World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

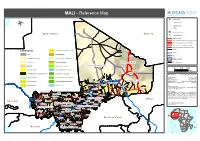

MALI - Reference Map

MALI - Reference Map !^ Capital of State !. Capital of region ® !( Capital of cercle ! Village o International airport M a u r ii t a n ii a A ll g e r ii a p Secondary airport Asphalted road Modern ground road, permanent practicability Vehicle track, permanent practicability Vehicle track, seasonal practicability Improved track, permanent practicability Tracks Landcover Open grassland with sparse shrubs Railway Cities Closed grassland Tesalit River (! Sandy desert and dunes Deciduous shrubland with sparse trees Region boundary Stony desert Deciduous woodland Region of Kidal State Boundary ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! Bare rock ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! Mosaic Forest / Savanna ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! Region of Tombouctou ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 0 100 200 Croplands (>50%) Swamp bushland and grassland !. Kidal Km Croplands with open woody vegetation Mosaic Forest / Croplands Map Doc Name: OCHA_RefMap_Draft_v9_111012 Irrigated croplands Submontane forest (900 -1500 m) Creation Date: 12 October 2011 Updated: -

Are the Fouta Djallon Highlands Still the Water Tower of West Africa?

water Article Are the Fouta Djallon Highlands Still the Water Tower of West Africa? Luc Descroix 1,2,*, Bakary Faty 3, Sylvie Paméla Manga 2,4,5, Ange Bouramanding Diedhiou 6 , Laurent A. Lambert 7 , Safietou Soumaré 2,8,9, Julien Andrieu 1,9, Andrew Ogilvie 10 , Ababacar Fall 8 , Gil Mahé 11 , Fatoumata Binta Sombily Diallo 12, Amirou Diallo 12, Kadiatou Diallo 13, Jean Albergel 14, Bachir Alkali Tanimoun 15, Ilia Amadou 15, Jean-Claude Bader 16, Aliou Barry 17, Ansoumana Bodian 18 , Yves Boulvert 19, Nadine Braquet 20, Jean-Louis Couture 21, Honoré Dacosta 22, Gwenaelle Dejacquelot 23, Mahamadou Diakité 24, Kourahoye Diallo 25, Eugenia Gallese 23, Luc Ferry 20, Lamine Konaté 26, Bernadette Nka Nnomo 27, Jean-Claude Olivry 19, Didier Orange 28 , Yaya Sakho 29, Saly Sambou 22 and Jean-Pierre Vandervaere 30 1 Museum National d’Histoire Naturelle, UMR PALOC IRD/MNHN/Sorbonne Université, 75231 Paris, France; [email protected] 2 LMI PATEO, UGB, St Louis 46024, Senegal; [email protected] (S.P.M.); [email protected] (S.S.) 3 Direction de la Gestion et de la Planification des Ressources en Eau (DGPRE), Dakar 12500, Senegal; [email protected] 4 Département de Géographie, Université Assane Seck de Ziguinchor, Ziguinchor 27000, Senegal 5 UFR des Sciences Humaines et Sociales, Université de Lorraine, 54015 Nancy, France 6 Master SPIBES/WABES Project (Centre d’Excellence sur les CC) Bingerville, Université Félix Houphouët Boigny, 582 Abidjan 22, Côte d’Ivoire; [email protected] 7 Doha Institute for Graduate Studies, -

Annuaire Statistique 2015 Du Secteur Développement Rural

MINISTERE DE L’AGRICULTURE REPUBLIQUE DU MALI ----------------- Un Peuple - Un But – Une Foi SECRETARIAT GENERAL ----------------- ----------------- CELLULE DE PLANIFICATION ET DE STATISTIQUE / SECTEUR DEVELOPPEMENT RURAL Annuaire Statistique 2015 du Secteur Développement Rural Juin 2016 1 LISTE DES TABLEAUX Tableau 1 : Répartition de la population par région selon le genre en 2015 ............................................................ 10 Tableau 2 : Population agricole par région selon le genre en 2015 ........................................................................ 10 Tableau 3 : Répartition de la Population agricole selon la situation de résidence par région en 2015 .............. 10 Tableau 4 : Répartition de la population agricole par tranche d'âge et par sexe en 2015 ................................. 11 Tableau 5 : Répartition de la population agricole par tranche d'âge et par Région en 2015 ...................................... 11 Tableau 6 : Population agricole par tranche d'âge et selon la situation de résidence en 2015 ............. 12 Tableau 7 : Pluviométrie décadaire enregistrée par station et par mois en 2015 ..................................................... 15 Tableau 8 : Pluviométrie décadaire enregistrée par station et par mois en 2015 (suite) ................................... 16 Tableau 9 : Pluviométrie enregistrée par mois 2015 ........................................................................................ 17 Tableau 10 : Pluviométrie enregistrée par station en 2015 et sa comparaison à -

