Emmis Communications Annual Meeting of Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

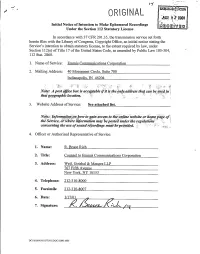

Qrli'anal N 5 J'8)Ol I Initial Notice Ofintention to Make Ephemeral Recordings 'C&Ct ~&Pg Under the Section 112 Statutory License

QRlI'ANAL N 5 J'8)ol I Initial Notice ofIntention to Make Ephemeral Recordings 'C&Ct ~&pg Under the Section 112 Statutory License In accordance with 37 CFR 201.35, fhe transmission service set forth herein files with the Library of Congress, Copyright Office, an initial notice stating the Service's intention to obtain statutory license, to the extent required by law, under Section 112(e) of Title 17 ofthe United States Code, as amended by Public Law 105-304, 112 Stat. 2860. 1. Name of Service: Emmis Communications Co oration 2. Mailing Address: 40 Monument Circle Suite 700 Indiana olis IN 46204 tli atgeogr pEiic locatioii. 3. Website Address of Service: See attached list. the Service, or::ivti ere iiifovmati on rriuy be poli d'urger tIie: reguEatioris ooiiceriiirig tEie1itse ofsouiid"rei ordilgs must'::be prii'ided. 4. Officer or Authorized Representative of Service: 1. Name: R. Bruce Rich 2. Title: Counsel to Emmis Communications Co oration 3. Address: Weil Gotshal k Man es LLP 767 Fifth Avenue New York NY 10153 4. Telephone: 212-310-8000 5. Facsimile 212-310-8007 6. Bate: 1/17/01 7. Signature: DC1 11026411011277501! .DOC112845.0003 EMMIS COMMUNICATIONS CORPORATION STREAMING SITES www.emmis.corn www.k-hits.corn www.q101.corn www.1057thepoint.corn www.kshe95.corn www.wluk.corn www.hi99.corn www.khon.corn www.wens.corn www.wthi.corn www.wibc.Com www.wftx.corn www.radionow93.corn www.wb18.corn www.radio971fm.corn www.koin.corn www.wtlc.corn www.krqe.corn www.cd1019.corn www.wsaz.corn www.power106.corn www.ksn.corn www.thema111041.corn www.kgmb.corn www.987kissfm.corn www.kmtv3.corn www.hot97.corn www.kgun9.corn www.thepeak.corn www.ksnt.corn www.kzla.corn www.kkltfm.corn www.620ktar.corn www.kmvp860.corn www.power92jams.corn DC1 197686&01Q3D$01!.DOCi41625.0003. -

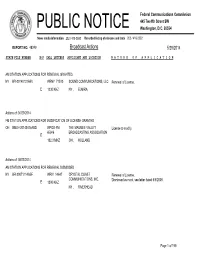

Broadcast Actions 5/29/2014

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48249 Broadcast Actions 5/29/2014 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR RENEWAL GRANTED NY BR-20140131ABV WENY 71510 SOUND COMMUNICATIONS, LLC Renewal of License. E 1230 KHZ NY ,ELMIRA Actions of: 04/29/2014 FM STATION APPLICATIONS FOR MODIFICATION OF LICENSE GRANTED OH BMLH-20140415ABD WPOS-FM THE MAUMEE VALLEY License to modify. 65946 BROADCASTING ASSOCIATION E 102.3 MHZ OH , HOLLAND Actions of: 05/23/2014 AM STATION APPLICATIONS FOR RENEWAL DISMISSED NY BR-20071114ABF WRIV 14647 CRYSTAL COAST Renewal of License. COMMUNICATIONS, INC. Dismissed as moot, see letter dated 5/5/2008. E 1390 KHZ NY , RIVERHEAD Page 1 of 199 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48249 Broadcast Actions 5/29/2014 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 05/23/2014 AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED NY BAL-20140212AEC WGGO 9409 PEMBROOK PINES, INC. Voluntary Assignment of License From: PEMBROOK PINES, INC. E 1590 KHZ NY , SALAMANCA To: SOUND COMMUNICATIONS, LLC Form 314 NY BAL-20140212AEE WOEN 19708 PEMBROOK PINES, INC. -

