June 2019 Total Term Ten Years

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vol. 84 Wednesday, No. 171 September 4, 2019 Pages 46419

Vol. 84 Wednesday, No. 171 September 4, 2019 Pages 46419–46652 OFFICE OF THE FEDERAL REGISTER VerDate Sep 11 2014 20:59 Sep 03, 2019 Jkt 247001 PO 00000 Frm 00001 Fmt 4710 Sfmt 4710 E:\FR\FM\04SEWS.LOC 04SEWS jbell on DSK3GLQ082PROD with FRONTWS II Federal Register / Vol. 84, No. 171 / Wednesday, September 4, 2019 The FEDERAL REGISTER (ISSN 0097–6326) is published daily, SUBSCRIPTIONS AND COPIES Monday through Friday, except official holidays, by the Office PUBLIC of the Federal Register, National Archives and Records Administration, under the Federal Register Act (44 U.S.C. Ch. 15) Subscriptions: and the regulations of the Administrative Committee of the Federal Paper or fiche 202–512–1800 Register (1 CFR Ch. I). The Superintendent of Documents, U.S. Assistance with public subscriptions 202–512–1806 Government Publishing Office, is the exclusive distributor of the official edition. Periodicals postage is paid at Washington, DC. General online information 202–512–1530; 1–888–293–6498 Single copies/back copies: The FEDERAL REGISTER provides a uniform system for making available to the public regulations and legal notices issued by Paper or fiche 202–512–1800 Federal agencies. These include Presidential proclamations and Assistance with public single copies 1–866–512–1800 Executive Orders, Federal agency documents having general (Toll-Free) applicability and legal effect, documents required to be published FEDERAL AGENCIES by act of Congress, and other Federal agency documents of public Subscriptions: interest. Assistance with Federal agency subscriptions: Documents are on file for public inspection in the Office of the Federal Register the day before they are published, unless the Email [email protected] issuing agency requests earlier filing. -

Buyouts' List of Candidates to Come Back to Market In

32 | BUYOUTS | December 3, 2018 www.buyoutsnews.com COVER STORY Buyouts’ list of candidates to come back to market in 2019 Firm Recent Fund Strategy Vintage Target ($ Amount Raised Year Mln) ($ Mln) Advent International Advent International GPE VII, L.P. Large Buyout 2012 $12,000.00 $13,000.00 Advent International Advent Latin American Private Equity Fund VI, L.P. Mid Buyout 2015 $2,100.00 $2,100.00 American Industrial Partners American Industrial Partners Capital Fund VI LP US MM Buyout 2015 N/A $1,800.00 Apollo Global Management Apollo Investment Fund IX Mega Buyout 2017 $23,500.00 $24,700.00 Aquiline Capital Partners Aquiline Financial Services Fund III Mid Buyout 2015 $1,000.00 $1,100.00 Arlington Capital Partners Arlington Capital Partners IV LP Mid Buyout 2016 $575.00 $700.00 Black Diamond Capital Management BDCM Opportunity Fund IV Turnarounds 2015 $1,500.00 $1,500.00 Blackstone Group Blackstone Real Estate Partners VIII LP Global Real Estate Opp 2015 $4,518.11 $4,518.11 Bunker Hill Capital Bunker Hill Capital II Lower mid market buyout 2011 $250.00 $200.00 CCMP Capital CCMP Capital Investors III, L.P. Buyout/Growth Equity 2014 N/A $1,695.65 Centerbridge Partners Centerbridge Capital Partners III Global Dist Debt Control 2014 $5,750.00 N/A Centerbridge Partners Centerbridge Special Credit Partners III Hedge Fund 2016 $1,500.00 N/A Charlesbank Capital Partners Charlesbank Equity Fund IX, L.P. Mid Buyout 2017 $2,750.00 $2,750.00 Craton Equity Partners Craton Equity Investors II, L.P. -

