CHRW John Wiehoff, CEO 952-683-3800

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Location of North American 3PL Headquarters

Location of North American 3PL Headquarters California - 18 HQs New Jersey - 14 HQs Agility Logistics - Irvine* Alliance Shippers - Englewood Cliffs Aspen Logistics - Temecula Damco USA - Madison* CaseStack - Santa Monica Flash Global Logistics - Montville D.W. Morgan Company - Pleasanton Geodis Wilson - Iselin* Number of HQs Dependable Distribution Centers - Kuehne + Nagel - Jersey City* Los Angeles National Retail Systems - North Ingram Micro Logistics - Santa Ana Bergen 1 Johanson Transportation Service NFI Industries - Cherry Hill - Fresno Panalpina - Morristown* Megatrux Companies - Rancho Port Jersey Logistics - Monroe 2-4 Cucamonga Township Menlo Worldwide Logistics - San Priority Solutions International - Mateo Swedesboro 5-9 Nexus Distribution - Oakland The Gilbert Company - Keasbey OOCL Logistics (USA) - Fountain Tucker Company Worldwide - Valley* Cherry Hill 10+ Pantos Logistics - Rancho Wallenius Wilhelmsen - Woodcliff Dominguez* Lake* Performance Team - Santa Fe Yusen Logistics - Secaucus* Springs Serec of California - Industry Source Logistics - Montebello Illinois - 13 HQs The RK Logistics Group - Fremont UTi Worldwide - Long Beach A&R Logistics - Morris Weber Logistics - Santa Fe Springs AFN - Niles AIT Worldwide - Itasca ArrowStream - Chicago Caterpillar Logistics Services - Morton DSC Logistics - Des Plaines Echo Global Logistics - Chicago Fidelitone Logistics - Wauconda Hub Group - Downers Grove LeSaint Logistics - Romeoville RR Donnelley - Chicago Sankyu USA - Wood Dale* * Denotes regional headquarters. SEKO Logistics -

Top Freight Brokerage Firms

Online Shopping Drives Growth in Demand For Faster, Cheaper Local Delivery Services By Daniel P. Bearth up local hubs to provide one-hour delivery in cities across Senior Features Writer the United States. In the 2016 edition of Transport Topics’ Top 50 s online sales continue to soar, so have Logistics Companies, we explore what the growth the expectations of consumers for goods of online commerce means to some of the largest to be delivered quickly and cheaply. logistics service providers in North America, including Fueling an increase in on-demand top-ranked UPS Inc., which has invested in several delivery services is Amazon.com, the delivery startups, and FedEx Corp., which last year Seattle-basedA online bookseller that has over the past acquired Genco, a distribution firm that handles order two decades morphed into a $100 billion-a-year global fulfillment and manages returned goods for Internet storehouse and potentially a provider of logistics services retailers. in its own right. While the companies have made investments to Since 2014, investors have poured more than $1 billion enhance their package delivery networks to handle into companies, such as California-based Postmates additional online commerce, they don’t yet see enough and Deliv, that use freelance drivers to provide same- demand from consumers to expand same-day or on- day pickup and delivery of merchandise and packages. demand delivery service. At the same time, Google and other high-tech firms On the other hand, the beginnings of a new and are developing driverless trucks and robotic delivery radically different transportation network appear to be vehicles in an effort to lower costs. -

