In Financial Institutions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Notice

PUBLIC NOTICE PROVISIONAL LIST OF TAXPAYERS EXEMPTED FROM 6% WITHHOLDING TAX FOR JANUARY – JUNE 2016 Section 119 (5) (f) (ii) of the Income Tax Act, Cap. 340 Uganda Revenue Authority hereby notifies the public that the list of taxpayers below, having satisfactorily fulfilled the requirements for this facility; will be exempted from 6% withholding tax for the period 1st January 2016 to 30th June 2016 PROVISIONAL WITHHOLDING TAX LIST FOR THE PERIOD JANUARY - JUNE 2016 SN TIN TAXPAYER NAME 1 1000380928 3R AGRO INDUSTRIES LIMITED 2 1000049868 3-Z FOUNDATION (U) LTD 3 1000024265 ABC CAPITAL BANK LIMITED 4 1000033223 AFRICA POLYSACK INDUSTRIES LIMITED 5 1000482081 AFRICAN FIELD EPIDEMIOLOGY NETWORK LTD 6 1000134272 AFRICAN FINE COFFEES ASSOCIATION 7 1000034607 AFRICAN QUEEN LIMITED 8 1000025846 APPLIANCE WORLD LIMITED 9 1000317043 BALYA STINT HARDWARE LIMITED 10 1000025663 BANK OF AFRICA - UGANDA LTD 11 1000025701 BANK OF BARODA (U) LIMITED 12 1000028435 BANK OF UGANDA 13 1000027755 BARCLAYS BANK (U) LTD. BAYLOR COLLEGE OF MEDICINE CHILDRENS FOUNDATION 14 1000098610 UGANDA 15 1000026105 BIDCO UGANDA LIMITED 16 1000026050 BOLLORE AFRICA LOGISTICS UGANDA LIMITED 17 1000038228 BRITISH AIRWAYS 18 1000124037 BYANSI FISHERIES LTD 19 1000024548 CENTENARY RURAL DEVELOPMENT BANK LIMITED 20 1000024303 CENTURY BOTTLING CO. LTD. 21 1001017514 CHILDREN AT RISK ACTION NETWORK 22 1000691587 CHIMPANZEE SANCTUARY & WILDLIFE 23 1000028566 CITIBANK UGANDA LIMITED 24 1000026312 CITY OIL (U) LIMITED 25 1000024410 CIVICON LIMITED 26 1000023516 CIVIL AVIATION AUTHORITY -

Managing Director's Statement

Summary Financial Statements Housing Finance Bank 2020 Performance Highlights For The Year Ended 31 December 2020 Report Of The Independent Auditor On The Summary Financial Statements To The Shareholders Of Housing Finance Bank Limited I II Statement Of Financial Position As At 31 December 2020 Our Opinion The Audited Financial Statements And 2020 2019 Our Report Thereon Assets Ushs '000 Ushs '000 In our opinion, the accompanying sum- Cash and balances with the central bank 78,801,610 115,135,554 mary financial statements of Housing Fi- We expressed an unmodified audit opin- Deposits and balances due from other banks 48,823,936 56,228,534 nance Bank Limited (“ the Bank”) for the ion on the audited financial statements of Government securities at FVPL 146,919,395 1,364,818 1,108 BN 654.2 BN 551 BN 20.69 BN 250.1 BN year ended 31 December 2020 are con- the Bank for the year ended 31 December Government securities at amortised cost 212,748,084 117,349,831 Total Assets Customer Net Loans Profit After Shareholders’ sistent, in all material respects, with the 2020 in our report dated 21 April 2021. Loans and advances (net) 550,608,755 553,524,657 Deposits Tax Equity audited financial statements of the Bank That report also includes the communi- Other assets 22,568,678 23,346,460 for the year ended 31 December 2020, in cation of a key audit matter. A key audit Property and equipment 31,789,871 29,171,335 Total assets Customer Net loans and Profit After Tax Shareholders’ accordance with the Financial Institutions matter is that which in our professional Intangible assets 7,032,093 6,212,368 increased by 22% deposits advances to declined by 8% equity increased (External Auditors) Regulations, 2010 and judgement, is of most significance in our Capital work in progress 739,311 2,002,197 from Shs 912 increased by 17% customers from Shs 22.5 by 18% from Shs the Financial Institutions Act, 2004. -

