Management's Discussion and Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Big Rock Brewery Inc. Quarterly Report

BIG ROCK BREWERY INC. QUARTERLY REPORT SECOND QUARTER 2016 HIGHLIGHTS Three months ended Six months ended June 30 June 30 $ thousands (unless otherwise stated) 2016 2015 2016 2015 Sales volumes (hectolitres or hl) 57,084 50,051 99,228 84,032 Net revenue 12,291 11,105 21,335 18,242 Operating profit (loss) 656 (304) (462) (1,135) Net income (loss) 382 (473) (400) (1,097) Earnings (loss) per share (basic and diluted) $ 0.06 $ (0.07) $ (0.06) $ (0.16) MANAGEMENT’S DISCUSSION AND ANALYSIS The following is Management’s Discussion and Analysis (“MD&A”) of the financial condition and results of operations of Big Rock Brewery Inc. (the “Corporation” or “Big Rock”) for the six months ended June 30, 2016, as compared to the same period in 2015. This MD&A should be read in conjunction with the unaudited consolidated financial statements of the Corporation and accompanying notes as at and for the six months ended June 30, 2016 (the “Financial Statements”) and in conjunction with the December 30, 2015 audited consolidated financial statements and MD&A contained within our 2015 Annual Report. The financial statements have been prepared using International Financial Reporting Standards (“IFRS”). All amounts are reported in thousands of Canadian dollars and comparative figures have been restated using IFRS, unless otherwise noted. Readers should also read the “Forward-Looking Information” contained at the end of this document. The MD&A is dated August 4, 2016. CORPORATE PROFILE Big Rock Brewery—headquartered in Calgary, Alberta—produces premium, all-natural craft beers. As Canada's leading craft brewer, Big Rock has a broad family of permanent ales and lagers, the Rock Creek series of craft ciders, and a continually changing variety of seasonal and limited-edition beers. -

Brewers Association Brewery Members As of June 14, 2012

Brewers Association Brewery Members as of June 14, 2012 (512) Brewing Co - Austin, TX 7 Seas Brewing Co - Gig Harbor, WA 10 Barrel Brewing Co - Bend, OR 75th Street Brewery - Kansas City, MO 12 String Brewing Co - Spokane, WA A1A Ale Works - St Augustine, FL 16 Mile Brewing Co - Georgetown, DE Aardwolf Pub and Brewery - Ponte Vedra, FL 1974 Brewing Company - Pottstown, PA Abandon Brewing - Victor, NY 21st Amendment Brewery Cafe - San Francisco, CA Abbey Beverage Co, LLC / Monastery of Christ In the Desert - Santa Fe, NM 23rd Street Brewery - Lawrence, KS Abbey Ridge - Alto Pass, IL 2nd Shift Brewing Co - New Haven, MO Abita Brewing Co - Abita Springs, LA 3 Guys and A Beer'd Brewing Co - Carbondale, PA AC Golden Brewing Company - Golden, CO 3 Sheeps Brewing Co - Sheboygan, WI Actual Brewing Company, LLC - Columbus, OH 3 Stars Brewing Co - Washington, DC Adelbert's Brewery LLC - Austin, TX 303 Brewing Company - Denver, CO Adirondack Pub and Brewery - Lake George, NY 4 Hands Brewing Co - Saint Louis, MO Adroit Theory Brewing Company - Sterling, VA 4 Paws Brewing - Chicago, IL Against the Grain Brewery - Louisville, KY 40 Arpent - New Orleans, LA Aiken Brewing Co - Aiken, SC 406 Brewing Company - Bozeman, MT Alameda Brewing Co - Portland, OR 49th State Brewing Co - Denali National Park, AK Alamo Beer Co - San Antonio, TX 4th Street Brewing Co - Gresham, OR Alaskan Brewing Co. - Juneau, AK 5 Boroughs Brewery - New York, NY Alchemist Cannery - Waterbury, VT 5 Rabbit Cerveceria Inc - Chicago, IL Ale Asylum - Madison, WI 515 Brewing Co - Clive, -

Osler, 2020 Diversity Disclosure Practices Report

2020 Diversity Disclosure Practices Diversity and leadership at Canadian public companies By Andrew MacDougall, John Valley and Jennifer Jeffrey DIVERSITY DISCLOSURE PRACTICES Osler, Hoskin & Harcourt llp Table of contents Introduction 3 Developments in diversity: A wider focus 6 Our methodology 14 2019 full-year results 19 Mid-year results for 2020: Women on boards 23 Mid-year results for 2020: Women in executive officer positions 33 Diversity beyond gender: 2020 results for CBCA corporations 43 Who has achieved gender parity and how to increase diversity 49 Going above and beyond: Best company disclosure 64 The 2020 Diversity Disclosure Practices report provides general information only and does not constitute legal or other professional advice. Specific advice should be sought in connection with your circumstances. For more information, please contact Osler’s Corporate Governance group. 2 DIVERSITY DISCLOSURE PRACTICES Osler, Hoskin & Harcourt llp Introduction The diversity discussion blossomed this year, with continued, slow growth in the advancement of women accompanied by an expanded focus into other facets of diversity. This year new disclosure requirements under the Canada Business Corporations Act (CBCA) broadened the range of corporations required to provide disclosure regarding women in leadership positions and added new requirements for disclosure regarding visible minorities, Aboriginal peoples and persons with disabilities. Our sixth annual comprehensive report on diversity disclosure practices now covers disclosure by TSX-listed companies and CBCA corporations subject to disclosure requirements. We continue to provide detailed disclosure on TSX-listed companies to provide year-over-year comparisons. However, we now include new chapters summarizing the results of our review of CBCA company disclosure. -

2019 Annual General Meeting May 9, 2019

2019 Annual General Meeting May 9, 2019 Big Rock Brewery Inc. (TSX: BR) Legal Disclaimers Caution Regarding Forward-Looking Statements Certain statements contained in this presentation constitute forward-looking statements. These statements relate to future events or Big Rock's future performance. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking information are not facts, but only expectations as to future events and generally can be identified by the use of statements that include words or phrases such as, "anticipate", "believe", "continue", "could", "estimate", "expect", "intend", "likely" "may", "project", "predict", "propose", "potential", "might", "plan", "seek", "should", "targeting", "will", and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Big Rock believes that the expectations reflected in those forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this presentation should not be unduly relied upon by investors as actual results may vary materially from such forward-looking statements. These statements speak only as of the date of this presentation and are expressly qualified, in their entirety, by this cautionary statement. In particular, this presentation contains forward-looking -

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

Annual-Report Final Colour.Pdf

FINANCIAL HIGHLIGHTS in thousands of Canadian dollars, except volumes, per share amounts and shares 2017 2016 Sales volume (hectolitres) 209,420 199,454 Net revenue 46,573 43,126 Gross profit 18,897 18,649 Operating loss (1,037) (266) Net loss (1,020) (453) Loss per share - basic and diluted ($ 0.15) ($ 0.07) Common shares outstanding 6,981,628 6,875,928 Total assets 52,119 55,209 Total debt (1) 6,416 8,844 (1) Includes bank indebtedness, long term debt and obligation under finance lease. Annual Meeting of Shareholders Table of Contents The annual meeting of Big Rock shareholders will be held at: 2 CEO’s Message Big Rock Brewery, 5555 - 76th Avenue SE, Calgary, AB, Canada 4 Management’s Discussion and Analysis Thursday May 10, 2018 at 2:00 pm (MST). 26 Magament Report 27 Independent Auditors’ Report 28 Financial Statements and Notes Big Rock Brewery Inc. - 2017 Annual Report | 1 CEO’S MESSAGE To: Big Rock Shareholders: It is an honour to be the given the opportunity to lead Canada’s iconic craft brewery. In 1985 Ed created Big Rock and pioneered a better beer movement that was well ahead of its time. Today we see the fruits of his innovation, a rapidly growing craft beer industry despite a beer market that is flat to declining. Consumers want more choice and better beer-drinking experiences, and that holds well for the future of the craft beer industry and Big Rock Brewery. In 2017 our sales volume grew by 5.0% led by strong performance in both the Alberta and Ontario markets. -

