Law 680 Unjust Enrichment Mcinnes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cumulative Index (Volumes 1-20)

Campbell Law Review Volume 20 Article 7 Issue 2 Spring 1998 February 2012 Cumulative Index (Volumes 1-20) Follow this and additional works at: http://scholarship.law.campbell.edu/clr Recommended Citation Cumulative Index (Volumes 1-20), 20 Campbell L. Rev. 497 (1998). This Index is brought to you for free and open access by Scholarly Repository @ Campbell University School of Law. It has been accepted for inclusion in Campbell Law Review by an authorized administrator of Scholarly Repository @ Campbell University School of Law. et al.: Cumulative Index (Volumes 1-20) INDEX BY VOLUME Volume 1 Prior Crimes as Evidence in Present Criminal Trials ................... 1:1 Charles W. Gamble In Praise of Pension Reform .......................................... 1:31 Ronald I. Kirschbaum A History of Liquor By-The-Drink Legislation in North Carolina ........ 1:61 Michael Crowell Statutory Standard of Care for North Carolina Health Care Providers... 1:111 John Marsh Tyson Separation Agreements: Effect of Resumed Marital Relations - Murphy v. M urphy ....................................................... 1:131 Donald R. Teeter Farmers as Merchants in North Carolina - Currituck Grain, Inc. v. Pow ell .......................................................... 1:141 Beverly Wheeler Massey The Effect of Unanimous Approval on Corporate Bylaws - Blount v. T aft ............................................................. 1:153 Margaret Person Currin North Carolina and Declarations Against Penal Interest - State v. H aywood ........................................................ 1:161 Samuel W. Meekins Confronting Accused With Evidence Against Him as "Interrogation" Within the Meaning of Miranda - State v. McLean ................. 1:173 William M. Spivey Public Documents in the Hands of Private Collectors - State v. West .... 1:179 Samuel R. Clawson Volume 2 Advisory Rulings by Administrative Agencies: Their Benefits and D angers ........................................................ -

Deed of Novation and Variation of The

DEED OF NOVATION AND VARIATION OF THE SUPPLEMENTAL FUNDING AGREEMENT FOR LISKEARD HIL.LFORT PRIMARY SCHOOL The Parties to this Deed are: (1) THE SECRETARY OF STATE FOR EDUCATION of Sanctuary Buildings, Great Smith Street, London SW1P 3BT (the “Secretary of State”); (2) ADVENTURE LEARNING ACADEMY TRUST, a charitable company incorporated in England and Wales with registered company number 08614382 whose registered 12th address is at Michelmores LLP, Floor, 6 New Street Square, London, EC4A 3SF (“Outgoing Academy Trust”); and (3) TRURO & PENWITH ACADEMY TRUST, a charitable company incorporated in England and Wales with registered company number 08880841 whose registered address is at College Road, Truro, Cornwall TR1 3XX (“Incoming Academy Trust”), together referred to as the “Parties”. INTRODUCTION A. Liskeard Hillfort Primary School is an academy within the meaning of the Academies Act 2010 (the “Academy”) and is currently operated by the Outgoing Academy Trust (a multi academy trust). S. The Secretary of State and the Outgoing Academy Trust entered into a Supplemental Funding Agreement on 29 May 2014 (the “Agreement”) for the maintenance and funding of the Academy (attached as Schedule 1 “Existing Supplemental Funding Agreement”). C. It is proposed that, with effect from 00.01 am on 1 April 2019 (“Transfer Date”), the Incoming Academy Trust will assume responsibility for the management and operation of the Academy in succession to Outgoing Academy Trust. D. The Parties wish to novate the Agreement to the Incoming Academy Trust and the Secretary of State and the Incoming Academy Trust wish to vary the terms of the Agreement subject to the provisions of this Deed. -

