Premliminary Annoucement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

British American Tobacco's Submission to the WHO's

British American Tobacco’s submission to the WHO’s Framework Convention on Tobacco Control This is the submission of the British American Tobacco group of companies commenting on the WHO’s Framework Convention on Tobacco Control. We are the world’s most international tobacco group with an active presence in 180 countries. Our companies sell some of the world’s best known brands including Dunhill, Kent, State Express 555, Lucky Strike, Benson & Hedges, Rothmans and Pall Mall. Executive summary • The WHO’s proposed ‘Framework Convention on Tobacco Control’ is fundamentally flawed and will not achieve its objectives. • The tobacco industry, along with other industries involved in the manufacture and distribution of legal but risky products, is the subject of considerable public attention. It is important that the debate about tobacco remains open, objective, constructive and free from opportunistic criticism if we are effectively to address the real issues associated with tobacco. • British American Tobacco is responsible tobacco. We seek to operate in partnership with governments, who are significant stakeholders in our business, and other interested parties, based on our open acknowledgement that we make a risky product and therefore support sensible regulation. • British American Tobacco shares the World Health Organisation’s desire to reduce the health impact of tobacco use. This paper outlines British American Tobacco’s proposal for the sensible regulation of tobacco. • Our proposal will relieve the WHO of the cost and bureaucracy involved in its wish to become a single global tobacco regulator, leaving it free to do what it should be doing – policy orientation. Some facts about tobacco • Today over one billion adults, about one third of the world’s adult population, choose to smoke. -

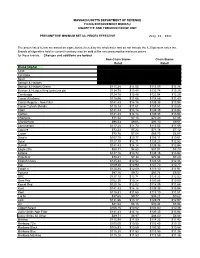

Cigarette Minimum Retail Price List

MASSACHUSETTS DEPARTMENT OF REVENUE FILING ENFORCEMENT BUREAU CIGARETTE AND TOBACCO EXCISE UNIT PRESUMPTIVE MINIMUM RETAIL PRICES EFFECTIVE July 26, 2021 The prices listed below are based on cigarettes delivered by the wholesaler and do not include the 6.25 percent sales tax. Brands of cigarettes held in current inventory may be sold at the new presumptive minimum prices for those brands. Changes and additions are bolded. Non-Chain Stores Chain Stores Retail Retail Brand (Alpha) Carton Pack Carton Pack 1839 $86.64 $8.66 $85.38 $8.54 1st Class $71.49 $7.15 $70.44 $7.04 Basic $122.21 $12.22 $120.41 $12.04 Benson & Hedges $136.55 $13.66 $134.54 $13.45 Benson & Hedges Green $115.28 $11.53 $113.59 $11.36 Benson & Hedges King (princess pk) $134.75 $13.48 $132.78 $13.28 Cambridge $124.78 $12.48 $122.94 $12.29 Camel All others $116.56 $11.66 $114.85 $11.49 Camel Regular - Non Filter $141.43 $14.14 $139.35 $13.94 Camel Turkish Blends $110.14 $11.01 $108.51 $10.85 Capri $141.43 $14.14 $139.35 $13.94 Carlton $141.43 $14.14 $139.35 $13.94 Checkers $71.54 $7.15 $70.49 $7.05 Chesterfield $96.53 $9.65 $95.10 $9.51 Commander $117.28 $11.73 $115.55 $11.56 Couture $72.23 $7.22 $71.16 $7.12 Crown $70.76 $7.08 $69.73 $6.97 Dave's $107.70 $10.77 $106.11 $10.61 Doral $127.10 $12.71 $125.23 $12.52 Dunhill $141.43 $14.14 $139.35 $13.94 Eagle 20's $88.31 $8.83 $87.01 $8.70 Eclipse $137.16 $13.72 $135.15 $13.52 Edgefield $73.41 $7.34 $72.34 $7.23 English Ovals $125.44 $12.54 $123.59 $12.36 Eve $109.30 $10.93 $107.70 $10.77 Export A $120.88 $12.09 $119.10 $11.91 -

![Ch 65, P.33 Environmental Protection[567] IAC 7/11/01](https://docslib.b-cdn.net/cover/2388/ch-65-p-33-environmental-protection-567-iac-7-11-01-1032388.webp)

