New Development Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brasília Declaration

BRASÍLIA DECLARATION 11th BRICS Summit Preamble 1. We, the Leaders of the Federative Republic of Brazil, the Russian Federation, the Republic of India, the People's Republic of China and the Republic of South Africa met on 14 November 2019 in Brasília, Brazil, at the Eleventh BRICS Summit, which was held under the theme “BRICS: economic growth for an innovative future”. 2. As leaders of vibrant nations, we reaffirm our fundamental commitment to the principle of sovereignty, mutual respect and equality and to the shared goal of building a peaceful, stable and prosperous world. These concepts, values and objectives provide a solid foundation and clear guidance for our mutually beneficial and pragmatic cooperation. Building on the work of successive summits in the pillars of economy, peace and security and people-to-people exchanges, we will continue to strengthen BRICS cooperation for the benefit and welfare of our peoples and enhance the traditional ties of friendship amongst our countries. 3. We are pleased with the outcomes of the 2019 BRICS Chairship (Annex 1). We recall the more than one hundred meetings held this year (Annex 2). We welcome the Ministerial and other high-level Meetings held this year in the areas of finance, trade, foreign affairs, national security matters, communications, environment, labor and employment, science, technology and innovation, energy, agriculture, health and culture. We also note the Meeting of New Development Bank Board of Governors. 4. We welcome, among other achievements, the establishment of the Innovation BRICS Network (iBRICS); the adoption of the New Architecture on Science, Technology and Innovation (STI), which will be implemented through the BRICS STI Steering Committee, and the Terms of Reference of the BRICS Energy Research Cooperation Platform. -

Media Advisory: Reminder to RSVP

REMINDER TO RSVP BEFORE MARCH 14, 2019 4th Annual Meeting of New Development Bank in Cape Town, South Africa Media are invited to attend the Fourth Annual Meeting of the New Development Bank (NDB) in Cape Town, South Africa. The theme is “Partnership for Sustainable Development,” recognising the importance of strengthening collective efforts and partnerships to bridge the infrastructure gap and addressing the development needs of the Bank’s member countries and other emerging markets and developing countries. The 4th Annual Meeting will bring together senior government officials from BRICS countries, leaders of multilateral and national development institutions, distinguished scholars, prominent commercial bankers, captains of industry, legal experts and representatives of civil society organizations. The meeting will present an excellent opportunity to reflect on the global development agenda and the role that the NDB could play in financing infrastructure and sustainable development. Media are invited as follows: Date: April 1-2, 2019 Venue: Cape Town International Convention Centre (CTICC) Convention Square, 1 Lower Long Street, Cape Town, South Africa Journalists who wish to attend the Annual Meeting are kindly invited to rsvp to [email protected] and [email protected] before March 14, 2019. Registration is essential, as media houses will not be granted access to the venue without prior screening. The closing date for registration is close of business, 18 March 2019. Registered and accredited media may start collecting their name badges from March 30, 2019 at the registration desk at CTICC 2. Please bring a form of identification, either an ID or a Passport as well as your media accreditation cards. -

General Awareness

GENERAL AWARENESS January 2021 Vol. 9, Issue 05 A PUBLICATION OF GYANM EDUCATION & TRAINING INSTITUTE PVT. LTD. SCO 13-14-15, 2ND FLOOR, SEC 34-A, CHANDIGARH Contents NATIONAL NEWS CURRENT AFFAIRS NOVEMBER 03-39 October to November 2020 BULLET NEWS VIRTUAL SUMMIT HELD WITH LUXEMBOURG PM 40-66 June 2020 to Sept 2020 LATEST 100 GK MCQs 67-74 SBI PO PRELIMS 75-86 MODEL TEST PAPER Current GK Bytes 87-110 FIGURES TO REMEMBER REPO RATE 4.00% REVERSE REPO RATE 3.35% MARGINAL STANDING 4.25% FACILITY RATE BANK RATE 4.25% Prime Minister Narendra Modi and his Luxembourg counterpart Xavier Bettel STATUTORY LIQUIDITY RATIO 18.00% held a virtual summit on Nov 19. This was the first stand-alone Summit CASH RESERVE RATIO 3.00% meeting between India and Luxembourg in the past two decades. The two BASE RATE(s) 8.15 to leaders discussed the entire spectrum of bilateral relationship, including (of various banks) 9.40% strengthening of India-Luxembourg cooperation in the post-COVID world. Luxembourg is a small European country, surrounded by Belgium, Germany INDIA’s RANK IN and France. Global Hunger Index 2020 94th PM MODI ATTENDS 12TH BRICS SUMMIT th Teacher Status Index (GTSI) 6 Prime Minister Narendra Modi attended the 12th BRICS Summit on November Asia Power Index 2020 4th 17 in virtual mode. The summit was hosted by Russia, under the theme Global Global Economic Freedom Index 105th Stability, Shared Security and Innovative Growth. India will be taking over the Chairship of the BRICS for the year 2021 and will host the 13th BRICS Summit Human Capital Index 116th next year. -