Contracts Course

Contracts A Contract A contract is a legally enforceable agreement between two or more parties with mutual obligations. The remedy at law for breach of contract is "damages" or monetary compensation. In equity, the remedy can be specific performance of the contract or an injunction. Both remedies award the damaged party the "benefit of the bargain" or expectation damages, which are greater than mere reliance damages, as in promissory estoppels. Origin and Scope Contract law is based on the principle expressed in the Latin phrase pacta sunt servanda, which is usually translated "agreements to be kept" but more literally means, "pacts must be kept". Contract law can be classified, as is habitual in civil law systems, as part of a general law of obligations, along with tort, unjust enrichment, and restitution. As a means of economic ordering, contract relies on the notion of consensual exchange and has been extensively discussed in broader economic, sociological, and anthropological terms. In American English, the term extends beyond the legal meaning to encompass a broader category of agreements. Such jurisdictions usually retain a high degree of freedom of contract, with parties largely at liberty to set their own terms. This is in contrast to the civil law, which typically applies certain overarching principles to disputes arising out of contract, as in the French Civil Code. However, contract is a form of economic ordering common throughout the world, and different rules apply in jurisdictions applying civil law (derived from Roman law principles), Islamic law, socialist legal systems, and customary or local law. 2014 All Star Training, Inc. -

INTERNAL REVENUE CODE SECTION 170(H): NATIONAL PERPETUITY STANDARDS for FEDERALLY SUBSIDIZED CONSERVATION EASEMENTS PART 1: the STANDARDS

INTERNAL REVENUE CODE SECTION 170(h): NATIONAL PERPETUITY STANDARDS FOR FEDERALLY SUBSIDIZED CONSERVATION EASEMENTS PART 1: THE STANDARDS Nancy A. McLaughlin Editors Synopsis: This Article is the first of two companion articles that (i) analyze the requirements in Internal Revenue Code section 170(h) that a deductible conservation easement be granted in perpetuity and its conservation purpose be protected in perpetuity and (ii) compare those requirements to state law provisions addressing the transfer, modification, or termination of conservation easements. This Article discusses the historical development of the federal charitable income tax deduction for conservation easement donations, the legislative history of section 170(h), and the Treasury Regulations interpreting that section. It explains that section 170(h) and the Treasury Regulations contain a complex web of requirements intended to ensure that a federal subsidy is provided only with respect to conservation easements that permanently protect unique or otherwise significant properties. Such requirements are also intended to ensure that, in the unlikely event changed conditions make continued use of the subject property for conservation or historic preservation purposes impossible or impractical and the easement is extinguished in a state court proceeding, the holder will receive proceeds and use those proceeds to replace the lost conservation or historic values on behalf of the public. The companion article, which will be published in the Winter 2010 edition of this journal, surveys the over one hundred statutes extant in the fifty states and the District of Columbia that authorize the creation or acquisition of conservation easements. That article explains that such statutes contain widely divergent transfer, modification, and termination provisions that were not, for the most part, crafted with an eye toward complying with federal tax law perpetuity requirements. -

PDF Print Version

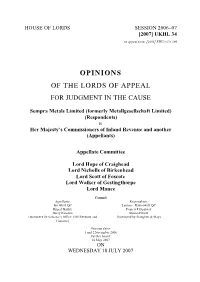

HOUSE OF LORDS SESSION 2006–07 [2007] UKHL 34 on appeal from: [2005] EWCA Civ 389 OPINIONS OF THE LORDS OF APPEAL FOR JUDGMENT IN THE CAUSE Sempra Metals Limited (formerly Metallgesellschaft Limited) (Respondents) v. Her Majesty’s Commissioners of Inland Revenue and another (Appellants) Appellate Committee Lord Hope of Craighead Lord Nicholls of Birkenhead Lord Scott of Foscote Lord Walker of Gestingthorpe Lord Mance Counsel Appellants: Respondents: Ian Glick QC Laurence Rabinowitz QC Rupert Baldry Francis Fitzpatrick Gerry Facenna Steven Elliott (Instructed by Solicitor’s Office, HM Revenue and (Instructed by Slaughter & May) Customs ) Hearing dates: 1 and 2 November 2006 Further heard: 16 May 2007 ON WEDNESDAY 18 JULY 2007 HOUSE OF LORDS OPINIONS OF THE LORDS OF APPEAL FOR JUDGMENT IN THE CAUSE Sempra Metals Limited (formerly Metallgesellschaft Limited) (Respondents) v. Her Majesty’s Commissioners of Inland Revenue and another (Appellants) [2007] UKHL 34 LORD HOPE OF CRAIGHEAD My Lords, 1. This is a case about the award of interest. Questions about interest usually arise where the claim is presented as ancillary to a claim for a principal sum for which the court is asked to give judgment for the recovery of a debt or as damages. Less usually they can arise where interest is sought on a principal sum which has been paid before judgment. But in this case interest is the measure of the principal sum itself. 2. The question is how that sum should be measured. It is agreed that the calculation of interest should be the method of measurement for the sum that is to be awarded. -

