A2A 2020 Investor Guidebook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eni Results for the Second Quarter and Half Year 2021

Registered Head Office, Piazzale Enrico Mattei, 1 00144 Roma Tel. +39 06598.21 www.eni.com Rome July 30, 2021 Eni results for the second quarter and half year 2021 Key operating and financial results IQ IIQ IH 2021 2021 2020 % Ch. 2021 2020 % Ch. 60.90 Brent dated $/bbl 68.83 29.20 136 64.86 39.73 63 1.205 Average EUR/USD exchange rate 1.206 1.101 9 1.205 1.102 9 198 Spot Gas price at Italian PSV €/kcm 264 74 256 231 97 138 3 Spread PSV vs. TTF 1 18 (94) 2 17 (90) (0.6) Standard Eni Refining Margin (SERM) $/bbl (0.4) 2.3 .. (0.5) 2.9 .. 1,704 Hydrocarbon production kboe/d 1,597 1,729 (8) 1,650 1,760 (6) 1,321 Adjusted operating profit (loss) ⁽ᵃ⁾ € million 2,045 (434) .. 3,366 873 286 1,378 E&P 1,841 (807) .. 3,219 230 .. (30) Global Gas & LNG Portfolio (GGP) 24 130 (82) (6) 363 (102) (120) R&M and Chemicals 190 73 160 70 89 (21) 202 Eni gas e luce, Power & Renewables 108 85 27 310 276 12 270 Adjusted net profit (loss) ⁽ᵃ⁾⁽ᵇ⁾ 929 (714) .. 1,199 (655) .. 0.08 per share - diluted (€) 0.24 (0.20) 0.32 (0.18) 856 Net profit (loss) ⁽ᵇ⁾ 247 (4,406) 1,103 (7,335) 0.24 per share - diluted (€) 0.06 (1.23) 0.30 (2.05) 1,960 Cash flow from operations before changes in working capital at replacement cost ⁽ᵃ⁾ 2,797 1,148 144 4,757 3,370 41 1,376 Net cash from operations 2,717 1,403 94 4,093 2,378 72 1,387 Net capital expenditure ⁽ᶜ⁾ 1,519 957 59 2,906 2,862 2 12,239 Net borrowings before lease liabilities ex IFRS 16 10,040 14,329 (30) 10,040 14,329 (30) 17,507 Net borrowings after lease liabilities ex IFRS 16 15,323 19,971 (23) 15,323 19,971 (23) 39,957 Shareholders' equity including non-controlling interest 40,580 38,839 4 40,580 38,839 4 0.31 Leverage before lease liabilities ex IFRS 16 0.25 0.37 0.25 0.37 0.44 Leverage after lease liabilities ex IFRS 16 0.38 0.51 0.38 0.51 (a) Non-GAAP measure. -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 12945-20 Date: February 10, 2020 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. BNY Mellon | ADRs | Qualified Dividends for Tax Year 2019 Subject: Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2019. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of these events. Non-Confidential DTCC Public (White) 2019 DIVIDEND CERTIFICATION CUSIP DR Name Country Exchange Qualified 000304105 AAC TECHNOLOGIES HLDGS INC CAYMAN ISLANDS OTC N 000380105 ABCAM PLC UNITED KINGDOM OTC Y 001201102 AGL ENERGY LTD AUSTRALIA OTC Y 001317205 AIA GROUP LTD HONG KONG OTC N 002482107 A2A SPA ITALY OTC Y 003381100 ABERTIS INFRAESTRUCTURAS S A SPAIN OTC Y 003725306 ABOITIZ EQUITY VENTURES INC PHILIPPINES OTC Y 003730108 ABOITIZ PWR CORP PHILIPPINES OTC Y 004563102 ACKERMANS & VAN HAAREN BELGIUM OTC Y 004845202 ACOM CO. JAPAN OTC Y 006754204 ADECCO GROUP AG SWITZERLAND OTC Y 007192107 ADMIRAL GROUP UNITED KINGDOM OTC Y 007627102 AEON CO LTD JAPAN OTC Y 008712200 AIDA ENGR LTD JAPAN OTC Y 009126202 AIR LIQUIDE FRANCE OTC Y 009279100 AIRBUS SE NETHERLANDS OTC Y 009707100 AJINOMOTO INC JAPAN OTC Y 015096209 ALEXANDRIA MINERAL - REG. S EGYPT None N 015393101 ALFA LAVAL AB SWEDEN SWEDEN OTC Y 021090204 ALPS ELEC LTD JAPAN OTC Y 021244207 ALSTOM FRANCE OTC Y 022205108 ALUMINA LTD AUSTRALIA OTC Y 022631204 AMADA HLDGS CO LTD JAPAN OTC Y 023511207 AMER GROUP HOLDING - REG. -

