Chevron Corporation; Rule 14A-8 No-Action Letter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sister Therese Decanio, OP 1930-2021

Sister Therese DeCanio, OP 1930-2021 On April 10, 1930, a young Chicago couple, Anthony and Frances (Liana) DeCanio, welcomed their first-born child, Therese Genevieve, into the world. At the time, the little family lived on the second floor of an apartment building owned by three unmarried Irish sisters. These early days of the Depression were difficult, for Anthony – whose occupation is listed as “printer” in later Congregational records – was unemployed at the time of Therese’s birth. But the family’s landladies told him to not worry about the rent until he got a job. “My mother and father often spoke of their kindness,” Sister Therese wrote in her autobiography. “… They were a great gift in my young life as they spent much time reading to me, making pancakes for my breakfast and simply loving me.” In the years following Therese’s birth, two more children were born, Joseph in 1933 and Loretta in 1938. Therese’s early school years were spent in public school, including Fort Dearborn School when the family moved into a home in St. Kilian Parish the summer before she entered fifth grade. That move proved pivotal, for she attended CCD classes at St. Kilian. It was her introduction to the Adrian Dominican Sisters, and she went on to attend St. Kilian School for sixth grade and then Aquinas Dominican High School. Her parents preferred that she attend high school closer to home, but to her the 45-minute trip to Aquinas was well worth it because she was drawn to the Sisters’ joyful and caring presence. -

The Adrian Dominican Sisters in the Us and Dominican Republic, 1933-61

UNIVERSITY OF CALIFORNIA SANTA CRUZ NOVICES, NUNS, AND COLEGIO GIRLS: THE ADRIAN DOMINICAN SISTERS IN THE U.S. AND DOMINICAN REPUBLIC, 1933-61. A dissertation submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in HISTORY with an emphasis in FEMINIST STUDIES by Elizabeth Dilkes Mullins March 2014 The dissertation of Elizabeth Dilkes Mullins is approved: ___________________________ Professor Marilyn J. Westerkamp ___________________________ Professor Susan Harding ___________________________ Professor Emily Honig ___________________________ Professor Alice Yang ________________________________ Tyrus Miller Vice Provost and Dean of Graduate Studies Table of Contents Introduction: Novices, Nuns, and Colegio Girls. ...................................................... i Chapter 1: Adrian Dominican Sisters in Context: The Adrian Congregation and Pre-War Catholic America ...................................................................................... 23 Chapter 2: “In the world but not of it”: Adrian Dominican Sisters Negotiating Modernity Through Body, 1933-39 ........................................................................... 46 Chapter 3: “This is a peculiar place, Mother”: The Post WWII Dominican Republic and the Foundation of Colegio Santo Domingo. .................................... 85 Chapter 4: Colegio Girls – The Colegio’s Two Curriculums ............................. 129 Chapter 5: Body Politics ........................................................................................ -

United States Securities and Exchange Commission Washington, D.C

United States Securities and Exchange Commission Washington, D.C. 20549 Notice of Exempt Solicitation Pursuant to Rule 14a-103 Name of the Registrant: Tyson Foods, Inc. Name of persons relying on exemption: American Baptist Home Mission Society and 22 co-filers: Adrian Dominican Sisters; Benedictine Sisters of Mount St. Scholastica; Congregation of Sisters of St. Agnes; Congregation of St. Joseph, OH; Congregation of the Sisters of St. Joseph of Peace; Daughters of Charity, Province of St. Louise; Felician Sisters of North America; Franciscan Sisters of Allegany, NY; Mercy Investment Services; Northwest Women Religious Investment Trust; PeaceHealth; Portico Benefit Services (ELCA); Sisters of Bon Secours; Sisters of Charity of St. Elizabeth, NJ; Sisters of Providence, Mother Joseph Province; Sisters of St. Francis of Dubuque, IA; Sisters of St. Francis of Philadelphia; Sisters of the Good Shepherd; Trinity Health; Dominican Sisters of Springfield, IL; Sisters of the Humility of Mary; and BMO Asset Management Address of persons relying on exemption: Investor Advocates for Social Justice (formerly the Tri-State Coalition for Responsible Investment), 40 S. Fullerton Ave, Montclair, NJ 07042 Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration of these important issues. The American Baptist Home Mission Society and 22 co-filers urge you to vote FOR Item 4: Shareholder Proposal to Request a Report Regarding Human Rights Due Diligence at the Tyson Foods Inc. Annual Meeting of Shareholders on February 11, 2021. -

Adrian Dominican Sisters General Council Issues Statement Opposing Offshore Drilling

