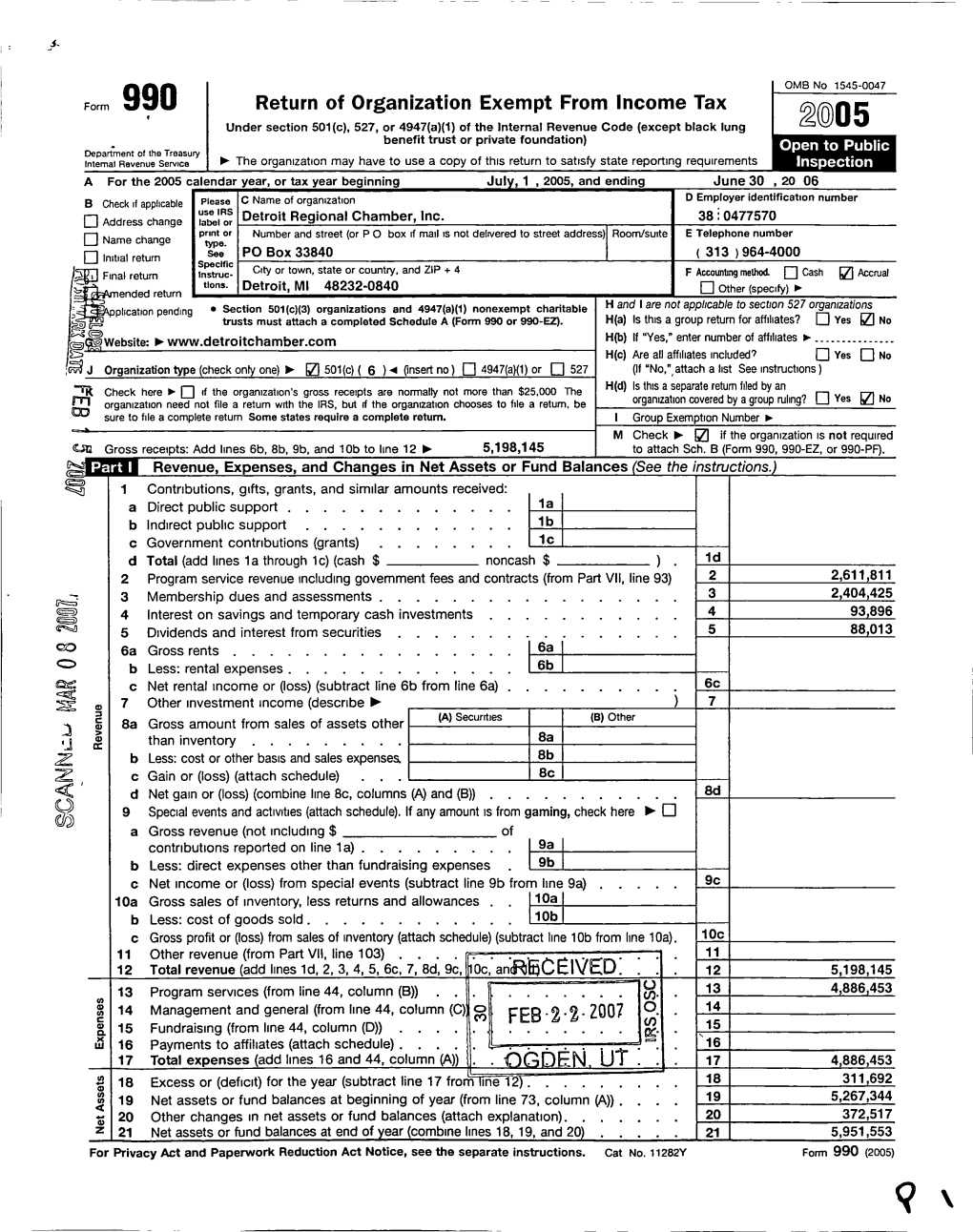

Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

8364 Licensed Charities As of 3/10/2020 MICS 24404 MICS 52720 T

8364 Licensed Charities as of 3/10/2020 MICS 24404 MICS 52720 T. Rowe Price Program for Charitable Giving, Inc. The David Sheldrick Wildlife Trust USA, Inc. 100 E. Pratt St 25283 Cabot Road, Ste. 101 Baltimore MD 21202 Laguna Hills CA 92653 Phone: (410)345-3457 Phone: (949)305-3785 Expiration Date: 10/31/2020 Expiration Date: 10/31/2020 MICS 52752 MICS 60851 1 For 2 Education Foundation 1 Michigan for the Global Majority 4337 E. Grand River, Ste. 198 1920 Scotten St. Howell MI 48843 Detroit MI 48209 Phone: (425)299-4484 Phone: (313)338-9397 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 46501 MICS 60769 1 Voice Can Help 10 Thousand Windows, Inc. 3290 Palm Aire Drive 348 N Canyons Pkwy Rochester Hills MI 48309 Livermore CA 94551 Phone: (248)703-3088 Phone: (571)263-2035 Expiration Date: 07/31/2021 Expiration Date: 03/31/2020 MICS 56240 MICS 10978 10/40 Connections, Inc. 100 Black Men of Greater Detroit, Inc 2120 Northgate Park Lane Suite 400 Attn: Donald Ferguson Chattanooga TN 37415 1432 Oakmont Ct. Phone: (423)468-4871 Lake Orion MI 48362 Expiration Date: 07/31/2020 Phone: (313)874-4811 Expiration Date: 07/31/2020 MICS 25388 MICS 43928 100 Club of Saginaw County 100 Women Strong, Inc. 5195 Hampton Place 2807 S. State Street Saginaw MI 48604 Saint Joseph MI 49085 Phone: (989)790-3900 Phone: (888)982-1400 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 58897 MICS 60079 1888 Message Study Committee, Inc. -

Detroit Business Certification Program (DBCP) Business Register (As of January 11, 2016)