Corporate Governance and Shareholding Structure Report 20151 Pursuant to Article 123-Bis of Law No

SAIPEM Corporate Governance and Shareholding Structure Report 20151 Pursuant to Article 123-bis of Law No. 58/1998, approved by the Board of Directors on March 16, 2016 (Traditional Management and Control Model) 1 The Corporate Governance Report is published on Saipem’s website www.saipem.com, under the ‘Governance’ section. 1 CONTENTS Page Contents 2 Glossary 4 Issuer profile 5 Principles and Values 5 Management and Control System 6 Regulatory system 6 Sustainability, Health, Safety and the Environment 9 Code of Ethics 10 Shareholding structure (pursuant to art. 123-bis, paragraph 1, of Law 58/98) 11 Share capital distribution 11 Restrictions on the transfer of shares 13 Relevant shareholdings 13 Shareholders by geographical area based on last dividend payments 13 Shareholders by number of shares held based on last dividend payments 13 Shareholders rights restrictions 13 Shareholding of employees: exercise of voting rights 14 Voting rights restrictions 14 Shareholders agreements as per art. 122 of Law 58/98 14 Change of control clauses (pursuant to art. 123-bis, paragraph 1, letter h), of Law 58/98) and statutory provisions for takeover bids (art. 104, paragraph 1-ter and art. 104-bis, paragraph 1) 17 Indemnification for Directors in case of dismissal (without just cause), resignation or termination following a public purchase offer 18 Directors’ appointment or replacement, and modifications to the Articles of Association 18 Share capital increases and buy-back of treasury shares 18 Direction and coordination (pursuant to art. 2497 of -

FTSE MIB Quarterly Rebalancing Changes 12 March 2018

FTSE MIB Quarterly Rebalancing Changes 12 March 2018 FTSE announces the new shares number and Investability Weighting Factors for the FTSE MIB Index effective after the close of business on Friday, 16 March 2018, i.e. on Monday, 19 March 2018. According to the FTSE MIB Ground Rules art. 7.4 and Appendix C, FTSE publishes share in issue & IWF figures updated at the cut-off date, where needed adjusted for capping based on capitalisation calculated with closing prices of five trading days before the rebalancing. The share in issue figure excludes all treasury shares and the Investability Weighting is computed with reference to shares in issue net of treasury shares. The new index divisor will be published after close of business on Friday, 16 March 2018. FTSE comunica il nuovo numero di azioni e i pesi di investibilità per l'Indice FTSE MIB che saranno effettivi dopo la chiusura delle contrattazioni di venerdì 16 marzo 2018 (vale a dire da lunedì 19 marzo 2018). Secondo le Regole di base del FTSE MIB art. 7.4 e l'Appendice C, sono indicati i valori del numero di azioni e peso di investibilità aggiornati alla data del cut-off, eventualmente soggetti alla correzione del capping applicata con riferimento alle capitalizzazioni calcolate con i prezzi di chiusura di cinque giorni di negoziazione prima della data di ribilanciamento. Il numero di azioni esclude tutte le azioni proprie e la percentuale di flottante è calcolata con riferimento al numero di azioni al netto delle azioni proprie. Il nuovo divisor per il FTSE MIB sarà reso disponibile dopo la chiusura delle contrattazioni di venerdì 16 marzo 2018. -