1 Kuehne + Nagel Inc. Switzerland 4053000 2 DHL Supply Chain

Container Volume Rank Company Headquarters (TEU equivalents) 1 Kuehne + Nagel Inc. Switzerland 4,053,000 2 DHL Supply Chain Germany 3,059,000 3 Sinotrans Ltd. China 2,801,300 4 DB Schenker USA Germany 1,952,600 5 Panalpina Inc. Switzerland 1,488,500 Copenhagen, 6 DSV Air & Sea Ltd. 1,305,594 Denmark Expeditors International of 7 United States 1,044,116 Washington Hellmann Worldwide 8 Germany 902,260 Logistics 9 Bollore Logistics France 844,000 10 Kerry Logistics Network Hong Kong 785,600 11 Damco International The Netherlands 744,000 12 Geodis United States 690,000 13 Ceva Logistics The Netherlands 681,600 14 Yusen Logistics Japan 633,056 15 Logwin Logistics Germany 600,000 Orient Overseas Container 15 Hong Kong 600,000 Line Ltd. 15 UPS Supply Chain Solutions United States 600,000 18 LF Logistics Hong Kong 550,000 18 Nippon Express Co. Japan 550,000 20 Toll Global Forwarding Australia 542,000 21 Agility Logistics Switzerland 513,500 China Resources Logistics 22 Hong Kong 500,000 (Group) Ltd. Mallory Alexander 22 United States 500,000 International Logistics 24 C.H. Robinson Worldwide United States 485,000 25 Kintetsu World Express Japan 463,000 26 Dachser SE Germany 462,700 27 Hitachi Transport System Japan 430,000 28 CJ Logistics South Korea 415,019 Container Volume Rank Company Headquarters (TEU equivalents) 29 Worldwide Logistics Group China 412,300 30 Sankyu Inc. Japan 402,531 Chinatrans International 31 China 300,000 Logistics 32 Mainfreight Ltd. New Zealand 267,144 Zhejiang Jiulong International 33 China 250,000 Logistics Co. -

The North American Third Party Logistics Industry in 2012: the Provider Ceo Perspective

The North American Third Party Logistics Industry In 2012: The Provider Ceo Perspective Dr. Robert C. Lieb Professor of Supply Chain Management College of Business Administration Northeastern University 214 Hayden Hall Boston, MA 02115 617-373-4813 [email protected] Dr. Kristin J. Lieb Assistant Professor of Marketing Communication Emerson College 120 Boylston Street Office 924 Boston, MA 02116 617-824-3425 [email protected] January 2013 *The authors would like to express their appreciation to Penske Logistics for their support of this project. 1 THE NORTH AMERICAN THIRD PARTY LOGISTICS INDUSTRY IN 2012: THE PROVIDER CEO PERSPECTIVE Introduction This paper, which is based on a survey of the CEOs of 20 large 3PLs serving North America, was conducted in mid-2012 and focused on the state of the North American marketplace for 3PL services at that time. This was the 19th iteration of this annual survey. The authors conduct similar annual surveys in Europe and the Asia-Pacific region. The 2012 survey focused on a variety of issues including the key marketplace dynamics in the North American 3PL industry, the industry’s ongoing commitment to environmental sustainability, its expanded use of social media tools, its current role in meeting the logistics service needs of companies in the healthcare industry, and a wide range of other aspects of the industry’s current status and future prospects in the region. The CEO of each company included in the survey was contacted by e-mail and asked to participate in a web- based survey. An initial target group of 20 of the 50 largest 3PLs in North America was contacted, and the CEOs of all those companies agreed to participate. -

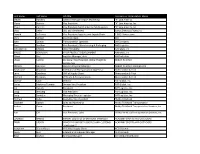

First Name Last Name Job Title Company Or Organization Name

First name Last name Job title Company or Organization Name Steven Hawkins General Manager Import Marketing "K" Line America Maria Bodnar Vice President "K" Line America, Inc. Shaun Gannon Vice President North America Field Logistics "K" Line America, Inc. Chas Deller CEO and CHAIRMAN 10XOCEANSOLUTIONS,INC Donald La France Vice President Logistics and Supply Chain 1-800-Flowers.com Chris McNeil Sourcing Agent 3M John Ladwig Transportation Specialist 3M Company Russ Boullion Vice President - Warehousing & Packaging A&R Logistics XIANGMING CHENG CEO/ PRESIDENT AAmetals, Inc BRUCE FERGUSON VP OF PRODUCT DEVELOPMENT AAmetals, Inc Eileen Wei Logistics Manager, Asia AB Electrolux Ulises Carrillo Divisional Vice President, Global Freight & Abbott Nutrition Distribution William Gaiennie Logistics Program Manager Abbott Nutrition International Sarah Jane Chapman International Transportation Supervisor Abercrombie & Fitch Larry Grischow GVP of Supply Chain Abercrombie & Fitch Michael Sherman VP Trade & Transportation Abercrombie & Fitch Gunnar Gose Director ABF Global, Inc. Carlos Martinez-Tomatis Division Vice President ABF Global, Inc. Jim Ingram President ABF Logistics, Inc. Doug Riesberg Vice President ABF Logistics, Inc. Craig Sandefur Managing Director Logistics ABF Logistics, Inc. Michael Kelso Executive Vice President Ability Tri-Modal Elizabeth Gaston Sales and Marketing Ability Tri-Modal Transportation Joshua Owen President Ability Tri-Modal Transportation Services, Inc. Ron Gill Vice President, Sales Ability/Tri-Modal Transportation Services, -