Ch 65, P.33 Environmental Protection[567] IAC 7/11/01

IAC 7/11/01 Environmental Protection[567] Ch 65, p.33 APPENDIX A MANURE CONTROL ALTERNATIVES FOR OPEN FEEDLOTS IAC 7/11/01 Introduction: Water pollution control requirements for animal feeding operations are given in Chapter 65 of the rules of the Iowa department of natural resources. Under these rules, open feedlots meeting the operation permit application requirements of rule 567—65.4(455B) must also comply with the minimum manure control requirements of subrule 65.2(2). Subrule 65.2(2) requires that all feedlot runoff and other manure flows resulting from precipitation events less than or equal to the 25-year, 24-hour rainfall event be collected and land applied. This appendix describes five feedlot runoff control systems that meet the requirements of subrule 65.2(2). The systems differ in the volume of manure storage provided and in the frequency of manure application. In general, the time interval between required applications increases with increased stor- age volume. A feedlot operator who constructs and operates a manure control facility in accordance with the re- quirements of any of these five systems will not have additional manure control requirements imposed, unless manure discharges from the facility cause state water quality standards violations. In describing the five systems, the major features of each are first reviewed, followed by detailed information on the construction and operation requirements of the system. The system descriptions are presented in this appendix as follows: System Pages System 1: One Manure Application Period Per Year. 33-35 System 2: July and November Manure Application. 35-37 System 3: April, July, and November Manure Application. -

Managing the Challenges in EEMEA Andrew Gray

"The material in this presentation is provided for the purpose of giving information about us to investors and is not provided for tobacco product advertising, promotional or marketing purposes. This material does not constitute and should not be construed as constituting an offer to sell, or a solicitation of an offer to buy, any of our tobacco products. Our products are sold only in compliance with the laws of the particular jurisdictions in which they are sold". Managing the challenges in EEMEA Andrew Gray Turkey - challenges & opportunities 1% population growth rate Strong GDP growth 8th biggest cigarette market Highest ASU30 High incidence of 37.2% population in Europe 73.3 mn 8.1 % 16.4 mn smokers 5.3 mn smokers Open to trial Large industry profit pool Crossroad between Political stability 16% GBP1.4bn NTO Europe & the East switching GBP9.4 bn CPTO Acquisition - integration & capability Tekel asset deal – USD1.76bn Cost synergies – Delivered Integration – Flawless execution within 9 months Competitive scale – Second biggest FMCG company, 2,000 employees, strong platform for stakeholder engagement High quality Increased reach with DSS Flexibility and capacity Enhanced consumer Low manufacturing cost communication Competitive Growing regional export hub Effective Efficient distribution Production Route To Market External challenges Extreme excise hikes Accelerated regulation 71% MCE increase in 2009 Reduced contestable 55% Price increase in Regulatory Board space 10 Months vs. 6.5% inflation Total PPS Ban Increased cost -

Maidstone Geneva. an Old Maidstone Industry

http://kentarchaeology.org.uk/research/archaeologia-cantiana/ Kent Archaeological Society is a registered charity number 223382 © 2017 Kent Archaeological Society MAIDSTONE GENEVA AN OLD MAIDSTONE INDUSTRY By JOHN' W. BRIDGE, F.S,A. The Hasid-Writing upon the Wall, a caricature in colour, published by James Gillray in 1803, depicts Napoleon and his wife, Josephine, sitting at a table with members of their court, enjoying the spoils of England after the " invasion " by the French. A hand has written "liens, tnene, tekel, upharsin " on the wall, and the King's crown is outweighing Despotism to a cry of" Vive is Boi " Among the viands and wines shown on the table are the Bank of England, St. James's, The Tower of London, together with the Roast Beef of old England, Maraschino, and some red liquor in a bottle labelled "Maidstone ". Thella.raschino, a liqueur made from the small black mamma cherries, was manufactured in England at this time, and might have been the forerunner of Maidstone's famous Cherry Brandy, as according to Walter Rowles' "Kentish Chronologer " of 1807, cherries were first planted at Teynkani in Kent by Richard Haynes in 1520. Also, Evelyn records that " It was by the plain industry of one, Harris (a fruiterer to Henry 'VIII) that the fields and environs of about 30 towns in Kent only, were planted with fruit to the universalbenefit and general improvement of that County to this day." • The bottle labelled "Maidstone ", however, was obviously intended to represent the well-known Maidstone Geneva, which was a very pope OT gin made in Maidstone at this time. -

