Defying Gravity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Active Members

List of Active Members ISVA The professional Society for Valuers and Auctioneers ACTIVE MEMBERS Abb-AIg Abbott, Dominic Charles, FRICS FSVA Adams, Richard John, FRICS FSVA Brogden &: Co, 38-39 Silver Street, Adams, Richard, 23 Warwick Row, Coventry, West Lincoln LN2 1EM Midlands CV1 lEY Tel No. 01522 531321 Tel No. 01203 251737 Elected 1975 Elected 1990 Ablitt, Ernest Henry, FSVA Adams, Roger Ian, FSVA Elected 1953 Elected 1979 Abrahams, Abi, ASVA Adamson, Gaye Elizabeth, DipVEM ASVA Elected 1994 Elected 1990 Abrahams, Peter David, FSVA Addison, Roy Matthew, DipREM ARICS ASVA Abrahams Consolidated Ltd, 51 London Road, Russell Baldwin &: Bright, (Chancellors Associates), St Albans, Hertfordshire AL11LJ 20 King Street, Hereford HR4 9DB Tel No. 01727 840111 Tel No. 01432 266663 Elected 1976 Elected 1989 Adetula, Francis Olajide Ipadeola, FSVA ARVA Abson, Stephen Paul Robert, ASVA ANAEA AlAS Elected 1995 Elected 1975 Acock, Malcolm Trevor, FSVA Aggett, Paul Anthony, ASVA Elected 1966 Ekins, 73 High Street, Burnham, Slough, Berkshire SL1 7jX Acquier, Andrew Francis, BA FSVA Tel No. 01628 604477 Andrew F Acquier, 6 Queen Street, Godalming, Elected 1981 Surrey GU7 1BD Tel No. 01483 424128 Agnew, Julian Michael, ASVA Elected 1979 Jones Lang Wootton, 22 Hanover Square, London W1A 2BN Acton, Martin Howard Harrison, ASVA Tel No. 0171 493 6040 Healey &: Baker, 29 St George Street, Hanover Elected 1988 Square, London W1A 3BG Tel No. 0171 6299292 Ahmed, Faida Yasmin, BSc ARICS ASVA Elected 1987 Elected 1995 Adams, John Alfred, FRICS FSVA Ainge, James Leonard, JP FSVA IRRV Adams Burnett, 138 Buckingham Palace Road, Elected 1973 London SW1W 9SA Tel No. -

Property Investor Profiles

AMA Property Investor Profiles Amazon Properties Plc Fund 23 Spring Street, London W2 1JA Angelo, Gordon Europe Ltd Tel: 020 7298 8700 Fax: 020 7298 8701 25 Hanover Square, London W1S 1JF Email: [email protected] Tel: 0207 758 5300 Fax: 0207 758 5420 Web: www.amazonproperty.com Web: www.angelogordon.com Contacts Contacts Charles Gourgey (Managing Director) Anuj Mittal (Real Estate) Chris Lanitis (Director) Comment Comment 07/09 - US private equity fund manager Angelo Gordon announced 03/10 - Amazon bought 5 Portland Place, W1, for around £10m for plans is to invest a substantial proportion of its $2bn of property conversion to luxury flats. funds in the UK. 07/10 - Amazon and Princeton Investments paid Resolution £12m Angelo Gordon is combing the UK for opportunities and has lined up for Paramount House, on Wardour Street, W1 a yield of around 5%. partnerships with UK property experts, such as Property Merchant The 22,000 sq ft retail and multilet office building has potential for Group and Investream, to work on the prospective transactions. conversion to loft-style apartments on the upper floors. Princeton and Amazon, which owns and manages a £150m The privately owned fund manager is investing two funds: its $800m portfolio, are both keen to increase their exposure to prime central AG Core Plus Realty Fund II, of which it has already spent around London. Paramount is their first joint venture. 35%; and its $1.25bn opportunity fund, the AG Realty Fund VII, of which around 25% is invested. Amsprop Ltd 05/10 - Angelo Gordon, Gracemark Investments and US hotelier West Wing, Sterling House, Langston Road Amerimar Enterprises bought the 275-bed Jolly St Ermin’s Hotel in Loughton, Essex IG10 3TS London’s St James’s rom NH Hoteles for £65m. -

