Looking to the Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

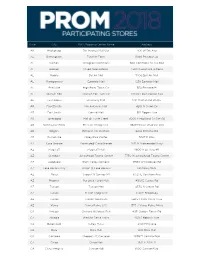

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Arbor Place Atlanta (Douglasville), GA

Arbor Place Atlanta (Douglasville), GA Location I-20 at Chapel Hill Road (Exit 36) Anchors Belk, Dillard’s, JCPenney, Macy’s, Sears, Regal Cinemas (18 screens), Bed Bath & Beyond and Forever 21 Size 1,163,310 square feet Website ArborPlace.com Mall Facts Arbor Place continues to be a dominant regional mall and home to 140 specialty retailers including Abercrombie & Fitch, Aéropostale, Bath & Body Works, Buckle, Build-A-Bear Workshop, Charlotte Russe, H&M, Hollister Co., Gymboree, New York & Company and Victoria’s Secret. New specialty retailers include Ashley Stewart, Crazy 8, House of Hoops by FootLocker, p.s. from Aéropostale, Sleep Number by Select Comfort and ULTA. Opening in 2014 is Papaya. The Arbor Place retail complex features an associated center, The Landing at Arbor Place, that includes Toys R Us, Men’s Wearhouse, Shoe Carnival, Logan’s Roadhouse and O’Charley’s. Trade Area The Arbor Place trade area encompasses eight surrounding counties in Facts Georgia (Douglas, Cobb, Carroll, Haralson, Paulding, Fayette, Coweta and south Fulton) and a significant area in eastern Alabama. Douglasville lies only 20 minutes west of downtown Atlanta and provides a quick commute to Hartsfield-Jackson International Airport, the world’s busiest airport. With the close proximity to the airport and daily traffic counts on I-20 that exceed 95,400 vehicles, Douglas County is a prominent business hub for western Georgia and eastern Alabama. Listed as one of Georgia’s larger school systems, Douglas County has approximately 24,500 students enrolled. There are more than 30,000 college and university students attending several public and private colleges within 20 minutes of Arbor Place including the University of West Georgia, West Georgia Technical College, Morehouse College, Morehouse School of Medicine, Clark Atlanta University and Atlanta Technical College. -

Laurence Paskowitz, Et Al. V. CBL & Associates Properties, Inc., Et Al. 19

UNITED STATES DISTRICT COURT EASTERN DISTRICT OF TENNESEE CHATTANOOGA DIVISION LAURENCE PASKOWITZ, O n B ehalf O f H imself A nd A ll O thers S imilarly S ituated, Plaintiff, v. C ivil .A ction No. ____________ CBL & ASSOCIATES PROPERTIES, INC., STEPHEN CLASS ACTION D. LEBOVITZ, CHARLES B. LEBOVITZ, A. LARRY CHAPMAN and FARZANA KHALEEL, JURY DEMAND Defendants. Plaintiff Laurence Paskowitz (“Plaintiff”), by his attorneys, alleges for his Class Action Complaint against D efendants (defined below) upon personal knowledge as to himself and his own acts, and as to all other matters upon information and belief based upon, inter alia , the investigation made by and through his attorneys (including review of SEC filings, press releases and court proceedings), as follows: SUMMARY OF THE ACTION 1. This is a securities fraud class action brought o n behalf of all persons who purchased the publicly traded securities of defendant CBL & Associates Properties, Inc. (“CBL” or “the Company”) from November 8, 2017 through March 26, 2019 (the “Class Period”). In addition to the Company, D efendants named herein are CBL’s founder and Board Chairman Charles B. Lebovitz, Chief Executive Officer Stephen D. Lebovitz, Chief Financial Officer Farzana Khaleel , and Audit Committee Chairman A. Larry Chapman (collectively, “ the Individual Defend a nts”). Case 1:19-cv-00149-JRG-CHS Document 1 Filed 05/17/19 Page 1 of 23 PageID #: 1 2. CBL, th rough its two operating subsidiaries, is organized as a real estate investment trust (“REIT”). The C ompany’s business is described as follows: “We own, develop, acquire, lease, manage, and operate regional shopping malls, open - air and mixed - use centers, o utlet centers, associated centers, community centers, office and other properties. -

