Real Estate Spotlight

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sangeeta Bhatia, Retirement Plan Manager Subject: Board Agenda Item

CITY OF LOS ANGELES DEPARTMENT OF WATER AND POWER INTERDEPARTMENTAL CORRESPONDENCE Date: August 18, 2010 To: Retirement Board Members From4?Sangeeta Bhatia, Retirement Plan Manager Subject: Board Agenda Item No.9: Presentation of New Investment Opportunities by Courtland Partners; Discussion and Possible Action (August 25, 2010, Regular Retirement Board Meeting) Representatives from Courtland Partners, the Plan's real estate consultant, are presenting two investment opportunities for the Retirement Fund and the Retiree Health Benefits Fund. Presentation material from Courtland and from Lone Star Funds is enclosed. Also enclosed are two resolutions to approve the investments, should the Board decide to do so. SB:jae 9.1 RESOLUTION NO. 11-16 RESOLUTION TO INVEST IN LONE STAR FUND VII WHEREAS, the Board of Administration (Board) for the Water and Power Employees' Retirement Plan (Plan) previouslyadopted a 5% allocation to the Real Estate asset class for the Retirement Fund (RF) and the Retiree Health Benefits Fund (RHBF) at the regular Board meeting held on January 16, 2008 (Board Resolution No. 08-49); and WHEREAS, representatives from Courtland Partners, the Plan's real estate consultant, recommend a total commitment of up to $10 million ($9 million from the RF and $1 million from the RHBF) to Lone Star Fund VII (Lone Star VII), a closed end commingled fund focused on opportunistic real estate and debt/loan investments; and WHEREAS, the final closing for Lone Star VII is anticipated to be in the Fall of 2010. NOW, THEREFORE, BE IT RESOLVED, the Retirement Plan Manager is hereby authorized to prepare and submit subscription documents for Lone Star VII pending legal review, and if the subscription documents are accepted by Lone Star, to proceed with the implementation of funding a commitment up to $10 million ($9 million from the RF and $1 million from the RHBF). -

3/9/2016 Regular Meeting

Oregon Investment Council March 9, 2016 - 9:00 AM PERS Headquarters 11410 S.W. 68th Parkway Tigard, OR 97223 Katy Durant Chair John Skjervem Chief Investment Officer Ted Wheeler State Treasurer OREGON INVESTMENT COUNCIL Agenda March 9, 2016 9:00 AM PERS Headquarters 11410 S.W. 68th Parkway Tigard, OR 97223 Time A. Action Items Presenter Tab 9:00-9:05 1. Review & Approval of Minutes Katy Durant 1 February 3, 2016 OIC Chair Committee Reports John Skjervem Chief Investment Officer 9:05-9:50 2. Lone Star Real Estate Fund V Tony Breault 2 OPERF Real Estate Portfolio Senior Investment Officer Austin Carmichael Investment Officer John Grayken CEO and Founder Nick Beevers Managing Director Christy Fields Pension Consulting Alliance 9:50-10:35 3. Brookfield Infrastructure Fund III, LP Ben Mahon 3 OPERF Alternatives Portfolio Senior Investment Officer Sam Pollock Senior Managing Partner & CEO, Infrastructure Group Chris Harris Senior Vice President, Client Relations Tom Martin TorreyCove 10:35-10:45 -------------------- BREAK -------------------- Katy Durant Rukaiyah Adams Rex Kim John Russell Ted Wheeler Steve Rodeman Chair Vice Chair Member Member State Treasurer PERS Director OIC Meeting Agenda March 9, 2016 Page 2 10:45-10:55 4. OPERF Real Estate Portfolio Tony Breault 4 Policy and Benchmark Update Christy Fields David Glickman Pension Consulting Alliance 10:55-11:05 5. Oregon Local Government Intermediate Fund Tom Lofton 5 Policy Update Investment Officer Kristin Dennis OST Legislative Director B. Information Items 11:05-11:25 6. OPERF Q4 2015 Performance & Risk Report Karl Cheng 6 Investment Officer Janet Becker-Wold Callan Uvan Tseng Callan Alan McKenzie Blackrock Tony Vorlicek Blackrock 11:25-11:45 7. -