LOGISTICS MANAGEMENT 1 Get Your Daily Fix of Industry News on Logisticsmgmt.Com

logisticsmgmt.com Includes: • Transportation Services • Third-party Logistics • Logistics Technology December 2017 ® • Warehouse/Distribution Centers 2018 Buyers’Buyers’ GuideGuide Page 19 23 YEARS OF BUSINESS WITH WALMART REGIONAL CARRIER OF THE YEAR 5 AWARDS IT ALL COMES DOWN TO THE POWER OF ONE. In 2017, we received our 5th Regional Carrier of the Year Award from the world’s largest retailer. While we certainly appreciate the recognition, we’re even more grateful for the people behind it. Because to us, this award is yet another example of what can happen Speaking of partnerships, when the right people come together. The power of teamwork. The power of partnership. scan here to see what Averitt The Power of One. Thank you Walmart and all our Averitt associates. can do for you. AVERITTEXPRESS.COM • 1.800.AVERITT Get your daily fix of industry news on logisticsmgmt.com management UPDATE AN EXECUTIVE SUMMARY OF INDUSTRY NEWS u CBRE report makes the case for on-demand strategies that enable UPS customers to participate in global warehousing. In its “2017 U.S. Holiday Trends Guide,” trade and finance. As for how it would like to leverage block- industrial real estate firm CBRE stated that the most appli- chain technology, UPS said it’s looking at blockchain applica- cable trend on the supply chain and logistics side centers tions for its customs brokerage business operations, with the around what it calls “warehouse space, on demand.” CBRE company focused on digitizing transactions. explained that this trend is being paced by online sales essentially creating instant, short-term demand for warehouse u Time to close the continuity gap. -

Small and Mid-Size Companies Enhance Financial Performance Through Supply Chain Management

SMALL AND MID-SIZE COMPANIES ENHANCE FINANCIAL PERFORMANCE THROUGH SUPPLY CHAIN MANAGEMENT Many small and mid-size companies may not have the resources in-house to effectively manage the challenges associated with logistics. Focused on their core business, they relegate supply chain management solutions to a back-room function, and fail to recognize the impact of their supply chain on revenue growth, operating expenses and capital utilization. For the small or mid-size company, the understanding that improvements in the current supply chain will help reduce costs of goods sold, days in inventory and overall hidden operational expenses is one thing. However, there are many issues these companies face that keep them from embarking on improved supply chain management and discovering its benefits on financial performance. For some companies, the manual processes that slow down productivity also do not allow for time to focus on logistics functions. For others, growth is the top priority; the cost of logistics is not identified and the potential for improvement is unknown. Smaller companies may not have the technology to track information or the personnel to deal with all aspects of logistics. Where to start By their very nature, supply chains are complex. One approach is to consider the logistics functions required to support your supply chain and then identify those areas offering the greatest potential to affect revenue growth, operating expense, and capital utilization. The Council of Supply Chain Management Professionals (CSCMP) defines logistics management activities as typically including inbound and outbound transportation management, fleet management, warehousing, materials handling, order fulfillment, logistics network design, inventory management, and supply/demand planning. -