Introduction of “Split Payment” Regulations for RCC Service Invoices

Market Notice 11 August 2017 MN_61/2017 Introduction of “Split Payment” regulations for RCC service invoices For the attention of: Intermediaries Priority: High Re: Invoicing of RCC charges Dear Client, Please note that following the publication of the Ministry of Economy and Finance Decree of 13 July 2017 in Official Gazette No. 171 of 24 July 2017, which amends the implementing regulations for the splitting of payments for VAT purposes (Article 17-ter, Presidential Decree No. 633/1972) in invoices payable as of 1 July 2017, the RCC fees invoicing application for issuer companies included in the list of listed companies in the FTSE MIB Index published by the Ministry of Economy and Finance (link) must be adapted to the new provisions. The Monte Titoli application is currently in the process of modification and therefore data indicated in the invoicing documentation issued by intermediaries to the issuers concerned (see the list below) in the period 1 July - 10 August is not consistent with the instructions in the Decree. Pending the adaption of the application, and in order to avoid issuing incorrect documents, the invoice request function has been temporarily suspended exclusively for sums due from Issuers to which the aforementioned Decree applies. It should be recalled that the RCC application allows the recovery of sums in suspension without time limits. Monte Titoli shall promptly inform clients by means of Market Notice when the application has been adapted. 1 Market Notice 11 August 2017 MN_61/2017 We apologise for this temporary inconvenience. Our operating offices are available for any clarifications or operating requirements. -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

BASE PROSPECTUS A2A S.P.A

BASE PROSPECTUS A2A S.p.A. (incorporated with limited liability in the Republic of Italy) €3,000,000,000 Euro Medium Term Note Programme Under this €3,000,000,000 Euro Medium Term Note Programme (the Programme), A2A S.p.A. (the Issuer) may from time to time issue notes (the Notes) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €3,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and any additional Dealer appointed under the Programme from time to time by the Issuer (each a Dealer and together the Dealers), which appointment may be for a specific issue or on an ongoing basis. References in this Base Prospectus to the relevant Dealer shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see "Risk Factors". Application has been made to the Commission de Surveillance du Secteur Financier (the CSSF) in its capacity as competent authority under the Luxembourg Act dated 10 July 2005 on prospectuses for securities (the Prospectus Act 2005) to approve this document as a base prospectus. -

DEA CAPITAL OUTPERFORM SECTOR: Holdings & RE Price (Eu): 1.10 Alberto Villa +39-02-77115.431 E-Mail: [email protected] Target Price (Eu): 1.55

Italian Research 4Q19 Results Milan, April 16, 2020 DEA CAPITAL OUTPERFORM SECTOR: Holdings & RE Price (Eu): 1.10 Alberto Villa +39-02-77115.431 e-mail: [email protected] Target Price (Eu): 1.55 AAM Transformation Continued in 2019. Net Cash Helps in Uncertain Times FY19 results confirmed ongoing trends. In 2019, DeA Capital increased total AuM to over DEA CAPITAL - 12m Performance Eu22bn, completing its transformation from an investment company to one of the most important Italian Alternative Asset Management operators, with a wide range of 02 investment solutions, ranging from Real Estate to Private Equity to Non-Performing 02 Exposure, including some of the most innovative proposals available on the Italian 01 market. As for FY19 financial results, the alternative asset management (AAM) platform 01 reported management fees at Eu65mn (+2.5% YoY) and a slightly lower operating result 01 at Eu14.6mn, as last year benefited from some extraordinary positive items (real estate 01 01 45% / investment solutions 33%, NPE 14% and private equity 8%). Net profit came to 01 Eu12mn, up 10% YoY, with a Eu0.12ps extraordinary dividend, flat YoY and in line with a-19 g-19 a-19 o-19 d-19 f-20 a-20 expectations; net cash was broadly stable at Eu65.8mn thanks to some asset disposals DEA CAPITAL DEA CAPITAL Rel. to FTSE All Shares (Reb.) and the cash-in of investments compensating investment activity and the Eu31mn dividend payout. NAVps was Eu1.76, up slightly YoY confirming the stable nature of the assets – management companies and investments – included in the portfolio. -

