2018 Food Service Report Food Service

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appetizers Specialties Mas (More)

Appetizers QUESADILLAS NACHOS (1/2 Order -6 Nachos)|(Full Order – 12 Large flour tortilla filled with cheddar, Nachos) Monterrey Jack cheddar and Pico de Served with guacamole, sour cream, tomatoes, Gallo served with rice, beans and guacamole. lettuce & Cheese 8.00 Jalapenos Spicy Beef 9.00 Cheese 5.25 | 7.25 Chicken Fajita 10.99 Bean & Cheese 6.75 | 8.75 Shrimp 12.99 Shredded Chicken 6.75 | 8.75 Beef Fajita 11.99 Bean & Beef 6.75 | 8.75 Spicy Chicken 9.00 Beef or Chicken Fajita 7.25 | 9.75 Spinach and Beef Fajita 13.99 Spinach and Chicken Fajita 12.99 SAMPLER PLATTER QUESO 3 bean & cheese nachos, 3 chicken fajita nachos White or Yellow (cup) 3.50 | (Bowl) 4.75 small, cheese quesadilla, small flautita cut in half, Spicy (Cup) 3.50 | (Bowl) 4.75 sour cream and guacamole 11.99 Tony’s Dip With ground beef & sour creme MARIA’S CHEESE FRIES Cup 3.95 | Bowl 5.25 Fries topped with shredded cheese, bacon bits & Jalapenos. Served with ranch 4.95 Green Sauce: Guacamole & sour cream Cup 2.95 | Bowl 4.25 Specialties SOUPS & SALADS ASADA Y ENCHILADA Taco Salad Fajita steak with 1 chicken enchilada covered Ground Beef or Shredded Chicken 8.25 with sour cream sauce & served with guacamole, Fajita Beef or Chicken 9.75 Pico de Gallo, rice & your choice of refried or Dinner Salad: Small 3.00 | Large 4.00 charro beans 10.95 Guacamole Salad: Small 3.50 | Large 4.75 Charro Beans Cup 3.50 | Bowl 5.00 STEAK PICANTE Los Arcos Bean Soup Cup 3.50 | Bowl 5.00 Fajita steak sautéed with onions, jalapenos & Chicken Tortilla Soup Cup 4.00 | Bowl 6.00 tomatoes. -

Autumn 2013 Print Post Approved - 44307/0006 Volume 24 No 1 Avocados Australia Limited

Managing avocado orchards affected by wet weather Managing Groundcover in Avocados Avocados Marketing Activity AUTUMN 2013 Print Post Approved - 44307/0006 Volume 24 No 1 Avocados Australia Limited Talking Avocados is published using avocado grower levies Printed by: Snap Brisbane Felix Street, Level 3, 10 Felix St Brisbane 4000 which are matched by the Australian Government through Phone: 07 3221 5850, Fax: 07 3221 3208 Horticulture Australia. Email: [email protected] www.brisfelix.snap.com.au Subscriptions: Four issues per year: Australia: AUS $65.00 Avocados Australia Limited New Zealand: AUS $85.00 ABN 87 105 853 807 Rest of the World: AUS $100.00 Level 1, 8/63 Annerley Road Advertising: Avocados Australia Limited, Woolloongabba, Qld 4102 Australia PO Box 8005 Woolloongabba Qld 4102 - Phone: 07 3846 6566, Fax: 07 3846 6577 Email: [email protected] PO Box 8005 Woolloongabba Disclaimer: This publication is produced upon the understanding that Qld 4102 Australia no responsibility is accepted by Avocados Australia Limited (ABN 87 Phone: 07 3846 6566 105 853 807), its Directors and Officers or the Editor for any opinions, claims, statements made and views expressed in any edition of Talking Fax: 07 3846 6577 Avocados. Readers should rely on their own inquiries when making Email: [email protected] decisions concerning their interests. All material in the magazine is Web: www.industry.avocado.org.au copyright. Reproduction in whole or part is not permitted without written permission of the editor. John Tyas [email protected] We all make mistakes: If we make a mistake please let us know so a Chief Executive Officer correction may be made in the next issue. -

