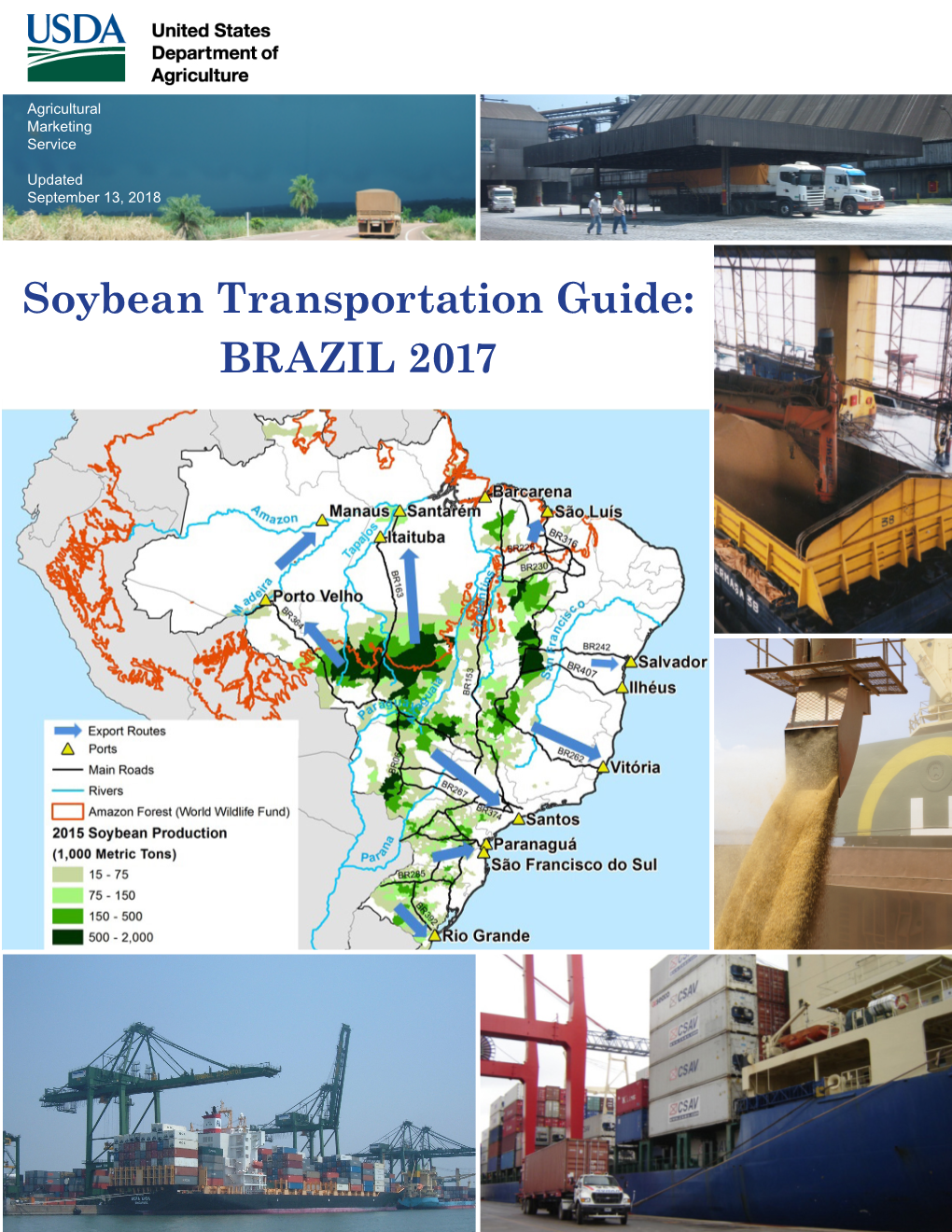

Soybean Transportation Guide: Brazil 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Currency and Coin Management