The Stewardship of the NHS's Property Portfolio

Developing a roadmap to cultural change: the stewardship of the NHS’s property portfolio Note: The contents of these papers represent the personal views and experiences of the individual speakers and do not purport to represent those of any organisation with which each speaker has been or is currently associated. Similarly they do not necessarily reflect those of the author or editors, nor of the Cambridge University Land Society, nor any of the other bodies associated with this publication or the University of Cambridge. Front cover: Sir Ludwig Guttmann Health and Wellbeing Centre in the Olympic Village Developing a roadmap to cultural change: the stewardship of the NHS’s property portfolio Contents Contents 3 Foreword: Roddy Houston 4 Programme 5 Introduction: Douglas Blausten 6 Overview: Victoria Ormond 8 Developing our new business: Simon Holden 9 Shaping a commercially run property portfolio with a publicly accountable owner: Peter Bennett 10 Comparing and contrasting a property PLC’s strategy: Ian Coull 13 Building a high-performing property team: Adam Dakin 16 Panel Q & A – Peter Bennett, Ian Coull, Adam Dakin and Rachel Kentleton 17 Running a single shareholder, publicly accountable, property portfolio - for profit: Roger Bright 18 Leadership and change: some personal perspectives from the journey in the private sector: Paul Marcuse 21 Case study: Transforming for the customer: Rachel Kentleton, easyJet 23 Running a large property portfolio for profit or for social purpose – is there a difference? Francis Salway 24 Developing and -

An Anniversary to Remember Alumni Relations O Ce Keeping You in Touch with Cambridge

magazine Summer 2010 An anniversary to remember Alumni Relations Oce Keeping you in touch with Cambridge What do we oer you? 1 CAMCard, providing access to a wide range of discounts 3 issues of CAM, the alumni magazine, dropping through your letterbox every year 1600 website pages (and counting) of news, events, information and links 380 network groups connecting you with other alumni across the globe 12 e-bulletin updates bringing you the latest news each month 10 events each year Wherever you are in the world, stay connected with Cambridge: Website Twitter www.alumni.cam.ac.uk www.twitter.com/CARO1209 Facebook Flickr f www.facebook.com/cambridgealumni www.ickr.com/photos/cambridge-alumni-relations www.alumni.cam.ac.uk Telephone +44 (0)1223 332288 Email [email protected] CAMBRIDGE UNIVERSITY LAND SOCIETY Contents Editorial The President’s year: 2009/10 was a very notable year for everyone connected Gerald Parkes, President 2009–10 4 with the Cambridge Jenny Buck, Senior Vice President, University Land Society. Against a very challenging President elect 2010–11 5 economic backdrop the Land Economy Department update society hosted its largest ever event, to mark the Phil Allmendinger 6 University’s 800th year, and Colin Lizieri 6 put on an outstanding seminar involving the Chief Executives Mentoring 7 of the major London landed Prize winners 7 estates. In addition to these huge endeavours have been Highlights of 2009–10 a number of unique and well received events ranging from 800th Anniversary Dinner 8 discussions on land law reform to pub crawls. None of these London Landed Estates 9 events would be able to take place without the hard work and dedication of the membership. -

CB Richard Ellis Goes Countrywide 9 World’S Biggest Property Adviser Taps Into UK Residential Market with Huge Estate Agency Partnership

08|04|11 £4.95 propertyweek.com NEWS ANALYSIS MARKETS PROFESSIONAL HMV pleads for monthly rents p5 Labour view p29 Hants, Dorset + Wiltshire p41 Newmarket’s racing form p62 CBRE boss’s £11.5m pay p17 Heron Tower’s hour p30 CoreNet Global salary survey p48 Interview for senior staff p65 Berkeley’s banked (from left): Berkeley chairman Tony Pidgley, comedian Michael McIntyre and British Land chief executive Chris Grigg were the big stars at Tuesday night’s Property Awards. More than 1,300 people packed into London’s Grosvenor House for the event, organised by Property Week. Go to propertyweek.com/awards2011 PHOTOGRAPHS: OLIVER KNIGHT OLIVER PHOTOGRAPHS: CB Richard Ellis goes Countrywide 9 World’s biggest property adviser taps into UK residential market with huge estate agency partnership BY NICK JOHNSTONE It is unusual for a leading commercial-led agency and Knight Frank in areas such as local residential to join a high street chain, but the two worlds’ sales, land valuations and social housing advice. CB Richard Ellis has taken a huge leap into the interests are converging. Mixed-use development The plan is that CBRE clients, such as government lucrative residential property market through is driving the change. Commercial firms in particular departments, will now have access to local a tie-up with the UK’s largest estate agency. are attracted by fees that are typically higher in the knowledge and advice on the timing of land The world’s biggest property services firm has residential sector. Residential development fees can disposals or the local residential market. -

