Property Alert!

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

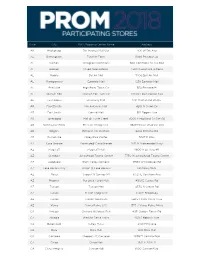

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

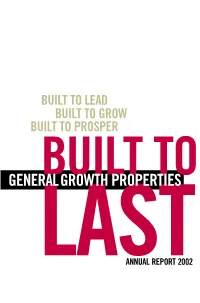

Generalgrowthproperties

BUILT TO LEAD BUILT TO GROW BUILT TO PROSPER GENERALGROWTHBUILT PROPERTIES TO LASTANNUAL REPORT 2002 COMPANY PROFILE General Growth Properties and its predecessor companies have been in the shopping center busi- ness for nearly fifty years. It is the second largest regional mall Real Estate Investment Trust (REIT) in the United States. General Growth owns, develops, operates and/or manages shopping malls in 39 states. GGP has ownership interests in, or management responsibility for, 160 regional shopping malls totaling more than 140 million square feet of retail space. The total retail space is inclusive of more than 16,000 retailers nationwide. General Growth provides investors with the opportunity to participate in the ownership of high-quality, income-producing real estate while maintaining liquidity. Our primary objective is to provide increasing dividends and capital appreciation for our shareholders. Creating shareholder value is the company’s mission. The Bucksbaum family, which founded General Growth, is still engaged in the operation of the company’s day-to-day business activities. As owners of a major stake in the company, General Growth management’s interests are aligned with those of each and every GGP shareholder. CONTENTS Shareholders’ Letter 4 Operating Principles 7 Portfolio 17 Financial Review 29 Directors and Officers 85 Corporate Information 86 Financial Highlights SHOPPING CENTERS OWNED at year end * 1997 64 1998 84 1999 93 2000 95 2001 97 2002 125 TOTAL SQUARE FOOTAGE OWNED in millions 1997 52 1998 71 1999 83 2000 85 2001 89 2002 114 REAL ESTATE ASSETS AT COST in millions 1997 $2,590 1998 $4,760 1999 $6,237 2000 $6,735 2001 $7,319 2002 $9,902 MALL SHOP SALES in millions ** 1997 $2,651 1998 $5,176 1999 $6,931 2000 $7,243 2001 $7,326 2002 $9,061 DIVIDEND GROWTH PER SHARE dollar/share declared 1997 $1.80 1998 $1.88 1999 $1.98 2000 $2.06 2001 $2.36 2002 $2.74 FFO GROWTH dollar/share 1997 $2.89 1998 $3.35 1999 $4.02 2000 $4.42 2001 $4.96 2002 $5.58 * Includes regional malls only. -

Pirates Theaters 010308

The Pirates Who Don't Do Anything - A VeggieTales Movie - - - In Theaters January 11th Please note: This list is current as of January 3, 2008 and is subject to change. Additional theaters are being added over the next few days, so be sure to check back later for an updated list. To arrange for group ticket sales, please call 1-888-863-8564. Thanks for your support and we'll see you at the movies! Theater Address City ST Zip Code Sunridge Spectrum Cinemas 400-2555 32nd Street NE Calgary AB(CAN) T1Y 7X3 Scotiabank Theatre Chinook (formerly Paramoun 6455 Macleod Trail S.W. Calgary AB(CAN) T2H 0K4 Empire Studio 16 Country Hills 388 Country Hills Blvd., N.E. Calgary AB(CAN) T3K 5J6 North Edmonton Cinemas 14231 137th Avenue NW Edmonton AB(CAN) T5L 5E8 Clareview Clareview Town Centre Edmonton AB(CAN) T5Y 2W8 South Edmonton Common Cinemas 1525-99th Street NW Edmonton AB(CAN) T6N 1K5 Lyric 11801 100th St. Grande Prairie AB(CAN) T8V 3Y2 Galaxy Cinemas Lethbridge 501 1st. Ave. S.W. Lethbridge AB(CAN) T1J 4L9 Uptown 4922-49th Street Red Deer AB(CAN) T4N 1V3 Parkland 7 Cinemas 130 Century Crossing Spruce Grove AB(CAN) T7X 0C8 Dimond Center 9 Cinemas 800 Dimond Boulevard Anchorage AK 99515 Goldstream Stadium 16 1855 Airport Road Fairbanks AK 99701 Grand 14 820 Colonial Promenade Parkway Alabaster AL 35007 Cinemagic Indoor 1702 South Jefferson Street Athens AL 35611 Wynnsong 16-Auburn 2111 East University Drive Auburn AL 36831 Trussville Stadium 16 Colonial Promenade Shopping Center Birmingham AL 35235 Lee Branch 15 801 Doug Baker Blvd. -

