Hartford Downtown Arena Feasibility Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

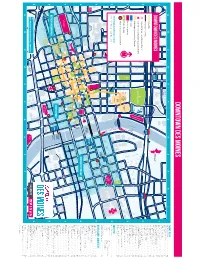

Downtown Des Moines

MERCY MEDICAL CENTER HOLIDAY INN DOWNTOWN AT MERCY CAMPUS GREATER DES MOINES BOTANICAL GARDEN KEOSAUQUA WAY ST 14TH E E 12TH ST R ST 7TH E (open during events) E ST 6TH E V QUALITY INN I 2ND AVE 2ND 5TH AVE 5TH 6TH AVE 6TH 7TH ST 7TH 3RD ST 3RD 8TH ST 8TH & SUITES R 9TH ST 9TH 12TH ST 12TH EVENTS S DES MOINES ST CENTER E ROBERT D. RAY N I ASIAN CROCKER ST CROCKER ST O GARDENS M LYON ST S E D E GRAND AVE WELLSWells Fargo FARGO Arena COMMUNITYCommunity Choice CHOICE ARENA Credit Union CREDITConvention Center UNION CONVENTION CENTER KEOSAUQUA WAY Iowa Events Center E 13TH ST IOWA PRINCIPAL RIVERWALK EVENTS E 12TH ST CENTER CENTER ST IOWA WOMEN OF CENTER ST ACHIEVEMENT E 2ND ST Hy-Vee Hall HY-VEE HALL BRIDGE ROBERT D RAY DR DES MOINES ST IOWA STATE CAPITOL FINKBINE DR IOWA HALL OF PRIDE STATE HISTORICAL E WALNUT ST PARK ST MUSEUM 10TH ST 10TH OF IOWA 9TH ST 9TH E GRAND AVE 8TH ST 2ND AVE 2ND 5TH AVE 5TH 7TH ST 7TH 6TH AVE 6TH 4TH ST 4TH 3RD ST 3RD BRENTON CHESTNUT ST SKATING PLAZA E 6TH ST WATSON POWELL JR WAY B E 7TH ST E LOCUST ST E COURT AVE E 5TH ST HISTORIC E 4TH ST EAST VILLAGE GRAND AVE E 3RD ST PLEASANT ST E 2ND ST HOYT UNITY POINT B EMBASSY SUITES SHERMAN IOWA METHODIST DES MOINES E WALNUT ST PLACE MEDICAL CENTER SIMON ESTES DOWNTOWN WOODLAND AVE RIVERFRONT LOCUST ST AMPHITHEATER RENAISSANCE WORLD FOOD SAVERY PRIZE HALL OF B DES MOINES LAUREATES DOWNTOWN DES MOINES HYATT PLACE E 1ST ST PERFORMING RIVERWALK DES MOINES PRINCIPAL HIGH ST CATCH DES MOINES ARTS DOWNTOWNE COURT AVE DES MOINES DES MOINES DOWNTOWN MARRIOTT INFORMATION WALNUT -

Dsmskatepark.Com Catchdesmoines.Com

⊲ 88,000 SQUARE FEET OF SKATEABLE TERRAIN, MAKING IT THE LARGEST OPEN PARK IN THE NATION! ⊲ OLYMPIC RATED PARK AND STREET COURSES! ⊲ CAPACITY TO HOST BOTH DEMONSTRATIONS AND COMPETITIONS. ⊲ OPPORTUNITIES FOR ALL SKILL AND ABILITY LEVELS FROM BEGINNERS TO PROFESSIONALS. Lauridsen Skatepark is located in the heart of downtown Des Moines on five acres at the northern edge of the Principal Riverwalk and just east of Wells Fargo Arena and Iowa Events Center. Designed by renowned skateboarders Lance Mountain and Colby Carter of California Skateparks, Lauridsen Skatepark is an attractive extension of the city’s beautiful Principal Riverwalk. Des Moines is poised to host major events at the skatepark beginning in spring 2021. With experience hosting national events such as the US Youth Regional and National Soccer Championships, NCAA Men’s Basketball and Wrestling, AAU Junior Olympics, USA Track and Field Championships, and the LPGA Solheim Cup, Des Moines can ensure your event is a success. Your participants and guests will experience a world-class event in a safe, affordable, and accessible destination. Downtown Des Moines is emerging, progressive, and probably not at all what you think. It’s a culture without the cost. Art without the attitude. Walkable without the worry. The Skatepark is in great proximity to Des Moines’ restaurant scene, attractions and hotel rooms. There are more than 2,800 hotel rooms downtown and 13,000+ rooms citywide. Downtown hotels are walkable from the Skatepark and include all the major brands, service levels and budgets. Event parking options surround the Skatepark, and range from street parking to large parking lots. -