Structured Finance

Financial Institutions U.S.A. Investcorp Bank B.S.C. Full Rating Report Ratings Key Rating Drivers Investcorp Bank B.S.C. Strong Gulf Franchise: The ratings of Investcorp B.S.C. (Investcorp, or the company) reflect Long-Term IDR BB Short-Term IDR B the company’s strong client franchise in the Gulf, established track record in private equity (PE) Viability Rating bb and commercial real estate investment, strong capital levels and solid funding profile. Rating constraints include sizable balance sheet co-investments and potential earnings volatility and Investcorp S.A. Investcorp Capital Ltd. placement risks presented by the business model, which could pressure interest coverage. Long-Term IDR BB Short-Term IDR B Gulf Institutional Owners Positive: The Positive Rating Outlook reflects franchise and Senior Unsecured Debt BB earnings benefits that may accrue to Investcorp from the 20% strategic equity stake sale to Support Rating Floor NF Mubadala Development Co. (Mubadala) in March 2017, a sovereign wealth fund of Abu Dhabi. This follows a 9.99% equity stake sale to another Gulf-based institution in 2015. Fitch Ratings Rating Outlook Positive views these transactions favorably, as the relationships may give Investcorp expanded access to potential new investors as well as a more stable equity base. 3i Business Diversifies AUM: The cash-funded acquisition of 3i Debt Management (3iDM) in March 2017 added $10.8 billion in AUM and is expected to be accretive for Investcorp, adding Financial Data stable management fee income. However, the acquired co-investment assets and ongoing risk Investcorp Bank B.S.C. retention requirements do increase Investcorp’s balance sheet risk exposure. -

Dear Fellow Shareholders

Dear Fellow Shareholders: At Evercore, we aspire to be the most respected independent investment banking advi- sory firm globally. Our overarching objective is to help a growing base of clients achieve superior results through trusted independent and innovative advice, provided by excep- tional professionals who bring to our clients diverse perspectives and experiences. Our clients include multinational corporations, financial sponsors, institutional investors, sov- ereign wealth funds, and wealthy individuals and family offices. Achieving this objective requires that we steadily build our team by recruiting the best, from those beginning their professional careers to veterans with decades of experience. We are deliberate in selecting and developing the members of our team, seeking to attract individuals who share our Core Values: Client Focus, Integrity, Excellence, Respect, Investment in People and Partnership. Our values are the defining elements of our culture, telling our clients and current and future generations of partners and employees what they can expect from our firm. Realizing our aspiration also requires that we deliver attractive financial results over time. Strong financial results create the opportunity to invest and grow, enabling us to serve more clients and enhance the range of services we offer. The environment for our business was generally favorable in 2017, providing both good opportunities and a few challenges: • Advisory Services: Demand for strategic corporate and capital markets advisory services remains strong. The appeal of purely independent, unconflicted advice continues to grow and the opportunities and challenges facing our clients are broad, as economic conditions, globalization, technology and regulation drive strategic change. We believe that we are well positioned here. -

Sovereign Wealth Funds As Sustainability Instruments? Disclosure of Sustainability Criteria in Worldwide Comparison

sustainability Article Sovereign Wealth Funds as Sustainability Instruments? Disclosure of Sustainability Criteria in Worldwide Comparison Stefan Wurster * and Steffen Johannes Schlosser TUM School of Governance, Technical University Munich, 80333 Munich, Germany * Correspondence: [email protected] Abstract: Sovereign wealth funds (SWFs) are state-owned investment vehicles intended to pursue national objectives. Their nature as long-term investors combined with their political mandate could make SWFs an instrument suited to promote sustainability. As an essential precondition, it is important for SWFs to commit to sustainability criteria as part of an overarching strategy. In the article, we present the sustainability disclosure index (SDI), an original new dataset for a selection of over 50 SWFs to investigate whether SWFs disclose sustainability criteria covering environmental, social, economic, and governance aspects into their mandate. In addition to an empirical measurement of the disclosure rate, we conduct multiple regressions to analyze what factors help to explain the variance between SWFs. We see that a majority of SWFs disclose at least some of the sustainability criteria. However, until today, only a small minority address a broad selection as a possible basis for a comprehensive sustainability strategy. While a high-state capacity and a young population in a country as well as a commitment to the international Santiago Principles are positively associated with a higher disclosure rate, we find no evidence for strong effects of the economic development level, the resource abundance, and the degree of democratization of a country or of the specific size and structure of a fund. Identifying favorable conditions for a higher commitment of SWFs could Citation: Wurster, S.; Schlosser, S.J. -

Did Lone Star Funds Buy a Loan Shark?*

December 2014 A report by UNITE HERE Contact: Elliott Mallen [email protected] 312-656-5807 Did Lone Star Funds buy a Loan Shark?* As institutional capital flows into private debt at a record pace, is Lone Star Funds’ acquisition of payday lender DFC Global outside of investors’ comfort zones? As banks and other traditional fnancial institutions globally have been required to strengthen their balance sheets following the fnancial crisis and subsequent regulatory changes, a growing number of fund managers and a wave of institutional capital have sought to fll the gap. Data provider Preqin Ltd. reported that private debt funds had raised a total of $77 billion in 2013.1 At the same time, an improving economy and a decline in corporate defaults has meant that distressed debt managers have had to search harder for deals.2 Lone Star Funds, a Texas-based institutional investment manager, has pursued a strategy of buying up distressed residential and corporate debt.3 As of September 2014, Lone Star topped the PDI 30 ranking of private debt investors.4 In July 2014, Lone Star closed its Lone Star Fund IX at $7.3 billion.5 But as Lone Star looks to deploy this capital as well as its $7 billion Lone Star Real Estate Fund III (closed October 2013), the manager’s April 2014 $1.3 billion acquisition of payday lender and pawnshop operator DFC Global raises questions about whether the current scarcity of distressed deals has forced Lone Star to look for deals in places outside of some of its LPs’ comfort zones. -

Private Equity

Kuwait Financial Centre “Markaz” P R I V A T E E Q U I T Y U P D A T E Private Equity Month End February, 2008 Market Trends Private Equity update: Compiled from various public - The Private Equity market in 2008 has started off slow, with no sources expectation to pick up quickly. The sluggish start was expected for 2008, so this doesn’t come as a surprise to investors. Total leveraged buy-out volume so far in 2008 is down to $34 billion, two-thirds of the volume at this time the previous year. A single mega-deal from 2007 eclipses the total buy-out volume for 2008. While the level of activity has been slow-moving, the industry is still sitting on $820 billion of uncalled capital from investors. The average size of buy-outs this year, $120 million, is the lowest since 2001. - For the average private equity firm, about 38 individuals are employed for every $1 billion of assets under management, and this number decreases to 15 or less at many of the larger firms. With this type of a work force, it will prove influential since $10 billion buy-outs occur daily. However, if the investors deploy the funds across an array of smaller deals, it will result in longer waiting periods, as well as smaller returns. - Investors in the real estate market in 2008 are the most optimistic, due to predictions of higher or the same returns for this year. Investors intend on using the same type of strategy for deals in 2008. -

Sovereign Wealth Funds": Regulatory Issues, Financial Stability and Prudential Supervision

EUROPEAN ECONOMY Economic Papers 378| April 2009 The so-called "Sovereign Wealth Funds": regulatory issues, financial stability and prudential supervision Simone Mezzacapo EUROPEAN COMMISSION Economic Papers are written by the Staff of the Directorate-General for Economic and Financial Affairs, or by experts working in association with them. The Papers are intended to increase awareness of the technical work being done by staff and to seek comments and suggestions for further analysis. The views expressed are the author’s alone and do not necessarily correspond to those of the European Commission. Comments and enquiries should be addressed to: European Commission Directorate-General for Economic and Financial Affairs Publications B-1049 Brussels Belgium E-mail: [email protected] This paper exists in English only and can be downloaded from the website http://ec.europa.eu/economy_finance/publications A great deal of additional information is available on the Internet. It can be accessed through the Europa server (http://europa.eu ) KC-AI-09-378-EN-N ISSN 1725-3187 ISBN 978-92-79-11189-1 DOI 10.2765/36156 © European Communities, 2009 THE SO-CALLED "SOVEREIGN WEALTH FUNDS": REGULATORY ISSUES, FINANCIAL STABILITY, AND PRUDENTIAL SUPERVISION By Simone Mezzacapo* University of Perugia Abstract This paper aims to contribute to the debate on the regulatory and economic issues raised by the recent gain in prominence of the so-called “Sovereign Wealth Funds” (SWFs), by first trying to better identify the actual legal and economic nature of such “special purpose” government investment vehicles. SWFs are generally deemed to bring significant benefits to global capital markets. -

Alternative Perspectives on Challenges and Opportunities of Financing Development

FINANCING FOR DEVELOPMENT Alternative Perspectives on Challenges and Opportunities of Financing Development ORGANISATION OF ISLAMIC COOPERATION STATISTICAL, ECONOMIC AND SOCIAL RESEARCH AND TRAINING CENTRE FOR ISLAMIC COUNTRIES Financing for Development Alternative Perspectives on Challenges and Opportunities of Financing Development Editors: Kenan Bağcı and Erhan Türbedar ORGANIZATION OF ISLAMIC COOPERATION THE STATISTICAL, ECONOMIC AND SOCIAL RESEARCH AND TRAINING CENTRE FOR ISLAMIC COUNTRIES (SESRIC) © May 2019 | Statistical, Economic and Social Research and Training Centre for Islamic Countries (SESRIC) Editors: Kenan Bağcı and Erhan Türbedar Kudüs Cad. No: 9, Diplomatik Site, 06450 Oran, Ankara –Turkey Telephone +90–312–468 6172 Internet www.sesric.org E-mail [email protected] The material presented in this publication is copyrighted. The authors give the permission to view, copy, download, and print the material presented provided that these materials are not going to be reused, on whatsoever condition, for commercial purposes. For permission to reproduce or reprint any part of this publication, please send a request with complete information to the Publication Department of SESRIC. All queries on rights and licenses should be addressed to the Publication Department, SESRIC, at the aforementioned address. The responsibility for the content, the views, interpretations and conditions expressed herein rests solely with the authors and can in no way be taken to reflect the views of the SESRIC or its Member States, partners, or of the OIC. The boundaries, colours and other information shown on any map in this work do not imply any judgment on the part of the SESRIC concerning the legal status of any territory or the endorsement of such boundaries. -

Sovereign Wealth Funds 2019 Managing Continuity, Embracing Change

SOVEREIGN WEALTH FUNDS 2019 MANAGING CONTINUITY, EMBRACING CHANGE SOVEREIGN WEALTH FUNDS 2019 Editor: Javier Capapé, PhD Director, Sovereign Wealth Research, IE Center for the Governance of Change Adjunct Professor, IE University 6 SOVEREIGN WEALTH FUNDS 2019. PREFACE Index 11 Executive Summary. Sovereign Wealth Funds 2019 23 Managing Continuity...Embracing Change: Sovereign Wealth Fund Direct Investments in 2018-2019 37 Technology, Venture Capital and SWFs: The Role of the Government Forging Innovation and Change 55 SWFs in a Bad Year: Challenges, Reporting, and Responses to a Low Return Environment 65 The Sustainable Development Goals and the Market for Sustainable Sovereign Investments 83 SWFs In-Depth. Mubadala: The 360-degree Sovereign Wealth Fund 97 Annex 1. Sovereign Wealth Research Ranking 2019 103 Annex 2. Sovereign Wealth Funds in Spain PREFACE 8 SOVEREIGN WEALTH FUNDS 2019. PREFACE Preface In 2019, the growth of the world economy slowed by very little margin for stimulating the economy to 2.9%, the lowest annual rate recorded since the through the fiscal and monetary policy strategies. subprime crisis. This was a year in which the ele- In any case, the developed world is undergoing its ments of uncertainty that had previously threate- tenth consecutive year of expansion, and the risks ned the stability of the cycle began to have a more of relapsing into a recessive cycle appear to have serious effect on economic expansion. Among these been allayed in view of the fact that, in spite of re- elements, there are essentially two – both of a poli- cord low interest rates, inflation and debt remain at tical nature – that stand out from the rest. -

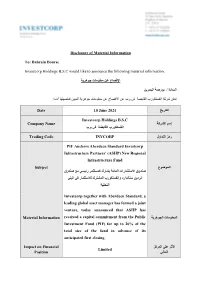

Disclosure of Material Information To: Bahrain Bourse Investcorp Holdings B.S.C Would Like to Announce the Following Material In

Disclosure of Material Information To: Bahrain Bourse Investcorp Holdings B.S.C would like to announce the following material information: اﻹفصاح عن معلومات جوهرية السادة / بورصة البحرين تعلن شركة إنفستكورب القابضة ش.م.ب عن اﻹفصاح عن معلومات جوهرية المبين تفاصيلها أدناه: التاريخ Date 10 June 2021 Investcorp Holdings B.S.C إسم الشركة Company Name إنفستكورب القابضة ش.م.ب رمز التداول Trading Code INVCORP PIF Anchors Aberdeen Standard Investcorp Infrastructure Partners’ (ASIIP) New Regional Infrastructure Fund الموضوع Subject صندوق اﻻستثمارات العامة يشارك كمستثمر رئيسي مع صندوق أبردين ستاندارد وإنفستكورب المشترك لﻻستثمار في البنى التحتية Investcorp together with Aberdeen Standard, a leading global asset manager has formed a joint venture, today announced that ASIIP has المعلومات الجوهرية Material Information received a capital commitment from the Public Investment Fund (PIF) for up to 20% of the total size of the fund in advance of its anticipated first closing. اﻷثر على المركز Impact on Financial Limited المالي Position إفصاحات سابقة ذات Previous relevant صلة )إن ُوجدت( (disclosures (if any ا ﻹسم Name Hazem Ben-Gacem المسمى الوظيفي Title Co-Chief Executive Officer of Investcorp التوقيع Signature ختم الشركة Company Seal PIF Anchors Aberdeen Standard Investcorp Infrastructure Partners’ (ASIIP) New Regional Infrastructure Fund Bahrain, 10th June 2021 – Investcorp together with Aberdeen Standard Investments, a leading global asset manager has formed a joint venture, today announced that ASIIP has received a capital commitment from the Public Investment Fund (PIF) for up to 20% of the total size of the fund in advance of its anticipated first closing. The fund has also received board approval from the Asian Infrastructure Investment Bank (AIIB) to commit US $90 million. -

Real Estate Alert’S 22Nd Annual Review of Closed- End Commingled Funds That Seek Yields of at Least 10% by Investing in Com- Mercial Real Estate

SPECIAL REPORT Fund Managers Flush With Capital, but Not Opportunities Capital, capital everywhere, but no place to invest. Number of Active Funds That’s the quandary facing managers of high-yield real estate funds. 488 466 466 By any measure, their industry is booming, with both the number of vehi- 445 427 429 425 440 cles and the amount of equity commitments at record levels. But finding suit- 415 406 able investments for all that capital is becoming harder and harder, because the long-running bull market has driven valuations sky-high. As a result, fund managers are lowering their return goals and sitting on an unprecedented hoard of uninvested capital. Those are key findings ofReal Estate Alert’s 22nd annual review of closed- end commingled funds that seek yields of at least 10% by investing in com- mercial real estate. The review identified a record 488 active vehicles, up 5% from 466 a year ago. Those funds are managed by a record 392 operators, up from the previous high of 374 last year. They have set an aggregate $339.9 billion equity goal and 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 have already raised $261.3 billion of that amount (or slightly more than three- quarters) — also new highs. But a whopping 72% of those commitments, or $186.9 billion, is still unin- vested. That tally is up 14% from a revised $164.5 billion of dry powder last Uninvested Equity ($Bil.) year and nearly double the $97.9 billion level in 2015. 187 164 The reason why is no mystery: Fund managers see fewer opportunities that 161 fit their return goals.