DB RREEF Trust Annual Report 2005 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report on Tenderers Using DSTA Etendering Process

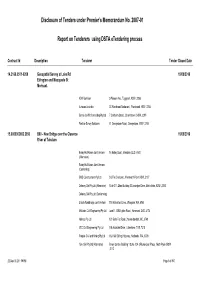

Disclosure of Tenders under Premier’s Memorandum No. 2007-01 Report on Tenderers using DSTA eTendering process Contract Id Description Tenderer Tender Closed Date 14.2166.0511-0209 Geospatial Survey at Lake Rd 19/09/2016 Elrington and Macquarie St Morisset. ADW Johnson 5 Pioneer Ave, ,Tuggerah ,NSW ,2259 Aurecon Australia 23 Warabrook Boulevard, ,Warabrook ,NSW ,2304 Bernie de Witt Consulting Pty Ltd 7 Canberra Street, ,Charlestown ,NSW ,2290 Positive Survey Solutions 51 Georgetown Road, ,Georgetown ,NSW ,2298 15.0000003652.2950 B60 - New Bridge over the Clarence 15/09/2016 River at Tabulam Bielby Hull Albem Joint Venture 16 Bailey Court, ,Brendale ,QLD ,4500 (Alternative) Bielby Hull Albem Joint Venture (Conforming) BMD Constructions Pty Ltd 3/3 The Crescent, ,Wentworth Point ,NSW ,2127 Delaney Civil Pty Ltd (Alternative) Suite 311, Zhen Building 33 Lexington Drive, ,Bella Vista ,NSW ,2153 Delaney Civil Pty Ltd (Conforming) Ertech Roadbridge Joint Venture 118 Motivation Drive, ,Wangara ,WA ,6065 McIlwain Civil Engineering Pty Ltd Level 1, 1283 Lytton Road, ,Hemmant ,QLD ,4174 Nelmac Pty Ltd 120 Bells Flat Road, ,Yackandandah ,VIC ,3749 VEC Civil Engineering Pty Ltd 10b Industrial Drive, ,Ulverstone ,TAS ,7315 Watpac Civil and Mining Pty Ltd 162-166 Stirling Highway, ,Nedlands ,WA ,6009 York Civil Pty Ltd (Alternative) Binary Centre, Building 1 Suite 1.04 3 Richardson Place, ,North Ryde ,NSW ,2113 22-Sep-16 2:11:59 PM Page 1 of 850 Disclosure of Tenders under Premier’s Memorandum No. 2007-01 Report on Tenderers using DSTA eTendering process -

Government Gazette

8933 Government Gazette OF THE STATE OF NEW SOUTH WALES Number 132 Friday, 28 October 2005 Published under authority by Government Advertising and Information LEGISLATION Assents to Acts ACTS OF PARLIAMENT ASSENTED TO Legislative Assembly Offi ce, Sydney, 19 October 2005 IT is hereby notifi ed, for general information, that Her Excellency the Governor has, in the name and on behalf of Her Majesty, this day assented to the undermentioned Acts passed by the Legislative Assembly and Legislative Council of New South Wales in Parliament assembled, viz.: Act No. 68 2005 - An Act to amend the Real Property Act 1900, the Conveyancing Act 1919, the Local Government Act 1993 and Acts relating to strata titles to make miscellaneous provisions concerning real property; and for other purposes. [Property Legislation Amendment Bill] Act No. 69 2005 - An Act with respect to security interests in goods; and for other purposes. [Security Interests in Goods Bill] Act No. 70 2005 - An Act to amend the Local Government Act 1993 to allow councils to make and levy annual charges for the provision of stormwater management services; and for other purposes. [Local Government Amendment (Stormwater) Bill] Act No. 71 2005 - An Act to amend the Standard Time Act 1987 to enable the daylight saving period to be prescribed by regulation and to extend this period by one week in the year 2006; and for other purposes. [Standard Time Amendment (Daylight Saving) Bill] Act No. 72 2005 - An Act to amend the Luna Park Site Act 1990 with respect to noise emissions from the Luna Park site. -

