Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Regulation 30 PR Gold Certificate

SEC/09/2021 May 05, 2021 National Stock Exchange of India Ltd BSE Limited Exchange plaza, 5th floor Phiroze Jeejeebhoy Towers Bandra-kurla Complex Dalal Street, Bandra (E), Mumbai 400051. Mumbai 400001. Symbol: KALYANKJIL Scrip code: 543278 Dear Sir/Madam, Intimation under Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 – Press Release --------------------------------------------------------------------------------------------------------------------- Pursuant to Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find attached the press release to be issued by the Company on Gold Ownership Certificate initiatives of the Company. This intimation is also made available on the website of the Company www.kalyanjewellers.net This is for your information and records. Thanking You. Yours faithfully, Jishnu RG Company Secretary & Compliance Officer Membership No – ACS 32820 Kalyan Jewellers India Limited Corporate Office -TC-32/204/2, Sitaram Mill Road, Punkunnam, Thrissur, Kerala – 680 002 CIN - U36911KL2009PLC024641 T -0487 2437333 Email – [email protected] WWW.KALYANJEWELLERS.NET Kalyan Jewellers reinitiates extension of Gold Ownership Certificate National, 5, May, 2021: Kalyan Jewellers has announced the extension of the Gold Ownership Certificate initiative. This was launched last year, during the lockdown, and with the lockdown imposed again, the brand has reinitiated the facility, based on customer request. Gold Ownership Certificate will indicate that the person now owns gold of a certain grammage/value. Once the lockdown is lifted, customers can redeem their certificates against physical gold, in the form of coins or jewellery. As the Gold Rate Protection offer is also included in the certificate, customers will get the additional benefit of protection against price fluctuations. -

Alukkas Residency - Nadathara, Thrissur 2BHK and 3BHK Residential Apartments in Nadathara, Thrissur Alukkas Builders and Developers Pvt

https://www.propertywala.com/alukkas-residency-thrissur Alukkas Residency - Nadathara, Thrissur 2BHK and 3BHK Residential Apartments in Nadathara, Thrissur Alukkas Builders And Developers Pvt. Ltd. presents luxurious 2BHK and 3BHK Residential Apartments in Nadathara, Thrissur in Alukkas Residency Project ID : J667119002 Builder: Alukkas Builders And Developers Pvt. Ltd. Properties: Residential Plots / Lands Location: Alukkas Residency, Nadathara, Thrissur - 680001 (Kerala) Completion Date: Dec, 2015 Status: Started Description Alukkas Builders And Developers Pvt. Ltd. is presenting its brand new luxurious residential project Alukkas Residency in the arm of Thrissur. The project is offering beautiful 2BHK and 3BHK residential apartments in various sizes starting from 1108 Sq.Ft. to 1745 Sq.Ft. in an affordable price. Alukkas Residency is the special project of the Alukkas Builders and Developers, it is the great combination of latest technology and the true nature. It means you can find all modern as well as stylish amenities and lots of features in this project and around it, you will find the lush greenery which is very far from the noisy and polluted environment. Alukkas Residency is the best place to make your dream house where you can raise your family, it is easily accessible from all parts of the Thrissur. Location - Nadathara, Thrissur Type - 2BHK and 3BHK Residential Apartments Size - 1108 Sq.Ft. to 1745 Sq. Ft. Price - On Request. Amenities 24 hour power back-up Extensive club facilities Eateries ATM Treated water Security High liquidity Holiday home option Library Indoor Games Coffee Shop Excellent location Guest Rooms Mini Theatre Business Centre Swimming Pool Fun & learning activities Bank Alukkas Builders and Developers Private Limited is one of the prestigious venture from the House of Alukkas, it is the trusted name in jewelers business since decades. -