ADRIAN DOMINICAN SISTERS 1257 East Siena Heights Drive Adrian, Michigan 49221-1793 www.adriandominicans.org IMMEDIATE RELEASE CONTACT: Barbara Kelley, OP Date: January 5, 2018 Office of Communications 517-266-3591 [email protected] Adrian Dominican Sisters General Council Issues Statement Opposing Offshore Drilling January 18, 2018, Adrian, Michigan – The General Council of the Adrian Dominican Sisters issued the following statement in opposition to President Donald Trump’s expansion of offshore oil and gas exploration. Statement of Adrian Dominican Sisters on Trump Administration’s Expansion of Offshore Drilling We are alarmed by the Trump Administration’s decision to open federal waters to new offshore oil and gas exploration in the Arctic, Atlantic, and Pacific Oceans, and the Gulf of Mexico. Lifting the ban on new offshore drilling makes no sense as our nation reels from the present impacts of climate change with record-freezing temperatures, unprecedented wildfires, and crippling hurricanes. Governors of coastal states also fear the potential negative impact on tourism, fisheries, and recreation threatened by the specter of oil spills like the Deepwater Horizon rig disaster in 2010 that killed 11 people and devastated the Gulf Coast. This move is all the more alarming as the Trump Administration rolls back oil rig safety regulations put in place after the Deepwater disaster. As women of faith concerned about the degradation of God’s creation and the future of humanity, we urge elected leaders to oppose this reckless unraveling of environmental protections and take legislative steps to put the nation on the path of a clean, renewables-based economy. # # # The Dominican Sisters of Adrian, a Congregation of more than 620 vowed women religious and 200 Associates, traces its roots back to St. -

As You Sow Challenges Chevron to Take Immediate Action on Methane Emissions for IMMEDIATE RELEASE

As You Sow Challenges Chevron to Take Immediate Action on Methane Emissions FOR IMMEDIATE RELEASE January 24, 2018 Media Contact: Cyrus Nemati, (510) 735-8157 Expert Contacts: Danielle Fugere, (510) 735-8141 Oakland, CA – In a new shareholder resolution, As You Sow and Dominican Sisters of Hope, Congregation of St. Joseph, Adrian Dominican Sisters, and Dignity Health are calling upon Chevron to report to shareholders on how it is detecting and mitigating methane emissions, a leading cause of climate change. Methane, the primary component of natural gas, has an intense, short-term climate forcing impact, at least 84 times that of carbon over 20 years. San Ramon-based Chevron is ranked near the top (17th out of the 100 highest) methane emitters from onshore production based on a 2016 study. Yet, Chevron ranks near the bottom of major oil and gas companies in its disclosures on how and whether it is managing and reducing its methane emissions. In a 2017 special methane edition of “Disclosing the Facts,” Chevron managed to score only 2 out of 13 points on its methane-related disclosures. In contrast, other large oil and gas companies have made significant gains in their methane management practices and disclosures. Peer company ExxonMobil scored 9 out of 13 points and nine other companies scored 10 or more points on their methane management and disclosure practices. While the oil and gas industry is the largest source of methane emissions in the U.S., methane emissions from the oil and gas value chain are among the cheapest to abate of all anthropogenic climate emissions, according to the International Energy Agency’s World Energy Outlook 2017. -

Sister Ann Seraphim Schenk, OP 1917 – 2018

Sister Ann Seraphim Schenk, OP 1917 – 2018 The feeling I had while preparing this reflection was that of being with a faithful, loving person who knew who she was and what her calling meant – a person of prayer and a solid kind of dependable person you’d want in your life. — Sister Joanne Peters, Co-Chapter Prioress of Holy Rosary Chapter, in her eulogy at the vigil service for Sister Ann Seraphim Schenk Out of the thousands of women who have been Adrian Dominican Sisters, only a handful have lived to the age of one hundred or more. Sister Ann Seraphim Schenk was one of those treasured few: when she died on June 24, 2018, she was just four months shy of her 101st birthday and was in her eighty-first year in the Congregation. Sister Ann Seraphim’s parents, Henry and Linda Hoff Schenk, were both of German descent, with Henry growing up in Quincy, Illinois, and Linda’s family living on a farm in Fayetteville, Illinois, a small town near Belleville. Linda was Henry’s second wife; his first wife died while their son was still an infant. The baby was raised by an aunt and her husband until after Henry remarried, at which point he went to live with Henry and Linda until he was of high school age and went back to the aunt and uncle’s home. The family moved often in those early years. Henry and Linda went to California on their honeymoon and stayed there for some time; a son, Floyd, was born to them in Santa Cruz and Henry, a carpenter, even built a house there. -

