Summary As Introduced (6/9/2021)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Michigan Commission of Agriculture and Rural Development Meeting Minutes January 20, 2021 Drafted January 25, 2021 Page 1

STATE OF MICHIGAN GRETCHEN WHITMER DEPARTMENT OF AGRICULTURE GARY MCDOWELL GO VERNOR AND RURAL DEVELOPMENT DIRECTOR February 24, 2021 NOTICE OF MEETING MICHIGAN COMMISSION OF AGRICULTURE AND RURAL DEVELOPMENT March 10, 2021 The regular meeting of the Michigan Commission of Agriculture and Rural Development will be held on March 10, 2021. The business session is scheduled to begin at 9:00 a.m. The meeting is open to the public and this notice is provided under the Open Meetings Act, 1976 PA 267, MCL 15.261 to 15.275. This meeting is being conducted electronically to protect the health of commission members, staff, and the public due to the Coronavirus by limiting the number of people at public gatherings. To join the meeting, dial by telephone: 1-248-509-0316 and enter Conference ID: 273 662 491#. In accordance with the Commission’s Public Appearance Guidelines, individuals wishing to address the Commission may pre-register to do so during the Public Comment period as noted below and will be allowed up to three minutes for their presentation. Documents distributed in conjunction with the meeting will be considered public documents and are subject to provisions of the Freedom of Information Act. The public comment time provides the public an opportunity to speak; the Commission will not necessarily respond to the public comment. To pre-register to speak during this remote meeting, individuals should contact the Commission Assistant no later than Fri., October 30, via email at [email protected] and provide their name, organization they represent, address, and telephone number, as well as indicate if they wish to speak to an agenda item. -

THE ARMENIAN Mirrorc SPECTATOR Since 1932

THE ARMENIAN MIRRORc SPECTATOR Since 1932 Volume LXXXXI, NO. 41, Issue 4683 MAY 1, 2021 $2.00 Thank You President Biden KEN MARTIN PHOTO STATEMENT BY PRESIDENT JOE BIDEN ON ARMENIAN GENOCIDE REMEMBRANCE DAY WASHINGTON — Each year on this day, we remem- ber the lives of all those who died in the Ottoman-era Ar- menian genocide and recommit ourselves to preventing such an atrocity from ever again occurring. Beginning on April 24, 1915, with the arrest of Armenian intellectuals and community leaders in Constantinople by Ottoman au- thorities, one and a half million Armenians were deported, massacred, or marched to their deaths in a campaign of ex- termination. We honor the victims of the Meds Yeghern so that the horrors of what happened are never lost to history. And we remember so that we remain ever-vigilant against the corrosive influence of hate in all its forms. Of those who survived, most were forced to find new homes and new lives around the world, including in the A large crowd turned out for the Boston April 24 commemoration. (See story inside) United States. With strength and resilience, the Armenian people survived and rebuilt their community. Over the decades Armenian immigrants have enriched the United States in countless ways, but they have never forgotten the tragic history that brought so many of their ancestors to our Armenia Delighted with US shores. We honor their story. We see that pain. We affirm the history. We do this not to cast blame but to ensure that what happened is never repeated. Recognition of Genocide Today, as we mourn what was lost, let us also turn our eyes to the future — toward the world that we wish to build trauma of the 106 year-old Genocide. -