Taoudeni Basin Report

Integrated and Sustainable Management of Shared Aquifer Systems and Basins of the Sahel Region RAF/7/011 TAOUDENI BASIN 2017 INTEGRATED AND SUSTAINABLE MANAGEMENT OF SHARED AQUIFER SYSTEMS AND BASINS OF THE SAHEL REGION EDITORIAL NOTE This is not an official publication of the International Atomic Energy Agency (IAEA). The content has not undergone an official review by the IAEA. The views expressed do not necessarily reflect those of the IAEA or its Member States. The use of particular designations of countries or territories does not imply any judgement by the IAEA as to the legal status of such countries or territories, or their authorities and institutions, or of the delimitation of their boundaries. The mention of names of specific companies or products (whether or not indicated as registered) does not imply any intention to infringe proprietary rights, nor should it be construed as an endorsement or recommendation on the part of the IAEA. INTEGRATED AND SUSTAINABLE MANAGEMENT OF SHARED AQUIFER SYSTEMS AND BASINS OF THE SAHEL REGION REPORT OF THE IAEA-SUPPORTED REGIONAL TECHNICAL COOPERATION PROJECT RAF/7/011 TAOUDENI BASIN COUNTERPARTS: Mr Adnane Souffi MOULLA (Algeria) Mr Abdelwaheb SMATI (Algeria) Ms Ratoussian Aline KABORE KOMI (Burkina Faso) Mr Alphonse GALBANE (Burkina Faso) Mr Sidi KONE (Mali) Mr Aly THIAM (Mali) Mr Brahim Labatt HMEYADE (Mauritania) Mr Sidi Haiba BACAR (Mauritania) EXPERT: Mr Jean Denis TAUPIN (France) Reproduced by the IAEA Vienna, Austria, 2017 INTEGRATED AND SUSTAINABLE MANAGEMENT OF SHARED AQUIFER SYSTEMS AND BASINS OF THE SAHEL REGION INTEGRATED AND SUSTAINABLE MANAGEMENT OF SHARED AQUIFER SYSTEMS AND BASINS OF THE SAHEL REGION Table of Contents 1. -

Projets Approuvés Pour Financement 2019 Du Fonds Climat Mali

Projets approuvés pour financement 2019 du Fonds Climat Mali Soumission ONG Domaines Zones d’intervention N° Intitulés des Projets naires Partenaires d’intervention Régions Cercles Communes Renforcement de la Résilience des Eau, Agriculture, Ségou Tominian Benena, Diora, Mandiakuy Programme Exploitations Familiales aux Élevage et la et Mafouné. Alimentaire AMEDD, 1. Changements Climatiques dans les Pisciculture, Yorosso Kiffosso1, Koumbia, Mondial SAHEL ECO anciens bassins Cotonniers des Cercles de l’Energie et la Sikasso Menamba 1. (PAM) Tominian, Koutiala et Yorosso foresterie Koutiala Sorobasso, Zanfigué. Organisation ONG Mali Dioumara Koussata, des Nations 2000, Diéma Dianguirgé, Gomitradougou, Appui à la résilience des groupements de Unies pour Fassoudebé et Sansankidé. Jeunesse Sans Agriculture, femmes et de jeunes du Cercle de Diéma le Frontière Kayes 2. Elevage et face aux changements climatiques Développem (JSF), Pisciculture ent CRADED, Industriel AVDEM, (ONUDI) GAEMR Amélioration de la résilience des Eau, Agriculture, San Sy, Karaba. Programme écosystèmes et des communautés dans les Élevage et la Tominian Sanekuy, Yasso. Alimentaire CAEB, Ségou 3. zones d’extrême vulnérabilité écologique Pisciculture, Barouéli Boidiè, Barouéli et Sanando. Mondial AMEDD et socioéconomique dans la région de l’Energie et la (PAM) Ségou foresterie Appui à la maitrise des eaux de surface et Nioro du Diaye Coura, Gavinané, Programme des eaux souterraines pour l’amélioration OMADEZA, Eau, Agriculture, Sahel Nioro Tougouné Rangabé et Alimentaire AMASSA Kayes 4. de la résilience des systèmes de Élevage et la Youri Mondial AFRIQUE productions agrosylvopastorales face aux Pisciculture (PAM) VERTE changements climatiques. Conseils et Kita Bendougouba, Sebecoro. Kayes Femmes et Développement Agricole « Appui pour Eau, Agriculture, ONU 5. FéDA Niéleni» l’Education à Élevage et la FEMMES Mopti Mopti. -

France's War in Mali: Lessons for an Expeditionary Army

CHILDREN AND FAMILIES The RAND Corporation is a nonprofit institution that helps improve policy and EDUCATION AND THE ARTS decisionmaking through research and analysis. ENERGY AND ENVIRONMENT HEALTH AND HEALTH CARE This electronic document was made available from www.rand.org as a public service INFRASTRUCTURE AND of the RAND Corporation. TRANSPORTATION INTERNATIONAL AFFAIRS LAW AND BUSINESS Skip all front matter: Jump to Page 16 NATIONAL SECURITY POPULATION AND AGING PUBLIC SAFETY Support RAND SCIENCE AND TECHNOLOGY Browse Reports & Bookstore TERRORISM AND Make a charitable contribution HOMELAND SECURITY For More Information Visit RAND at www.rand.org Explore the RAND Corporation View document details Limited Electronic Distribution Rights This document and trademark(s) contained herein are protected by law as indicated in a notice appearing later in this work. This electronic representation of RAND intellectual property is provided for non- commercial use only. Unauthorized posting of RAND electronic documents to a non-RAND website is prohibited. RAND electronic documents are protected under copyright law. Permission is required from RAND to reproduce, or reuse in another form, any of our research documents for commercial use. For information on reprint and linking permissions, please see RAND Permissions. This report is part of the RAND Corporation research report series. RAND reports present research findings and objective analysis that address the challenges facing the public and private sectors. All RAND reports undergo rigorous peer review to ensure high standards for research quality and objectivity. C O R P O R A T I O N France’s War in Mali Lessons for an Expeditionary Army Michael Shurkin Prepared for the United States Army Approved for public release; distribution unlimited For more information on this publication, visit www.rand.org/t/rr770 Published by the RAND Corporation, Santa Monica, Calif. -

Impacts of Climate Change on Environmental Flows in West

© 2021 The Authors Hydrology Research Vol 52 No 4, 958 doi: 10.2166/nh.2021.041 Impacts of climate change on environmental flows in West Africa’s Upper Niger Basin and the Inner Niger Delta Julian R. Thompson a,*, Cédric L. R. Laizé b, Michael C. Acreman b, Andrew Crawleya and Daniel G. Kingston c a Wetland Research Unit, UCL Department of Geography, University College London, Gower Street, London WC1E 6BT, UK b UK Centre for Ecology & Hydrology, Maclean Building, Crowmarsh Gifford, Wallingford OX10 8BB, UK c School of Geography, University of Otago, P.O. Box 56, Dunedin, New Zealand *Corresponding author. E-mail: [email protected] JRT, 0000-0002-8927-6462; CLRL, 0000-0002-7560-7769; MCA, 0000-0002-8946-739X; DGK, 0000-0003-4205-4181 ABSTRACT Modified water regimes due to climate change are likely to be a major cause of freshwater ecosystem alteration. General Circulation Model (GCM)-related uncertainty in environmental flows at 12 gauging stations in the Upper Niger Basin and flooding within the Inner Niger Delta is assessed using the Ecological Risk due to the Flow Alteration method and a hydrological model forced with projections from 12 GCM groups for RCP 4.5 in the 2050s and 2080s. Risk varies between GCM groups and stations. It increases into the future and is larger for changes in low flows compared to high flows. For the ensemble mean, a small minority of GCM groups projects no risk for high flows in the 2050s (low risk otherwise). This reverses for the 2080s. For low flows, no risk is limited to three stations in the 2050s and one station in the 2080s, the other experience either low or medium risk. -

Redeployment of the State in Central Mali What Role for the Communities in the Return of State Services in the Mopti and Segou Regions?