Remapping Global Economic Governance: Rising Powers and Global Development Finance

Global Development Policy Center GEGI POLICY BRIEF 004• 10/2017 GLOBAL ECONOMIC GOVERNANCE INITIATIVE Remapping Global Economic Governance: Rising Powers and Global Development Finance Kevin P. Gallagher is KEVIN P. GALLAGHER AND WILLIAM N. KRING Professor of Global Development Policy at Boston University’s ABSTRACT Pardee School of Global The landscape of the global financial architecture has changed significantly in the ten years since the Studies and directs the Global global financial crisis. Over the past decade, the scale of financing available for short-term liquidity Development Policy Center. needs has increased more than threefold and the scale of development finance has roughly doubled. His latest books are The China According to data we compiled for this policy brief, there is now more than $15 trillion in short-term Triangle: Latin America’s liquidity assistance available in the world economy and $6 trillion in development finance. Perhaps China Boom and the Fate of most significant is the fact that the vast majority of this growth—63 percent of the growth in liquid- the Washington Consensus ity finance and over 90 percent of the growth in development finance—has come from contributions and Ruling Capital: Emerging by emerging market and developing countries (EMDs). Sixty-three percent of all liquidity finance is Markets and the Reregulation housed with the EMDs, and 80 percent of all development bank finance. What is more, more than of Cross-Border Finance. three quarters of this finance is national—in the form of currency reserves and national development William N. Kring is Assistant banks. Director and Research Fellow at the Global Development Policy This new financing brings real benefits to an architecture that has long been under stress, especially Center. -

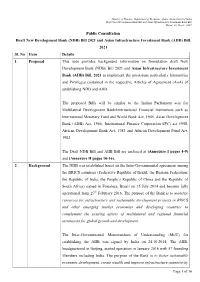

(NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 Sl

Ministry of Finance, Department of Economic Affairs, Government of India Draft New Development Bank Bill and Asian Infrastructure Investment Bank Bill Dated- 04-March- 2021 Public Consultation Draft New Development Bank (NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 Sl. No Item Details 1 Proposal This note provides background information on formulation draft New Development Bank (NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 to implement the provisions particularly Immunities and Privileges contained in the respective Articles of Agreement (AoA) of establishing NDB and AIIB. The proposed Bills will be similar to the Indian Parliament acts for Multilateral Development Bank/International Financial Institutions such as International Monetary Fund and World Bank Act, 1945, Asian Development Bank (ADB) Act, 1966, International Finance Corporation (IFC) act 1958, African Development Bank Act, 1983 and African Development Fund Act, 1982. The Draft NDB Bill and AIIB Bill are enclosed at (Annexure I pages 4-9) and (Annexure II pages 10-16). 2 Background The NDB was established based on the Inter-Governmental agreement among the BRICS countries (Federative Republic of Brazil, the Russian Federation, the Republic of India, the People’s Republic of China and the Republic of South Africa) signed in Fortaleza, Brazil on 15 July 2014 and became fully operational from 27th February 2016. The purpose of the Bank is to mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging market economies and developing countries to complement the existing efforts of multilateral and regional financial institutions for global growth and development. The Inter-Governmental Memorandum of Understanding (MoU) for establishing the AIIB was signed by India on 24.10.2014. -

Agreement on the New Development Bank – Fortaleza, July 15

Agreement on the New Development Bank – Fortaleza, July 15 Agreement on the New Development Bank The Governments of the Federative Republic of Brazil, the Russian Federation, the Republic of India, the People’s Republic of China and the Republic of South Africa, collectively the BRICS countries, RECALLING the decision taken in the fourth BRICS Summit in New Delhi in 2012 and subsequently announced in the fifth BRICS Summit in Durban in 2013 to establish a development bank; RECOGNIZING the work undertaken by the respective finance ministries; CONVINCED that the establishment of such a Bank would reflect the close relations among the BRICS countries, while providing a powerful instrument for increasing their economic cooperation; MINDFUL of a context where emerging market economies and developing countries continue to face significant financing constraints to address infrastructure gaps and sustainable development needs; Have agreed on the establishment of the New Development Bank (NDB), hereinafter referred to as the Bank, which shall operate in accordance with the provisions of the annexed Articles of Agreement, that constitute an integral part of this Agreement. Article 1 Purpose and Functions The Bank shall mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging economies and developing countries, complementing the existing efforts of multilateral and regional financial institutions for global growth and development. To fulfill its purpose, the Bank shall support public or private projects through loans, guarantees, equity participation and other financial instruments. It shall also cooperate with international organizations and other financial entities, and provide technical assistance for projects to be supported by the Bank. -