Health & Beauty Manufacturer

HEALTH & BEAUTY MANUFACTURER AND DIRECT MARKETER IMPROVES SUPPLY CHAIN WELLNESS MIQ LOGISTICS GLOBAL SERVICES DELIVERING SOLUTIONS CASE STUDY OVERVIEW The Customer The customer is a growing multi-national manufacturer direct marketer The Challenge: of health, beauty and household cleaning products. It’s structure Determine whether supply chain places responsibility for P&L within each country. In the United States, optimization opportunities exist. a leadership change in the Transportation department offered MIQ Logistics an opportunity to discuss new approaches to Strategy: logistics management. Analyze the customer’s pricing and route information. The Challenge The customer felt its supply chain was working fine. No pain, no Solution: need to change! However, having worked with MIQ Logistics in the Centralize outbound logistics past, and experienced improved operations, the new leader was processes in Hong Kong and willing to let us review the company’s pricing and route information implement state-of-the-art on outbound shipments to the United States, Japan, Taiwan, technologies. Malaysia and Australia. Results: The Strategy Reduce transportation expenses Analyze the pricing and route information to determine if we could and increase productivity. optimize the customer’s supply chain. miq.com The Solution The analysis uncovered opportunities to reduce transportation expenses, reduce reliance on airfreight, streamline communications and improve service levels. The MIQ Logistics solution also increased shipment visibility. Following implementation, a Hong Kong “control tower” provides a centralized resource for managing and monitoring the customs clearance processes and transportation on trade lanes used by the customer. The control tower oversees pricing and coordinates distribution to local markets. This aids the customer in enforcing price-to-market strategies, while stabilizing ship dates. -

2016 Companies at AGC 100116 FINAL

Companies In Attendance as of FINAL CSCMP 2016 Annual Global Conference 2016 "Fortune" Companies in Attendance as of FINAL 50% 45% 40% 40% 35% 30% 30% 25% 24% 20% 17% 15% Percentinof Attendance Companies 10% 5% 0% 1 to 50 1 to 100 1 to 250 1 to 500 CSCMP 2016 Annual Conference FORTUNE 500 Companies Attending as of FINAL FORTUNE 50 FORTUNE 100 FORTUNE 250 FORTUNE 500 Fortune 50 Plus Fortune 100 Plus Fortune 250 Plus 1 Wal-Mart Stores 51 Pfizer 102 Time Warner Inc. 262 AGCO Corporation 7 General Motors 53 Intel Corporation 105 International Paper 269 BB&T Corporation 9 General Electric 58 The Coca-Cola Co 106 McDonald's Corporation 279 The Estee Lauder Co 12 CVS Caremark 61 The Walt Disney Co 108 The TJX Companies 295 W.W. Grainger, Inc. 16 Verizon 68 Johnson Controls, Inc. 111 Tech Data Corporation 309 Sonic Automotive, Inc. 17 Hewlett-Packard 77 Honeywell International 115 Nike, Inc. 320 Weyerhaeuser Co 18 J.P. Morgan Chase 80 Deere & Company 127 Staples, Inc. 321 Ball Corporation 22 Cardinal Health 82 Oracle Corporation 136 Abbott Laboratories 331 Charter Communications 29 Wells Fargo 89 Mondelez International 140 U.S. Bancorp 348 Coca-Cola 30 Boeing 99 General Dynamics 149 Danaher Corporation 363 CBRE Group, Inc. 31 Procter & Gamble 153 Whirlpool Corporation 366 The Hershey Co 33 Home Depot 159 General Mills, Inc. 375 Biogen Idec Inc. 34 Microsoft 160 Southwest Airlines Co. 386 Dillard's, Inc. 35 Amazon.com 161 Altria Group, Inc. 398 Avery Dennison Corp 36 Target 167 Colgate-Palmolive 400 Foot Locker, Inc. -

Lineage Logistics $900 0 NA NA NA Industrial and Manufacturing, Food and Custom Brokerage, Dedicated Contract Novi, Mich

E-COMMERCE DRIVES GROWTH IN PRODUCT RETURNS 2018 LOGISTICS COMPANIES Reinventing Logistics Innovation is changing the way firms do business. Senior features writer Daniel P. Bearth investigates. ideas venture capital What drives the nation’s leading provider of transportation and workforce solutions? Higher standards. There’s a wide world of choices in driver recruitment. But when it comes to the things that truly matter, one name stands out. TransForce holds drivers to the highest standards of safety and professionalism, while holding our customer service team to equally high standards for responsiveness. Just a few reasons we’re #1 in North America and the perfect partner when your company’s destination is success. 1-800-308-6989 | transforce.com XPO Logistics Takes Its Place at the Top moved up to No. 2 this year, with freight brokerage giant By Daniel P. Bearth C.H. Robinson Worldwide and Seattle-based freight Senior Features Writer forwarder Expeditors International of Washington rounding out the top five positions. s companies grow, so do expectations, and XPO In March, FedEx Corp. (No. 8) combined several of Logistics is not taking its newfound status as the largest its logistics-oriented business units to operate under Alogistics company in North America for granted. FedEx Trade Networks. The new business will offer After a string of high-profile acquisitions pushed XPO warehousing and service parts distribution, freight to the top of the Transport Topics Logistics 50 list in brokerage, expedited shipping, cross border services, 2017, the company kept its No. 1 ranking this year freight forwarding and supply chain consulting and is by growing its business organically and by effectively headed by Richard Smith, the son of FedEx founder cross-selling transportation and logistics services to Fred Smith. -