G) Mrlecotr Cl5eoile'ui

ce.oo cilQ)ocruc "roil(r)celco Glo!6,Co (ruccoe(r)o (r)as@ Jlo(r)oilscoro cdcolo :540 27.02. 2018 d ooddl6" 66. ooau'. p. 6pll. (orloe, fipccncr5)'16 @dt(rufitl)l GelcBJo 9olo@o qgl.Jl.mrl.cecdee- oO.. o6rD1 @;1. "O". (ooclJBl('il o6,.d o@t) ocolo cojloe$"Jgoel oe. o6cru'. p. c5Dicdn" o6.oocu".p.6rtl ejloleo.D- 6mr(ril(o)lcer6)- , "O(m enl enci|goolq. mrccnrooi]o ooaoc8o odqo.sS 6)o6ocP onuoi qo,coo dloLrnorco:os tg4oicrumr:l qe$ ooroS.sroo ooJaa.sd 6r)lc(r)J(o@,ua nioccrgccncco.ll odo8.soa .106r]3- o8o Qs6sEO0cm clcdoro @"J16(016)ccro. (grb(oilcragE oo."6mr-.p.5rrl ellolgorloo! oll"rll<orq. qgarcojkdo.g$gcsnec; rrudelc@1oQ oll"rllcoq. crcdndle rooslfru.ocmorotd cncfo,ccno eoorBdld p(6jl6)(r)ojl6@ olloroccrilqilormo. p@6cco 12.02.2011cf, @ccpld o"ro8",so8 Grgd oooclocofi) (r)S.,JElO,go @cqojlgl rsc*I q"Jleol maqo 01.012016 q(od o.uoE"goE ollcoroomo ffuJl6(o14ili6')6rEm' ojlooB- Greooc1.66 qqernccoll. ooorB{otl c6rucdcdci .rilnD" cils(a)d oalg oc6)ccoc; qgoroS ooJoA.so06crio. qso. gsco(o) o"JoA"EoA (r)(i@;lc/l(olcno6rB-. etolcncortrdlocco @6 o6,."Ocru".p.5njl."4yci occp,;rd csrp,li)cag O(0)Jaco)l o(i@,cro6rB". oceld €$laeJgi (r)cia@,6r8 g6(ql(i (r)1e{ril(i6(m odlqf€, .uol.oolormoilno. cnsasla,crE mllleol4or<oxno. (6ni)c1cd"ril@,, cr{oiruccor p(r)dsBeild cjlrnoo 31.01.2018 (6ni) 31.01.2018-oer ddl$|o fuo6ru(ur.4 ojlcro. -

Kalyan Jewellers

Kalyan Jewellers https://www.indiamart.com/kalyan-jewellers/ The group derives its origins from textile retailing and wholesaling and has an experience of over 100 years in the trade. Kalyan branched out into the field of Jewellery retailing in the year 1993 by opening its first store in Thrissur. The ... About Us The group derives its origins from textile retailing and wholesaling and has an experience of over 100 years in the trade. Kalyan branched out into the field of Jewellery retailing in the year 1993 by opening its first store in Thrissur. The reason behind the Kalyan group's foray into business itself is quite unique and makes it interesting to read. The ancestors of the current management come from a pious background that comprised of priests, saints and advisors to kings. Hailing from the Tanjavur district of Tamilnadu, these ancestors had migrated to Kerala.The decision to start a business was taken in response to the call of one of the senior relatives of the clan, who was a Dewan to the Maharaja of Kochi, who believed 'Enterprise and business was necessary to create job opportunities and to make India self dependent'. He also believed that 'business should be fair with a social objective and not just for selfish motives'. The group still adheres to the founding principles of its forefathers and this explains the group's firm grounding in fair business practices and ethics. For more information, please visit https://www.indiamart.com/kalyan-jewellers/aboutus.html DIAMOND JEWELLERY SETS P r o d u c t s & S e r v i c e s Diamond Diamond Diamond Diamond GOLD JEWELRY P r o d u c t s & S e r v i c e s Gold Gold Gold Gold P r o OTHER PRODUCTS: d u c t s & S e r v i c e s Diamond Gold Platinum Platinum F a c t s h e e t Year of Establishment : 1993 Nature of Business : Wholesaler CONTACT US Kalyan Jewellers Contact Person: Anand A S Sreekrishna Building, West Palace Road Thrissur - 680022, Kerala, India https://www.indiamart.com/kalyan-jewellers/. -