Prime Minister Shri Narendra Modi Leads India's Participation at the 12Th BRICS Summit

Sitemap Contact Feedback Intranet Media Login Skip to main content Screen Reader Access A- A A+ Search English Home › Media Center › Press Releases Prime Minister Shri Narendra Modi leads India's participation at the 12th BRICS Summit November 18, 2020 Prime Minister Shri Narendra Modi led India’s participation at the 12th BRICS Summit, convened under the Chairship of President Vladimir Putin of Russia on 17 November 2020, in a virtual format. The theme of the Summit was "Global Stability, Shared Security and Innovative Growth”. President Jair Bolsonaro of Brazil, President Xi Jinping of China and President Cyril Ramaphosa of South Africa also participated in the Summit. Prime Minister conveyed his appreciation to President Putin for the momentum in BRICS under the Russian Chair, despite the challenges of the COVID-19 pandemic. He noted that BRICS has played a significant role in fight against terrorism and in promoting the global economy. Prime Minister called for necessary reform of the UN and especially the Security Council, and other international bodies like WTO, IMF, WHO etc. to make them relevant to contemporary realities. Prime Minister called for cooperation in addressing the Covid-19 pandemic and in this regard noted the supply of essential medicines to over 150 countries by India. He said that during its Chairship of the BRICS in 2021, India would focus on consolidation of intra-BRICS cooperation, including in the fields of traditional medicine and digital health, people-to-people ties and cultural exchanges. At the conclusion of the Summit, BRICS Leaders adopted the "Moscow Declaration”. New Delhi November 18, 2020 *****. -

New South–South Co-Operation and the Brics New Development Bank

NEW SOUTH–SOUTH CO-OPERATION AND THE BRICS NEW DEVELOPMENT BANK BY ZHU JIEJIN INTRODUCTION The establishment of the BRICS New Development Bank (NDB) marks a milestone in BRICS co- operation and is a symbolic achievement in the reform of global financial governance. It will help to promote the financing of infrastructure among developing countries, improve global governance and propel the revival of the global economy. From China’s perspective, the NDB will be the first international financial organisation to be headquartered in China and will help promote China’s influence in the international development system while raising its profile as a responsible power. At present, there are a number of misperceptions surrounding the role of the NDB. Some mistakenly view it as an institution whose objective is to challenge the post-Second World War international economic order, reverse the Bretton Wood System, overturn the US’ finance hegemony, and eventually plunge global finance governance into chaos. Rather, as the first international development finance institution proposed by several developing great powers since the Second World War, the foundation and strategic positioning of the NDB lies in new South–South co-operation. Its purpose is to act as an innovate international financing mechanism to better serve the needs of developing countries in terms of infrastructure and sustainable development, rather than challenging or replacing the existing multilateral development institutions. WHY ESTABLISH THE NDB? Developing countries face enormous investment and financing gaps to fund infrastructure development. These have only worsened since the global financial crisis in 2008. The failure by the multilateral development banks controlled by developed countries to make up the gap prompted BRICS to establish a new development bank. -

2020-50Full Text: Fighting COVID-19 in Solidarity and Advancing BRICS

DOCUMENT / Xi Jinping’s Remarks at the 12th BRICS Summit Xi Jinping’s Remarks at the 27th APEC Economic Leaders’ Meeting Xi Jinping’s Remarks at the Leaders’ Side Event on Safeguarding the Planet of the G20 Riyadh Summit Fighting COVID-19 in Solidarity and Advancing BRICS Cooperation Through Concerted Efforts Remarks at the 12th BRICS Summit Xi Jinping, President of the People’s Republic of China Beijing, November 17, 2020 Your Excellency President Vladimir Putin, Your Excellency Prime Minister Narendra Modi, Your Excellency President Cyril Ramaphosa, Your Excellency President Jair Bolsonaro, I wish to begin by thanking President Putin and the Russian govern- ment for their thoughtful organization of this BRICS Summit. Right now, the world is caught between a pandemic of the century and momentous changes never seen in the last one hundred years. The international landscape keeps evolving in profound ways. At such a critical moment, we are meeting to discuss our joint response to COVID-19 and draw a blueprint for the future of BRICS. The meeting has thus taken on a special Around the world, COVID-19 is posing a grave threat to people’s life and well-being. The global public health system is facing a severe test. Human society is going through the most serious pandemic in the past century. International trade and investment have shrunk considerably. The and instability are numerous. The world economy is witnessing the worst recession since the Great Depression in the 1930s. Unilateralism, protec- - ernance, trust, development and peace is widening instead of narrowing. Despite all this, we remain convinced that the theme of our times, peace and development, has not changed, and that the trend toward mul- BEIJING REVIEW NO.50 DECEMBER 10, 2020 1 DOCUMENT / tipolarity and economic globalization cannot be turned around. -

