The Annual Report on the Most Valuable Chinese Brands March 2018 Foreword

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Evergrande Real Estate Group (Stock Code: 3333.HK)

Evergrande Real Estate Group (Stock code: 3333.HK) 1 Table of Contents • ExecuBve Summary Page 3 • SecBon 1: Fraudulent AccounBng Masks Insolvent Balance Sheet Page 13 • SecBon 2: Bribes, Illegally Procured Land Rights and Severe Idle Land LiabiliBes Page 27 • Secon 3: Crisis Page 39 • SecBon 4: Chairman Hui Page 47 • SecBon 5: Pet Projects Page 52 • Appendix: Recent development Page 57 2 ExecuBve Summary 3 Evergrande Valuaon Evergrande has a market capitalizaon of US$ 8.9bn and trades at 1.6x book value. By market capitalizaon, Evergrande ranks among the top 5 listed Chinese properBes companies. [1] [2] RMB, HKD and USD in billions, except as noted 6/15/2012 in RMB in HKD in USD Share Price 3.80 4.60 0.59 Total Shares Outstanding 14.9 Market Capitalization 56.7 68.7 8.9 + Current Borrowing 10.2 + Non-Current Borrowing 41.5 + Income Tax Liability 11.6 + Cash Advance from Customers 31.6 Subtotal: Debt 95.0 115.0 14.8 - Unrestricted cash (20.1) (24.3) (3.1) Net debt 74.9 90.7 11.7 Enterprise value 131.6 159.4 20.6 Book Value as of 12/31/2011 34.9 Ratio of Equity Market Capitalization to Book Value 1.6x Note: Assuming RMB /USD exchange rate of 6.4 and HKD/ USD exchange rate of 7.75 1] As of June 15, 2012, Evergrande ranked 5th in market capitalizaon behind China Overseas (668 HK), Vanke (000002 SZ), Poly Real Estate (6000048 SH) and China Resources Land (1109 HK) 2] Balance sheet data as of December 31, 2011 4 PercepBon • Evergrande, which primarily operates in 2nd and 3rd Ber ciBes, has grown its assets 23 fold since 2006, becoming the largest condo/ home developer in China. -

Announcement Report for the First Quarter of 2021 Of

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. ANNOUNCEMENT REPORT FOR THE FIRST QUARTER OF 2021 OF CHINA CITIC BANK CORPORATION LIMITED This announcement is made by CITIC Limited (the “Company”) pursuant to Rule 13.09(2)(a) of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and the Inside Information Provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). The Company notes the announcement (the “CITIC Bank Announcement”) of today’s date made by China CITIC Bank Corporation Limited (“CITIC Bank”), a principal subsidiary of the Company, in relation to the unaudited consolidated results of CITIC Bank and its subsidiaries for the first quarter ended 31 March 2021. The CITIC Bank Announcement is available on the website of Hong Kong Exchanges and Clearing Limited at www.hkexnews.hk and is set out at the end of this announcement. By Order of the Board CITIC Limited Zhu Hexin Chairman Hong Kong, 29 April 2021 As at the date of this announcement, the executive directors of the Company are Mr Zhu Hexin (Chairman), Mr Xi Guohua and Ms Li Qingping; the non-executive directors of the Company are Mr Song Kangle, Mr Liu Zhuyu, Mr Peng Yanxiang, Ms Yu Yang, Mr Liu Zhongyuan and Mr Yang Xiaoping; and the independent non-executive directors of the Company are Mr Francis Siu Wai Keung, Dr Xu Jinwu, Mr Anthony Francis Neoh, Mr Shohei Harada and Mr Gregory Lynn Curl. -