Annual Report Kalyan Jewellers India Limited 2019 - 2020

ANNUAL REPORT KALYAN JEWELLERS INDIA LIMITED 2019 - 2020 Corporate Information Board of Directors Mr. T.S. Kalyanaraman - Chairman & Managing Director Mr. T.K Seetharam - Whole-time Director Mr. T. K Ramesh - Whole-time Director Mr. Salil Nair - Non-Executive Director Mr. Anish Saraf - Non-Executive, Nominee Director Mr. A.D.M Chavali - Independent Director Mr. Mahalingam Ramaswamy - Independent Director Mr. T.S. Anantharaman - Independent Director Ms. Kishori Jayendra Udeshi - Independent Director Mr. Anil Sadasivan Nair - Independent Director Audit Committee Mr. A.D.M Chavali - Chairman Mr. Anish Saraf Mr. Mahalingam Ramaswamy Nomination & Remuneration Committee Mr. Mahalingam Ramaswamy - Chairman Mr. A.D.M Chavali Mr. Anish Saraf Corporate Social Responsibility Committee Mr. T.S. Kalyanaraman - Chairman Mr. Mahalingam Ramaswamy Mr. T.K Seetharam Mr. T. K Ramesh Risk Management Committee Mr. Salil Nair - Chairman Mr. Anil Sadasivan Nair Mr. T.K Seetharam Stakeholders Relationship Committee Mr. T.S. Anantharaman – Chairman Mr. T.K Seetharam Mr. T. K Ramesh Chief Financial Officer Mr. V Swaminathan Chief Executive Officer Mr. Sanjay Raghuraman (appointed as CEO w.e.f 01st July 2020) Company Secretary & Compliance Officer Mr. Jishnu RG (designated as Compliance Officer w.e.f 01st July 2020) Statutory Auditors Deloitte Haskins & Sells LLP 7th Floor, Times Square, Door No. 62, A.T.T. Colony Road, Coimbatore – 641018 Registered & Corporate Office TC-32/204/2, Sitaram Mill Road, Punkunnam, Thrissur, Kerala – 680 002 Registrar and Transfer Agent Link Intime India Private Limited C-101, 1st Floor, 247 Park Lal Bahadur Shastri Marg Vikhroli (West), Mumbai 400083 DIRECTORS REPORT Dear Shareholders Your Directors have pleasure in submitting their 12th Annual Report of Kalyan Jewellers India Limited (“the Company”) together with Audited Statement of Accounts for the financial year ended on 31st March, 2020. -

Kalyan Jewellers India Ltd

Kalyan Jewellers India Ltd Price Band | 86-87 UNRATED March 15, 2021 ` Established in 1993, Kalyan Jewellers is one of India’s largest jewellery companies having ~6% market share in the organised jewellery space. The company designs, manufactures and sells a wide range of jewellery products at varying price points for uses ranging from jewellery for special occasions such as weddings, which is its highest selling product category, to daily-wear jewellery. Over the years, the company has successfully expanded to become a pan-India player with 107 showrooms across 21 states in India and 30 showrooms located in the Middle East. One of the key strengths of the company has been to operate as a hyperlocal jewellery Particulars player. It endeavours to cater to customers’ unique preferences, which often IPO Review Issue Details vary significantly by geography and micro market, through its local market expertise and region-specific marketing strategy and advertising campaigns. Issue Opens 16-03-2021 Issue Closes 18-03-2021 Following hyperlocal strategy to cater to wide range of segments Issue Size ~ | 1175 crore Fresh Issue/ Offer Jewellery consumption patterns in India are highly localised with customer Issue Type preferences varying significantly by region. The company strives to appeal for sale to a broad base of customers via a multi-faceted hyperlocal strategy by Price Band | 86 - | 87 deploying initiatives such as: a) localisation of product portfolio, b) No of shares ~ 13.51 crore localisation of brand communication and marketing and c) localisation of Market Lot 172.0 showroom experience for customers. Localisation strategy, combined with large scale of operations, allows it to cater to a wide range of customers Face Value 10.0 across geographies, age groups, socio-economic status levels and genders as well as across urban, rural and semi-urban markets. -