List of Marginable Otc Stocks1 List of Foreign

LIST OF MARGINABLE OTC STOCKS 1 AND LIST OF FOREIGN MARGIN STOCKS 2 AS OF November 10, 1997 The List of Marginable OTC Stocks and the List of Foreign Margin Stocks are published quarterly by the Board of Governors of the Federal Reserve System (the Board). The List of Marginable OTC Stocks is composed of stocks traded in the United States over-the-counter (OTC) that have been determined by the Board to be subject to margin requirements as of November 10, 1997, pursuant to Section 207.6 of Federal Reserve Regulation G, ‘‘Securities Credit by Persons Other Than Banks, Brokers, or Dealers,’’ Section 220.17 of Regulation T, ‘‘Credit by Brokers and Dealers,’’ and Section 221.7 of Regulation U, ‘‘Credit by Banks for the Purpose of Purchasing or Carrying Margin Stocks.’’ It also includes all OTC stocks designated as National Market System (NMS) securities. Additional NMS securities may be added in the interim between Board quarterly publications; these securities are immediately marginable upon designation as NMS securities. The names of these securities are available at the National Association of Securities Dealers, Inc. and at the Securities and Exchange Commission. This List supersedes the previous List of Marginable OTC Stocks published effective August 11, 1997. The List of Foreign Margin Stocks is composed of foreign equity securities that have met the Board’s eligibility criteria, pursuant to Regulation T, Section 220.17. These foreign equity securities are eligible for margin treatment at broker–dealers on the same basis as domestic margin securities. This list supersedes the previous List of Foreign Margin Stocks published effective August 11, 1997. -

FINANCIAL HIGHLIGHTS in Thousands of Canadian Dollars, Unless Otherwise Noted 2016 2015

Big Rock’s 2016 Family FINANCIAL HIGHLIGHTS in thousands of Canadian dollars, unless otherwise noted 2016 2015 Sales volumes (hectolitres or hl) 199,454 181,857 Net revenue 43,126 39,582 Cash from operating activities 3,543 2,103 Net loss 453 1,075 Net loss per share (basic and diluted) $ 0.07 $ 0.16 Shareholders’ equity 37,270 37,540 Common shares outstanding 6,875,928 6,875,928 Annual Meeting of Shareholders Table of Contents The annual meeting of the shareholders will be held at: 2 CEO’s Message Big Rock Brewery, 5555 - 76th Avenue SE, Calgary, AB, Canada 3 Brewmaster’s Message Thursday May 11, 2017 at 2:00 pm (MST). 10 Management’s Discussion and Analysis 34 Management Report 35 Independent Auditors’ Report 36 Financial Statements and Notes CEO’S MESSAGE I consider it a privilege to have the opportunity to reflect on 2016 and set the stage for the upcoming year. Although I assumed Interim CEO responsibilities late in 2016, in my previous role as CFO I was fortunate to be extensively involved in all aspects of Big Rock’s business. 2016 was a pivotal year in refocusing our efforts to becoming a more consumer-driven company, which we believe is fundamental to the financial success of Big Rock. We increased brand awareness in Ontario with the opening of our Etobicoke brewery in September and our Liberty Village tasting room in December, and started 2017 with the launch of the Liberty Commons restaurant in January. These sites provide fresh made-in-market beer and new opportunities to experience the Big Rock brand first-hand for consumers in the Toronto area. -

