Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Second Issue Of

Explore Singapore through NHB’s self-guided heritage trails! Booklets and maps are downloadable at www.roots.sg/visit/trails. FOREWORD elcome to the second issue of our This issue ends with a feature on Orchard, Singapore’s four-part series that commemorates most prestigious address, tracing its evolution from W Singapore’s bicentennial by showcasing an area of plantations and nutmeg orchards to a place histories which have shaped and contributed desirable suburb and finally to the shopping heart of to the Singapore Story! Singapore it is today. For this issue, the National Heritage Board has On behalf of the team at MUSE SG, we hope that partnered students from National University of you will find the place histories of these eight towns Singapore’s History Society (NUS HISSOC) to to be interesting and insightful, and we certainly jointly explore the history of eight more towns, their hope that they will spark off your interest to explore key milestones and the challenges they have faced in even more of Singapore’s rich heritage! their development. We first shine the spotlight on Hougang and Chai Chee, highlighting how these two towns navigated their changes in ethnic composition and built up a strong spirit of neighbourliness. We also trace the evolution of two formerly remote towns, Woodlands and Jurong, into industrial and transport nodes that played key roles in Singapore’s economic development. We then examine how the philanthropic legacies of Eunos and Whampoa were kept alive through the various community self-help initiatives in these towns, and explore the interesting transformation of Tai Seng from a town once known for its gang and criminal activities, to a quiet industrial and residential estate today. -

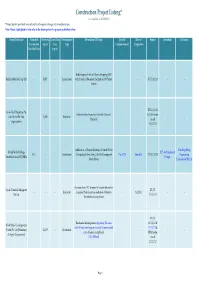

Construction Project Listing* (Last Updated on 20/12/2013) *Project Details Provided May Subject to Subsequent Changes by Owner/Developer

Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. Note: Words highlighted in blue refer to the latest updates for projects published before. Owner/Developer Estimated Site Area Gross Floor Development Description Of Project Date Of Date of Source Consultant Contractor Construction (sq m) Area Type Commencement Completion Cost ($million) (sq m) Redevelopment into a 6 Storey Shopping Mall Raffles Medical Group Ltd - 5,827 - Institutional with 2 levels of Basement Carpark at 100 Taman - - ST 17/12/13 - - Warna BT 11/12/13 Grow-Tech Properties Pte Industrial development at Gambas Crescent & URA tender Ltd (Part of Far East - 14,302 - Industrial -- -- (Parcel 3) result Organization) 13/12/13 Addition of a 5 Storey Building to United World Kim Seng Heng United World College BLT Architecture & 42.5 - - Institutional College South East Asia (UWCSEA) campus at Dec-2013 Aug-2015 BT 13/12/13 Engineering South East Asia (UWCSEA) Design Dover Road Construction Pte Ltd Erection of an LPG Terminal to import alternative Vopak Terminals Singapore BT/ST - - - Industrial Liquefied Petroleum Gas feedstock at Banyan - 1Q 2016 -- Pte Ltd 11/12/13 Terminal in Jurong Island BT/ST Residential development comprising 281 units 16/11/12 & World Class Developments with 24 hour concierge service and 18 commercial 11/12/13 & (North) Pte Ltd [Subsidiary - 10,170 - Residential -- -- units at Jalan Jurong Kechil URA tender of Aspial Corporation] (The Hillford) result 22/11/12 Page 1 Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. -

NEW PARALLEL BUS SERVICE 951E from 17 JUNE - Service Connects Woodlands Residents to and from the City

Jun 11, 2013 16:00 +08 NEW PARALLEL BUS SERVICE 951E FROM 17 JUNE - Service connects Woodlands residents to and from the city A new SMRT parallel bus service – Service 951E – that connects the Woodlands neighbourhoods to the Central Business District (CBD) will begin operations from Monday, 17 June 2013. This is the 12th bus service to be rolled out under the Land Transport Authority’s Bus Service Enhancement Programme (BSEP). The new service will provide greater connectivity and an alternative travel option for Woodlands residents travelling to and from areas in the CBD during weekday morning and evening peak-hours (excluding public holidays). Parallel Service 951E will operate two one-way trips on weekday mornings at 7.30 am and 7.45 am from Woodlands Street 82, Woodlands Avenue 4 and Woodlands Avenue 1 to areas within the CBD such as Orchard Road, Bras Basah Road, Nicoll Highway, Collyer Quay, Raffles Quay and Shenton Way. On weekday evenings, two one-way trips at 6.15 pm and 6.30 pm will connect commuters from areas such as Anson Road, Collyer Quay, Fullerton Road, Esplanade Drive, Stamford Road, Orchard Road and Penang Road to the Woodlands neighbourhoods. Please refer to the attached poster for more details. Vice President for SMRT Buses Ltd, Tan Kian Heong said: "We are pleased to have the opportunity to operate yet another new parallel bus service that directly connects the heartlands and the city. Utilising the Central Expressway (CTE), Seletar Expressway (SLE) and with less bus stops along its route, this parallel bus service enhances the overall travelling experience of our customers by offering them not only more convenience when commuting to and from the CBD, but also presents them an alternative travel option on top of other bus services and the MRT." Passengers may contact SMRT Customer Relations Centre at 1800-336-8900 from 7.30am to 6.30pm on weekdays (excluding public holidays) or visit www.smrt.com.sg for more information on Service 951E. -