DB RREEF Trust Annual Report 2006 Contents

DB RREEF Trust annual report 2006 contents key financial data and results summary 2 highlights 3 letter from the chair 4 chief executive officer’s report 6 DB RREEF Trust overview 12 commercial portfolio – australasia 20 industrial portfolio – australia 22 retail portfolio – australia 24 industrial portfolio – united states 26 third party funds under management 28 sustainability report 30 corporate governance statement 35 directors 42 executive committee 44 management team 45 financial reports 46 registry information 118 investor information 119 directory Capitalising on global strength FRONT COVER AND ABOVE: Governor Phillip Tower and Governor Macquarie Tower Office Complex, 1 Farrer Place, Sydney NSW (Photos provided by Hamilton Lund of Visual Eyes International) DB RREEF Trust (ASX: DRT) comprising DB RREEF Diversified Trust ARSN 089 324 541 (DDF), DB RREEF Industrial Trust ARSN 090 879 137 (DIT), DB RREEF Office Trust ARSN 090 768 531 (DOT) and DB RREEF Operations Trust ARSN 110 521 223 (DRO). Also referred to in this annual report as “DB RREEF”, “the Trust”, “or “the Trusts”. “DAL” means Deutsche Australia Limited. The DB RREEF group “the Group” refers to the business as a whole and includes the Responsible Entity of each of the Trusts, DB RREEF Funds Management Limited ABN 24 060 920 783. EM or Explanatory Memorandum means Explanatory Memorandum and Product Disclosure Statement dated 30 August 2004 DB refers to Deutsche Bank AG. All amounts are in Australian dollars unless otherwise stated. key financial data and results summary -

FDC Group Capability Statement About Us 01 Who We Are What We Do How We Do It Where We Work Our Team Our National Leadership Team

FDC Group Capability Statement About Us 01 Who we are What we do How we do it Where we work Our team Our national leadership team Project Experience 02 Overview Fitout Refurbishment Construction Technologies & Mechanical Delivery 03 Our journey Corporate Data 04 FDC and the environment Sustainability in building: Green Star, NABERS, WELL & LEED Accreditations and certifications Industrial Relations & insurances Industry awards Corporate social responsibility CONTENTS 01 About Us 01 Who we are A multi-disciplinary building contractor A builder with construction, fitout and refurbishment expertise Company A builder with integrated services divisions (data, electrical and mechanical) A team of over 600 people passionate about building A significant portfolio of mission critical projects Established in 1990 A group with a consistently profitable trading history History A business with annual turnover of circa $1B Financially sound, without debt or overdraft Owned and operated by our shareholders Construction Management, Head Contractor or Turnkey delivery options Proven performance in high risk environments Focus Impressive record for on-time, on-budget delivery Dedicated, specialist delivery teams assembled Risk mitigation a primary objective Focused on service, quality and relationships Flexible, non adversarial attitude Culture Dedicated to team oriented success Multi-award winning project portfolio Strong community and charitable spirit Quality certified QA:ISO 9001:2015 Safety certified OHS:AS/NZS 4801:2001 Accreditations Environment certified EMS:ISO 14001:2015 Pre-qualified for State Government works Federal Safety Commissioner Certification (FSC) 01 We construct, fitout and refurbish spaces, often after hours. Projects What we do across a broad spectrum of clients may be a new fitout, modifications and market sectors. -

The Australian National Registry of Emissions Units

The Australian National Registry of Emissions Units Personal information of Account Representatives, including their identification numbers, names, addresses, email and phone and fax numbers, is confidential and is not published, in accordance with Decision 13/CMP.1 Paragraph 44 of the Conference of the Parties to the Kyoto Protocol and Regulation 50 of the Australian National Registry of Emissions Units Regulations 2011. ANREU - Current Accounts Report 13/CMP.1 Paragraph 45 13/CMP.1 Paragraph 47 (a) and (l) Report Generated: 3/01/21 10:59:24 PM Total Number of Accounts: 1192 1 Account Name 1st Energy Pty Ltd Account Number AU-2777 Account Type 100 Account Commitment Period Account Status Open Account Holder 1st Energy Pty Ltd Account Holder's Address Level 23 HWT Tower, 40 City Road , Southbank, Victoria, Australia, 3006 Account Holdings by Unit Type AAU RMU ERU (from AAU) ERU (from RMU) CER tCER lCER Beginning of Calendar Year 0 0 0 0 0 0 0 Current (as of report date) 0 0 0 0 0 0 0 2 2 Account Name A. A. Company Pty. Ltd. Account Number AU-2947 Account Type 100 Account Commitment Period Account Status Open Account Holder A. A. Company Pty. Ltd. Account Holder's Address 'Tower A' Level 1, 76 Skyring Terrace, Newstead, Queensland, Australia, 4006 Account Holdings by Unit Type AAU RMU ERU (from AAU) ERU (from RMU) CER tCER lCER Beginning of Calendar Year 0 0 0 0 0 0 0 Current (as of report date) 0 0 0 0 0 0 0 3 3 Account Name A.B.C. -

