Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Section 3 - Investment Information

SECTION 3 - INVESTMENT INFORMATION Investment Risk Management and Capital Market Assumptions ....................................... .......Tab 8 Asset Exposure and Investment Program Summary ................................................................ .......Tab 9 Performance .............................................................................................................................................. ....... Tab 10 Managing Investment Expenses and Investment Fees by Manager ................................... .......Tab 11 Commitment to Pennsylvania-Based Investments .................................................................... .......Tab 12 This page intentionally left blank Section 3 - Investment Information Investment Risk Management for future developments, PSERS cannot know with complete certainty how markets or particular isk management is essential to the entire investment strategies will perform. The strategic Rinvestment process. The goal of investment asset allocation mix, more than implementation risk management is to find the appropriate balance or any other factor or decision, largely determines between expected returns and the risks taken the portfolio’s overall risk and return. to generate those returns. An entirely risk-free investment portfolio that has a high probability Given its long-term investment horizon, PSERS of meeting all investment goals does not exist. accepts prudent investment risk in exchange Therefore, PSERS does not attempt to eliminate for acceptable levels of additional incremental -

Financial Technology Sector Report

FINTECH SECTOR REPORT October 2018 Q3 2018 INSURANCE TECHNOLOGY SECTOR SUMMARY Case Study: Sale of QuoteWizard.com LLC to LendingTree, Inc. (NasdaqGS: TREE) GCA acted as exclusive financial advisor to QuoteWizard, provider of a customer acquisition technology platform, on its sale to LendingTree. Transaction Summary Strategic Rationale ▪ On October 4th, 2018, QuoteWizard.com LLC ▪ QuoteWizard will immediately establish LendingTree as a (“QuoteWizard”) announced it had entered into a leader in the high growth online insurance market definitive agreement to be acquired by LendingTree, Inc. − Since its founding in 2006, QuoteWizard has helped (NasdaqGS:TREE) (“LendingTree”) for up to $370MM over 40 million consumers compare and find TRANSACTION DETAILS − $300MM in up-front consideration at close, payable insurance policies online Closed in cash October 2018 ▪ QuoteWizard’s customer acquisition technology platform − $70MM in potential earn-out consideration based and network of over 30 top tier carriers and 10,000 SECTOR on achievement of certain growth milestones in the insurance agents across the country create a scale and Insurance Technology first three years following transaction close network advantage for high-quality insurance lead distribution Digital Media ▪ The QuoteWizard management team, led by CEO Scott Peyree, will continue as QuoteWizard leadership − Will significantly expand LendingTree’s relationships DEAL TYPE following closing with insurance carriers and agents enable cross M&A ▪ QuoteWizard generated $75.6MM in revenue -

SEI Investments Annual Report 2020

SEI Investments Annual Report 2020 Form 10-K (NASDAQ:SEIC) Published: February 24th, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from_________to ________ Commission File Number: 0-10200 ________________________________________ ________________________________________ SEI INVESTMENTS COMPANY (Exact name of Registrant as Specified in Its Charter) Pennsylvania 23-1707341 State or Other Jurisdiction of Incorporation or Organization I.R.S. Employer Identification No. 1 Freedom Valley Drive Oaks, PA 19456 (Address of Principal Executive Offices and Zip Code) 610-676-1000 (Registrant’s Telephone Number, Including Area Code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common Stock, par value $.01 per share SEIC The NASDAQ Stock Market LLC (The NASDAQ Global Select Market®) Securities registered pursuant to Section 12(g) of the Act: None (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Y es ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

SEI INVESTMENTS COMPANY (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2014 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from_________to ________ Commission File Number: 0-10200 SEI INVESTMENTS COMPANY (Exact name of registrant as specified in its charter) Pennsylvania 23-1707341 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 1 Freedom Valley Drive, Oaks, Pennsylvania 19456-1100 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code 610-676-1000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $.01 per share The NASDAQ Stock Market LLC (The NASDAQ Global Select Market®) Securities registered pursuant to Section 12(g) of the Act: None (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