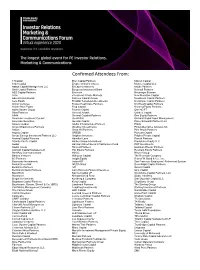

Investor Relations Marketing & Communications Forum

Investor Relations Marketing & Communications Forum Virtual experience 2020 September 2-3 | Available anywhere The largest global event for PE Investor Relations, Marketing & Communications A new virtual experience Customize your agenda Available anywhere Industry leading IR and Mix and match 3 think tank Enjoy the Forum from the marketing content selections, 3 interactive comfort of your home office and The Forum’s in-depth sessions are discussion rooms, 12 breakouts on-demand access for up to 12 designed to help you formulate and panel sessions to your liking months after the event is over effective plans and develop crucial for a personalize event strategies to attract investors experience A new kind of networking Built-in calendar and Networking lounges Gain early access to the attendee automated reminders Explore and meet with industry list and start scheduling 1-to-1 Easily download and sync your service providers to discover the or small group meetings or direct event agenda with preferred latest trends and technologies message fellow attendees in tracks and 1-to-1 meetings to your advance own work calendar Speakers include Marilyn Adler Nicole Adrien Christine Anderson Mary Armstrong Michael Bane Managing Partner Chief Product Officer Senior Managing Senior Vice President, Head of US Investor Mizzen Capital and Global Head of Director, Global Head Global Head of Relations Client Relations of Public Affairs & Marketing and Ardian Oaktree Capital Marketing Communications Blackstone General Atlantic Devin Banerjee Charles Bauer Gina -

Public Investment Memorandum Searchlight Capital II, L.P. Private

COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM Public Investment Memorandum Searchlight Capital II, L.P. Private Debt Commitment James F. Del Gaudio Senior Investment Professional September 22, 2015 COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM Recommendation: Staff, together with Portfolio Advisors, recommends to the Board a commitment of up to $100 million to Searchlight Capital II, L.P. (“Fund II” or the “Fund”). Searchlight Capital Partners, L.P. (“Searchlight” or the “Firm”) is sponsoring the Fund to make value oriented investments in private equity and distressed situations across North America and Europe. Firm Overview: Searchlight was founded in 2010 by Oliver Haarmann, Erol Uzumeri and Eric Zinterhofer (collectively, the "Founding Partners"). At that time, Searchlight established three offices, one in each of New York, London and Toronto. Searchlight completed the final closing of its first fund, Searchlight Capital, L.P. (“Fund I”) in March 2012, with $864 million of committed capital. The Firm has 31 employees; including 18 investment professionals and seven finance, legal and investor relations professionals. The Founding Partners of Searchlight have invested over $6.6 billion during their careers and have over 60 years of collective experience. Prior to co-founding Searchlight, Oliver Haarmann was a senior partner of KKR in London, Erol Uzumeri was the head of Private Equity for the Ontario Teachers’ Pension Plan in Toronto and Eric Zinterhofer was a senior partner at Apollo in New York. Investment Strategy: Searchlight employs a value-oriented investment philosophy which seeks to deliver strong performance across economic cycles. The Fund will pursue private equity and distressed investments in leading North American and European businesses. -

Supplementary Data Supplementary Data 1

Building Long-term Wealth by Investing in Private Companies Annual Report and Accounts 12 Months to 31 January 2021 Supplementary Data Supplementary Data 1 HVPE’s HarbourVest Fund Investments at 31 January 2021 HVPE’s HarbourVest Fund investments and secondary co-investments are profiled below. Financial information at 31 January 2021 for each fund is provided in the Financial Statements of the Company’s Annual Report and Accounts on pages 79 to 82. V = Venture, B = Buyout, O = Other, P = Primary, S = Secondary, D = Direct Co-investment HarbourVest Fund Phase Vintage Year Stage Geography Strategy Investment Phase HIPEP IX Partnership Fund Investment 2020 V, B EUR, AP, RoW P, S, D Secondary Overflow Fund IV Investment 2020 V, B Global S 2020 Global Fund Investment 2020 V, B, O Global P, S, D HarbourVest Real Assets IV Investment 2019 O Global S HarbourVest Credit Opportunities Fund II Investment 2019 O US D Dover Street X Investment 2019 V, B Global S HarbourVest 2019 Global Fund Investment 2019 V, B, O Global P, S, D HarbourVest Partners Co-Investment V Investment 2018 V, B, O Global D HarbourVest Adelaide Investment 2018 O US, EUR, RoW S, D HarbourVest 2018 Global Fund Investment 2018 V, B, O Global P, S, D HarbourVest Partners XI Venture Investment 2018 V US P, S, D HarbourVest Partners XI Micro Buyout Investment 2018 B US P, S, D HarbourVest Partners XI Buyout Investment 2018 B US P, S, D HIPEP VIII Asia Pacific Fund Investment 2017 V, B AP P, S, D HarbourVest 2017 Global Fund Investment 2017 V, B, O Global P, S, D HIPEP VIII Partnership -