United States District Court Southern District of Florida

Case 9:18-cv-80110-RLR Document 92 Entered on FLSD Docket 02/21/2019 Page 1 of 7 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA CASE NO. 9:18-CV-80110-ROSENBERG/REINHART WEBSTER HUGHES, Plaintiff, v. PRIDEROCK CAPITAL PARTNERS, LLC, Defendant. ______________________________________/ ORDER DENYING DEFENDANT’S RENEWED MOTION TO STRIKE JURY DEMAND [DE 84] THIS MATTER is before the Court on Defendant, Priderock Capital Partners’ (“Defendant”) Renewed Motion to Strike Jury Demand (“the Motion”), DE 84. I. Background & Procedural History In brief, Defendant seeks to strike Plaintiff Webster Hughes’ (“Plaintiff”) demand for a jury trial, because only one count, Count III, for Breach of Contract-Implied-in-Law/Quasi Contract, remains at issue in this case. See id; DE 73; DE 66. After summary judgment was granted in favor of Defendant as to Counts I and II, see DE 65, Defendant moved to strike Plaintiff’s jury demand at DE 66. That request was denied without prejudice in order for Defendant to consider and address additional case law cited by the Court, see DE 68, DE 69, DE 71. Defendant renewed its request at DE 73. Plaintiff responded at DE 74, and Defendant replied at DE 77. The Court denied Defendant’s second motion to strike the jury demand without prejudice: Defendant argues its Motion assuming that liability as to Count III has been conceded. See, e.g., DE 73, 2. However, liability has not been formally admitted, through an amended pleading, stipulation, or the like. See DE 10, 12. Accordingly, Defendant is ordered to either seek leave of the Court to amend its pleadings or to file a Second Amended Motion that does not presume that liability has been determined by no later than 2/21/19. -

Jurisdiction of a Tribunal - Extinguishment

Jurisdiction of a tribunal - extinguishment De Lacey v Juunyjuwarra People [2004] QCA 297 Davies JA, Mackenzie and Mullins JJ, 13 August 2004 Issue The main issue before the court was whether the Land and Resources Tribunal (LRT) established under the Mineral Resources Act 1989 (Qld) (the Act) had jurisdiction to determine whether the Starcke Pastoral Holdings Acquisition Act 1994 (Qld) extinguished native title in relation to an area the subject of a claimant application. Background In December 2003, Ralph De Lacey, an applicant for a ‘high impact’ exploration permit, applied to the LRT for a determination as to whether or not it had jurisdiction to decide that native title has been extinguished by the Act. On 27 February 2004, the LRT decided that it did have jurisdiction to determine that question and that it would be determined as a preliminary issue. An appeal against that decision was filed in the Supreme Court of Queensland by the State of Queensland. Decision Davies JA (with MacKenzie and Mullins JJ agreeing) held that: • there was no provision in the Act that contemplated an application to the LRT as was made in December 2003 or any decision by the LRT of the question stated in that application; • the LRT plainly saw that its jurisdiction to make the decision which it did make, was found in, or implied by, s. 669 of the Act, which governed the making of a ‘native title issues decision’ by the LRT. Where, in a proceeding otherwise properly instituted in a tribunal, there remains a condition upon the fulfilment or existence of which the jurisdiction of the tribunal exists (here, non-extinguishment of native title), the fulfilment or existence of that condition remains an outstanding question until it has been decided by a court competent to decide it: Parisienne Basket Shoes Pty Ltd v Whyte (1938) 59 CLR 359 at 391. -

Cite As: 18 Ny3d 753, 967 N

967 N.E.2d 1170 Page 1 18 N.Y.3d 753, 967 N.E.2d 1170, 944 N.Y.S.2d 725, 2012 N.Y. Slip Op. 02249 (Cite as: 18 N.Y.3d 753, 967 N.E.2d 1170, 944 N.Y.S.2d 725) on such renewal, where lessee did not pay any ser- vice termination fees and did not pay for services he did not receive. McKinney's General Obligations Law §§ 5–901, 5–903. Court of Appeals of New York. Bruce OVITZ, on Behalf of Himself and All Others Similarly Situated, Appellant, [2] Antitrust and Trade Regulation 29T 134 v. BLOOMBERG L.P. et al., Respondents. 29T Antitrust and Trade Regulation 29TIII Statutory Unfair Trade Practices and Con- March 27, 2012. sumer Protection 29TIII(A) In General 29Tk133 Nature and Elements Background: Lessee of financial information ser- 29Tk134 k. In general. Most Cited vices and equipment brought action against lessor Cases following automatic renewal of parties' subscription agreement. The Supreme Court, New York County, Judith J. Gische, J., denied lessor's motion to dismiss, A prima facie showing under the deceptive trade and it appealed. The Supreme Court, Appellate Divi- practices statute requires allegations that a defendant sion, 77 A.D.3d 515, 909 N.Y.S.2d 710, reversed, is engaging in an act or practice that is deceptive or and leave to appeal was granted. misleading in a material way and that plaintiff has been injured by reason thereof. McKinney's General Business Law § 349(a). Holdings: The Court of Appeals, Jones, J., held that: (1) even assuming that General Obligations Law's lease renewal provisions supported implied private [3] Antitrust and Trade Regulation 29T 179 right of action, lessee did not suffer harm, so as to support claim based on lease renewal; 29T Antitrust and Trade Regulation (2) lessee failed to state claim against lessor under the 29TIII Statutory Unfair Trade Practices and Con- deceptive trade practices statute; and sumer Protection (3) action did not present justiciable controversy 29TIII(B) Particular Practices upon which a declaratory judgment could be rendered 29Tk179 k. -

United States District Court Southern District of Florida

Case 9:16-cv-80076-RLR Document 177 Entered on FLSD Docket 04/25/2018 Page 1 of 14 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA Case No. 16-80076-Civ-Rosenberg/Brannon INSPIRED DEVELOPMENT GROUP, LLC, Plaintiff, v. INSPIRED PRODUCTS GROUP, LLC, Defendant. ______________________________/ REPORT AND RECOMMENDATION THIS CAUSE is before the Court on Defendant’s Motion for Its Attorneys’ Fees and Costs (“Motion”) [DE 160], Plaintiff’s response in opposition [DE 162], and Defendant’s reply [DE 165], which has been referred to the undersigned for appropriate disposition [DE 175]. Being fully advised, the Court RECOMMENDS that Defendant’s Motion [DE 160] be GRANTED IN PART and DENIED IN PART, and that Defendant be awarded $205,946.80 in attorneys’ fees and Defendant’s request for costs be denied. I. BACKGROUND This case arises from Defendant’s, Inspired Products Group, LLC (“IPG”/“Defendant”), alleged breach of its promise to pay $3 million to Plaintiff, Inspired Development Group (“IDG”/“Plaintiff”), in exchange for using IDG’s character car seat concept and licensing its patents. On December 5, 2016, IPG served on IDG a Proposal for Settlement for $300,000 pursuant to Fla. Stat. § 768.79 (the “Offer”) [DE 160-1], which IDG never accepted. Thereafter, the parties engaged in mediation and filed briefs on motions for summary judgment and motions in limine. On January 25, 2017, the Court granted summary judgment to IPG on Counts II 1 Case 9:16-cv-80076-RLR Document 177 Entered on FLSD Docket 04/25/2018 Page 2 of 14 (breach of contract), III (unjust enrichment), and IV (promissory estoppel) of the four-count complaint.1 On February 2, 2017, the remaining count, Count I for breach of contract, was dismissed with prejudice after the parties entered into a stipulated settlement agreement of $50,000, with IPG to make payment upon conclusion of the appeal or other proceedings in this case. -