An Analysis of New And/Or Expanded Event and Convention Facilities In

A N ANALYSIS OF N EW AND / OR E XPANDED E VENT AND C ONVENTION F ACILITIES IN S ASKATOON Prepared for: SaskTel Centre, TCU Place and the City of Saskatoon March 2018 Final Report: March 2018 1 T ABLE OF C ONTENTS 1. Introduction ………………………………………………………………………………………… 3 2. Saskatoon Context ……………………………………………………………………………… 7 3. Facility Condition Assessments …………………………………………………………… 15 4. Market Potential and Size Parameters ………………………………………………. 20 5. Location, Co - Location and Preferred Site Characteristics …………………. 25 6. Location Options and Project Cost ……..……………………………………......... 31 7. Financial Analysis ………………………………………………………………………………… 40 8. Economic Impact Analysis …………………………………………………………………. 47 9. Capital Sources …………………………………………………………………………………… 55 10. Conclusions …………………………………………………………………………………………. 59 Appendices Appendix 1: Interviewees …………………………………………………………………… 63 Appendix 2: Case Study Write Ups …………………………………………………….. 65 Appendix 3: Large format 3D Study Models …………………………………..... 88 Appendix 4: SJ Research Services Economic Impact Report …………… 91 Volume I: SaskTel Centre Volume II: TCU Place Final Report: March 2018 2 2 1. I NTRODUCTION Final Report: March 2018 3 3 I NTRODUCTION Saskatoon is a growing community and is currently the 17th largest metropolitan centre in Canada with a population of over 250,000. Between 2006 and 2014, Saskatoon experienced a prolonged economic boom, with rapid growth driven by residents returning from out - of - province for unprecedented job opportunities created by a booming resource economy. Saskatchewan is rich in natural resources with uranium, oil, potash and farming representing the foundation of the region’s economy. Although the economy has slowed since 2014, the City of Saskatoon (the “City”) is planning ahead to ensure the right decisions are made now to prepare for a future population of 500,000. TCU Place and SaskTel Centre are City - owned public assembly facilities. -

Catch Des Moines Customer Advisory Board October 22 – 23, 2019

Catch Des Moines Customer Advisory Board October 22 – 23, 2019 Meeting moderated and report authored by: David Kliman, CMM The Kliman Group 415.339.0237 [email protected] Customer Advisory Board Attendees Morgan Basham ConferenceDirect Mary Byrne UnityPoint Health Tonya Cameron United Methodist Women Dan Cataldi Iowa Soccer Association Teresa Cox Corteva Agriscience Teresa Paramenter Iowa AAU Naomi Romanchok Association of Farmworker Opportunity Programs Monica Russell American Association of State Highway and Transportation Officials Brenda Shaver American Public Works Association Valerie Smith United Church of Christ Lauren Swanson National Pork Producers Council David Tharp International Association for Food Protection Scott Wunn National Speech & Debate Association Meghan Wulster-Radcliffe American Society of Animal Science/American Dairy Science Association Des Moines Leadership, Speakers and Hosts Greg Edwards President & CEO, Catch Des Moines Angela Connolly Chair of Board of Directors, Catch Des Moines; Polk County Board of Supervisors Trina Flack Vice President of Sales, Catch Des Moines Ben Handfelt Director of Creative & Communications, Catch Des Moines Carrie Jackson Assistant General Manager and Director of Sales, Iowa Event Center Christina Cook Destination Sales Executive, Des Moines Marriott Patrick Miller General Manager, Des Moines Marriott Tamara Chubb Director of Sales, Hilton Des Moines Downtown Social Media @catchdesmoines #CATCHdsm Catch Des Moines Customer Advisory Board October 22 – 23, 2019 Page 2 WELCOME -