2019-2020 Legislative Scorecard Summary

2019-2020 LEGISLATIVE SCORECARD SUMMARY WHAT MADE THIS POSSIBLE? YOU! TOWARD A CONSERVATION MAJORITY In 2019 and 2020, you used your voice to tell your Because Michigan LCV is both political and non- legislators to move forward with clean energy, partisan, our goal is to build a pro-conservation demand clean drinking water in our communities majority of state lawmakers from both parties who and conserve our state’s incredible natural support protecting the health of our communities resources. by tackling the big issues facing Michigan’s land, air, and water. Together, we are making a difference. An important part of our work is holding our elected officials accountable. This scorecard tells HOUSE you whether your representatives in Lansing Conservation Majority Breakdown listened to you and your neighbors, or if they listened to special interests. YES = 50 TELL YOUR LEGISLATORS MAYBE = 31 YOU KNOW THE SCORE NO = 31 1 It only takes a minute to say thanks-- or to TOTAL = 112 say no thanks-- to your legislators. DONATE Because we could not accomplish our 2 mission without the generous support of SENATE our members, please make a donation so Conservation Majority Breakdown we can continue fighting for clean air and clean water in your community and continue YES = 16 our stewardship of Michigan’s unparalleled natural resources. MAYBE = 3 NO = 19 SPREAD THE WORD Finally, share this scorecard with your TOTAL = 38 3 friends and family so they know the score of their elected officials, too. Total number of legislators in the Michigan House exceeds number YOU CAN DO ALL OF THIS AT of House districts due to an early resignation and the passing of one MICHIGANLCV.ORG/SCORECARD Representative during the term. -

Number 1, 01/09/2019

No. 1 STATE OF MICHIGAN Journal of the Senate 100th Legislature REGULAR SESSION OF 2019 Senate Chamber, Lansing, Wednesday, January 9, 2019. 12:00 noon. In conformity with the requirements of the Constitution of the state of Michigan, the Senators of the 100th Legislature of the state of Michigan assembled in the Senate Chamber in the Capitol at Lansing this day (being the second Wednesday of January 2019), at twelve o’clock noon, and were called to order by the President, Lieutenant Governor Garlin D. Gilchrist II. Pastor Kerby Fannin of Word of Promise Church of Addison offered the following invocation: Dear Heavenly Father, Yahweh, You have made this day and we thank You for it. Now we thank You for this moment for which You have brought us here to begin a new session in this chamber. We thank You for Your love and forgiveness, and we pray that we can pass on that same kind of love and forgiveness to others. Many of us are wise in our own eyes because of our own worldview. It convinces us that our thoughts are right. However, true wisdom comes from You and is given to those that hear counsel. Out of Your mouth comes knowledge and understanding. If we can remember that Your ways are higher than our ways and Your thoughts are higher than our thoughts, then we will seek Your counsel in the decisions that we make. You speak to us in many ways, including through those from whom we would least expect to hear Your words. However, we can only hear them when we receive them in a spirit of meekness, recognizing that we’re all imperfect beings, considering that the faults we see in others may be also found in ourselves. -

Cancer Action Month

CANCER ACTION MONTH SOCIAL MEDIA POSTING GUIDE Social media is a powerful tool to help amplify our advocacy messages. We encourage you to post on social media prior to our Cancer Action Month and throughout the month when you take action. Please use our campaign hashtag in all your posts and use the templates below to share on Facebook, Twitter and Instagram. First Step: Cancer Action Month Hashtags #MICancerActionMonth – please use in all posts #MICancerStoryMatters – please use when sharing your personal cancer story this month #MIAccesstoCare – Add this hashtag when posting about Oral Chemotherapy Fairness #ItsTimeToChoose – Add this hashtag when posting about Tobacco Reform #MILeg – Add this hashtag if you are tagging a lawmaker in your post Second Step: Pre-Event Sample Posts (May 25th – May 29th) • During the month of June, I will be advocating for cancer fighting policies from home for Michigan’s virtual Cancer Action month! Check out my posts and click on the hashtags to see how me and my fellow cancer advocates are making a difference. #MICancerActionMonth • I am a volunteer with @ACSCANMichigan and during June, I will be advocating for cancer fighting policies with advocates from across the state for Michigan’s Cancer Action Month. We may not be at the capitol in Lansing this year, but we will still make an impact and tell our lawmakers to make fighting cancer a top priority! #MICancerActionMonth • The current pandemic puts increased stress on so many cancer patients. That’s why I am advocating with @ACSCANMichigan during the month of June for Michigan’s Virtual Cancer Action Month. -

