2001 Annual Report Supplement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(Nueva) Guia Canales Cable Del Norte

Paquete Paquete Paquete Paquete Paquete Paquete Paquete Paquete Basico Premium Internac. Adultos XTIME HD Musicales PPV ●210‐Guatevision ●325‐NBC Sports ●1661‐History 2 HD Nacionales Variados ●211‐Senal Colombia ●330‐EuroSport Peliculas Educativos Pay Per View ●1671‐Sun Channel HD ●1‐TV Guia ●100‐Telemundo ●212‐Canal UNO ●331‐Baseball ●500‐HBO ●650‐Discovery ●800‐PPV Events ●2‐TeleAntillas ●101‐Telemundo ●213‐TeleCaribe ●332‐Basketball ●501‐HBO2 ●651‐Discovery Turbo ●810‐XTASY ●3‐Costa Norte ●103‐AzMundo ●214‐TRO ●333‐Golf TV ●502‐HBO LA ●652‐Discovery Science ●811‐Canal Adultos ●4‐CERTV ●104‐AzCorazon ●215‐Meridiano ●334‐Gol TV ●510‐CineMax ●653‐Civilization Disc. ●5‐Telemicro ●110‐Estrellas ●215‐Televen ●335‐NHL ●520‐Peliculas ●654‐Travel & Living High Definition ●6‐OLA TV ●111‐DTV ●216‐Tves ●336‐NFL ●530‐Peliculas ●655‐Home & Health ●1008‐El Mazo TV HD ●7‐Antena Latina ●112‐TV Novelas ●217‐Vive ●337‐Tennis Channel ●540‐Peliculas ●656‐Animal Planet ●1100‐Telemundo HD ●8‐El Mazo TV ●113‐Distrito Comedia ●218‐VTV ●338‐Horse Racing TV ●550‐Xtime ●657‐ID ●1103‐AzMundo HD ●9‐Color Vision ●114‐Antiestres TV ●220‐Globovision ●339‐F1 LA ●551‐Xtime 2 ●660‐History ●1104‐AzCorazon HD ●10‐GH TV ●115‐Ve Plus TV ●240‐Arirang TV ●552‐Xtime 3 ●661‐History 2 ●1129‐TeleXitos HD ●11‐Telesistema ●120‐Wapa Entretenimiento ●553‐Xtime Family ●665‐National Geo. ●1256‐NHK HD ●12‐JM TV ●121‐Wapa 2 Noticias ●400‐ABC ●554‐Xtime Comedy ●670‐Mas Chic ●1257‐France 24 HD ●13‐TeleCentro ●122‐Canal i ●250‐CNN ●401‐NBC ●555‐Xtime Action ●672‐Destinos TV ●1265‐RT ESP HD ●14‐OEPM TV ●123‐City TV ●251‐CNN (Es) ●402‐CBS ●556‐Xtime Horror ●673‐TV Agro ●1266‐RT USA HD ●15‐Digital 15 ●124‐PRTV ●252‐CNN Int. -

LED TV Installation Manual

LED TV Installation manual Thank you for purchasing Samsung product. To receive more service, please register your product at www.samsung.com/register Model Serial No. Figures and illustrations in this User Manual are provided for reference only and may differ from actual product appearance. Product design and specifications may be changed without notice. Introduction This TV B2B (Business to Business) model is designed for hotels or the other hospitality businesses, supports a variety of special functions, and lets you limit some user (guest) controls. Operational Modes This TV has two modes: Interactive and Stand-alone mode. y Interactive mode: In this mode, the TV communicates with and is fully or partially controlled by a connected Set Back Box (SBB) or Set Top Box (STB) provided by a hospitality SI (System Integration) vendor. When the TV is initially plugged in, it sends a command that attempts to identify the SSB or STB connected to it. If the TV identifies the SBB or STB and the SBB or STB identifies the TV, the TV gives full control to the SBB or STB. y Stand-alone mode: In this mode, this TV works alone without an external SBB or the STB. The TV has a Hotel (Hospitality) Menu that lets you easily set its various hospitality functions. Please see pages 26 to 30. The Menu also lets you activate or de-activate some TV and hospitality functions so you can create your optimal hospitality configuration. Still image warning Avoid displaying still images (such as jpeg picture files) or still image elements (such as TV channel logos, panorama or 4:3 format images, stock or news bars or crawls) on the screen. -