Illustrated Plans

K I N L T H R O N N R YISHUN TA E E L S HOUSING & TRANSPORT S E L E TA R N O R T H L I N K Lentor Hills NORTHSHORE DRIVE KHATIB E PUNGGOL POINT I V R D E SAMUDERA C A Punggol Point P PUNGGOL COAST S D O A R P UNGGO O E L CO R A A ERO S A S R T P PA R C A D M R E T TECK LEE A E A V T IE L C E L W E E S T S NIBONG SE S SAM KEE LO E L C K W O N G I G L N T U S P E W R P SELETAR LINK A I T C L E C S E A SUMANG D S I E L L L E Y P T U A N R G G S E A O L E E E L T V R N A I O R R O SUMANG WALK PUNGGOL DRIVE A D S R E R E P SOO TECK PUNGGOL WALKPUNGGOL DAMAI T O S PA C A H C L E I N W K A Y PUNGGOL CENTRAL TA M P I N E S E X P R E S S W AY OASIS PUNGGOL ROAD PUNGGOL WAY PUNGGOL FIELD FERNVALE STREET KADALOOR A COVE NCHORV FARMWAY ALE STR SPRINGLEAF EET KUPANG CHENG LIM TA X P R E S S W AY THANGGAM M TA R E P L E I N MERIDIAN S E D PUNGGOL EAST A E S O S E N G R K JALAN KAYU A N G E A S T W AY R E T IVE X S R VA E L P RIVIERA COMPASSVALE E D R Y W R A I S E L E S S W VE E T E G A R E X P R L S CORAL EDGE E N NT FERNVALE LINK S OR D A A A K FERNVALE ROAD W V O K E R G N G N A I U N N SENGK E A ANG W LAYAR S L Y K E EST AVE E NUE FERNVALE N E U S G CH K L SENGKANG RUMBIA A A IO YIO NG V Y CHU R O KA NG H R OA E C D A ST N A A SENGKANG EAST ROAD TONGKANG V EN U N E UPPER THOMSON ROAD Y O GERALD DRIVE PUNGGOL ROAD BAKAU A R S EN D T W G A K BUANGKOK DRIVE A H S RENJONG O N G SENGKANG EAST DRIVE R S - N S E O D S O R A M U O O LENTOR P R E H A T X S T R K RANGGUNGT R N KANGKAR H A I E E T L P A E K BUANGKOK V P E U L O L E K D L S G C O A N A B O -

Police News Release

POLICE NEWS RELEASE Annual Road Traffic Situation 2014 Overview The road traffic situation in 2014 showed encouraging improvements in several areas. Fatal traffic accidents and fatalities continued to fall although injury accidents increased slightly. Fatal accidents involving red-running also fell, and motorists’ compliance with traffic light signals improved after the installation of Digital Traffic Red Light System (DTRLS) cameras at road junctions. The drink- driving situation also improved. The Traffic Police will continue to work with stakeholders including the community to create a culture of safe and courteous road use by all. Declining Trend in Fatal Accidents and Fatalities 2. Even with more people and vehicles on the road, the number of fatal traffic accidents and fatalities in 2014 continued to fall, after the sharp drop in 2012. 3. There were 149 cases of fatal accidents in 2014, compared to 150 cases in 2013. The number of fatalities also dropped slightly from 160 in 2013 to 154 in 2014. The fatality rate per 100,000 persons decreased from 2.96 in 2013 to 2.82 in 2014. Please refer to Chart 1 for the number of fatal accidents over the past five years, and Chart 2 for the number of fatalities and fatality rate over the past five years. 1 Chart 1: Fatal Accidents, 2010 – 2014 Chart 2: Fatalities and Fatality Rate, 2010 – 2014 2 Improvements in Drink-Driving and Red-Running Situation Fewer Drink-Drivers Arrested 4. The drink-driving situation improved in 2014 as a result of sustained education and enforcement efforts. Even though there was an increase in the number of drink-driving enforcement operations conducted in 2014, the number of persons arrested for drink-driving dropped by 2.2%, from 3,019 persons in 2013 to 2,954 persons in 2014. -