GAC Motor Unveils Concept Car ENTRANZE at NAIAS 2019

GAC Motor Unveils Concept Car ENTRANZE at NAIAS 2019 Detroit, U.S., January 14, 2019 Automaker GAC Motor impressed audiences at the 2019 North American International Auto Show (NAIAS) on January 14 with the world premiere of its ENTRANZE concept car, emphasizing the automaker's human-centric approach to family vehicles. The ceremony was attended by distinguished guests, including media, global suppliers and partners. Developed by the GAC Motor’s Advanced Design Center in Los Angeles, the bullet- inspired ENTRANZE concept is designed to meet the needs of American consumers. It offers a revolutionary vision of future mobility, showcasing new energy breakthroughs, an upgraded user experience (UI), unique interior and exterior design concepts, and technology features including: Replacement of traditional control panel with an advanced voice-controlled UI and dynamic buttons on the steering wheel New 3+2+2 seating arrangement and aircraft-inspired aisle Two-side mounted displays for functional feature control, plus curved displays for passenger entertainment Integrated cargo system with a central movable storage unit in the second row, removable backpacks doubling as in-vehicle storage and folding rocker panel for leisure seating. “Ultimately, automotive products are a means for people to connect during life’s great journey. The ENTRANZE concept embodies our vision to provide mobility solutions that enrich lives,” said Yu Jun, president of GAC Motor. GAC Motor has also displayed its portfolio of star vehicles of SUVs, sedans, minivans and NEVs, including GS3, GS4, GS5, GS7, GS8, GA4, GM6, GM8, and GE3 530 at NAIAS 2019. California Headquarters Announced At the show, GAC Motor officially announced that it has registered its North American Sales Company in Irvine, Calif., near Los Angeles. -

The Annual Report on the Most Valuable and Strongest Real Estate Brands June 2020 Contents

Real Estate 25 2020The annual report on the most valuable and strongest real estate brands June 2020 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Brand Finance Real Estate 25 (USD m) 13 Sector Reputation Analysis 14 COVID-19 Global Impact Analysis 16 Definitions 20 Brand Valuation Methodology 22 Market Research Methodology 23 Stakeholder Equity Measures 23 Consulting Services 24 Brand Evaluation Services 25 Communications Services 26 Brand Finance Network 28 © 2020 All rights reserved. Brand Finance Plc, UK. Brand Finance Real Estate 25 June 2020 3 About Brand Finance. Brand Finance is the world's leading independent brand valuation consultancy. Request your own We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For more than 20 A Brand Value Report provides a years, we have helped companies and organisations of all types to connect their brands to the bottom line. complete breakdown of the assumptions, data sources, and calculations used We quantify the financial value of brands We put 5,000 of the world’s biggest brands to the test to arrive at your brand’s value. every year. Ranking brands across all sectors and countries, we publish nearly 100 reports annually. Each report includes expert recommendations for growing brand We offer a unique combination of expertise Insight Our teams have experience across a wide range of value to drive business performance disciplines from marketing and market research, to and offers a cost-effective way to brand strategy and visual identity, to tax and accounting. -

Company Report: Longfor Properties (00960 HK) Van Liu 刘斐凡 Equity Research Equity 公司报告:龙湖地产 (00960 HK) +86 755 23976672 [email protected]

股 票 研 究 Company Report: Longfor Properties (00960 HK) Van Liu 刘斐凡 Equity Research Equity 公司报告:龙湖地产 (00960 HK) +86 755 23976672 [email protected] 28 March 2017 Benign Prospective Fundamentals with Strong Contracted Sales, Reiterate "Buy" 强劲合约销售下的良好基本面展望,重申“买入” 公 2016 underlying net profit missed our expectation. Top line increased by 司 Rating: Buy 15.6% YoY to RMB54,799 mn. Underlying net profit increased 7.0% YoY to Maintained 报 RMB8,169 mn. 评级: 买入 维持 ( ) 告 The Company is expected to have sustainable revenue growth with Company Report Company stable margins. Contracted sales are likely to experience fast growth despite 目标价 policy tightening. Rental income is expected to grow fast. In addition, a quality 6-18m TP : HK$15.07 Revised from 原目标价: HK$13.22 land bank, appropriate unit land cost (27.6% of ASP in 2016) and low funding costs could result in stable margins. 股价: HK$13.120 Share price The Company is expected to maintain a healthy financial position. We estimate net gearing ratios to gradually decline in 2017-2019 and to maintain Stock performance below 60.0%. 股价表现 We think that Longfor deserves a low NAV discount. We revise up our target price from HK$13.22 to HK$15.07, representing a 24% discount to its 2017E 证 NAV, 7.0x 2017 underlying PER and 1.1x 2017 PBR. Therefore, we reiterate "Buy". Risk: lower-than-expected contracted sales and absent rental income 券 growth. 研 究 2016 年核心净利低于预期。总收入同比增长 15.6%到人民币 54,799 百万元。核心净利同 比上升 7.0%到人民币 8,169 百万元。 报 公司预计获得在稳定利润率下的可持续收入增长。尽管政策收紧但合约销售很有可能快速 告 增长。租金收入将快速增长。另外,有质量的土储,合适的单位土地成本(2016 年销售单 Equity Research Report Research Equity 价的 )以及低的财务成本能导致稳定的利润率。 27.6% 公司能够维持一个健康的财务状况。我们预测净资产负债率在 2017-2019 年逐渐降低并维 Change in Share Price 1 M 3 M 1 Y 股价变动 1 个月 3 个月 1 年 持在 60.0%以下。 Abs. -