Latinos | Creating Shopping Centers to Meet Their Needs May 23, 2014 by Anthony Pingicer

Latinos | Creating shopping centers to meet their needs May 23, 2014 by Anthony Pingicer Source: DealMakers.net One in every six Americans is Latino. Since 1980, the Latino population in the United States has increased dramatically from 14.6 million, per the Census Bureau, to exceeding 50 million today. This escalation is not just seen in major metropolitan cities and along the America-Mexico border, but throughout the country, from Cook County, Illinois to Miami-Dade, Florida. By 2050, the Latino population is projected to reach 134.8 million, resulting in a 30.2 percent share of the U.S. population. Latinos are key players in the nation’s economy. While the present economy benefits from Latinos, the future of the U.S. economy is most likely to depend on the Latino market, according to “State of the Hispanic Consumer: The Hispanic Market Imperative,” a report released by Nielsen, an advertising and global marketing research company. According to the report, the Latino buying power of $1 trillion in 2010 is predicted to see a 50 percent increase by next year, reaching close to $1.5 trillion in 2015. The U.S. Latino market is one of the top 10 economies in the world and Latino households in America that earn $50,000 or more are growing at a faster rate than total U.S. households. As for consumption trends, Latinos tend to spend more money per shopping trip and are also expected to become a powerful force in home purchasing during the next decade. Business is booming for Latinos. According to a study by the Partnership for a New Economy, the number of U.S. -

I Amtrak~ II Amtrak~ ~ CJCJ CJCJ CJCJ CJC)

CAMDEN COUNTY PUBLIC TRANSPORTATION PLAN DDDDDI '\ YTRANSIT D 0 0 DO 0 0 D D 0 0 DO 0 0 D ==- :::::::::: PATCO- PATCO I Amtrak~ II Amtrak~ ~ CJCJ CJCJ CJCJ CJC) DELAWARE VALLEY REGIONAL PLANNING COMMISSION DECEMBER 1997 CAMDEN COUNTY PUBLIC TRANSPORTATION PLAN Final Document DELAWARE VALLEY REGIONAL PLANNING COMMISSION The Bourse Building 21 South 5th Street, Philadelphia, PA 19106 DECEMBER 1997 This Report is Printed on Recycled Paper CAMDEN COUNTY BOARD OF CHOSEN FREEHOLDERS Jeffrey L. Nash, Freeholder Director Annette Castiglione-Degan, Freeholder Deputy Director Scott M. Goldberg, Freeholder, Department of Public Works (Divisions of Engineering and Planning) Riletta Cream Edward T. McDonnell Bernard A. Platt Frank Spencer CAMDEN COUNTY PLANNING BOARD Jeffrey L. Nash, Freeholder Director Scott M. Goldberg, Freeholder Frank Spencer, Freeholder Barry Malesich, Board Chairperson Carole Miller, Board Vice-Chairperson Robert E. Kelly, P.E., County Engineer Thomas Quackenbush William J. Controvich William J. Snyder Margaret A. Young Joseph Forte George Jones Michael Brennan, Esquire, Board Solicitor CAMDEN COUNTY DEPARTMENT OF PUBLIC WORKS: Dominic J. Vesper, Jr., Director George C. Fallon, Supervisor of Roads DIVISION OF ENGINEERING: Robert E. Kelly, P.E., County Engineer DIVISION OF PLANNING: 1. Douglas Griffith, P.P., AICP, Planning Director Thomas B. Chamberlin, Supervising Planner Land Development and Review Gail Elbert, Supervising Planner Ronald Jernegan, Data Processing Technician Louise M. Sawchuk, Principal Clerk Typist DELA W ARE -

