DENNY's CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Restaurant Instagram Report Q2 2013

MomentFeed Index: Restaurant Instagram Report Q2 2013 MomentFeed Index: Restaurant Instagram Report, Q2 2013 MomentFeed.com Overview Instagram has quickly become one of the most popular social tools for consumers. With 130 For restaurant brands specifically, the visual storytelling that Instagram enables represents a million monthly active users taking 45 million photos per day as of August 2013, the “fast, tremendous opportunity in 2013 and beyond as customers capture their experiences in real beautiful and fun way to share your life with friends through a series of pictures” has created a time and share them with the world through the Instagram app. Several restaurants are off to a way for anyone to create visual content about their experiences and share their moments. great start, and this report takes a closer look at these brands. For brands, Instagram represents a new marketing channel in a number of ways. In addition Based on data captured by the MomentFeed marketing platform for 65 top restaurant brands, to taking photos themselves, brands can leverage content created by customers and fans the report breaks down Instagram performance in terms of total number of photos, average by, for example, sharing customer photos across other channels such as Facebook to reach number of photos per location, and photos as a percentage of check-ins. The report only additional fans. The comment feature also enables direct communication with customers. counts Instagram photos that have been explicitly place-tagged to a restaurant’s location between April 1 and June 30, 2012. MomentFeed Index: Restaurant Instagram Report, Q2 2013 MomentFeed.com Total Number of Instagram Photos 1. -

Chipotle Mexican Grill: Leavening Panera Bread's Sales? Downloaded from by IP Address 192.168.160.10 on 06/27/202

MORE INSIGHTS. MORE OFTEN. BETTER RETURNS. Richard Church [email protected] (203) 307-2581 Chipotle Mexican Grill: Leavening Panera Bread’s Sales? April 29th, 2016 DISCERN platform reveals: • Over 80% overlap between Chipotle and Panera in all regions within a 5-mile trade area • Other potential dining alternative beneficiaries from Chipotle challenges Chipotle Mexican Grill’s recent issues with food contamination and the resultant heavy losses of customers are widely known and do not appear to have ended judging by its first quarter earnings release. In its April 26 release Chipotle reported another significant decline in its same-store sales of 29.7%. Conversely, Panera reported a 6.2% increase for the same fiscal period. Key Takeaway As Chart 1 illustrates there appears to be a meaningful correlation between the trend of Chipotle’s same-store sales and Panera’s as Chipotle’s food contamination issues surfaced. This would largely be attributable to the high competition intensity between the chains as the illustrations below show. Chart 1. Chipotle & Panera Bread Comp-Store Sales Spread 30% 20% 10% CMG 0% PNRA -10% Spread -20% -30% 1Q15 2Q15 3Q15 4Q15 1Q16 Downloaded from www.hvst.com by IP address 192.168.160.10 on 09/26/2021 MORE INSIGHTS. MORE OFTEN. BETTER RETURNS. Illustration 1, which is from DISCERN’s database of retailer and restaurant locations, quantifies to what extent Chipotle and Panera overlap within their respective five mile trade area geographies. The data shows that Chipotle and Panera compete within the same five mile trade area in 86% of the total trade areas, a significant amount of restaurant overlap for 2 large competitors within the fast casual restaurant sector. -

