Proxy Voting Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Accounting University of Northern Iowa College of Business Administration

Accounting University of Northern Iowa College of Business Administration https://business.uni.edu/undergraduate/accounting ABOUT THE MAJOR SAMPLE COURSEWORK Accounting is the action or process of keeping financial accounts. Principles of Financial Cost Accounting The purpose of accounting is to accumulate and report on Accounting financial information about the performance, financial position, Accounting Information and cash flows of a business. This information is then used to Business Professionals in Systems reach decisions about how to manage the business, or invest in it, Training or lend money to it. As an accountant, you can easily work for big Income tax and small businesses, school districts and various nonprofit and Principles of Managerial government organizations. Students can also become certified Accounting Auditing public accountants (CPA) which is one of the most highly trusted professionals in the business world. Intro to Information Systems Corporate Finance POSSIBLE CAREERS *some titles may require further education Accountant Financial Analyst Payroll Manager Tax Accountant Accounting Clerk Budget Analyst Private Accountant Forensic Accountant Auditor Financial Assurance Specialist Revenue Cycle Manager Credit Analyst Chief Financial Officer Industrial Accountant Strategic Planner Controller UNI GRADUATES: WHERE ARE THEY NOW? SKILLS NEEDED Integrity Organization skills Wells Fargo University of Northern Iowa The Lint Companies Interpersonal skills John Deere MidAmerican Renewables Meredith Corporation Written -

Market Cap Close ADV

Market Cap Close ADV 1598 67th Pctl $745,214,477.91 $23.96 225,966.94 801 33rd Pctl $199,581,478.89 $10.09 53,054.83 2399 Listing_ Revised Ticker_Symbol Security_Name Exchange Effective_Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M Altisource Asset Management AAMC Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L American Equity Inv Life Hldg AEL Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L ASPEN Insurance Holding AHL Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

Grapevine Dispatch•Argus•Qconline.Com ADVERTORIAL

the A feature of GrapeVine Dispatch•Argus•QCOnline.com ADVERTORIAL of Trustees; and Marion Public Library Quad City Bank & Trust Foundation Trustee. He also volunteers for United Way of East Central Iowa Foundation, announces promotions the Greater Cedar Rapids Community Quad City Bank & Foundation, the African American Museum Trust (QCBT) prides of Iowa, and Cedar Rapids Self Supporting itself on having the Municipal Improvement District. very best employees About QCR Holdings, Inc. — people who are QCR Holdings, Inc., headquartered in passionate about Moline, Illinois, is a relationship-driven, customer relationships — and is proud to multi-bank holding company, which serves announce the following promotions: the Quad City, Cedar Rapids, Rockford, Bob Eby — Executive Vice President, Chief Waterloo/Cedar Falls, and Des Moines com- Credit Officer munities through its wholly owned subsidiary Therese Gerwe — Senior Vice President, banks, and also engages in commercial leas- Treasury Management ing through its wholly owned subsidiary, m2 John Nagle — Senior Vice President, Lease Funds, LLC based in Milwaukee, WI. Commercial Banking For more information, visit www.qcrh.com. Kris Decker — Vice President, Residential Real Estate & Consumer Lending Manager Nicole Murphy — Vice President, Credit QCR Holdings, Inc. Department Manager Olivia Ortega — Vice President, Items announces promotions Processing Officer Kate Johnson — Assistant Vice President, QCR Holdings, Inc. Correspondent Banking Manager (NASDAQ/QCRH), Myra Dougherty — Assistant Vice is passionate about President, Retail Banking Officer our employees’ suc- Matt Powers — Investment Analyst cess and is proud to announce the following promotions: About Quad City Bank & Trust Tim Harding — Executive Vice President, The mission of Quad City Bank & Trust Director of Internal Audit is to be the most customer-focused financial Pam Goodwin — Senior Vice President, institution in the Quad Cities. -