First Name Last Name Job Title Company Bruce Abbe Executive

First Name Last Name Job Title Company Bruce Abbe Executive Director Midwest Shippers Association Randy Abbott Intermodal VP of Sales XPO Logistics Mark Aberle Supply Chain Operations Eddie Bauer John Abisch RCEO Ecu Worldwide Thomas Abramowitz Drayage Sales Representative JSK Transportation David Adam Chairman & CEO US Maritime Alliance (USMX) Frank Adcock AVP Marketing TTX Company Eric Adelstein SVP Supply Chain Bob's Discount Furniture Ian Aguilar Sales Manager Shippabo Tony Aguilar Import Logistics Coordinator Handgards Craig Akers Director of Operations AFMSToy Shippers Global AssociationTransportation Inc Lisa Akers-Stein Vice President Consultant Natalie Akiyama Assistant to Division Manager Yamaha Motor Corporation Deniz Akkirman TPEB Tradelane Manager UPS Supply Chain Solutions TONY ALANIS Executive Board Member ILWU LOCAL 13 Global Forwarding Director of Stefania Albanese-Monforti Sales XPO Logisitics Director Of Logistics and Trade Alex Albertini Compliance Charlotte Russe Inc. Progressive Transportation Kenneth Albertson Vice President Sales & Marketing Services, LLC. Mark Aldridge Director of Sales NFI Global LLC Edward Aldridge Director, Head of FCL USA DB Schenker Goetz Alebrand VP Seafreight Kuehne + Nagel Raul Alfonso EVP & CCO Port Tampa Bay Stuart ALLEN EVP Sherwood Global Commerce Steve Alonso Director International Logistics The Home Depot TammyLynn Alsup Manager Carhartt Beverly Altimore Executive Director USSA Ricardo Alvarez Director of Operations DP World Prince Rupert Evergreen Shipping Agency Roy Amalfitano Vice -

Transportation & Logistics

www.mercercapital.com VALUE FOCUS Transportation & Logistics Second Quarter 2018 First Quarter 2019 | Article: The Rise of FreightTech In This Issue The Rise of FreightTech 1 Industry Macro Trends 4 Trucking 7 Rail & Intermodal 10 M&A Activity 12 Public Company Performance 15 Mercer Capital’s Value Focus: Transportation & Logistics Fourth Quarter 2018 FEATURE To the lay person, transportation may seem like the farthest end of the spectrum from the technology industry – telephone orders and paper shipment tracking. But those in the know understand just how tech-enabled the industry has become. The Rise of Advancements in machine learning, artificial intelligence, and predictive technology could have the power to disrupt the way goods are transported, stored, and tracked. And investors are clearly willing to take bets on that. FreightTech Over the past few years, FreightTech has emerged as its own category of technology. The level of excitement in the space grew in 2018 as global venture capital investment increased to $2.9 billion from $1.3 billion the prior year. FreightTech is on track for another year of exponential growth in 2019, with $1.6B of funding raised in the first quarter alone. FreightTech VC Funding $7.0 $4.8 $6.0 Billions $5.0 $4.0 $2.9 $3.0 $2.0 $1.3 $1.0 $1.6 $0.0 2017 2018 2019* Source: Pitchbook, Freightwaves 2019 data through Q1 annualized © 2019 Mercer Capital // www.mercercapital.com 1 Mercer Capital’s Value Focus: Transportation & Logistics Fourth Quarter 2018 FEATURE The willingness of industry participants to adopt logistics technology is evident as well.