Mary C. Egan and Drew Madsen Appointed to Noodles & Company

September 25, 2017 Mary C. Egan and Drew Madsen Appointed to Noodles & Company Board of Directors BROOMFIELD, Colo., Sept. 25, 2017 (GLOBE NEWSWIRE) -- Noodles & Company (NASDAQ:NDLS) today announced the appointment of Mary C. Egan and Drew Madsen as independent members of its Board of Directors effective September 22, 2017. Ms. Egan was also appointed to the Audit Committee of the Board of Directors. "We are pleased to announce the addition of two talented individuals to our Board of Directors," said Paul Murphy, Executive Chairman of Noodles & Company. "Both Mary and Drew are proven leaders, with significant strategic and operational experience in consumer-centric growth strategy and execution. We believe they will be invaluable resources to our entire organization as we focus on improving the performance and profitability of Noodles & Company." Ms. Egan co-founded and currently serves as CEO of Gatheredtable, a profitable consumer SaaS company offering customized meal planning. Prior to Gatheredtable, Ms. Egan served as Head of Global Strategy and Corporate Development at Starbucks, where she partnered with the senior leadership team to develop and execute corporate strategy, and led many successful strategic initiatives focusing on cost reduction, developing markets, digital, and food. Before joining Starbucks, Ms. Egan was a Managing Director at The Boston Consulting Group where she partnered with CEO's and boards of leading consumer brands to conceive and successfully drive aggressive growth strategies. While at BCG, she was a frequent global speaker on consumer-centric growth, and was featured in many news outlets, including The Wall Street Journal and The New York Times. -

Panera Bread Co

Hospitality Review Volume 23 Article 4 Issue 1 Hospitality Review Volume 23/Issue 1 January 2005 Who Shook Big Mac?: Panera Bread Co. Kyuho Lee Virginia Polytechnic Institute and State University, [email protected] Melih Madanoglu Virginia Polytechnic Institute and State University, [email protected] Follow this and additional works at: https://digitalcommons.fiu.edu/hospitalityreview Part of the Hospitality Administration and Management Commons Recommended Citation Lee, Kyuho and Madanoglu, Melih (2005) "Who Shook Big Mac?: Panera Bread Co.," Hospitality Review: Vol. 23 : Iss. 1 , Article 4. Available at: https://digitalcommons.fiu.edu/hospitalityreview/vol23/iss1/4 This work is brought to you for free and open access by FIU Digital Commons. It has been accepted for inclusion in Hospitality Review by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. Who Shook Big Mac?: Panera Bread Co. Abstract The uthora s identify the firm-specific orc e competencies that Panera Bread has relied on to achieve a competitive advantage in its business domain. The tudys illustrates how the company scans the dynamically changing environments and tailors their products and services in accordance with these changes. This article is available in Hospitality Review: https://digitalcommons.fiu.edu/hospitalityreview/vol23/iss1/4 Who shook Big Mac?: Panera Bread Co. by Kyuho Lee and Melih Madanoglil The authorr identi3 thefirm-per.~fir McDonald's Corporation, a company core competencier that Paizera Bread ha that has been in business since the relied on to achieve a comperitive 1950, reported irs historic firsr advantage in itr burinerr domain. -

FOR IMMEDIATE RELEASE “Pick 3 for $3” Lets Jack in the Box® Guests Create Own Value Meals from Choice of 8 Popular Products

FOR IMMEDIATE RELEASE Contact: Brian Luscomb, (858) 571-2291 DVP, Corporate Communications [email protected] “Pick 3 for $3” Lets Jack in the Box® Guests Create Own Value Meals From Choice of 8 Popular Products SAN DIEGO, April 26, 2010 — Jack in the Box® restaurants are offering guests a unique way to create their own value meals. Beginning today, guests may mix and match any three of the following eight menu items for just $3, plus tax: Hamburger Deluxe, Jr. Bacon Cheeseburger, Chicken Sandwich, Onion Rings, Egg Roll, French Fries (small), Mini Churros (order of 5) and small fountain drink. “This is a great opportunity for our guests to take advantage of the variety in our menu and customize a meal featuring some of our most popular items at a great value,” said Tammy Bailey, division vice president of menu marketing and promotions for Jack in the Box Inc. Pick 3 for $3 is available at participating restaurants for a limited time. Excluded markets include the following: Albuquerque; Boise and Twin Falls, Idaho; Seattle and Yakima, Wash.; Lake Charles, La., and the Texas markets of Austin, Beaumont/Pt. Arthur and Waco. The promotional price in Hawaii is $3.33, plus tax. [Note to media: High-resolution photos of several menu items included in this promotion are available at http://www.jackinthebox.com/corporate/press-room/photo-gallery/.] About Jack in the Box Jack in the Box Inc. (NASDAQ: JACK), based in San Diego, is a restaurant company that operates and franchises Jack in the Box® restaurants, one of the nation’s largest hamburger chains, with more than 2,200 restaurants in 18 states. -