ILPA Releases Second Report in Diversity in Action Series

ILPA Releases Second Report in Diversity in Action Series Diversity in Action – Sharing Our Progress Report Details the Initiative’s Growth and Insights Into Integrating DEI Into Investment Strategies 1776 Eye St. NW August 31, 2021 (Washington, D.C.) The Institutional Limited Partners Association (ILPA) today released the Suite 525 second report in its Diversity in Action – Sharing Our Progress series. The report series is an extension of ILPA’s Washington, DC Diversity in Action initiative and aims to provide actionable recommendations on steps that can be taken to 20006 improve diversity, equity and inclusion in private markets. “The industry continues to respond positively to the Diversity in Action Initiative with new signatories joining every week,” said Steve Nelson, CEO of ILPA. “The Initiative now claims 180 signatories who have all been incredibly active in conversations with one another and have acted as tremendous partners to ILPA on our related work, having meaningfully contributed to our updated ILPA Diversity Metrics Template.” The Diversity in Action – Sharing Our Progress report series tracks the evolution of Initiative signatories by geography, strategy and fund size as well as progress on adoption of all the actions within the Framework. As of August 2021, the Initiative’s geographic reach is increasing, now with 38 signatories outside North America, a 52% increase in this cohort since April. The latest report focuses on how signatories are integrating diversity, equity and inclusion into investment strategies including -

Investment Vendors

INVESTMENT VENDORS The following is a listing of the investment managers, custodians, and consultants that serve the Massachusetts public pension systems. The listing is based on information supplied by the retirement boards. Retirement Investment Vendors Board Adams • PRIT Amesbury • PRIT Andover • PRIT • RhumbLine Advisers Consultant: Dahab Associates Arlington • PRIT Custodian: People’s United Bank Attleboro • Amalgated Bank • Hancock Timber Resource Group, Inc. • PRIT Custodian: People’s United Bank • BTG Pactual Timberland Investment Group • Intercontinental Real Estate Corp. • RhumbLine Advisers Consultant: Dahab Associates Inc. • Copeland Capital Management • Invesco Core Real Estate USA, LP • State Street Global Advisors • Fidelity Institutional Asset Management • Invesco National Trust Company • Van Eck • Frontier Capital Management Co., LLC • Peregrine Capital Barnstable County • PRIT Belmont • AEW Capital Management, LP • HarbourVest Partners, LLC • PRIT Custodian: People’s United Bank • Atlanta Capital • Loomis, Sayles & Company • RhumbLine Advisers Consultant: NEPC, LLC • Carillion Tower Advisors • Pacific Investment Management Company, LLC • Rothschild Asset Management Inc. Berkshire County • PRIT Beverly • PRIT Blue Hills Regional • PRIT Boston (City) • 57 Stars, LLC • EnTrust Global Partners • Polunin Capital Partners • AEW Capital Management, LP • Goldentree Asset Management, LP • Prudential Capital Partners Custodian: State Street Bank & Trust • Alcentra NY, LLC • Grosvenor Capital Management, LP • Prudential -