Investor Presentation

SEC/18/2021 May 27, 2021 BSE Limited National Stock Exchange of India Ltd. 1st Floor, New Trading Ring, Bandra - Kurla Complex Rotunda Building, P J Towers, Dalal Bandra (E), Street, Mumbai – 400001, Mumbai- 400051, Maharashtra Maharashtra Scrip code: 543278 Scrip: KALYANKJIL Dear Sir/ Madam, Sub: Investors/ Analysts Presentation Further to our communication dated May 21, 2021, please find enclosed the presentation on the Standalone and Consolidated Financial Results of the Company for the quarter and year ended March 31, 2021, for the Investors/ Analysts call scheduled on Friday, 28th May 2021. The presentation is also being uploaded on the website of the Company www. kalyanjewellers.net Please take the information on record. Thanking You Yours Faithfully Jishnu RG Company Secretary & Compliance Officer Encl: As above. Kalyan Jewellers India Limited Corporate Office -TC-32/204/2, Sitaram Mill Road, Punkunnam, Thrissur, Kerala – 680 002 CIN - U36911KL2009PLC024641 T -0487 2437333 Email – [email protected] WWW.KALYANJEWELLERS.NET INVESTOR PRESENTATION MAY 2021 KALYAN JEWELLERS INDIA LIMITED Safe Harbor This presentation and the accompanying slides (the “Presentation”), which have been prepared by Kalyan Jewellers India Limited (the “Company”), have been prepared solely for information purposes and do not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment whatsoever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. -

Annexure 1B 18416

Annexure 1 B List of taxpayers allotted to State having turnover of more than or equal to 1.5 Crore Sl.No Taxpayers Name GSTIN 1 BROTHERS OF ST.GABRIEL EDUCATION SOCIETY 36AAAAB0175C1ZE 2 BALAJI BEEDI PRODUCERS PRODUCTIVE INDUSTRIAL COOPERATIVE SOCIETY LIMITED 36AAAAB7475M1ZC 3 CENTRAL POWER RESEARCH INSTITUTE 36AAAAC0268P1ZK 4 CO OPERATIVE ELECTRIC SUPPLY SOCIETY LTD 36AAAAC0346G1Z8 5 CENTRE FOR MATERIALS FOR ELECTRONIC TECHNOLOGY 36AAAAC0801E1ZK 6 CYBER SPAZIO OWNERS WELFARE ASSOCIATION 36AAAAC5706G1Z2 7 DHANALAXMI DHANYA VITHANA RAITHU PARASPARA SAHAKARA PARIMITHA SANGHAM 36AAAAD2220N1ZZ 8 DSRB ASSOCIATES 36AAAAD7272Q1Z7 9 D S R EDUCATIONAL SOCIETY 36AAAAD7497D1ZN 10 DIRECTOR SAINIK WELFARE 36AAAAD9115E1Z2 11 GIRIJAN PRIMARY COOPE MARKETING SOCIETY LIMITED ADILABAD 36AAAAG4299E1ZO 12 GIRIJAN PRIMARY CO OP MARKETING SOCIETY LTD UTNOOR 36AAAAG4426D1Z5 13 GIRIJANA PRIMARY CO-OPERATIVE MARKETING SOCIETY LIMITED VENKATAPURAM 36AAAAG5461E1ZY 14 GANGA HITECH CITY 2 SOCIETY 36AAAAG6290R1Z2 15 GSK - VISHWA (JV) 36AAAAG8669E1ZI 16 HASSAN CO OPERATIVE MILK PRODUCERS SOCIETIES UNION LTD 36AAAAH0229B1ZF 17 HCC SEW MEIL JOINT VENTURE 36AAAAH3286Q1Z5 18 INDIAN FARMERS FERTILISER COOPERATIVE LIMITED 36AAAAI0050M1ZW 19 INDU FORTUNE FIELDS GARDENIA APARTMENT OWNERS ASSOCIATION 36AAAAI4338L1ZJ 20 INDUR INTIDEEPAM MUTUAL AIDED CO-OP THRIFT/CREDIT SOC FEDERATION LIMITED 36AAAAI5080P1ZA 21 INSURANCE INFORMATION BUREAU OF INDIA 36AAAAI6771M1Z8 22 INSTITUTE OF DEFENCE SCIENTISTS AND TECHNOLOGISTS 36AAAAI7233A1Z6 23 KARNATAKA CO-OPERATIVE MILK PRODUCER\S FEDERATION -