Geocoding Guide for Singapore Table of Contents

Spectrum Technology Platform Version 2018.2.0 Geocoding Guide for Singapore Table of Contents 1 - Geocode Address Global Adding an Enterprise Geocoding Module Global Database Resource 4 2 - Input Input Fields 7 Address Input Guidelines 9 Single Line Input 12 Street Intersection Input 13 3 - Options Geocoding Options 15 Matching Options 18 Data Options 22 4 - Output Address Output 26 Geocode Output 33 Result Codes 33 Result Codes for International Geocoding 37 5 - Reverse Geocode Address Global Input 43 Options 44 Output 48 1 - Geocode Address Global Geocode Address Global provides street-level geocoding for many countries. It can also determine city or locality centroids, as well as postal code centroids. Geocode Address Global handles street addresses in the native language and format. For example, a typical French formatted address might have a street name of Rue des Remparts. A typical German formatted address could have a street name Bahnhofstrasse. Note: Geocode Address Global does not support U.S. addresses. To geocode U.S. addresses, use Geocode US Address. The countries available to you depends on which country databases you have installed. For example, if you have databases for Canada, Italy, and Australia installed, Geocode Address Global would be able to geocode addresses in these countries in a single stage. Before you can work with Geocode Address Global, you must define a global database resource containing a database for one or more countries. Once you create the database resource, Geocode Address Global will become available. Geocode Address Global is an optional component of the Enterprise Geocoding Module. In this section Adding an Enterprise Geocoding Module Global Database Resource 4 Geocode Address Global Adding an Enterprise Geocoding Module Global Database Resource Unlike other stages, the Geocode Address Global and Reverse Geocode Global stages are not visible in Management Console or Enterprise Designer until you define a database resource. -

ANNEX B Locations of the 120 Digital Traffic Red Light Cameras S/N Location 1 Adam Road by Sime Road Towards Lornie Road 2 Admi

ANNEX B Locations of the 120 Digital Traffic Red Light Cameras S/N Location 1 Adam Road by Sime Road towards Lornie Road 2 Admiralty Road by Marsiling Lane towards Woodlands Centre Road Admiralty Road by Woodlands Centre Road towards Bukit Timah 3 Expressway 4 Airport Road by Ubi Ave 2 towards Macpherson Road 5 Alexandra Road by Commonwealth Ave towards Tiong Bahru Road 6 Ang Mo Kio Ave 1 by Ang Mo Kio Ave 10 towards Lor Chuan 7 Ang Mo Kio Ave 1 by Ang Mo Kio Ave 6 towards Ang Mo Kio Ave 8 8 Ang Mo Kio Ave 1 by Central Expressway towards Ang Mo Kio Ave 10 9 Ang Mo Kio Ave 1 by Central Expressway towards Lor Chuan 10 Ang Mo Kio Ave 1 by Lor Chuan towards Boundary Road 11 Ang Mo Kio Ave 1 by Marymount Rd towards Upper Thomson Road Ang Mo Kio Ave 3 by Ang Mo Kio Industrial Park 2 towards Central 12 Expressway 13 Ang Mo Kio Ave 6 by Ang Mo Kio Ave 5 towards Ang Mo Kio Ave 3 14 Ang Mo Kio Ave 6 by Ang Mo Kio Ave 5 towards Lentor Ave 15 Ang Mo Kio Ave 6 by Ang Mo Kio Ave 8 towards Ang Mo Kio Ave 5 16 Ang Mo Kio Ave 8 by Ang Mo Kio Ave 3 towards Ang Mo Kio Ave 5 Bedok North Ave 1 by Bedok North Street 1 towards New Upper 17 Changi Road 18 Bedok Reservoir Road by Bedok North Ave 3 towards Tampines Ave 4 Bedok South Ave 1 by Bedok South Road towards Upper East Coast 19 Road 20 Bishan Street 11 by Bishan Street 12 towards Bishan Street 21 21 Boon Lay Drive by Corporation Road towards Boon Lay Way 22 Boon Lay Way by Jurong East Central towards Jurong Town Hall Road 23 Brickland Road by Choa Chu Kang Ave 3 towards Bukit Batok Road Bukit Batok East -