Detroit Business Certification Program (DBCP) Business Register (as of January 11, 2016) Certification Certification Type Expire Date (1 yr from end date or prev. cert date use Business NIGP Name/Mailing Address of Business Contact Information DBB DHB DSB MBE WBE later date) Type Codes Goods & Services Offered Web Site Email address 1 Way Service, Inc. 4195 Central Street Chelsea Laginess Specialty 912 913 [email protected] Detroit, MI 48210 313-846-0550 DHB DSB 02/19/16 Construction 962 999 [email protected] 360water creates customized online Operation & Maintenance, 715 910 Asset Management, Safety, 913 918 Document Storage, training for 360 Water, Inc. 920 924 water, power, and private utlitities. 965 W. Third Avenue Laura Raish Professional 936 958 Our online training is certified for Columbus, OH 43212 614-294-3600 WBE 04/22/16 Service 968 license renewal purposes. www.360water.com [email protected] 3LK Construction, LLC 1401 Howard Street Lorenzo Walker General Detroit, MI 48216 313-962-8700 DHB DSB MBE 06/16/16 Construction 912 www.3LKconstruction.com [email protected] Providing towing & storage service for all types of vehicles, boats, SUVs, Motorcycles, tractor, trailers, light & Heavy duty for accidents, stolen recovers, aban vehicles & auction them for the 7-D's Towing & Storage Inc. 060 065 Detroit Police Department. Also 5700 E. Nevada Julie Semma-Lieberman 070 075 used cars and auto parts and Detroit, MI 48234 313-891-1640 DHB DSB 01/29/16 Retail, Service 560 928 repair vehicles. [email protected] 84 Lumber Company 540 630 Lumbar Yard, building supply 1019 Route 519 Bethany Cypher General 635 770 business, installed sales, roof Eighty Four, PA 15330 724-228-8820 WBE 11/04/16 Construction 445 450 truss manufacturing www.84Lumber.com [email protected] Page 1 of 38 Detroit Business Certification Program (DBCP) Business Register (as of January 11, 2016) Certification Certification Type Expire Date (1 yr from end date or prev. -

