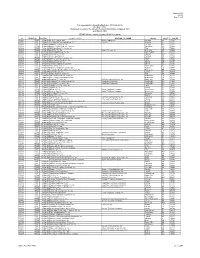

Table 3. Increase in Special Accesslprivate Line Competition: 1999 Vs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2001 Scope of Competition in Telecommunications Markets

Public Utility Commission of Texas 1701 N. Congress Avenue Austin, Texas 78711-3326 512 / 936-7000 • (Fax) 936-7003 Web Site: www.puc.state.tx.us January 11, 2001 Honorable Members of the Seventy-Seventh Texas Legislature: We are pleased to submit our 2001 Report on the Scope of Competition in Telecommunications Markets, as required by Section 52.006 of the Public Utility Regulatory Act (PURA). Since we issued our previous report on telecommunications competition in January 1999, the Commission has continued to make significant progress in managing the transition to competitive local telecommunications markets. Numerous new providers have entered the market, and the market share held by competitive providers has increased significantly. Recent developments, however, have shown that some of the new providers are having difficulties staying in the residential local exchange market. In the four largest metro areas of Texas, facilities-based competitors have developed increased capacity for long-run competition with incumbent providers. As a result, the market for business customers in these metro areas has strong potential for genuine competition, although market penetration levels are too low to conclude that full competition has arrived. Whether residential and rural customers will have competitive choices is more uncertain. Chapter 6 presents an economic diagnosis for why residential and rural customers have largely been left behind in the move to competition. The regulatory tradition of maintaining low (often below cost) rates for residential local telephone service is the key reason. As outlined in the Executive Summary and discussed in its first legislative recommendation, the Commission presents the Texas Legislature with several alternative strategies to create greater opportunity for residential and rural customers to benefit from local exchange competition. -

751-100-112 Issue 4, April 2002

COMMON LANGUAGE® General Codes−Telecommunications Service Providers IAC Codes, Exchange Carrier Names, Company Codes− Telcordia and Regions Telcordia Technologies Practice BR-751-100-112 Issue 4, April 2002 Proprietary — Licensed Material Possession and/or use of this material or any of the COMMON LANGUAGE® Product Codes, Rules, and Information disclosed herein requires a written license agreement and is governed by its terms and conditions. For more information, visit www.commonlanguage.com/ notices. An SAIC Company BR-751-100-112 TSP IAC Codes, EC Names, Company Codes−Telcordia and Regions Issue 4, April 2002 Copyright Page COMMON LANGUAGE® General Codes−Telecommunications Service Providers IAC Codes, Exchange Carrier Names, Company Codes−Telcordia and Regions Prepared for Telcordia Technologies by: Lois Modrell, [email protected] Target audience: Telecommunications Service Providers This document replaces: BR-751-100-112, Issue 3, July 2000 Technical contact: Lois Modrell, [email protected] To obtain copies of this document, contact your company’s document coordinator or your Telcordia account manager, or call 1.800.521.2673 (from the USA and Canada) or +1.732.699.5800 (all others), or visit our Web site at http://www.telcordia.com. Telcordia employees should call 1.732.699.5802. Copyright © 1997-2002 Telcordia Technologies, Inc. All rights reserved. Trademark Acknowledgments Telcordia is a trademark of Telcordia Technologies, Inc. COMMON LANGUAGE is a registered trademark of Telcordia Technologies, Inc. Proprietary — Licensed Material See proprietary restrictions on title page. ii BR-751-100-112 Issue 4, April 2002 TSP IAC Codes, EC Names, Company Codes−Telcordia and Regions Notice of Disclaimer Notice of Disclaimer This document is issued by Telcordia Technologies, Inc. -

Appendix M05 3Q2004 Page 1 of 25 05/04 Filed?