NVWA Nr. Merk/Type Nicotine (Mg/Sig) NFDPM (Teer)

NVWA nr. Merk/type Nicotine (mg/sig) NFDPM (teer) (mg/sig) CO (mg/sig) 89537347 Lexington 1,06 12,1 7,6 89398436 Camel Original 0,92 11,7 8,9 89398339 Lucky Strike Original Red 0,88 11,4 11,6 89398223 JPS Red 0,87 11,1 10,9 89399459 Bastos Filter 1,04 10,9 10,1 89399483 Belinda Super Kings 0,86 10,8 11,8 89398347 Mantano 0,83 10,8 7,3 89398274 Gauloises Brunes 0,74 10,7 10,1 89398967 Winston Classic 0,94 10,6 11,4 89399394 Titaan Red 0,75 10,5 11,1 89399572 Gauloises 0,88 10,5 10,6 89399408 Elixyr Groen 0,85 10,4 10,9 89398266 Gauloises Blondes Blue 0,77 10,4 9,8 89398886 Lucky Strike Red Additive Free 0,85 10,3 10,4 89537266 Dunhill International 0,94 10,3 9,9 89398932 Superkings Original Black 0,92 10,1 10,1 89537231 Mark 1 New Red 0,78 10 11,2 89399467 Benson & Hedges Gold 0,9 10 10,9 89398118 Peter Stuyvesant Red 0,82 10 10,9 89398428 L & M Red Label 0,78 10 10,5 89398959 Lambert & Butler Original Silver 0,91 10 10,3 89399645 Gladstone Classic 0,77 10 10,3 89398851 Lucky Strike Ice Gold 0,75 9,9 11,5 89537223 Mark 1 Green 0,68 9,8 11,2 89393671 Pall Mall Red 0,84 9,8 10,8 89399653 Chesterfield Red 0,75 9,8 10 89398371 Lucky strike Gold 0,76 9,7 11,1 89399599 Marlboro Gold 0,78 9,6 10,3 89398193 Davidoff Classic 0,88 9,6 10,1 89399637 Marlboro Red 100 0,79 9,6 9 89398878 Lucky Strike Ice 0,71 9,5 10,9 89398045 Pall Mall Red 0,81 9,5 10,5 89398355 Dunhill Master Blend Red 0,82 9,5 9,8 89399475 JPS Red 0,81 9,5 9,6 89398029 Marlboro Red 0,79 9,5 9 89537355 Elixyr Red 0,79 9,4 9,8 89398037 Marlboro Menthol 0,72 9,3 10,3 89399505 Marlboro -

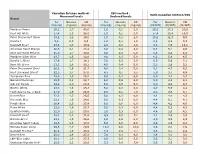

TNCO Levels and Ratio's

Canadian Intense method - ISO method - Ratio Canadian Intense/ISO Measured levels Declared levels Brand Tar Nicotine CO Tar Nicotine CO Tar Nicotine CO (mg/cig) (mg/cig) (mg/cig) (mg/cig) (mg/cig) (mg/cig) (CI/ISO) (CI/ISO) (CI/ISO) Marlboro Prime 26,1 1,7 40,0 1,0 0,1 2,0 26,1 17,2 20,0 Kent HD White 17,4 1,3 28,0 1,0 0,1 2,0 17,4 13,4 14,0 Peter Stuyvesant Silver 15,2 1,2 19,0 1,0 0,1 2,0 15,2 12,3 9,5 Karelia I 9,6 0,9 9,3 1,0 0,1 1,0 9,6 8,6 9,3 Davidoff Blue* 23,6 1,7 30,9 2,9 0,2 2,6 8,3 7,0 12,1 American Spirit Orange 20,5 2,1 18,4 3,0 0,4 4,0 6,8 5,1 4,6 Kent Surround Menthol 25,0 1,7 30,8 4,0 0,4 5,0 6,3 4,3 6,2 Marlboro Silver Blue 24,7 1,5 32,6 4,0 0,3 5,0 6,2 5,0 6,5 Karelia L (Blue) 17,6 1,7 14,1 3,0 0,3 2,0 5,9 5,6 7,1 Kent HD Silver 21,1 1,6 26,2 4,0 0,4 5,0 5,3 3,9 5,2 Peter Stuyvesant Blue* 20,2 1,6 21,7 4,0 0,4 5,0 5,1 4,7 4,3 Kent Surround Silver* 22,5 1,7 27,0 4,5 0,5 5,5 5,0 3,7 4,9 Templeton Blue 25,0 1,8 26,2 5,0 0,4 6,0 5,0 4,4 4,4 Belinda Filterkings 29,9 2,2 24,7 6,0 0,5 6,0 5,0 4,3 4,1 Silk Cut Purple 24,9 2,0 23,4 5,0 0,5 5,0 5,0 4,0 4,7 Boston White 23,3 1,6 25,3 5,0 0,3 6,0 4,7 5,5 4,2 Mark Adams No. -