![Uri Seiden and Associates Records (K1228); the State Historical Society of Missouri Research Center-Kansas City [After First Mention May Be Abbreviated to SHSMO-KC]](https://docslib.b-cdn.net/cover/2911/uri-seiden-and-associates-records-k1228-the-state-historical-society-of-missouri-research-center-kansas-city-after-first-mention-may-be-abbreviated-to-shsmo-kc-252911.webp)

Uri Seiden and Associates Records (K1228); the State Historical Society of Missouri Research Center-Kansas City [After First Mention May Be Abbreviated to SHSMO-KC]

THE STATE HISTORICAL SOCIETY OF MISSOURI RESEARCH CENTER-KANSAS CITY K1228 Uri Seiden and Associates Records [Jewish Community Archives] 1950-1988 38 cubic feet, 1 folder Drawings of an engineering/architecture firm in Kansas City, MO. BIOGRAPHY: PROVENANCE: This gift was received from Uri Seiden as accession KA1627 on May 12, 2008. COPYRIGHT AND RESTRICTIONS: The Donor has given and assigned to the State Historical Society of Missouri all rights of copyright which the Donor has in the Materials and in such of the Donor’s works as may be found among any collections of Materials received by the Society from others. PREFERRED CITATION: Specific item; folder number; Uri Seiden and Associates Records (K1228); The State Historical Society of Missouri Research Center-Kansas City [after first mention may be abbreviated to SHSMO-KC]. CONTACT: The State Historical Society of Missouri Research Center-Kansas City 302 Newcomb Hall, University of Missouri-Kansas City 5123 Holmes Street, Kansas City, MO 64110-2499 (816) 235-1543 [email protected] http://shs.umsystem.edu/index.shtml SHSMO-KC November 22, 2013 PRELIMINARY K1228 Uri Seiden and Associates Records Page 2 DESCRIPTION: The collection includes drawings of an engineering/architecture firm in Kansas City, Missouri. INVENTORY: BOX 001 Folder 1. Photographs-aerial-85th and Holmes area, Chestnut Hill ARCHITECTURAL DRAWINGS (see ARC database and table below) BOX AND ROLL TITLE ADDRESS STATE CITY YEAR LOCATION 103rd and Holmes 103rd and Holmes MO Kansas City K1228 Box 001x3 Roll 01 63rd and -

Personal Rapid Transit (PRT) New Jersey

Personal Rapid Transit (PRT) for New Jersey By ORF 467 Transportation Systems Analysis, Fall 2004/05 Princeton University Prof. Alain L. Kornhauser Nkonye Okoh Mathe Y. Mosny Shawn Woodruff Rachel M. Blair Jeffery R Jones James H. Cong Jessica Blankshain Mike Daylamani Diana M. Zakem Darius A Craton Michael R Eber Matthew M Lauria Bradford Lyman M Martin-Easton Robert M Bauer Neset I Pirkul Megan L. Bernard Eugene Gokhvat Nike Lawrence Charles Wiggins Table of Contents: Executive Summary ....................................................................................................................... 2 Introduction to Personal Rapid Transit .......................................................................................... 3 New Jersey Coastline Summary .................................................................................................... 5 Burlington County (M. Mosney '06) ..............................................................................................6 Monmouth County (M. Bernard '06 & N. Pirkul '05) .....................................................................9 Hunterdon County (S. Woodruff GS .......................................................................................... 24 Mercer County (M. Martin-Easton '05) ........................................................................................31 Union County (B. Chu '05) ...........................................................................................................37 Cape May County (M. Eber '06) …...............................................................................................42 -