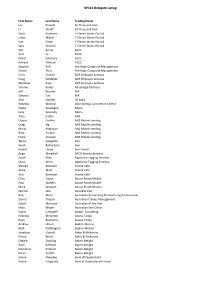

NFC16 Delegate Listing

NFC16 Delegate Listing First Name Last Name Trading Name Ian Krawitz 10 Thousand Feet Fi Shroff 10 Thousand Feet Scott Buckman 7-Eleven Stores Pty Ltd Lukas Michel 7-Eleven Stores Pty Ltd Sue Owen 7-Eleven Stores Pty Ltd Sara Stevens 7-Eleven Stores Pty Ltd Tim Byrne ACCC Vinh Le ACCC David Salisbury ACCC Richard Weksler ACCC Stephen Raff Ace Body Corporate Management Daniel Hunt Ace Body Corporate Management Chris Chilton ADP Employer Services Craig Goldblatt ADP Employer Services Matthew Ryan ADP Employer Services Simone Pentis Advantage Partners Jeff Brooker AIA Simonie Fox AIA Alan Holmes Ali Baba Rebecca Watling Alice Springs Convention Centre Nadia Guadagno Allens Julia Kovarsky Allens Tony Cotter ANZ Liljana Cerilles ANZ Mobile Lending Greg Ng ANZ Mobile Lending Maria Robinson ANZ Mobile Lending Brad Treloar ANZ Mobile Lending Frank Versace ANZ Mobile Lending Tanya Dasgupta Aon Sarah Richardson Aon Robert Olney Aon Hewitt Ange Meredith APCO Service Stations Sarah Allen Appliance Tagging Services Steve Wren Appliance Tagging Services Stewart Bermann Aroma Cafe Alicia Mule Aroma Cafe Ann Bermann Aroma Café Chris Taylor Aussie Pooch Mobile Paul Walters Aussie Pooch Mobile Mark Welham Aussie Pooch Mobile Warren Jack Australia Post Rob Melin Australian Accounting & Franchising Professionals Samra Tripodi Australian Fitness Management David Morrison Australian of the Year Nicki Wright Australian Skin Clinics David Campbell Avatar Consulting Rebecca Milverton Axsess Today Ryan Raymond Axsess Today Andrew Hilson Back In Motion Beth Pocklington -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken -

Consumer Behaviour and PR

Consumer Behaviour and PR Dr. Breda McCarthy chools.in Dr. Breda McCarthy Consumer Behaviour and PR 2 chools.in Consumer Behaviour and PR Contents Contents Part 1: Consumer behaviour 8 1 Overview 9 2 Case Study: virtual smoking and apps – the new frontier of cigarette marketing communications? 10 2.1 Consumer purchasing process 11 2.2 Problem recognition 12 2.3 Information search 15 2.4 Evaluation of alternatives 20 2.5 Store choice and purchase 23 2.6 Post-purchase behavior 26 2.7 Consumer attitudes 28 2.8 Consumer values 31 2.9 Ethics box: marketers turn to advergames to appeal to children 32 As an intern, you’re eager to put what you’ve learned to the test. At Ernst & Young, you’ll have the perfect testing ground. There are plenty of real work challenges. Real drive. Along with real-time feedback from mentors and leaders. You’ll also get to test what you learn. Even better, you’ll Unreal destination. get experience to learn where your career may lead. Visit ey.com/internships. See More | Opportunities © 2012 Ernst & Young LLP. All Rights Reserved. All Rights LLP. & Young © 2012 Ernst 4 Click on the ad to read more chools.in Consumer Behaviour and PR Contents 3 Perception 35 3.1 Cognition 35 3.2 Learning and memory 37 3.3 External influences on consumer behaviour 38 3.4 Household decision-making 39 3.5 Culture 40 3.6 Reference groups and opinion leaders 41 3.7 Trends in the consumer buying environment 42 3.8 Ethics box: advertiser required to mend ITS wicked ways 51 3.9 Summary 53 3 Case Study: male fashion 54 4 Case Study: Contiki Australia -

New Zealand Country and Sector Analysis Report

MAY 2014 NEW ZEALAND COUNTRY AND SECTOR ANALysIS REPORT 2014 DFS Services L.L.C. Auckland, NZ SECTOR ANALysIS OVERVIEW Diners Club International® is owned by Discover We realize our customers, especially those in Financial Services® (NYSE: DFS), a direct the corporate sector, desire ease of card use banking and payment services company with when traveling globally. In recognition of this one of the most recognized brands in U.S. need, Diners Club continues to increase card financial services. Established in 1950, Diners acceptance in the travel and entertainment Club International became the first multi-purpose (T&E) sector. Additionally, we are optimizing charge card in the world, launching a financial geographical and sector penetration within revolution in how consumers and companies select markets. pay for products and services. Today, Diners This Country and Sector Analysis report serves as Club® is a globally recognized brand serving the a quarterly guide to merchant acceptance within payment needs of select and affluent consumers, select countries. This report provides a snapshot offering access to more than 512 airport lounges of acceptance at travel and entertainment worldwide, and providing corporations and (T&E) merchants which had a minimum of one small business owners with a complete array of transaction over a rolling 12 month period. expense management solutions. With acceptance Additionally, we have added an external source, in more than 185 countries and territories, millions Lanyon1, as a source for the hotel sector. of merchant locations and access to over 1M cash access locations and ATMs, Diners Club is uniquely qualified to serve its cardmembers all over the world. -