The George Washington University WASHINGTON DC IBI - INSTITUTE OF BRAZILIAN BUSINESS AND PUBLIC MANAGEMENT ISSUES The Minerva Program Fall 2004 CURRENCY AND COIN MANAGEMENT: A COMPARISON OF AMERICAN AND BRAZILIAN MODELS Author: Francisco José Baptista Campos Advisor: Prof. William Handorf Washington, DC – December 2004 AKNOWLEDGMENTS ? to Dr. Gilberto Paim and the Instituto Cultural Minerva for the opportunity to participate in the Minerva Program; ? to the Central Bank of Brazil for having allowed my participation; ? to Professor James Ferrer Jr., Ph.D., and his staff, for supporting me at the several events of this Program; ? to Professor William Handorf, Ph.D., for the suggestions and advices on this paper; ? to Mr. José dos Santos Barbosa, Head of the Currency Management Department, and other Central Bank of Brazil officials, for the information on Brazilian currency and coin management; ? to the Federal Reserve Bank of Richmond and, in particular, to Mr. William Tignanelli and Miss Amy L. Eschman, who provided me precious information about US currency and coin management; ? to Mr. Peter Roehrich, GWU undergraduate finance student, for sharing data about US crrency and coin management; and, ? to Professor César Augusto Vieira de Queiroz, Ph.D., and his family, for their hospitality during my stay in Washington, DC. 2 ? TABLE OF CONTENTS I – Introduction 1.1. Objectives of this paper 1.2. A brief view of US and Brazilian currency and coin II – The currency and coin service structures in the USA and in Brazil 2.1. The US currency management structure 2.1.1. The legal basis 2.1.2. The Federal Reserve (Fed) and the Reserve Banks 2.1.3. -

Economic Impacts of Tourism in Protected Areas of Brazil

Journal of Sustainable Tourism ISSN: 0966-9582 (Print) 1747-7646 (Online) Journal homepage: http://www.tandfonline.com/loi/rsus20 Economic impacts of tourism in protected areas of Brazil Thiago do Val Simardi Beraldo Souza, Brijesh Thapa, Camila Gonçalves de Oliveira Rodrigues & Denise Imori To cite this article: Thiago do Val Simardi Beraldo Souza, Brijesh Thapa, Camila Gonçalves de Oliveira Rodrigues & Denise Imori (2018): Economic impacts of tourism in protected areas of Brazil, Journal of Sustainable Tourism, DOI: 10.1080/09669582.2017.1408633 To link to this article: https://doi.org/10.1080/09669582.2017.1408633 Published online: 02 Jan 2018. Submit your article to this journal View related articles View Crossmark data Full Terms & Conditions of access and use can be found at http://www.tandfonline.com/action/journalInformation?journalCode=rsus20 Download by: [Thiago Souza] Date: 03 January 2018, At: 03:26 JOURNAL OF SUSTAINABLE TOURISM, 2017 https://doi.org/10.1080/09669582.2017.1408633 Economic impacts of tourism in protected areas of Brazil Thiago do Val Simardi Beraldo Souzaa, Brijesh Thapa b, Camila Goncalves¸ de Oliveira Rodriguesc and Denise Imorid aChico Mendes Institute for Biodiversity Conservation and School of Natural Resources and Environment, EQSW, Complexo Administrativo, Brazil & University of Florida, Brasilia, DF, Brazil; bDepartment of Tourism, Recreation & Sport Management, FLG, University of Florida, Gainesville, FL, USA; cDepartment of Business and Tourism, Rua Marquesa de Santos, Federal Rural University of Rio de Janeiro, Rio de Janeiro, RJ, Brazil; dDepartment of Economy, Rua Comendador Miguel Calfat, University of S~ao Paulo, S~ao Paulo, SP, Brazil ABSTRACT ARTICLE HISTORY Protected areas (PAs) are globally considered as a key strategy for Received 31 October 2016 biodiversity conservation and provision of ecosystem services. -

Epidemiological Update Yellow Fever

Epidemiological Update Yellow Fever 9 March 2017 Situation summary in the Americas Since epidemiological week (EW) 1 to EW 8 of 2017, Brazil, Colombia, Peru, and the Plurinational State of Bolivia, have reported suspected and confirmed yellow fever cases. The following is a situation summary in Brazil. In Brazil, since the beginning of the outbreak in December 2016 to EW 9 of 2017, there were 1,500 cases of yellow fever reported (371 confirmed, 163 discarded, and 966 suspected cases remain under investigation), including 241 deaths (127 confirmed, 8 discarded, and 106 under investigation). The case fatality rate (CFR) is 34% among confirmed cases and 11% among suspected cases. According to the probable site of infection, 79% of the suspected and confirmed cases were reported in the state of Minas Gerais (1,057), followed by Espírito Santo (226), São Paulo (15), Bahia (7), Tocantins (6), Goías (1) and Rio Grande do Norte (1).1 The confirmed cases are distributed in three states: Minas Gerais (288), Espírito Santo (79), and São Paulo (4). Figure 1 illustrates the municipalities with confirmed cases and cases under investigation, as well as confirmed epizootics, and epizootics under investigation. In the state of Minas Gerais, the downward trend in suspected and confirmed cases continues to decline for the fourth consecutive week. Meanwhile, in the state of Espírito Santo cases have increased from EW 1 to EW 4 of 2017 and it will be necessary to continue to observe the evolution of the epidemic (Figure 2). With regard to the number of new cases (confirmed and under investigation) reported between 6 February and 6 March, there were 137 new cases in Espírito Santo and in Minas Gerais during the same period there were 239 new cases reported. -

