20May200921180164

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

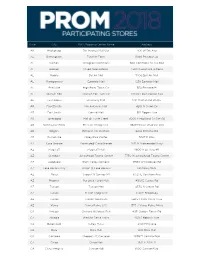

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Phoenix Metro Area Trade an Icon in Valley

INDUSTRY UPDATE Biweekly Period Ending June 1, 2002 Phoenix Metro Area 20-screen Harkins Theater, plus as-yet-to- be-named sporting-goods, electronics, and Trade furniture stores. An icon in Valley and Arizona mall devel- RMB Enterprises plans to open about a opment was sold for nearly $1.5 billion in dozen Seattle’s Best Coffee locations in the late May. Macerich Co. of Santa Monica, Valley within the next year-and-a-half. A bit- Calif., purchased Westcor Realty, developer ter (not taste wise) rival of Starbucks, also and owner of eight malls throughout the state based in Seattle, the chain already has one (including recently opened Gateway Mall in store at the Chandler Fashion Center in Chan- Prescott and Chandler Fashion Center) and dler and will shortly open stores in Ahwa- dozens of Phoenix-area shopping centers. tukee, Mesa, and Gilbert. If coffee isn’t Westcor was formed more than three decades your cup of tea, the stores will also feature a ago by three local real estate developers who wide variety of pastries. have been able to create unique and highly Another hot, rather “cold” franchise, is Scotts- profitable properties that enjoy average-sales- per-square-foot rates much higher than the dale-based Cold Stone Creamery, which is national average. Macerich is one of the 10 eating its way into the hearts of customers largest owners of malls in the country. across the country. Now 250 franchise stores strong and projected to grow to 1,000 In related news, Westcor-owned Superstition stores by 2004, the 14-year-old chain’s 65 Springs Mall in east Mesa will undergo a administrative employees are currently $2.7 million make over and other searching for larger quarters than their changes, while Home Depot will open its current home at Scottsdale Airpark. -

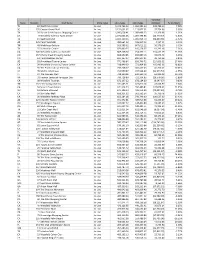

State Storeno Mall Name Store Type 2015 Sales 2014 Sales Variance

Variance State StoreNo Mall Name Store Type 2015 Sales 2014 Sales Inc/(Dec) % Inc/(Dec) TX 83 NorthPark Center In-Line 1,472,766.00 1,363,984.00 108,782.00 7.98% SC 135 Coastal Grand Mall In-Line 1,151,631.67 1,113,877.31 37,754.36 3.39% TX 20 Barton Creek Square Shopping Center In-Line 1,096,658.41 1,083,499.33 13,159.08 1.21% CA 8 Westfield Valencia Town Center In-Line 1,071,022.26 1,087,795.83 (16,773.57) -1.54% TX 19 Baybrook Mall In-Line 1,025,120.43 1,055,953.79 (30,833.36) -2.92% AZ 125 Park Place Mall In-Line 950,664.23 946,527.12 4,137.11 0.44% TN 48 Wolfchase Galleria In-Line 923,588.32 867,012.22 56,576.10 6.53% TX 55 Stonebriar Centre In-Line 876,800.55 815,558.37 61,242.18 7.51% CA 126 Westfield Galleria at Roseville In-Line 869,168.30 754,757.11 114,411.19 15.16% CO 167 Cherry Creek Shopping Center In-Line 868,959.85 835,887.13 33,072.72 3.96% CO 61 Park Meadows Center In-Line 831,157.07 800,397.91 30,759.16 3.84% AZ 28 Arrowhead Towne Center In-Line 771,406.64 656,746.72 114,659.92 17.46% CA 39 Westfield University Towne Center In-Line 738,949.33 573,464.00 165,485.33 28.86% CA 35 The Promenade at Temecula In-Line 733,268.27 666,557.65 66,710.62 10.01% KY 78 Mall St. -