Usbancorp Electronic EDGAR Proof

usbancorp Electronic EDGAR Proof Job Number: N-PX Filer: Quaker Investment Trust Form Type: N-PX Reporting Period / Event Date: 06-30-2018 Customer Service Representative: Mary Szymanski Version Number: N/A This proof may not fit on letter-sized (8.5 x 11 inch) paper. If copy is cut off, please print to a larger format, e.g., legal-sized (8.5 x 14 inch) paper or oversized (11 x 17 inch) paper. Accuracy of proof is guaranteed ONLY if printed to a PostScript printer using the correct PostScript driver for that printer make and model. (this header is not part of the document) EDGAR Submission Header Summary Submission Form Type N-PX Period of Report 06-30-2018 Filer Quaker Investment Trust CIK 0000870355 CCC xxxxxxxx Exchanges NONE Investment Company Type N-1A Submission Contact Mary Szymanski Contact Phone Number 414-765-4880 Documents 1 Notification Emails Emails [email protected] Series / Classes Series ID S000008762 Quaker Strategic Growth Fund Class ID C000023851 Class A Class ID C000023853 Class C Class ID C000023854 Institutional Class Series ID S000008770 Quaker Mid Cap Value Fund Class ID C000023879 Class A Class ID C000023881 Class C Class ID C000023882 Institutional Class Series ID S000008771 Quaker Small Cap Value Fund Class ID C000023883 Class A Class ID C000023885 Class C Class ID C000023886 Institutional Class Series ID S000013296 Quaker Global Tactical Allocation Fund Class ID C000035752 Class A Class ID C000035753 Class C Class ID C000068042 Institutional Class Series ID S000028027 Quaker Event Arbitrage Fund Class ID C000085297 Class A Class ID C000085298 Class C Class ID C000085299 Class I Documents N-PX quaker_npx.txt Description Annual Report of Proxy Voting UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. -

Ctpf Illinois Economic Opportunity Report

CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT As Required by Public Act 096-0753 for the period ending June 30, 2021 202 1 TABLE OF CONTENTS TABLE I 1 Illinois-based Investment Manager Firms Investing on Behalf of CTPF TABLE II Illinois-based Private Equity Partnerships, Portfolio Companies, 2 Infrastructure, and Real Estate Properties in the CTPF Portfolio TABLE III 14 Illinois-based Public Equity Market Value of Shares Held in CTPF’s Portfolio TABLE IV 18 Illinois-based Fixed Income Market Value of Shares Held in CTPF’s Portfolio TABLE V Domestic Equity Brokerage Commissions Paid to Illinois-based 19 Brokers/Dealers TABLE VI 20 International Equity Brokerage Commissions Paid to Illinois-based Brokers/Dealers TABLE VII Fixed Income Volume Traded through Illinois-based Brokers/Dealers 21 (par value) 2021 CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT REQUIRED BY PUBLIC ACT 096-0753 FOR THE PERIOD ENDING JUNE 30, 2021 TABLE I Illinois-based Investment Manager Firms Investing on Behalf of CTPF Table I identifies the economic opportunity investments made by CTPF with Illinois-based investment management companies. As of June 30, 2021, Total Market/Fair Value of Illinois-based investment managers was $3,121,157,662.18 (23.74%) of the total CTPF investment portfolio of $13,145,258,889.14. Market/Fair Value % of Total Fund Investment Manager Firms Location As of 6/30/2021 (reported in millions) Adams Street Chicago $ 319.69 2.43% Ariel Capital Management Chicago 83.44 0.63% Attucks Asset Management Chicago 274.06 2.08% Ativo Capital Management1 Chicago -

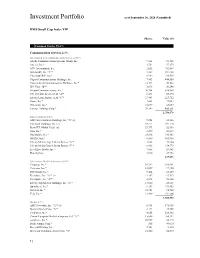

DWS Small Cap Index VIP

Investment Portfolio as of September 30, 2020 (Unaudited) DWS Small Cap Index VIP ______________________Shares Value ($) Common Stocks 98.6% Communication Services 2.3% Diversified Telecommunication Services 0.8% Alaska Communications Systems Group, Inc. 9,664 19,328 Anterix, Inc.* 1,751 57,275 ATN International, Inc. 2,052 102,887 Bandwidth, Inc. "A"* 3,387 591,268 Cincinnati Bell, Inc.* 8,969 134,535 Cogent Communications Holdings, Inc. 7,403 444,550 Consolidated Communications Holdings, Inc.* 12,394 70,522 IDT Corp. "B"* 3,076 20,240 Iridium Communications, Inc.* 20,284 518,865 Liberty Latin America Ltd. "A"* 8,472 69,894 Liberty Latin America Ltd. "C"* 27,483 223,712 Ooma, Inc.* 3,608 47,084 Orbcomm, Inc.* 12,899 43,857 Vonage Holdings Corp.* 39,742 _________406,561 2,750,578 Entertainment 0.2% AMC Entertainment Holdings, Inc. "A" (a) 9,254 43,586 Cinemark Holdings, Inc. (a) 19,171 191,710 Eros STX Global Corp* (a) 23,773 52,538 Gaia, Inc.* 2,099 20,633 Glu Mobile, Inc.* 24,816 190,463 IMAX Corp.* 8,860 105,966 Liberty Media Corp.-Liberty Braves "A"* 1,868 39,004 Liberty Media Corp.-Liberty Braves "C"* 6,415 134,779 LiveXLive Media, Inc.* 7,885 20,462 Marcus Corp. 3,616 _________27,952 827,093 Interactive Media & Services 0.4% Cargurus, Inc.* 14,792 319,951 Cars.com, Inc.* 12,057 97,420 DHI Group, Inc.* 9,464 21,389 Eventbrite, Inc. "A"* (a) 11,367 123,332 EverQuote, Inc. "A"* 2,494 96,368 Liberty TripAdvisor Holdings, Inc. -