Soybean Transportation Guide: Brazil 2018 (Pdf)

Agricultural Marketing Service July 2019 Soybean Transportation Guide: BRAZIL 2018 United States Department of Agriculture Marketing and Regulatory Programs Agricultural Marketing Service Transportation and Marketing Program July 2019 Author: Delmy L. Salin, USDA, Agricultural Marketing Service Graphic Designer: Jessica E. Ladd, USDA, Agricultural Marketing Service Preferred Citation Salin, Delmy. Soybean Transportation Guide: Brazil 2018. July 2019. U.S. Dept. of Agriculture, Agricultural Marketing Service. Web. <http://dx.doi.org/10.9752/TS048.07-2019> USDA is an equal opportunity provider, employer, and lender. 2 Contents Soybean Transportation Guide: Brazil 2018 . 4 General Information. 7 2018 Summary . 8 Transportation Infrastructure. 25 Transportation Indicators. 28 Soybean Production . 38 Exports. 40 Exports to China . 45 Transportation Modes . 54 Reference Material. 66 Photo Credits. 75 3 Soybean Transportation Guide: Brazil 2018 Executive Summary The Soybean Transportation Guide is a visual snapshot of Brazilian soybean transportation in 2018. It provides data on the cost of shipping soybeans, via highways and ocean, to Shanghai, China, and Hamburg, Germany. It also includes information about soybean production, exports, railways, ports, and infrastructural developments. Brazil is one of the most important U.S. competitors in the world oilseed market. Brazil’s competitiveness in the world market depends largely on its transportation infrastructure, both production and transportation cost, increases in planted area, and productivity. Brazilian and U.S. producers use the same advanced production and technological methods, making their soybeans relative substitutes. U.S soybean competitiveness worldwide rests upon critical factors such as transportation costs and infrastructure improvements. Brazil is gaining a cost advantage. However, the United States retains a significant share of global soybean exports. -

Polyethylene Terephthalate Resin from Brazil

A-351-852 Investigation Public Document E&C/Office VII: EB/KW September 17, 2018 MEMORANDUM TO: Gary Taverman Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations, performing the non-exclusive functions and duties of the Assistant Secretary for Enforcement and Compliance FROM: James Maeder Associate Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations performing the duties of Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations SUBJECT: Issues and Decision Memorandum for the Final Affirmative Determination in the Less-Than-Fair-Value Investigation of Polyethylene Terephthalate Resin from Brazil I. SUMMARY The Department of Commerce (Commerce) determines that polyethylene terephthalate (PET) resin from Brazil is being, or is likely to be, sold in the United States at less than fair value, as provided in section 735 of the Tariff Act of 1930, as amended (the Act). The period of investigation is July 1, 2016, through June 30, 2017. We analyzed the comments of the interested parties. As a result of this analysis, and based on our findings at verification, we made certain changes to M&G Polimeros Brasil S.A.’s (MGP Brasil’s) margin calculation program with respect to packing expenses. In addition, we applied total facts otherwise available, with an adverse inference, to Companhia Integrada Textil de Pernambuco (Textil de Pernambuco). We recommend that you approve the positions described in the “Discussion of the Issues” section of this memorandum. Below is the complete list of the issues in this investigation on which we received comments from parties. Comment 1: Whether MGP Brasil’s Unverified Bank Charges Should Result in the Application of Adverse Facts Available. -

No Cachoeiradoc O Futuro E Os Caminhos Encantados: Cachoeira Reencontra Os Tupinambá