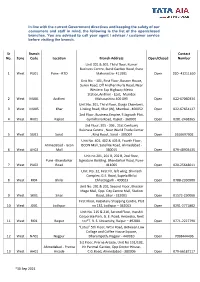

*06 Sep 2021 in Line with the Current Government Directives

In line with the current Government directives and keeping the safety of our consumers and staff in mind, the following is the list of the open/closed branches. You are advised to call your agent / advisor / customer service before visiting the branch. Sr Branch Contact No. Zone Code Location Branch Address Open/Closed Number Unit 301 & 302, Third floor, Kumar Business Centre, Bund Garden Road, Pune 1 West PU01 Pune - RTO Maharastra- 411001 Open 020- 41211610 Unit No. - 101, First Floor, Boston House, Suren Road, Off Andheri Kurla Road, Near Western Exp Highway Metro Station,Andheri - East, Mumbai 2 West MU01 Andheri Maharashtra 400 093 Open 022-67060334 Unit No. 301, Third Floor, Durga Chambers, 3 West MU05 Khar Linking Road, Khar (W), Mumbai - 400052 Open 022-67654127 2nd Floor, Business Empire, 5 Jagnath Plot, 4 West RK01 Rajkot Gymkhana Road, Rajkot - 360001 Open 0281-2468365 3rd Floor, 305 - 306 , 21st Centuary Buisness Centre , Near World Trade Center 5 West SU01 Surat , Ring Road , Surat - 395007 Open 2616697902 Unit No. 401, 402 & 403 B, Fourth Floor, Ahmedabad - Iscon ISCON Mall, Satellite Road, Ahmedabad - 6 West AH02 Mall 380015 Open 079-48903435 Unit no 201, 201 B, 202 B, 2nd floor, Pune -Bhandarkar Signature Building, Bhandarkar Road, Pune- 7 West PU02 Road 411005 Open 020-25648011 Unit No. 32, First Flr, left wing. Shivnath Complex, G.E. Road, Supela Bhilai 8 West RI04 Bhilai Chhattisgarh - 490023 Open 0788-2350900 Unit No. 201 & 202, Second Floor, Bhaskar Mega Mall, Opp. City Centre Mall, Station 9 West SK01 Sikar Road, Sikar - 332001 Open 01572-250066 First Floor, Kalpataru Shopping Centre, Plot 10 West JD01 Jodhpur no 132, Jodhpur – 342003 Open 0291-2771802 Unit No. -

The Chairman and the CEO Visited Thrissur, Kerala. the GJSCI Formed the Kerala State Skill Advisory Committee. the Committee

The Chairman and the CEO visited Thrissur, Kerala. The GJSCI formed the Kerala State Skill Advisory Committee. The Committee comprises of representatives from jewellery manufacturers and retailers of Kerala. The committee also has representation from the Additional Skill Acquisition Programme, a Kerala State Government enterprise. The objective of the Committee is to provide on–ground support to GJSCI activities in Kerala and guide the GJSCI board on requirements specifically pertaining to Kerala. The Government of Kerala through ASAP has funds available for skills training and they would like to ensure that the funds are well utilised under the aegis of the GJSCI and this new committee. The members of the first Kerala State Skill Advisory Committee are: Mr. James Jose, Managing Director, Chemanur Gold Refinery; Dr. K. M. Abraham (IAS, Additional Chief Secretary, Government of Kerala), Mr. Riyas (Additional Skill Acquisition Program, Govt of Kerala), Mr. Raphy Antony (Peeyar Exports,Thrissur), Mr. PV Jose (State President, Jewellers Manufacturers Association, Kerala), Mr. Rajesh Kalyanaraman (Executive Director, Kalyan Jewellers,Thrissur), Mr. A. K Nishad (Executive Director, Malabar Group,Kochi), Mr. Ravinath Mohandas (Managing Director, VNM Jewel Crafts Ltd. ,Kochi), Mr. Antony Thottan (Thottan Group,Thrissur). Mr. P.V Jose was elected as the first convener and Mr. Ravinath Mohandas as the co–convener. The first meeting was a success and the committee pledged support for the Recognition of Prior Learning pilot project at Thrissur for a 1000 goldsmiths. The committee also pledged full support to the WorldSkills regional Competition which will be held at Thrissur on 16/17/18 June 2014 at Mr. -

Government of Andhra Pradesh C.T.DEPARTMENT CST271405191807778 CST271405191807778