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20

Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 1 of 54 Fill in this information to identify the case: United States Bankruptcy Court for the Southern District of Texas Case number (if known): Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name Laredo Outlet Shoppes, LLC 2. All other names debtor used N/A in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer Identification Number (EIN) 81-1563566 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 2030 Hamilton Place Blvd. Number Street Number Street CBL Center, Suite 500 P.O. Box Chattanooga Tennessee 37421 City State ZIP Code City State ZIP Code Location of principal assets, if different from principal place of business Hamilton County County 1600 Water Street Number Street Laredo Texas 78040 City State ZIP Code 5. Debtor’s website (URL) www.cblproperties.com 6. Type of debtor ☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) ☐ Partnership (excluding LLP) ☐ Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 WEIL:\97969900\8\32626.0004 Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 2 of 54 Debtor Laredo Outlet Shoppes, LLC Case number (if known) 21-_____ ( ) Name A. -

SACRAMENTO | RETAIL Q3 2017 Research & Forecast Report SACRAMENTO | RETAIL Q3 2017

Research & Forecast Report SACRAMENTO | RETAIL Q3 2017 Research & Forecast Report SACRAMENTO | RETAIL Q3 2017 BIG ASORPTION AT DELTA SHORES, REST OF MARKET STABLE HEADING INTO HOLIDAYS Net absorption was well above average for Q3, but with the majority of new occupants taking newly constructed space, the overall vacancy rate hardly budged. A number of big box vacancies remain unfilled, but new developments are pushing average asking rates, the biggest shift evident in the vicinity of Downtown Commons and the new Delta Shores along I-5. The first new stores at these two major development sites have opened in the last 90 days or will open before the end of 2017. Meanwhile, the rest of the market has remained relatively stable, with no major retailers exiting or entering the market. Investors from outside the Sacramento market have been active, as properties in this market offer cap rates more than 100 basis points higher than Bay Area and Southern California markets and more than 50 basis points above the average for the Western region. Net Absorption Community Power > 373,290 square feet of positive net absorption was more than Market Indicators Neighborhood Regional Specialty Strip two times the three-year rolling average per quarter. Relative to prior period 2017 Q3 2017 Q3 2017 Q3 2017 Q3 > Roughly 60 percent of the absorption total came from new VACANCY Delta Shores tenants, including Dick’s Sporting Goods, PetSmart and Ross Dress for Less. NET ABSORPTION CONSTRUCTION Vacancy RENTAL RATE > The overall vacancy declined 10 basis points to 9.4 percent. > About a dozen notable big box vacancies (including Macy’s, Note: Construction is the change in SF Under construction Sports Authority, and Borders) comprise 12.6 percent of the total vacant square footage or 1.2 percent of the total market inventory. -

South Shore Park Comprehensive Plan for Strategic Place Activation Report Prepared As a Collaboration Between A.W

South Shore Park Comprehensive Plan For Strategic Place Activation Report prepared as a collaboration between A.W. Perry, Place Strategists and Vanz Consulting. The material produced herein has been compiled at the exclusive request of A.W. Perry as a framework for the activation of their real estate holdings in Hingham & Rockland. Any conclusions presented reflect the research and opinions of A.W. Perry, Place Strategists and Vanz Consulting. These materials do not necessarily reflect the positions of the Towns of Hingham or Rockland. 15 November 2019 SOUTH SHORE PARK | COMPREHENSIVE PLAN FOR STRATEGIC PLACE ACTIVATION 3 COMPREHENSIVE PLAN FOR STRATEGIC PLACE ACTIVATION (CPSPA) FOR THE SOUTH SHORE PARK A Comprehensive Plan for Strategic Place Activation (CPSPA) for the South Shore Park The following report includes Step 1 | Deep Dive + Discovery, Step 2 | The Scientific (SSP), Hingham and Rockland, MA, is developed to meet the market demand and Research Plan, Steps 3 | Programmatic Plan, and Step 4 | Place Activation Guidelines. opportunities, providing the required spatial environments for a more seamless and Steps 1 and 2 focus on analyzing the existing site conditions, and the initial proposed resilient development phasing. conceptual master plan design. These steps aim to provide the analytical framework for Steps 3 and 4 that focus on proposing a programmatic development scheme for A bottom up approach is adopted to ensure the link between a large-scale the overall master plan and two sets of guidelines to be adopted by specialists along comprehensive framework and the human scale. The focus of the CPSPA is to the development process. -