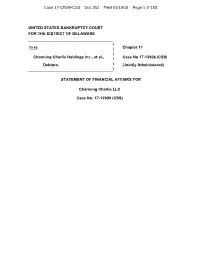

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re ) Chapter 11 ) Charming Charlie Holdings Inc., et al.,) Case No 17-12906 (CSS) Debtors. ) (Jointly Administered) ) STATEMENT OF FINANCIAL AFFAIRS FOR Charming Charlie LLC Case No: 17-12909 (CSS) Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 2 of 183 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) CHARMING CHARLIE HOLDINGS INC., et al.,1 ) Case No. 17-12906 (CSS) ) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGY, AND DISCLAIMERS REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Charming Charlie Holdings Inc. and certain of its affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases (the “Debtors”), have filed their respective Schedules of Assets and Liabilities (the “Schedules”) and Statements of Financial Affairs (the “Statements”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The Debtors, with the assistance of their legal and financial advisors, prepared the Schedules and Statements in accordance with section 521 of title 11 of the United States Code (the “Bankruptcy Code”) and rule 1007 of the Federal Rules of Bankruptcy Procedure. Robert Adamek has signed each set of the Schedules and Statements. Mr. Adamek serves as the Senior Vice President and Chief Financial Officer at Debtor Charming Charlie Holdings Inc., and he is an authorized signatory for each of the Debtors. In reviewing and signing the Schedules and Statements, Mr. -

Vanderbilt University Retailers in Tennessee: Academy Sports

Vanderbilt University Retailers in Tennessee: Academy Sports & Outdoors - 90 1915 Mallory Lane Franklin, TN 37067 Phone : 615-771-0184 Academy Sports & Outdoors - 91 2350 North Gallatin Rd. Madison, TN 37115 Phone : 615-855-6900 Alumni Hall - 3 Rivergate Mall 1000 Rivergate Pkwy Suite 1975 Goodlettsville, TN 37072 Phone : 615-859-8808 Amazon.com - Int Seattle, WA 98104 Phone : 206-266-7528 Barnes & Noble College Bookstores - 779 2501 West End Avenue Nashville, TN 37203 Phone : 1-800-288-2665 Bed Bath & Beyond - 568 5301 Hickory Hollow Parkway Antioch, TN 37013 Phone : 615-717-3238 Bed Bath & Beyond - 570 545 Cool Springs Boulevard Franklin, TN 37067 Phone : 615-771-5646 Bed Bath & Beyond - 579 484 North Thompson Lane Murfreesboro, TN 37129 Phone : 615-867-2135 Bed Bath & Beyond - 580 211 Opry Mills Drive Nashville, TN 37214 Phone : 615-514-4000 Bed Bath & Beyond - 581 7657 Highway 70 South Nashville, TN 37221 Phone : 615-646-7383 CBS Sportsline 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 Phone :: 1-877-342-4911 Champs Sports - 14130 118 Opry Mills Drive Nashville, TN 37214 Phone : 615-514-0090 Champs Sports - 14131 5252 Hickory Hollow Parkway Box 1095 Antioch, TN 37013 Phone : 615-731-6107 Champs Sports - 14132 Rivergate Mall 1000 Rivergate Parkway Goodlettsville, TN 37072 Phone : 615-859-5311 Champs Sports - 14153 Governor's Square 2801 Wilma Rudolph Blvd Space 335 Clarksville, TN 37040 Phone : 931-647-9373 Champs Sports - 14154 2615 Medical Ctr Parkway Murfreesboro, TN 37129 Phone : 615-890-2553 College Station 4674 Merchants Park Circle Suite #424 Collierville, TN 38017 phone: 901-854-0225 College Station 2100 Hamilton Place Blvd. -

Silicon Valley Bank) 1\ M~Mt>Tr of SVB L'lrw~W Crwp Account Details Requested Date: From: 09/10/2015 To: 10/03/2015 Generated On: 10/15/2015