Parte 2 - No CachoeiraDoc O futuro e os caminhos encantados: Cachoeira reencontra os Tupinambá Jurema Machado de Andrade Souza SciELO Books / SciELO Livros / SciELO Libros SOUZA, J. M. A. O futuro e os caminhos encantados: Cachoeira reencontra os Tupinambá. In: CESAR, A., MARQUES, A. R., PIMENTA, F., COSTA, L., eds. Desaguar em cinema: documentário, memória e ação com o CachoeiraDoc [online]. Salvador: EDUFBA, 2020, pp. 111-122. ISBN: 978-65-5630-192-1. https://doi.org/10.7476/9786556301921.0008. All the contents of this work, except where otherwise noted, is licensed under a Creative Commons Attribution 4.0 International license. Todo o conteúdo deste trabalho, exceto quando houver ressalva, é publicado sob a licença Creative Commons Atribição 4.0. Todo el contenido de esta obra, excepto donde se indique lo contrario, está bajo licencia de la licencia Creative Commons Reconocimento 4.0. O futuro e os caminhos encantados: Cachoeira reencontra os Tupinambá Jurema Machado de Andrade Souza Em um dia de agosto de 1999, dezenas de indígenas Pataxó e Pataxó Hãhãhãi retomavam a área compreendida como Parque Nacional e Histórico do Monte Pascoal, município de Porto Seguro, na Bahia. Os indígenas, especificamente os Pataxó, que contavam com o apoio dos Hãhãhãi, reivindicavam aquela área como seu território tradicional e solicitavam à Fundação Nacional do Índio (Funai) a revisão de limites da terra indígena, de maneira que a área do parque, uma unidade de conservação criada sobrepondo-se ao território indígena, vol- tasse a ser de sua livre circulação. Os Pataxó já estavam desde o ano anterior em um movimento para restaurar seu território tradicional, esbulhado em décadas de omissões e descaso dos pode- res locais e federal. -

Social Distancing Measures in the Fight Against COVID-19 in Brazil

ARTIGO ARTICLE Medidas de distanciamento social para o enfrentamento da COVID-19 no Brasil: caracterização e análise epidemiológica por estado Social distancing measures in the fight against COVID-19 in Brazil: description and epidemiological analysis by state Lara Lívia Santos da Silva 1 Alex Felipe Rodrigues Lima 2 Medidas de distanciamiento social para el Démerson André Polli 3 Paulo Fellipe Silvério Razia 1 combate a la COVID-19 en Brasil: caracterización Luis Felipe Alvim Pavão 4 y análisis epidemiológico por estado Marco Antônio Freitas de Hollanda Cavalcanti 5 Cristiana Maria Toscano 1 doi: 10.1590/0102-311X00185020 Resumo Correspondência L. L. S. Silva Universidade Federal de Goiás. Medidas de distanciamento social vêm sendo amplamente adotadas para mi- Rua 235 s/n, Setor Leste Universitário, Goiânia, GO tigar a pandemia da COVID-19. No entanto, pouco se sabe quanto ao seu 74605-050, Brasil. impacto no momento da implementação, abrangência e duração da vigência [email protected] das medidas. O objetivo deste estudo foi caracterizar as medidas de distan- 1 ciamento social implementadas pelas Unidades da Federação (UF) brasileiras, Universidade Federal de Goiás, Goiânia, Brasil. 2 Instituto Mauro Borges de Estatística e Estudos incluindo o tipo de medida e o momento de sua adoção. Trata-se de um estudo Socioeconômicos, Goiânia, Brasil. descritivo com caracterização do tipo, momento cronológico e epidemiológico 3 Universidade de Brasília, Brasília, Brasil. da implementação e abrangência das medidas. O levantamento das medidas 4 Secretaria do Tesouro Nacional, Brasília, Brasil. foi realizado por meio de buscas em sites oficiais das Secretarias de Governo 5 Instituto de Pesquisa Econômica Aplicada, Rio de Janeiro, Brasil. -