Multilateral Development Banks: Overview and Issues for Congress

Multilateral Development Banks: Overview and Issues for Congress Updated February 11, 2020 Congressional Research Service https://crsreports.congress.gov R41170 Multilateral Development Banks: Overview and Issues for Congress Summary Multilateral development banks (MDBs) provide financial assistance to developing countries in order to promote economic and social development. The United States is a member, and donor, to five major MDBs: the World Bank and four regional development banks, including the African Development Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, and the Inter-American Development Bank. The MDBs primarily fund large infrastructure and other development projects and provide loans tied to policy reforms by the government. The MDBs provide non-concessional financial assistance to middle-income countries and some creditworthy low-income countries on market- based terms. They also provide concessional assistance, including grants and loans at below- market rate interest rates, to low-income countries. The Role of Congress in U.S. Policy at the MDBs Congress plays a critical role in U.S. participation in the MDBs through funding and oversight. Congressional legislation is required for the United States to make financial contributions to the banks. Appropriations for the concessional windows occur regularly, while appropriations for the non-concessional windows are less frequent. Congress exercises oversight over U.S. participation in the MDBs, managed by the Treasury Department, through confirmations of U.S. representatives at the MDBs, hearings, and legislative mandates. For example, legislative mandates direct the U.S. Executive Directors to the MDBs to advocate certain policies and how to vote on various issues at the MDBs. -

The 4Th International Online Mathematics Competition —

The 4th international online mathematics competition — for students from classes 1–12 A competition that brings children from 7 countries together Trial round: 19 October – 15 November Main round: 16 November – 20 December What is ? BRICSMATH.COM+ is a large annual international online mathematics competition for students of grades 1–12. Since 2020, the geography of the competition has been expanding, now students from 7 countries will be able to take part in it: Brazil, Russia, India, China, South Africa, Indonesia and Vietnam. The competition tasks are available in the official languages of each participating country. The purpose of the competition is to cultivate interest in mathematics and develop logical reasoning skills, as well to unite children from different countries. In 2020, the BRICSMATH.COM+ will be held for the fourth time and is dedicated to the 12th BRICS Summit which will take place in Russia. The competition was included in the Brasilia Declaration of the 11th BRICS Summit. 2017 2018 2019 2020 1st competition 2nd competition 3rd competition 4th competition 9th BRICS Summit, 10th BRICS Summit, 11th BRICS Summit, 12th BRICS Summit, China South Africa Brazil Russia 670 000 1 000 000 1 600 000 3 000 000 PARTICIPANTS PARTICIPANTS PARTICIPANTS PARTICIPANTS ARE EXPECTED FROM 5 COUNTRIES FROM 5 COUNTRIES FROM 5 COUNTRIES Recognition and support MINISTRY OF ENLIGHTENMENT MINISTRY OF HUMAN CENTRAL BOARD MINISTRY OF EDUCATION BASIC EDUCATION HANOI DEPARTMENT MINISTRY OF OF THE RUSSIAN FEDERATION RESOURCE DEVELOPMENT, OF SECONDARY -

The New Development Bank Request for Proposal (This Is Not a Purchase

The New Development Bank Request for Proposal (This is not a Purchase Order) 1. Introduction The New Development Bank (NDB) is issuing a Request for Proposal (RFP) to invite qualified suppliers to provide proposals to NDB’s S-AD-2019-00160 Outsourcing Administrative support project. Please refer to the following information or attached TOR (Service Scope) for detailed requirements. Those interested and qualified companies please register into NDB’s e-procurement system to be NDB’s registered suppliers and participate in the bidding process (please be noted the contact information provided in registration especially email address must be correct as all communications regarding the bid including RFP distribution and award notice will be sent through it). NDB will choose the most suitable one(s) from the shortlisted suppliers. NDB at its sole discretion reserves the right to reject all proposals in accordance with its internal policy and guidelines. 2. RFP Schedule Please be noted the following activities could take place in the RFP process. NDB will inform the specific arrangements in advance and the suppliers are requested to respond timely. Activity Date Distribution of RFP March, 6 ,c2020 Deadline for Questions March, 26, 2020 Proposal Response Due March 27, 2020 Negotiation on contract Tbc Signing Contract tbc Project Kick Off tbc 3. Instruction to bidders 3.1 Contact Information Please use the following contact information for all correspondence with NDB concerning this RFP. Suppliers who solicit information about this RFP either directly or indirectly from other sources will be disqualified. Mr. Ivan Nepeivoda Address: 33rd Floor, BRICS Tower, No. 333, Lujiazui Ring Road, Pudong, Shanghai 上海浦东陆家嘴环路 333 号,金砖大厦 33 层 Email: [email protected] 3.2 Submission of Proposals Proposals shall be prepared in English.