Local Majority and the Michigan Elections of 2018

11/21/2018 JR Local Majority and the Michigan Elections of 2018 Overview Since 2011 Michigan has been under a Republican trifecta with a Republican Governor and Republican majorities in the state House and state Senate. In the November 2018 midterm election, Democrats not only broke the GOP trifecta with the victory of Democratic Governor-elect Gretchen Whitmer, they also gained two seats in the U.S. House of Representatives, maintained their U.S. Senate seats, and made significant inroads into the state legislature. Democrats gained 6 seats each in the state House and state Senate. The Republicans went into the contest with a 63-46 majority in the state House, now whittled down to a 58-52 margin. In the state Senate, Democrats improved their margin from 27-10 to 22-16, thereby depriving Republicans of their supermajority. These Democratic gains in the US House, state house, and state senate were all the more impressive given Michigan’s extreme gerrymandering. Reflecting the record-breaking voter turnout across the country, Michigan’s voter turnout was the highest for midterm elections in nearly 50 years. Good news continued to rock the state for Democrats as they also dismantled the Republican triplex, flipping all three executive leadership spots for Governor, Attorney General, and Secretary of State. These Democratic wins are especially important because those officials will be overseeing the state’s redistricting process following the upcoming 2020 census. Complementing the electoral results, Michigan voters ushered in by margins of nearly 70 percent significant new laws to ensure fair redistricting processes and protect voting rights across the state. -

Endorsement List Michigan Building and Construction Trades Council for the Nov. 3, 2020 Statewide General Election Updated 10.2

Endorsement List Michigan Building and Construction Trades Council for the Nov. 3, 2020 Statewide General Election updated 10.26.20 (Candidates' hometowns or nearest large community are in parenthesis) U.S. President: Joe Biden U.S. Senator Gary Peters Michigan Supreme Court Justice Bridget McCormack Elizabeth Welch U.S. Congress District 1 (Negaunee): Dana Ferguson District 2 (Holland): Bryan Berghoef District 3 (Grand Rapids) Hillary Scholten District 5 (Flint): Daniel Kildee District 7 (Ann Arbor): Gretchen Driskell District 8 (Holly) Elissa Slotkin District 9 (Warren) Andy Levin District 11 (Birmingham): Haley Stevens District 12 (Dearborn): Debbie Dingell District 14 (Southfield): Brenda Lawrence Michigan State University Board of Trustees: Brian Mossalam University of Michigan Board of Trustees: Mark Bernstein, Shauna Ryder Diggs State Representative District 2 (Detroit): Joe Tate District 4 (Hamtramck): Abraham Aiyash District 8 (Detroit): Stephanie Young District 10 (Detroit): Kevin Harris District 19 (Livonia): Laurie Pohutsky District 20 (Plymouth): Matt Koleszar District 21 (Canton): Ranjeev Puri District 22 (Roseville): Richard Steenland District 25 (Sterling Hts.): Nate Shannon District 29 (Pontiac): Brenda Carter District 31 (Clinton Twp.): Bill Sowerby District 34 (Flint): Cynthia Neely District 37 (Farmington Hills): Samantha Steckloff District 38 (Novi): Kelly Breen District 39 (Commerce): Julia Pulver District 40 (Birmingham) Mari Manoogian District 43 (Clarkston): Nicole Breadon District 44 (Milford): Denise Forrest -