April 2013 Kent State Faculty Abroad: Istanbul, Turkey by Jen Fisette

April 2013 An Introduction to NJ Akbar: Director Kent State Faculty Abroad: Istanbul, Turkey of Diversity Outreach & Development By Jen Fisette & Theresa Walton In November 2012, N.J. Akbar On February 22nd, 2013, we joined EHHS as the Director of Diversity began our voyage to Istanbul, Outreach and Development focusing on the Turkey, to work with the sport/ retention of current students of color, physical education teachers, outreach efforts to area high schools, and coaches, and administrators at Kent other diversity efforts college-wide. His philosophy for State Koleji and Avrupa Koleji on both the European and Asian diversity is centered on his beliefs in unity and understanding. sides. We were excited and uncertain of what to expect, since He thinks that the goal should be less about numbers of people this was our first time visiting Istanbul. Over the course of our from different races and more about creating an environment 8 days there, we embarked on a personal and professional that stimulates unity between individuals. “True beauty exists cultural journey, providing experiences we never imagined. when we all come together for the growth of one another. Not Throughout the week, we presented workshops that in competition or in opposition of one another.” Akbar sees focused on: curriculum development and curriculum models, this as a goal of his office’s outreach for the college. assessment in physical education, power of positive coaching, He began his career in higher education at Eastern accessing student voice and sociocultural perspectives in Michigan University working with students experiencing physical education, and media literacy. -

The Dark Side of Marketing Seemingly “Light” Cigarettes: Successful Images and Failed Fact R W Pollay, T Dewhirst

i18 Tob Control: first published as 10.1136/tc.11.suppl_1.i18 on 1 March 2002. Downloaded from The dark side of marketing seemingly “Light” cigarettes: successful images and failed fact R W Pollay, T Dewhirst ............................................................................................................................. Tobacco Control 2002;11(Suppl I):i18–i31 Objective: To understand the development, intent, and consequences of US tobacco industry advertis- ing for low machine yield cigarettes. Methods: Analysis of trade sources and internal US tobacco company documents now available on various web sites created by corporations, litigation, or public health bodies. Results: When introducing low yield products, cigarette manufacturers were concerned about maintaining products with acceptable taste/flavour and feared consumers might become weaned from See end of article for smoking. Several tactics were employed by cigarette manufacturers, leading consumers to perceive fil- authors’ affiliations tered and low machine yield brands as safer relative to other brands. Tactics include using cosmetic ....................... (that is, ineffective) filters, loosening filters over time, using medicinal menthol, using high tech imagery, using virtuous brand names and descriptors, adding a virtuous variant to a brand’s product line, and Correspondence to: Richard W Pollay, Faculty generating misleading data on tar and nicotine yields. of Commerce and Business Conclusions: Advertisements of filtered and low tar cigarettes were intended -