1612517024List of Dormant Accounts.Pdf

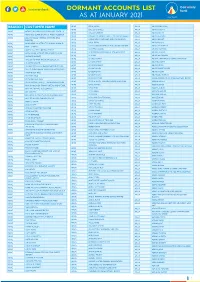

DORMANT ACCOUNTS LIST AS AT JANUARY 2021 BRANCH CUSTOMER NAME APAC OKAE JASPER ARUA ABIRIGA ABUNASA APAC OKELLO CHARLES ARUA ABIRIGA AGATA APAC ACHOLI INN BMU CO.OPERATIVE SOCIETY APAC OKELLO ERIAKIM ARUA ABIRIGA JOHN APAC ADONGO EUNICE KAY ITF ACEN REBECCA . APAC OKELLO PATRICK IN TRUST FOR OGORO ISAIAH . ARUA ABIRU BEATRICE APAC ADUKU ROAD VEHICLE OWNERS AND OKIBA NELSON GEORGE AND OMODI JAMES . ABIRU KNIGHT DRIVERS APAC ARUA OKOL DENIS ABIYO BOSCO APAC AKAKI BENSON INTRUST FOR AKAKI RONALD . APAC ARUA OKONO DAUDI INTRUST FOR OKONO LAKANA . ABRAHAM WAFULA APAC AKELLO ANNA APAC ARUA OKWERA LAKANA ABUDALLA MUSA APAC AKETO YOUTH IN DEVELOPMENT APAC ARUA OLELPEK PRIMARY SCHOOL PTA ACCOUNT ABUKO ONGUA APAC AKOL SARAH IN TRUST FOR AYANG PIUS JOB . APAC ARUA OLIK RAY ABUKUAM IBRAHIM APAC AKONGO HARRIET APAC ARUA OLOBO TONNY ABUMA STEPHEN ITO ASIBAZU PATIENCE . APAC AKULLU KEVIN IN TRUST OF OLAL SILAS . APAC ARUA OMARA CHRIST ABUME JOSEPH APAC ALABA ROZOLINE APAC ARUA OMARA RONALD ABURA ISMAIL APAC ALFRED OMARA I.T.F GERALD EBONG OMARA . APAC ARUA OMING LAMEX ABURE CHRISTOPHER APAC ALUPO CHRISTINE IN TRUST FOR ELOYU JOVIN . APAC ARUA ONGOM JIMMY ABURE YASSIN APAC AMONG BEATRICE APAC ARUA ONGOM SILVIA ABUTALIBU AYIMANI APAC ANAM PATRICK APAC ARUA ONONO SIMON ACABE WANDI POULTRY DEVELPMENT GROUP APAC ANYANGO BEATRASE APAC ARUA ONOTE IRWOT VILLAGE SAVINGS AND LOAN ACEMA ASSAFU APAC ANYANZO MICHEAL ITF TIZA BRENDA EVELYN . APAC ARUA OPIO JASPHER ACEMA DAVID APAC APAC BODABODA TRANSPORTERS AND SPECIAL APAC ARUA OPIO MARY ACEMA ZUBEIR APAC APALIKA FARMERS ASSOCIATION APAC ARUA OPIO RIGAN ACHEMA ALAHAI APAC APILI JUDITH APAC ARUA OPIO SAM ACHIDRI RASULU APAC APIO BENA IN TRUST OF ODUR JONAN AKOC . -

Bernard Bahemuka

Resume: Bernard Bahemuka Personal Information Application Title CHIEF CREDIT OFFICE First Name Bernard Middle Name N/A Last Name Bahemuka Email Address [email protected] Cell Nationality Uganda Gender Male Category Banking/ Finance Sub Category Private Banking Job Type Full-Time Highest Education University Total Experience 16 Year Date of Birth 27-03-1977 Work Phone +2560782366689 Home Phone N/A Date you can start 01-10-2020 Driving License Yes License No. 10143096/2/1 Searchable Yes I am Available Yes Address Address Address Hoima District City Hoima State N/A Country Uganda Institutes Institute Kampala International University City Kampala State N/A Country Uganda Address Kampala,Uganda Certificate Name Bachelors Degree in Business Administration Study Area Accounting & Management Institute Institute Of Teachers Education Kyambogo City Kampala State N/A Country Uganda Address Kampala, Uganda Certificate Name Diploma in Business Education Study Area Business Education Employers Employer Employer Encot Microfinance Limited Position Credit Manager Responsibilities Maintain and preserve Credit Operations policies , manage Credit Operations activities,Manage Credit Risk and grow the portfolio and clientele qualitatively Pay Upon Leaving 5,000,000 uganda Shillings Supervisor Chief Operating Officer From Date 01-10-2017 To Date N/A Leave Reason Carrier Growth City Kampala State N/A Country Uganda Phone N/A Address P.O.Box 389 Masindi Employer Employer Finance Trust Bank Position Branch Manager Responsibilities Over seeing general Branch -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

Notes to the Financial Statements 34

Secure Online Payments Open your online store to international customers by accepting & payments. Transactions are settled NO FOREX UGX USD in both UGX and USD EXPOSURE Powered by for more Information 0417 719229 [email protected] XpressPay is a registered TradeMark Secure Online Payments 2016 ANNUAL REPORT Open your online store to international customers by accepting & payments. Transactions are settled NO FOREX UGX USD in both UGX and USD EXPOSURE Powered by for more Information 0417 719229 [email protected] XpressPay is a registered TradeMark ENJOY INTEREST OF UP TO 7% P.A. WITH OUR PREMIUM CURRENT ACCOUNT INTEREST IS CALCULATED DAILY AND PAID MONTHLY. CONTENTS Overview About Us 6 Our Branch Network 7 Our Corporate Social Responsibility 8 Corporate Information 11 Governance Chairman’s Statement 12 Managing Director/CEO’s Statement 14 Board of Directors’ Profiles 18 Executive Committee 20 Directors’ Report 21 Statement of Directors’ Responsibilities 23 Report of the Independent Auditors 24 Orient Bank Limited Annual Report and Consolidated 04 Financial Statements For the year ended 31 December 2016 OVERVIEW GOVERNANCE FINANCIAL STATEMENTS Financial Statements Consolidated Statement of Comprehensive Income 26 Bank Statement of Comprehensive Income 27 Consolidated Statement of Financial Position 28 Bank Statement of Financial Position 29 Consolidated Statement of Changes in Equity 30 Bank Statement of Changes in Equity 31 Consolidated Statement of Cash flows 32 Bank Statement of Cash flows 33 Notes to the Financial Statements 34 Orient Bank Limited Annual Report and Consolidated Financial Statements For the year ended 31 December 2016 05 ...Think Possibilities ABOUT US Orient Bank is a leading private sector commercial Bank in Uganda. -

List of URA Service Offices Callcenter Toll Free Line: 0800117000 Email: [email protected] Facebook: @Urapage Twitter: @Urauganda

List of URA Service Offices Callcenter Toll free line: 0800117000 Email: [email protected] Facebook: @URApage Twitter: @URAuganda CENTRAL REGION ( Kampala, Wakiso, Entebbe, Mukono) s/n Station Location Tax Heads URA Head URA Tower , plot M 193/4 Nakawa Industrial Ara, 1 Domestic Taxes/Customs Office P.O. Box 7279, Kampala 2 Katwe Branch Finance Trust Bank, Plot No 115 & 121. Domestic Taxes 3 Bwaise Branch Diamond Trust Bank,Bombo Road Domestic Taxes 4 William Street Post Bank, Plot 68/70 Domestic Taxes Nakivubo 5 Diamond Trust Bank,Ham Shopping Domestic Taxes Branch United Bank of Africa- Aponye Hotel Building Plot 6 William Street Domestic Taxes 17 7 Kampala Road Diamond Trust Building opposite Cham Towers Domestic Taxes 8 Mukono Mukono T.C Domestic Taxes 9 Entebbe Entebbe Kitooro Domestic Taxes 10 Entebbe Entebbe Arrivals section, Airport Customs Nansana T.C, Katonda ya bigera House Block 203 11 Nansana Domestic Taxes Nansana Hoima road Plot 125; Next to new police station 12 Natete Domestic Taxes Natete Birus Mall Plot 1667; KyaliwajalaNamugongoKira Road - 13 Kyaliwajala Domestic Taxes Martyrs Mall. NORTHERN REGION ( East Nile and West Nile) s/n Station Location Tax Heads 1 Vurra Vurra (UG/DRC-Border) Customs 2 Pakwach Pakwach TC Customs 3 Goli Goli (UG/DRC- Border) Customs 4 Padea Padea (UG/DRC- Border) Customs 5 Lia Lia (UG/DRC - Border) Customs 6 Oraba Oraba (UG/S Sudan-Border) Customs 7 Afogi Afogi (UG/S Sudan – Border) Customs 8 Elegu Elegu (UG/S Sudan – Border) Customs 9 Madi-opei Kitgum S/Sudan - Border Customs 10 Kamdini Corner -

Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report Editors: Madhyam & SOMO December 2010 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report By: Lawrence Bategeka & Luka Jovita Okumu (Economic Policy Research Centre, Uganda) Editors: Kavaljit Singh (Madhyam), Myriam Vander Stichele (SOMO) December 2010 SOMO is an independent research organisation. In 1973, SOMO was founded to provide civil society organizations with knowledge on the structure and organisation of multinationals by conducting independent research. SOMO has built up considerable expertise in among others the following areas: corporate accountability, financial and trade regulation and the position of developing countries regarding the financial industry and trade agreements. Furthermore, SOMO has built up knowledge of many different business fields by conducting sector studies. 2 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Colophon Banking Sector Liberalisation in Uganda: Process, Results and Policy Options Research report December 2010 Authors: Lawrence Bategeka and Luka Jovita Okumu (EPRC) Editors: Kavaljit Singh (Madhyam) and Myriam Vander Stichele (SOMO) Layout design: Annelies Vlasblom ISBN: 978-90-71284-76-2 Financed by: This publication has been produced with the financial assistance of the Dutch Ministry of Foreign Affairs. The contents of this publication are the sole responsibility of SOMO and the authors, and can under no circumstances be regarded as reflecting the position of the Dutch Ministry of Foreign Affairs. Published by: Stichting Onderzoek Multinationale Ondernemingen Centre for Research on Multinational Corporations Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl Madhyam 142 Maitri Apartments, Plot No. -

Uganda Country Strategy Paper 2017-2021

AFRICAN DEVELOPMENT BANK GROUP UGANDA COUNTRY STRATEGY PAPER 2017-2021 RDGE/COUG June 2017 TABLE OF CONTENTS EXECUTIVE SUMMARY ................................................................................................................. iii I. INTRODUCTION ............................................................................................................................. 1 II. THE COUNTRY CONTEXT ......................................................................................................... 1 2.1 Political Context ......................................................................................................................................... 1 2.2 Economic Context ...................................................................................................................................... 2 2.3 Social development and Cross-cutting Issues……………………………………………………………….. .............................................. 5 III. STRATEGIC OPTIONS, PORTFOLIO PERFORMANCE AND LESSONS ........................ 7 3.1 Country Strategic Framework .................................................................................................................. 7 3.2 Aid Coordination and Harmonization ...................................................................................................... 8 3.3 Country Challenges & Weaknesses and Opportunities and Strengths ................................................. 8 3.5 Key Findings of the CSP 2011-16 Country Portfolio Performance Review (CPPR) ......................... -

Manufacturing Transformation: Comparative Studies of Industrial Development in Africa and Emerging Asia

OUP CORRECTED PROOF – FINAL, 31/5/2016, SPi Manufacturing Transformation OUP CORRECTED PROOF – FINAL, 31/5/2016, SPi UNU World Institute for Development Economics Research (UNU-WIDER) was established by the United Nations University as its first research and training centre and started work in Helsinki, Finland, in 1985. The mandate of the institute is to undertake applied research and policy analysis on structural changes affecting developing and transitional economies, to provide a forum for the advocacy of policies leading to robust, equitable, and environmentally sustainable growth, and to promote capacity strengthening and training in the field of economic and social policy-making. Its work is carried out by staff researchers and visiting scholars in Helsinki and via networks of collaborating scholars and institutions around the world. United Nations University World Institute for Development Economics Research (UNU-WIDER) Katajanokanlaituri 6B, 00160 Helsinki, Finland www.wider.unu.edu OUP CORRECTED PROOF – FINAL, 31/5/2016, SPi Manufacturing Transformation Comparative Studies of Industrial Development in Africa and Emerging Asia Edited by Carol Newman, John Page, John Rand, Abebe Shimeles, Måns Söderbom, and Finn Tarp A study prepared by the United Nations University World Institute for Development Economics Research (UNU-WIDER) 1 OUP UNCORRECTED PROOF – REVISES, 6/6/2016, SPi 3 Great Clarendon Street, Oxford, OX2 6DP, United Kingdom Oxford University Press is a department of the University of Oxford. It furthers the University’s objective of excellence in research, scholarship, and education by publishing worldwide. Oxford is a registered trade mark of Oxford University Press in the UK and in certain other countries. -

Mapping Uganda's Social Impact Investment Landscape

MAPPING UGANDA’S SOCIAL IMPACT INVESTMENT LANDSCAPE Joseph Kibombo Balikuddembe | Josephine Kaleebi This research is produced as part of the Platform for Uganda Green Growth (PLUG) research series KONRAD ADENAUER STIFTUNG UGANDA ACTADE Plot. 51A Prince Charles Drive, Kololo Plot 2, Agape Close | Ntinda, P.O. Box 647, Kampala/Uganda Kigoowa on Kiwatule Road T: +256-393-262011/2 P.O.BOX, 16452, Kampala Uganda www.kas.de/Uganda T: +256 414 664 616 www. actade.org Mapping SII in Uganda – Study Report November 2019 i DISCLAIMER Copyright ©KAS2020. Process maps, project plans, investigation results, opinions and supporting documentation to this document contain proprietary confidential information some or all of which may be legally privileged and/or subject to the provisions of privacy legislation. It is intended solely for the addressee. If you are not the intended recipient, you must not read, use, disclose, copy, print or disseminate the information contained within this document. Any views expressed are those of the authors. The electronic version of this document has been scanned for viruses and all reasonable precautions have been taken to ensure that no viruses are present. The authors do not accept responsibility for any loss or damage arising from the use of this document. Please notify the authors immediately by email if this document has been wrongly addressed or delivered. In giving these opinions, the authors do not accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by the prior written consent of the author This document has been prepared solely for the KAS and ACTADE. -

Market Survey on Possible Co-Operation with Finance Institutions for Energy Financing in Kenya, Uganda and Tanzania

Market Survey on Possible Co-operation with Finance Institutions for Energy Financing in Kenya, Uganda and Tanzania February 2010 Phyllis Kariuki Kavita Rai Other Contributors: Felistas Coutinho, Anna Mulalo and Jon Gore (Tanzania) Hidde Bekaan and Andrew Obara (Uganda) Table of Contents Acronyms.................................................................................................................................................... 3 Executive Summary ................................................................................................................................ 4 1 Introduction..................................................................................................................................... 5 1.1 Study Outputs.................................................................................................................................................5 1.2 Financing Models .........................................................................................................................................5 2 Overview and access of the financial sector......................................................................... 6 2.1 The Financial Sectors .................................................................................................................................6 2.2 Overall Access to Financial Sector by Population.........................................................................8 2.3 Rural versus urban access to Financial Access...............................................................................9