Caja Laboral Popular Coop. De Crédito and Subsidiaries (Consolidated Group)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Supervised Entities (As of 1 September 2020)

List of supervised entities Cut-off date for changes: 1 September 2020 Number of significant entities directly supervised by the ECB: 114 This list displays the significant supervised entities, which are directly supervised by the ECB (part A) and the less significant supervised entities which are indirectly supervised by the ECB (Part B). Based on Article 2(20) of Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014 establishing the framework for cooperation within the Single Supervisory Mechanism between the European Central Bank and national competent authorities and with national designated authorities (OJ L 141, 14.5.2014, p. 1 - SSM Framework Regulation) a ‘supervised entity’ means any of the following: (a) a credit institution established in a participating Member State; (b) a financial holding company established in a participating Member State; (c) a mixed financial holding company established in a participating Member State, provided that the coordinator of the financial conglomerate is an authority competent for the supervision of credit institutions and is also the coordinator in its function as supervisor of credit institutions (d) a branch established in a participating Member State by a credit institution which is established in a non-participating Member State. The list is compiled on the basis of significance decisions which have been adopted and notified by the ECB to the supervised entity and that have become effective up to the cut-off date. A. List of significant entities directly supervised by the ECB Country of LEI Type Name establishment Grounds for significance MFI code for branches of group entities Belgium Article 6(5)(b) of Regulation (EU) No 1 LSGM84136ACA92XCN876 Credit Institution AXA Bank Belgium SA ; AXA Bank Belgium NV 1024/2013 CVRWQDHDBEPUUVU2FD09 Credit Institution AXA Bank Europe SCF France 2 549300NBLHT5Z7ZV1241 Credit Institution Banque Degroof Petercam SA ; Bank Degroof Petercam NV Significant cross-border assets 54930017BFF0C5RWQ245 Credit Institution Banque Degroof Petercam France S.A. -

FINANCIAL SERVICES.Pdf

INTERNATIONAL REFERENCES FINANCIAL SERVICES Algeria Bank of Algeria, Société Générale Algérie, BNP, Salama Bank of Blida Australia Bank of Scotland international Austria “Creditanstalt AG”, National Savings, “Oberbank”, “Raiffeisenkasse” banks France Barclay’s, Banque de France, Credit Lyonnais, Citibank, Credi Mutuel, CIAL of CIC group, Commerzbank Paris Germany Deutsche Bank, Berliner Bank, Commerzbank, Dresdner Bank Hungary National Bank (KFKI) Budapest Hong Kong Hong Kong bank Indonesia BNT Jakarta Italia Banks, Banca popolare di Bescia, Banca commerciale Italiana, Instituto bancario S. Paolo Torno, Banca popolare di Crema Ivory Coast Société Générale de Banque Morocco Banque Centrale Populaire, Commercial Bank of Morocco New Zealand Deutsche Bank Auckland Niger Banque Centrale des Etats d’Afrique de l’Ouest au Niger Norway Oslo Bank of Norway, Bank of Scotland international Philippines Zambales Subic Financial building corporation, Manilla Bangkok bank Portugal Banks Portugal, Pinto & Sotto Mayor, Portugues do Atlantico, Fonsecas & Burnay, Do Fomento, Acores, Uniao de bancos Portugueses, Caixa Geral de depositos, Stock exchange Lisbon Senegal Bank B.C.E.A.O. Dakar Serbia National Bank of Serbia Singapore City Bank South Africa South African Reserve Bank in Durban Spain Caja Rural de Granada, Cajamar, Banco BBVA, Banco Popular, Banca March, Bankinter, Caja Laboral, Unicaja, Caja de Ahorros de Ávila Thailand Bangkok Thai Farmers bank head office, Bangkok bank head office, Bangkok Bank of Ayudhya head office, Chiangmai Central bank of Thailand, Bank of Thailand, BTS Depot United Arab Emirates Abu Dhabi Barclays Bank, National bank of Abu Dhabi United Kingdom Barclays Bank London, Northern Trust London, Bank of England, Lloyds, Blue Crest, HSBC, Schroders. . -

