KMC Cebu Office Briefing 2Q2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mandani Bay Quay Tower 2 Brochure

THE MANDANI BAY DIFFERENCE Features and elements that set the township apart from other developments TRANSFORMING CEBU INTO A Strategic Location WORLD-CLASS LIFESTYLE DESTINATION Mandani Bay is sited between the cities of Cebu, the Philippines’ oldest city and main domestic shipping port, and Mandaue, a significant center of trade and commerce in the Visayas and known as the country’s Furniture Capital. Panoramic views and easy access Strategically located along the Mactan Channel in Mandaue City, Cebu, points frame the expansive community. Mandani Bay is a world-class 20-hectare waterfront development with a stunning view of the coast and encompassing cityscape. Residential towers rise from podium blocks interconnected by footbridges, exclusive parking links buildings at the base, and wide boulevards, a 500-meter water frontage, and a tree-lined central avenue together create a lifestyle of connectivity in the community. Artist’s Impression Artist’s Impression Mandani Bay has set the bar for a new era of development in the Philippines. Impressive Scale Element of Water Mandani Bay spans 20 hectares and will have 21 towers. Residential, commercial, office, and recreational components have been designed to seamlessly blend One of the most defining with expansive features including Lifestyle Spaces and podium amenities. characteristics of Mandani Bay is its harbourside setting. The extensive water frontage stretches Artist’s Impression 500 meters and the Boardwalk that underlines it will feature retail Master-planned Layout spaces and restaurants. -

Cebu-Ebook.Pdf

About Cebu .........................................................................................................................................2 Sinulog festival....................................................................................................................................3 Cebu Facts and Figures .....................................................................................................................4 Cebu Province Towns & Municipalities...........................................................................................5 Sites About Cebu and Cebu City ......................................................................................................6 Cebu Island, Malapascus, Moalboal Dive Sites...............................................................................8 Cebu City Hotels...............................................................................................................................10 Lapu Lapu Hotels.............................................................................................................................13 Mactan Island Hotels and Resorts..................................................................................................14 Safety Travel Tips ............................................................................................................................16 Cebu City ( Digital pdf Map ) .........................................................................................................17 Mactan Island ( Digital -

Cebu Landmasters Launches Iconic Tower and Home of Sofitel Cebu City, to Open in 2025

Cebu Landmasters launches iconic tower and home of Sofitel Cebu City, to open in 2025 In anticipation of a robust economic recovery in the next few years, leading VisMin developer Cebu Landmasters unveils an iconic tower planned by the designers of the world’s most acclaimed skyscrapers, Skidmore, Owings and Merrill (SOM) in tandem with one of the country’s top architects GF Partners and Architects. Masters Tower Cebu, set to be completed in 2025, will offer prime office and retail spaces and the first five-star luxury hotel in the Queen City of the South. Sofitel Cebu City will be operated by multinational chain Accor, a world leading hospitality group headquartered in France. The tower is Cebu Landmasters' most iconic architectural structure to date, building a towering crown- like structure to represent the “Queen City of the South”. The development valued at over Php4 billion will rise on a 2,840 sqm property considered to be the remaining prime corner lot in the Cebu Business Park, Cebu City’s prestigious central business district. The architectural masterpiece will top-off at 192 meters above sea level and will be among the top three tallest structures in the metropolis. It will have a structural height of 172 meters high, with an architectural design inspired by the best of Cebuano creativity and craftsmanship, and with sustainability as one of its cornerstones having been conceptualized to use energy and resources efficiently and responsibly. Groundbreaking of the LEED-registered Masters Tower Cebu is slated for the second quarter of 2021. CLI is aiming for the building’s LEED Gold certification. -

