Blackberry Breakdown

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Blackberry Storm 9500 Smartphone MAT-23037-001 | PRINTSPEC-016 SWD-468881-1111095918-001 | RCC51UW Contents

Getting Started Guide BlackBerry Storm 9500 Smartphone MAT-23037-001 | PRINTSPEC-016 SWD-468881-1111095918-001 | RCC51UW Contents Welcome to BlackBerry!...............................................................................................................................3 Set up your device.........................................................................................................................................5 Insert the SIM card and battery .........................................................................................................................5 Charge the battery................................................................................................................................................7 Complete the setup wizard.................................................................................................................................9 Learn the basics........................................................................................................................................... 13 Move around the screen ....................................................................................................................................14 Applications..........................................................................................................................................................14 Move between screens.......................................................................................................................................16 Open -

Hearing Aid Compatibility with Blackberry Smartphones

Hearing Aid Compatibility with BlackBerry Smartphones About hearing aid compatibility Several BlackBerry smartphones have received certification from the United States Federal Communications Commission (FCC) stating that the smartphones meet the hearing aid compatibility requirements. BlackBerry smartphones rated M3 or M4 meet FCC requirements and are likely to generate less interference with hearing devices than wireless devices that are not rated. M4 is the higher of the two ratings. BlackBerry smartphones rated T3 or T4 meet FCC requirements and are likely to be more compatible with a hearing device's telecoil (T-coil, T Switch, or Telephone Switch) than wireless devices that are not rated. T4 is the higher of the two ratings. Not all hearing devices have telecoils in them. Results might vary depending on the hearing device and the degree of hearing loss. If your hearing device is vulnerable to interference, you might not be able to use a rated wireless device successfully. The best way to evaluate compatibility of your hearing device and a rated wireless device is to test the devices together and consult with your hearing health professional. For more information about hearing aid compatibility, see the Description of Hearing Aid Compliance Ratings booklet at http://www.blackberry.com/accessibility. Hearing aid compatibility ratings The following table lists BlackBerry smartphones rated for hearing aid compatibility and their respective M and T ratings. Note: M and T compatibility ratings apply only to cellular bands. Smartphone Wi-Fi -

Blackberry Storm 9530 Smartphone LANG-001 | PRINTSPEC-016 SWD-595321-1112074336-001 | RBW71CW Contents

Getting Started Guide BlackBerry Storm 9530 Smartphone LANG-001 | PRINTSPEC-016 SWD-595321-1112074336-001 | RBW71CW Contents Welcome to BlackBerry!...............................................................................................................................3 Set up your device.........................................................................................................................................5 Insert the battery..................................................................................................................................................5 Charge the battery...............................................................................................................................................6 Complete the setup wizard..................................................................................................................................8 Learn the basics............................................................................................................................................11 Move around the screen ....................................................................................................................................12 Applications..........................................................................................................................................................12 Move between screens.......................................................................................................................................14 -

Blackberry Theme Studio Version: 6.0

BlackBerry Theme Studio Version: 6.0 Release Notes Published: 2011-05-19 SWD-1247392-0519083318-001 Contents 1 New in this release............................................................................................................................................ 2 2 Fixed in this release.......................................................................................................................................... 5 3 Known Issues.................................................................................................................................................... 6 4 Legal notice....................................................................................................................................................... 11 Release Notes New in this release New in this release 1 The following is a list of features for the BlackBerry® Theme Studio. Feature Description Enhanced UI The BlackBerry Theme Builder features a more intuitive UI that includes descriptive labels in order to make it easier to identify the element that you want to change. You can click on any object on the preview area of the canvas and make changes directly to the object. Support for new BlackBerry devices You can create themes for the following BlackBerry devices that are running BlackBerry® 6: • BlackBerry® Bold™ 9780 smartphone • BlackBerry® Bold™ 9700 smartphone • BlackBerry® Bold™ 9650 smartphone • BlackBerry® Curve™ 9300 smartphone • BlackBerry® Curve™ 9330 smartphone • BlackBerry® Pearl™ 9100 Series smartphone • BlackBerry® -