Detroit First Quarter 2003 A

NATIONAL REAL ESTATE INDEX M M ETRO Detroit ETRO Vol. 37 First Quarter 2003 M M ARKET ARKET Analyzes: Reports: CBD Office Property Prices Retail Property Rents Apartments Sector Forecasts Suburban Office Demographic Highlights Industrial Job Formation Trends Local Economy Economic Base Profile Educational Achievement F Tax Structure F Quality of Life Factors ACTS ACTS A publication of the National Real Estate Index PPR GlobalGlobal RealReal AnalyticsAnalytics Detroit Vol. 37 ✯ Report Format This report is organized as follows. Section I A series of other important factors, including provides a snapshot that highlights the key eco- retail sales trends and international trade, are nomic, demographic and real estate-related reported in Section VI. Local and state fiscal findings of the study. Sections II through IX policies, including taxes and federal spending, provide an in-depth look (generally in a tabular are highlighted in Section VII. Several key qual- format) at the key economic, demographic, ity-of-life considerations are summarized in public policy, and quality of life factors that can Section VIII. affect the demand for real estate. In Section IX, local market price, rent and capi- In Section II, recent population trends are talization rate trends for the preceding 12 months reported. Section III analyzes the local eco- are reported. Section X provides a quarterly nomic base and current labor force and job for- review, including analysis of the local economy, mation trends. Various educational costs and as well as analyses of the office, light industrial, parameters are provided in Section IV. Local liv- retail, apartment, and hospitality sectors. ing costs are explored in Section V. -

Commissioning Projects

FIRST DRAFT Peter Basso Associates Commissioning and Retro- Commissioning Projects This is a comprehensive listing of projects for which Peter Basso Associates has provided commissioning and retro-commissioning services, as of June 12, 2019. 150 West Jefferson LEED Interiors EA Pr1&EA Cr2 Bedrock Detroit Monroe Block A Initial Services Commissioning, Detroit, Michigan Commissioning, Detroit, Michigan 615 Griswold MEP DD 2016 Update Commissioning, Bedrock Detroit One Campus Martius Nexant/DTE Energy Detroit, Michigan Retro-Commissioning, Detroit, Michigan Adient CTU Bulding Renovation Commissioning, Bedrock Detroit Quicken Loans Data Center Additional Retro- Plymouth, Michigan Commissioning, Detroit, Michigan Affirmations Lesbian & Gay Community Center Bell Memorial Replacement Hospital Mechanical/Electrical Commissioning, Ferndale, Michigan Michigan Ascension Real Estate Facility Condition Assessment Systems Commissioning Manual Production, Ishpeming, Commissioning, Burton, Ohio Bloomfield Hills School District High School and Physical Plant Commissioning, Bloomfield Hills, Michigan Auto Owners Insurance Company South Carolina Regional Office Building Commissioning, Columbia, South Carolina Blue Cross Blue Shield of Michigan Lyon Meadows Conference Center Commissioning, New Hudson, Michigan Auto-Owner’s Insurance Company Branch Office Commissioning, Traverse City, Michigan Boll Family YMCA Nexant/DTE Energy Retro-Commissioning Lite, Detroit, Michigan Beaumont Health Beaumont Cancer & Breast Center- Farmington Hills Generator Commissioning, -

Downtown Detroit Self-Guided Walking Tour D N O C E S

DOWNTOWN This self-guided tour is a great intro to downtown! Be sure to join us on one of our public tours or contact DETROIT us to a create a customized experience that fits your schedule. DOWNTOWN DETROIT SELF-GUIDED WALKING TOUR SECOND C H E R R Y P L U M Midtown M O N T C A L M J N O E L I Z A B E T H H N GRAND RIVER AVE C P L U M C O L U M B I A L WOODWARD AVE C H U R C H O MICHIGAN AVE THIRD D TRUMBULL G E L I Z A B E T H E E L I Z A B E T H COMERICA PARK BRUSH FORD FIELD ADAMS TENTH B E E C H C L FORD FIELD I P SECOND F A Corktown F R F O F I R S T O K U R P L A Z A R A BEAUBIEN B A G L E Y T D V EIGHTH H E M BROOKLYN A R D 13 11 I S N O N 12 H O B A G L E Y J GRATIOT AVE L A B R O S S E RANDOLPH 12 BROADWAY M U L L E T MICHIGAN AVE 1 TIMES SQUARE 10 P O R T E R WASHINGTON BLVD E A V DETROIT EXPERIENCE C L I N T O N E R G R A N D R I V LIBRARY9 FACTORY Lafayette Park A B B O T T A B B O T T STATE S T A N T O I N E M A C O M B PA R K P L A C E GRISWOLD 11 2 F A H O W A R D WASHINGTON BLVD R M O N R O E 8 TENTH BROOKLYN 10 M 10 375 E R FIFTH TRUMBULL E LAFAYETTE W LAFAYETTE BLVD W LAFAYETTE BLVD SHELBY SIXTH EIGHT 1 BRUSH 3 C A S S AV E S F O R T E RANDOLPH WOODWARD AVE F O R T 9 F O R T T PEOPLE MOVER A (ELEVATED MONORAIL) B BEAUBIEN E C O N G R E S S E C O N G R E S S W C O N G R E S S W J E F F E R S O N A V E 4 2 E L A R N E D RIVARD 6 3 4 7 COBO CENTER E JEFFERSON AVE W JEFFERSON AVE 5 7 5 8 RivertownW O O D B R I D G E W O O D B R I D G E RIOPELLE JOE LOUIS ARENA S T A U B I N O R L E A N S F R A N K L I N D U B O I S C I V I C C E N T E R AT W AT E R RIVARD PLAZA Detroit River 6 AT W AT E R AT W AT E R MILLIKEN STATE PARK DETROIT RIVER People Mover Tour Stops MAP LEGEND DXF Welcome Center Stations DXF creates experiences that are enlightening, entertaining and led by Detroiters. -

5461 Filed 06/19/14 Entered 06/19/14 16:52:44 Page 1 of 30 the "Assumed Leases").2 in Support of This Motion, the City Respectfully Represents As Follows

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION -----------------------------------------------------x : In re : Chapter 9 : CITY OF DETROIT, MICHIGAN, : Case No. 13-53846 : Debtor. : Hon. Steven W. Rhodes : -----------------------------------------------------x MOTION OF THE CITY OF DETROIT, PURSUANT TO SECTION 365 OF THE BANKRUPTCY CODE, FOR AN ORDER AUTHORIZING THE CITY TO ASSUME CERTAIN UNEXPIRED LEASES OF NONRESIDENTIAL REAL PROPERTY The City of Detroit, Michigan (the "City") hereby files this motion ("Motion"), pursuant to section 365 of title 11 of the United States Code (the "Bankruptcy Code"), for the entry of an order1 authorizing the City to assume certain of its unexpired leases of nonresidential real property (such leases, including all exhibits, amendments, supplements or modifications thereto, 1 This Motion includes certain attachments that are labeled in accordance with Rule 9014-1(b)(1) of the Local Rules of the Bankruptcy Court for the Eastern District of Michigan (the "Local Rules"). Consistent with Local Rule 9014-1(b), a copy of the proposed form of order granting this Motion is attached hereto as Exhibit 1 (the "Proposed Order"). A summary identifying each included attachment by exhibit number is appended to this Motion. CHI-1933539v1 13-53846-swr Doc 5461 Filed 06/19/14 Entered 06/19/14 16:52:44 Page 1 of 30 the "Assumed Leases").2 In support of this Motion, the City respectfully represents as follows: Jurisdiction 1. This Court has jurisdiction over this Motion pursuant to 28 U.S.C. § 1334. This is a core proceeding pursuant to 28 U.S.C. § 157(b). Venue is proper before this Court pursuant to 28 U.S.C. -