Explanatory Memorandum and Product Disclosure Statement (“EM”) Dated on Or About 25 August 2004 for the Stapling of Units in Four Deutsche Trusts

EM_Cover 25/8/04 11:52 PM Page 2 DB Real Estate Explanatory Memorandum & Product Disclosure Statement EM_Cover 25/8/04 11:52 PM Page 3 This document This document (the Explanatory Memorandum) provides future performance of DRT. If you have any questions, you should Unitholders in the Deutsche Diversified Trust (DDF), Deutsche contact your investment, financial, taxation or other professional Industrial Trust (DIT) and Deutsche Office Trust (DOT) adviser before deciding whether to vote in favour of the with details relating to the creation of DB RREEF Trust (DRT) Resolutions. Some of the risk factors that should be considered for which the approval of Unitholders of DDF, DIT and DOT are set out in Section 11. is sought at meetings of Unitholders of DDF, DIT and DOT No cooling-off rights apply to the issue of Units in the Trusts to be held on 27 September 2004 (Unitholder Meetings). Cooling off rights do not apply in relation to the issue of Units in This Explanatory Memorandum is also a Product Disclosure the Trusts. Statement (PDS) issued by DB RREEF Funds Management Limited (AFS Licence No. 238163) (DRFM) (and no other person) Tr ading in Stapled Securities in so far as it relates to the issue of Units by DRFM in DDF, DIT, It is your responsibility to determine your allocation of Stapled DOT and DB RREEF Operations Trust (DRO) (collectively the Securities before trading Stapled Securities to avoid the risk of Trusts) for the purposes of Part 7.9 of the Corporations Act. selling Stapled Securities you do not own. -

2011 10 11 DXS ASX 2 Sydney Office Tour Book and Presentation COMBINED

DEXUS Property Group - ASX release 11 October 2011 DEXUS Property Group (ASX: DXS) Sydney Office Tour DEXUS Funds Management Limited, as responsible entity for DEXUS Property Group (DXS), provides a copy of the 2011 Sydney Office Tour booklet and presentation. For further information contact: Media Relations Investor Relations Emma Parry T: (02) 9017 1133 Daniel Rubinstein T: (02) 9017 1336 M: 0421 000 329 M: 0466 016 725 E: [email protected] E: [email protected] Ben Leeson T: (02) 9017 1343 David Brewin T: (02) 9017 1256 M: 0403 260 754 M: 0411 162 457 E: [email protected] E: [email protected] About DEXUS DEXUS is one of Australia’s leading property groups specialising in world-class office, industrial and retail properties with total assets under management of $13.7bn. In Australia, DEXUS is the market leader in office and industrial and, on behalf of third party clients, a leading manager and developer of shopping centres. DEXUS is committed to being a market leader in Corporate Responsibility and Sustainability. www.dexus.com DEXUS Funds Management Ltd ABN 24 060 920 783, AFSL 238163, as Responsible Entity for DEXUS Property Group (ASX: DXS) 2011 DEXUS Property Group SYDNEY OFFICE TOUR 11 OCTOBER C ONTENTS TO UR AgeNDA 1 DXS PORTFOLIO OVERVIEW 2 DXS SYDNEY CBD OFFICE PORTFOLIO 4 44 MARKET STREET, SYDNEY 6 383-395 KENT STREET, SYDNEY 8 309-321 KENT STREET, SYDNEY 10 ONE MARGARET STREET, SYDNEY 12 45 CLARENCE STREET, SYDNEY 14 AUSTRALIA SQUARE, 264-278 GEORGE STREET, SYDNEY 16 1 BLIGH STREET, SYDNEY 18 GOVERNOR PHILLIP AND MACQUARIE TOWER, 1 FARRER PLACE, SYDNEY 20 NOTES 22 Cover: 1 Bligh Street and Governor Phillip & Macquarie Tower Complex, 1 Farrer Place, Sydney, NSW This page: Sydney CBD including Governor Phillip Tower, 1 Bligh Street, Gateway and Australia Square All figures are as at 30 June 2011 unless otherwise stated. -