Disposición 1560 Del BOE Núm. 27 De 2010

BOLETÍN OFICIAL DEL ESTADO Núm. 27 Lunes 1 de febrero de 2010 Sec. III. Pág. 9202 III. OTRAS DISPOSICIONES BANCO DE ESPAÑA 1560 Resolución de 21 de enero de 2010, del Banco de España, por la que se publica la relación de entidades participantes (asociadas y representadas) a 15 de enero de 2010 en el Sistema Nacional de Compensación Electrónica. En cumplimiento de lo dispuesto en el capítulo II, artículo 7, de la Ley 41/1999, de 12 de noviembre, sobre sistemas de pagos y de liquidación de valores, se publica la relación de Entidades participantes (asociadas y representadas) a 15 de enero de 2010 en el Sistema Nacional de Compensación Electrónica. Madrid, 21 de enero de 2010.–El Director General de Operaciones, Mercados y Sistemas de Pago, Javier Alonso Ruiz-Ojeda. RELACIÓN DE ENTIDADES ASOCIADAS DEL S.N.C.E. A 15 DE ENERO DE 2010 NRBE Denominación 0019 Deutsche Bank, S.A.E. 0030 Banco Español de Crédito, S.A. 0042 Banco Guipuzcoano, S.A. 0049 Banco Santander, S.A. 0061 Banca March, S.A. 0065 Barclays Bank, S.A. 0072 Banco Pastor, S.A. 0075 Banco Popular Español, S.A. 0081 Banco de Sabadell, S.A. 0093 Banco de Valencia, S.A. 0128 Bankinter, S.A. 0182 Banco Bilbao Vizcaya Argentaria, S.A. 0198 Banco Cooperativo Español, S.A. 2000 Confederación Española de Cajas de Ahorros. 2013 Caixa d’Estalvis de Catalunya. 2038 Caja de Ahorros y M.P. de Madrid. 2077 C.A. de Valencia, Castellón y Alicante, Bancaja. 2085 C.A.M.P. Zaragoza, Aragón y Rioja (IBERCAJA). -

Memoria ANEL 2018

ANEL Memoria 2018 www.anel.es ÍNDICE 1. Informe de la JUNTA DIRECTIVA 2. REPRESENTACIÓN de las Cooperativas y Sociedades Laborales 3. Actividades con las EMPRESAS ASOCIADAS 4. Promoción del modelo ECONOMÍA SOCIAL EMPRESARIAL 5. CREACIÓN de Cooperativas y Sociedades Laborales 6. FORMACIÓN y Liderazgo Participativo 7. INNOVACIÓN SOCIAL 8. VALOR SOCIAL generado por ANEL 9. ANEXO 1: ANEL 2018 a través de sus noticias www.anel.es 10. ANEXO 2: Contribución de ANEL al Plan Integral de Economía Social de Navarra. 11. ANEXO 3: Reconocimiento empresas 20 años ANEL. 2 1.- Informe de la JUNTA DIRECTIVA En la Asamblea de ANEL, celebrada el 4 de mayo de 2018, se aprobó el Plan de Gestión 2018, encomendando a la Junta Directiva el impulso y seguimiento de sus actuaciones y objetivos, cuyos principales resultados aparecen recogidos en la presente Memoria, de acuerdo con la Misión de ANEL. JUNTA DIRECTIVA Ignacio Ugalde , Presidente (FAGOR EDERLAN TAFALLA, S.Coop.) Ainhoa Castellano , Vicepresidenta (DESARROLLOS ANASINF, SL.) Javier Baztarrika , Secretario (INICIATIVAS INNOVADORAS, SAL.) Juantxo Martínez-Garciriain , Tesorero (MAPSA, S.Coop.) José María Martínez (MUEBLES DE VIANA, S.Coop.) José María Tabar (FONTANERÍA TABAR, SL.) Elena Sarasa (MEDIACIÓN NAVARRA, S. Microcoop.) 3 MISIÓN DE ANEL ANEL es la Asociación empresarial que agrupa a las empresas de Economía Social de Navarra, tanto Sociedades Laborales como Cooperativas de Trabajo Asociado. Representa a las empresas y promueve el modelo de empresa de Economía Social. Fomenta el crecimiento de la -