House of Representatives

No. 1 STATE OF MICHIGAN JOURNAL OF THE House of Representatives 100th Legislature REGULAR SESSION OF 2019 House Chamber, Lansing, Wednesday, January 9, 2019. 12:00 Noon. Pursuant to the requirements of the Constitution, the Representatives-elect to the House of Representatives of the State of Michigan for the years 2019 and 2020, assembled in Representative Hall in the Capitol at Lansing on the second Wednesday in January, the 9th of January, 2019 at 12:00 o’clock noon, and in accordance with law, were called to order by Gary L. Randall, Clerk of the preceding House. Pastor Rusty Chatfield, Pastor of Northern Michigan Baptist Bible Church in Burt Lake, offered the following invocation: “Dear Heavenly Father, We are grateful to You, Almighty God, for the blessings of freedom and we are earnestly desiring to secure these blessings undiminished to ourselves and our posterity. I pray that You would grant wisdom to this legislative body. I pray that the words of these legislators’ mouths and the mediations of their hearts would honor You in all that they say and do. I pray that everyone would argue honestly and that they would be quick to listen, slow to speak and slow to become angry. Let no personal animosity ever cloud anyone’s judgment. May everyone recognize that we are all created in the image of God. I ask You, Father, to bless the work of this chamber. May every bill passed and every law enacted reflect Your supreme law. Father, have mercy on our State and country. I pray that all of us would have malice for none and charity for all. -

Misafestart: Restaurant / Bar Workgroup Recommendations

Department of Labor and Economic Opportunity MiSafeStart: Restaurant / Bar workgroup recommendations PRELIMINARY AND PRE-DECISIONAL | MAY 21ST, 2020 Executive summary Distance, not capacity • Strict distancing rules for floor plan rather than capacity limit based on current seating or Fire Code Occupancy • Clarify exception to 6-foot distancing requirement where physical barriers (e.g., plexiglass shield between booths) are used Noninvasive customer • No requirement for verbal wellness check between host and customer entry screening (maintain normal patron relationship) • Instead, post clear signage and watch for symptoms “Michigan Promise” • Create standard public health “pledge” signage for both proprietors, patrons Targeted closure for • Amend policy to allow portions of large facilities to stay open after deep cleaning symptomatic event • Define COVID-10 symptoms to exclude common / allergy symptoms Time to ramp up • Give 7-10 days of notice before scheduled opening to permit implementation of risk mitigation strategies, activation of supply chain Eight steps for employers to keep their workers safe, within the hierarchy of controls 1 Administrative controls 2 Access control 3 Distancing 4 Sanitation 5 Hygiene 6 PPE 7 Positive case protocols 8 Facility closure Administrative controls Requirements – “must” Best practices – “should consider” • Create an exposure control plan • Define scope of response team ‒ State should provide a template ‒ Ensure robust implementation of ‒ State should provide examples safety protocols of high-quality -

Fec Form 3X Report of Receipts and Disbursements

07/07/2021 16 : 44 Image# 202107079450991301 PAGE 1 / 98 REPORT OF RECEIPTS FEC AND DISBURSEMENTS FORM 3X For Other Than An Authorized Committee Office Use Only 1. NAME OF TYPE OR PRINT ▼ Example: If typing, type COMMITTEE (in full) over the lines. 12FE4M5 Dow Inc. PAC (DowPAC) Global Dow Center ADDRESS (number and street) ▼ 2211 H.H. Dow Way Check if different than previously Midland MI 48674 reported. (ACC) ▼ ▼ 2. FEC IDENTIFICATION NUMBER ▼ CITY ▼ STATE ZIP CODE C00074096 3. IS THIS ✘ NEW AMENDED C REPORT (N) OR (A) 4. TYPE OF REPORT (b) Monthly Feb 20 (M2) May 20 (M5) Aug 20 (M8) Nov 20 (M11) (Non-Election (Choose One) Report Year Only) Due On: Mar 20 (M3) Jun 20 (M6) Sep 20 (M9) Dec 20 (M12) (Non-Election (a) Quarterly Reports: Year Only) Apr 20 (M4) ✘ Jul 20 (M7) Oct 20 (M10) Jan 31 (YE) April 15 Quarterly Report (Q1) (c) 12-Day Primary (12P) General (12G) Runoff (12R) July 15 PRE-Election Quarterly Report (Q2) Report for the: Convention (12C) Special (12S) October 15 Quarterly Report (Q3) M M / D D / Y Y Y Y in the January 31 Year-End Report (YE) Election on State of July 31 Mid-Year (d) 30-Day Report (Non-election Year Only) (MY) POST-Election General (30G) Runoff (30R) Special (30S) Report for the: Termination Report (TER) M M / D D / Y Y Y Y in the Election on State of M M / D D / Y Y Y Y M M / D D / Y Y Y Y 5. Covering Period 06 01 2021 through 06 30 I certify that I have examined this Report and to the best of my knowledge and belief it is true, correct and complete. -