150 West Jefferson | Stacking Plan

150Detroit, MichiganWest Jefferson Magnificent, Class A Office Building with Spectacular Skyline and Waterfront Views Office and Retail Space Available in the Financial District’s Premier Location • 2,961 SF – 62,574 SF office space available • 1,679 SF ground level retail space available • 3,152 SF restaurant location available on ground floor with liquor license available • Outstanding location with views of the city, the waterfront, and the city of Windsor • Home to the Financial District People Mover stop • 500,000 SF Class A landmark building • Outstanding amenities and services include a fitness center, beautiful outdoor patio with putting green, restaurants, carry-out deli, ATM, dry cleaning services, and 24-hour security • 526 space parking garage offering valet and self- park services • Convenient access to Campus Martius, Renaissance Center, COBO Center, and the Congress Station stop of the Q-Line • Energy Star certified • Managed by REDICO For more information, please contact: Garrett Keais Jarrod Champine Mike Spisak 27777 Franklin Road, Suite 1050 Managing Principal Senior Associate Associate Southfield, MI 48034 +1 248 358 6112 +1 248 358 6111 +1 248 358 6116 +1 248 358 6100 [email protected] [email protected] [email protected] cushmanwakefield.com Cushman & Wakefield Copyright 2018. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by the property owner(s). As applicable, we make no representation as to the condition of the property (or properties) in question. -

Taxation Section: Michigan Tax Lawyer Fall 1996

r Volume XXII, Issue 4 Fourth Quarter 1996 TABLE OF CONTENTS CHAIRPERSON'S LETTER TO TAXATION SECTION MEMBERS 2 REPORTS FROM THE COMMITTEES Corporation Committee 5 Employee Benefits Committee 6 Estates & Trusts Committee 6 International Tax Law Committee 7 Partnership Committee 7 Practice & Procedure Committee 8 State & Local Committee 9 FEATURE ARTICLES Pension Simplification - Really! A Summary of Selected Pension Related Provisions in the Small Business Job Protection Act of 1996 By: David B. Walters 11 1996 Legislative Improvements for S Corporations By: Dean A. Rocheleau, J.D., C.P.A. 17 STATE AND LOCAL TAX UPDATE Recent Cases 22 SHORT SUBJECTS Taypayer Bill of Rights 2 24 By: James H. Novis MICHIGAN TAX LAWYER ~' ( I The Michigan Tax Lawyer is a quarterly publication of the Taxation Section of the State Bar of Michigan that is designed to be a practical and useful resource for the tax practitioner. Features include concise reports in a uniform format from the Section's committees, practitioner articles with the ''how to" approach, news of events and of other Section members, and "Short Subjects" providing helpful practice information. Input from members of the Taxation Section is most welcome. Our publication is aimed toward involving you in Section activities and assisting you in your practice. If you have suggestions or an article you wish to have considered for publication, please contact Eric T. Weiss, Esq., 27777 Franklin Road, Suite 1400, Southfield, Michigan 48034 (810) 355-5000. ERIC T. WEISS Editor Publication Committee EDWARD M. DERON ::;I State Bar of Michigan Taxation Section Council STEPHEN M. FELDMAN GEORGE W. -

LID - Left NONE CDB.Qxp 10/13/2014 4:16 PM Page 1 CDB Living in the D New CD Magazine Sized 10/6/2014 3:18 PM Page 1

