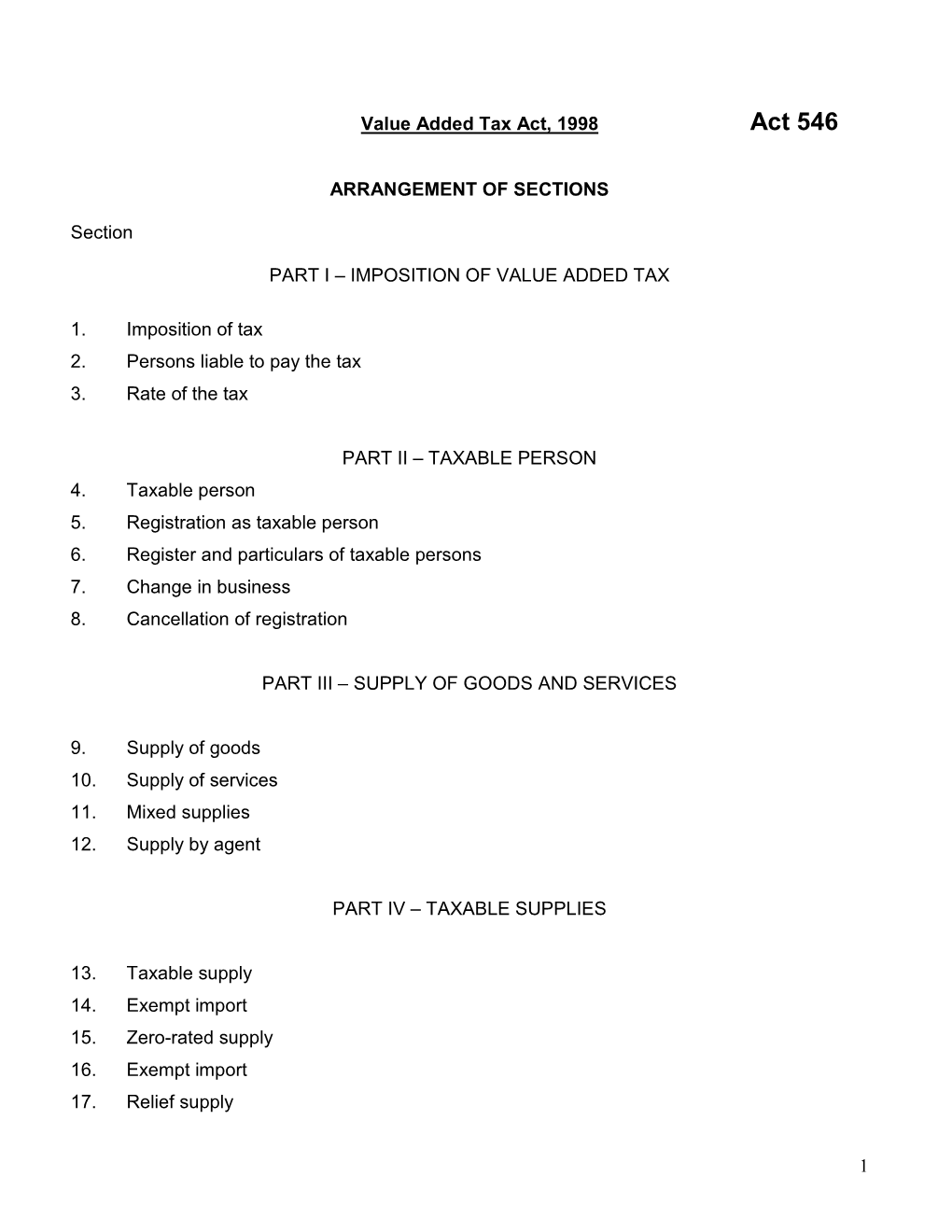

Value Added Tax Act, 1998 Act 546

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ghana Immigration Service Legal Handbook