CEBU | OFFICE 1Q 2018 9 March 2018

Colliers Bi-Annual CEBU | OFFICE 1Q 2018 9 March 2018 Offshore Forecast at a glance Demand Total office transactions reached nearly gambling rises 107,000 sq m (1.2 million sq ft) in 2017. Offshore gambling is an emerging office Joey Roi Bondoc Research Manager segment and we see greater absorption from this sector over the next two to three years. The continued demand from Offshore gambling is emerging as a critical segment BPO and KPO firms should support at of the Cebu office market as it accounted for almost least a 10% annual growth in 25% of recorded transactions in 2017. Business transactions until 2020. Process Outsourcing(BPO)-Voice companies continue to dominate covering more than a half of Supply transactions while the Knowledge Process We see Cebu's office stock breaching Outsourcing (KPO) firms that provide higher value the 1 million sq m (10.8 million sq ft) services also sustained demand, taking 20% of the mark this year. Between 2018 and 2020, total office leases. Colliers sees the current we expect the completion of close to administration's infrastructure implementation and 400,000 sq m (4.3 million sq ft) of new office space. A combined 60% of the decentralization thrust benefiting Cebu as it is the new supply will be in Cebu Business largest business destination outside Metro Manila. Park (CBP) and Cebu IT Park (CITP). This should entice more offshore gambling, BPO, KPO and traditional firms to set up shop or expand Vacancy rate operations. We encourage both landlords and Overall vacancy in Cebu stood at 9.7% tenants to as of end-2017.This is lower than the 12% recorded at end-2016. -

Metro Manila Market Update Q4 2018

RESEARCH METRO MANILA MARKET UPDATE Q4 2018 METRO MANILA REAL ESTATE SECTOR REVIEW FDI RISES AS NEIGHBORING COUNTRIES CONTINUE TO BET ON “ASIA’S RISING TIGER” COVER | The Philippines remains a popular investment destination for Asian investors FIGURE 1 Net Foreign Direct Investment Level By Country of Origin (in USD Mn) 905.65 SNAPSHOTS 900 750 2017 2018 Economic Indicators 600 450 384.25 263.97 300 189.33 183.51 64.4 150 13.25 8.56 6.1% 0 GDP SINGAPORE HONGKONG CHINA JAPAN Q4 2018 Source: Bangko Sentral ng Pilipinas The Philippines continues to attract Foreign Direct Investments (FDI) as formulates policies that will limit the economy carries on constraints in doing business in the experiencing growth of above 6% 6.1% country. On October 2018, the 11th Inflation Rate for the past 7 consecutive years. Regular Foreign Investment December 2018 The growth was mainly brought Negative List was amended to about by the increase in include five areas that will allow government spending from the 100% foreign investment present administration’s “Build, participation. The list includes Build, Build” infrastructure program. internet businesses (as excluded from mass media), teaching at 3.1% At the end of 2017, the Philippines higher education levels provided the OFW Remittances posted the highest rise in Foreign subject being taught is not a November 2018 Direct Investments (FDI) among professional subject (i.e., included in a government board or bar ASEAN countries. FDI remains examination), training centers that robust as investments increased by are engaged in short-term high- 42% in the first half of 2018. -

GUEST of HONOR and SPEAKER the ROTARY CLUB of MANILA BOARD of DIRECTORS and Executive Officers 2017-2018

1 Official Newsletter of Rotary Club of Manila 0 balita No. 3722, November 23, 2017 GUEST OF HONOR AND SPEAKER THE ROTARY CLUB OF MANILA BOARD OF DIRECTORS and Executive Officers 2017-2018 JIMMIE POLICARPIO President TEDDY OCAMPO Immediate Past President BABE ROMUALDEZ CHITO ZALDARRIAGA Vice President BOBBY JOSEPH ISSAM ELDEBS LANCE MASTERS CALOY REYES SUSING PINEDA Directors ALVIN LACAMBACAL Secretary NICKY VILLASEÑOR What’s Inside Treasurer Program 2 Presidential Timeline 3-4 DAVE REYNOLDS Guest of Honor & Speaker’s Profile 5 Sergeant-At-Arms The Week that was 6-10 RCM Weekly Birthday Celebrants 11 AMADING VALDEZ Centennial 12 Board Legal Adviser Fellowship 13 Music 14-15 RENE POLICARPIO New Generations 16-17 Assistant Secretary RC Cebu 85th Charter Anniversary 18 Pres-Elect Training Seminar 19-28 NER LONZAGA District Bingo/ RCM Paul Harris Fellows 29-31 Assistant Treasurer Centennial 32-33 Interclub/ One Rotary One Philippines 34 Secretariat Gusi Awards 2017 35-36 ANNA KUN TOLEDO News Release/ Interclub 36-38 Obituary 39 Public Health Nutrition and Child Care 40 Advertisement 41-43 2 PROGRAM RCM’s 21th for Rotary Year 2017-2018 November 23, 2017, Thursday, 12Noon, New World Makati Hotel Officer-In-Charge/ Program Moderator DE/Dir. “Issam” Eldebs P R O G R A M TIMETABLE 11:30 AM Registration & Cocktails (WINES courtesy of Dir.-elect/Dir. “Bobby” Joseph) 12:25 PM Bell to be Rung: Members and Guests are requested to be seated by OIC/Moderator : DE/Dir. Issam Eldebs 12:30 PM Call to Order Pres. Jimmie Policarpio Singing of the Republic of the Philippines National Anthem RCM WF Music Chorale Invocation Rtn. -