By Taxing Body, the Hundred Taxpayers

BY TAXING BODY, THE HUNDRED TAXPAYERS WITH THE LARGEST VALUATIONS TAXING BODY TWP-PINNUM VALUATION TAXPAYER NAME ANDALUSIA FPD 161526301023 472,030 PITHAN LARRY C 161532200009 304,320 SNOWSTAR CORP 152218400006 277,685 BIG RIVER RESOURCES W BUR 161527200005 228,240 ANDALUSIA COMMUNITY BANK 152208101001 223,640 AT&T/PROPERTY/TAX/ADMINIS 161525100007 216,319 MIDWEST METHANE INC 152215100001 186,400 JAHN CLARISSA M 172114100002 171,783 FUHR ALLAN W 161532301034 160,833 LONG ROBERT M 152218400005 154,356 MARTIN CAROL M 161528300012 154,189 SCHADLER JOSEPH 161535100006 153,389 ANDERSON JOANN 152217300001 150,203 MARTIN CAROL M 161529400027 143,882 DUCKYS LAGOON 161526300003 138,583 ANDALUSIA VENTURES/DIFRYE 152204400001 137,196 BOSSEN TIFFANY A 171426400009 133,670 CORWIN LLOYD L/DARLENE 171425401013 132,396 SKOREPA THOMAS A 152201200007 128,687 BOSSEN LEE G 161527301009 126,800 STINE MICHAEL C 172102300002 125,357 STEWART JAMES E/DONNA L 152208300008 124,574 BLACKHAWK BANK & TRUST 161532301048 123,277 RICHHART DON R 161532301032 122,742 COOK KIMBER E 161527137006 122,356 CASEYS RETAIL CO/ACCT DEP 152218300001 121,972 MUELLER THOMAS E 171425402006 121,787 FIRTH WILLIAM L/JANICE R 161526200019 119,709 SCHMIDT JEFFREY A 161534300013 115,208 WOEBER KYLE A/JAYNE 161535300003 114,627 WILKENS WILL/CONST 161536401030 114,252 ALLEN RONALD R 161527406014 114,104 HOLBERT JOHN E 161535100005 112,300 BAYNE LISA 161535400007 111,584 SCHAUENBERG ROBERT D 161532301040 111,467 DUDZIK STEPHEN J 161534300001 111,281 COLLINS CAROL A 161536101002 110,744 LAWRENCE -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Board of Directors' Pay up from Last Year

Published By 200 Business Park Drive Armonk, NY 10504 Phone: 914.730.7300 Fax: 914.730.7303 www.total-comp.com 2017 / 2018 BOARD OF DIRECTORS COMPENSATION REPORT January 2018 All rights reserved. © 2018 Total Compensation Solutions, LLC. Printed in the United States of America. This publication of the 2017/2018 Board of Directors Compensation Report may not be reproduced, stored in a retrieval system, or transmitted in whole or in part, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of Total Compensation Solutions, LLC. 200 Business Park Drive, Armonk, NY 10504. The information provided in this report is confidential and for the use of the subscribing organization only. By accepting this material, you agree that it will not be reproduced, copied, transmitted or disclosed to organizations or persons outside of your organization. Table of Contents Section Page I. Executive Summary Introduction ------------------------------------------------------------------- 2 Company Demographics -------------------------------------------------- 5 Findings and Observations ----------------------------------------------- 8 II. Data Analysis Board Structure -------------------------------------------------------------- 13 Committee Structure ------------------------------------------------------- 16 Board Compensation ------------------------------------------------------ 19 III. Board Compensation All Companies -------------------------------------------------------------- -