Sister Ann Rena Shinkey, OP 1933-2021

Sister Ann Rena Shinkey, OP 1933-2021 I lay claim to being pure “Dominican” from birth. Marilyn Rita Shinkey, the future Sister Ann Rena, was not only the daughter of a mother born to Italian-immigrant parents, but her mother’s name – Rena Dominic – even fit the bill. Born in Streator, Illinois, on August 31, 1933, Marilyn was the only child of Rena and Frederick Shinkey. Frederick was born in Paxton, Illinois, and had farmed and ranched out West before returning to his home state and settling in Streator, where he worked as a plant foreman. Marilyn’s childhood was a happy, active one. She loved sports and anything to do with the outdoors. From the age of ten she knew she wanted to be a teacher, and because of her athletic as well as academic abilities, she earned scholarships in both areas to Illinois State University. She earned her bachelor’s degree in education, majoring in physical education, in 1955. “Only the hand of God could account for my next move,” she wrote in her autobiography. After graduating from college, she was hired to teach physical education and social studies at Mount St. Mary Academy. It was her introduction to the Adrian Dominican Sisters, as well as something of a re- introduction to Catholicism in general; her parents were both lapsed Catholics, and although she had been baptized and made her first Communion she had not been confirmed. “Needless to say, that was completed in my three years at the Mount,” she wrote. In the persons of Sister Rita Marie Callaghan and the other Adrian Dominicans at the Mount, Marilyn soon came to see that being a teacher alone did not provide the complete life she saw in the Sisters. -

A Brief History of the Dominican Order in the U.S. Mary Nona Mcgreal, OP

A Brief History of the Dominican Order in the U.S. Mary Nona McGreal, OP Originally published as the entry "Dominicans (O.P.)," pp.440-448, in The Encyclopedia of American Catholic History edited by Michael Glazier and Thomas J. Shelly, The Liturgical Press. This augmented and hyperlink enabled version is presented with permission of the publisher. © 1997 by The Order of St. Benedict, Inc., Collegeville, Minnesota. Members of the Dominican Order (Order of Preachers) have been on mission in the United States for more than two centuries. The mission given them by Dominic de Guzman (1170–1221) from the founding of the Order is to proclaim the word of God by preaching, teaching and example, while they are sustained by life in common. The single mission of the Order of Preachers embraces many ministries, developed as needed to bring the word of God to persons in varying societies and circumstances. St. Dominic had this in mind when he urged the first members to identify with each culture through the use of the languages. For the same purpose he asked the meet all people as mendicants, ready to exchange gifts and necessities with others in the spirit of Jesus and the apostles. The Order of Preachers is composed of men and women of four branches: friars, who may be priests or brothers; cloistered nuns; sisters; and laity. Dominic de Guzman was called to ministry in the universal Church. His followers have proclaimed the gospel around the world to peoples never known to the founder, including those of the Americas. Early Missionaries to the United States Three centuries after the death of St. -

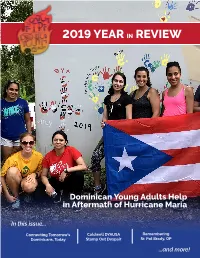

2019 Year in Review1.Indd

2019 YEAR IN REVIEW Dominican Young Adults Help in Aftermath of Hurricane Maria In this issue... Connecting Tomorrow’s Caldwell DYAUSA Remembering Dominicans, Today Stamp Out Despair Sr. Pat Brady, OP ...and more! Partners in Mission A donation program for those who believe the Future of our Church begins with an Investment. 6 DYMUSA’s director reflects on the life of CATCH THE FIRE S. Patricia Barady, OP (1939-2019) MAGAZINE 20 DYA in Puerto Rico help in the atch the Fire Magazine is aftermath of Hurricane Maria produced for participants, Calumni, and friends annually by the Dominican Youth Movement USA. Its goal is to provide news and information about the Dominican Youth Movement USA’s participants, staff, alumni, and friends. We welcome your comments, Veritas St. Rose of St. Martin de St. Catherine St. Dominic suggestions and stories! Please email us at [email protected]. Level Lima Level Porres Level Level Level $10.00/month $15.00/month $20.00/month $25.00/month $50.00/month A donation such as this A donation such as this A donation such as this A donation such as this A donation such as this will assist with registration will assist with registration will provide transportation will provide a scholarship will provide a scholarship fees for one student to one fees for one student to one for one student to our one students to attend one for two students to attend MANAGING EDITOR of our programs. of our programs. programs. of our programs. our programs. Sr. Gina Fleming, OP 24 Almost 15 students commit to WRITERS become Dominican Young Adults S. -