THE OZHARVEST EFFECT Adelaide Brisbane Gold Coast Melbourne

OzHarvest Book of Thanks 2016 THE OZHARVEST EFFECT The OzHarvest Effect can only be achieved thanks to a massive team effort made up of devoted staff, passionate chefs and ambassadors, like-minded partners, generous food and financial donors and the every growing ‘yellow army’ of volunteers. We love and appreciate everyone who is part of this special family and have made every effort to ensure we list all involved. As you can see, the list is very long and we apologise if someone has been overlooked. Please contact us at OzHarvest HQ on 1800 108 006 to ensure we capture you in our next Book of Thanks. Adelaide advisory Amanda Dalton-Winks / Anne Duncan / Harriette Huis in’t Veld / Hayley Everuss / Jason James / Sharyn Booth / Vicki Cirillo COrporate Volunteer AMP / AON Risk Solutions / Aussie / Biogen / BUPA / Caltex / Commonwealth Bank / Country Health SA / Deloitte / Department of Environment / Govenor’s Leadership Foundation Program / KPMG / Mental Illness Fellowship / Michels Warren / O-I Glass / Olympus / Paxus / People’s Choice Credit Union / The University of Adelaide / Victor Harbour Childcare Centre Vodafone / Tropcorp / SA Power Networks / Santos / Uni SA / Woolworths FINANCIAL DONOR 30 Grosvenor Street Pty Ltd as Trustee for FWH Foundation / A Touch of Beauty / Accounting Buddy / Adam Delaine / Adam Wittwer / Adelaide Cellar Door Wine Festival / Adelaide Fuel and Safety / Adelaide Sustainability Centre / Adelaide Youth Courts / Adrian Dipilato / Adrian M Hinton / Albert Bensimon / Ali Roush / Amanda Dalton-Winks / Andrew John -

William H. Mullin Jr

WILLIAM H. MULLIN JR. Taco Bill, Inc. was named by Mary Lou Mullin in 1984, when it became a California Corporation, but it all started much, much earlier. William H. Mullin, or Bill Mullin as known to most everyone and “Taco Bill” by a few, always wanted to be President of his own company. After finishing his B.A. degree at the University of Colorado School of Business he married his college sweetheart, Mary Lou Todd, in 1963. They moved to San Francisco, where Bill sold printed circuit board materials and supplies. That was uneventful and Bill moved to the casualty insurance business and Mary Lou continued her passion, teaching in the primary grades, particularly kindergarten. After five years of insurance, and another move, to So. California, Bill changed from insurance to real estate, while he did site selection and lease negotiations for Pioneer Chicken and Payless Shoes, Mary Lou again found another school district and this time she could use her Spanish! In 1969 they started their family, and Bill decided there was great opportunity in owning your own franchised business in the fast food arena. He started a ten year training program to learn the fast food business top to bottom, by working in the industry. Over the next ten years he worked as site selector, lease and purchase negotiator, Operations Construction Supervisor, Restaurant Manager Trainee, Assistant Manager, General Manager, Regional Training Manager, District Manager and franchise Consultant. He spent five years as Promotion Manager, Marketing Manager, Field Marketing Director, New Concept Development Assistant Manager and Director of Advertising. -

Paulette Aurignac 6

T 1 V JLen/ -A. N/OUUM& L **W ( N\>MSE^ *U • MAtCH :i, lo o < l » WW\W, r*\* $ tA N b D A \ _vy. v k + News editor: Kate McIntyre mustangdailynews(S gmail.com Friday, March 12, 2010 Many stay home RANCHO OBISPO as banks defer some evictions A p a r tm e n ts Alana Semuels to remain in their homes, essentially lO S A N d E IE S I'lMES rent-free. www.ranchoobispoproperties.com Several factors are driving the LOS ANGELES — It's been 16 trend, industry experts say, includ months since Eugene and Patricia ing government pressure on banks Harrison last paid the mortgage on to modify loans and keep people in their lVrris, Calif., home. Eleven their homes. months since the notice got slapped And with a glut of inventory in on their front door, warning that it places like Southern California's In would be sold at auction. land Empire, Nevada and Arizona, A terse letter from a law yer came lenders are loath to depress hous eight months ago, telling them that ing prices further by dumping more P" their lender now owned the house. properties into a weak market. Three months later, the bank told Finally, allowing borrowers to them to pay up or get out by the stay in their homes helps protect the lb ........ end of the week. bank's investment as it negotiates *£ * " • Still, they remain in the yel with the homeowners, said Gary low ranch-style home they bought Kirshner, a spokesman for Chase seven years ago for $128.(100, with bank, a major lender. -

Why Register a Trade Mark? Do Not Go Where the Path May Lead, Go Instead Where There Is No Path and Leave a Trail