Costar Database for Clients to View at a Granular Level and Also Run Powerful, Real-Time Analytics On, with the Exception of Any Confidential Deals Yields

Investment Review 2017 £62.1 BILLION IN 20171 Soaring investment in the regions in Q4 caps surprisingly strong year UK Commercial Property Investment Review 2017 Table of ContentsInvestment Review 2017 2 Overview ........................................................3 Key Infographics ..............................................4 The figures in this report are based on all UK commercial property deals that have completed (not exchanged/under offer) during the relevant quarterly period. The deal data is collated by our dedicated invest- Key Investment Deals in 2017 .............................5 ment research team who endeavour to speak to all investment agents, investors, and other involved parties ensuring the widest possible By Sector .........................................................6 engagement and most representative figures. All deals are for UK- based commercial properties including alternative classes such as student accommodation, hospitality, and Build-to-Rent. By Region .......................................................8 The figures exclude all debt transactions, refinancing, auction deals, Sources of Capital ...........................................9 and business acquisitions. All deals submitted are added to the CoStar database for clients to view at a granular level and also run powerful, real-time analytics on, with the exception of any confidential deals Yields .............................................................11 submitted in confidence for aggregation purposes. With over 100 ded- icated researchers, -

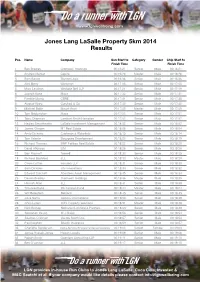

Jones Lang Lasalle Property 5Km 2014 Results

www.lgnwellbeing.com Jones Lang LaSalle Property 5km 2014 Results Pos. Name Company Gun Start to Category Gender Chip Start to Finish Time Finish Time 1 Ben Bradley Cromwell Holdings 00:16:21 Senior Male 00:16:21 2 Andrew Mercer Capita 00:16:26 Master Male 00:16:26 3 Sam Baxter Tsunami Axis 00:16:36 Senior Male 00:16:36 4 Alex Berry Workman 00:17:05 Senior Male 00:17:05 5 Marc Leyshon Wedlake Bell LLP 00:17:21 Senior Male 00:17:19 6 Joseph Kane Mace 00:17:33 Senior Male 00:17:31 7 Freddie Morris CBRE 00:17:41 Senior Male 00:17:35 8 Alastair Ward Curchod & Co 00:17:43 Senior Male 00:17:42 9 Michael Rolfe Mount Anvil 00:17:50 Master Male 00:17:49 10 Tom Babbington Mace 00:17:52 Senior Male 00:17:51 11 Toby Chapman Lambert Smith Hampton 00:17:57 Senior Male 00:17:57 12 Hadley Smorthwaite LaSalle Investment Management 00:18:02 Senior Male 00:18:02 13 James Chasen M7 Real Estate 00:18:06 Senior Male 00:18:04 14 Andy Dickens Cushman & Wakefield 00:18:15 Senior Male 00:18:14 15 Tom Valente Bouygues Development 00:18:20 Senior Male 00:18:19 16 Richard Thomas BNP Paribas Real Estate 00:18:22 Senior Male 00:18:20 17 David Atkinson LIM 00:18:26 Senior Male 00:18:25 19 Ben Mackett Tower8 00:18:30 Senior Male 00:18:25 18 Richard Bashford JLL 00:18:30 Master Male 00:18:29 20 Owen Dutton Forsters LLP 00:18:31 Senior Male 00:18:30 21 Sam Dickson city innovations 00:18:34 Senior Male 00:18:32 22 Edward Crockett Aberdeen Asset Management 00:18:35 Senior Male 00:18:34 23 Darren Bradley Cromwell Holdings 00:18:36 Master Male 00:18:35 24 Hamish Allan JLL 00:18:41 Senior Male 00:18:38 25 Tim Greenland BA Pension Fund 00:18:44 Master Male 00:18:44 26 Will Beresford Bellrock 00:18:45 Senior Male 00:18:45 27 Giles Sams Colliers International 00:18:50 Senior Male 00:18:49 28 Chris Lydon CWL Property solutions 00:18:51 Master Male 00:18:48 29 Nick Bishop Nathaniel Lichfield & Partners 00:18:53 Senior Male 00:18:49 30 Sebastian Young M J Mapp 00:18:56 Senior Male 00:18:54 31 Séamus O’dwyer Vectos South Ltd. -