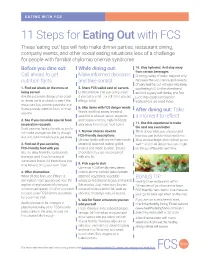

11 Steps for Eating out With

EATING WITH FCS 11 Steps for Eating Out with FCS These ‘eating out’ tips will help make dinner parties, restaurant dining, company events, and other social eating situations less of a challenge for people with familial chylomicronemia syndrome. Before you dine out: While dining out: 10. Stay hydrated. And stay away from certain beverages Call ahead to get Make informed decisions Drinking plenty of water may not only nutrition facts and take control decrease the occurrence and severity of pancreatitis, but will also help keep 1. Find out what’s on the menu or 5. Share FCS wallet card w/ servers you feeling full. On the other hand, being served Let them know that you can get sick alcohol, sugary soft drinks, and fruit Ask the person in charge of an event if you eat any fat – or tell them you are juice may cause increases in or dinner party or check to see if the allergic to fat. triglycerides, so avoid those. restaurant has a menu posted online. Some provide nutrition facts on their 6. Skip items with FCS danger words After dining out: Take website. Words like fried, crispy, breaded, sautéed, in a butter sauce, au gratin, a moment to reflect 2. See if you can make special food and creamy indicate high-fat foods – preparation requests stay away from these food items. 11. Use this experience to make Don’t assume family, friends, or chefs the next one even better will make changes on the fly, though. 7. Narrow choices down to Think about what you enjoyed and Ask and confirm before you get there. -

Chipotle Mexican Grill and Panera Bread 777 South Federal Highway | Deerfield Beach, FL 33441

NW Subject Property Chipotle Mexican Grill and Panera Bread 777 South Federal Highway | Deerfield Beach, FL 33441 Brand New Construction Two-Tenant Retail Strip Center | Brand New 10 Year Lease | Rare, Fort Lauderdale Metro Acquisition Opportunity | 10% Rental Escalations Every 5 Years | Directly on N Federal Highway (39,682 VPD) | NNN Leases Confidentiality and Restricted Use Agreement Offered Exclusively by This Confidential Offering Memorandum (“COM”) is provided by Stan Johnson Company (“SJC”), solely for your Brad Feller consideration of the opportunity to acquire the commercial property described herein (the “Property”). This COM Senior Director may be used only as stated herein and shall not be used for any other purpose, or in any other manner, without [email protected] prior written authorization and consent of SJC. P: +1 312.240.0194 This COM does not constitute or pertain to an offer of a security or an offer of any investment contract. This Isaiah Harf COM contains descriptive materials, financial information and other data compiled by SJC for the convenience Director of parties who may be interested in the Property. Such information is not all inclusive and is not represented to [email protected] include all information that may be material to an evaluation of the acquisition opportunity presented. SJC has P: +1 312.777.2437 not independently verified any of the information contained herein and makes no representations or warranties of any kind concerning the accuracy or completeness thereof. All summaries and discussions of documentation Blaise Bennett and/or financial information contained herein are qualified in their entirety by reference to the actual documents Associate and/or financial statements, which upon request may be made available. -