Printmgr File

Exhibit 99.2 Supplemental Financial Information For the three months ended March 31, 2019 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate Overview 1-4 Overview 1-2 Capital Information and Market Capitalization 3 Changes in Total Common and Equivalent Shares/Units 4 Financial Data 5-11 Consolidated Statements of Operations (Unaudited) 5 Consolidated Balance Sheet (Unaudited) 6 Non-GAAP Pro Rata Financial Information (Unaudited) 7-9 2019 Guidance Range 10 Supplemental FFO Information 11 Capital Expenditures 12 Operational Data 13-27 Sales Per Square Foot 13 Sales Per Square Foot by Property Ranking 14-17 Occupancy 18 Average Base Rent Per Square Foot 19 Cost of Occupancy 20 Percentage of Net Operating Income by State 21 Property Listing 22-25 Joint Venture List 26-27 Debt Tables 28-30 Debt Summary 28 Outstanding Debt by Maturity Date 29-30 Development Pipeline 31 Corporate Information 32 This Supplemental Financial Information should be read in connection with the Company’s first quarter 2019 earnings announcement (included as Exhibit 99.1 of the Company’s Current Report on 8-K, event date May 2, 2019) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Financial Information. The Macerich Company Supplemental Financial and Operating Information Overview The Macerich Company (the “Company”) is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional shopping centers located in the United States in many of the country’s most attractive, densely populated markets with significant presence on the West Coast, Arizona, Chicago and the Metro New York to Washington, DC corridor. -

Glendale Police Department

Glendale Police Department Smart Policing Initiative II: Final Report By Michael D. White, Ph.D. Charles M. Katz, Ph.D. David Choate, MA Center for Violence Prevention and Community Safety School of Criminology and Criminal Justice Arizona State University With Commander Andre Anderson Commander Rich Levander Lt. Mark Carpenter Lt. Nick Susuras Glendale, Arizona Police Department December 2014 1 Table of Contents Page Executive Summary 3 Introduction 4 Problem-Oriented Policing and the SARA Model: The Foundation of the Glendale 6 SPI The Emergence of Problem-Oriented Policing 6 Empirical Research on Problem-Oriented Policing 8 The Glendale SPI Training on Problem-Oriented Policing 9 Problem 1: Prolific Property Crime Offenders at 6201 West Olive (Foothills) 13 Additional Analysis: Apartment Complex Residents’ Survey 13 Response 1: Social and Physical Disorders Surveys 15 Response 2: Law Enforcement and Suppression 17 Response 3: Outreach and Public Education 18 Response 4: Social Network Analysis and Informal Focused Deterrence 19 Assessment: Bivariate and Interrupted Time Series Analysis 26 Problem 2: Property Crime at Arrowhead Towne Center (Foothills) 31 Response 1: Prevention and Collaboration Activities 33 Response 2: Crime Suppression 35 Response 3: ATC Incident Reporting 35 Assessment: Interrupted time Series Analysis (ARIMA) 38 Problem 3: Advanced POP Team (APOP, Gateway Sector) 41 Process Evaluation 41 Micro-Hot Spots 50 Focused Deterrence Training in July 2014 (Call-in planned for early 2015) 55 Conclusion 56 Reflecting on the Impact of the Glendale SPI II 56 Sustainability 58 References 61 Appendices A: Training Assignments B: 6201 West Olive Resident Survey C: Social and Physical Disorder Survey D: Vehicle Report Card E: Floor Plan of Arrowhead Towne Center F: ATC Reporting Form G: ATC Partner of the Month Certificate 2 Executive Summary In 2011, the Glendale Police Department was awarded a second SPI grant. -