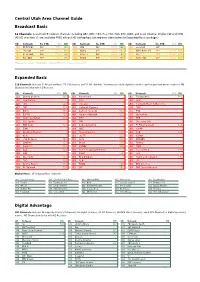

Central Utah Area Channel Guide Broadcast Basic

Central Utah Area Channel Guide Broadcast Basic 12 Channels: Local Utah Broadcast channels including ABC, NBC, CBS, Fox, PBS, PAX, BYU, KJZZ, and Local Channel 10 plus CW and UEN. (All HD channels {} are available FREE without HD set top box, but requires subscription to Expanded Basic package.) SD Network No STB DTV HD SD Network No STB DTV HD SD Network No STB DTV HD 102 KUTV CBS 02* {77-1} 502 106 ION 06* {81-13} 506 110 Local 10 10* 103 The CW 03* {81-3} 503 107 KUED 07* {80-3} 507 111 KMTI-Retro TV 11* {106-1} 511 104 KTVX ABC 04* {77-11} 504 108 BYU-TV 08* {106-2} 508 112 KJZZ 12* {79-13} 512 105 KSL NBC 05* {78-3} 505 109 KUEN 09* {80-13} 509 113 KSTU FOX 13* {79-3} 513 *Broadcast Basic customer without digital set-top box (STB) must use analog channels 02-13. Expanded Basic 120 Channels: Includes 12 Broadcast Basic, 55 SD Channels and 52 HD channels. You may also add a digital receiver to get the premium movie channels. HD Channels included with HD Receiver. SD Network DTV HD SD Network DTV HD SD Network DTV HD 114 Disney Channel 515 135 Paramount 162 Fox Business 562 115 New Nation 136 CMT 163 INSP 116 TBS 516 140 TV Land 164 Hallmark Movie & Mysteries 117 TNT 517 141 Hallmark Channel 170 FXM 118 ESPN 518 142 Cartoon Network 554 171 RFD 119 ESPN2 519 143 Outdoor Network 557 172 Sportsman 120 AT&T SportsNet 520 144 MTV 185 TBN 121 CBS Sports 145 VH1 186 Discovery Life 122 FOX News 522 146 Comedy Central 187 E! Entertainment 587 123 CNN 149 QVC 188 ESPNU 124 Weather Channel 150 Travel Channel 550 189 Golf 598 125 Nick 151 tru TV 551 190 CSPAN 126 USA Network 526 152 SyFy 552 191 OXYGEN 127 Lifetime 527 153 Bravo 553 192 History 128 Freeform 528 154 MSNBC 555 193 OWN 129 A&E 529 155 Home Shopping Network 194 Fox Sports 1 589 130 AMC 156 CNBC 556 195 FXX 131 Discovery 531 158 NFL Network 196 National Geographic 595 132 TLC 532 159 HLN 197 I.D. -

Nombre Señal Nueva Frecuencia

NOMBRE SEÑAL NUEVA FRECUENCIA On Demand 1 Canal de la Ciudad 7 Metro 8 América 9 Telefe 10 Tv Pública 11 El Trece 12 Canal 9 13 Todo Noticias 14 A 24 15 C5N 16 Crónica TV 17 26 TV 18 La Nación TV 19 Ciudad Magazine 20 NET TV 21 Encuentro 22 KZO 30 Diputados TV 36 Canal 90 - TyC Max - Senado TV 90 Deportv 100 T y C Sports 101 ESPN 102 ESPN 2 103 ESPN 3 104 ESPN + 105 Fox Sports 106 Fox Sports 2 107 Fox Sports 3 108 El Garage 109 The Golf Channel 110 NBA - Tv 111 Discovery Turbo 112 America Sports 115 Fox Sports Premium 123 TNT Sports 124 Paka Paka 200 Disney Channel 201 Nickelodeon 202 Cartoon Network 203 Disney XD 204 Discovery Kids 205 Boomerang 206 Disney Jr 207 Baby TV 208 Tooncast 209 Nick Jr 210 Natgeo Kids 211 HBO Este 250 HBO 2 251 HBO Plus Este 252 HBO Plus Oeste 253 Max Este 254 Max Up 255 Max Prime Este 256 Max Prime Oeste 257 HBO Family Este 258 HBO Signature 259 Fox Movies 260 Fox Series Este 261 Fox Series Oeste 262 Fox Action 263 Fox Family 264 Fox Comedy 265 Fox Cinema 266 Fox Classics 267 Incaa TV 300 Cinemax 301 FX Movies 302 Volver 303 Space 304 Cinecanal Este 305 TNT 306 TNT Series 307 FX 308 Fox 309 Sony 310 Warner Channel 311 Universal Channel 312 AXN 313 Studio Universal 314 A & E Mundo 315 Europa Europa 316 TBS 317 TCM 318 AMC 319 I-Sat 320 Atres Series 321 Syfy 322 Fox Life 323 Eurochannel 324 ID Investigacion Discovery 325 Comedy Central 326 Paramount 327 Pasiones 330 Telemundo 331 Lifetime 400 Gourmet.com 401 Food Network 403 E! Entertainment Television 404 Discovery Home & Health 405 Maschic 406 TLC 407 Hola TV 409 Glitz 410 INTI 411 Canal Rural 420 Viajar 421 Sun Channel 422 Telemax 423 Señal María (24 hs) 424 Nueva Imagen 425 EWTN 426 Canal 21 427 Wobi 428 Juegos APTIV 429 Juegos APTIV 430 National Geographic 450 Discovery Channel 451 Animal Planet 452 Discovery Theatre 453 The History Channel 454 TRU TV 455 Canal a 456 Film & Arts 457 History 2 458 Natgeo Wild 459 Discovery World 460 Discovery Civilization 461 Discovery Science 462 MTV 500 Quiero.. -