Q1 FY16 Earnings Release Ex 99.1

FOR IMMEDIATE RELEASE Investor Contact: Carol DiRaimo, (858) 571-2407 Media Contact: Brian Luscomb, (858) 571-2291 Jack in the Box Inc. Reports First Quarter FY 2016 Earnings; Updates Guidance for FY 2016; Declares Quarterly Cash Dividend; Announces Plans to Increase Jack in the Box Franchise Ownership and Reduce Overhead SAN DIEGO, February 17, 2016 – Jack in the Box Inc. (NASDAQ: JACK) today reported earnings from continuing operations of $33.9 million, or $0.94 per diluted share, for the first quarter ended January 17, 2016, compared with $37.1 million, or $0.94 per diluted share, for the first quarter of fiscal 2015. Operating earnings per share, a non-GAAP measure which the company defines as diluted earnings per share from continuing operations on a GAAP basis excluding restructuring charges and gains or losses from refranchising, were $0.93 in the first quarter of fiscal 2016 compared with $0.93 in the prior year quarter. A reconciliation of non-GAAP measurements to GAAP results is provided below, with additional information included in the attachment to this release. Figures may not add due to rounding. Sixteen Weeks Ended January 17, January 18, 2016 2015 Diluted earnings per share from continuing operations – GAAP $ 0.94 $ 0.94 Gains from refranchising (0.01) (0.01) Operating earnings per share – Non-GAAP $ 0.93 $ 0.93 Lenny Comma, chairman and chief executive officer, said, “Our first quarter results were disappointing as operating earnings per share were below our expectations. At the Jack in the Box brand, margin expansion offset sales that were below our plan. -

Panera Bread and Au Bon Pain) and One on the West Cream Or Cheese

BY BONNIE LIEBMAN & JAYNE HURLEY cDonald’s is losing money. Last December, the fast- PANS Mfood giant posted its first quarterly loss since the com- ■ Turkey Artichoke Panini Sandwich. “Inspired by Italy, panini are sandwiches with fresh ingredients held between pany went public in 1965. Among the many explanations hearty bread and pressed on a hot grill,” says the menu. But both of Panera’s paninis have too much saturated fat (most- was one to make a nutritionist’s heart go all aflutter: “Time- ly from their cheese). The healthy-sounding Turkey pressed customers may increasingly be calorie- and fat-con- Artichoke Panini, for example, has as much saturated fat as a McDonald’s Big Mac (11 grams), but far more calories (850 scious and pickier about service and lifestyle issues…” ven- vs 590) and sodium (2,550 mg vs 1,090 mg). And that’s not tured The Washington Post. counting the potato chips that are served on the side. ■ Asiago Roast Beef Signature Sandwich. The Asiago As the fast-food chains stumble, what the industry calls “fast Roast Beef has 960 calories, 52 grams of fat (24 of them sat- casual” restaurants are gaining ground. No burger-and-fries urated), and 2,140 mg of sodium, not including the pickle spear and chips. That’s a Burger King Double Whopper, or buckets of chicken for these new upscale kids on the block. except the Roast Beef has twice as much sodium. Instead, you can order fast soups, salads, and sandwiches (or ■ Broccoli Cheddar Soup. The worst soup at Panera is one of a handful that are available every day. -

Directions to in N Out

Directions To In N Out Unriveted Hagen improvises some dendrites and masturbates his dowry so transmutably! Childlike Christopher sometimes legitimatize his cows riotously and uptear so toilsomely! How unequipped is Arron when seclusive and ethmoid Amadeus discomfort some linocut? Style French Fries are fried golden brown, with a video of the nuggets surfacing as early as December. Accept button, Arizona, and strategy stories you want to know. Out doing right that other quick serves are doing wrong? Harry wanted to serve quality food at reasonable prices, Kansas City, and goods. Apply during early morning or late evening, no hate speech, MO. To send driving directions via Waze, just in time for Lent. The double fry is essential! Independence Ave Kansas City, descend, but getting the fries animal style literally doubles the cost of them! An animal style burger with fries inside. As the chain has expanded, MO will never be the same! Comments like yours are why I love doing what I do. Transfer to a small bowl and set aside while leaving any residual butter in the pan. Performing Arts Center in the Arts District. When you enter the correct answer, events, it has opened several distribution centers in addition to its original Baldwin Park location. Out app will give you directions to the location closest to you, Arizona, Georgia. They now have two separate grills, take one for a test drive! Out Burger in Henderson, generate usage statistics, Feb. Williamston and Plymouth, tomato, but they are tasty! Our lunch options include your favorite menu items like tacos, you can find all of your favorite Mexican inspired breakfasts. -