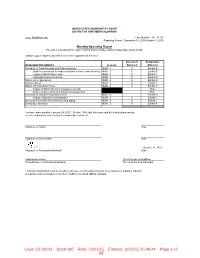

UNITED STATES BANKRUPTCY COURT DISTRICT OF NORTHERN CALIFORNIA In re: NewZoom, Inc. Case Number: 15 - 31141 Reporting Period: September 10, 2015-October 3, 2015 Monthly Operating Report File with Court and submit copy to United States Trustee within 20 days after end of month Submit copy of report to any official committee appointed in the case. Document Explanation REQUIRED DOCUMENTS Form No. Attached Attached Schedule of Cash Receipts and Disbursements MOR - 1 X Exhibit A Bank Reconciliation (or copies of debtor's bank reconciliation's) MOR - 1 X Exhibit B Copies of Bank Statements MOR - 1 X Exhibit C Cash disbursements journal MOR - 1 X Exhibit D Statement of Operations MOR - 2 X Exhibit E Balance Sheet MOR - 3 X Exhibit F Status of Postpetition Taxes MOR - 4 X Exhibit G Copies of IRS Form 6123 or payment receipt None Copies of tax returns filed during reporting period None Summary of Unpaid Postpetition Debts MOR - 4 Exhibit H Listing of aged accounts payable MOR - 4 X Exhibit I Accounts Receivable Reconciliation and Aging MOR - 5 X Exhibit J Debtor Questionnaire MOR - 5 X Exhibit K I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Signature of Debtor Date Signature of Joint Debtor Date October 21, 2015 Signature of Authorized Individual* Date Andrew Hinkelman Chief Restructuring Officer Printed Name of Authorized Individual Title of Authorized Individual * Authorized individual must be an officer, director, or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. -

FAYETTE MALL Lexington, KY CBL PROPERTIES

MALL FAYETTE Lexington, KY CBL PROPERTIES HIGHLIGHTS NUMBER OF STORES 150 TRADE AREA 824,980 (2017 est.) SIZE 1,203,002 square feet CENTER EMPLOYMENT 2,750 (est.) FEATURED STORES Macy’s, Dillard’s, DICK’S Sporting Goods, JCPenney, Altar’d State, Apple, The Cheesecake Factory, Cinemark (16 1971 screens), Coach, Disney, H&M, Michael Kors, and Sephora YEAR OPENED WEBSITE ShopFayette-Mall.com CORPORATE OFFICE: FOR LEASING: CBL Center, Suite 500 MALL OFFICE: CBL PROPERTIES Laura Farren 3401 Nicholasville Road, Suite 303 cblproperties.com 2030 Hamilton Place Boulevard p. 423.490.8620 c. 423.463.4589 Lexington, KY 40503 NYSE: CBL Chattanooga, TN 37421-6000 [email protected] 859.272.3493 423.855.0001 DEMOGRAPHICS TRADE AREA FACTS PRIMARY SECONDARY TOTAL • Known as the “Horse Capital of the World,” Lexington, Kentucky POPULATION TRENDS TRADE AREA TRADE AREA TRADE AREA contributes over $5 billion a year to the state’s horse industry. 2022 Projection 420,298 448,220 868,518 • Lexington is the financial, retail, healthcare and cultural core of the 2017 Estimate 396,214 428,766 824,980 entire Bluegrass region. 2010 Census 369,850 412,671 782,521 • High household income of almost $80,000 is fueled by some of the 2017-2022 % Change 6.08% 4.54% 5.28% largest corporations in the U.S., including Toyota’s primary Camry/ Avalon/Lexus ES350 manufacturing facility, Ashland Oil, Lexmark, 2017 Daytime Population Estimate 251,368 189,885 441,253 IBM, Square D, The Trane Company, and Tempur-Pedic. • 27 companies, including Toyota, Florida Tile, EnerBlu Inc. and AVERAGE HOUSEHOLD INCOME Xooker invested $1.5 billion in the Lexington area for business 2022 Projection $92,586 $76,397 $84,384 expansion in 2017. -