Private Treaty Listing

Auction & Sales Private Treaty. NOVEMBER 2018: RESIDENTIAL Salespersons to contact: Tricia Tan, CEA R021904I, 6228 7349 / 9387 9668 Gwen Lim, CEA R027862B, 6228 7331 / 9199 2377 Sharon Lee, CEA R027845B, 6228 6891 / 9686 4449 Teddy Ng, CEA R006630G, 6228 7326 / 9030 4603 Noelle Tan, CEA R047713G, 6228 7380 / 9766 7797 Ong HuiQi, Admin Support, 6228 7302 Website: http://www.knightfrank.com.sg/auction Email: [email protected] Apps : https://play.google.com/store/apps/details?id=com.novitee.knightfrankacution LANDED PROPERTIES FOR SALE * Owner's ** Public Trustee's *** Estate's @ Liquidator's % Receiver's # Mortgagee's ## Developer's ### MCST's Approx. Land / Guide Contact S/no District Street Name Tenure Property Type Room Remarks Floor Area (sqft) Price Person 3-Storey Detached Leasehold Bungalow with Waterway view! Exclusive. With lift. Quality finishes with * 1 D04 8 PEARL ISLAND 99 years wef. Basement, 5 + 1 7,287 / 5,830 $16.XM Tricia sleek design. Bright & airy. Lifestyle living. 2008 Swimming Pool & Berth Leasehold 2-Storey Detached MORTGAGEE SALE # 2 D04 17 CORAL ISLAND 99 years wef. Bungalow with Attic 4 7,557 / 8,697 $11.5M Sharon 4 ensuite bedrooms. Waterway view! Chair lift installed. 2005 and Swimming Pool Bright & airy. Can park 3 cars. Lifestyle living. MORTGAGEE SALE. AUCTION 14 NOV 2018 2 Storey Detached Elevated with unblocked views. Good sized bedrooms; House with house is well-lit naturally. Property is surrounded by a # 3 D05 2A FABER PARK Freehold Basement, Roof 5 + 1 6,012 / 10,853 $7.XM Tricia mixture of condominium apartments and landed homes. Terrace, Swimming Clementi MRT station and bus interchange are located Pool and Lift within the vicinity. -

OKP Holdings Limited Secures S$50.6 Million PUB Contract to Construct Stamford Diversion Canal

30 Tagore Lane Singapore 787484 Tel: (65) 6456 7667 Fax: (65) 6459 4316 FOR IMMEDIATE RELEASE OKP Holdings Limited secures S$50.6 million PUB contract to construct Stamford Diversion Canal Singapore, 22 May 2014 – MAINBOARD-LISTED infrastructure and civil engineering company, OKP Holdings Limited (胡金标控股有限公司) (“OKP” or “the Group”), today announced that its wholly-owned subsidiary, Or Kim Peow Contractors (Pte) Ltd (胡金标建筑 (私人) 有限公司) has been awarded with a S$50.6 million contract from PUB, the national water agency, to construct Stamford Diversion Canal (“SDC”), Contract 1 – Tanglin and Kim Seng. The project involves the construction of a canal underneath the road and road-raising works at Tanglin and Kim Seng Road areas. Mr Or Toh Wat (胡土发), the Group Managing Director remarked,“We are pleased to secure this contract as it is testament to our civil engineering expertise. Our extensive experience and track record in projects of such complex nature allow us to consistently grow our pipeline of projects. We continue to view our customers within both the public and private sectors as our priority and actively work with them to better understand their business needs to serve them better.” This contract with a contract period of 42 months commences on 18 June 2014. This contract win updates OKP’s net construction order book to S$240.2 million, extending till 2017. OKP is a leading home-grown infrastructure and civil engineering company specialising in the construction of urban and arterial roads, expressways, vehicular bridges, flyovers, airport infrastructure and oil and gas-related infrastructure for petrochemical plants and oil storage terminals. -