Chairman's View

Investment IPF Property Forum forumforum THE MAGAZINE OF THE INVESTMENT PROPERTY FORUM ISSUE 10 JUNE 2003 viewview Chairman’s view As my year as Chairman of the IPF draws to a close, I I should stress that the would like reflect on the work which has been IPF does not consider undertaken by the Executive team and the itself to be a lobbying Management Board. In this role, I have assisted the organisation but rather a Board in the strategic development of the Forum and thought-leader able to also seen come to fruition a number initiatives give an impartial cross- introduced by previous chairmen, most recently Rob industry perspective. We Bould, Martin Moore and Rupert Clarke. are keen to co-ordinate our work with other Much of the focus for this year has been the leading industry bodies development of the research strategy and the vision such as the BPF (with for the IPF. whom we have kept in Many meetings have taken place developing the touch with on the research strategy and I would like to thank my Treasury briefing) and colleagues at the IPF Educational Trust for their input the RICS. and also the Chairman of the IPF Research Another development Committee, John Gellatly, and our President Alastair which you will have noticed being gradually Ross Goobey for his guidance. Our aim is to provide introduced is the new IPF corporate identity. The the industry with a rolling programme of independent In this Issue rationale behind the logo is that it reflects the forward research to improve the functioning and efficiency of thinking approach which the IPF takes to its activities. -

Property Investor Profiles ALT

Property Investor Profiles ALT Alterity Investments Ltd Ameriscot Commercial Montgomery House, 29-33 Montgomery Street, Belfast BT1 4NX Avalon, 26-32 Oxford Road, Bournemouth BH8 8EZ Tel: 028 9024 4030 Fax: 028 9024 3652 Tel: 01202 315110 Email: [email protected] Email: [email protected] Web: www.alterityinvestments.com Web: www.ameriscot.co.uk Contacts Contacts Aiden Lonergan (Chief Executive) Robert Mckay Kay IV (Director) Andrew Carleton (Managing Director) Comment Richard Faloon (Commercial Director) Ameriscot is a Bournemouth based developer with a strong track Comment record in successful office refurbishments. 12/16 - Alterity Investments sold Dearne House, Cortonwood Business Park, Rotherham for £5.25m, reflecting a net initial yield 01/17 - Ameriscot paid around £4m for 2 Grosvenor Square , of 6.75% Southampton. The building, constructed in the 1980s totals 29,489 sq ft, and will be subject to a high specification refurbishment. Year Ending Mar 2016 Mar 2015 Mar 2014 Net Worth £75.9m £70.6m £56.2m Total Assets £108m £121m £127m Amiri Capital LLP 67-68 Grosvenor Street, London W1K 3JN Altitude Investments & Asset Management Tel: 020 7355 6350 20 Southernhay West, Exeter EX1 1PR Email: [email protected] Tel: 01392 660 000 Web: www.amiricapital.com Email: [email protected] Contacts Web: www.altitude-investments.com Richard Ellis (Co-Founder) Contacts Bindesh Shah (Co-Founder) George Turnbull (Director) Comment 10/16 - Amiri Capital is planning to float a UK student accommodation REIT early next year with the company expecting Altitude Real Estate LLP to raise initial equity of more than £100m. The London-based firm Eleven Brindleyplace, Brunswick Square, Brindleyplace which has invested more than £1.5bn over the last seven years Birmingham B1 2LP plans to amass a £1bn REIT portfolio and has already identified a Tel: 0121 230 9908 pipeline of acquisition opportunities. -