Ghana Immigration Service Legal Handbook August 2016 Project Funded by the European Union Table of Contents FOREWORD .................................................................................................. 3 ACKNOWLEDGEMENTS ............................................................................ 5 INTRODUCTION .......................................................................................... 6 PART 1: IMMIGRATION RELATED LAWS .............................................. 8 1992 CONSTITUTION OF THE REPUBLIC OF GHANA ................. 9 L.I. 856 ALIENS (REGISTRATION) REGULATIONS, 1974 .......... 23 CITIZENSHIP ACT, 2000 (ACT 591) ................................................ 34 CITIZENSHIP REGULATIONS, 2001 (LI 1690) .............................. 47 IMMIGRATION ACT, 2000 (ACT 573) ............................................ 53 IMMIGRATION REGULATIONS, 2001 (LI 1691) ........................... 89 IMMIGRATION SERVICE ACT, 2016 ........................................... 102 PART 2: SECURITY RELATED LAWS .................................................. 138 ANTI-TERRORISM ACT, 2008 (ACT 762)..................................... 138 ANTI-TERRORISM REGULATIONS, 2012 (LI 2181) ................... 170 CRIMINAL AND OTHER OFFENCES (PROCEDURE) ACT, 1960 (ACT 30) ............................................................................................ 205 SECURITY AND INTELLIGENCE AGENCIES ACT, 1996 (ACT 526) .................................................................................................... 223 PART -

The International Journal of Humanities & Social Studies

THE INTERNATIONAL JOURNAL OF HUMANITIES & SOCIAL STUDIES ISSN 2321 - 9203 www.theijhss.com THE INTERNATIONAL JOURNAL OF HUMANITIES & SOCIAL STUDIES Trend in Revenue Performance before and After Integration of Ghana Revenue Authority (GRA): The Case of Wa Municipality, Ghana Mariama Suleman Student, School of Business, University for Development Studies, Ghana Abstract: This paper examined the integration of Internal Revenue service, Value Added Tax Service and Custom Excise and Preventive Service into Ghana Revenue Authority and its impact on revenue Mobilization in the Wa municipality. Using a cross sectional study, both secondary and primary data were sourced for this survey. The primary data was gathered through structured questionnaires from 30staff of Ghana Revenue Authority, Wa office. Whereas the secondary data was sourced from the archives of Ghana revenue authority from 2007 to 2014 (the periods before and after the integration). This paper found that the integration of Internal Revenue Service, Value Added Tax Service and Customs Excise and Preventive Service into Ghana Revenue Authority has have significant impacts on revenue mobilization in the Wa Municipality. Such that, the authority has seen considerable increases in the revenue mobilization since the integration. Keywords: Revenue performance, tax reforms, revenue mobilization, Ghana revenue authority 1. Background to the Study As part of the tax administration reforms in Ghana, the Ghana Revenue Authority (GRA) was established to ensure the efficient and effective administration of taxes by providing a holistic approach to tax and customs administration and among other things reduce administrative and tax compliance costs (Armah-Attoh & Awal, 2013; Bekoe, Danquah & Senahey, 2016). An efficient and effective revenue collection system is an important tool for local and national governments towards ensuring the success of revenue mobilization to meet developmental projects and economic objectives (Fjeldstad and Heggstad, 2012; Bird 2010; Martinez-Vázques and Smoke 2010). -