Geocoding Guide for Singapore - REST Table of Contents

Spectrum Technology Platform Version 2018.2.0 Geocoding Guide for Singapore - REST Table of Contents 1 - GeocodeAddressGlobal Adding an Enterprise Geocoding Module Global Database Resource 4 2 - Input Input Fields 7 Address Input Guidelines 9 Single Line Input 12 Street Intersection Input 13 3 - Options Geocoding Options 15 Matching Options 19 Data Options 25 4 - Output Address Output 28 Geocode Output 35 Result Codes 35 Result Codes for International Geocoding 39 5 - ReverseGeocodeAddressGlobal Input 45 Options 46 Output 50 1 - GeocodeAddressGlobal GeocodeAddressGlobal provides street-level geocoding for many countries. It can also determine city or locality centroids, as well as postal code centroids. GeocodeAddressGlobal handles street addresses in the native language and format. For example, a typical French formatted address might have a street name of Rue des Remparts. A typical German formatted address could have a street name Bahnhofstrasse. Note: GeocodeAddressGlobal does not support U.S. addresses. To geocode U.S. addresses, use GeocodeUSAddress. The countries available to you depends on which country databases you have installed. For example, if you have databases for Canada, Italy, and Australia installed, GeocodeAddressGlobal would be able to geocode addresses in these countries in a single stage. Before you can work with GeocodeAddressGlobal, you must define a global database resource containing a database for one or more countries. Once you create the database resource, GeocodeAddressGlobal will become available. GeocodeAddressGlobal is an optional component of the Enterprise Geocoding Module. In this section Adding an Enterprise Geocoding Module Global Database Resource 4 GeocodeAddressGlobal Adding an Enterprise Geocoding Module Global Database Resource Unlike other stages, the Geocode Address Global and Reverse Geocode Global stages are not visible in Management Console or Enterprise Designer until you define a database resource. -

Singapore City Overview and Residential Buyer Guide 2018 Edition Singapore Market Overview Singapore Market Overview Singapore Market Overview

Powered by Powered by Singapore City Overview and Residential Buyer Guide 2018 Edition Singapore Market Overview Singapore Market Overview Singapore Market Overview Despite its lack of natural for innovation to thrive. The urban Most condominiums in Singapore resources and limited land landscape is also diversifying, are well-equipped with facilities area, Singapore has not only with new shops, restaurants and such as gyms, swimming pools, survived the early years of entertainment to enjoy. barbecue pits, playgrounds postcolonial independence, and 24-hour security. Landed but has thrived, moving from Against this backdrop, Singapore residential properties are also being a low-income country ranks among the top destinations available for lease, but may not to a high-income one. It’s for investors in local residential have such facilities. accomplished this through property, as highlighted by Knight pragmatism and an unrelenting Frank’s City Wealth Index 2018. For foreign investors and focus on being both politically Singapore’s residential property expatriates relocating to neutral and economically relevant. sector has grown in size and Singapore, prime residential variety. There are approximately districts 9, 10 and 11 are among Singapore’s appeal comes from 1.1 million public housing (HDB) the top choices. These districts political stability, a well-defined units and 370,000 private dwelling are attractive because of their rule of law, world-class air and units, collectively housing a total close proximity to the Orchard sea infrastructure, sound labour population of 5.6 million residents. Road shopping belt, the famous relations and global connectivity. international and local schools, Its location enables access to the There are also hybrid units, known and Holland Village and vast 650-million population of as Executive Condominiums (ECs), Dempsey Hill – retail and South-East Asia, and you can fly to built by private developers who restaurant areas loved by many parts of Australasia in under bid for the sites by open tender. -

Official Opening of Seletar Expressway (Sle) Phase Ii - from Upper Thomson Road to Woodlands a Venue 2 21 February 1998 at 10:00 Am

~1 ~,, M;ta Duty Officer Med;a/MIT A/SI NGOV \- .. 02/20/98 06:24 PM i Sent by: MITA Duty Officer To: cc: (bee: Bing Tang NG/MTI/SINGOV) Subject: (Embargoed) Speech by Dr John Chen, 21 Feb 98, 10 am . Singapore Government PRESS RELEASE Media Division, Ministry of Information and the Arts, #36-00 PSA Building, 460 Alexandra Road, Singapore 119963. Tel: 3757794/5 EMBARGO INSTRUCTIONS The attached press release/speech is EMBARGOED UNTIL AFTER DELIVERY. Please check against delivery. For assistance call 3757795 SPRinter 3.0, Singapore's Press Releases on the Internet, is located at: http://www.gov.sg/sprinter/ SPEECH BY DR JOHN CHEN MINISTER OF STATE FOR COMMUNICATIONS AT THE OFFICIAL OPENING OF SELETAR EXPRESSWAY (SLE) PHASE II - FROM UPPER THOMSON ROAD TO WOODLANDS A VENUE 2 21 FEBRUARY 1998 AT 10:00 AM Parliamentary Colleagues, Distinguished Guests, Ladies & Gentlemen, Good Morning, In mid-November last year, when I opened the Extension to the Ayer Rajah Expressway (A YE), I announced that within the next six months, motorists could look forward to the completion of three other major road projects. These were the 3-tier interchanges at the junction of Adam Road and Farrer Road, and at the junction of Holland Road/Farrer Road and Queensway, and Phase II of the Seletar Expressway. The 3-tier interchanges at the Adam Road/Farrer Road and the Holland Road/Farrer Road junctions were opened to traffic just last month and today I am delighted to be here to open the Seletar Expressway (SLE) Phase II.