Know How Much You Matter to This World

KNOW HOW MUCH YOU MATTER TO THIS WORLD. 2017 Donor List Iowa Methodist | Iowa Lutheran | Blank Children’s | Methodist West John Stoddard Cancer Center | UnityPoint at Home | UnityPoint Clinic Taylor House Hospice Distribution of Support The UnityPoint Health – Des Moines Foundation is privileged to serve as the development and fundraising organization for Iowa Methodist, Iowa Lutheran, Blank Children’s, Methodist West, John Stoddard Cancer Center, Taylor House Hospice, UnityPoint at Home, and UnityPoint Clinic. Thoughtful gifts of all sizes make advancements possible in medical research, state-of-the-art equipment, programs, and services to help meet the specific needs of our community. 2,998 NEW 3,984 DONORS TRIBUTE 2017 QUICK STATS 7,511 GIFTS DONORS 12,338 GIFTS MADE $8,502,241 DONATIONS 18,019 15,330 TOTAL FIVE-YEAR QUICK STATS NEW TRIBUTE 34,509 DONORS GIFTS TOTAL DONORS 52,816 TOTAL GIFTS MADE $43,310,288 DONATIONS 1 0.9% 0.1% 4.2% 2017 FUNDING PURPOSES 5% Programs and Services - - - - - - - - - - $4,792,817 4.3% Capital - - - - - - - - - - - - - - - - $3,179,531 Equipment - - - - - - - - - - - - - - - - $401,273 Education - - - - - - - - - - - - - - - - $470,279 Patient Assistance - - - - - - - - - - - - - $387,329 51.4% Employee Assistance - - - - - - - - - - - - - $81,466 34.1% Other - - - - - - - - - - - - - - - - - - - $13,861 Total: $9,326,556 2.4% 3.9% 2017 DISTRIBUTION OF SUPPORT Blank Children’s Hospital - - - - - - - - - - - - - - - - - - $4,317,913 8.7% Iowa Methodist, Iowa Lutheran, Methodist West - - - - - - - - - $3,606,955 -

2018 Event Program

2018 EVENT PROGRAM Friday, NOV. 9, 4–9 PM SAturday, NOV. 10, 1–8 PM HY-VEE HALL | IOWA EVENTS CENTER 730 3RD STREET DES MOINES, IA 50309 iowaeventscenter.com/wineandfood Iowa’s Premier Beer, Wine & Food Expo 2018 1 Your Hy-Vee offers a wide variety of all of Cheers! your favorite beers! SUPER COUPON LU 86288 Craft or Imported Beer 12 pack select varieties, 12 fl. oz. ¢ bottles or cans (plus deposit) 10 save 10¢ per gallon with each craft beer 12 pack purchased Limit 1 offer per coupon. Limit 1 coupon per customer. We reserve the right to limit quantities. Cannot be combined with other fuel saver promotions. Limited to 20 gallons of fuel per purchase, per vehicle. Offer valid at all Des Moines Hy-Vee stores through November 30, 2018. SUPER COUPON LU 86289 Craft Beer 4 pack or 6 pack select varieties, 12 fl. oz. ¢ bottles or cans (plus deposit) 5 save 5¢ per gallon with each craft beer 4 pack or 6 pack purchased Limit 1 offer per coupon. Limit 1 coupon per customer. We reserve the right to limit quantities. Cannot be combined with other fuel saver promotions. Limited to 20 gallons of fuel per purchase, per vehicle. Offer valid2 at allIowa’s Des Moines Premier Hy-Vee Beer, stores Wine through & FoodNovember Expo 30, 2018 2018. 66153_DSM Grp_WineShow_ad.indd 2 9/27/18 9:36 AM TABLE OF CONTENTS Booth & Stage Layout 4 Show Features 5 Event Schedule 6 Iowa Sampling Instructions 6 Exhibitors 8 Gourmet Pairing Experience 13 Jason Scafuri, Waukee Hy-Vee 14 Your Hy-Vee offers a Marc Carrigan, Foley Family Wines wide variety of all of Aaron Lenz, Hotel Pattee 15 Tom Crowder, Southwest Wines your favorite beers! Cheers! Matt Drennan, Fleming's Prime Steakhouse & Wine Bar 16 Benjamin Poole, representing Mondavi Winery LU 86288 Alex Strauss, SUPER COUPON West Lakes Hy-Vee 17 Chris Anderson, Odell Brewing Company Dawn Musgrove, Craft or Imported New Day Catering Company 20 Nick Marino, Hilton Des Moines Downtown Beer 12 pack Dave Morgan, SingleSpeed Brewing Co. -