Bennett-J-Michael-Md.Pdf

James Michael Bennett, M.D. www.orthopedicsportsdoctor.com 4690 Sweetwater Blvd., Ste. 240 Sugar Land, Texas 77479 281-633-8600 EDUCATION Sports Medicine Fellowship UHZ (Uribe, Hechtman, and Zvijac) Sports Medicine Institute- University of Miami, Miami FL 7/2004 – 7/2005 Orthopedic Residency Baylor College of Medicine, Houston TX 6/2000 – 6/2004 General Surgery Internship Baylor College of Medicine, Houston TX 6/1999 – 6/2000 Doctor of Medicine The University of Louisville School of Medicine, Louisville KY 8/1995 – 5/1999 Masters in Public Health Program- Occupational Medicine The University of Texas School of Public Health, Houston TX 8/1994 – 5/1995 Bachelor of Arts in Psychology/ Zoology The University of Texas, Austin TX 8/1990 – 12/1993 WORK HISTORY Fondren Orthopedic Group L.L.P. 09/2005-present 7401 South Main Houston, Tx OTHER EMPLOYMENT/ APPOINTMENTS Co-Founder 2018-present LucentMD Houston, Tx Co-Chairman 2017-present AAOS Innovation Committee Chicago, Il Regional Medical Director 2015-present AngelMD Houston, Tx Executive Director of Physician Relations 2018-present AngelMD Houston, Tx Advisor/ Consultant 2016-present Texas Medical Center Innovation Center Houston, Tx Chairman 2014-2018 Multimedia Education Committee Orthopedic Video Theater American Academy of Orthopedic Surgeons Rosemont, Il Committee Board Member 2010-2018 Multimedia Education Committee American Academy of Orthopedic Surgeons Rosemont, Il Team Physician 2008-2010 Fort Bend Baptist Academy Sugarland, Tx Team Physician 2008-2010 Fort Bend Baptist Academy Sugarland, -

When Being No. 1 Is Not Enough

A Report Prepared by the Civil Rights Forum on Communications Policy When Being No. 1 Is Not Enough: The Impact of Advertising Practices On Minority- Owned & Minority-Formatted Broadcast Stations Kofi Asiedu Ofori Principal Investigator submitted to the Office of Communications Business Opportunities Federal Communications Commission Washington, D.C. All Rights Reserved to the Civil Rights Forum on Communications Policy a project of the Tides Center Synopsis As part of its mandate to identify and eliminate market entry barriers for small businesses under Section 257 of the Telecommunications Act of 1996, the Federal Communications Commission chartered this study to investigate practices in the advertising industry that pose potential barriers to competition in the broadcast marketplace. The study focuses on practices called "no Urban/Spanish dictates" (i.e. the practice of not advertising on stations that target programming to ethnic/racial minorities) and "minority discounts" (i.e. the practice of paying minority- formatted radio stations less than what is paid to general market stations with comparable audience size). The study consists of a qualitative and a quantitative analysis of these practices. Based upon comparisons of nationwide data, the study indicates that stations that target programming to minority listeners are unable to earn as much revenue per listener as stations that air general market programming. The quantitative analysis also suggests that minority-owned radio stations earn less revenues per listener than majority broadcasters that own a comparable number of stations nationwide. These disparities in advertising performance may be attributed to a variety of factors including economic efficiencies derived from common ownership, assessments of listener income and spending patterns, or ethnic/racial stereotypes that influence the media buying process. -

Emmis Communications Annual Meeting of Shareholders

Emmis Communications Annual Meeting of Shareholders July 13, 2017 10:00 a.m. • Note: Certain statements in this presentation constitute “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Reference is made to the company’s Annual Report on Form 10-K and other public documents filed with the Securities and Exchange Commission for additional information concerning such risks and uncertainties. • Additional disclosure related to non-GAAP financial measures can be found under the Investors tab on our website, www.emmis.com. 2 Emmis Overview Company overview Radio market statistics Headquartered in Indianapolis, IN, Emmis is a publicly traded radio broadcasting communications company (NASDAQ: EMMS). Market Revenue Stations The Company was incorporated in 1979 and went public in 1994 Market Name Rank Share FM AM Total Emmis owns 16 FM and 3 AM radio stations in New York, Los Los Angeles, CA ** 1 4% 1 - 1 Angeles, St. Louis, Austin (has 50.1% controlling interest) and New York, NY 2 10% 3 1 4 Indianapolis St. Louis, MO 23 24% 4 - 4 Includes most prominent hip-hop station in the world Austin, TX 32 40% 5 1 6 (Hot 97 – New York City) and most listened to urban station Indianapolis, -