LID - Left _NONE CDB.qxp 10/13/2014 4:16 PM Page 1 CDB Living In The D_New CD Magazine sized 10/6/2014 3:18 PM Page 1 Let’s do this together... We couldn’t be more excited about The District Detroit, a project that engages the entire city, has a far reaching impact for our community, its people, workers and businesses from every corner of the state. We can, and we are, changing the conversation about Detroit. It’s an incredible comeback story in the making. Learn more at DistrictDetroit.com 20141020-SUPP--0001-NAT-CCI-CD_-- 10/15/2014 5:12 PM Page 1 FALL 2014 Page 1 FALL 2006 doing business in our bilities and future of Detroit.” Publisher’s note state. The research is clear: Billionaire/philanthropist Eli Broad spoke Metro areas with strong on the opening night about opportunities in ake no mistake, there is a big bet on core cities do better eco- Detroit and how improving education was key. Detroit. nomically than those that Nicole Curtis, host of “Rehab Addict” on ca- M In this special annual Detroit-fo- don’t. Everybody has a ble TV, announced she would focus the sixth cused supplement, we outline just a few: stake in Detroit’s financial season of her popular show on homes in De- ■ Gov. Rick Snyder bet his political capi- well-being. troit. tal that bankruptcy was Detroit’s best path But to become truly sus- Or this from a top executive in the head- to a sustainable future. tainable, Detroit needs investments to create hunting world: “It felt good to be back in ■ Mayor Mike Duggan, a Democrat, jobs for lower-income — and lower-skilled — Detroit and welcomed by the city that raised took a calculated risk that working with Detroiters, and better schools to attract and me,” wrote Billy Dexter, a Chadsey High Snyder’s Republican team and Emergency keep residents. -

City of Detroit Bankruptcy Plan of Adjustment

THE BANKRUPTCY COURT HAS NOT APPROVED THE PROPOSED DISCLOSURE STATEMENT TO ACCOMPANY THIS PLAN. THE DISTRIBUTION OF THIS PLAN AND THE DISCLOSURE STATEMENT IS NOT INTENDED TO BE, AND SHOULD NOT BE CONSTRUED AS, A SOLICITATION OF VOTES ON THIS PLAN. THE CITY OF DETROIT, MICHIGAN RESERVES THE RIGHT TO MODIFY, AMEND, SUPPLEMENT, RESTATE OR WITHDRAW THIS PLAN, THE DISCLOSURE STATEMENT AND ALL ANCILLARY DOCUMENTS AT ANY TIME. UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN ------------------------------------------------------------ x : In re : Chapter 9 : CITY OF DETROIT, MICHIGAN, : Case No. 13-53846 : Debtor. : Hon. Steven W. Rhodes : : ------------------------------------------------------------ x PLAN FOR THE ADJUSTMENT OF DEBTS OF THE CITY OF DETROIT (February 21, 2014) DAVID G. HEIMAN BRUCE BENNETT JONATHAN S. GREEN HEATHER LENNOX JONES DAY STEPHEN S. LAPLANTE THOMAS A. WILSON 555 South Flower Street MILLER, CANFIELD, JONES DAY Fiftieth Floor PADDOCK AND STONE, P.L.C. North Point Los Angeles, California 90071 150 West Jefferson 901 Lakeside Avenue Telephone: (213) 489-3939 Suite 2500 Cleveland, Ohio 44114 Facsimile: (213) 243-2539 Detroit, Michigan 48226 Telephone: (216) 586-3939 [email protected] Telephone: (313) 963-6420 Facsimile: (216) 579-0212 Facsimile: (313) 496-7500 [email protected] [email protected] [email protected] [email protected] ATTORNEYS FOR THE DEBTOR 13-53846-swr Doc 2708 Filed 02/21/14 Entered 02/21/14 10:55:20 Page 1 of 120 TABLE OF CONTENTS ARTICLE I DEFINED TERMS, RULES OF INTERPRETATION AND COMPUTATION OF TIME .................. 1 A. Defined Terms. ............................................................................................................................... 1 B. Rules of Interpretation and Computation of Time. ....................................................................... 21 1. Rules of Interpretation. ................................................................................................... 21 2. -

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT of MICHIGAN SOUTHERN DIVISION in Re CITY of DETROIT, MICHIGAN Debtor. Chapter 9