Appendix M05 3Q2004 Page 1 of 25 Telecommunications Reporting Worksheet, FCC Form 499-Q Due May 3, 2004 Worksheets received by the Universal Service Administrative Company (USAC) as of May 24, 2004 ("TRUE" indicates that the company filed a Form 499-Q) ID 05/04 filed? Rcvd Date Legal Name of Carrier HOLDING_CO_NAME HQ City HQ_ST HQ_ZIP 801003 TRUE 30-Apr-04 Otelco Telephone LLC Otelco Holding, LLC Oneonta AL 35121 801004 TRUE 29-Apr-04 Corr Wireless Communications, LLC Corr, Inc. Oneonta AL 35121 801006 TRUE 09-Apr-04 Marne & Elk Horn Tel. Co. Elk Horn IA 51531 801012 TRUE 26-Apr-04 Bulloch County Rural Tel. Coop. Inc. Statesboro GA 30458 801024 TRUE 19-Apr-04 Mid-Plains Rural Tel. Co-op. Inc. Tulia TX 79088 801030 TRUE 30-Apr-04 Scott Rice Tel. Co. Integra Telecom, Inc. Beaverton OR 97006 801033 TRUE 03-May-04 North English Coop. Tel. Co. North English IA 52316 801048 TRUE 03-May-04 Wikstrom Tel. Co. Inc. Karlstad MN 56732 801051 TRUE 30-Apr-04 Union Telephone Co. Plainfield WI 54966 801054 TRUE 30-Apr-04 Kaplan Telephone Company, Inc. Kaplan LA 70548 801060 TRUE 30-Apr-04 Nucla-Naturita Telephone Co. Nucla CO 81424 801063 TRUE 29-Apr-04 Stayton Coop. Tel. Co. Stayton OR 97383 801066 TRUE 29-Apr-04 Citizens Telephone Corporation Warren IN 46792 801069 TRUE 26-Apr-04 West Liberty Tel. Co. West Liberty IA 52776 801078 TRUE 03-May-04 Ardmore Telephone Company, Inc. Ardmore TN 38449 801084 TRUE 29-Apr-04 The Golden Belt Telephone Association, Inc. -

Download PDF Scan

Extreme BY HUNTER NEWBY Measures Meet Me in Miami A continuing series examining the dominant “meet me” facilities in major North American cities Miami is a hot place to be and not just because of its aver- interconnect point. As always, this reduces the need for multiple age daily temperatures, spicy foods or rich cultural mixes. It’s home run cables and demarcation points, which create inventory also a hot spot for core network access. The market is one of and points of failure issues. the best examples of what facilities a gateway city normally pos- There is a great deal that can be said about both LayerOne sesses, and that helps to clarify the difference between a core and the NAP. The history of the NAP and the type of facility in interconnection facility and a data center or hosting facility. The terms of construction could take up pages, but what is particu- state of Florida, having such an extensive coastline, with prox- larly interesting about the NAP is that it is a core interconnection imity to Caribbean islands and all of Central and Latin America, facility for major transport networks and a major Internet network has natural advantages as a landing spot for many undersea access point. This is the only site in the entire “Meet Me” series cables. These cables come ashore all over the coast, but most that is both in one. That says a lot about it, as well as the clear of them backhaul to Miami. Miami is not just a city in Florida but difference between all of the other major core sites in North also the key gateway to the Caribbean and Latin America. -

Fatpipe 2-04.Indd

A CHANCE AT THE CHEDDAR Local Access Market Outlook Playing to the Customer Rebuilding Brands Slam Survey Suddenly Surcharged CONTENTS FEATURES A CHANCE AT THE CHEDDAR Though the fight to retain lines will remain intense, by this 20 time next year, there’s a good chance local access provid- ers will have discovered how integrated services can help them grab a nice chunk of cheese. Of course, some sim- ply will get whacked. By Gary Kim A BETTER BRANDING While there are several reasons to launch a branding or rebranding effort, most campaigns must stand up to the 32 same bottom-line metrics. And while awareness is good, it’s what’s behind a brand that really matters. By Kelly Kirkendoll Shafer SEGMENT SEGUE Justifying the expense to obtain and retain a good custom- er is relatively easy, but most service providers also must learn to play bass when margins and volumes get low. By Gary Kim 44 SUDDENLY SURCHARGED Qwest resellers face a newly enforced stipulation in their blended rate agreements that’s creating a much wider dis- tinction between on- and off-net switched traffic. By Kelly Kirkendoll Shafer VERIFICATION DOCUMENTATION Details from a FAT PIPE-sponsored study on the verifica- tion methods being employed to control slamming. 50 DEPARTMENTS Inscriptions 6 HOLD YOUR FIRE The flock follows a familiar migration, and it always comes back around. Facts Broadcast 12 Megabytes of news; Bandwidth Barometer 56 Extreme Measures 66 REMEMBER THE ALAMO! Our tour of carrier interconnection options in major North American cities stops at 100 Taylor. In the Trenches 70 WIDER, TIGHTER & WORLDWIDE Three words that will impact telecom agent sales in 2004. -