A Fourth Decade of Brazilian Democracy

INTRODUCTION Peter R. Kingstone and Timothy J. Power A Fourth Decade of Brazilian Democracy Achievements, Challenges, and Polarization IN 2009 THE Economist magazine celebrated Brazil’s meteoric rise as an emerging power with a cover featuring Rio de Janeiro’s mountaintop icon, “Christ the Redeemer,” taking off into the stratosphere. Four years later, with the economy in decline and protestors marching in the streets, the magazine again featured the Cristo, this time in a horrific nosedive, asking “Has Brazil blown it?” Brazil’s situation had deteriorated but still remained hopeful enough to allow the incumbent Workers’ Party (Partido dos Trabalhadores; PT) president Dilma Rousseff to win reelection in October 2014. Within months of her victory, however, the country was plunged even deeper into re- cession and was caught up in the sharpest and most polarizing political crisis in the young democracy’s history. In a short period, Brazil had moved from triumphant emerging power to a nation divided against itself. At the heart of the political crisis was the impeachment of Dilma, a process that began barely a year into her second term. Dilma’s reelection campaign had withstood declining economic performance and a rapidly widening cor- ruption investigation—the Lava Jato (car wash) scandal that ensnared dozens of leading business people and politicians, including many key PT figures, though not Dilma herself. In October 2015, the Federal Accounting Court (Tribunal de Contas da União; TCU) rejected Dilma’s budget accounts, having identified a series of practices that violated federal budget and fiscal 3 © 2017 University of Pittsburgh Press. All rights reserved. -

Colonização E Resistência No Paraguaçu – Bahia, 1530 – 1678

Universidade Federal da Bahia Progama de pós-graduação em História Curso de mestrado em História social COLONIZAÇÃO E RESISTÊNCIA NO PARAGUAÇU – BAHIA, 1530 – 1678 Juliana Brainer Barroso Neves Orientador(a): Maria Hilda Baqueiro Paraíso Dissertação apresentada ao Programa de Pós-Graduação em História da Universidade Federal da Bahia, como requisito parcial para obtenção do grau de mestra em História. Recife, 2008 1 DEDICATÓRIA A minha família representada por Pedro, e aos meus amigos, representados por Nanda. 2 AGRADECIMENTOS Relutei um pouco para escrever esse agradecimento temendo que minha memória me traísse e eu acabasse esquecendo alguém importante. Mas diante do significado que esse trabalho tem para mim acredito que seria no mínimo indelicado da minha parte não fazer essa pequena homenagem àqueles que tanto influenciaram para que essa dissertação chegasse ao fim. Primeiro e sempre, quero agradecer a minha mãe, Ana e meu pai, Mano, que mesmo diante de todas as dificuldades da vida, encontraram um meio de “patrocinar” todas minhas “invenções”, inclusive e especialmente essa. Aos meus irmãos, Nelly e Dinho também devo agradecer, já que em muitos momentos difíceis eles me escutaram e me aconselharam a respeito da minha profissão e da minha vida em geral. Aos meus sobrinhos, Camila e Davi, agradeço todas às vezes que eu ficava com preguiça de estudar e os usava como desculpa para não faze-lo. A toda minha família tenho que agradecer o apoio e fé que sempre tiveram em mim. Em especial a tia Lucinha, e mais especial ainda a meu “tio Feo”, um dos que mais me incentivou a me meter nessa vida acadêmica e que também ficou pendurado algumas horas comigo ao telefone nos últimos anos, me dando coragem para continuar. -

Evolution of Land Use in the Brazilian Amazon: from Frontier Expansion to Market Chain Dynamics

Land 2014, 3, 981-1014; doi:10.3390/land3030981 OPEN ACCESS land ISSN 2073-445X www.mdpi.com/journal/land/ Article Evolution of Land Use in the Brazilian Amazon: From Frontier Expansion to Market Chain Dynamics Luciana S. Soler 1,2,*, Peter H. Verburg 3 and Diógenes S. Alves 4 1 Land Dynamics Group, Wageningen University, PO Box 47, 6700 AA Wageningen, The Netherlands 2 National Early Warning and Monitoring Centre of Natural Disasters (Cemaden), Parque Tecnológico, Av. Dr. Altino Bondensan 500, São José dos Campos 12247, Brazil 3 Institute for Environmental Studies, VU University Amsterdam, De Boelelaan 1087, Amsterdam 1081 HV, The Netherlands; E-Mail: [email protected] 4 Image Processing Division, National Institute for Space Research (INPE), Av. dos Astronautas 1758, São José dos Campos 12227, Brazil; E-Mail: [email protected] * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel.: +55-12-3186-9236. Received: 31 December 2013; in revised form: 30 July 2014 / Accepted: 7 August 2014 / Published: 19 August 2014 Abstract: Agricultural census data and fieldwork observations are used to analyze changes in land cover/use intensity across Rondônia and Mato Grosso states along the agricultural frontier in the Brazilian Amazon. Results show that the development of land use is strongly related to land distribution structure. While large farms have increased their share of annual and perennial crops, small and medium size farms have strongly contributed to the development of beef and milk market chains in both Rondônia and Mato Grosso. Land use intensification has occurred in the form of increased use of machinery, labor in agriculture and stocking rates of cattle herds. -