Over 200 Filipinas Died in Hands of Employers in 4 Years Rep

“Radiating positivity, creating connectivity” CEBU January 28 - February 3, 2020 P15.00 BUSINESSVolume 2 Series 19 12 PAGES Room 310-A, 3rd floor WDC Bldg. Osmeña Blvd., Cebu City WEEK You may visit Cebu Business Week Facebook page. Ban PH workers in Kuwait: Mendoza Over 200 Filipinas died in hands of employers in 4 years Rep. Raymond Demo- generalized like injuries. at Philippine Embassy in crito Mendoza (TUCP Party- But the National Bureau Kuwait. List) has urged government of Investigation (NBI) They discussed about to fully implement a total ban reported that she was raped, problems in Kuwait on deployment of Overseas sodomized, and her genital like employers illegally Filipino Workers (OFWs) was mutilated. She suffered confiscating the passports in Kuwait and recall home broken arms, broken head and mobile phones of home existing workers. and countless wounds at the service workers. Mendoza made the back. A joint monitoring call while conducting a According to NBI doctors, committee in the Philippines congressional inquiry on the Villavende suffered a painful and Kuwait was tasked death of Jennelyn Villavende, and humiliating death. She to monitor incidents like 26, of South Cotabato. She was malnourished. this but there was only one worked as an OFW in Kuwait In four years time, meeting in 2018. and was tortured to death by Mendoza said more than With the Memorandum her Kuwaiti employer. 200 Filipinas already died of Agreement (MOA) bet- Mendoza said there is with questionable causes or ween the Philippines and an estimated 1,600 OFWs in killed by their employers in Kuwait, diplomatic ties was Kuwait who are not inclined Kuwait. -

REAL ESTATE MARKET INSIGHTS August 2018 Executive Summary

REAL ESTATE MARKET INSIGHTS August 2018 Executive Summary • Philippine office supply is forecasted to grow by 46% in the next 6 years adding 5.28 million to the current supply of 11.58 million. • 688,474 square meters of the 2018 office supply are already either leased or pre- committed. This makes our forecasted FY 2018 take-up of 937,000 square meters achievable. • The IT-BPM industry, which includes shared services, took up 46% of FY 2017 demand, while Offshore/Online Gaming took up 30%. The IT-BPM industry is expected to rebound while the Offshore/Online Gaming is expected to grow this 2018. • Rents and land values remain at all-time high across most districts. • China has become a significant investor in economies all over the world. • AI will benefit diverse industries primarily healthcare/medical sciences, agriculture, environment, banking and finance. • Tourism has the potential to be one of the biggest drivers of the Philippine economy. • Developers, investors, and stakeholders must all partake in credible, sensible, and sustainable Masterplanning. 2 METRO MANILA OFFICE MARKET Metro Manila Cityscapes • Most of these districts will be fully developed by 2018. • There will be little land left for development. • The most important districts moving forward will be Bonifacio Global City, Bay Area, Filinvest City, Evia and Arca South. Quezon City 3 MAJOR CBDs MAKATI MAKATI CBD. CENTURY CITY. ROCKWELL CENTER. CIRCUIT MAKATI. San Juan Manila ORTIGAS ORTIGAS CBD. ROCKWELL BUSINESS CENTER. ARCOVIA CITY. SILVER CITY. CAPITOL COMMONS. Manda- luyong Ortigas/ BGC BONIFACIO GLOBAL CITY. MCKINLEY WEST. MCKINLEY HILL. Pasig UPTOWN. VERITOWN. Makati Bay/ Pasay BGC / Taguig 46 BUSINESS PARKS QUEZON CITY. -

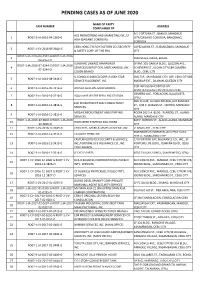

Pending Cases As of June 2020

PENDING CASES AS OF JUNE 2020 NAME OF PARTY CASE NUMBER ADDRESS COMPLAINED OF A.S. FORTUNA ST., BAKILID, MANDAUE ACE PROMOTIONS AND MARKETING INC./LF 1 RO07-2-JA-2016-04-2589-G CITY/GAISANO CORDOVA, BANGBANG, ASIA (GAISANO CORDOVA) CORDOVA CEBU HONG TIN SOY FACTORY CO./SECURITY LOPEZ JAENA ST., SUBANGDAKU, MANDAUE 2 RO07-1-CV-2016-05-2810-G & SAFETY CORP. OF THE PHIL CITY RO07-5-JA-2016-06-2952-G RO07-5-JA-2016- 3 MARIVELES, DAUIS, BOHOL 06-2952-O SUNSHINE LINKAGE MANPOWER 3F RM. 301 GARCIA BLDG., QUEZON AVE., RO07-1-JA-2016-07-3244-G RO07-1-JA-2016- 4 SERVICES/UNITOP GEN. MERCHANDISE, INC. - ECHEVERRI ST., ILIGAN CITY/184 OSMEÑA 07-3244-O COLON BRANCH BLVD., CEBU CITY IL CONIGLIO BIANCO CORP./LUCKY STAR 2ND FLR., SM SEASIDE CITY, SRP, CEBU CITY/85 5 RO07-1-JA-2016-08-3441-G SERVICE PLACEMENT, INC. MASIKAP EXT., DILIMAN, QUEZON CITY COR.INAYAGAN-CANTAO-AN 6 RO07-2-JA-2016-09-3516-G BOJANA GENERAL MERCHANDISE ROAD,INAYAGAN,CITY OF NAGA,CEBU OSMEÑA AVE., POBLACION, DALAGUETE, 7 RO07-2-JA-2016-10-3718-G AQUA MAE WATER REFILLING STATION CEBU 2ND FLOOR, LA CHEF ARCADE, 607 ZAMORA JASI RECRUITMENT AND CONSULTANCY 8 RO07-1-JA-2016-12-3814-G ST., COR P. BURGOS ST., CENTRO, MANDAUE SERVICES CITY MOZAIC RECRUITMENT AND STAFFING ROOM 202 S.A. BLDG., PLARIDEL ST., ALANG- 9 RO07-1-JA-2016-12-3815-G SERVICES ALANG, MANDAUE CITY RO07-1-JA-2016-12-3816-G RO07-1-JA-2016- 829 P. -

June 2015 MPSA 2A.Pdf

MRMS Report No. 002A Department of Environment and Natural Resources MINES AND GEOSCIENCES BUREAU Mining Tenements Management Division COMPLETE LIST OF EXISTING MINERAL PRODUCTION SHARING AGREEMENT (MPSA ) As of June 30, 2015 Total = 338 Total Area (Hectares) = 601,679.3364 COMMODITY DATE DATE OF Item No. CONTRACTOR MPSA No. CONTACT INFORMATION LOCATION AREA (Has.) (including associated REMARKS APPROVED EXPIRY minerals) 1 Lepanto Consolidated Mining 001-90-CAR Bryan U. Yap- President Mankayan, Benguet 948.9695 Gold and copper 3/19/1990 3/19/2015 Commercial Operation Co. and Far Southeast Gold Lepanto Cons. Mining Co. 21st Flr., Resources Inc. BA-Lepanto Bldg. 8747 Paseo de Roxas, Makati City, Tel No. 815-9447 2 Sinosteel Philippines HY Mining 002-90-X (SMR) Lyonel Ty Tiao Hui - Director Loreto, Dinagat Islands 972.0000 Chromite 1/22/1991 1/22/2016 Development/Commercial Operation in the Corporation (assignment from 6 Araneta Avenue, Quezon City. (Within Parcel III of portion of the contract area covered by Partial JLB Enterprises Inc.) Tel. No. 7151231; 7151035 Surigao Mineral Declaration of Mining Project Feasibility (DMPF) Reservation) which approved on interim basis on April 13,2012 and Exploration in the remaining portion of the contract area. 3 Comet Mining Corp. 003-90-X (SMR) Mario G. Pronstroller - President Loreto, Dinagat Islands 1,296.0000 Chromite 11/14/1991 11/14/2016 With pending Declaration of Mining Project Rm. 603 Ermita Center Bldg. 1350 (Within Parcel III of Feasibility (DMPF). Roxas Blvd., Ermita Manila Tel. No. Surigao Mineral 5219941 Fax - 5260509 Reservation) 4 San Manuel Mining Corp. 004-91-X (SMR) Manuel G. -