TTY Support on Blackberry Smartphones

TTY Support on BlackBerry Smartphones About TTY support When you turn on TTY (teletype) support and you connect your BlackBerry smartphone to a TTY device that operates at 45.45 bps, you can make calls to and receive calls from TTY devices. Your BlackBerry smartphone is designed to convert received calls to text that you can read on your TTY device. Your TTY device must have an audio connector. If your TTY device is designed for use with a 2.5-mm headset jack, or if your TTY device has an RJ-11 connector (phone plug), you must use an adapter accessory to connect your TTY device to your BlackBerry smartphone. To get an adapter accessory that BlackBerry has approved for use with your BlackBerry smartphone, visit http:// www.shopblackberry.com. Depending on your wireless service provider or wireless coverage area, TTY support might not be available. This feature is not supported over a Wi-Fi connection. For more information, contact your wireless service provider. Compatible BlackBerry smartphones The following BlackBerry smartphones are capable of communicating with TTY devices. • BlackBerry Classic SQC100-2 smartphone • BlackBerry Classic SQC100-3 smartphone • BlackBerry Classic SQC100-4 smartphone • BlackBerry Classic SQC100-5 smartphone • BlackBerry Leap STR100-2 smartphone • BlackBerry Passport SQW100-1 smartphone • BlackBerry Passport SQW100-3 smartphone • BlackBerry Passport Silver Edition SQW100-4 smartphone • DTEK50 STH100-1 smartphone • DTEK60 BBA100-1 smartphone • PRIV STV100-1 smartphone • PRIV STV100-2 smartphone The following BlackBerry smartphones are capable of communicating with TTY devices. Although these BlackBerry smartphones are no longer in production, they might still be available from some resellers. -

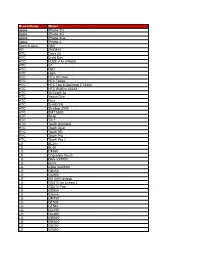

BT IOP Status Report (20110307)

Brand Name Model Apple iPhone 2G Apple iPhone 3G Apple iPhone 3Gs Apple iPhone 4 Garmin asus G60 HP iPAD912 HTC Dash 3G HTC Droid Eris HTC FUZE (TM ) P4600 HTC G1 HTC HD2 HTC Hero HTC HTC HD mini HTC HTC Tattoo HTC HTC Touch Diamond 2 T5353 HTC HTC Wildfire A3333 HTC MyTouch 3g HTC Nexus One HTC Pure HTC SHADOW HTC Shadow 2009 HTC SMT 5800 HTC Snap HTC Tilt 2 HTC Touch Diamond HTC Touch Dual HTC Touch HD HTC Touch Pro HTC Touch Pro 2 LG BL20v LG BL40 LG CF360 LG Chocolate Touch LG Dare VX9700 LG enV3 LG eXpo (GW820) LG GB250 LG GC900 LG GD 580 Lollipop LG GD310 Ice Cream 2 LG GD510 Pop LG GD900 LG Glance LG GM750 LG GT505 LG GT540 LG GU230 LG GU285 LG GW520 LG GW620 LG GX200 LG GX500 LG INCITE LG KC910 LG KM555 LG KM900 LG KP275 LG KP500 LG KS360 LG Lotus LX600 LG LX290 LG LX370 LG Neon (TM ) GT365 LG Rumor 2 LG Scoop / AX-260 LG Shine 2 LG Shine II GD710 AT&T LG Shine KE970 LG Versa LG Voyager VX10000 LG VX5500 LG VX8360 LG VX8610 LG Xenon (TM ) GR500 LG LX400 Moto Backflip ME600 Moto EM35 Moto Z9N Motorola Cliq Motorola Clutch (i465) Motorola Droid Motorola E1 Motorola E1070 Motorola E398 Motorola E8 Motorola EM30 Motorola i365 Motorola i576 Motorola i776 Motorola I9 Motorola K3 Motorola Karma QA1 Motorola MOTO (TM ) Z9 Motorola Q11 Motorola Q9H Motorola RAZR V3 Motorola RAZR V3xx Pink Motorola RAZR2 V9 Motorola Rival Motorola SLVR L72 Motorola U9 Motorola V1100 Motorola V360 Motorola V365 Motorola V3i Motorola V3x Motorola V500 Motorola V550 Motorola V551 Motorola V6 Motorola V750 Motorola V80 Motorola V860 Motorola V9 Motorola V950 -

Supported Media Types on Blackberry Smartphones

Supported Media Types on BlackBerry Smartphones 711-01774-123 v2.0 © 2009 Research In Motion Limited. All rights reserved. BlackBerry®, RIM®, Research In Motion®, SurePress™, SureType® and related trademarks, names and logos are the property of Research In Motion Limited and are registered and/or used in the U.S. and countries around the world. Windows Media is a trademark of Microsoft Corporation. All other trademarks are the property of their respective owners. The BlackBerry smartphone and other devices and/or associated software are protected by copyright, international treaties, and various patents, including one or more of the following U.S. patents: 6,278,442; 6,271,605; 6,219,694; 6,075,470; 6,073,318; D445,428; D433,460; D416,256. Other patents are registered or pending in the U.S. and in various countries around the world. Visit www.rim.com/patents for a list of RIM (as hereinafter defined) patents. This documentation including all documentation incorporated by reference herein such as those provided or made available by hyperlink is provided or made accessible “AS IS” and “AS AVAILABLE” and without condition, endorsement, guarantee, representation or warranty of any kind by Research In Motion Limited and its affiliated companies (“RIM”) and RIM assumes no responsibility for any typographical, technical, or other inaccuracies, errors or omissions in this documentation. In order to protect RIM proprietary and confidential information and/or trade secrets, this documentation may describe some aspects of RIM technology in generalized terms. RIM reserves the right to periodically change information that is contained in this documentation; however, RIM makes no commitment to provide any such changes, updates, enhancements, or other additions to this documentation to you in a timely manner or at all. -

A Playbook for Fighting Apple and Google

SPECIAL REPORT A PLAYBOOK FOR FIGHTING APPLE AND GOOGLE With its new tablet computer, RIM has a small window of opportunity to reinvigorate itself and match the momentum of its rivals. REUTERS/ROBert GALBRAITH BY ALAstAIR SHARP its way -- if not quite its throne. millions of its workaholic devices each WATERLOO, ONtario, MARCH 15 Research In Motion is holding on to profit quarter to a growing global audience. growth and impressive margins. For all But the attention of investors, analysts NCE UPON A TIME, BlackBerry was the consumer appeal of Apple products, and developers is drifting elsewhere and king. Then came the iPhone, followed BlackBerry is still dominant in corporate the Canadian company, in the midst of byO Android. And BlackBerry seemingly lost mobile communications and RIM sells a major platform and product transition, MARCH 2011 RIM MARCH 2011 is seen possessing but a small window of opportunity to reinvigorate itself and match Research In Motion and its peers the momentum of rival mobile monarchs Apple and Google. RIM valuation limited by expectation of slowing earnings. The PlayBook tablet computer, due to Research In Motion Apple Google Nokia launch within weeks after a six-month pitch, Share price performance – percent Forward P/E ratio is RIM’s first product to use an industrial- 400 50 strength operating system based on QNX, a powerhouse microkernel (rather than the 300 40 typical monolithic kernel) which RIM bought last year and aims to incorporate into its future smartphones. 200 30 QNX -- which also runs nuclear power plants, medical instrumentation and Cisco’s 100 20 core Internet routers -- is the brains behind many of the infotainment systems shipping in new cars, and RIM plans seamless interaction 0 10 08/03/1 between those dashboards, its PlayBook and 1 its range of BlackBerry smartphones. -

Blackberry Storm 9500 Smartphone Version: 4.7

BlackBerry Storm 9500 Smartphone Version: 4.7 User Guide To find the latest user guides, visit www.blackberry.com/docs/smartphones. SWD-491985-0820043944-001 Contents Shortcuts..................................................................................................................................................................................................................................................... 8 BlackBerry basics shortcuts...................................................................................................................................................................................................................... 8 Phone shortcuts.......................................................................................................................................................................................................................................... 8 Camera shortcuts....................................................................................................................................................................................................................................... 8 Media shortcuts.......................................................................................................................................................................................................................................... 8 Typing shortcuts........................................................................................................................................................................................................................................ -

Blackberry Storm 9530 Smartphone

User Guide BlackBerry Storm 9530 Smartphone Version: 4.7 SWD-490426-0909090640-001 Contents Shortcuts....................................................................................................................................................................................................................................... 9 BlackBerry basics shortcuts................................................................................................................................................................................................................. 9 Phone shortcuts..................................................................................................................................................................................................................................... 9 Camera shortcuts................................................................................................................................................................................................................................... 9 Media shortcuts...................................................................................................................................................................................................................................... 9 Typing shortcuts.................................................................................................................................................................................................................................... -

Why the Iphone Won't Last Forever and What The

WHY THE IPHONE WON’T LAST FOREVER AND WHAT THE GOVERNMENT SHOULD DO TO PROMOTE ITS SUCCESSOR ROBERT HAHN* AND HAL J. SINGER** INTRODUCTION ................................................................................... 314 I. A BRIEF ECONOMIC HISTORY OF DISRUPTIVE REVOLUTIONS IN THE HANDSET MARKET ........................... 317 A. Innovative Handsets From the Last Two Decades .................. 317 B. Market Dynamics: Share Changes Among Handset Makers Around the Introduction of the Iconic Device .......................... 326 1. Smartphone Segment .................................................... 326 2. Other Segments of the Handset Market ...................... 329 II. WHAT MAKES THE IPHONE SPECIAL YET NOT A MUST- HAVE INPUT FOR WIRELESS CARRIERS? ................................ 331 A. Identifying the Key Attributes of the iPhone ........................... 333 B. Are Those Attributes Currently Offered By Rival Smartphones—And if Not, Will They Soon Be Replicated or Superseded? ........................................................................... 333 C. Even the Best Device Makers, Including Apple, Stumble at Times ................................................................................... 336 III. THE ROLE OF EXCLUSIVE AGREEMENTS IN PROMOTING INNOVATION IN THE HANDSET MARKET IN THE UNITED STATES ....................................................................................... 337 A. Procompetitive Motivations for Exclusive Handset Contracts ............................................................................. -

Mini-Case Study: the Downfall of Blackberry Ali Moussi Universteit Van Amsterdam 6068324 [email protected]

Mini-Case study: The downfall of Blackberry Ali Moussi Universteit van Amsterdam 6068324 [email protected] continuously take losses, while section 3 expands on the 1. INTRODUCTION influence of management which allows such losses to In 1984 Research In Motion (RIM), later renamed Blackberry continuously happen. was founded. The company designed complex wireless data connection networks which were used by the police forces, military, ambulance services and such. Following rapid growth 2. INNOVATIVE COMPETITION AND and innovation, RIM developed a revolutionary pager, a device CYCLIC ADAPTATION MISALIGNMENT that can be used to send and receive messages which used their In the period 1984 to 2007 Blackberry was extremely successful communication technologies. Soon, this ‘personal in their launches of innovative products and services. During communicator’ was labelled as the next big thing. The this period we can see a clear pattern in the adaptive cycle of Inter@active was deployed in 1996 as RIM’s first handheld Blackberry. Their secure data connection networks where communication device. In the next years, RIM continued a exploited, and conserved which made the company a key player steady line of innovations and improved the handheld in enterprise communication. Soon, these technologies where communication device greatly. By 1999, RIM launched the ‘released’ and through innovation and reorganization their Blackberry rebranded devices and email services which allowed products where significantly improved, even new products were users to sync their devices with corporate email systems. introduced like the pager, and the BBM messenger service for Demand exploded, innovation continued. Blackberry became the consumers. A cycle that Blackberry used to steadily improved iconic in enterprise communication while their Blackberry their mobile communication businesses.