Sustainability Report and Non-Financial Information Statement 2020

CSR SUSTAINABILITY REPORT AND NON-FINANCIAL INFORMATION STATEMENT 2020 LABORAL Kutxa declares that this Report has been prepared in accordance with the GRI standards: the exhaustive option, and complies with the requirements of Law 11/2018, dated 28 December, on non-financial information and diversity, according to the external verification carried out by AENOR. INDEX 0. Letter ........................................................................................................................................ 4 1. About us ................................................................................................................................... 7 1.1. Group Presentation ..................................................................................................... 8 1.2. Operating structure ..................................................................................................... 9 1.3. Cooperativism ........................................................................................................... 10 1.4. Values, principles, standards and rules of conduct .................................................... 11 1.5. Geographic distribution of offices ............................................................................. 12 1.6. Key figures of the Group ........................................................................................... 13 1.7. Strategy and risk management .................................................................................. 15 1.8. Principles and governance -

INFORME ANUAL 2014 Annual Report 2014

1 INFORME ANUALANNUA L 2014REPORT 2014 01 Basic figures p.04 02 Message from the Chair 03 p.08 Finance p.10 3 04 Industry p.16 06 Knowledge p.32 05 Distribution p.28 125 8 1 13 13 103 PRODUCTION FOUNDATIONS MUTUAL COVERAGE INTERNATIONAL COOPERATIVES SUBSIDIARIES ASSISTANCE ORGANISATIONS DEPARTMENTS ORGANISATION 01 Basic figures In millions of euros BUSINESS 5 DEVELOPMENT 2013* 2014 Varia- tion % Total income 12,108 11,875 -1.9 Total sales (Industry and Distribution) 11,138 10,985 -1.4 Net investments 392 345 -11.9 EBITDA 1,220 1,168 -4.3 Intermediated Funds LABORAL Kutxa 1,160 18,063 5.3 LagunAro equity fund 5,205 5,566 6.9 EMPLOYMENT 2013* 2014 Varia- tion % Average jobs 74,060 74,117 0.1 % of shareholders in Industrial Area 84 83 -1.2 cooperative workforce % of female shareholders in cooperative 43.1 43 -0.2 workforce Rate of Industrial Area incidents or 31.0 29.3 -5.5 accidents SHAREHOLDING 2013* 2014 Varia- tion % 1,711 1,688 -1.3 Working shareholders capital stock Number of workers in governing bodies 812 810 -0.2 SolidaritY 2013* 2014 Varia- tion % Funds for activities with a SOCIAL 13.5 14.7 8.9 CONTENT No. of students IN educational centres 11,404 11,439 0.3 Environmental 2013* 2014 Varia- management tion % 56 69 23.2 No. of ISO 14000 certifications in force Number of eco-design certifications 4 4 0.0 INVESTMENT IN THE 2013* 2014 Varia- FUTURE tion % % funds allocated to R&D of Industrial 8.5 8.9 4.7 Area value added No. -

Book Provides Us with the Compelling Evidence That This Is Not Only Necessary but Also Possible.” - Prabir Purkayastha, Founder and Chief Editor At