26 September 2006 the Manager Australian Stock Exchange Limited

DB RREEF Funds Management Limited 26 September 2006 ABN 24 060 920 783 Australian Financial Services Licence Holder Level 9 343 George Street Sydney NSW 2000 The Manager PO Box R1822 Australian Stock Exchange Limited Royal Exchange NSW 1225 20 Bridge Street Telephone 61 2 9017 1100 Sydney NSW 2000 Direct 61 2 9017 1136 Facsimile 61 2 9017 1132 Email: [email protected] Dear Sir / Madam DB RREEF Trust (ASX: DRT) – Annual Report 2006 DB RREEF Funds Management Limited, as responsible entity for DB RREEF Trust (DRT), confirms the lodgement of the following documents with the Australian Stock Exchange today: • DB RREEF Trust Annual Report 2006 For further information, please contact • DRT Fund Manager: Tony Dixon (02) 9017 1136 • Investor Relations: Karol O’Reilly (03) 8611 2930 Yours sincerely Tanya Cox Company Secretary DB RREEF Trust annual report 2006 contents key financial data and results summary 2 highlights 3 letter from the chair 4 chief executive officer’s report 6 DB RREEF Trust overview 12 commercial portfolio – australasia 20 industrial portfolio – australia 22 retail portfolio – australia 24 industrial portfolio – united states 26 third party funds under management 28 sustainability report 30 corporate governance statement 35 directors 42 executive committee 44 management team 45 financial reports 46 registry information 118 investor information 119 directory Capitalising on global strength FRONT COVER AND ABOVE: Governor Phillip Tower and Governor Macquarie Tower Office Complex, 1 Farrer Place, Sydney NSW (Photos provided by Hamilton Lund of Visual Eyes International) DB RREEF Trust (ASX: DRT) comprising DB RREEF Diversified Trust ARSN 089 324 541 (DDF), DB RREEF Industrial Trust ARSN 090 879 137 (DIT), DB RREEF Office Trust ARSN 090 768 531 (DOT) and DB RREEF Operations Trust ARSN 110 521 223 (DRO). -

DB Real Estate Deutsche Bank Group

DB Real Estate Deutsche Bank Group DB Real Estate Australia Limited ABN 47 006 036 442 Australian Financial Services 3 May 2004 Licence Holder Level 21 83 Clarence Street Sydney NSW 2000 The Manager PO Box N127 Company Announcements Office Grosvenor Place NSW 1220 Australian Stock Exchange Telephone 61 2 9249 9000 20 Bridge Street Direct 61 2 9249 9346 SYDNEY NSW 2000 Facsimile 61 2 9249 9121 Email [email protected] Dear Sir/Madam Deutsche Office Trust Deutsche Asset Management (Australia) Limited as the responsible entity for the Deutsche Office Trust (DOT), provides the following information: S ASX announcement on a A$500 million CMBS issue; and S Deutsche Office Finance 2004 - CMBS Trust Debt Strategy Briefing Presentation Yours sincerely Ian Thompson Company Secretary DB Real Estate Deutsche Bank Group DB Real Estate Australia Limited ABN 47 006 036 442 Australian Financial Services Licence Holder Level 21 83 Clarence Street 3 May 2004 Sydney NSW 2000 PO Box N127 Grosvenor Place NSW 1220 Telephone 61 2 9249 9000 Direct 61 2 9249 9346 ASX Release Facsimile 61 2 9249 9121 Email [email protected] A$500 Million CMBS Issue for Deutsche Office Trust DB Real Estate’s $2.3 billion Deutsche Office Trust (ASX: DOT) today announced the commencement of a series of debt investor briefings to be held this week in Sydney, Melbourne and Brisbane in relation to issuance of up to A$500 million of commercial mortgage backed securities (CMBS). The CMBS issue is expected to be rated “AAA” by Standard & Poor’s and “Aaa” by Moodys. -

DB RREEF Trust Annual Report 2007 Contents

DB RREEF Trust annual report 2007 contents highlights funds management report 30 building value 2 about DB RREEF 33 international reach 4 corporate responsibility and sustainability 38 portfolio highlights 6 corporate governance statement 58 letter from the chair 8 fi nancial reports 66 chief executive offi cer’s report 10 investor information 128 our portfolio 14 directory 132 FRONT COVER: Sydney aerial view featuring DB RREEF assets – 30 The Bond, Gateway, 45 Clarence Street, One Margaret Street, Governor Phillip Tower and Governor Macquarie Tower, Australia Square, 309–321 Kent Street ABOVE: View from Governor Phillip Tower and Governor Macquarie Tower to Australia Square, Sydney NSW DB RREEF Trust (ASX: DRT) comprising DB RREEF Diversified Trust ARSN 089 324 541 (DDF), DB RREEF Industrial Trust ARSN 090 879 137 (DIT), DB RREEF Office Trust ARSN 090 768 531 (DOT) and DB RREEF Operations Trust ARSN 110 521 223 (DRO). The DB RREEF group refers to the business as a whole and includes the Responsible Entity of each of the Trusts, DB RREEF Funds Management Limited ABN 24 060 920 783. DB RREEF Trust is referred to as DB RREEF Trust. DB RREEF group is referred to as DB RREEF. DB RREEF Funds Management Limited is referred to as the Responsible Entity. USD/AUD conversion rate US$0.8487 as at 30 June 2007. €/AUD conversion rate €0.6311 as at 30 June 2007. All amounts are in Australian dollars unless otherwise stated. delivering solid performance and leveraging our integrated platform building value March Completes 30 The Bond, Sydney NSW, a winner of over 30 design and sustainability awards including Australia’s first 5 Star ABGR energy rating. -

Retail Properties to DWPF

DB RREEF Funds Management Limited 26 September 2007 ABN 24 060 920 783 Australian Financial Services Licence Holder Level 9 343 George Street Sydney NSW 2000 The Manager PO Box R1822 Australian Stock Exchange Limited Royal Exchange NSW 1225 20 Bridge Street Telephone 61 2 9017 1100 Direct 61 2 9017 1266 Sydney NSW 2000 Facsimile 61 2 9017 1110 Email: [email protected] Dear Sir / Madam DB RREEF Trust (ASX: DRT) Annual Report for the period ending 30 June 2007 DB RREEF Funds Management Limited, as responsible entity for DB RREEF Trust (DRT), provides a copy of the DB RREEF Trust 2007 Annual Report. For further information, please contact: Fund Manager, DB RREEF Trust: Ben Lehmann (02) 9017 1266 Investor Relations: Karol O’Reilly (03) 8611 2930 Media Enquiries: Emma Parry (02) 9017 1133 Yours sincerely Tanya Cox Company Secretary For personal use only DB RREEF Trust annual report 2007 For personal use only contents highlights funds management report 30 building value 2 about DB RREEF 33 international reach 4 corporate responsibility and sustainability 38 portfolio highlights 6 corporate governance statement 58 letter from the chair 8 fi nancial reports 66 chief executive offi cer’s report 10 investor information 128 our portfolio 14 directory 132 For personal use only FRONT COVER: Sydney aerial view featuring DB RREEF assets – 30 The Bond, Gateway, 45 Clarence Street, One Margaret Street, Governor Phillip Tower and Governor Macquarie Tower, Australia Square, 309–321 Kent Street ABOVE: View from Governor Phillip Tower and Governor Macquarie Tower to Australia Square, Sydney NSW DB RREEF Trust (ASX: DRT) comprising DB RREEF Diversified Trust ARSN 089 324 541 (DDF), DB RREEF Industrial Trust ARSN 090 879 137 (DIT), DB RREEF Office Trust ARSN 090 768 531 (DOT) and DB RREEF Operations Trust ARSN 110 521 223 (DRO).