QCR Holdings, Inc

QCR Holdings, Inc. will be the premier provider of financial services premier to businesses and individuals for whom relationships matter, in markets where werelationships can excel. QUAD CITY BANK & TRUST CEDAR RAPIDS BANK & TRUST ROCKFORD BANK & TRUST m2 LEASE FUNDS QCR Holdings, Inc. Quad City Bank & Trust Cedar Rapids Bank & Trust A Relationship Driven Organization.® Rockford Bank & Trust m2 Lease Funds QCR Holdings, Inc. will be The QCR Holdings, Inc. business model is based not on simply serving customers; rather, our key competitive advantage is to create meaningful the premier provider of financial services and lasting relationships with our clients. This focus on relationships is at the very core of everything we do and to businesses and individuals has been the heartbeat of our rapid growth since 1994. We accomplish this by making investments in outstanding people that demonstrate KEY TOTALS (In Millions of Dollars) for whom relationships matter, an unwavering commitment to developing and nurturing long-lasting relationships with our clients, and we then provide them with the best technology, operational support and facilities to help them exceed our NET LOANS/LEASES in markets where we can excel. clients’ expectations. 12.31.09 $1,222 Key to executing on this mission is that each QCR Holdings entity is 12.31.08 $1,197 given the autonomy to tailor products, services and decisions unique to 12.31.07 $1,046 the market that it serves, facilitating the customized relationship-based service that drives our organization. $1,100 $1,200 $1,300 Our local bankers are supported by a QCR Holdings Group Operations team that delivers operational services in a centralized and efficient manner. -

More Women on Corporate Boards©

HQ FINANCIAL VIEWS Volume IX, Issue II, September 2014 More Women On Corporate Boards© 30 WOMEN JOINING ILLINOIS CORPORATE BOARDS 1994-2013 26 25 NASDAQ COMPANIES 22 20 13 NYSE COMPANIES 18 15 14 14 14 14 8 3 12 6 1 10 7 9 3 8 4 6 13 5 5 5 5 11 11 10 0 4 2 8 8 0 3 4 6 5 7 3 0 2 2 2 4 0 2 4 2 1 3 1 1 3 2 2 01 1 1 1 1 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 More Women On Corporate Boards© by Kathy Graham [email protected] Twitter: @TheHQCompanies SUMMARY i.e., front line (not staff) positions with full This paper is the author’s answer to a question profit and loss responsibility for a sizeable frequently posed by many accomplished women for profit corporation or a large division of regarding how to be considered for a position on a a major company. U.S. corporate board of directors. Completed using 2. Over 90% do not work for nor are they the latest available public data as of 7/31/14, the obviously related to the company’s top research captures two emerging structural shifts in leaders. the U.S., one the likely result of economic changes 3. Around 70% have advanced degrees (JD, and the other likely due to a societal trend. MA, MBA, PhD) or certifications (CPA, CFA). FIRST STRUCTURAL SHIFT: The number 4. -

Catholic United Investment Trust Annual Report

CATHOLIC UNITED INVESTMENT TRUST ANNUAL REPORT (AUDITED) DECEMBER 31, 2016 CATHOLIC UNITED INVESTMENT TRUST TABLE OF CONTENTS Page REPORT OF INDEPENDENT AUDITORS 1-2 Statement of Assets and Liabilities 3-4 Schedule of Investments: Money Market Fund 5-7 Short Bond Fund 8-10 Intermediate Diversified Bond Fund 11-20 Opportunistic Bond Fund 21-26 Balanced Fund 27-37 Value Equity Fund 38-40 Core Equity Index Fund 41-47 Growth Fund 48-51 International Equity Fund 52-55 Small Capitalization Equity Index Fund 56-71 Statements of Operations 72-74 Statements of Changes in Net Assets 75-77 FINANCIAL HIGHLIGHTS 78-80 NOTES TO FINANCIAL STATEMENTS 81-96 Grant Thornton LLP Grant Thornton Tower 171 N. Clark Street, Suite 200 Chicago, IL 60601-3370 REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS T +1 312 856 0200 F +1 312 565 4719 grantthornton.com To the Members of the Board of Trustees And Unitholders of the Catholic United Investment Trust We have audited the accompanying financial statements of the Catholic United Investment Trust, including the Money Market Fund, Short Bond Fund, Intermediate Diversified Bond Fund, Opportunistic Bond Fund, Balanced Fund, Value Equity Fund, Core Equity Index Fund, Growth Fund, International Equity Fund, and Small Capitalization Equity Index Fund, (collectively, the Funds), which comprise the statements of assets and liabilities, including the schedules of investments, as of December 31, 2016, and the related statements of operations, changes in net assets, and financial highlights for the year then ended, and the related notes to the financial statements. The accompanying statements of operations and changes in net assets for the year ended December 31, 2015, and financial highlights for the years ended December 31, 2015, 2014, 2013 and 2012, were audited by other auditors whose report thereon dated March 8, 2016, expressed an unqualified opinion on the financial statements and financial highlights.