Existing and Future Conditions Inventory

Michigan / Grand River Avenue Transportation Study TECHNICAL MEMORANDUM From: URS Consultant Team To: CATA Project Staff and Technical Committee Date: October 28, 2009 Topic: Technical Memorandum #2 – Existing/Future Conditions Inventory 1.0 INTRODUCTION The Existing/Future Conditions Inventory is the second in a series of technical memorandums for the Michigan/Grand River Avenue Transportation Corridor. This information will be referred to as part of the development and evaluation of alternatives and, ultimately the definition of a Locally Preferred Alternative for improving transit service and overall multimodal transportation service in the Michigan / Grand River Avenue Transportation Corridor (Map 1-1). This Technical Memorandum is divided into the following sections: Section 2 provides an inventory of the Corridor’s existing transportation network characteristics and conditions. Section 3 describes population and household trends impacting transportation in the Corridor. Section 4 gives an overview of existing employment clusters and projected trends for future job growth in the Region and Corridor. Section 5 provides a summary of the land uses and development trends in the Corridor. Section 6 gives an overview of cultural resource needs analysis in Region and Corridor. Section 7 provides a summary of natural environment concerns including floodplains, wetlands, 4(f) and 6(f) impacts, and groundwater Section 8 describes hazardous materials/waste site analysis needs in the Corridor Technical Memorandum #2: 10/28/2009 1 Existing/Future Conditions Analysis Michigan Ave/Grand River Ave Multimodal Corridor Studies Section 9 provides an overview of air quality analysis needs and the process to identify the regulatory framework for the Corridor air quality Section 10 discusses noise and vibration analysis needs within the Corridor 2.0 TRANSPORTATION CHARACTERISTICS Communities in the Michigan / Grand River Corridor are experiencing a host of transportation related problems and needs. -

Arts District 20 Fashion District 22 Little Tokyo 13 23 Chinatown 24 Statistics

DOWNTOWN LA ABOUT THE DCBID Figueroa St. 1st St. Hope St. Grand Ave. 110 Freeway 6th St. Broadway BUNKER 7th St. HILL FINANCIAL DISTRICT J. Wood Blvd. 4th St. Main St. 8th St. 9th St. Flower St. Hope St. Olympic Hill St. Founded in 1998, the Downtown Center Business Improvement District (DCBID) has been a catalyst in Downtown Los Angeles’ transformation into a vibrant 24/7 neighborhood. A coalition of nearly 2,000 property owners in the Central Business District, the DCBID members are united in their commitment to enhance the quality of life in Downtown Los Angeles. Bounded by the Harbor Freeway to the west, First Street to the north, Main and Hill streets to the east, and Olympic Boulevard and 9th Street to the south, the organization helps the 65-block Central Business District achieve its full potential as a great place to live, work, and play. DCBID services include: • 24 Hr. Safety and Maintenance Services – “The Purple Patrol” • Economic Development and Business Recruitment/Retention programs • Strategic Marketing Programs that promote the area to residents, workers and visitors. For more than 20 years, these programs and initiatives have been the driving force behind the Downtown Los Angeles Renaissance that has seen the city become one of the nation’s most dynamic urban centers. 2 Downtown Center Business Improvement District I Retail Report 9 INSIDE 4 RETAIL IN THE CITY OF DTLA 6 MAP OF DTLA 8 FINANCIAL DISTRICT 10 7th STREET CORRIDOR 12 JEWELRY DISTRICT 13 BUNKER HILL 14 SOUTH PARK 16 HISTORIC CORE 18 ARTS DISTRICT 20 FASHION DISTRICT 22 LITTLE TOKYO 13 23 CHINATOWN 24 STATISTICS 22 Retail Report I Downtown Center Business Improvement District 3 RETAIL IN THE CITY OF DTLA owntown LA is becoming a city unto itself.