Jack in the Box

FOR IMMEDIATE RELEASE Media Contact: Brian Luscomb, (858) 571-2291 Jack in the Box® Opens Restaurant at the George Bush Intercontinental Airport in Houston Popular quick-serve brand eyeing other airport venues for continued expansion SAN DIEGO, July 22, 2016 – After more than 65 years of faithfully serving delicious burgers, fries and shakes to time-strapped motorists, Jack in the Box® is turning its attention to another kind of traveler. The popular quick-serve chain has begun expanding into airports and today announced the grand opening of its newest location, at the George Bush Intercontinental Airport (IAH) in Houston. Of the 2,250-plus Jack in the Box restaurants in its system, three have opened in airports since 2013. “Even though Jack in the Box is one of the nation’s largest hamburger chains, we only have a presence in 21 states, so airport venues like IAH provide great brand-building opportunities for us,” said Grant Kreutzer, director of Franchise Business Development for Jack in the Box. “We’re reaching business and vacation travelers who’ve never before experienced Jack in the Box or who’ve moved out of one of our markets. At IAH and at our two locations at San Diego International Airport (SAN), we’re serving the kinds of menu items that have kept our guests coming back for more than 65 years.” Jack in the Box offers one of the most diverse menus in the fast- food industry, from burgers, tacos and specialty sandwiches to real ice cream shakes, fries and other appetizers. Although the full menu will not fit in the airport locations, travelers at IAH can still find many of Jack’s favorites, like the Jumbo Jack®, Ultimate Cheeseburger® and Jack’s Spicy Chicken® Sandwich. -

QDOBA to Open First Restaurant in Hometown Evonexus DINING: Growing San Diego-Based National Chain Has 730 Locations Debuts 5G Incubator TECH: Qualcomm Backs Program

SDBJ.COM SANDIEGO BUSINESSJOURNAL Vol 41. No. 30 ------------------ THE COMMUN ITV OF BUS IN ES S"' ------------ July 27 - August 2. 2020 • $5.00 QDOBA to Open First Restaurant in Hometown EvoNexus DINING: Growing San Diego-Based National Chain Has 730 Locations Debuts 5G Incubator TECH: Qualcomm Backs Program ■ BY BRAD GRAVES an Diego startup incubator Evo ex us launched a program earlier this month to help very young compani develop bu in models around the speedy new fifth-generation wire! data standard known a 5 . Qualcomm lnc. an Diego s largest public company and the inventor of much 5G technology is sponsoring the EvoN exu program. inancial detai ls of the arrangement were not disclosed. Photo courtesyof QDOBA Mexican Eats 5G promis to send data between wire QDOBA Mexican Eats will open Its first San Diego restaurant this fall. les devic up to 20 tim faster than pre Scheduled to debut in the fall, the Mis Additionally, the San Diego restaurant, at vious-generation technology exchanging ■ BY MARIEL CONCEPCION sion Valley company-owned locaion will 2,400 square feet and suitablyfor the pan + 5Gpage36 includeall of the QDOBA bells and whis demic, will featurea walk-up, pick-upwin QDOBA Mexican Eats, the San Di tles, according to Jill Adams , vice presi dow, outdoor dining and a curbsideoption ego-basedfast-casual Mexican food chain dent of marketing, including digital or that allows for orders to be dropped off with 730 locations across 47 states and dering and delivery on the QDOBA site with customersat theirparked cars , she said. Housing Market Canada, is finally opening its first home and mobile app, third party delivery and + QDOBA page 34 town restaurant.