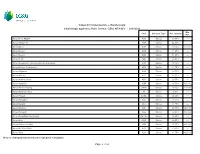

Cassa Di Compensazione E Garanzia Spa Initial Margin Applied to Share Section GEM, MTA/MIV - 28/6/2021 Min

Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 28/6/2021 Min. Code Contract Type Mar. Interval Mar. Azioni A. S. ROMA ASR Stocks 49.00% --- Azioni Abitare IN ABT Stocks 22.00% --- Azioni Acea ACE Stocks 13.25% €0.106 Azioni Acotel ACO Stocks 41.25% --- Azioni Aedes AED Stocks 51.25% --- Azioni Aeffe AEF Stocks 20.50% --- Azioni Aeroporto Guglielmo Marconi di Bologna ADB Stocks 18.25% --- Azioni Alerion Cleanpower ARN Stocks 41.75% --- Azioni Algowatt ALW Stocks 30.75% --- Azioni Alkemy ALK Stocks 25.00% --- Azioni Ambienthesis ATH Stocks 29.75% --- Azioni Amplifon AMP Stocks 13.00% €0.186 Azioni Anima Holding ANIM Stocks 19.25% €0.038 Azioni Antares Vision AV Stocks 9.25% --- Azioni Aquafil ECNL Stocks 26.25% --- Azioni Ascopiave ASC Stocks 13.00% --- Azioni Astaldi AST Stocks 41.75% --- Azioni Atlantia ATL Stocks 23.75% €0.146 Azioni Autogrill AGL Stocks 33.50% €0.094 Azioni Autostrade Meridionali AUTME Stocks 26.50% --- Azioni Avio AVIO Stocks 22.50% --- Azioni Azimut Holding AZM Stocks 17.50% €0.164 Azioni ACSM AGAM ACS Stocks 19.00% --- Azioni A2A A2A Stocks 14.75% €0.012 New or changed instruments are indicated in boldface Page 1 of 16 Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 28/6/2021 Min. Code Contract Type Mar. Interval Mar. Azioni B.F. BFG Stocks 13.50% --- Azioni B&C Speakers BEC Stocks 13.00% --- Azioni Banca Carige CRG Stocks 97.50% --- Azioni Banca Carige Rnc CRGR Stocks 96.50% --- Azioni Banca Farmafactoring BFF Stocks 17.25% -