March Activity Calendar

March Activity Calendar Ongoing Activity Ideas: 1. Visit www.DesMoinesRegister.com/events for a calendar of activities that you can search by date, location, and type of event 2. Karaoke is back at Royal Flush Restaurant from 5-8:00pm on the first and third Thursday of each month at 4440 Hubbell Ave, Des Moines. We encourage customers to purchase a drink or food item since we are enjoying Royal Flush’s facility. Call 515-564-1140 for more details! 3. Two for Tuesdays @ The Playground for Kids in Ankeny (2401 SE Tones Dr. Suite &), two kids can play for $8 (max 4 kids) 515-965-9899 4. Brenton Skating Plaza: (520 Robert D Ray Dr - Des Moines) - Bring your family to the coolest outdoor ice skating plaza in Central Iowa from November to March. We offer public skating seven days a week. During the rest of the year, the plaza transforms into an outdoor event center. Private rentals and concessions are available year-round. 5. Skating @ Skate West from 6:00pm-8:00 pm (2019 Grand Ave, West Des Moines, IA 50265). Wednesday Dollar Skate night! Skate rental is only $2. 6. (Train to Inspire) Tae Kwon Do @ 4503 NE 50th St, Des Moines, IA 50317. 6pm on the 3rd Monday of every month beginning Monday, February 20. Enter through the back of the building and look for the East Coast Tae Kwon Do sign on the door. 7. (Train to Inspire) Yoga @ 4503 NE 50th St, Des Moines, IA 50317. 5:30pm on the 4th Monday of every month beginning Monday, February 27. -

Downtown Des Moines

DOWNTOWN DES MOINES PREMIUM BUSINESS ENVIRONMENT Best City for Young # Professionals 3B 1 — Forbes INVESTED # Farmers’ Market More than four miles of connected skywalks. 2 — Shape Magazine 75,000 $3 billion of people Up-and-Coming capital invested in work # Downtown past 10 years. 75,000 Downtown. 1 — Fortune Magazine VIBRANT URBAN ENVIRONMENT 98% Occupancy rate for 10,000 people live Downtown. Downtown apartments is 98%. 3,700 new housing units under construction/planned. DesMoinesMetro.com | DowntownDesMoines.com RECENT PROJECTS IN DOWNTOWN DES MOINES 7TH & GRAND PARKING GARAGE ................ $28 MILLION HOTEL FORT DES MOINES ......................$40 MILLION Parking/Residential/Commercial Hospitality 7TH & WALNUT ............................... $85 MILLION IOWA EVENTS CENTER CONVENTION ............. $101 MILLION Residential HOTEL-HILTON HOTELS & RESORTS Hospitality 300 MLK OFFICE ............................$13.5 MILLION Commercial JACKSON CROSSING ........................... $40 MILLION Residential AC HOTEL BY MARRIOTT ......................$18.5 MILLION Hospitality JUSTICE CENTER, POLK ........................ $81 MILLION COUNTY COURT COMPLEX BRIDGE DISTRICT DEVELOPMENT ...............$18.2 MILLION Civic Commercial/Hospitality/Residential KRAUSE GATEWAY CENTER .....................$151 MILLION CITY SQUARE ................................ $49 MILLION Commercial Residential MERCY MEDICAL CENTER TOWER ................ $500 MILLION CITYVILLE II & III ............................ $50 MILLION Medical Residential MEISBLOCK ................................ -