“An incredibly important and timely collection of essays, offering a detailed diagnosis of the issues afflicting modern financialized economies and a vision of a future beyond neoliberalism. Required reading for all those involved in the project to build a new economy.” - Grace Blakeley, research fellow at the Institute for Public Policy Research and economics commentator at The New Statesman “This thought-provoking series of essays reminds us of a truth often denied: there is no shortage of money for transformation of the economy away from addiction to fossil fuels. The questions tackled by the authors are this: who controls the monetary system and how can the wider public regain control over a) their own savings and b) a great public good - the monetary system.” - Ann Pettifor, director of Policy Research in Macroeconomics (PRIME) and author of The Production of Money “The dominant narrative today is that financial and private capital, will lead – at some distant date – to public good. Increasingly, even public infra- structure is being handed over to big capital. We urgently need a global movement to rein in global finance and safeguard our future. This impor- tant book provides us with the compelling evidence that this is not only necessary but also possible.” - Prabir Purkayastha, founder and chief editor at www.newsclick.in “Here is yet another major contribution from TNI to our understanding of the complex world of high-finance. TNI has gained an international reputation for its extraordinary work on helping us understand the real world machinations of the high-level investment world of financiers.” - Saskia Sassen, Columbia University and author of Expulsions: Brutality and Complexity in the Global Economy “The stark reality is that the world stands on the brink of another crash owing to the failure to reform a global financial system dominated by private banking behemoths. -

A. List of Significant Supervised Entities

List of supervised entities Cut-off date for significance decisions: 01 January 2016 Number of significant supervised entities: 129 A. List of significant supervised entities Belgium Name Country of Grounds for establishment significance of the group entities Investeringsmaatschappij Argenta nv Size (total assets EUR 30 - 50 bn) Argenta Bank- en Verzekeringsgroep nv Belgium Argenta Spaarbank NV Belgium AXA Bank Europe SA Size (total assets EUR 30-50 bn) AXA Bank Europe SCF France Banque Degroof Petercam SA Significant cross-border assets Banque Degroof Petercam France S.A. France Banque Degroof Luxembourg S.A. Luxembourg Privat Bank Degroof, S.A.U. Spain Belfius Banque S.A. Size (total assets EUR 150-300 bn) Dexia NV Size (total assets EUR 150-300 bn) Dexia Crédit Local France Dexia Flobail France Dexia CLF Banque France Dexia CLF Régions Bail France Dexia Kommunalbank Deutschland AG Germany Dexia Crediop S.p.A. Italy Dexia Sabadell, S.A. Spain KBC Group N.V. Size (total assets EUR 150-300 bn) KBC Bank N.V. Belgium CBC Banque Belgium KBC Bank Ireland plc Ireland Československá obchodná banka, a.s. Slovakia ČSOB stavebná sporiteľňa, a.s. Slovakia The Bank of New York Mellon S.A. Size (total assets EUR 50-75 bn) Germany Name Country of Grounds for establishment significance of the group entities Aareal Bank AG Size (total assets EUR 50-75 bn) Westdeutsche ImmobilienBank AG Germany Bayerische Landesbank Size (total assets EUR 150-300 bn) Deutsche Kreditbank Aktiengesellschaft Germany COMMERZBANK Aktiengesellschaft Size (total assets EUR 500-1,000 bn) European Bank for Financial Services GmbH (ebase) Germany Hypothekenbank Frankfurt AG Germany comdirect bank AG Germany Commerzbank International S.A. -