For Immediate Release Thursday, January 10, 2019 Contact: Ryan

For Immediate Release Thursday, January 10, 2019 Contact: Ryan Hornaday, EVP/CFO & Treasurer [email protected] 317.266.0100 Emmis Announces Third Quarter Earnings Outperforms markets both quarter and year-to-date Indianapolis...Emmis Communications Corporation (NASDAQ: EMMS) today announced results for its third fiscal quarter ending November 30, 2018. Emmis’ radio net revenues for the third fiscal quarter were $28.7 million, down from $34.0 million in the prior year. Sales of radio stations (KPWR in LA in August 2017 and four radio stations in St. Louis on April 30, 2018) make Emmis’ reported results not comparable year-over-year. Pro forma for all radio station sales, Emmis’ third quarter radio revenues, as reported to Miller Kaplan, which excludes barter and certain other revenues, were up 5% in markets that were up 2%. “With this quarter’s strong performance, Emmis is now outperforming its markets through the first nine months of this fiscal year– quite an achievement,” said Emmis Chairman and CEO Jeff Smulyan. “Political revenues certainly helped, but we also saw growth in our core advertising categories, all of which contributed to Emmis having its strongest quarter in four years. New York and Indianapolis both outperformed their markets and continue to produce strong ratings, which should help sustain Emmis’ revenue growth. That certainly appears to be the case in January and February, where both months are pacing up mid-to-high single digits.” A conference call regarding earnings will be hosted today at 9 a.m. Eastern today by dialing 1-517-623-4891 with passcode Emmis. -

Jazz and Radio in the United States: Mediation, Genre, and Patronage

Jazz and Radio in the United States: Mediation, Genre, and Patronage Aaron Joseph Johnson Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Graduate School of Arts and Sciences COLUMBIA UNIVERSITY 2014 © 2014 Aaron Joseph Johnson All rights reserved ABSTRACT Jazz and Radio in the United States: Mediation, Genre, and Patronage Aaron Joseph Johnson This dissertation is a study of jazz on American radio. The dissertation's meta-subjects are mediation, classification, and patronage in the presentation of music via distribution channels capable of reaching widespread audiences. The dissertation also addresses questions of race in the representation of jazz on radio. A central claim of the dissertation is that a given direction in jazz radio programming reflects the ideological, aesthetic, and political imperatives of a given broadcasting entity. I further argue that this ideological deployment of jazz can appear as conservative or progressive programming philosophies, and that these tendencies reflect discursive struggles over the identity of jazz. The first chapter, "Jazz on Noncommercial Radio," describes in some detail the current (circa 2013) taxonomy of American jazz radio. The remaining chapters are case studies of different aspects of jazz radio in the United States. Chapter 2, "Jazz is on the Left End of the Dial," presents considerable detail to the way the music is positioned on specific noncommercial stations. Chapter 3, "Duke Ellington and Radio," uses Ellington's multifaceted radio career (1925-1953) as radio bandleader, radio celebrity, and celebrity DJ to examine the medium's shifting relationship with jazz and black American creative ambition. -

The Rise of Talk Radio and Its Impact on Politics and Public Policy

Mount Rushmore: The Rise of Talk Radio and Its Impact on Politics and Public Policy Brian Asher Rosenwald Wynnewood, PA Master of Arts, University of Virginia, 2009 Bachelor of Arts, University of Pennsylvania, 2006 A Dissertation presented to the Graduate Faculty of the University of Virginia in Candidacy for the Degree of Doctor of Philosophy Department of History University of Virginia August, 2015 !1 © Copyright 2015 by Brian Asher Rosenwald All Rights Reserved August 2015 !2 Acknowledgements I am deeply indebted to the many people without whom this project would not have been possible. First, a huge thank you to the more than two hundred and twenty five people from the radio and political worlds who graciously took time from their busy schedules to answer my questions. Some of them put up with repeated follow ups and nagging emails as I tried to develop an understanding of the business and its political implications. They allowed me to keep most things on the record, and provided me with an understanding that simply would not have been possible without their participation. When I began this project, I never imagined that I would interview anywhere near this many people, but now, almost five years later, I cannot imagine the project without the information gleaned from these invaluable interviews. I have been fortunate enough to receive fellowships from the Fox Leadership Program at the University of Pennsylvania and the Corcoran Department of History at the University of Virginia, which made it far easier to complete this dissertation. I am grateful to be a part of the Fox family, both because of the great work that the program does, but also because of the terrific people who work at Fox. -

Resolution Adopting Affirmative Marketing Plan with Checklist

BER-L-006120-15 01/22/2021 1:19:30 PM Pg 1 of 22 Trans ID: LCV2021170382 R# 51-21 COUNCIL OF THE BOROUGH OF SADDLE RIVER Resolution Offered by Council President Ruffino Date: 2/1/21 Seconded by Councilmember RESOLUTION ADOPTING AN AFFIRMATIVE MARKETING PLAN WHEREAS, in accordance with applicable Council on Affordable Housing (“COAH”) regulations, the New Jersey Uniform Housing Affordability Controls (“UHAC”)(N.J.A.C. 5:80- 26., et seq.), and the terms of a Settlement Agreement between the Borough of Saddle River and Fair Share Housing Center (“FSHC”), which was entered into as part of the Borough’s Declaratory Judgment action entitled “In the Matter of the Borough of Saddle River, County of Bergen, Docket No. BER-L-6120-15, which was filed in response to Supreme Court decision In re N.J.A.C. 5:96 and 5:97, 221 N.J. 1, 30 (2015) (“Mount Laurel IV”), the Borough of Saddle River is required to adopt by resolution an Affirmative Marketing Plan to ensure that all affordable housing units created, including those created by rehabilitation, are affirmatively marketed to very low, low and moderate income households, particularly those living and/or working within Housing Region 1, which encompasses the Borough of Saddle River; and NOW, THEREFORE, BE IT RESOLVED, that the Mayor and Council of the Borough of Saddle River, County of Bergen, State of New Jersey, do hereby adopt the following Affirmative Marketing Plan: Affirmative Marketing Plan A. All affordable housing units in the Borough of Saddle River shall be marketed in accordance with the provisions herein unless otherwise provided in N.J.A.C. -