FSSA China a Shares Fund Class III USD a Subfund of First Sentier Investors Global Umbrella Fund Plc (The Company)

Monthly Fund Factsheet 31 August 2021 FSSA China A Shares Fund Class III USD a subfund of First Sentier Investors Global Umbrella Fund plc (the Company) Investment objective and policy Ten Largest Company Holdings The Fund aims to grow your investment. Stock Name % The Fund invests at least 70% of its assets in shares of companies listed Chinese Stock Exchanges. China Merchants Bank Co., Ltd. Class A 8.8 The Fund may invest up to 100% of its assets in any industry and in companies of Zhejiang Weixing New Building any size. 8.4 Materials Co. Ltd. Class A The Fund may invest up to 100% of its assets in China A Shares and up to 10% in China B shares. Bank of Ningbo 7.4 The Fund may use derivatives with the aim of risk reduction or efficient management. China Mengniu Dairy Co. Ltd. 5.4 Fund information Midea Group 4.4 China Resources Land Limited 4.1 Fund Launch Date 04 June 2019 S.F. Holding Co., Ltd. Class A 4.0 Share Class Launch Date 26 July 2019 Gree Electric Appliances, Inc. of Zhuhai Fund Size (US$m) 974.2 3.1 Co., Ltd. Class A Benchmark MSCI China A Onshore Net Index Zhejiang Chint Electrics Co., Ltd Class A 3.1 Number of holdings 43 Ping An Insurance (Group) Company of 2.9 Fund Manager(s) Winston Ke/Martin Lau China, Ltd. Class A Minimum Investment US$500,000 Initial charge 0%< Sector Breakdown Ongoing Charges † 1.50% Industrials 32.4% (15.5%*) Financials 21.8% (18.1%*) Share Type Accumulation Consumer Discretionary 10.5% (8.3%*) Sedol BKF2S62 Health Care 9.4% (9.5%*) Consumer Staples 9.1% (11.7%*) ISIN IE00BKF2S627 Real Estate 4.7% -

中 國 民 生 銀 行 股 份 有 限 公 司 China Minsheng Banking Corp., Ltd

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 中國民生銀行股份有限公司 CHINA MINSHENG BANKING CORP., LTD. (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 01988) (USD Preference Shares Stock Code: 04609) Results Announcement For the Year Ended 31 December 2019 The Board of Directors (the “Board”) of China Minsheng Banking Corp., Ltd. (the “Company”) hereby announces the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”) in relation to information to accompany preliminary announcements of annual results. Publication of Annual Results Announcement and Annual Report This results announcement will be published on the HKEXnews website of Hong Kong Stock Exchange (www.hkexnews.hk) and the Company’s website (www.cmbc.com.cn). The 2019 Annual Report of the Company will be dispatched to holders of H shares of the Company and published on the websites of the Company and Hong Kong Stock Exchange in due course. Profit Distribution On 30 March 2020, the 20th meeting of the seventh session of the Board of the Company approved the profit distribution plan to declare to holders of A shares and H shares whose names appear on the registers as at the record dates as indicated in the notice of 2019 annual general meeting of the Company to be published by the Company in due course, a cash dividend of RMB3.70 (tax inclusive) for every 10 shares being held. -