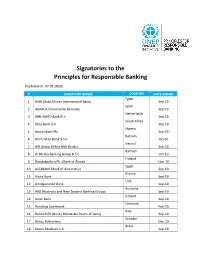

Signatories to the Principles for Responsible Banking

Signatories to the Principles for Responsible Banking (Updated on: 07.09.2020) # SIGNATORY BANKS COUNTRY DATE SIGNED Egypt 1 AAIB (Arab African International Bank) Sep-19 Spain 2 ABANCA Corporación Bancaria Sep-19 Netherlands 3 ABN AMRO Bank N.V. Sep-19 South Africa 4 Absa Bank Ltd. Sep-19 Nigeria 5 Access Bank Plc Sep-19 Bahrain 6 Ahli United Bank B.S.C Jan-20 Ireland 7 AIB Group (Allied Irish Banks) Sep-19 Bahrain 8 Al Baraka Banking Group B.S.C. Oct-19 Finland 9 Ålandsbanken Plc. (Bank of Åland) Nov-19 Egypt 10 ALEXBANK (Bank of Alexandria) Sep-19 Greece 11 Alpha Bank Sep-19 USA 12 Amalgamated Bank Sep-19 Australia 13 ANZ (Australia and New Zealand Banking Group) Sep-19 Iceland 14 Arion Bank Sep-19 Denmark 15 Aurskorg Sparebank Feb-20 Italy 16 Banca MPS (Banca Monte dei Paschi di Siena) Sep-19 Ecuador 17 Banco Bolivariano Dec-19 Brazil 18 Banco Bradesco S.A. Sep-19 Brazil 19 Banco da Amazônia Jan-20 Argentina 20 Banco de Galicia y Buenos Aires SA Sep-19 Ecuador 21 Banco de la Produccion S.A Produbanco Sep-19 Ecuador 22 Banco de Machala S.A. Sep-19 Mexico 23 Banco del Bajio, S.A. Aug-20 Ecuador 24 Banco Diners Club del Ecuador S.A. Nov-19 Nicaragua 25 Banco Grupo Promerica Nicaragua Sep-19 Ecuador 26 Banco Guayaquil Sep-19 El Salvador 27 Banco Hipotecario de El Salvador S.A. Sep-19 Ecuador 28 Banco Pichincha Sep-19 Dominican Republic 29 Banco Popular Dominicano Sep-19 Costa Rica 30 Banco Promerica Costa Rica Sep-19 Paraguay 31 Banco Regional Jul-20 Spain 32 Banco Sabadell Sep-19 Ecuador 33 Banco Solidario Nov-19 Colombia 34 Bancolombia -

RMA Established As on December 2014.Xls EXBKBDDH Page # 1 RMA ESTABLISHED (EXBKBDDH) As on December 2014 File No

RMA ESTABLISHED (EXBKBDDH) as on December 2014 File No. Country City Name of Bank Swift ID 001 Albania Tirana Banka Kombetare Tregtare SH.A.(CW) NCBAALTX 002 Algeria Algiers BNP Paribas EL Djazair BNPADZAL 003 Algeria Algiers Citibank N.A. CITIDZAL 004 Algeria Algiers Banque De L'Agriculture Et De Developement Rural BADRDZAL 005 Argentina Buenos Aires BNP Paribas - Succursale De Buenos Aires BNPAARBA 006 Argentina Buenos Aires HSBC Bank Argentina SA BACOARBA 007 Argentina Buenos Aires Banco De La Provincia De Buenos Aires PRBAARBA 008 Australia Sydney BNP Paribas SA (CW) BNPAAU2S 009 Australia Sydney Korea Exchange Bank KOEXAU2S 010 Australia CANBERRA AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZBAU2C 011 Australia SYDNEY AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZBAU2S 012 Australia Melbourne Australia and New Zeland Banking Group Limitd (CW) ANZBAU3M 013 Australia BRISBANE AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZBAU4B 014 Australia ADELADE AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZBAU5A 015 Australia Brisbane Suncorp-Metway Limited METWAU4B 016 Australia MELBOURNE NATIONAL AUSTRALIA BANK LIMITED NATAAU33 017 Australia SYDNEY CITIGROUP PTY LIMITED, SYDNEY CITIAU2X 018 Australia MELBOURNE CITIGROUP PTY LIMITED CITIAU3X 019 Australia SYDNEY CITIBANK N.A. CITIAUSX 020 Australia Sydney Bank of America, N. A. BOFAAUSX 021 Australia Sydney HSBC Bank Australia Limited HKBAAU2S 022 Australia SYDNEY JPMORGAN CHASE BANK, N.A. CHASAU2X 023 Austria VIENNA ING BANK N.V., VIENNA BRANCH INGBATWW 024 Austria Vienna Bank Austria Creditanstalt AG (CW) BKAUATWW 025 Austria VIENNA ERSTE GROUP BANK AG GIBAATWG 026 Austria Vienna Erste Bank Der Oesterreichischen Sparkassen AG (CW) GIBAATWW 027 Austria Linz Ober Bank A G OBKLAT2L 028 Austria Vienna Raiffeisenlandesbank Niederoesterreich-Wien AG (CW) RLNWATWW 029 Austria SALZBURG RAIFFEISENVERBAND SALZBURG, REG.GEN.M.B.H. -