Santos: Main Port for Brazil and Japan Interchange

POOORT OF SANTOS O THE PORT OF BRAZIL MAIN PORT FOR BRASIL AND JAPAN INTERCHANGE 1 Toshi-ichi Tachibana University of São Paulo SANTOS: MAIN PORT FOR BRASIL AND JAPAN INTERCHANGE "Treaty of Friendship, Commerce and Navigg,gation, signed in Paris in France , November 5, 1895, was officially started diplomatic relations between Japan and Brazil . In 1908 the ship Kasato-maru docked in Santos, in São Paulo State, carrying the first 791 Japanese immigrants, and this event is the starting point for a close relationship between thihe two countries. 2 from 1908 to 1970, approximately 210 thousand Japanese immigrants came to Brazil and are incorporated in the formation of a new cultural identity, the Japanese-Brazilian. The result of these exchanges can be found in our day to day in many ways. The recent popularity of football in Japan is due to the performance of players and Brazilian technicians. The music and Brazilian cuisine has been appreciated by the Japp,anese, who increasing gyyply sympathize with Brazil and its people, known for his joyful spirit and big heart. 3 A bilingual dictionary Portuguese Japanese came to be edited in the old 1602,,p when Japan came out of the feudal era and join the process of political unification and territorial. It may be that some copies of that precious editorial departed the port of Kobe on 28 April 1908, aboard the ship "Kasato Maru", and were transported to the coffee-west of Sao Paulo, whhiihere the immigrants hdfihifihad to fix their first roots. 4 Santos Immigrations 5 Train São Paulo to Santos - 1920 6 The immigrants guesthouse in Kobe 7 Dormitory of the immigrants guesthouse in Sao Paulo 8 Local wh ere th e processi ng was d one on th e coff ee 9 Working in sugar cane planting in the times of migration mediated by the government 10 Japanese Immigrants Numbers 11 Technical Cooperation of Japan to Brazil 12 13 SÃO VICENTE ENTRANCE ISLAND & EXIT RIGHT BANK LEFT BANK SANTO AMARO ISLAND 14 AERIAL VIEW 15 THE DRAFT OF THE CANAL OF PORT OF SANTOS 14 m 16 Beggginning of the 20th century.. -

Spatial Productivity and Commodity, Mato Grosso Do Sul - Brazil

Mercator - Revista de Geografia da UFC ISSN: 1984-2201 [email protected] Universidade Federal do Ceará Brasil SPATIAL PRODUCTIVITY AND COMMODITY, MATO GROSSO DO SUL - BRAZIL Lamoso, Lisandra Pereira SPATIAL PRODUCTIVITY AND COMMODITY, MATO GROSSO DO SUL - BRAZIL Mercator - Revista de Geografia da UFC, vol. 17, no. 6, 2018 Universidade Federal do Ceará, Brasil Available in: https://www.redalyc.org/articulo.oa?id=273655428002 PDF generated from XML JATS4R by Redalyc Project academic non-profit, developed under the open access initiative Lisandra Pereira Lamoso. SPATIAL PRODUCTIVITY AND COMMODITY, MATO GROSSO DO SUL - BRAZIL SPATIAL PRODUCTIVITY AND COMMODITY, MATO GROSSO DO SUL - BRAZIL Lisandra Pereira Lamoso Redalyc: https://www.redalyc.org/articulo.oa? Federal University of Grande Dourados (UFGD), Brasil id=273655428002 [email protected] Received: 13 February 2018 Accepted: 19 April 2018 Published: 15 May 2018 Abstract: is text aims to promote a reflection on the subject of the privileged geographical location that is credited to the State of Mato Grosso do Sul, analyzing the point of view of its trade relationships, based on the exports of commodities. is essay does not consider “logistic efficiency” as a given, as a value in itself. e relationships of production have not reached a level of maturity in a way that designs, defines and funds a technical apparatus that can be called “efficient” in its displacement costs. ere is an unsatisfactory materiality that, if it does not compromise the international insertion of the state, at the very least weakens it. Methodologically, the notion of spatial productivity developed by Milton Santos is used.