Our Services Why register a trade mark? Do not go where the path may lead, go instead where there is no path and leave a trail. Ralph Waldo Emerson Our Trade mark Services registration Who really owns your business name? Every business creates an image to portray its brand values and purpose – quality and prestige, reliability, competitive pricing, community support. This image is most often communicated to customers through a business name, a logo or something broader. But what ownership do you actually have over these assets? A business name or company name alone will not protect your brand. A registered trade mark will. Why bother with a trade mark? I already have I’ve used my business name for years… a registered business and company name. What’s the worst that can happen? It’s a common misconception that registering a In , Luda Productions began making business or company name means that you own sheepskin boots under the branding UGG that name. AUSTRALIA. Luda registered the business name “Ugg Australia” and changed its company name Business name registration is required when a to Ugg Australia Pty Ltd, in the mistaken belief the person trades under a name other than his or her brand would be protected. own or a company name. It does not give you any proprietary rights over that name. A competitor years later, the American company Deckers may still register a similar or even identical name applied for an Australian trade mark containing as a trade mark. the words “Ugg Australia”. Registration was granted. Deckers used its trade mark registration Did you know that ASIC does not check the trade to prevent Australian retailers (including Luda) mark database for potential conflicts when from calling their sheepskin boots ‘Ugg’. -

Parliamentary Joint Committee on Corporations and Financial Services

Parliamentary Joint Committee on Corporations and Financial Services Fairness in Franchising March 2019 © Commonwealth of Australia 2019 978-1-76010-891-5 This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License. The details of this licence are available on the Creative Commons website: http://creativecommons.org/licenses/by-nc-nd/3.0/au/ Printed by the Senate Printing Unit, Parliament House, Canberra. Committee membership Committee members Mr Michael Sukkar MP, Chair VIC, LP (from 10 September 2018) Ms Terri Butler MP QLD, ALP (from 15 September 2016–10 September 2018) Senator Anthony Chisholm, Deputy Chair QLD, ALP (from 13 February 2019) Mr Jason Falinski MP NSW, LP Senator Jane Hume VIC, LP Mr Steve Irons MP WA, LP (from 14 September 2016–10 September 2018) Ms Ged Kearney MP NSW, ALP (from 10 September 2018) Mr Matt Keogh MP WA, ALP Senator Chris Ketter QLD, ALP Senator Deborah O'Neill NSW, ALP (from 12 September 2016–13 February 2019) Mr Bert van Manen MP QLD, LP Senator Peter Whish-Wilson AG, TAS Senator John Williams NSW, NATS Committee secretariat Dr Patrick Hodder, Secretary PO Box 6100 Parliament House Canberra ACT 2600 T: +61 2 6277 3583 F: +61 2 6277 5719 E: [email protected] W: www.aph.gov.au/joint_corporations iii Table of Contents Committee membership ................................................................................... iii Executive Summary ........................................................................................ xiii Recommendations -

Explore Hundreds of Offers in One Destination. 2XU AUSTRALIAN SKIN CLINICS 30% Off Full Priced Merchandise 50% Off Skin and Laser Treatments, Conditions Apply

Explore hundreds of offers in one destination. 2XU AUSTRALIAN SKIN CLINICS 30% off full priced merchandise 50% off skin and laser treatments, Conditions apply. See in-store for details. 20% off skincare products Magic mirror photo booth, ADAIRS 5:30pm – 9pm 40% off full priced merchandise, Conditions apply. See in-store for details. 20% off sale merchandise Conditions apply. See in-store for details. BABY BUNTING Spend $200 or more, get $20 off, ADIDAS ORIGINALS spend $500 or more, get $50 off, 30% off storewide spend $750 or more, get $100 off Conditions apply. See in-store for details. Conditions apply. See in-store for details. ADIDAS PERFORMANCE BAILEY NELSON 20% off storewide 30% off storewide Conditions apply. See in-store for details. Conditions apply. See in-store for details. BAKERS DELIGHT AESOP Buy a six pack of tarts, receive six Personalised skincare traditional rolls free consultations, all day, Conditions apply. See in-store for details. complimentary refreshments, 12pm – 11pm Conditions apply. See in-store for details. BALLY Up to 40% off selected items AJE Conditions apply. See in-store for details. 15% off selected styles BANG & OLUFSEN Conditions apply. See in-store for details. $249 Bang and Olufsen Beoplay ALICE MCCALL E8 1.0 truly wireless earphones 20% off selected styles Conditions apply. See in-store for details. Conditions apply. See in-store for details. BARDOT ALLY FASHION 20% off storewide 20% off full priced merchandise Conditions apply. See in-store for details. Conditions apply. See in-store for details. BARDOT JUNIOR ANTON JEWELLERY 20% off storewide Conditions apply.