SEI 2015 Annual Report This Was a Successful Year for Your Company

SEI 2015 Annual Report This was a successful year for your company. We achieved record sales of new business and made progress executing growth strategies. We delivered improved financial results while we continued investments to serve clients and support growth for the long term. seic.com About SEI SEI is a leading global provider of asset management, investment processing, and investment operations solutions. We help professional wealth managers, institutional investors, investment management firms and private investors create and manage wealth. We also enable their long-term success by providing solutions that are both innovative and comprehensive. Contents Additional Information Financial Highlights SEIͭb;]cRa]RcbWcR͜bRWP͙P^\͜^ŪRab additional information about the company Letter to Shareholders including earnings announcements, Annual Report on Form 1 0-K corporate press releases, and regulatory ŬZW]Ub͙FVWb2]]dMZDR_^ac͜7^a\=͜ and Proxy Statement are available in the Investors section of the website. Forward-Looking Statements FVWbaR_^acP^]cMW]bbcMcR\R]cbcVMcP^]bcWcdcRS^afMaQZ^^YW]UbcMcR\R]cbMbQRŬ]RQ d]QRaG͙E͙SRQRaMZbRPdaWcWRbZMfb͙FVRbRbcMcR\R]cbW]PZdQRQWbPdbbW^]bMO^dcSdcdaR bcaMcRUWRb͜^_RaMcW^]b͜M]QŬ]M]PWMZaRbdZcb͙FVRbRbcMcR\R]cbMaROMbRQd_^]RbcW\McRb M]QMbbd\_cW^]bcVMcW]e^ZeRaWbYbM]Qd]PRacMW]cWRbM]Q\Mh]^c_a^eRc^ORMPPdaMcR͙ 7dcdaRaReR]dRbM]QW]P^\RP^dZQQWŪRa\McRaWMZZhSa^\Rg_RPcRQaRbdZcb͙K^dbV^dZQaRSRa c^cVR 2]]dMZDR_^ac^]7^a\=͜W]PZdQRQVRaRW]͜S^aMQRbPaW_cW^]^SeMaW^dbaWbYb M]Qd]PRacMW]cWRbcVMcP^dZQMŪRPc^daSdcdaRŬ]M]PWMZaRbdZcb͙ SEI Oaks, -

New Opportunties - TF

New Opportunties - TF Schedule of Investments as of 2017-09-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) Cotiviti Holdings Inc 82,434 2,965,975 LogMeIn Inc 26,688 2,937,014 CDW Corp/DE 44,273 2,922,018 Tivity Health Inc 65,176 2,659,181 XPO Logistics Inc 38,536 2,611,970 Burlington Stores Inc 26,646 2,543,627 Ball Corp 58,574 2,419,106 RingCentral Inc 57,626 2,405,886 Bright Horizons Family Solutions Inc 27,768 2,393,879 MSCI Inc 20,395 2,384,176 Catalent Inc 58,551 2,337,356 CyrusOne Inc 39,336 2,318,070 Dolby Laboratories Inc 38,884 2,236,608 Granite Construction Inc 38,149 2,210,735 SiteOne Landscape Supply Inc 37,779 2,194,960 CBOE Holdings Inc 20,195 2,173,588 2U Inc 38,578 2,161,911 LKQ Corp 59,115 2,127,549 Summit Materials Inc 66,267 2,122,532 AAR Corp 56,143 2,121,083 Planet Fitness Inc 78,462 2,116,905 Callidus Software Inc 83,778 2,065,128 Mercury Systems Inc 39,658 2,057,457 Pool Corp 18,587 2,010,556 Fortune Brands Home & Security Inc 29,197 1,962,914 Brunswick Corp/DE 34,991 1,958,446 Brink's Co/The 23,134 1,949,040 Cooper Cos Inc/The 8,214 1,947,622 Chegg Inc 131,125 1,945,895 Tyler Technologies Inc 11,070 1,929,722 KLX Inc 36,290 1,920,830 Paycom Software Inc 25,177 1,887,268 WABCO Holdings Inc 12,660 1,873,680 Advanced Disposal Services Inc 72,336 1,822,144 Essent Group Ltd 44,825 1,815,412 Installed Building Products Inc 28,011 1,815,113 John Bean Technologies Corp 17,938 1,813,532 Alarm.com Holdings Inc 39,789 1,797,667 ITT Inc 40,325 1,785,188 Acadia Healthcare Co Inc 37,106 1,772,183 Broadridge -

SEI INVESTMENTS COMPANY (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2005 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 0 - 10200 SEI INVESTMENTS COMPANY (Exact name of registrant as specified in its charter) Pennsylvania 23-1707341 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 1 Freedom Valley Drive, Oaks, Pennsylvania 19456-1100 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code 610-676-1000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered None Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01 per share (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Printmgr File