This project is funded by the European Union Redeployment of the State in Central Mali What role for the communities in the return of state services in the Mopti and Segou regions? Alerted to the emergence of a new conflict in the This permanent mechanism for dialogue seeks to centre of Mali, the Government of Mali developed facilitate a series of negotiations to ensure that the Integrated Security Plan for the Central Re- the return of the state services meets the priority gions (Plan de Sécurisation Intégrée des Régions needs identified by the communities and it does du Centre, PSIRC) in 2017, with its aim to pacify not expose them to reprisals. and stabilize the region by restoring the state’s presence in the area. It is within this context that In addition to roadmaps drawn up jointly by par- in 2018 the Malian government called upon the ties for each of the seven target administrative Centre for Humanitarian Dialogue (HD) to help districts in the Mopti and Ségou regions, these secure the support of local communities. Since 180 leaders, split into district-based dialogue then, HD, with its mandate as a neutral interme- frameworks, are contributing to the return of pu- diary, has been facilitating an ongoing dialogue blic services and to improved collaboration between 180 community leaders, identified to between local communities and state authorities. represent the interests of their communities to A sampling of their achievements, in part due to the public authorities and state representatives HD support, are presented here. involved in the redeployment of public services. -

The Economic and Ecological Effects of Water Management

View metadata, citation and similar papers at core.ac.uk brought to you by CORE This article was downloaded by: [Vrije Universiteit Amsterdam] provided by DSpace at VU On: 26 October 2012, At: 03:44 Publisher: Routledge Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK International Journal of Water Resources Development Publication details, including instructions for authors and subscription information: http://www.tandfonline.com/loi/cijw20 The Economic and Ecological Effects of Water Management Choices in the Upper Niger River: Development of Decision Support Methods Leo Zwarts a , Pieter Van Beukering b , Bakary Koné c , Eddy Wymenga d & Douglas Taylor c a Rijkswaterstaat RIZA, Lelystad, The Netherlands b Institute for Environmental Studies, Amsterdam, The Netherlands c Wetlands International, Wageningen, The Netherlands d Altenburg & Wymenga Ecological Consultants, Veenwouden, The Netherlands Version of record first published: 15 Aug 2006. To cite this article: Leo Zwarts, Pieter Van Beukering, Bakary Koné, Eddy Wymenga & Douglas Taylor (2006): The Economic and Ecological Effects of Water Management Choices in the Upper Niger River: Development of Decision Support Methods, International Journal of Water Resources Development, 22:1, 135-156 To link to this article: http://dx.doi.org/10.1080/07900620500405874 PLEASE SCROLL DOWN FOR ARTICLE Full terms and conditions of use: http://www.tandfonline.com/page/terms-and-conditions This article may be used for research, teaching, and private study purposes. Any substantial or systematic reproduction, redistribution, reselling, loan, sub-licensing, systematic supply, or distribution in any form to anyone is expressly forbidden. -

DEPARTMENT of ENGLISH LETTERS and LANGUAGE the West African Medieval Empire of Mali (13 -15 Centuries)

Ministry of Higher Education and Scientific Research AHMED DRAÏA UNIVERSITY - ADRAR FACULTY OF LETTERS AND LANGUAGES DEPARTMENT OF ENGLISH LETTERS AND LANGUAGE A Thesis Submitted in Partial Fulfillment for the Requirements of a Master’s Degree in Literature and Civilization The West African Medieval Empire of Mali (13th-15th Centuries) Candidate: Supervisor: Mohamed Oulhadji Mr. Tahar Abbou The Board of Examiners Examiner: Pr. Faouzi Borsali President: Dr. Aziz Mostefaoui Supervisor: Mr.Tahar Abbou Academic Year: 2017-2018 Dedication I dedicate this work: To my parents, To my sisters and brothers, To all my Teachers, And to all my relatives, friends, and colleagues. I Acknowledgements I have first to thank Allah, the Almighty Who provided with the power to conduct this work. I would like also to express my deepest gratitude to my supervisor, Mr. Tahar Abbou, for his help, patience, guidance, pieces of advices, and encouragement during the progress of this research paper, and also for providing me with valuable documents. Iam also indebted to my parents for their care and help. And I would like also to thank my teachers for enlightening and guiding me along the years I have spent at Adrar University. At last, I would like to thank my friends and colleagues. II Abstract Mali was a great Islamic empire that emerged from a small ethnic kingdom which gathered the Mande in the early 13th century. This Kingdom was ruled by Sundiata’s father (Maghan Kon Fata the Mande King) who chose Kangaba as the capital of his newly established kingdom, but after the arrival of Sundiata Keita to the throne in 1235 a lot would change in the Mande Kingdom. -

M650kv1906mlia1p-Mliadm22302-Koulikoro.Pdf (French (Français))