Outlets of Des Moines Pop up Fact Sheet

POP-UP OPPORTUNITIES POP-UP KIOSK, CART, SIGNAGE AND STORE SPACE AVAILABLE OUTLETS OF DES MOINES Outlets of Des Moines brings some of the best brand names in retail to the 801 Bass Pro Drive NW Des Moines regional metropolitan area, one of the strongest economies in Altoona, Iowa 50009 the United States. Stores include ASICS Outlet, American Eagle Outfitters, 515.380.7400 Bath & Body Works, Coach Outlet, Converse, Eddie Bauer Outlet, Express OutletsofDesMoines.com Factory Outlet, francesca’s, kate spade new york, Le Creuset, LOFT Outlet, Lucky Brand, Michael Kors Outlet, Nike Factory Store, Old Navy Outlet, Polo TJ JUST Ralph Lauren, SKECHERS, Tommy Hilfiger, Under Armour Factory House, General Manager Vera Bradley Factory Outlet Store. 515.380.7211 LOCATION [email protected] ▪ Six miles from downtown Des Moines, the capital of Iowa and the most populous city in the state ▪ At the intersection of I-80 and US-65 in Altoona, an established destination for entertainment and shopping ▪ 13.7 million annual visitors to Greater Des Moines ▪ Adjacent to Bass Pro Shops Outdoor World OPPORTUNITY ▪ Highlight your brand among today’s hottest retailers ▪ Take advantage of untapped East Polk County market ▪ Increase customer recognition of your store ▪ Find low risk move-in ready spaces, varying in size, and flexible lease terms OUTLETS OF DES MOINES ALTOONA, IOWA ANKENY 141 35 GREATER DES MOINES AREA 60 MILE DEMOGRAPHICS (2021) Population 1.04M 69 6 Households 419,050 80 28 Average Household Income $88,523 Bass Pro Shops Adventureland Park -

Map of Downtown Des Moines

9 6 5 8 2 4 3 7 1 SHERMAN PLACE HOYT Grand Ave Locust St 15th St 15th A B C D E A B C D E DOWNTOWN DES MOINES WESTERN GATEWAY PARK WESTERN GATEWAY Ingersoll Ave catchdesmoines.com (515) 286-4960 | (800) 451-2625 B DES MOINES INTERNATIONAL AIRPORT DES MOINES INTERNATIONAL – TO S B P JOHN & MARY PAPPAJOHN JOHN & MARY SCULPTURE PARK SCULPTURE Bcycle Kiosks (bicycle rental) Bcycle Kiosks Public Parking of Interest Points Hotels Buildings Accessed by Skywalk Convention Center/Arena Access Points Access Points Level Skywalk/Street Closing Temporary Skywalks 14th St 14th IOWA METHODIST IOWA MEDICAL CENTER MEDICAL UNITY POINT Keosauqua Way Keosauqua Woodland Ave Woodland 13th St 13th High St B Grand Ave Locust ST S Walnut St Mulberry St St 12th 12th St 12th PUBLIC LIBRARY PUBLIC DES MOINES DES S 12th St 12th Keosauqua Way Keosauqua 10th St 10th FORT DES MOINES FORT MAINFRAME STUDIOS DES MOINES Chestnut St Chestnut S St Pleasant THEATER TEMPLE HOTEL 11th St 11th B S S 9th St 9th B S 9th St 9th 10th St 10th S St 8th S S Cherry St DES LUX HOLIDAY INN EXPRESS & INN EXPRESS HOLIDAY S HOTEL SUITES DES MOINES SUITES DOWNTOWN St 8th 9th St 9th CAMPUS MERCY S DOWNTOWN AT DOWNTOWN HOLIDAY INN HOLIDAY Crocker St Crocker Center St S Park St DOWNTOWN DES MOINES MARRIOTT S 7th St 7th Watson Powell Jr. Way Jr. Powell Watson St 7th 8th St 8th S S S S HYATT PLACE HYATT DOWNTOWN S DES MOINES BUS STATION CENTRAL TRANSIT) (PUBLIC DART AVE 6th 6th AVE 6th 7th St 7th S HILTON DES MOINES DES MOINES HILTON S S DOWNTOWN SURETY HOTEL S WELLMARK YMCA S S B 5th Ave 5th 5th Ave 5th 6th Ave 6th B (OPEN DURING EVENTS) (OPEN DURING S W Martin Luther King Jr. -