Michigan PTA Advocacy & Election Guide

Michigan PTA Advocacy & Election Guide 2019-2020 “Nothing you do for children is ever wasted.” Garrison Keiller Michigan PTA Advocacy MATTERS! I. Michigan PTA Advocacy Committee II. Michigan PTA Public Policy Priorities III. Important Dates IV. Legislative Contact Information V. Timeline VI. National PTA® Nonprofits, Voting And Elections Guide VII. Lobbying Guidelines VIII. Political Campaigns Guideline Important Dates Since Proposal 3 passed in 2018, there is no deadline to register to vote in the State of Michigan. Michigan now allows Same Day registration. We always encourage voters to get registered ahead of time. November 5th, 2019 Elections List of elections by county th March 10 , 2020 Presidential Primary Election rd November 3 , 2020 General Election Advocacy Committee Team Members Marcy Dwyer - VP Children’s Advocacy Barb Anness, Federal Legislative Chair Kathy Carter, Michigan PTA President Jennifer Johnson, VP Student Involvement/ Diversity, Equity & Inclusion Jennifer Garland, Member Carin Meyer, Member Tanya Pitkin, Member Open Appointment, Special Education Joyce Krom, Health & Wellness Open Appointment Legislative Consultant Open Appointment Legislative Intern Open Appointment Education Consultant Michigan PTA Mission Statement To mobilize the forces of school, home, and community in order to ensure a quality education and nurturing environment for every child. Michigan PTA Advocacy Committee Promotes local, county, state and national efforts to focus on the education and well-being of all children in our state by working with families, educators, school boards, statewide associations and non-profit organizations, business and community leaders, the legislature, the State Board of Education and the Michigan Department of Education to ensure child-related concerns are being met. -

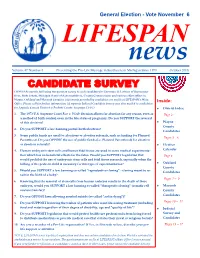

CANDIDATE SURVEY LIFESPAN Sent the Following Ten-Question Survey to Each Candidate for Governor, U.S

General Election - Vote November 6 LIFESPAN news Volume 47 Number 8 Presenting the Pro-Life Message in Southeastern Michigan Since 1970 October 2018 CANDIDATE SURVEY LIFESPAN sent the following ten-question survey to each candidate for Governor, U.S. House of Representa- tives, State Senate, Michigan House of Representatives, County Commissioner and various other offices in Wayne, Oakland and Macomb Counties. Statements provided by candidates are on file at LIFESPAN’s Main Inside: Office. Please call for further information. (A separate Judicial Candidate Survey was also mailed to candidates for Appeals, Circuit, District & Probate Courts. See pages 13-16.) District Index 1. The 1973 U.S. Supreme Court Roe v. Wade decision allows for abortion for any reason, even as Page 2 a method of birth control, even in the late states of pregnancy. Do you SUPPORT the reversal of this decision? Wayne County 2. Do you SUPPORT a law banning partial-birth abortions? Candidates 3. Some public funds are used for abortions or abortion referrals, such as funding for Planned Pages 3—6 Parenthood. Do you OPPOSE the use of public funds (i.e. Planned Parenthood) for abortion or abortion referrals? Election 4. Human embryonic stem cells and human fetal tissue are used in some medical experimenta- Calendar tion which has no beneficial effects for the fetus. Would you SUPPORT legislation that Page 6 would prohibit the use of embryonic stem cells and fetal tissue research, especially when the killing of the preborn child is necessary for this type of experimentation? Oakland County 5. Would you SUPPORT a law banning so-called “reproductive cloning” - cloning meant to re- Candidates sult in the birth of a baby? Pages 7— 9 6.