Combined List of Creditors Entity Name 1 Street Address City State

Combined List of Creditors Entity Name 1 Street Address City State ZIP Code Telephone 1 Fax Number ENA BRAZOS VPP LIMITED PARTNERSHIP ACCT# 30444825 HOUSTON TX 77002 ENA Global Natural Resources Corp. of Nevada PO Box 200771 HOUSTON TX 77216-0001 7139514700 ENA Cascade Natural Gas Corporation 222 Fairview Ave N SEATTLE WA 98109-5312 2066243900 2066247215 ENA Peoples Gas System, Inc. 702 N Franklin St Plz 7 TAMPA FL 33601-9990 8132284594 ENA Questar Pipeline Company 79 S State St SALT LAKE CITY UT 84111-1502 8015302400 ENA Riverside Pipeline Company 433 Metairie Rd Ste 600 METAIRIE LA 70005-4328 5048312700 5048312722 ENA Arizona Public Service Company PO Box 53999 (85072-3999) PHOENIX AZ 85004-2167 6022501000 6022503813 ENA Tauber Oil Company 55 Waugh Dr Ste 700 HOUSTON TX 77007-5837 7138698700 7138698069 ENA Georgia-Pacific Corporation 133 Peachtree St NE ATLANTA GA 30303-1847 4046524000 4042301632 ENA Cargill, Incorporated PO Box 9300 MINNEAPOLIS MN 55440-9300 6127427575 9785241691 ENA South Jersey Industries Inc. One S Jersey Plaza Rt 54 FOLSOM NJ 08037-9109 6095619000 6095618225 ENA Wagner & Brown Ltd. 333 Clay St Ste 4620 HOUSTON TX 77002 9156827936 9156861501 ENA Tide West Oil Company 6666 S Sheridan Rd Ste 250 TULSA OK 74133 9184888962 9184810992 ENA Hall-Houston Oil Company 700 Louisiana Ste 2100 HOUSTON TX 77002-2728 7132280711 7132282250 ENA Boyd Rosene and Associates, Inc. 525 S Main St Ste 1200 TULSA OK 74103-4409 9185838617 9185824143 ENA Sprague Energy Corp. Two International Dr Ste 200 PORTSMOUTH NH 03801-6810 6034311000 6034305320 ENA Virginia Natural Gas Inc. -

Attachment A

Attachment A Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Review of the Section 251 Unbundling ) Obligations of Incumbent Local ) CC Docket No. 01-338 Exchange Carriers ) ) Implementation of the Local Competition ) Provisions in the Telecommunications ) CC Docket No. 96-98 Act of 1996 ) ) Deployment of Wireline Services ) Offering Advanced Telecommunications ) CC Docket No. 98-147 Capability ) UNE FACT REPORT 2002 Prepared for and Submitted by BellSouth, SBC, Qwest, and Verizon April 2002 TABLE OF CONTENTS I. COMPETITIVE OVERVIEW..........................................................................................I-1 A. Competitive Facilities and Networks. ...................................................................I-1 B. Competitive Lines Served. ....................................................................................I-5 C. Capital Investment...............................................................................................I-10 D. Revenues. ............................................................................................................I-12 E. Outlook................................................................................................................I-15 II. LOCAL SWITCHING .................................................................................................... II-1 A. CLEC Circuit Switches. ...................................................................................... II-4 1. Geographic Areas Served by CLEC Circuit -

Technology Report 2H 2018

Investment Banking & Securities Offered Through SDR Capital Markets, Inc., Member FINRA & SIPC. BRAIN DRAIN LEADERS BRAIN CONCENTRATION LEADERS Sources: Bloomberg; Denver Post; Built In Colorado 250 204 200 Financial 150 131 98 23% 96 80 100 49 47 32 45 50 13 - - Strategic 77% Amount TEV/ Date Target Buyer(s) Segment TEV/ EBITDA ($ in Mil) Rev 12/24/2018 MINDBODY, Inc. Vista Equity Partners Management LLC Financial Technology 1,674 - - 11/12/2018 athenahealth, Inc. Elliott Management Corp.; Veritas Capital Healthcare IT 5,442 4.15x 16.19x 11/11/2018 Qualtrics International, Inc. SAPFund SE Management LLC; Evergreen Coast Enterprise Software 7,992 21.11x - 11/11/2018 Apptio, Inc. Vista Equity Partners Management LLC Enterprise Software 1,586 - - 11/6/2018 ConvergeOne Holdings, Inc. CVC Advisers Ltd. Infrastructure/Hosting 1,671 1.52x 18.88x 10/28/2018 Red Hat, Inc. International Business Machines Corp. Other SaaS 32,332 - - 10/15/2018 SendGrid, Inc. Twilio, Inc. Marketing Software 1,568 11.43x - 10/10/2018 Imperva, Inc. Thoma Bravo LLC IT Security 1,671 - - 9/24/2018 Pandora Media, Inc. Sirius XM Holdings, Inc. Other SaaS 3,063 1.73x - 9/20/2018 Marketo, Inc. Adobe Systems, Inc. Marketing Software 4,750 - - 8/23/2018 Resideo Technologies, Inc. Shareholders Other SaaS 3,534 0.74x 6.15x 7/22/2018 Syntel, Inc. ATOS SE IT Services 3,542 3.67x 13.49x 7/11/2018 CA, Inc. Broadcom, Inc. Enterprise Software 18,202 4.39x 12.58x Strategic Buyer Inv. Date Select Corporate Acquisitions Accenture Plc 12/20/2018 ▪Knowledgent Group, Inc. -