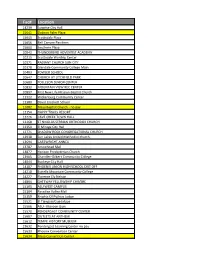

Fac# Location

Fac# Location 14239 Surprise City Hall 15641 Dobson Palm Plaza 15645 Scottsdale Plaza 15656 Bell Canyon Pavilions 15660 Southern Plaza 10042 THUNDERBIRD ADVENTIST ACADEMY 10215 Scottsdale Worship Center 10371 RADIANT CHURCH SUN CITY 10378 Glendale Community College Main 10403 FOWLER SCHOOL 10647 CHURCH AT LITCHFIELD PARK 10689 TOLLESON SENIOR CENTER 10830 MOUNTAIN VIEW REC CENTER 10897 First New Life Mission Baptist Church 11322 Wickenburg Community Center 11380 David Crockett School 12082 Mesa Baptist Church - no pay 12154 HAPPY TRAILS RESORT 12226 CAVE CREEK TOWN HALL 12268 ST NIKOLAS SERBIAN ORTHODOX CHURCH 12350 El Mirage City Hall 12771 SHADOW ROCK CONGREGATIONAL CHURCH 12938 Sun Lakes United Methodist church 13694 CARTWRIGHT ANNEX 13787 Arrowhead Mall 13877 Horizon Presbyterian Church 13905 Chandler-Gilbert Community College 14044 Buckeye City Hall 14187 PHOENIX UNION HIGH SCHOOL DIST OFF 14218 Estrella Mountain Community College 14227 Florence Ely Nelson 14864 GATEWAY FELLOWSHIP CHR/SBC 15105 ASU WEST CAMPUS 15164 Paradise Valley Mall 15359 Knights Of Pythias Lodge 15521 El Tianguis/Guadalupe 15566 ASU - Maroon Gym 15570 PENDERGAST COMMUNITY CENTER 15607 OUTLETS AT ANTHEM 15612 TEMPE HISTORY MUSEUM 15632 Pendergast Learning Center no pay 15633 Phoenix Convention Center 15634 Mesa Convention Center 15642 ASU Poly Campus 15646 Plaza Fountainside 15647 Signal Butte Marketplace 15649 Village Square 15650 Camelback Center 15658 Glendale Market Square 15659 McDowell Square 15661 Peoria Power Center 15663 Chandler Fashion Center 15664 -

Retail/Restaurant Pads Available Estrella Falls | Northwest Corner Mcdowell Rd & Bullard Ave | Goodyear, Arizona 99 99 Citrus Citrus El Mirage El Mirage Cotton Cotton

Retail/Restaurant Pads Available Estrella Falls | Northwest Corner McDowell Rd & Bullard Ave | Goodyear, Arizona 99 99 Citrus Citrus El Mirage El Mirage Cotton Cotton 303 107th Ave 107th Ave 91st Ave 91st Ave Sarival Sarival Litchfield Litchfield Dysart Dysart Perryville Highest Perryville Jackrabbit Jackrabbit 99th Ave 99th Ave Bullard Bullard Pebble Creek Pebble Creek Performing Buckeye Theatre in Lower Buckeye Lower Buckeye Arizona Southern Southern Property Highlights Intersection / Area Co-Tenants Contact • Pads 1, 2, & 3 Available BRYAN LEDBETTER .........602.795.8670 [email protected] • Anchored by Harkins Estrella Falls 16; RYAN DESMOND ...........602.931.4489 Opened October 2016; Largest movie screen in [email protected] Arizona (over 80 feet); #1 Theatre in Arizona based on box office sales • Less than 1 mile to the I-10 Fwy. WESTERN RETAIL ADVISORS The information contained within this brochure has been obtained from sources other than Western Retail Advisors, LLC. Western Retail Advisors has not verified such information and makes no guarantee warranty or representation about such 2525 E Camelback Rd, Ste 625, Phoenix, AZ 85016 information. It is your responsibility to independently confirm its accuracy and completeness. Any dimensions, specifications, floor plans and information may not be accurate and should be verified by you prior to the lease or purchase of the property. Retail/Restaurant Pads Available Estrella Falls | Northwest Corner McDowell Rd & Bullard Ave | Goodyear, Arizona 101 Dunlap Ave Olive Ave Northern -