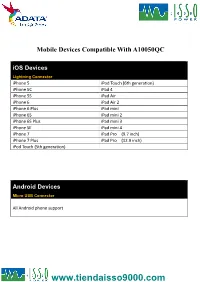

Android Devices

Mobile Devices Compatible With A10050QC iOS Devices Lightning Connector iPhone 5 iPod Touch (6th generation) iPhone 5C iPad 4 iPhone 5S iPad Air iPhone 6 iPad Air 2 iPhone 6 Plus iPad mini iPhone 6S iPad mini 2 iPhone 6S Plus iPad mini 3 iPhone SE iPad mini 4 iPhone 7 iPad Pro (9.7 inch) iPhone 7 Plus iPad Pro (12.9 inch) iPod Touch (5th generation) Android Devices Micro USB Connector All Android phone support Smartphone With Quick Charge 3.0 Technology Type-C Connector Asus ZenFone 3 LG V20 TCL Idol 4S Asus ZenFone 3 Deluxe NuAns NEO VIVO Xplay6 Asus ZenFone 3 Ultra Nubia Z11 Max Wiley Fox Swift 2 Alcatel Idol 4 Nubia Z11miniS Xiaomi Mi 5 Alcatel Idol 4S Nubia Z11 Xiaomi Mi 5s General Mobile GM5+ Qiku Q5 Xiaomi Mi 5s Plus HP Elite x3 Qiku Q5 Plus Xiaomi Mi Note 2 LeEco Le MAX 2 Smartisan M1 Xiaomi MIX LeEco (LeTV) Le MAX Pro Smartisan M1L ZTE Axon 7 Max LeEco Le Pro 3 Sony Xperia XZ ZTE Axon 7 Lenovo ZUK Z2 Pro TCL Idol 4-Pro Smartphone With Quick Charge 3.0 Technology Micro USB Connector HTC One A9 Vodafone Smart platinum 7 Qiku N45 Wiley Fox Swift Sugar F7 Xiaomi Mi Max Compatible With Quick Charge 3.0 Technology Micro USB Connector Asus Zenfone 2 New Moto X by Motorola Sony Xperia Z4 BlackBerry Priv Nextbit Robin Sony Xperia Z4 Tablet Disney Mobile on docomo Panasonic CM-1 Sony Xperia Z5 Droid Turbo by Motorola Ramos Mos1 Sony Xperia Z5 Compact Eben 8848 Samsung Galaxy A8 Sony Xperia Z5 Premium (KDDI Japan) EE 4GEE WiFi (MiFi) Samsung Galaxy Note 4 Vertu Signature Touch Fujitsu Arrows Samsung Galaxy Note 5 Vestel Venus V3 5070 Fujitsu -

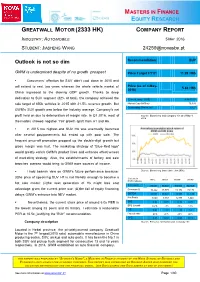

Outlook Is Not So Dim Recommendation: BUY

MASTERS IN FINANCE QUITY ESEARCH E R GREATWALL MOTOR (2333 HK) COMPANY REPORT INDUSTRY : AUTOMOBILE 5 MAY 2016 STUDENT: JIASHENG WANG [email protected] Outlook is not so dim Recommendation: BUY GWM is underpriced despite of no growth prospect Price Target FY17: 11.29 HK$ . Consumers’ affection for SUV didn’t cool down in 2015 and Price (as of 4-May- will extend to next two years whereas the whole vehicle market of 5.88 HK$ 2016) China regressed to the slowing GDP growth. Thanks to deep dedication to SUV segment (82% of total), the company achieved the 52-week range (HK$) 4.96-18.57 sale target of 850k vehicles in 2015 with 21.5% revenue growth. But Market Cap (HK$ m) 79,399 Outstanding Shares (m) 9,127 GWM’s SUV growth was below the industry average. Company’s net profit held on due to deterioration of margin rate. In Q1 2016, most of Source: Bloomberg and company f ile as of May 4, 2016 the models showed negative YoY growth apart from H1 and H6. In 2015 the highest-end SUV H8 was eventually launched after several postponements but ended up with poor sale. The frequent price-off promotion propped up the double-digit growth but gross margin was hurt. The marketing strategy of “Blue-Red logo” would greatly enrich GWM’s product lines and enhance effectiveness of marketing strategy. Also, the establishments of factory and sale branches oversea would bring to GWM more sources of income. I hold bearish view on GWM’s future performance because: Source: Bloomberg (base date: Jan 2005) (i)the price of upcoming SUV H7 is not friendly enough to become a (Values in 2015 2016E 2017E 2018E RMB millions) hot sale model; (ii)the next generation of H6 might loss cost Rev enues 76,033 80,943 89,560 94,568 advantage given the current price war; (iii)the fail of equity financing Gross prof it 16,222 17,979 18,174 19,176 delays GWM’s entrance into NEV market. -

葡萄酒 House Pouring Wine

葡萄酒 House Pouring Wine 150ml 750ml 有气的葡萄酒 Sparkling Wine Glass Bottle SP101 Pol Remy Brut Nv (France) $12 $44 白葡萄酒 White Wine W201 Bellevie Pavillon Sauvignon Blanc (France) $11 $40 W202 Pierre Jean Colombard Chardonnay (France) $12 $44 W203 De Bortoli DB Family Selection $13 $50 Sauvignon Blanc (Australia) 红葡萄酒 Red Wine R301 Bellevie Pavillon Merlot (France) $11 $40 R302 Pierre Jean Merlot (France) $12 $44 R303 De Bortoli DB Family Selection $13 $50 Cabernet Sauvignon (Australia) 葡萄酒促销 Wine Promotion *Special deal with minimum purchase of 2 bottles house pouring wine to entitle to 15% discount off from the usual price listed above. Prices subjected to prevailing GST and Service Charge. 消费税与服务费另计。 All photos are meant for reference only. Presentation of dishes may vary without prior notice. 照片只供参考之用,摆设更改恕不作另行通知。 主酒单 Master Wine List 150ml 750ml 有气的葡萄酒 Sparkling Wine Glass Bottle SP101 Pol Remy Brut Nv (France) $12 $44 Pol Remy is produced in Burgundy, France from classic wine varieties perfect for the production of sparkling wine. It is light, fresh and fruity with aromas of apple and peach. With a delightfully easy-drinking style, it exudes aromas of creamy lemon and peach. The palate is gently off-dry and flows through to a satisfying finish. 香槟 Champagne CH102 Henri Abele Brut NV (France) $110 Pale golden colour with greenish highlights. Remarkably fine bubbles and a beautiful, persistent bead. Attractive and luscious, with hints of hawthorn and acacia blossoms as well as overtones of peach and apricot. Exceptional ripeness on the palate. Toasty, honey, and cinnamon flavours. This elegant cuvée has a full bodied, generous aftertaste. -

Credit Trend Monitor: Earnings Rising with GDP; Leverage Trends Driven by Investment

CORPORATES SECTOR IN-DEPTH Nonfinancial Companies – China 24 June 2021 Credit Trend Monitor: Earnings rising with GDP; leverage trends driven by investment TABLE OF CONTENTS » Economic recovery drives revenue and earnings growth; leverage varies. Rising Summary 1 demand for goods and services in China (A1 stable), driven by the country's GDP growth, Auto and auto services 6 will benefit most rated companies this year and next. Leverage trends will vary by sector. Chemicals 8 Strong demand growth in certain sectors has increased investment requirements, which in Construction and engineering 10 turn could slow some companies’ deleveraging efforts. Food and beverage 12 Internet and technology 14 » EBITDA growth will outpace debt growth for auto and auto services, food and Metals and mining 16 beverages, and technology hardware. As a result, leverage will improve for rated Oil and gas 18 companies in these sectors. A resumption of travel, outdoor activities and business Oilfield services 20 operations, with work-from-home options, as the coronavirus pandemic remains under Property 22 control in China will continue to drive demand. Steel, aluminum and cement 24 Technology hardware 26 » Strong demand and higher pricing will support earnings growth for commodity- Transportation 28 related sectors. These sectors include chemicals, metals and mining, oil and gas, oilfield Utilities 30 services, steel, aluminum and cement. Leverage will improve as earnings increase. Carbon Moody's related publications 32 transition may increase investments for steel, aluminum and cement companies. But List of rated Chinese companies 34 rated companies, which are mostly industry leaders, will benefit in the long term because of market consolidation. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co.