Government of Andhra Pradesh C.T.DEPARTMENT (Self Printed CST e-Way Bill) FORM OF WAY BILL FORM X or FORM 600 {See Rules 33(1)(d) & 55(1)&(4)} ORIGINAL - CST Way Bill No. : 271405191807778 1. Office of Issue : CTD-ON LINE SERVICE 2. Date of Issue : 19-05-2014 3. Name and address of the Dealer to whom Waybill issued by the CTD : Name : KALYAN JEWELLERS INDIA PVT LTD Address : NO 21 47/4 21 19/1 PLOT NO 25 AND 26 SY NO 1092,BALAJINAGAR,KUKAT PALLY,KUKATPALLY, RANGAREDDY,ANDHRA PRADESH,500037 TIN : 28372001292 STATE : Andhra Pradesh 4. Place From which consigned : KUKATPALLY To which consigned : THRISSUR 5. IF THE CONSIGNOR IS TRANSPORTING THE GOODS : From shop or godown to another shop or godown for purpose of storage or sale (a) In pursuance of sale for purpose of delivery to the buyer ; or (b) After purchasing them; or (c) From one of the shops or godown to an agent for sale; (d) From shop or godown to another shop or godown for purpose of storage or sale; or (e) To his principal, having purchased them on his behalf ; or (f) To his agent for sale on consignment basis. (Mark whichever is applicable) Name and address of the Other Dealer/Person to whom the Goods are Consigned or from whom Goods were Purchased : (Buyer or self or Agent or Principal) Name : KALYAN JEWELLERS INDIA PVT LTD Address : KALYAN JEWLELERS INDIA PVT LTD,ROUND NORTH,THRISSUR,KERALA TIN : 32080204326 CST271405191807778 6. Description, Quantity and Value of the Goods Commodity Invoice No./Date Quantity Value (Rs.) BULLION, SPECIE, PLATINUM,JEWELLERY AND KPROGH00016,278 / 6918.556 1,68,25,057.00 PRECIOUS STONES 19-05-2014 0 GRAMS TOTAL 1,68,25,057.00 7. -

India's Obsession with Gold

VOL1 ISSUE 4 | SUBSCRIBER COPY, NOT FOR SALE AN EXCLUSIVE BI-MONTHLY PUBLISHED BY JEWELBUZZ IN ASSOCIATION WITH INDIA BULLION & JEWELLERS ASSOCIATION KERALA JEWELLERY SHOW FIRST EDITION SPARKLING INDIA’S GOLD SUCCESS DEMAND IN 2017 SEEN FALLING TO LOWEST IN 8 YEARS:WGC th EDITION OF IIBS TO BE HELD IN MARCH 2018 HRD ANTWERP LAUNCHES NEW ID CARD India’s Obsession with Gold is a weakness, not a strength IBJA TIMES 1 VOL1 ISSUE4 The best mangalsutra collections showcased under one roof REDEFINING RULES OF JEWELLERY BUSINESS For the fi rst time in India 100% return | exchange | buy back Free logistics delivery pan India Product with GST compliance All products below 2 lakh UID code compliance 99.9% stone less (0.1% error and omission in weighing scale) 100% track record for BIS hallmarking 1st ethical jewellery manufacturer in India RM JEWELLERY THE JEWELLERS' JEWELLER www.penitup.com www.rmjewellery.com 16th - 18th December 2017 AKM Resort, Chandigarh Balaji Complex, 2nd Floor, 81, Ibrahim Sahib Street, Bangalore - 560 001. +91-80-2558 2364 | 2559 4364 | 99027 74400 Email : [email protected] We are now in Delhi too. Contact : Shekhar Guru, +91 98110 58591 REDEFINING RULES OF JEWELLERY BUSINESS For the fi rst time in India 100% return | exchange | buy back Free logistics delivery pan India Product with GST compliance All products below 2 lakh UID code compliance 99.9% stone less (0.1% error and omission in weighing scale) 100% track record for BIS hallmarking 1st ethical jewellery manufacturer in India RM JEWELLERY THE JEWELLERS' JEWELLER www.penitup.com www.rmjewellery.com 16th - 18th December 2017 AKM Resort, Chandigarh Balaji Complex, 2nd Floor, 81, Ibrahim Sahib Street, Bangalore - 560 001.