Phoenix Metro Area Manufacturing If You See a Funny-Looking Yellow

INDUSTRY UPDATE Biweekly Period Ending June 2, 2001 Phoenix Metro Area the fast-growing discount department store Manufacturing are: Desert Ridge Marketplace, northeast Phoenix; Agua Fria Towne Center, Glendale; If you see a funny-looking yellow object cir- Gilbert Gateway Towne Center; and Loop 202 cling the Valley sky in the near future, don’t and Power Road, Mesa. Developer Vestar call the UFO hotline. It’s probably a test will build all of these centers. … With four flight of a gyroplane, whose manufacturer months until opening, Chandler Fashion intends to open a 200,000-square-foot Center, Loop 101 and Chandler Boulevard, is manufacturing facility in Glendale by 90 percent leased. About 3,500 jobs will spring 2002. Salt Lake City-based Groen be created by the 1.3 million-square-foot Brothers, which builds the odd-looking com- mall. … Scottsdale Fashion Square bination (Scottsdale and Camelback roads) is expected plane and to land either Bloomingdale’s or Macy’s to helicopter (it replace the 235,000-square site formerly used has a propel- by Sears, which exited the mall earlier this ler on the top year. It would be the Valley’s first Blooming- and middle), dale’s or sixth Macy’s. … Westcor Cos., intends to which owns the Chandler and Scottsdale move its Fashion Centers, has two power centers in manufactur- the development stage and is expand- UFO? No, this is newest ver- ing operation ing/renovating several others. Westcor is sion of the gyroplane Hawk 4. to the Glen- pre-leasing a planned 1 million-square-foot dale Airport, th Gilbert Crossroads center, Williams Field 107 and Glendale avenues. -

Renovation Last Fall

Going Places Macerich Annual Report 2006 It’s more than the end result—it’s the journey. At Macerich®, what’s important isn’t just the destination. It’s the bigger picture, the before and after...the path we take to create remarkable places. For retailers, it’s about collaboration and continual reinvestment in our business and theirs. For the communities we serve, it’s about working together to create destinations that reflect their wants and needs. For investors, it’s about long-term value creation stemming from a clear vision. For consumers, it’s about the total experience our destinations deliver. 0 LETTER TO STOCKHOLDERS Letter to Our Stockholders Macerich continued to create significant value in 2006 by elevating our portfolio and building a sizeable return for our stockholders. Total stockholder return for the year was 33.9%, contributing to a three-year total return of 121.5% and a five-year total return of 326.2%. In 2006, the company increased dividends for the 13th consecutive year. As a company that considers its pipeline a tremendous source of strength BoulderTwenty Ninth is a prime Street example is a prime of howexample 2006 of was how indeed 2006 awas remarkable indeed a yearremark of - and growth, Macerich reached an important milestone in 2006 with the buildingable year netof building asset value net for asset Macerich. value for We Macerich. also completed We also the completed redevelop the- re- opening of Twenty Ninth Street in Boulder, Colorado. Not only is this a mentdevelopment of Carmel of CarmelPlaza in Plaza Northern in Northern California, California, another another excellent excellent model of model terrific new asset in an attractive, affluent community—it represents a sig- valueof value creation, creation, where where we we realized realized a significant a significant return return on onour our investment. -