Name Description Address Borough Zip Code Phone Number Email Apostle NYC Film & Televsion Production Company

Name Description Address Borough Zip Code Phone Number Email Apostle NYC Film & Televsion Production Company. Mainly dealing with tv production. 568 Broadway SuiteManhattan 601 10012 212-541-4323 http://apostlenyc.com/contact/ Atlatntic Televsion Documentaries, Reality shows, Magazine shows, promos, and corporate videos 150 West 28th St,Manhattan 8th Floor 10001 212 625-9327 Belladonna Offers production services to international producers who want to shoot in North America 164 W 25th St, 9thManhattan Floor 10001 212 807-0108 [email protected] Casual Films Shoots coprorate, consumer, employer or CSR communications, commerical, etc 73 Calyer Street Brooklyn 11222 212 796-4933 [email protected] Chelsea Production and Talent Management Company, has directors who shot various movies, commericals, direcotrs,33 Bond etc. Street UnitManhattan 1 10012 212 431-3434 Click Play Films Produces corporate videos, commercials and animation 154 Grand Street Manhattan 10013 646 417-5330 [email protected] Co. Mission Content Groupcreative production company focusing on global video creation and participatory brand experiences. Deals202 with Plymouth mostly commercials St. EntranceBrooklyn B 11201 718 374-5205 [email protected] DePalma Productions Produces videos for the corporate, health care & entertainment industries. Also offers post-production. Also159 offers East equipmentMain Street,New including Suite Rochelle 300 green screen 10807 914 576-3500 Departure Films Produces mostly non-scripted shows for cable channels 240 West 37th -

Ted Primich , Et Al. V. Emmis Communications Corporation, Et Al

l ,. Case 1:10-cv-00782-SEB-TAB Document 1 Filed 06/18/10 Page 1 of 22 U.S."F!LE1) IN THE UNITED STATES DISTRICT COURT NUTANAPOL S^ A^ V '?ON SOUTHERN DISTRICT OF INDIANA ^,(lx P,. :IGUTHEPN GSI'RIC-' TED PRIMICH, individually and on behalf of) I 4F INDIA NA 111 URA all others similarly situated, A, 6RIG(aS ' C L f R X Plaintiff, ) CLASS ACTION COMPLAINT FOR VIOLATION OF THE V. ) FEDERAL SECURITIES LAWS AND INDIANA STATE LAW JEFFREY SMULYAN, PATRICK WALSH, ) SUSAN BAYH, GARY KASEFF, RICHARD ) LEVENTHAL, LAWRENCE SORREL, ) JURY TRIAL DEMANDED GREG NATHANSON, PETER LUND, ) EMMIS COMMUNICATIONS ) CORPORATION, JS ACQUISITION, INC. ) and JS ACQUISITION, LLC, ) Defendants. Ale IL0-cv-0 78 2SEB -TAB Plaintiff, by his attorneys, alleges upon information and belief, except for his own acts, which are alleged on knowledge, as follows: 1. Plaintiff brings this action on behalf of the Class A common stockholders of Emmis Communications Corporation ("Emmis" or the "Company") in connection with a tender offer (the "Tender Offer") commenced by JS Acquisition, Inc. ("JS Acquisition") and JS Acquisition, LLC ("JS Parent"), entities owned by Emmis's Chief Executive Officer, Jeffrey H. Smulyan ("Smulyan") (JS Acquisition, JS Parent, and Smulyan are collectively referred to as the "Buyout Group") to purchase all of the common stock of the Company not already owned by JS Acquisition, JS Parent, Smulyan and his affiliates, Alden (defined below) and the Rollover Shares (defined below) for an unfair price of $2.40 per share. 2. Upon the successful completion of the Tender Offer, JS Acquisition will merge with and into Emmis (the "Merger") with Emmis surviving the Merger as a subsidiary whose Case 1:10-cv-00782-SEB-TAB Document 1 Filed 06/18/10 Page 2 of 22 equity securities are owned entirely by JS Parent and Mr. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM