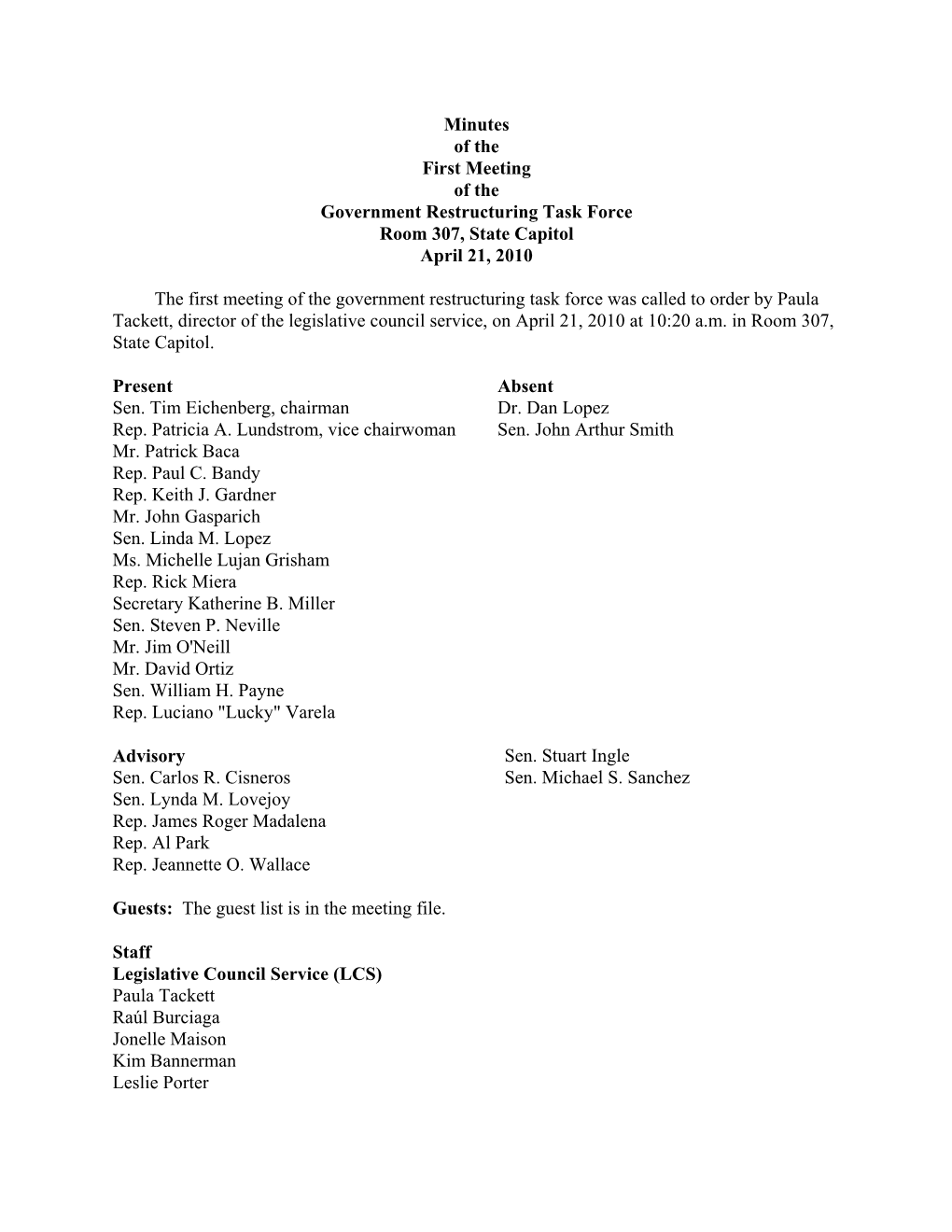

Minutes of the First Meeting of the Government Restructuring Task Force Room 307, State Capitol April 21, 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rethinking Judicial Minimalism: Abortion Politics, Party Polarization, and the Consequences of Returning the Constitution to Elected Government Neal Devins

Vanderbilt Law Review Volume 69 | Issue 4 Article 3 5-2016 Rethinking Judicial Minimalism: Abortion Politics, Party Polarization, and the Consequences of Returning the Constitution to Elected Government Neal Devins Follow this and additional works at: https://scholarship.law.vanderbilt.edu/vlr Part of the Supreme Court of the United States Commons Recommended Citation Neal Devins, Rethinking Judicial Minimalism: Abortion Politics, Party Polarization, and the Consequences of Returning the Constitution to Elected Government, 69 Vanderbilt Law Review 935 (2019) Available at: https://scholarship.law.vanderbilt.edu/vlr/vol69/iss4/3 This Article is brought to you for free and open access by Scholarship@Vanderbilt Law. It has been accepted for inclusion in Vanderbilt Law Review by an authorized editor of Scholarship@Vanderbilt Law. For more information, please contact [email protected]. Rethinking Judicial Minimalism: Abortion Politics, Party Polarization, and the Consequences of Returning the Constitution to Elected Government Neal Devins* IN TROD U CTION ............................................................................... 935 I. MINIMALISM THEORY AND ABORTION ................................. 939 II. WHAT ABORTION POLITICS TELLS US ABOUT JUDICIAL M INIMALISM ........................................................ 946 A . R oe v. W ade ............................................................. 947 B . From Roe to Casey ................................................... 953 C. Casey and Beyond .................................................. -

Inside Report 2010

® 200 9–2010 Annual Repo rt FOO D TAX DEFEATE D Again About the Cover The cover features a photograph of Dixon’s apple orchard at har - vest time. Dixon’s, located in Peña Blanca, New Mexico, close to Cochiti, is a New Mexico institution. It was founded by Fred and Faye Dixon in 1943, and is currently run by their granddaughter, Becky, and her husband, Jim. The photo was taken by Mark Kane, a Santa Fe-based photographer who has had many museum and Design gallery shows and whose work has been published extensively. Kristina G. Fisher More of his photos can be seen at markkane.net. The inside cover photo was taken by Elizabeth Field and depicts tomatoes for sale Design Consultant at the Santa Fe Farmer’s Market. Arlyn Eve Nathan Acknowledgments Pre-Press We wish to acknowledge the Albuquerque Journal , the Associated Peter Ellzey Press, the Deming Headlight , the Las Cruces Sun-News , Paul Gessing and the Rio Grande Foundation, the Santa Fe New Mexican , the Printe r Santa Fe Reporter, and the Truth or Consequences Herald for Craftsman Printers allowing us to reprint the excerpts of articles and editorials that appear in this annual report. In addition, we wish to thank Distribution Elizabeth Field, Geraint Smith, Clay Ellis, Sarah Noss, Pam Roy, Frank Gonzales and Alex Candelaria Sedillos, and Don Usner for their permission to David Casados reprint the photographs that appear throughout this annual report. Permission does not imply endorsement. Production Manager The paper used to print this report meets the sourcing requirements Lynne Loucks Buchen established by the forest stewardship council. -

New Mexico Lobo, Volume 074, No 37, 11/2/1970." 74, 37 (1970)

University of New Mexico UNM Digital Repository 1970 The aiD ly Lobo 1961 - 1970 11-2-1970 New Mexico Lobo, Volume 074, No 37, 11/2/ 1970 University of New Mexico Follow this and additional works at: https://digitalrepository.unm.edu/daily_lobo_1970 Recommended Citation University of New Mexico. "New Mexico Lobo, Volume 074, No 37, 11/2/1970." 74, 37 (1970). https://digitalrepository.unm.edu/ daily_lobo_1970/120 This Newspaper is brought to you for free and open access by the The aiD ly Lobo 1961 - 1970 at UNM Digital Repository. It has been accepted for inclusion in 1970 by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. .----------------------------------~--~ weeks ago, the three biggest Quebec people obviously know only one side trade union federations-the of Greek life-the side that likes to Confederation of National Trade have a good time. There is another side. One of the major activities of Unions, the Quebec Federation of Labor, and the Quebec Teachers Greek Week is Work-Day. All of the Corporation representing a total of Greeks unite to do something helpful more than a half a million people, for the Albuquerque community-we Bema don't just send them money-we set denounced the attitude of the out and do some plain old-fashioned Bourassa government which for no work. I'm sorry to say that I've never apparent reason went from one day heard that the rest of the campus does to the next from a moderate position r~-------·-·-- ·-- -----·-· -·- .-· ,+--;....,..__,_~·-:-···""""~-·--·~-~.-._.._ anything even remotely resembling to an inexplicable attitude of total submission to the federal authorities. -

Contested Education, Continuity, and Change in Arizona and New Mexico, 1945-2010 Stephen D

University of New Mexico UNM Digital Repository History ETDs Electronic Theses and Dissertations Fall 12-14-2018 Contested Education, Continuity, and Change in Arizona and New Mexico, 1945-2010 Stephen D. Mandrgoc University of New Mexico - Main Campus Follow this and additional works at: https://digitalrepository.unm.edu/hist_etds Part of the United States History Commons Recommended Citation Mandrgoc, Stephen D.. "Contested Education, Continuity, and Change in Arizona and New Mexico, 1945-2010." (2018). https://digitalrepository.unm.edu/hist_etds/260 This Dissertation is brought to you for free and open access by the Electronic Theses and Dissertations at UNM Digital Repository. It has been accepted for inclusion in History ETDs by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. i Stephen Mandrgoc Candidate History Department This dissertation is approved, and it is acceptable in quality and form for publication: Approved by the Dissertation Committee: Dr. L.M. García y Griego, Chairperson Dr. Bárbara Reyes Dr. Jason Scott-Smith Dr. Diane Torres-Velásquez Dr. Joseph P. Sánchez ii CONTESTED EDUCATION, CONTINUITY, AND CHANGE IN ARIZONA AND NEW MEXICO, 1945-2010 by STEPHEN MANDRGOC Bachelor of Arts, Classics University of Illinois at Urbana-Champaign Master of Arts, History Illinois State University DISSERTATION Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy, History The University of New Mexico Albuquerque, New Mexico May 2019 iii Dedication To my parents, David and Agnus Mandrgoc, and my sister Melissa for their constant support and love over this long process; to my chair, Manuel García y Griego for his helpful suggestions and patience; to Dr. -

Message from the President

Volume 47, Issue 2 March / April 2017 Inside this issue: January/February 2016 New Mexico Library 2 Foundation Grants State Library joins 3 LC Program Submitted by: Stephanie Wilson, NMLA Member at Large MLA/SCC Save the 3 Date Make plans to visit Las Vegas on April 6 & 7 for the NMLA Mini-Conference! Our conference site is New Mexico Highlands University. This year’s theme, “Libraries Transform New Mexico!” ALA Councilor 4 continues the conversation that started with the 2016 assessment of our state’s libraries. Report Informative programs will explore how librarians in New Mexico are working to transform the landscape within their communities. This conference provides a forum to discover the creative NMLA Nominations 5 ways in which diverse libraries are meeting the shared challenge of serving our communities and Elections throughout New Mexico. UNM Libraries 6 Preconference activities on Thursday begin with a FREE morning program "Project Outcome: News Outcome Measurements Made Easy!" presented by Emily Plagman, the American Library Association, and Kathleen Moeller-Peiffer, New Mexico State Library. Project Outcome is a FREE toolkit designed to help public libraries understand and share the true impact of essential NMLA Twitter 6 library services and programs by providing simple surveys and an easy-to-use process for measuring and analyzing outcomes. Project Outcome also provides libraries with the resources NMSU Library News 7 and training support needed to apply their results and confidently advocate for their library’s future. Library Legislative 8,9 Thursday afternoon includes a guided tour of 2 historic Harvey Hotels in Las Vegas. -

SM 89 Page 1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

1 A MEMORIAL 2 CELEBRATING THE SUCCESS OF THE FILM INDUSTRY IN NEW MEXICO. 3 4 WHEREAS, in 2018, New Mexico commemorated one hundred 5 twenty years of film production in the state, beginning with 6 the Thomas A. Edison company's 1898 filming of Indian Day 7 School in the New Mexico territory; and 8 WHEREAS, also in 2018, the New Mexico film division of 9 the economic development department, also known as the 10 New Mexico film office, celebrated the fiftieth anniversary 11 of its founding by then-Governor David Cargo; and 12 WHEREAS, New Mexico established the first state film 13 office in the United States; and 14 WHEREAS, film and televison production continue to 15 flourish in New Mexico; and 16 WHEREAS, New Mexico has experienced an unprecedented 17 boom in film and television production because of the state's 18 competitive incentives, talented crew both behind and in 19 front of the camera and robust infrastructure; and 20 WHEREAS, New Mexico also boasts unique architecture, 21 varied landscapes, breathtaking vistas and mystical skies and 22 more than three hundred days a year of sunshine; and 23 WHEREAS, the New Mexico film industry has made a 24 significant impact on the economic vitality of New Mexico; 25 and SM 89 Page 1 1 WHEREAS, the film industry has created high-wage jobs 2 for skilled technical crew, business opportunities for local 3 vendors and investment opportunities; and 4 WHEREAS, New Mexico boasts the largest film crew base 5 between the east and west coasts; and 6 WHEREAS, New Mexico's current film and television -

19-09-HR Haldeman Political File

Richard Nixon Presidential Library Contested Materials Collection Folder List Box Number Folder Number Document Date No Date Subject Document Type Document Description 19 9 4/9/1970 Campaign Memo From: H.R. Haldeman To: Murray Chotiner RE: State coordinators for 1970 elections. States between Chotiner and Dent are attached. 7 pgs. 19 9 3/31/1970 Campaign Memo From: Murray Chotiner To: Larry Higby RE: Campaigns managed by the Spencer-Roberts firm. 1 pg. 19 9 3/31/1970 Campaign Memo From: Murray Chotiner To: H.R. Haldeman RE: Ohio Gubernatorial and Senatorial races. 8 pgs. 19 9 3/14/1970 Campaign Memo From: Donald Rumsfeld To: H.R. Haldeman RE: Administration Policy on White House Staff Participation in Primaries. 1 pg. Wednesday, April 06, 2011 Page 1 of 4 Box Number Folder Number Document Date No Date Subject Document Type Document Description 19 9 3/13/1970 Campaign Memo From: H.R. Haldeman To: White House Staff RE: Policy on participation in the Republican primary contests. 1 pg. 19 9 3/18/1970 Campaign Memo From: David R. Derge To: The President RE: Brewer vs. Wallace in the 1970 Alabama Gubernatorial Primary. 4 pgs. 19 9 3/19/1970 Campaign Memo From: herbert G. Klein To: The President RE: New York Republican independent poll. 5 pgs. 19 9 4/1/1970 Campaign Memo From: John Ehrlichman To: H.R. Haldeman RE: Quick note about date of Republican National Leadership Conference. 1 pg. 19 9 3/31/1970 Campaign Letter From: Elly M. Peterson To: John Ehrlichman RE: Republican National Leadership Conference dates and appearance of the President and Johnny Cash. -

New Mexico Lobo, Volume 073, No 41, 11/12/1969." 73, 41 (1969)

University of New Mexico UNM Digital Repository 1969 The aiD ly Lobo 1961 - 1970 11-12-1969 New Mexico Lobo, Volume 073, No 41, 11/12/ 1969 University of New Mexico Follow this and additional works at: https://digitalrepository.unm.edu/daily_lobo_1969 Recommended Citation University of New Mexico. "New Mexico Lobo, Volume 073, No 41, 11/12/1969." 73, 41 (1969). https://digitalrepository.unm.edu/ daily_lobo_1969/125 This Newspaper is brought to you for free and open access by the The aiD ly Lobo 1961 - 1970 at UNM Digital Repository. It has been accepted for inclusion in 1969 by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. ~----~-------~--------------------~-------~~-- Page 8 NEW MEXICO LOBO Tuesday, November 11,.1969 I Soccer Team llllllllllllllllllllllllllllllllllllfllllllflllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllft IIIUIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII!IIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIJUIIHIIIIIIIIWHIIIIIIIIIIIIIIIIIIIIIIBIIIllll The UNM Soccer Team will Queen Coronation Recruiters representing the following travel to Santa Fe this Sunday for companies or agenclea will visit the Center a game against the College of CALLING-U ·Recruiting U to interview candidates for po_sitions: Santa Fe. In their first game the 1111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111111 Will Be -

New Mexico Lobo, Volume 070, No 25, 11/2/1966." 70, 25 (1966)

University of New Mexico UNM Digital Repository 1966 The aiD ly Lobo 1961 - 1970 11-2-1966 New Mexico Lobo, Volume 070, No 25, 11/2/ 1966 University of New Mexico Follow this and additional works at: https://digitalrepository.unm.edu/daily_lobo_1966 Recommended Citation University of New Mexico. "New Mexico Lobo, Volume 070, No 25, 11/2/1966." 70, 25 (1966). https://digitalrepository.unm.edu/ daily_lobo_1966/99 This Newspaper is brought to you for free and open access by the The aiD ly Lobo 1961 - 1970 at UNM Digital Repository. It has been accepted for inclusion in 1966 by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. ,- . .. 37'6.'7'17 . Page 8 NEW MEXICO LOBO Monday, Oc~ober 31, 1966 Un3G,.'vJ Wolfpups Defeat TWC PATRONIZE LOBO ADVERTISERS Stud~ff(Parking Gripes Aired at MeeJ By TOM GARCIA The UNM Wolfpups, Jed by the game after starting quarterback when the 'Pups picked off the nrst .President, pointed out thai the years there will be no student Univesrity community compro ert Riley from the University outstanding play of quarterback, Mike Casey was injured ea1•Jy in of their six interceptions. Shortly FAMOUS NAME The present problem with the new Jot opened a few weeks ago parking on campus, if the pres mises about five per cent of the architectural department. They Gilbert Lope~, surprised the the game. before the half the UNM frosh parking situation on campus and· behind Hokona Dorm, is no more ent construction plans are fol population of Albuquerque, the presented blueprints on existing Texas Western frosh as they beat . -

New Mexico History – 1870-2020 (150 Years)

New Mexico History – 1870-2020 (150 Years) 1848-1889 – US Territorial Period Notable items prior to 1870: 1820 – Pueblos became Mexican citizens at the conclusion of the Mexican revolution 1821 – Captain William Becknell blazed the path of what would become known as the Santa Fe Trail 1848 – Pueblos became U.S. citizens at the conclusion of the Mexican War 9/9/1850 – New Mexico Becomes a US Territory – The Compromise of 1850 - President Millard Fillmore signs into law the Organic Act, admitting New Mexico into the Union as a territory and allowing for the formation of a territorial government. 1851 – Jean Bapt6iste Lamy Arrives – Future Archbishop of Santa Fe 1851 – Sodomy becomes a capital offense 1854 – Gadsden Purchase - US pays Mexico $10 million for 29,670 square miles of Mexican territory that becomes part of Arizona and New Mexico, giving the US a route for a southern transcontinental railroad and ownership of the copper mines at Santa Rita. 1862 – Civil War Battles in New Mexico 1864 Navajo Long Walk – they walked 450 miles in eighteen days. At least two hundred Navajos perish on the Long Walk. 1869-8/1871 – Governor: William Anderson Pie (R) 1869 – Building began for the St. Francis Cathedral; finished in 1886 1870 – Federal Census – New Mexico territory’s population was 91,874 8/1/1871-6/3/1875 – Governor: Marsh Giddings (R) 6/3/1875-7/30/1875 – Governor: William G. Ritch (R) 7/30/1875-9/29/1878 – Governor: Samuel Beach Axtell (R) 9/29/1878-3/9/1881 – Governor: Lewis Wallace (R) 2/13/1879 Railroad Reaches New Mexico – first passenger train arrives in Otero. -

