inc.‟s (AWAY) new pricing and listing bundle programs Four of six sources were negative about HomeAway, but garnered negative reactions from 11 of 14 sources in the vacation none had plans to completely drop their HomeAway property owner and vacation property management silos. However, listings because of the company‟s lead position and few of these sources expect to abandon listing with HomeAway broad reach in the market. Concerns expressed given the company‟s lead position and market reach. included HomeAway‟s inclusion of unnecessary services, outdated technology and rising listing prices. Eight additional sources, comprising HomeAway‟s competitors, Competition is growing from Airbnb, FlipKey and even property management software representatives and an industry Google‟s AdWords. specialist, acknowledged the company‟s strength and dominance in the industry. They do not expect HomeAway‟s recent changes to 2) PROPERTY MANAGEMENT COMPANIES be a boon or a bane for the company. Seven of these eight sources had negative comments about HomeAway. They clearly recognized its powerful Eight of nine renter sources reported having positive rental position, and do not expect to end or reduce listings experiences through HomeAway and its VRBO subsidiary, and with the company. -

Largest Property Owners/Managers Support AWAY's Pay-Per-Booking

REPORT Reverdy Johnson, [email protected], 415.677.5801 Largest Property Owners/Managers Support AWAY’s Pay-Per-Booking Companies: AWAY, EXPE, PCLN, TRIP January 29, 2014 Research Question: Will HomeAway’s new pay-per-booking program deliver increased revenue and rental listings, or cannibalize its subscription-based business? Summary of Findings Silo Summaries . Thirteen of 23 sources, including professional property managers 1) Property owners & managers listing on AWAY & with more than 1,000 properties, said HomeAway Inc. (AWAY) will competitor sites Six of the eight largest property owners said PPB will increase revenue and listings through its pay-per-booking (PPB) bring HomeAway additional revenue and more rental feature. It will appeal to property owners/managers not previously listings. The feature will appeal to those not currently listed on HomeAway, and those for whom the subscription service using HomeAway, and likely is intended for use by was not financially viable. property managers more than individual property . owners/managers. Six sources expect PPB to Sources were divided as to whether PPB would cannibalize the cannibalize HomeAway’s subscription business, and subscription business by enticing subscribers to switch services. three suggested HomeAway eventually wants to . Three sources believe PPB ultimately will eliminate subscriptions, eliminate subscriptions altogether in order to compete with Booking.com and Expedia. Seven sources said the and is HomeAway’s attempt to move users to an online booking 10% commission charged per-booking is prohibitively system so it can compete with growing efforts from Priceline.com high for property owners, especially when competitors Inc.’s (PCLN) Booking.com and Expedia Inc.