Confirmed Attendees From

Confirmed Attendees From: 17Capital Eller Capital Partners Mizzen Capital 1843 Capital Empire Global Ventures Monroe Capital LLC Abbott Capital Management LLC EnCap Investments Nautic Partners Abris Capital Partners European Investment Bank Nebrodi Partners ABS Capital Partners Evercore Neuberger Berman Actis eVestment Private Markets New Mountain Capital Advent International Fairview Capital Group NewQuest Capital Partners Aero Equity Franklin Templeton Investments Nonantum Capital Partners Alcion Ventures Frazier Healthcare Partners Northleaf Capital Partners Allianz Real Estate Frog Capital Norwest Equity Partners Alpha Square Group Frontier Capital Oak HC/FT Altas Partners General Atlantic Oaktree Capital AIMA General Catalyst Partners One Equity Partners American Investment Council GenNx360 Orchard Global Asset Management American Securities Genstar Capital Paine Schwartz Partners LLC Angelo Gordon Global Infrastructure Partners Patria Arcus Infrastructure Partners Goodwell Investments Pictet Alternative Advisors SA Ardian Great Hill Partners Pine Brook Partners Argosy Capital GRESB Pomona Capital Arroyo Energy Investment Partners LLC Gryphon Investors Pritzker Private Capital Arsenal Capital Partners Hamilton Lane Prosek Partners Atlantic-Pacific Capital Harbor Group International Providence Equity LLC Audax Harrison Street Social Infrastructure Fund PSP Investments Audax Group Harvest Partners Quantum Energy Partners Azimuth Capital Management HCI Equity Partners Resmark Equity Partners BackBay Communications HGGC Rhone Group Battery -

Alumni Report

Alumni Career Plans Report Huntsman alumni hail from across the U.S. and around the world, but what defines them is their international perspective. They share an eagerness to learn about languages, cultures and ideas different from their own—qualities that subsequently distinguish them as leaders in a variety of fields in the private, public and non-profit sectors. Huntsman graduates pursue careers around the world in diverse areas such as finance, consulting, politics, public policy, law, marketing, medicine, diplomacy, non-profit management, public health, international development, and technology, and many are entrepreneurs. Huntsman alumni have become Rhodes, Marshall and Fulbright Scholars, and many attend graduate and professional school, usually after a few years of work. Soon after the program held its 20th anniversary, in 2019 we surveyed all Huntsman alumni to learn about their career paths and how their time in the Huntsman Program and at Penn and Wharton shaped their careers. This report presents data on alumni career plans up to five, 10, 15, and 20 years after graduation, including transitions from their first jobs and changes over time leading up to their current roles, as well as graduate or professional school attainment. Over 460 alumni completed the survey, for a 56% response rate, helping us share a comprehensive overview of the wide range of career paths and professional accomplishments Huntsman alumni pursue, and their global impact. Report Contents Report Highlights Industry Breakdown Graduate and Professional -

FKR2373 SI INTER 2015.Indd

15th Annual Fundraising Summit: 17 November 2015 Private Debt Summit: 17 November 2015 Secondaries Summit: 17 November 2015 Main Conference: 18 – 20 November 2015 Hotel Okura, Amsterdam www.icbi-superinvestor.com • 900+ Key Private Equity Professionals • 300+ Powerful Global LPs • 3 Invaluable Summits The World’s Largest Private Equity LP/GP Networking Event David Rubenstein Jim Fasano Allen MacDonell Jan Janshen Tim Jenkinson Josh Lerner Jim Coulter John Hulsman THE CARLYLE CANADA PENSION TEACHER ADVENT SAID BUSINESS HARVARD BUSINESS TPG US COUNCIL GROUP PLAN INVESTMENT RETIREMENT INTERNATIONAL SCHOOL, OXFORD SCHOOL ON FOREIGN BOARD SYSTEM OF TEXAS UNIVERSITY RELATIONS www.icbi-superinvestor.com Tel: +44 (0) 20 7017 7200 Email: [email protected] Meet our Supporters Principal Law Firm Sponsor: Co-Sponsors: Associate Sponsors: RAISE YOUR PROFILE Opportunities remain to become an event supporter. Whether you are looking to network with key prospects, raise your brand awareness or promote your expertise in front of the 900+ SuperInvestor audience we can tailor a package to suit your goals. For more information, and a bespoke proposal, do not hesitate to reach out. Contact me on: [email protected] +44 (0) 20 7017 7219 2 www.icbi-superinvestor.com Tel: +44 (0) 20 7017 7200 Email: [email protected] Free for pension Contents event schedule funds, endowments, foundations, SWFs & ILPA members. Email Pg2 Meet Our Supporters Tuesday 17 November 2015 laura.griffi [email protected] Pg3 Contents & Event Schedule • The Private Debt Summit to apply -