RÉGION DE KOULIKORO - MALI Map No: MLIADM22302 9°0'W 8°0'W 7°0'W 6°0'W M A U R I T A N I E ! ! ! Mo!ila Mantionga Hamd!allaye Guirel Bineou Niakate Sam!anko Diakoya ! Kassakare ! Garnen El Hassane ! Mborie ! ! Tint!ane ! Bague Guessery Ballé Mou! nta ! Bou!ras ! Koronga! Diakoya !Palaly Sar!era ! Tedouma Nbordat!i ! Guen!eibé ! Diontessegue Bassaka ! Kolal ! ! ! Our-Barka Liboize Idabouk ! Siramani Peulh Allahina ! ! ! Guimbatti Moneke Baniere Koré ! Chedem 1 ! 7 ! ! Tiap! ato Chegue Dankel Moussaweli Nara ! ! ! Bofo! nde Korera Koré ! Sekelo ! Dally ! Bamb!oyaha N'Dourba N 1 Boulal Hi!rte ! Tanganagaba ! S É G O U ! Djingodji N N ' Reke!rkaye ' To!le 0 Boulambougou Dilly Dembassala 0 ° ! ! ! ° 5 ! ! 5 1 Fogoty Goumbou 1 Boug!oufie Fero!bes ! Mouraka N A R A Fiah ! ! Dabaye Ourdo-Matia G!nigna-Diawara ! ! ! Kaw! ari ! Boudjiguire Ngalabougou ! ! Bourdiadie Groumera Dabaye Dembamare ! Torog! ome ! Tarbakaro ! Magnyambougou Dogofryba K12 ! Louady! Cherif ! Sokolo N'Tjib! ougou ! Warwassi ! Diabaly Guiré Ntomb!ougou ! Boro! dio Benco Moribougou ! ! Fallou ! Bangolo K A Y E S ! Diéma Sanabougou Dioumara ! ! ! Diag! ala Kamalendou!gou ! Guerigabougou ! Naou! lena N'Tomodo Kolo!mina Dianguirdé ! ! ! ! Mourdiah ! N'Tjibougou Kolonkoroba Bekelo Ouolo! koro ! Gomitra ! ! Douabougou ! Mpete Bolib! ana Koira Bougouni N16 ! Sira! do Madina-Kagoro ! ! N'Débougou Toumboula Sirao!uma Sanmana ! ! ! Dessela Djemene ! ! ! Werekéla N8 N'Gai Ntom! ono Diadiekabougou ! ! Dalibougou !Siribila ! ! Barassafe Molodo-Centre Niono Tiemabougou ! Sirado ! Tallan ! ! Begn!inga ! ! Dando! ugou Toukoni Kounako Dossorola ! Salle Siguima ! Keke Magassi ! ! Kon!goy Ou!aro ! Dampha Ma!rela Bal!lala ! Dou!bala ! Segue D.T. -

Review Fish Stoc-B1

199 REVIEW OF THE PRESENT STATE OF THE ENVIRONMENT, FISH STOCKS AND FISHERIES OF THE RIVER NIGER (WEST AFRICA) R. Laë1 S. Williams2 A. Malam Massou3 P. Morand4 O. Mikolasek5 1 IRD, BP 1386, 99 341, Dakar, Senegal 2 Department of Agricultural Economics, Obafeni Awolowo University, Ile-Ife, Osun State, Nigeria 3 INRAN, Département GRN, BP 429, Niamey, Niger 4 Centre de Recherche Halieutique, Avenue Jean Monnet - B.P. 171, 34203, Sète, France 5 CIRAD-GAMET, TA 30/01, 34398 Montpellier Cedex 5, France Correspondence to: Raymond Lae, IRD, Route des Hydrocarbures, Bel-Air, BP 1386, 99341 Dakar, Senegal ABSTRACT The Niger River is the fourth most impor- tant river in Africa. It is 4 200 km long with an esti- mated watershed area of 1 125 000 km2. It travers- es a variety of ecological areas shared by a number of countries in the West African Region: Guinea, Mali, Niger and Nigeria for its main course; Cote d’Ivoire, Burkina Faso, Benin, Chad and the Cameroon for its tributaries. The mean annual flow is 6 100 m3 s-1. Since the beginning of the cen- tury, the Niger River has been subjected to several natural and anthropogenic perturbations: first, a Key words: Niger River, biodiversity, capture very long drought period started in the 1970s when fisheries, aquaculture, management the discharges decreased strongly and the areas 200 Review of the present state of the environment, flooded were considerably reduced. Second, the build- GENERAL INFORMATION ON THE NIGER ing of dams and numerous irrigated perimeters fed by RIVER water pumping modify the hydrologic conditions of The Niger River is the fourth longest river in the Niger, increasing the effects of drought.