Regulatory Bodies

Newsletter Edition 6 | September 2019 INTEGRATED LEGAL CONSULTANTS FOREIGN INVESTORS- REGULATORY BODIES 1 Editor’s Note Integrated Legal Consultants (ILC) was founded in April 2007, in Accra, Ghana, to offer dedicated and innovative corporate legal services while ensuring that the Ghanaian and West African business community and our network of international clients benefit from the highest quality of corporate and commercial legal services that the Practice provides. As part of this vision, our Practice has introduced the publication of newsletters on legal and economic issues that would be of interest to its clients and equally affect their transactions. This is our sixth edition. Regulation of business entities is a key factor to be considered by a potential investor in Ghana. It is important that they are aware of the four (4) main regulatory bodies that guide the activities of companies in Ghana to ensure they remain complaint. In this issue, we have highlighted the four (4) main regulatory bodies that foreign investors should be mindful of while doing or intending to carry on business in Ghana. The issue also highlights the registration requirements and some of the documents required for registering with each of these regulatory bodies in Ghana. We hope you find it informative and educative. Your feedback is welcome. Esohe Olajide Editor Olusola Ogundimu Editor-In-Chief 2 INTEGRATED LEGAL CONSULTANTS FOUR MAIN REGULATORY BODIES A FOREIGN • Availability of proposed Business Name INVESTOR WISHING TO SET UP IN GHANA NEED KNOW • Capital Requirement • Directorship and secretary Doing business globally can be challenging, especially for • Auditors foreign investors who are strangers to the navigations of the • Shareholders business terrain of a new jurisdiction. -

Tax Reform Study in Ghana's Tax System

TAX REFORM STUDY IN GHANA’S TAX SYSTEM GEORGE K. ADEYIGA AUGUST, 2013 1 Content page 1.0. Introduction 1.1. Background. ……………………………………………………………………................ 1 1.2. Context: Mobilising Enough Domestic (Tax) Revenue……………………………… 2 2.0. OBJECTIVES OF TAX REFORM AND PROGRESSIVE TAXATION PRACTICES TO ACCELERATE ECONOMIC GROWTH IN AFRICA 2.1. Objectives of tax reform. ……………………………………………………………... 4 2.1.1. Economic Growth / Development. …………………………………………………….. 4 2.1.2. Tax Policy and Growth ………………………………………………………………… 4 2.1.2.1. Greater use of Resources ………………………………………………………………. 4 2.1.2.2. Needed Rate of Capital Formation. …………………………………………………… 5 2.1.2.3. Public Sector Investment ………………………………………………………………. 5 2.1.2.4. Compatible Revenue Structure. ………………………………………………………... 6 2.1.3. Maintenance of Economic Stability. …………………………………………………... 7 2.1.3.1. Internal Stability. ……………………………………………………………………….. 7 2.1.3.2. External Stability.………………………………………………………………………… 9 2.1.4. Distribution of Income. ………………………………………………………………….. 10 2.1.4.1. Location Distribution. …………………………………………………………………… 11 2.2. Tax Reform and the African Economies …………………………………………......... 11 2.2.1. African Countries per Capita Constraints …………………………………………… 11 2.2.2. Brighter Future Prospects for Growth…………………………………………………. 13 2.2.3. Influences on Economic Growth ……………………………………………………….. 14 2.2.4. Common Problems with African Tax Systems………………………………………… 16 2.2.4.1. The Heavy Tax Burden…………………………………………………………………. 16 2.2.4.2. The GDP Indicator……………………………………………………………………… 17 2.2.4.3. Excessive High Tax Rates………………………………………………………………. 18 2.2.4.4. Revenue Structure………………………………………………………………………. 21 2.4.4.5. Administrative Problems……………………………………………………………….. 21 3.0 TAX REFORM IN GHANA 3.1. Colonial Rule Independence and Economic Decline……………………………………….. 23 3.1.1 Colonial Foundation (1920s to Independence)………………………………………………23 2 3.1.1.1 Incipient Colonial Taxation ………………………………………………………………….24 3.1.1 Independent Ghana (1957 – 1966 ………………………………………………………. -

Tax Culture: Perspectives from an African State

Law Review ISSN 2313-4747 (Print); ISSN 2313-4755 (Online) Tax Culture: Perspectives from an African State Raymond A. Atuguba Dean and Associate Professor, School of Law, University of Ghana, GHANA E-mail for correspondence: [email protected] *E-mail for correspondence: [email protected] Received: Jun 12, 2017; Accepted: Jun 27, 2017; Published: Feb 20, 2017 ABSTRACT Universally, Tax Culture is not a very common topic but it is critical to administrative governance and economic development. This article argues that the Tax Culture of any milieu is an assemblage of various indices and criteria. These include: the history of taxation; tax laws; tax information; tax education; tax revenue mobilisation; tax system transparency; tax delinquency; tax dispute resolution; and taxpayer satisfaction. The article sheds light on these instrumental wheels of the Tax Culture of Ghana by providing the research results of field surveys conducted a decade and a half ago. Though dated, any observer of the Tax Culture of Ghana, and indeed of much of Africa and the Global South, will realise that little has since changed. In some instances, the article provides more up-to-date evidence beyond the 2005 data. The article goes beyond an assessment of the Tax Culture of Ghana and articulates recommendations for improving the same. Additionally, it attempts to interconnect issues of Taxation, Good Governance and Legal Pluralism. Although popular themes in public discourse in Africa today, these concepts are often spoken of in different thematic spheres other than taxation. The article links these themes in practical and concrete ways to taxation, cast in the light of historical institutionalism – an examination of the institutions of taxation, governance and traditional authority as they interacted through time. -

Value Added Tax Administration in the Construction Industry in Ghana

Value Added Tax Administration In The Construction Industry In Ghana Dadson Awunyo-Vitor Department of Agricultural Economics and Agribusiness, Kwame Nkru- mah University of Science and Technology, Ghana Address for correspondence:- [email protected] Journal of Finance and Management in Public Services. Volume 14. Number 2 Abstract The objective of the study is to assess the level of awareness of contractors and consultants within the construction industry about Value Added Tax (VAT) and challenges of its admin- istration or implementations within the industry. Data was collected from 52 contractors and 8 consultants in Brong Ahafo Region of Ghana using questionnaires. Descriptive statis- tics were used to analyse the data. The study revealed that a large proportion (75%) of the respondents were aware of the need to register and charge Value Added Tax as a result of sensitisation workshops organised by Ghana Revenue Authority in the region. The consult- ants perceive the implementation of the Value Added Tax as important in national develop- ment, however, they see the registration process as cumbersome. Contractors also had a good perception about Value Added Tax implementation within the construction industry but believed that they need more education about the modalities of registration and pay- ment. The study further revealed that the state lost GH¢ 8,053,407.52 ($5,033,379.70) in the 2012 fiscal year due to non-compliance with Value Added Tax by contractors and consult- ants in the region. In order to improve the implementation of Value Added Tax within the construction industry Ghana Revenue Authority must intensify education of contractors on modalities of registration and payment. -

Agclir Ghana September 2017

Feed the Future Enabling Environment for Food Security AgCLIR Ghana September 2017 Agribusiness Commercial, Legal, and Institutional Reform (AgCLIR) – Ghana CONTENTS List of Acronyms ............................................................................................................................ i Executive Summary ...................................................................................................................... 1 Ghana’s Agricultural Enabling Environment ............................................................................................................ 1 Table of Recommendations ......................................................................................................... 5 Introduction ................................................................................................................................... 8 Methodology .................................................................................................................................................................. 8 Country Context: Agriculture in Ghana ............................................................................................................... 10 Starting a Business ...................................................................................................................... 13 Legal Framework ......................................................................................................................................................... 14 Implementing Institutions ......................................................................................................................................... -