Canal Institucional *Hq Co | Canal Trece *Hd Co

CO | CABLE NOTICIAS *HD CL | CANAL 13 *FHD | Directo AR | AMERICA TV *HD | op2 AR | SENADO *HD CO | CANAL CAPITAL *HD CL | CANAL 13 CABLE *HD AR | C5N *HD AR | TELEFE *FHD CO | CANAL INSTITUCIONAL *HQ CL | CANAL 13 AR | C5N *HD | op2 AR | TELEFE *HD CO | CANAL TRECE *HD INTERNACIONACIONAL *HD AR | CANAL 21 *HD AR | TELEFE *HD CO | CANAL UNO *HD CL | CHV *HQ AR | CANAL 26 *HD AR | TELEMAX *HD CO | CANTINAZO *HD CL | CHV *HD AR | CANAL 26 NOTICIAS *HD AR | TELESUR *HD CO | CARACOL *HQ CL | CHV *FHD AR | CANAL 26 NOTICIAS *HD AR | TN *HD CO | CARACOL *HD CL | CHV *FHD | Directo AR | CANAL DE LA CIUDAD *HD AR | TV PUBLICA *FHD CO | CARACOL *FHD CL | LA RED *HQ AR | CANAL DE LA MUSICA AR | TV PUBLICA *HD CO | CARACOL 2 *FHD CL | LA RED *HD *HD AR | CINE AR *HD AR | AR | TV PUBLICA *HD | op2 CO | CARACOL INTERNACIONAL *HD CL | LA RED *FHD CINE AR *HD AR | TV5 *HD CO | CITY TV *HD CL | LA RED *FHD | Directo AR | CIUDAD MAGAZINE *HD AR | TVE *HD CO | COSMOVISION *HD CL | MEGA *HQ AR | CN23 *HD AR | VOLVER *HD CO | EL TIEMPO *HD CL | MEGA *HD AR | CN23 *HD AR | TELEFE INTERNACIONAL CO | LA KALLE *HD CL | MEGA *FHD AR | CONEXION *HD *HD A&E *FHD CO | NTN24 *HD CL | MEGA *HD | Op2 AR | CONSTRUIR *HD A3 SERIES *FHD CO | RCN *HQ CL | MEGA *FHD | Directo AR | CRONICA *HD AMC *FHD CO | RCN *HD CL | MEGA PLUS *FHD AR | CRONICA *HD ANTENA 3 *FHD CO | RCN *FHD CL | TVN *HQ AR | DEPORTV *HD AXN *FHD CO | RCN 2 *FHD CL | TVN *HD AR | EL NUEVE *HD CINECANAL *FHD CO | RCN NOVELAS *HD CL | TVN *FHD AR | EL NUEVE *FHD CINEMAX *FHD CO | RCN INTERNACIONAL CL | -