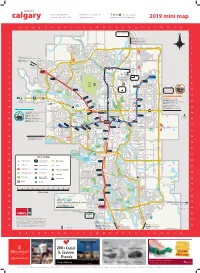

2019 Mini Map

phone: 403-263-8510 [email protected] /tourismcalgary toll free: 1-800-661-1678 visitcalgary.com #capturecalgary | #askmeyyc 2019 mini map A B C D E F G H I J K L M N O P Q R S T U V W X Y Z ? 1 58 10 1 Airdrie 13 km / 8 miles SY MON Drumheller 117 km / 73 miles S VA L Red Deer 128 km / 80 miles 2 L 2 E Y Edmonton 278 km / 173 miles 144 AV NW R S D H A N G W A 3 N #201 W #201 E STONEY TR NE 3 A P P K I E T E R R C N E W S O R 4 T 4 N T O FO Cochrane 17 km / 10 miles ER W E to Yamnuska Wolfdog Sanctuary 31 km / 19 miles EST D 13 NO 5 S 5 Banff (alternate route) E COUNTRY HILLS BV NE C 117 km / 73 miles R TR E E K 6 36 ST NE 6 43 ARLOW 96 B Spring Hill RV Park AV NE 300 NW 300 300 27 km / 17 miles COUNTRY HILLS BV 300 AIRPORT TRAIL (96 AV NE) TUNNEL 7 Tuscany BEDDINGT 62 7 W 44 ST NE N R ON ? 300 W T TR N I NOSE HILL DR P P R 300 80 AV NE Saddletowne T A 8 8 N YYC CALGARY Y A E Crowfoot 14 ST NW 300 G N TR NW INTERNATIONAL A O H T R Martindale S S AIRPORT 60 T CRO S SARCEE NOSE I 9 WCHILD T 9 300 Deerfoot E HILL City M 64 AV NE TR NW McKnight/ PARK 64 AV NE Westwinds t 66 r o JOHN LA 10 rp Dalhousie 10 BO i W R A I o V t BOWNESS URIE BV 300 ER E 29 14 1 PARK McKNIGHT BV 0 2 11 Calaway Park # 50 McKNIGHT BV 11 6 km / 4 miles 33 40 Hangar Flight 300 Museum 36 ST NE Brentwood Chestermere 8 km / 5 miles Calgary West Canada’s CF 34 Whitehorn Calaway RV Park Campground Market N Sports O DEERFOO Strathmore 38 km / 24 miles 12 & Campground Mall 12 Hall of Fame 19 University S 72 32 AV NE Dinosaur Prov. -

Big Rock Brewery Inc. Quarterly Report

BIG ROCK BREWERY INC. QUARTERLY REPORT FIRST QUARTER 2017 HIGHLIGHTS Three months ended March 31 $000, except hl and per share amounts 2017 2016 Sales volumes (hectolitres or “hl”) 43,477 41,700 Net revenue $ 9,589 $ 8,901 Operating loss (1,157) (1,118) Net loss (907) (783) Loss per share (basic and diluted) $ (0.13) $ (0.11) MANAGEMENT’S DISCUSSION AND ANALYSIS The following is Management’s Discussion and Analysis (“MD&A”) of the financial condition and results of operations of Big Rock Brewery Inc. (“the Corporation” or “Big Rock”) for the three months ended March 31, 2017, as compared to the same period in 2016. This MD&A should be read in conjunction with 1) the unaudited consolidated financial statements of the Corporation and accompanying notes as at and for the three months ended March 31, 2017 (the “Financial Statements”) and 2) the December 30, 2016 audited consolidated financial statements and MD&A contained within our 2016 Annual Report. The financial statements have been prepared using International Financial Reporting Standards (“IFRS”). All amounts are reported in thousands of Canadian dollars and comparative figures have been restated using IFRS, unless otherwise noted. Additional information about the Corporation, including the Annual Information Form for the year ended December 30, 2016 can be found on SEDAR at www.sedar.com and on Big Rock’s corporate website at www.bigrockbeer.com. Readers should also read the “Forward-Looking Information” contained at the end of this document. This MD&A is dated May 4, 2017. CORPORATE PROFILE Big Rock Brewery—headquartered in Calgary, Alberta—produces premium, all-natural craft beers and ciders. -