FY 2019 Adrian Dominican Ministry Trust Member Initiatives

FY 2019 Adrian Dominican Ministry Trust Member Initiatives The Congregation Grants Committee of the Adrian experiencing domestic violence in Lenawee Dominican Ministry Trust approved $739,300 for County homes. The Ministry Trust funds will the following 29 Member Initiatives for the fscal assist clients in the development of individualized year 2019. These projects refect the Mission and safety plans based on current and future Vision of the Adrian Dominican Sisters. relationship needs. Survivors and their children will learn to build their resilience and re-establish Angela House violence-free households on the solid foundation Houston, Texas of improved mental, social, and emotional well- Maureen O’Connell, OP, Executive Director being. Angela House provides safe, drug- and violence- free transitional housing and holistic programs Catholic Committee of the South for women re-entering society after incarceration. Avondale Estates, Georgia With the Ministry Trust grant, the staff at Angela Mary Priniski, OP, Staff and Board Member House will continue to assist them as they re- Gathering for Mission, a program of the Catholic enter society. Each participant will have access Committee of the South, seeks to empower church to structured case management to help address leadership, clerics, and lay leaders; to embrace the factors that can lead to homelessness and re- dialogue with voices often unheard; and to address incarceration. Angela House will organize weekly social justice issues that often cannot be resolved programs to ensure an effective, evidence-based at the local level. The organization’s purpose is to curriculum and coordinate individual outside stand in solidarity with those who are struggling appointments. -

Fy 2022 Ministry Trust Grant Member Initiatives

FY 2022 MINISTRY TRUST GRANT MEMBER INITIATIVES The Congregation Grants Committee of the Adrian Catholic Charities of Jackson, Lenawee, Dominican Ministry Trust approved $794,500 for and Hillsdale Counties, Counseling Center the following 27 Member Initiatives for Fiscal Adrian, Michigan Year 2022. Ministry Trust Grant criteria require Pam Millenbach, OP, Staff an alignment between the funded project and the The grant will ensure the continued 2016 General Chapter Enactments and the development of a Counseling Center for Mission and Vision of the Adrian Dominican Lenawee County for treatment of children Sisters. who are victims of trauma and abuse. The grant will partially fund critical work in Angela House the Child Advocacy Center, where schools, Houston, Texas educators, and para-professionals help in the Maureen O’Connell, OP, Board Member Angela identification, assessment, and treatment of House provides safe, drug- and violence-free abuse. This will ensure the appropriate level transitional housing and holistic programs for of care and treatment. The 2022 grant funds women re-entering society after incarceration. this new phase of the Catholic Charities The grant allows Angela House to continue counseling program. structured case management for residents while initiating a new program component to Centro Latino of Shelbyville, Inc. provide services at the Harris County Jail. Shelbyville, Kentucky “Angela House on the Inside” will engage Patricia Reno, OP, Executive Director incarcerated women in voluntary shame- Centro Latino assists the vulnerable Latinx resilience group therapy sessions, conduct community through programs and advocacy interviews for Angela House applicants, and work, providing a haven for the Latinx people offer referrals for community services to and protecting them as they adjust to living facilitate re-entry. -

Program in Theological Studies

“I came to the PTS program looking to meet the academic requirements for my ministerial program. What I found was that and so much more. I fell in love with the Church. The knowledge I received has already proven invaluable in my ministry. But it is my newfound love for the Church that really drives and sustains my ministry. The Holy Spirit has used the program to not only form my mind but to transform my heart.” — Randal Desrochers About Siena Heights University 2012 Graduate Siena Heights is a Catholic, coeducational liberal arts university founded by the Adrian Dominican Congregation in 1919. The main campus in Adrian enrolls about 1,200 students in full- time and part-time study leading to associate’s, bachelor’s, and master’s degrees. Locations A leader in non-traditional education, Siena Heights has 30 years PROGRAM IN THEOLOGICAL experience providing service-oriented education for working STUDIES SITES adults. Siena Heights has distinguished itself as the first private • St. Casimir Parish Education Center liberal arts college in Michigan to offer degree completion Lansing, MI programs designed specifically for adult students. In addition to the Program in Theological Studies, Siena Heights University • Queen of the Miraculous operates degree completion centers in Benton Harbor, Battle Medal Parish Creek, Metropolitan Detroit, Monroe, Lansing, Jackson, and Jackson, MI Online. • St. Pius X Parish Flint, MI Siena Heights University is accredited by the North Central PROGRAM IN THEOLOGICAL STUDIES Siena Heights University • 1247 E Siena Heights Drive • Adrian, MI 49221 www.sienaheights.edu Association of Colleges and Schools. • Christ the King Parish Ann Arbor, MI Mission Contact Us The Program in Theological Studies helps to fulfill the Siena Kevin M.