Effects of Covid-19 on 9M 2020 Results

EFFECTS OF COVID -19 ON 9M 2020 RESULTS FOR MULTINATIONALS A ND FTSE MIB COMPANIES MULTINAT IONAL S: SOFTWARE /INTERNET , LARGE -SCALE DISTRIBUTION A ND ELECTRONICS CONTINUE TO GROW ; OIL /GAS , FASHION AND A UTOMOTIVE STRUGGLING FTSE MIB COMPANIES : €46 BN IN MARKET CAP WIPED OFF THE STOCK MARKET IN 9M, SOME OF WHICH HAS BEEN RECOVERED ALREADY ; POSITIVE RESPONSE FR OM MANUFACTURING INDUST RY IN 3Q Milan, 19 November 2020 The Mediobanca Research Area has analysed the impact of the Covid-19 pandemic on the 9M 2020 financial statements of over 160 global industrial multinationals with annual turnover of more than €3bn, and the 26 industrial and services companies included in the FTSE MIB index. 1 The presentation is available for download from the company’s website at www.mbres.it. ****** Industrial multinationals in 9M 2020: comparison between sectors In the first nine months of 2020, the turnover posted by the industrial multinationals analysed shrank by 4.3% Y.o.Y., with the reductions by certain sectors offset in part by the growth in others. Software/internet, large-scale distribution, electronics and food are the only sectors that saw total sales increase in all the first three quarters of 2020. In particular, top-line growth was reported by the software/internet companies (total sales up 18.4% Y.o.Y.), followed by large-scale distribution (up 8.8%) and electronics (up 5.7%). Other good performances were reported by the food multinationals (total sales up 3.7%), the pharmaceutical companies (up 3.1%) and the firms operating in the pay tech industry (up 0.3%). -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 4/30/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.90% SAMSUNG ELECTRONICS CO LTD 2.08% TENCENT HOLDINGS LTD 1.94% ISHARES MSCI CANADA ETF 1.83% MSCI INDIA FUTURE JUN21 1.77% DREYFUS GOVT CASH MGMT-I 1.75% ALIBABA GROUP HOLDING LTD 1.06% AIA GROUP LTD 1.04% ASML HOLDING NV 1.03% HDFC BANK LTD 1.00% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.87% DSV PANALPINA A/S 0.85% INFINEON TECHNOLOGIES AG 0.75% MEDIATEK INC 0.75% BHP GROUP LTD 0.68% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.64% SIKA AG 0.61% TOYOTA MOTOR CORP 0.59% AMBU A/S 0.57% ISHARES MSCI ACWI EX US ETF 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.56% ISHARES MSCI EAFE GROWTH ETF 0.54% RIO TINTO LTD 0.54% NOVO NORDISK A/S 0.54% CSL LTD 0.53% MIDEA GROUP CO LTD 0.53% LVMH MOET HENNESSY LOUIS VUITTON SE 0.52% SAP SE 0.52% NAVER CORP 0.51% SK MATERIALS CO LTD 0.51% PARTNERS GROUP HOLDING AG 0.50% ISHARES MSCI EUROPE FINANCIALS ETF 0.50% JD.COM INC 0.49% HITACHI LTD 0.48% ZALANDO SE 0.47% EDENRED 0.46% SOFTBANK GROUP CORP 0.46% HAITIAN INTERNATIONAL HOLDINGS LTD 0.45% MERIDA INDUSTRY CO LTD 0.45% SONY GROUP CORP 0.45% CHINA PACIFIC INSURANCE GROUP CO LTD 0.44% HEXAGON AB 0.44% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.44% HUAZHU GROUP LTD 0.44% TOMRA SYSTEMS ASA 0.44% LVMH MOET HENNESSY LOUIS VUITTON SE 0.43% ADIDAS AG 0.43% SWECO AB 0.43% JARDINE MATHESON HOLDINGS LTD 0.43% DREYFUS GOVT CASH MGMT-I 0.42% ATLAS COPCO AB 0.41% L'OREAL SA 0.40% HONG KONG -

Investor Presentation Italian Retail Market

Investor Presentation Italian retail market April 2016 Italian retail market Italian retail market1 2013-2015 Customers (mn) Power Sold (Twh) 37.0 36.8 36.9 288.8 282.1 287.6 66.8 63.9 66.6 29.4 29.3 29.5 222.0 218.2 221 7.6 7.4 7.3 2013 2014 2015 2013 2014 2015 Business Residential Business Residential 1. Source: AEEGSI, Terna 1 Italian retail market Italian retail market1: free vs. regulated Customers (mn) Power Sold (Twh) 9.4 29.5 24.2 66.6 20.2 42.4 Residential LV HV & MV Regulated Free Total Regulated Free Total 3.4 7.3 199.3 221.0 0.1 0.1 3.3 3.9 143.5 143.5 7.2 Business 21.7 55.8 77.5 Regulated Free Total Regulated Free Total 12.8 36.9 223.5 287.6 0.1 0.1 24.1 12.6 143.5 143.5 36.8 64.1 80.0 Total 144.1 Regulated Free Total Regulated Free Total 2 1. Source: 2015 based on figures from AEEGSI, Terna Italian retail market Italian retail market1: 2014 market share Electricity demand (Regulated) Electricity demand (Free) Enel Servizio Elettrico 85.4% Enel 17.9% Edison 10.9% Acea Energia 5.0% Eni 5.3% A2A Energia 3.6% Gaia 3.9% Iren Mercato 1.2% Sorgenia 3.7% Acea 3.6% Trenta 0.7% Hera 3.4% Hera Comm 0.6% E.On 3.4% Etschwerke Trading 0.5% Axpo Group 3.1% AcegasAps Service 0.4% Green Network 2.5% C.V.A.