Public Foundation Greater Des Moines Art

PUBLIC FOUNDATION GREATER DES MOINES ART 2013–14 ANNUAL REPORT 1 greater des moines public art Foundation 2 greater des moines public art Foundation Mission AnD Vision Mission Greater Des Moines Public Art Foundation engages, inspires, and enriches the lives of citizens and visitors in our community. Vision The Public Art Foundation is recognized for increasing cultural awareness by establishing a world-class destination for public art. Greater Des Moines Public Art Foundation proudly: ■ selects, and commissions works of art created by venerated professional artists for installation in public spaces; ■ acquires artworks for a public art collection by means of direct commissions, invitationals, community-initiated projects, and gifts; ■ enhances greater des moines’ environment, public buildings, and lands; ■ provides inancial support and assistance in commissioning professional artists for private or municipal urban development projects; ■ integrates professional artists into the planning, design, and construction of city and privately developed facilities, e.g., buildings, parks, streetscapes, and other facilities and spaces that would beneit from participation by an artist; ■ celebrates the multi-cultural and diverse character of the community’s neighborhoods and citizens; ■ nurtures a sense of citizen ownership and pride in a public art collection; and ■ encourages creative partnerships between artists and residents, neighborhoods, businesses, and community organizations located in the city. DETAIL Seven children play in front of the illuminated mural called Expansion (2013) by Jun Kaneko. The project is integrated into the north exterior wall of the Court Avenue Pump Station (CAPS) between the Des Moines River and Water Street, south of Court Avenue, Des Moines. 3 greater des moines public art Foundation 2013-2014 annual report 1 FRoM THE DiRECToR Des Moines’ public art experience expanDs It is gratifying to work in a public art drew large crowds throughout the eleven- environment which offers people day event. -

IOWA EVENTS CENTER Des Moines, IA CASE STUDY

IOWA EVENTS CENTER Des Moines, IA CASE STUDY PortaBLE ProFits Improving the bottom line with a change from fixed to flexible seating The Iowa Events Center’s 3-facility complex included a vintage, fixed- seat civic auditorium that wasn’t very viable anymore. Larger events moved elsewhere in the complex, leaving it hosting only small to mid- Convention Center | Grand Ballroom sized events. Polk County felt the aged venue might be able to play an important role in the community again, but it would need to be a more flexible, dynamic space and complement the other two venues in the complex. So the search began for a seating solution that would provide the flexibility they needed, attract new events, and improve operating profits. A successful collaboration between the Operations team and Hussey Seating accomplished all of that and more – read on to discover how a switch from fixed to portable seating transformed the bottom line at the Iowa Events Center. Hy-Vee Hall “It’s been a game changer – in the number of events and the amount of revenue we’ve generated. It’s been a huge game changer.” -Bill Shaw, Director of Operations Convention Center | Meeting Room IOWA EVENTS CENTER Des Moines, IA CASE STUDY “It used to take 6 guys 4 hours to set up a basic set, where now we can do it with 2 guys in 2 hours.” -Bill Shaw, Director of Operations Convention Center | Grand Ballroom Convention Center | Grand Ballroom Hy-Vee Hall OBstacLes & Opportunities SOLutions THE PayoFF The Iowa Events Center is a 3-facility entertainment/event complex Sitting down together, Hussey and Bill’s team walked through Now the Iowa Events Center can host virtually any event – from in downtown Des Moines.