ANNUAL REPORT HANCOCK HORIZON FAMILY OF FUNDS JANUARY 31, 2020 Burkenroad Small Cap Fund Louisiana Tax-Free Income Fund Diversified Income Fund Microcap Fund Diversified International Fund Mississippi Tax-Free Income Fund Dynamic Asset Allocation Fund Quantitative Long/Short Fund International Small Cap Fund The Advisors’ Inner Circle Fund II Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, or, if you are a direct investor, by calling 1-800-990-2434. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-990-2434. -

A Challenging Year

SEI 2008 ANNUAL REPORT A Challenging Year Although revenues and earnings per share declined significantly, we were profitable, generated positive cash flow, repurchased company stock, and continued to invest in key growth strategies. SEI is a leading global provider of asset management, investment processing, and investment operations solutions. We help banks, investment advisors, institutional investors, investment managers, and ultra-high-net-worth investors create and manage wealth — and enable their long-term success — by providing comprehensive, innovative, investment and investment business solutions. CONTENTS FORWarD-LOOKING STATEMENTS Financial Highlights . 1 This report contains statements that constitute forward-looking statements as defined under U.S. federal securities laws. These statements include Letter to Shareholders . 2 discussions about future strategies, operations, and financial results. These Annual Report on Form 10-K . 7 statements are based upon estimates and assumptions that involve risk and uncertainties and may not prove to be accurate. Future revenues and income ADDITIONAL INFORMATION could differ materially from expected results. You should refer to the 2008 SEI’s Internet site, www.seic.com, offers additional information about the Annual Report on Form 10-K, included herein, for a description of various company, including earnings announcements, corporate press releases, and risks and uncertainties that could affect our future financial results. regulatory filings. This Annual Report, Form 10-K, and Proxy Statement are available in the Investors section of the website. SEI 2008 Annual Report FiNANciaL SUMMARY (In thousands, except per-share data) 2008 Percent Change from 2007 Revenues $1,247,919 (9%) Net Income Before Taxes $224,974 (45%) Net Income $139,254 (46%) Diluted common shares outstanding 195,233 (3%) Diluted Earnings Per Share $0.71 (45%) HIGHLIGHTS SEI’s financial performance in 2008 was significantly affected by the downturn in the capital markets. -

Annual Report 2020

The Advisors’ Inner Circle Fund III Aperture New World Opportunities Fund Aperture Endeavour Equity Fund Aperture Discover Equity Fund Aperture International Equity Fund Annual Report December 31, 2020 Investment Adviser: Aperture Investors, LLC TABLE OF CONTENTS Shareholder Letters .............................................. 1 Schedules of Investments ......................................... 10 Aperture New World Opportunities Fund ............................ 10 Aperture Endeavour Equity Fund .................................. 39 Aperture Discover Equity Fund ................................... 50 Aperture International Equity Fund ................................ 55 Statements of Assets and Liabilities ................................. 61 Statements of Operations .......................................... 63 Statements of Changes in Net Assets ................................ 65 Financial Highlights ............................................... 73 Notes to Financial Statements ...................................... 81 Report of Independent Registered Public Accounting Firm ............... 112 Disclosure of Fund Expenses ...................................... 114 Trustee and Officers Table ......................................... 116 Renewal of Investment Advisory Agreement .......................... 120 Approval of Investment Advisory Agreement .......................... 124 Notice to Shareholders ............................................ 127 The Funds file their complete schedule of investments of Fund holdings with the -

JSMDID Janus Index & Calculation Services LLC Announces The

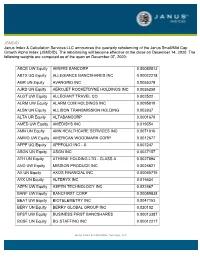

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

Lendingtree, Inc

LENDINGTREE, INC. FORM 10-K (Annual Report) Filed 02/28/17 for the Period Ending 12/31/16 Address 11115 RUSHMORE DRIVE CHARLOTTE, NC 28277 Telephone 704-943-8942 CIK 0001434621 Symbol TREE SIC Code 6163 - Loan Brokers Industry Consumer Lending Sector Financials Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2017, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________________________ FORM 10-K __________________________________________________ (Mark One) ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2016 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-34063 __________________________________________________ LendingTree, Inc. (Exact name of Registrant as specified in its charter) Delaware (State or other jurisdiction of 26-2414818 incorporation or organization) (I.R.S. Employer Identification No.) 11115 Rushmore Drive, Charlotte, North Carolina 28277 (Address of principal executive offices) (704) 541-5351 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of each exchange on which registered Common Stock, $0.01 Par Value The NASDAQ Stock Market Securities registered pursuant to Section 12(g) of the Act: None ________________________________________________________________________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.