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re Chapter 9 CITY OF DETROIT, MICHIGAN Case No. 13-53846 Debtor. CERTIFICATE OF SERVICE I, William W. Kannel, do hereby certify that on the 2nd day of August 2013, I caused a copy of the Verified Statement of Mintz Levin Cohn Ferris Glovsky and Popeo, PC and Andrew J. Gerdes, P.L.C. Pursuant to Federal Rule of Bankruptcy Procedure 2019(a), to be served upon the parties at their respective addresses set forth on Exhibit A hereto through the Court’s ECF system, and that copies will be sent electronically to registered participants as identified on the Notice of Electronic Filing (NEF) and paper copies will be sent to those indicated as non- registered participants as of the date herein. Dated: August 2, 2013 /s/ William W. Kannel William W. Kannel, Esq. 1 13-53846-swr Doc 272-1 Filed 08/02/13 Entered 08/02/13 15:01:57 Page 1 of 9 Exhibit A AFSCME Council #25 AFSCME Council #25 Attn: Albert Garrett Attn: Ed McNeil 1034 N. Washington 600 W. Lafayette, Ste. 500 Lansing, MI 48906 Detroit, MI 48226 AFSCME Council #25 AFSCME Council #25 AFSCME Local # 6087 Attn: Catherine Phillips Attn: DeAngelo Malcolm Attn: Clarence Sanders 600 W. Lafayette, Ste. 500 600 W. Lafayette, Ste. 500 2633 Michigan Avenue Detroit, MI 48226 Detroit, MI 48226 Detroit, MI 48216 AFSCME Local #0023 AFSCME Local #0062 AFSCME Local #0207 Attn: Robert Stokes Attn: Lacydia Moore-Reese Attn: James Williams 600 W. Lafayette, Ste. 134 600 W. -

Bedrock Detroit Acquisitions Maps 2017 February

W. Grand River Ave. W. Elizabeth St. THETHE LITTLELITTLE CAESARSCAESARS COMERICACOMERICA FORDFORD DISTRICTDISTRICT ARENAARENA PARKPARK FIELDFIELD DETROIT Brush St. FEBRUARY 1,2017 N P E. Adams Ave. Beech St. a . r t BEDROCK DETROIT REAL ESTATE PORTFOLIO k S A BY ACQUISITION DATE l v GRANDGRAND CIRCUSCIRCUS l e e 1 Madison Building . r 2 Two Detroit Center Garage PARKPARK e th 3 Chase Tower MGMMGM GRANDGRAND i W 4 Chrysler House CASINOCASINO Plaza Dr. 5 Financial District Garage Beacon St. 8181 6 First National Building DTEDTE ENERGYENERGY HQHQ 7 Madison Surface Lot 3rd St. 8 1500 Woodward 9 1520 Woodward 11 Michigan Ave. 1st St. 10 1528 Woodward 11 1550 Woodward Bagley Ave. 1111 Clifford St. 77 12 Federal Reserve Building Madison St. 13 1521 Broadway 8383 1010 Centre St. 14-15 1000 Farmer & 815 Bates 1313 16 One Woodward Avenue 82 99 82 John R St. 17 1412 Woodward 28 18 The Z 28 88 Farmer St. 19 1301 Broadway PARADISEPARADISE Washington Blvd. E. Grand River Ave. 20 1201 Woodward 8787 4646 4949 VALLEYVALLEY 21 1217 Woodward 77-8077-80 GRATIOTGRATIOT 22 Vinton Building 59 23 1001 Woodward 59 66-6966-69 DEVELOPMENTDEVELOPMENT Cass Ave. 45 Times Square 45 24 1001 Woodward Garage 4444 SITESITE Griswold St. Gratiot Ave. 25 620 Woodward DETROITDETROIT PUBLICPUBLIC 6060 8484 26 630 Woodward AT&TAT&T 3838 1717 SAFETY HQ Broadway St. 27 1238 Randolph SAFETY HQ MICHIGANMICHIGAN HQHQ 3232 28 1505 Woodward 2929 5454 29 1265 Griswold 6161 Library St. 37375757 Clinton St. 30 1215 Griswold 1818 31 1401 Rosa Parks Not pictured on map 7676 62-65 St.