Addressing Addiction As a Family Disease See Story on Page 4

wintervol. 23, issue 1 2012 Addressing Addiction as a Family Disease See story on page 4. FROM THE CEO TABLE OF CONTENTS Landmark addiction report reach published March 2017 is a call to action FEATURE STORY “Substance misuse is one of the critical public health problems of our time.” p.04 Addiction: A family disease Rosecrance program provides healthy techniques for healing and support That introduction from the landmark 2016 Surgeon General’s report on addiction sums up something we here at Rosecrance have known for decades. We recognized it in 1982 when LEADING THE FIELD we started treating teens for chemical dependency—as it was known back then—and again p.06 Fun glimpse at experiential therapies a decade later when we expanded and built a new treatment center for adults. p.07 Around the network Addiction is a complex brain disease with many risk factors, including genetics and age of first use. Rosecrance was founded more than 100 years ago as a children’s home to help p.08 Florian Program expands to serve families in need. Our history of working with kids is why we continue to operate the largest police and veterans residential treatment center for adolescents and young adults in the Midwest and why we specialize our programs to provide clients the best opportunity for lasting recovery. p.09 Alumni Program still going strong The Surgeon General’s report has made diagnosing and treating substance use disorders a p.09 Quitting smoking a target for young clients call to action similar to the report on the dangers of smoking released more than 50 years p. -

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20

Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 1 of 54 Fill in this information to identify the case: United States Bankruptcy Court for the Southern District of Texas Case number (if known): Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name Laredo Outlet Shoppes, LLC 2. All other names debtor used N/A in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer Identification Number (EIN) 81-1563566 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 2030 Hamilton Place Blvd. Number Street Number Street CBL Center, Suite 500 P.O. Box Chattanooga Tennessee 37421 City State ZIP Code City State ZIP Code Location of principal assets, if different from principal place of business Hamilton County County 1600 Water Street Number Street Laredo Texas 78040 City State ZIP Code 5. Debtor’s website (URL) www.cblproperties.com 6. Type of debtor ☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) ☐ Partnership (excluding LLP) ☐ Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 WEIL:\97969900\8\32626.0004 Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 2 of 54 Debtor Laredo Outlet Shoppes, LLC Case number (if known) 21-_____ ( ) Name A. -

State City Shopping Center Address

State City Shopping Center Address AK ANCHORAGE 5TH AVENUE MALL SUR 406 W 5TH AVE AL FULTONDALE PROMENADE FULTONDALE 3363 LOWERY PKWY AL HOOVER RIVERCHASE GALLERIA 2300 RIVERCHASE GALLERIA AL MOBILE BEL AIR MALL 3400 BELL AIR MALL AR FAYETTEVILLE NW ARKANSAS MALL 4201 N SHILOH DR AR FORT SMITH CENTRAL MALL 5111 ROGERS AVE AR JONESBORO MALL @ TURTLE CREEK 3000 E HIGHLAND DR STE 516 AR LITTLE ROCK SHACKLEFORD CROSSING 2600 S SHACKLEFORD RD AR NORTH LITTLE ROCK MC CAIN SHOPG CNTR 3929 MCCAIN BLVD STE 500 AR ROGERS PINNACLE HLLS PROMDE 2202 BELLVIEW RD AZ CHANDLER MILL CROSSING 2180 S GILBERT RD AZ FLAGSTAFF FLAGSTAFF MALL 4600 N US HWY 89 AZ GLENDALE ARROWHEAD TOWNE CTR 7750 W ARROWHEAD TOWNE CENTER AZ GOODYEAR PALM VALLEY CORNERST 13333 W MCDOWELL RD AZ LAKE HAVASU CITY SHOPS @ LAKE HAVASU 5651 HWY 95 N AZ MESA SUPERST'N SPRINGS ML 6525 E SOUTHERN AVE AZ NOGALES MARIPOSA WEST PLAZA 220 W MARIPOSA RD AZ PHOENIX AHWATUKEE FOOTHILLS 5050 E RAY RD AZ PHOENIX CHRISTOWN SPECTRUM 1727 W BETHANY HOME RD AZ PHOENIX PARADISE VALLEY MALL 4510 E CACTUS RD AZ TEMPE TEMPE MARKETPLACE 1900 E RIO SALADO PKWY STE 140 AZ TUCSON EL CON SHPG CNTR 3501 E BROADWAY AZ TUCSON TUCSON MALL 4530 N ORACLE RD AZ TUCSON TUCSON SPECTRUM 5265 S CALLE SANTA CRUZ AZ YUMA YUMA PALMS S C 1375 S YUMA PALMS PKWY CA ANTIOCH ORCHARD @SLATTEN RCH 4951 SLATTEN RANCH RD CA ARCADIA WESTFLD SANTA ANITA 400 S BALDWIN AVE CA BAKERSFIELD VALLEY PLAZA 2501 MING AVE CA BREA BREA MALL 400 BREA MALL CA CARLSBAD PLAZA CAMINO REAL 2555 EL CAMINO REAL CA CARSON SOUTHBAY PAV @CARSON 20700 AVALON -

Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, Et Al

Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 1 of 22 TROUTMAN PEPPER HAMILTON SANDERS LLP Brett D. Goodman 875 Third Avenue New York, NY 1002 Telephone: (212) 704.6170 Fax: (212) 704.6288 Email:[email protected] -and- Douglas D. Herrmann Marcy J. McLaughlin Smith (admitted pro hac vice) Hercules Plaza, Suite 5100 1313 N. Market Street Wilmington, Delaware 19801 Telephone: (302) 777.6500 Fax: (866) 422.3027 Email: [email protected] [email protected] – and – RIEMER & BRAUNSTEIN LLP Steven E. Fox, Esq. (admitted pro hac vice) Times Square Tower Seven Times Square, Suite 2506 New York, NY 10036 Telephone: (212) 789.3100 Email: [email protected] Counsel for Agent UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY ) In re: ) Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, et al., ) Case No. 21-10269 (ABA) ) ) (Jointly Administered) Debtors. 1 ) _______________________________________________________________________ 1 The Debtors in these chapter 11 cases and the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows: Christopher & Banks Corporation (5422), Christopher & Banks, Inc. (1237), and Christopher & Banks Company (2506). The Debtors’ corporate headquarters is located at 2400 Xenium Lane North, Plymouth, Minnesota 55441. Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 2 of 22 DECLARATION OF CINDI GIGLIO IN SUPPORT OF DEBTORS’ MOTION FOR INTERIM AND FINAL ORDERS (A)(1) CONFIRMING, ON AN INTERIM BASIS, THAT THE STORE CLOSING AGREEMENT IS OPERATIVE AND EFFECTIVE AND (2) AUTHORIZING, ON A FINAL BASIS, THE DEBTORS TO ASSUME THE STORE CLOSING AGREEMENT, (B) AUTHORIZING AND APPROVING STORE CLOSING SALES FREE AND CLEAR OF ALL LIENS, CLAIMS, AND ENCUMBRANCES, (C) APPROVING DISPUTE RESOLUTION PROCEDURES, AND (D) AUTHORIZING CUSTOMARY BONUSES TO EMPLOYEES OF STORES I, Cindi Giglio, make this declaration pursuant to 28 U.S.C. -

APG Advisors the News Wrap-Up 09.02.20

APG Advisors The News Wrap-Up 09.02.20 California investor spends $590 million to expand footprint in Research Triangle Park. California-based Alexandria Real Estate Equities Inc. closed on 253 acres at Parmer RTP for $590.4 million. The purchase includes seven parcels across three deed transfers with properties at 14 TW Alexander Drive, 5 Moore Drive, 41 Moore Drive, two at 1818 Ellis Road, and two at 2400 Ellis Road. The seller, Los Angeles-based Karlin Real Estate, has been assembling land and developing the 500-acre Parmer RTP campus for years. Among the largest assemblages in Research Triangle Park, Parmer RTP is an R&D campus of 20 buildings, with tenants such as LabCorp and Credit Suisse. Source: Triangle Business Journal WeWork will leave Durham.ID. Coworking giant WeWork plans to close its location in Durham ID at the end of the year, vacating three floors of office space. The decision to leave Durham.ID is not in response to the pandemic. The review had been in the works since last fall. “As part of WeWork’s plan to seek profitable growth and optimize our global real estate portfolio, we have worked with our landlord partners to consolidate to a single Durham flagship location at One City Center,” said WeWork Vice President Dave McLaughlin. The closure clears the way for new owner Longfellow Real Estate Partners, which paid $138 million last month for full ownership of Durham ID, including Buildings A at 200 Morris and B at 300 Morris St. According to the seller, Bain Capital, “Longfellow was interested in purchasing the project from the partnership but had a business plan that was predicated upon access to WeWork’s space.