Cost Sharing and Equity in Higher Education: Experiences of Selected Ghanaian

Cost Sharing and Equity in Higher Education: Experiences of Selected Ghanaian Students A dissertation presented to the faculty of the College of Education of Ohio University In partial fulfillment of the requirements for the degree Doctor of Philosophy Dominic S. Dadzie June 2009 © 2009 Dominic S.Dadzie. All Rights Reserved. 2 This dissertation titled Cost Sharing and Equity in Higher Education: Experiences of Selected Ghanaian Students by DOMINIC S.DADZIE has been approved for the Department of Educational Studies and the College of Education by Francis E. Godwyll Assistant Professor of Educational Studies Renée A. Middleton Dean, College of Education 3 ABSTRACT DADZIE, DOMINIC S., Ph.D., June 2009, Curriculum and Instruction, Cultural Studies Cost Sharing and Equity in Higher Education: Experiences of Selected Ghanaian Students (291 pp.) Director of Dissertation: Francis E.Godwyll This phenomenological research study examined sources available to students for funding education and the experiences of students in public higher education in relation to cost sharing as an educational policy for funding tertiary education in six Ghanaian public universities. The research examines students’ use of social networks in social capital formation to meet challenges of cost sharing. The economic value of social networks within the family, the extended family, the community, and the government in social capital formation to pay for higher education were examined. The study adopted a qualitative methodology using structured, semi-structured, and open-ended in-depth interviews to collect data from 44 students from the six public universities and three administrators. Document sources from the universities, Ministry of Education, GET Fund, and the Ministry of Finance and Economic Planning were also analyzed. -

Taxcompliancethroughed

GSJ: Volume 7, Issue 10, October 2019 ISSN 2320-9186 202 GSJ: Volume 7, Issue 10, October 2019, Online: ISSN 2320-9186 www.globalscientificjournal.com TAX COMPLIANCE THROUGH EDUCATION TO SME’S *APPIAH KUSI, SULEMAN YUSSIF+, AND ALHASSAN ISMAIL# *LECTURER, WA POLYTECHNIC, WA, GHANA +LECTURER, WA POLYTECHNIC, WA, GHANA #ASSISTANT REGISTRAR, WA POLYTECHNIC, WA, GHANA ABSTRACT Tax compliance refers to the degree to which a tax payer complies (or fails to comply) with tax rules to the country for instance by declaring income, filing a return and paying the tax due in a timely manner. The main objective of this research was to educate (SME‘s) on the need to comply with tax payment in the Wa municipality. The survey research method was used for the research. It was used to collect data on the phenomenon with the purpose of employing the data to make more relevant recommendation to improve and enhance the current condition and practice. The study recorded a high rate of tax evasion, this tax non-compliance by SME‘s do not receive any punishment as tax laws stipulated. The results of the study suggested that tax knowledge has a positive correlation with tax compliance. The study found that Ghanaian tax payer knows that taxes are the major sources of government revenue as well as the funding of public expenditures; they also have a perception that taxes paid to the government are not used for their intended purposes. The study have concluded based on the evidence that general tax knowledge has a very close relationship with taxpayers‘ ability to understand the laws and regulations of taxation, and their ability to comply with them. -

Ghana Country Correspondent Mr Yaw Opoku

Ghana Country Correspondent Mr Yaw Opoku Integration of Revenue Agencies In Ghana In the last decade one significant thing which has happened in some Tax Administrations of CATA member countries is the integration of Revenue Agencies. Ghana joined the band wagon on the 31st of December, 2009 when the current President H.E. Prof. John Evans Atta Mills (a former Commissioner of the erstwhile Internal Revenue Service) gave his assent to an Act of Parliament (Act 791) to pave the way for the Integration of the three (3) main Revenue Agencies, namely The Internal Revenue Service, The Customs Excise and Preventive Service and the VAT Service. As a member of CATA we deem it necessary to share with you some highlights of the integration process for the benefit of countries who are already on the roadmap of Integration or about to enter the Road. This compilation is credited to the Ghana Revenue Authority (GRA) Integration Project Management Team and the GRA News letter. Historical Background. In 1986, Customs, Excise and Preventive (CEPS) and Internal Revenue Service (IRS) were taken out of the Civil Service and made semi-autonomous self-Accounting Public Sector Institutions with separate Boards to govern them. An Institution called the National Revenue Secretariat was also set up in 1986 by the Government to formulate Revenue Policies and to manage Tax reforms as well as supervise and co-ordinate the activities of IRS and CEPS. The NRS had no legal backing and therefore was made a department under the Ministry of Finance after some few years of its existence. -