Fashion Center Chandler Viridian

CHANDLER VIRIDIAN PRIMEGATE AT FASHION CENTER A SPECIALTY EXPERIENCE CHANDLER’S FIRST MIXED-USE RESTAURANT & RETAIL VENUE AND THE CENTRAL BUSINESS DISTRICT OF THE SOUTHEAST VALLEY PRIMEGATE is the ±24,000 square foot Restaurant & Retail component of the $150,000,000 Mixed-Use Chandler Viridian Development in conjunction with Hines, Alliance Residential & WinLee Development. The ±26-Acre project features 330 Broadstone Fashion Center luxury multi-family units; a ±250,000 square foot Class-A, LEED designed 6-story office building; and a 138-room Cambria Hotel. The project represents the first truly mixed-use development in Chandler Arizona with all components being linked together with extensive pedestrian esplanades and jogging paths and is integrated with the Super Regional Luxury Mall Chandler Fashion Center (Nordstrom’s, Macy’s, Dillard’s, Apple, Lululemon, Dick’s, Pottery Barn, Lego, Microsoft, etc.). It is also flanked by both the Super Target-anchored Chandler Festival power center and the Chandler Costco adjacent to the west and southwest respectively. LEASING CONTACTS Carol Schillne +1 602 735 5680 [email protected] Kerry Linthicum +1 602 735 1764 [email protected] 17 10 CHANDLER BLVD. 10 17 N CHANDLER VIRIDIAN PRIMEGATE NOT TO SCALE SWC FRYE ROAD AND PRICE ROAD, CHANDLER, AZ 10 101 CHANDLER BLVD. W FRYE RD CHANDLER VIRIDIAN 10 D A O S GALLERIA WAY R E CHANDLER VIRIDIAN C I R PRIMEGATE P AT FASHION CENTER 202 PRICE FWY 110,400 VPD WY E F RIC P SANTAN FWY 105,000 VPD N TRAFFIC COUNTS: CITY OF CHANDLER SITE PLAN NOT -

7Jan201320492499 26Jul201619053826

7JAN201320492499 Exhibit 99.2 Supplemental Financial Information For the three and six months ended June 30, 2016 26JUL201619053826 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate Overview ....................................................... 1-3 Overview .............................................................. 1 Capital Information and Market Capitalization ................................... 2 Changes in Total Common and Equivalent Shares/Units ............................ 3 Financial Data .......................................................... 4-9 Unaudited Pro Rata Statement of Operations .................................... 5-6 Notes to Unaudited Pro Rata Statement of Operations ............................. 7 Unaudited Pro Rata Balance Sheet ........................................... 8 2016 Guidance Range ..................................................... 9 Supplemental FFO Information .............................................. 10 Capital Expenditures ...................................................... 11 Operational Data ........................................................ 12-26 Sales Per Square Foot ..................................................... 12 Sales Per Square Foot by Property Ranking ..................................... 13-16 Occupancy ............................................................. 17 Average Base Rent Per Square -

Macerich Shopping Centers & Fashion Outlets

Macerich Shopping Centers & Fashion Outlets Tourism Fact Sheet Overview Experience the top two activities when traveling in the US – shopping and dining – at our premier shopping destinations located in major cities across the country. A unique blend of MACERICH RETAIL BRANDS INCLUDE: stores, restaurants, and entertainment – many of which are exclusives – as well as unparalleled guest services create the ultimate experience for visitors. Tourism programs benefit travel trade AMERICAN GIRL professionals and welcome both individuals and groups including: commissionable, experiential APPLE shopping packages; visitor savings; motorcoach meet-and-greet plus driver and guide incentives; resort and hotel partnerships; group programs, and dedicated marketing campaigns. BARNEYS NEW YORK Shopping Centers & Fashion Outlets BLOOMINGDALE’S Shopping in major destinations include Santa Monica Place in Santa Monica, California; Scottsdale BURBERRY Fashion Square in Scottsdale, Arizona; The Shops at North Bridge and Fashion Outlets Chicago in COACH Chicago, Illinois; Fashion Outlets Niagara Falls in Niagara Falls, New York; Tysons Corner Center in the Washington DC area; and the soon-to-open Fashion District Philadelphia in Pennsylvania. DISNEY ARIZONA 1 Scottsdale Fashion Square* Scottsdale GAP 2 Biltmore Fashion Park Phoenix GUCCI 3 Chandler Fashion Center Chandler 4 Kierland Commons Scottsdale H&M 5 La Encantada Tucson LOUIS VUITTON CALIFORNIA 6 Santa Monica Place* Santa Monica 7 La Cumbre Plaza Santa Barbara KATE SPADE NEW YORK 8 Broadway Plaza Walnut