The National Academy of Television Arts & Sciences

FOR IMMEDIATE RELEASE THE NATIONAL ACADEMY OF TELEVISION ARTS & SCIENCES ANNOUNCES WINNERS OF 32 nd ANNUAL SPORTS EMMY® AWARDS Al Michaels Honored with Lifetime Achievement Award New York, NY – May 2, 2011 – The National Academy of Television Arts and Sciences (NATAS) announced the winners tonight of the 32 nd Annual Sports Emmy® Awards at a special ceremony at Frederick P. Rose Hall, Home of Jazz at Lincoln Center in New York City. Winners in 33 categories including outstanding live sports special, live series, sports documentary, studio show, promotional announcements, play-by-play personality and studio analyst were honored. The awards were presented by a distinguished group of sports figures and television personalities including Cris Collinsworth (sports analyst for NBC’s “Sunday Night Football”); Dan Hicks ( NBC’s Golf host); Jim Nantz (lead play-by-play announcer of The NFL on CBS and play-by-play broadcaster for NCAA college basketball and golf on CBS); Vern Lundquist (CBS Sports play-by-play broadcaster); Chris Myers (FOX Sports Host); Scott Van Pelt (anchor, ESPN’s Sportscenter and ESPN’s radio show, “The Scott Van Pelt Show”); Hannah Storm (anchor on the weekday morning editions of ESPN’s SportsCenter); Mike Tirico (play-by-play announcer for ESPN's NFL Monday Night Football, and golf on ABC); Bob Papa (HBO Sports Broadcaster); Andrea Kremer (Correspondent, HBO’s “Real Sports with Bryant Gumbel”); Ernie Johnson (host of Inside the NBA on TNT); Cal Ripken, Jr. (TNT Sports Analyst and member of Baseball’s Hall of Fame); Ron Darling (TNT & TBS MLB Analyst and former star, NY Mets); Hazel Mae (MLB Network host, “Quick Pitch”); Steve Mariucci (Former NFL Coach and NFL Network Analyst); Marshall Faulk (Former NFL Running Back and NFL Network Analyst); and Harold Reynolds (MLB Network Studio Analyst). -

Listado De Canales Tv Prime Plus

Listado de Canales Tv Prime Plus ARGENTINA AR | TELEFE *FHD BR | TELECINE CULT *HD BR | DISNEY JUNIOR *HD CA | PBS Buffalo (WNED) AR | AMERICA 24 *FHD AR | TELEFE *HD BR | TELECINE ACTION *HD BR | DISNEY CHANNEL *HD CA | OWN AR | AMERICA 24 *HD AR | TELEFE *HD BR | TCM *HD BR | DISCOVERY WORLD *HD CA | OMNI_2 AR | AMERICA TV *FHD AR | TELEMAX *HD BR | TBS *HD BR | DISCOVERY TURBO *HD CA | OMNI_1 AR | AMERICA TV *HD AR | TELESUR *HD BR | SYFY *HD BR | DISCOVERY THEATHER *HD CA | OLN AR | AMERICA TV *HD | op2 AR | TN *HD BR | STUDIO UNIVERSAL *HD BR | DISCOVERY SCIENCE *HD CA | CablePulse 24 AR | C5N *HD AR | TV PUBLICA *FHD BR | SPACE *HD BR | DISCOVERY KIDS *HD CA | NBA_TV AR | C5N *HD | op2 AR | TV PUBLICA *HD BR | SONY *HD BR | DISCOVERY ID *HD CA | NAT_GEO AR | CANAL 21 *HD AR | TV PUBLICA *HD | op2 BR | REDE VIDA *HD BR | DISCOVERY H&H *HD CA | MUCH_MUSIC AR | CANAL 26 *HD AR | TV5 *HD BR | REDE TV *HD BR | DISCOVERY CIVILIZATION *HD CA | MTV AR | CANAL 26 NOTICIAS *HD AR | TVE *HD BR | REDE BRASIL *HD BR | DISCOVERY CH. *HD CA | Makeful AR | CANAL 26 NOTICIAS *HD AR | VOLVER *HD BR | RECORD NEWS *HD BR | COMEDY CENTRAL *HD CA | HLN AR | CANAL DE LA CIUDAD *HD BR | RECORD *HD BR | COMBATE *HD CA | History Channel AR | CANAL DE LA MUSICA *HD BOLIVIA BR | PLAY TV *HD BR | CINEMAX *HD CA | GOLF AR | CINE AR *HD BO | ATB BR | PARAMOUNT *HD BR | CARTOON NETWORK *HD CA | Global Toronto (CIII) AR | CINE AR *HD BO | BOLIVIA TV BR | NICKELODEON *HD BR | CANAL BRASIL *HD CA | Game TV AR | CIUDAD MAGAZINE *HD BO | BOLIVISION *HD BR | NICK JR -