Memoria De Responsabilidad Social Empresarial

RSE 2017 MEMORIA DE RESPONSABILIDAD SOCIAL EMPRESARIAL LABORAL Kutxa declara esta Memoria con el nivel exhaustivo en cuanto a la aplicación de GRI Standards de acuerdo a la verificación externa realizada por Aenor. 1. Carta del Presidente ______________________________________________________ 4 2. La gestión socialmente responsable de LABORAL Kutxa __________________________ 7 2.1. COMPROMISOS Y LOGROS RSE EN LABORAL KUTXA _____________________________________ 8 2.2. CUADRO DE MANDO RSE DE LABORAL KUTXA ________________________________________ 12 2.3. INDICADORES BÁSICOS COMPARADOS ________________________________________________ 13 2.4. PERFIL DE LA MEMORIA _________________________________________________________ 15 2.5. MATERIALIDAD _______________________________________________________________ 16 2.6. ENFOQUE DE GESTIÓN __________________________________________________________ 19 2.7. ESTRATEGIA DE LA ENTIDAD Y GESTIÓN DEL RIESGO ______________________________________ 22 3. Organización, estructura de gobierno y participadas ___________________________ 25 3.1. ESTRUCTURA DE LA ENTIDAD ______________________________________________________ 26 ESTRUCTURA ORGANIZATIVA ________________________________________________________________ 26 RETRIBUCIÓN DE LOS ÓRGANOS DE GOBIERNO ____________________________________________________ 28 ESTRUCTURA OPERATIVA __________________________________________________________________ 29 3.2. EMPRESAS PARTICIPADAS ________________________________________________________ 30 3.3. PRINCIPALES MAGNITUDES DE -

THE-MONDRAGON-REPORT.Pdf

The Mondragón Report Published by Praxis Peace Institute Compiled and edited by Georgia Kelly February 2017 www.praxispeace.org 1 Cover design by Leslie Hendin. Book layout by Tom McKean. Copyright © 2017 Praxis Peace Institute All rights reserved. No part of this book may be used or reproduced in any manner without written permission from Praxis Peace Institute., P.O. Box 523, Sonoma, CA 95476. Exceptions to this copyright include page 11, Mondragón's Ten Core Principles and all quotes from Don José María Arizmendiarrieta. 2 Table of Contents Introduction page 5 Corrections and Explanations page 6 The Culture of Mondragón by Georgia Kelly page 7 The Ten Core Principles of the Mondragón Cooperatives Corporation page 11 Essays and Interviews from Participants of the Praxis Mondragón Seminars Christine Mrak page 12 Jo Ann McNerthney page 43 Gayle McLaughlin page 15 Eric Kornacki page 45 Jabari Jones page 19 Marilyn Langlois page 48 Tim Palmer page 21 Derrick Johnson page 50 Mariela Cedeño page 24 John Bloom page 52 Sushil Jacob page 26 Mallory Cochrane page 55 Matthew Keesan page 28 Omar Freilla page 56 Esteban Kelly page 31 Carl Davison page 58 Brian Van Slyke page 35 Phyllis Robinson/ page 63 Mehie Atay Caitlin Quigley page 36 Jihan Gearon page 64 Nancy Berlin page 38 Group Photos of the Seven Mondragón Trips (2008-2016) pages 39-42 Conclusion page 67 3 4 Introduction As of May 2016, Praxis Peace Institute completed its seventh seminar and tour of the Mondragón Cooperatives in the Basque region of Spain. These seminars have had a profound effect on the state of cooperatives in the United States and on the education about cooperatives.