Report: Redistricting NM 2021

Redistricting NM 2021 A troubled history and opportunities for change. By Gwyneth Doland Term Faculty, University of New Mexico Department of Communication and Journalism Commissioned by New Mexico in Depth Supported by the Thornburg Foundation Table of Contents A Glossary of Terms 3 Executive Summary 5 Introduction 8 Decisions Made Behind Closed Doors 11 Advantages for Incumbents 13 Vulnerability to Partisan Manipulation 16 A History of Racial Discrimination in Voting 19 and Redistricting An Evolving Process 23 Looking Forward 26 Sources 27 Acknowledgments 29 Report: A History of Redistricting in New Mexico | 02 A Glossary of Terms Adapted and condensed from “A Guide to State and Congressional Redistricting in New Mexico 2011,” prepared by the Legislative Council Service Apportionment: The process of assigning the number of members of Congress that each state may elect following each census. At large: When one or several candidates run for an office, and they are elected by the whole area of a local political subdivision, they are being elected at large. Census: The enumeration or count of the population as mandated by the Unit- ed States Constitution. Community of interest: A community defined by actual shared interests, be they political, social or economic. Compactness: Having the minimum distance between all the parts of a con- stituency (a circle is the most compact district). There are various methods of measuring compactness. Contiguity: All parts of a district being connected at some point with the rest of the district and not divided into two or more discrete pieces. Deviation: The degree by which a single district’s population varies from the “ideal” may be stated in terms of “absolute deviation” or “relative deviation.” Absolute deviation is equal to the difference between a district’s actual popula- tion and its ideal population, expressed as a plus (+) or minus (-) number indi- cating that the district’s population exceeds or falls short of that ideal. -

Ed 042 524 Institution Edrs Price Descriptors

DOCUMENT RESUME ED 042 524 RC 004 558 TITLE Federal-State Indian Affairs Conference. INSTITUTION National Council on Indian Opportunity, Washington, D.C. PUB DATE 21 Aug 69 NOTE 115p.; Proceedings of Federal-State Indian Affairs Conference (Lake Tahoe, Stateline, Nevada, August 19-21, 1969) EDRS PRICE EDRS Price MF-$0.50 HC-$5.85 DESCRIPTORS Agency Role, *American Indians, Communications, Community, *Conference Reports, Education, Educational Administration, *Federal Prpgrams, Health, Management, Program Planning, *Socioecouomic Status, *State Programs, Vocational Education ABSTRACT Governors of 30 states having significant Indian populations were invited to this conference to create better intergovernmental relations in Indian affairs. State involvement was stressed in formulating Federal policy and services, as was allowing the Indians to participate in planning programs affecting them. At the conference, officials from the Bureau of Indian affairs explained various successful and unsuccessful programs. Special reports on Indian Affairs in Arizona, Oklahoma, Nevada, and Minnesota were given, as well as individual reports from the other 26 states. A summary of the conferente is included along with complete conference proceedings and a list of all participants. (EL) 111 U.S. DEPARTMENT OF HEALTH, EDUCATION & WELFARE OFFICE OF EDUCATION CD THIS DOCUMENT HAS BEEN REPRODUCED EXACTLY AS RECEIVED FROM THE PERSON OR ORGANIZATION ORIGINATING IT. POINTS OF VIEW OR OPINIONS STATED DO NOT NECES Le ./ SA RILY REPRESENT OFFICIAL OFFICE OF EDU CATION POSITION OR POLICY FEDERAL-STATE INDIAN AFFAIRS CONFERENCE Sahara Tahoe Hotel, Lake Tahoe Stateline, Nevada August 19-21, 1969 National Council on Indian Opportunity Office of the Vice President Washington, D. C. 00 Vice Pkezident Spiro T.