The Plan for Stafford Borough Part 2 Submission Consultation Statement

Submission Consultation Statement (Regulation 22) The Plan for Stafford Borough Part 2 Submission Consultation Statement (Regulation 22) March 2016 1 Submission Consultation Statement (Regulation 22) Contents 1. Submission Consultation Statement (Regulation 22(1) (c)) 2. Regulation 18 Statement 3. Regulation 20 Statement 4. Next Steps 2 Submission Consultation Statement (Regulation 22) 1. Submission Consultation Statement (Reg. 22 (1)(c)) 3 Submission Consultation Statement (Regulation 22) 1 Submission Consultation Statement (Reg. 22 (1)(c)) 1.1 This Consultation Statement (Reg 22(1)(c)) has been prepared to meet the requirements set out in Regulation 22 of the Town and Country Planning (Local Planning) (England) Regulations 2012, which came into force on 6 April 2012, regarding the submission of documents and information to the Secretary of State in order to progress through the Examination process. In particular section c of Regulation 22 defines the following requirement: Submission of documents and information to the Secretary of State 22. – (1) The documents prescribed for the purposes of section 20(3) of the Act are – (c) a statement setting out – (i) which bodies and persons the local planning authority invited to make representations under regulation 18, (ii) how those bodies and persons were invited to make representations under regulation 18, (iii) a summary of the main issues raised by the representations made pursuant to regulation 18, (iv) how any representations made pursuant to regulation 18 have been taken into account; (v) if representations were made pursuant to regulation 20, the number of representations made and a summary of the main issues raised in those representations; and (vi) if no representations were made in regulation 20, that no such representations were made. -

AL INVESTMENT from 1 Jan 2006 - 31 Oct 2006 Volume Deal Count £40,439M 1,525

The Property Investors Bulletin N O V E M B E R 2 0 0 6 E D I T I O N TOTAL INVESTMENT FROM 1 Jan 2006 - 31 Oct 2006 Volume Deal Count £40,439m 1,525 TRANSACTION NOTES Total Value of UK Investment Transactions (Year to Date October 2006) Property Data recorded 131 investment transactions during October 2006 with a total value of £3.94bn. 50,000 44,078 45,000 Office investment has been the dominant 40,439 sector during 2006. Office deals represent 40,000 46% of the value of this year's total sales, opposed to 36% for 2005. Central London 35,000 31,803 appears on track to break last year's record figure of £16bn. The value of City 30,000 investment has already exceeded 2005's 25,000 23,097 22,110 figure of £6.4bn, and is on course to reach close to £10bn for the year. The West End 20,000 appears somewhat constrained by supply, which has caused average transaction m £ Volume Transaction 15,000 yields to fall from 5.2% in 2005 to 4.3% in 10,000 2006. 5,000 Outside of London the country's major cities have also seen increased turnover in the 0 office sector. For example Bristol sales for 2002 2003 2004 2005 2006 the year-to-date are £390m (2005: £212m) and Manchester £448m (2006: £361m). Year to Date (Jan - Oct) The next edition of the bulletin will be published on Tuesday 5th December. Office Retail Industrial Leisure Other Total Y-T-D I N V E S T O R A C T I V I T Y 1 Jan 2006 - 31 Oct 2006 INSTITUTIONS PROPERTY CO'S PRIVATE OVERSEAS OTHER BUY £m 10,607 11,277 4,293 10,989 3,273 SELL £m 6,722 14,477 3,077 9,579 6,585 NET £m 3,885 -3,200 1,216 1,410 -3,312 Y-T-D S E C T O R A C T I V I T Y 1 Jan 2006 - 31 Oct 2006 OFFICE RETAIL INDUSTRIAL LEISURE OTHER 2006 £m 18,530 9,233 3,643 4,363 4,669 2005 £m 16,901 13,742 3,568 3,573 6,294 DIFFERENCE £m 1,629 -4,509 75 790 -1,625 The Property Investors Bulletin - November 2006 Edition Page 1 The Property Investors Bulletin Contents October 2006 Investment Deals By Sector 3 - 6 Investment transactions listed by key sectors.