Social Media B2B Analytics Comparative Case Study Wild Rose Brewery Speaking Today: Kim Latreille and Haley Overland Today We’Re Talking About Data

Social Media B2B Analytics Comparative Case Study Wild Rose Brewery Speaking today: Kim Latreille and Haley Overland Today we’re talking about data. • Big Data • Social Media Reporng Data • Data Sets • Business Analycs Data Source: hps://www.pinterest.com/startrek/star-trek-the-next-generaon/ And, how it’s important in publishing. • Social Media Analycs • Social Audience as a Dataset – Business Analyst view – Social Media Editor view Haley Overland • How we use our social Senior Editor, Social Media data, working together Chatelaine Why listen to me? • 20 years experience in a rapidly changing environment • Analyc thinker with senior management experience publishing content on mulple plaorms, devices, and in print • Currently, a media industry Kim Latreille consultant, and lecturer at Publishing & Digital Media Ryerson, School of Graphics of Consultant Communicaons Management • In my career in publishing, oversaw print and digital edion magazine planning, producon: – St. Joseph Media – Coage Life Media • Acve in a variety of industry groups, seminars, conferences: – Magazines Canada – Publishers Execu3ve / GraphExpo, Chicago – Folio, NYC Why I learned about this stuff… • I like math • I like variable data and its applicaon in print • Magazine circulaon is interesng • Sourcing PMB data for media kits is fun • Social media is also fun • Learning how to use social media for publishing and distribung magazine content is… fun! …so, when I saw the (customer) user data that could be gathered through reports from social media plaorms, the geek in me was sold. In 2013, Don O’Dwyer called. • I le St. Joseph Media in December 2012 – Naonal Director, Producon (print & digital edions) • Started consulng for Raven Bay Services, a Photo: Don Dicks business consultaon Don O’Dwyer company in Calgary, Alberta CEO that specializes in analycs Raven Bay Services Don had a client request. -

2021 Annual Report

2021 ANNUAL REPORT Table of Contents 2 Financial Highlights 3 CEO’s Message 5 Management’s Discussion and Analysis 25 Management Report 26 Independent Auditors’ Report 29 Financial Statements and Notes Big Rock Brewery Inc. - 2021 Annual Report | 1 FINANCIAL HIGHLIGHTS in thousands of Canadian dollars, except volumes, per share amounts and shares 2020 2019 Sales volume (hectolitres) (1) 172,996 171,563 Net revenue 43,984 42,653 Gross profit 16,485 12,336 Operating loss (134) (5,100) Net loss (666) (2,922) Loss per share - basic and diluted ($ 0.10) ($ 0.42) Common shares outstanding (2) 6,967,967 6,981,628 Total assets 51,955 49,782 Total debt (3) 3,905 6,060 (1) Excludes contract manufacturing volumes due to the nature of the agreements. (2) Amounts in 2020 are net of 13,661 shares held in trust. (3) Includes current and long term portions of debt and equipment lease net of cash. Annual Meeting of Shareholders The annual meeting of Big Rock shareholders will be held: Thursday, May 13, 2021. Big Rock Brewery Inc. - 2021 Annual Report | 2 CEO’S MESSAGE To: Big Rock Shareholders 2020 has been an unprecedented time for all. Many of us have felt the severe impacts of the COVID-19 pandemic whether its through financial uncertainty linked to job loss or forced business closures and restrictions; mental health impacts as our ability to have personal connection with friends and family have been limited; or having to experience the terrible loss of losing a loved one. As we look forward to 2021, there is a new sense of optimism as the rapid development and deployment of vaccines will hopefully see this chapter in human history soon come to a close.