Download the Brochure

We are BAT2016 02 WE LEAD THE WAY 04 WE ARE DEVELOPING SAFER CHOICES 06 WE WORK AS PARTNERS 08 WE ARE A TOP EMPLOYER 10 WE OPERATE RESPONSIBLY 1 We are one of the world’s leading multinational companies. We are proud of our heritage and of our continuing success today – and we are excited about our future. We have produced this brochure because we would like to tell you more about us and how we operate. We are proud to share it with you. We are BAT 2 We are BAT 2016 We lead Founded in 1902, we have grown into a global business that continues to go from strength to strength. We have world-class tobacco brands and we are committed to leading in Next Generation Products. 55+ DELIVERING TODAY countries where we are We are one of the world’s most international market leader companies – we sell more than 200 tobacco brands in over 200 markets. We are also one of the world’s most successful 200+ businesses. We are consistently among the top 10 markets where our companies on the London Stock Exchange. We make brands are sold the cigarettes chosen by around one in eight of the world’s one billion smokers and we are market leaders in more than 55 countries. Our world-famous Global Drive Brands – Dunhill, Kent, Lucky Strike, Pall Mall and Rothmans – drive our year-on-year share growth in our major markets worldwide. We are also investing in developing a range of high-quality Next Generation Products. We employ around 50,000 people worldwide, working with farmers, in our factories, in city offices and out on the road supporting retailers. -

Biomarkers of Cigarette Smoking

BLANK PAGE MONOGRAPH The FTC Cigarette Test Method for Determining Tar, Nicotins, . and Carbon Monoxide Yields of US. Cigarettes Report of the NCI Expert Committee. U.S. DEPARTMENT OF HEALTH AND HUMAN SERVICES Public Health Service National Institutes of Health Foreword In response to the emerging scientific evidence that cigarette smoking posed a significant health risk to the user, in the early 1950’s the major cigarette manufacturers began widespread promotion of filtered cigarettes to reassure smokers that, regardless of whatever unhealthy constituents were in cigarette smoke, filters were a “scientific” breakthrough. Advertisements for Viceroy’s “health guard filter” stated, “DENTISTS ADVISE-Smoke VICEROYS-The Nicotine and Tars Trapped by The Viceroy Filter CAN NEVER STAIN YOUR TEETH!” and “Leading N.Y. Doctor,Tells His Patients What to Smoke-Filtered Cigarette Smoke Is Better For Health. The Nicotine and Tars Trapped . ..Cannot Reach Mouth, Throat Or Lungs.” Chesterfield was “Best for you--low in nicotine, highest in quality,” while L&M’s were “Just What the Doctor Ordered.” Lorillard Tobacco Company stressed its science-based Kent micronite filter (the original micronite filter was made of asbestos) and claimed it removed seven times more tar and nicotine than any other cigarette, which “put Kent in a class all by itself where health protection is concerned.” Of course, we know today that not only were these claims patently false, but the cigarette companies knew ,it. In the early 1950’s the Federal Trade Commission (FTC) challenged a variety of health claims made for cigarettes in their advertising, including claims about tar and nicotine. -

British American Tobacco Tekel Announcement Friday, 22Nd February 2008

www.bat.com British American Tobacco Tekel Announcement Friday, 22nd February 2008 CORPORATE PARTICIPANTS Paul Adams British American Tobacco – Chief Executive Paul Rayner British American Tobacco – Finance Director Michael Prideaux British American Tobacco - Corporate & Regulatory Affairs Director Ralph Edmondson British American Tobacco - Head of Investor Relations CONFERENCE CALL PARTICIPANTS Pan Yuk - Financial Times Adam Spielman - Citigroup – Analyst David Hayes - Lehman Brothers – Analyst David Jones - Reuters Elise Badoy - Goldman Sachs – Analyst Arefre Lewison Maria Gancheva – Merrill Lynch Eric Bloomquist - JPMorgan – Analyst Maretta Kelkey – DowJones Jonathan Fell - Deutsche Bank – Analyst Chas Manso - Dresdner Kleinwort - Analyst Operator Good afternoon, ladies and gentlemen, and welcome to the British American Tobacco Conference call hosted by Paul Adams. My name is Clementine and I will be your co-ordinator for today’s conference. For the duration of the call, you will be on listen-only; however, at the end of the call you will have the opportunity to ask questions. If at any time you need assistance, please press *0 on your telephone keypad and you will be connected to an operator. I am now handing you over to Paul Adams to begin today’s conference. Paul Adams - Chief Executive, British American Tobacco Well, good afternoon, everybody. It’s Paul Adams, Chief Executive, British American Tobacco. With me this afternoon, Paul Rayner, finance director, Michael Prideaux, corporate and regulatory affairs director and Ralph Edmondson, head of investor relations. We weren’t going to say anything beyond the press release in terms of any statement, and we’re open for any questions there may be. Operator Thank you.