Rural Broadband Meet Me Room

telx-final-VPF-magazine-Ad.pdf 7/6/06 11:06:07 AM C M Y CM MY CY CMY K The “Meet Me” Series Fat Pipe Magazine, February 2003 - November 2005 Table of Contents The Meet Me Series 2003 Meet Me in New York……………………………………..………………….………......................February 2003 Meet Me in L.A…………………………………….……………………………………………..…...March 2003 Meet Me in Atlanta…………………............…………......................……………………………...…...April 2003 Meet Me in Toronto…………..…………………………………………………………………….…...May 2003 Meet Me in Seattle……………………….……………………………………………………....…......June 2003 Meet Me in San Francisco…………………….…………………………………….…………....…...….July 2003 Meet Me in Chicago……………….……………………………………………….……………........August 2003 Meet Me in Dallas…………………………….………………………………………………..…September 2003 Meet Me in Philly………………….…………………………………………………….……..……October 2003 Meet Me in Miami………………………….……………………………………………….….....November 2003 The Meet Me Series 2004 Meet Me in Boston……………….…………………………………………………………….…....January 2004 Meet Me in San Antonio………………….……………………………………….…………...........February 2004 Meet Me in Phoenix………………………………………………………………….…….…….........March 2004 Meet Me in Vegas………………………………………………………….……………….…….....….April 2004 Meet Me in Denver…………………………………………………………….………………………..May 2004 Meet Me in Santa Clara…………………………………………….……………………….…………..June 2004 Meet Me in St. Louis…………………………………….………………………………….….………...July 2004 Meet Me in Cleveland……………………….……………….………………………….…………....August 2004 Meet Me in Vancouver……………………………….………………………….………….…….September 2004 Meet Me in Charlotte…………………………………….…………………….………………........October -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau September 2007 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by contacting Best Copy and Printing, Inc., Portals II, 445 12th Street S.W., Room CY-B402, Washington, D.C. 20554, telephone 800-378-3160, facsimile 202-488-5563, or via e-mail at [email protected]. This report can be downloaded and interactively searched on the Wireline Competition Bureau Statistical Reports Internet site located at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information, primary telecommunications business and service(s) offered by 5,428 telecommunications providers. The last report was released March 10, 2006.1 The information in this report is drawn from providers’ Telecommunications Reporting Worksheets (FCC Form 499-A). It can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.2 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. The pool of filers contained in this edition consists of companies that operated and collected revenue during 2005, as well as new companies that file the form to fulfill the Commission’s registration requirement.3 Information from filings received by USAC after November 1, 2006, and from filings that were incomplete has been excluded from this report. -

NEWS MEDIA CONTACT: March 10, 2005 Mark Wigfield 202-418-0253 Email: [email protected]

News media Information 202 / 418-0500 TTY 202 / 418-2555 Fax-On-Demand 202 / 418-2830 Internet: http://www.fcc.gov NEWS ftp.fcc.gov Federal Communications Commission th 445 12 Street, S.W. Washington, D. C. 20554 This is an unofficial announcement of Commission action. Release of the full text of a Commission order constitutes official action. See MCI v. FCC. 515 F 2d 385 (D.C. Circ 1974). FOR IMMEDIATE RELEASE: NEWS MEDIA CONTACT: March 10, 2005 Mark Wigfield 202-418-0253 Email: [email protected] FEDERAL COMMUNICATIONS COMMISSION RELEASES TELECOMMUNICATIONS PROVIDER LOCATOR Washington D.C. – Today, the Federal Communications Commission (FCC) released its annual Telecommunications Provider Locator report. The report lists 5,283 companies registered to provide interstate telecommunications as of October 2004, as compared to 4,748 companies as of October 2003. For each of these providers, the report identifies whether it reported revenue for local, wireless, payphone, operator and prepaid calling card, or other toll services, and whether it contributed to support universal service. The report also provides contact information for each company. This report was compiled using information from FCC Form 499-A Telecommunications Reporting Worksheets filed by telecommunications providers. The filed worksheets are proprietary and therefore not available to the public. The report is available for reference in the FCC's Reference Information Center, Courtyard Level, 445 12th Street, S.W., Washington, D.C. 20554. Copies may be purchased by contacting Best Copy and Printing, Inc., Portals II, 445 12th Street S.W., Room CY-B402, Washington, D.C. 20554, telephone 800-378-3160, facsimile 202-488- 5563, or via e-mail at [email protected].