Reading 3.2 Toby Miller, Geoffrey Lawrence, Jim Mckay and David

94 D170 This sporting planet Reading 3.2 Toby Miller,GeoffreyLawrence, Jim McKay and David Rowe, ‘ Sports media sans frontières’ God wore number 23. ( De Morgen,Belgium) The ‘ Michelangelo’ of sportshoes will not return. ( Faz,Germany) His royalAirness will never fly again. ( Telegraaf,The Netherlands) God is going home. ( Yedioth Ahrnonoth,Israel) [B]asketball is alone. ( La Repubblica,Italy) The King is Leaving. ( Sport,Spain) Earthquake. ( El Mundo Deportivo,Spain) Amyththat has gone beyond sports. ( El Periodico,Spain) Tell us it is not true. ( El Pais,Spain) [H]e’ sthe greatest.(Herald Sun,Australia) King MikeAbdicates. ( Age,Australia) God will never fly again. ( Asahi Shimbun,Japan) God finally to retire. ( Tochu Sports,Jordan) [His] nameisengraved on theheartofeveryone. ( Beijing Morning Post,China) Año Uno D. De J. [Year One After Jordan]. ( Ole,Argentina) (quoted in ‘ The World Bids’ ,1999) Theseresponses to Michael Jordan’ sretirement testify to three things – his exceptional athletic ability, thesuccess of Nikeworldwide, and the spread of theNBA acrossTVscreens: Rafaga NBA in Mexico, La Magia de la NBA in Argentina, Give Me Five in Belgium, NBAMania in Japan, NBAJam in Taiwan, and Zou Jin in thePRC (Andrews, 1999: 508).Just as Nikeand theNBA built their strategies forgrowtharound Jordan, so his career can only be understood in terms of thoseinstitutions. While this is perhaps themost spectacular instance of themedia– sports link, TV in particular is inseparable fromglobal sport, as bothamarker of globalization and one of its prime movers. IOC official historymarksthe Olympics in terms of broadcast revenues – atotal of US$1.25 billion forthe 2000 and 2002Games – and their status as ‘ asocial, even sociological event, whichmore or less reflects thestate of theworld’ (Macleod, 1996: 23; Verdier,1996: 34). -

Fox Sports Premium, TNT Sports Debut with €˜Sinceros’ Campaign

Fox Sports Premium, TNT Sports Debut With ‘Sinceros’ Campaign 10.27.2017 Driven by the desire to grow their Argentine audiences, Fox Networks Group Latin America and Turner Latin America have teamed up to acquire the broadcast rights to Superliga Argentina de Fútbol. As a result of that mega-deal, both media companies also have launched 24/7 sports networks in the country. The five-year contract is an example of a growing international trend of two companies partnering to acquire broadcast rights, while each maintaining independent operations. Hernán Donnari, EVP of Fox Sports South America, says for many years Argentine soccer has been decentralized among different channels, resulting in high levels of overlap and audience flight. "We set out to rearrange the whole process and broadcast what is now called Superliga Argentina de Fútbol, in the same way major leagues across the world organize their events, by planning, ordering and setting high-production values with HD quality," he says. According to Donnari, making this business model sustainable required a premium product which, because of the size of the required investment, needed to be shared by two large companies. Taking that into account, in August 24/7 cable channels Fox Sports Premium and TNT Sports were born. "Given the magnitude of the business, Turner and Fox were the only types of companies that could undertake such a project, which requires making a significant investment in a single country," says Mariano Cesar, VP and channel manager Latin America of TNT, TNT Sports, TNT Series, TBS, truTV, HTV, MuchMusic and Glitz. -