7 Trends Shaping Philippine Real Estate in 2020

Report 7 Trends Shaping Philippine Real Estate santosknightfrank.com/research in 2020 he beginning of 2020 has been marked by a series of unexpected events that continue to affect the global economy. Despite the impact of COVID-19 and downturn in international stock markets, the Philippine real estate industry continues to have reasons to be optimistic, according to leading real estate service company, Santos Knight Frank. This is due to various drivers, including the roll out of REITs, continuous expansion of BPO companies, and strong consumer demand. (Since 1985, household consumption has accounted for 70-75% of Philippine GDP). Santos Knight Frank identifies the seven key trends that will be shaping the real estate industry this 2020. Media inquiries — Paolo Abellanosa Santos Knight Frank Research Reports are available [email protected] at santosknightfrank.com/market-reports 1. The year for REITs More property companies have expressed interest in Real Estate Investment Trusts (REITs) after regulators unveiled the revised rules in January. Property giant Ayala Land recently filed its application for its own REIT subsidiary, AREIT, while DoubleDragon Properties Corp is looking at raising PHP 11 billion annually over a six- year period via REITs. Companies such as Megaworld, SM Prime Holdings Inc., Robinsons Land, and Ortigas & Co. have also expressed interests on REITs. Asia-Pacific REIT markets Australia, Japan, and Singapore have all performed well in 2019, producing higher dividend yields than listed property companies, according to Santos Knight Frank. In addition to the impressive performance of dividend yields in the three markets, REITs in Hong Kong and Japan have delivered higher total returns versus listed property companies during the year. -

The Mandani Bay Difference

ThePowerhouse Mandani DeveloperBay Difference Top-notch Consultants Mandani Bay is a development of HTLand, Inc., the international Some of the world’s most awarded architects, planners, and land Hallmarks ofjoint excellence venture of Hongkong Land & Taft Properties. The development consultants have come together to create Mandani Bay. partnership brings together over a century of leadership in international property development and expertise in the local 1. Strategic Locationrealty market. Sits on a central business district between the cities of Cebu and Mandaue Master Planner Retail Master Planner 2. Impressive Scale Twenty hectares of prime land host to residential enclaves, corporate towers, commercial centers, hospitality businesses, hubs of art and culture, and leisure parks 3. Master-planned Layout HongkongUnderpinned Land by comprehensivenessis a listed leading andproperty sustainability; investment, and markedmanagement, by seamless and natural and structural spaces, an emphasis on open areas, and a prioritisation for development group. The Group owns and manages more than 850,000 sq. m. of walkability and human connections prime office and luxury retail property in key Asian cities, principally in Hong Kong, Singapore,4. Element and of Water Beijing. Project Architect Landscape Architect Runs along the 500-meter Waterfront and Boardwalk, and includes various water Thefeatures Group also has a number of high quality residential, commercial, and mixed- use projects under development in cities across Greater China and Southeast Asia. In5. EmbracingSingapore, its Nature subsidiary, MCL Land, is a well-established residential developer. HongkongPuts sustainability Land Holdings at the heart Limited of each is incorporated structure; has in Bermudaa 300-meter and green has a parkstandard right listingat the oncenter, the landscapedLondon Stock gardens Exchange, between with buildings, secondary and listings pocket in parksBermuda in every and Singapore.space available The Group’s assets and investments are managed from Hong Kong by Hongkong Land Limited.