''Effects of Changes in the Rates of Value Added Tax On

‘’EFFECTS OF CHANGES IN THE RATES OF VALUE ADDED TAX ON VAT REVENUE IN GHANA FROM 2003 TO 2010’’ By Dominic Adamnor Nartey (B.A. Hons Economics) A Thesis submitted to the Institute of Distance Learning, Kwame Nkrumah University of Science and Technology in partial fulfilment of the requirements for the degree of Commonwealth Executive Masters In Business Administration (CEMBA) July 2011 DECLARATION I hereby declare that this submission is my own work towards the MBA and that to the best of my knowledge , it contain no material previously published by another person or material which has been accepted for the award of any other degree of the University, except where due acknowledgement has been made in the text. Nartey Adamnor Dominic .Signature..................... Date....................... (PG 3075309) Certified by : Anthony Kwabla Dekagbe Signature .................... Date...................... Certified by: Prof. I.K. Dontwi Signature..................... Date......................... Dean, IDL ii DEDICATION I dedicate this thesis to my dear wife, Abigail Adwoa Nartey, whose prayers, love, endurance and encouragement inspired me throughout my study. She took care of the children when I was always away on weekends. Also to my two sons Ariel Adamtey Nartey and Julian Adamnor Nartey for enduring my absence on weekends and in the evenings when I was always away from home. iii ABSTRACT One of the critical activities of any government is the raising of revenue to achieve fiscal policy objectives of matching expenditure to the revenue and reducing budget deficit. Most of these revenues are raised through taxes. The most viable of which is indirect tax which include VAT. The Value Added Tax was introduced in March 1995, but had to be withdrawn barely after three months of operations as a result of public outcry against the tax. -

A GLOBAL / COUNTRY STUDY and REPORT on ―GHANA‖ Submitted to Gujarat Technological University in PARTIAL FULFILLMENT of the R

A GLOBAL / COUNTRY STUDY AND REPORT ON ―GHANA‖ Submitted to Gujarat Technological University IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF BUSINESS ADMINISTRATION UNDER THE GUIDANCE OF Dr. Manish Vyas (The Director- Indu Management Institute) Submitted by (Hiren Shroff, Meha Desai, Rahul Kothari, Arun Mali, Usha Chaudhary & Komal Joshi) [Enrolment no: 117190592001-117190592006] [Batch: 2011-13] MBA SEMESTER III/IV 1 INDU MANAGEMENT INSTITUTE MBA PROGRAMME Affiliated To Gujarat Technological University, Ahmedabad. 2011-2013 STUDENTS’ DECLARATION We, Hiren Shroff, Meha Desai, Rahul Kothari, Arun Mali, Usha Chaudhary and Komal Joshi hereby declare that the report for Global/ Country Study Report entitled “GHANA” of country Ghana is a result of our own work and our indebtedness to other work publications, references, if any, have been duly acknowledged. Place: Vadodara Signature: Date: Hiren Shroff: Meha Desai: Rahul Kothari: Arun Mali: Usha Chaudhary: Komal Joshi: 2 INSTITUTE’S CERTIFICATE ―Certified that this Global /Country Study and Report Titled “GHANA” is the bonafide work of Hiren Shroff, Meha Desai, Rahul, Arun Mali, Usha and Komal (Enrolments No.: 117190592001-117190592006), who carried out the research under my supervisions. I also certify that to the best of my knowledge, the work done here is not a part of any other project report on the basis of which any degree or award was declared to these or any other students.‖ Signature of the Faculty Guide (Dr. Manish Vyas) (The Director- Indu Managemet Institute) (Certificate is to be signed by the Director Of The Institute) 3 PREFACE The Global /Country Study and Report is an integral part of the MBA programmed study and it is designed in such a way that students can get maximum knowledge, experience and can get practical as well as theoretical exposure to the corporate and the global world and scenarios.