Remotedoc9515288c9cbbec-5F6b-4A Page 1 Typestreamcategory Live

remotedoc9515288c9cbbec-5f6b-4a TypeStreamCategory Live StreamsEvents: Corona Virus - Covid 19Live: Netherland Live StreamsNL: 100% TVLive: Netherland Live StreamsNL: 192 TVLive: Netherland Live StreamsNL: 24 Kitchen HDLive: Netherland Live StreamsNL: 24KitchenLive: Netherland Live StreamsNL: Animal Planet HDLive: Netherland Live StreamsNL: AT5 HDLive: Netherland Live StreamsNL: Baby TVLive: Netherland Live StreamsNL: BBC First HDLive: Netherland Live StreamsNL: BBC OneLive: Netherland Live StreamsNL: BoomerangLive: Netherland Live StreamsNL: BVNLive: Netherland Live StreamsNL: Cartoon NetworkLive: Netherland Live StreamsNL: CBS Reality HDLive: Netherland Live StreamsNL: Comedy CentralLive: Netherland Live StreamsNL: Comedy Central ExtraLive: Netherland Live StreamsNL: Crime & InvestigationLive: Netherland Live StreamsNL: DanceTrippinLive: Netherland Live StreamsNL: Discover Science HDLive: Netherland Live StreamsNL: Discover WorldLive: Netherland Live StreamsNL: Discovery Channel HDLive: Netherland Live StreamsNL: Discovery ID FHDLive: Netherland Live StreamsNL: Disney ChannelLive: Netherland Live StreamsNL: Disney XDLive: Netherland Live StreamsNL: Djazz TVLive: Netherland Live StreamsNL: DRTVLive: Netherland Live StreamsNL: DTV UdenLive: Netherland Live StreamsNL: Duck TVLive: Netherland Live StreamsNL: E! entertainement HDLive: Netherland Live StreamsNL: Edge Sport HDLive: Netherland Live StreamsNL: ESPN 1Live: Netherland Live StreamsNL: ESPN 1 FHDLive: Netherland Live StreamsNL: ESPN 1 HDLive: Netherland Live StreamsNL: ESPN 1 SDLive: -

DOCKEJ File COPY OR\G\Nal in the Matter of ) ) Annual Assessment Ofthe Status of ) CS Docket No

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. 20554 "~:':':"~ \1 DOCKEJ FilE COPY OR\G\NAl In the Matter of ) ) Annual Assessment ofthe Status of ) CS Docket No. 97-141 Competition in the Markets for the ) Delivery ofVideo Programming ) COMMENTS OF DIRECTV, INC. DlRECTV, Inc. ("DlRECTV") hereby submits the following comments in response to the Commission's Notice ofInquiry ("NOI") in the above-captioned matter. I. INTRODUCTION & OVERVIEW As ofJune 1997, DlRECTV provided direct broadcast satellite ("DBS") service to more than 2.6 million subscribers nationwide.! Using three high-powered DBS satellites at 101 0 W.L., DlRECTV offers approximately 175 channels of digitally-delivered entertainment, educational, and informational programming directly to homes and businesses equipped with the DSS® receiving system, which features satellite dish antennas only 18 inches in diameter. When DlRECTV first launched its DBS-1 satellite three years ago -- the culmination often years and $750 million worth of effort and investment -- DlRECTV was dedicated to providing consumers with a multichannel video programming distributor ("MVPD") alternative to incumbent cable television operators. Three years and more than 2.6 million subscribers later, DlRECTV remains dedicated to that same goal. And while the last three years DlRECTV is a DBS licensee and a wholly-owned subsidiary ofDlRECTV Enterprises, Inc., which is a majority-owned subsidiary ofHE Holdings, Inc., a Delaware corporation. No. of Copies rec'd 0.1---3 IDC_DOCS\69256.611 List ABCDE have been successful for DIRECTV -- aided significantly by the Commission's continuing commitment to fostering competition to cable television -- neither DIRECTV or DBS has yet achieved a competitive position on par with local cable operators. -

An Economic Analysis of the Prime Time Access Rule

BEFORE THE FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. 20554 In re: Review of the Prime Time Access Rule, Section 73.658 (k) of the Commission’s } MM Docket No. 94-123 Rules AN ECONOMIC ANALYSIS OF THE PRIME TIME ACCESS RULE March 7, 1995 ECONOMISTS INCORPORATED WASHINGTON, D.C. CONTENTS I. Introduction……………………………...……………………………………………1 II. Is ABC, CBS or NBC Dominant Today? A. No single network dominates any market...........................................................5 B. Factors facilitating the growth of competing video distributors ................................................................................................7 1. Cable penetration ....................................................................................7 2. Number and strength of independent stations.........................................9 3. Other video outlets................................................................................12 C. Competing video distributors............................................................................13 1. New broadcast networks .......................................................................13 2. New cable networks..............................................................................16 3. First-run syndication .............................................................................17 D. Impact on networks of increased competition ..................................................18 1. Audience shares ....................................................................................18