PUBLIC NOTICE Federal Communications Commission 445 12Th St., S.W

PUBLIC NOTICE Federal Communications Commission 445 12th St., S.W. News Media Information 202 / 418-0500 Internet: https://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 DA No. 20-488 Released: May 5, 2020 MEDIA BUREAU ANNOUNCES FILING OF PETITION FOR DECLARATORY RULING BY UNIVISION HOLDINGS, INC. MB Docket No. 20-122 Comment Date: June 4, 2020 Reply Date: June 19, 2020 Univision Holdings, Inc. (Univision), the indirect parent of subsidiaries that hold broadcast television, radio, and other Commission licenses, has filed a petition for declaratory ruling1 (Petition) asking the Federal Communications Commission (Commission) to allow it to accept foreign investment in excess of the 25% benchmark set forth in section 310(b)(4) of the Communications Act of 1934, as amended (the Act).2 Specifically, Univision seeks Commission authorization for foreign investors to own up to 100% of its voting and equity interests, as well as specific approval3 for certain foreign investors that seek to hold directly or indirectly more than 10% of the company’s equity interests and/or hold equity interests that would cause them to be deemed to hold more than 10% of Univision’s voting rights.4 1 47 CFR § 1.5000 et seq. Concurrently with the filing of the present Petition, on March 25, 2020, Searchlight III UTD, L.P., ForgeLight (United) Investors, LLC, and Grupo Televisa, S.A.B., as the Transferees along with Madison Dearborn Partners, Providence Equity Partners, TPG, Thomas H. Lee Partners, and Saban Capital Group as the Transferors (collectively, the Applicants) filed applications with the Federal Communications Commission seeking consent to the transfer of control of broadcast radio and television station licenses held by indirect, wholly-owned subsidiaries of Univision. -

Growth Capital Investor

Growth Capital Investor Vol. I Issue 5 The Journal of Emerging Growth Company Finance September 17, 2012 IN THIS ISSUE Emerging Growth Issuers Largely Muddy Solicitation Proposal Takes Wind Out of Crowdfunders Immune to Broad Market Sentiment The SEC’s proposed rules on general solicitation of investments draws jeers from the crowd cap- by Joe Gose italists ..............................................................2 or all the focus being placed on boosting small business to create jobs and NIR Group Investors Faced fuel an economic recovery, emerging growth companies struggling to find with 97% Loss Ftraction in the public markets. Investors in beleaguered PIPE fund manager received As a group, small issuers that have conducted private placements over the last harsh news last week ............................................3 several months have generally lagged the stock market’s rise over the last year – the PIPE Player Rodman Dow Jones Industrial Average Index has risen 20% – suggesting that the firms are Closes Banking Business less influenced by broad market sentiment. The long-time most active banker in the PIPE market But exactly how far out of whack is the performance of small private place- closes its doors .......................................................4 ment issuers with the rest of the market? Growth Capital Investor reviewed equity ALSO INSIDE private placement (EPP) activity from June 1, 2011 through May 30, 2012, using Direct Markets Investor Pared Holdings Ahead of Sagient Research’s PlacementTracker database. News; Internal Fixation Accused of Manipulation, The analysis focused on growth equity private placements (GEPPs): unregis- Misleading Reporting; China Hydroelectric Sues tered and registered common stock sales, rights offerings, fixed-price convertible Dissidents in Value Fracas; Fairfax Financial Shorting issuances, and non-convertible debt and preferred stock sales, issued at fixed-price Case Tossed; SEC Suspends Shell Accountant Hatfield; issuance and conversion terms.