Jacob Hale Russell, Rutgers Law School DATE

TO: UPF Civil Law Seminar Participants FROM: Jacob Hale Russell, Rutgers Law School DATE: 6 December 2017 Thanks for the opportunity to present my work-in-progress on unconscionability later this month. I’m attaching a draft of the project, which is at an early stage and still has many flaws to address. My approach and normative conclusions remain very tentative, so I am eager to hear your views, critiques, and suggestions. In addition, although the piece is not comparative in nature, I would be interested in your thoughts on whether I would benefit from any scrutiny of the distinct approaches to unfair terms in consumer contracts in EU private law and in civil law systems. (It may be that those approaches are too different to be relevant for this particular project and my pri- mary focus — how unconscionability, and more broadly consumer protection law, should deal with the heterogeneity of consumers.) I look forward to talking with you all on 18 December. 1 Unconscionability’s Resurrection Jacob Hale Russell Rutgers Law School DRAFT | December 6, 2017 Abstract Reports of unconscionability’s death are greatly exaggerated. The widespread view among courts and scholars is that the common-law con- tracts doctrine is rarely used, except in limiting clauses that purport to waive consumers’ procedural rights. As this Article documents, the doctrine ap- pears to be quietly flourishing in state courts over recent years, used to strike down substantive terms, including interest rates, in consumer finance con- tracts. To name just a few recent examples, courts have rewritten or voided payday loans, signature loans, overdraft fees, and mortgage contracts on the basis of unconscionability. -

Extinguishment of Agency General Condition Revocation Withdrawal Of

Extinguishment of Agency General condition Revocation Withdrawal of agent Death of the Principal Death of the Agent CASES Republic of the Philippines SUPREME COURT Manila FIRST DIVISION G.R. No. L-36585 July 16, 1984 MARIANO DIOLOSA and ALEGRIA VILLANUEVA-DIOLOSA, petitioners, vs. THE HON. COURT OF APPEALS, and QUIRINO BATERNA (As owner and proprietor of QUIN BATERNA REALTY), respondents. Enrique L. Soriano for petitioners. Domingo Laurea for private respondent. RELOVA, J.: Appeal by certiorari from a decision of the then Court of Appeals ordering herein petitioners to pay private respondent "the sum of P10,000.00 as damages and the sum of P2,000.00 as attorney's fees, and the costs." This case originated in the then Court of First Instance of Iloilo where private respondents instituted a case of recovery of unpaid commission against petitioners over some of the lots subject of an agency agreement that were not sold. Said complaint, docketed as Civil Case No. 7864 and entitled: "Quirino Baterna vs. Mariano Diolosa and Alegria Villanueva-Diolosa", was dismissed by the trial court after hearing. Thereafter, private respondent elevated the case to respondent court whose decision is the subject of the present petition. The parties — petitioners and respondents-agree on the findings of facts made by respondent court which are based largely on the pre-trial order of the trial court, as follows: PRE-TRIAL ORDER When this case was called for a pre-trial conference today, the plaintiff, assisted by Atty. Domingo Laurea, appeared and the defendants, assisted by Atty. Enrique Soriano, also appeared. A. -

Introduction to Law and Legal Reasoning Law Is

CHAPTER 1: INTRODUCTION TO LAW AND LEGAL REASONING LAW IS "MAN MADE" IT CHANGES OVER TIME TO ACCOMMODATE SOCIETY'S NEEDS LAW IS MADE BY LEGISLATURE LAW IS INTERPRETED BY COURTS TO DETERMINE 1)WHETHER IT IS "CONSTITUTIONAL" 2)WHO IS RIGHT OR WRONG THERE IS A PROCESS WHICH MUST BE FOLLOWED (CALLED "PROCEDURAL LAW") I. Thomas Jefferson: "The study of the law qualifies a man to be useful to himself, to his neighbors, and to the public." II. Ask Several Students to give their definition of "Law." A. Even after years and thousands of dollars, "LAW" still is not easy to define B. What does law Consist of ? Law consists of enforceable rule governing relationships among individuals and between individuals and their society. 1. Students Need to Understand. a. The law is a set of general ideas b. When these general ideas are applied, a judge cannot fit a case to suit a rule; he must fit (or find) a rule to suit the unique case at hand. c. The judge must also supply legitimate reasons for his decisions. C. So, How was the Law Created. The law considered in this text are "man made" law. This law can (and will) change over time in response to the changes and needs of society. D. Example. Grandma, who is 87 years old, walks into a pawn shop. She wants to sell her ring that has been in the family for 200 years. Grandma asks the dealer, "how much will you give me for this ring." The dealer, in good faith, tells Grandma he doesn't know what kind of metal is in the ring, but he will give her $150.