DB Real Estate Deutsche Bank Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Built Pedagogy

Above any other faculty, the very fabric of the New Building Built for the Faculty of Architecture, Building and Planning must Pedagogy function as an experiential resource for research, teaching and knowledge transfer. This presents a rare opportunity for profound, intrinsic and meaningful links between building programme and architectural expression Cultural resources can engage communities in collective experiences, providing opportunities for reflection and conversation on the never-ending questions of how we make our lives meaningful, our work valuable and our values workable. 05.1.1 Growing Esteem, 2005 The Gallery Building reinforces the horizontal lines in the landscape and respects, engages with and reinforces the character of the Collections and Research Building Urban Design Exemplar Precinct established by the High Court and the National Gallery of Australia; Australian Museum, Sydney Integration with Environment Seeking to learn about sustainable build- ing through study of the natural world, Enduring, High Quality, Timeless the double skin façade is a collaboration Distinctive Materials and Detailing with the Museums scientists - a visible, intrinsic and poetic link between architec- National Portrait Gallery tural expression and the institution’s iden- Canberra, Australia tity. Nature’s golden ratio and the filigree of a moth’s wing scale, seen through a Won in open international scanning electron microscope, inspire the competition and completed in glazing pattern. Innovative inventive use 2008, the National Portrait Gallery of dichroic glass and advanced concealed is the most significant new national edgelighting produces dynamic colours institution in the Parliamentary through optical interference as do irides- Triangle for almost 20 years. cent butterflies. Canberra - City and Environs, Griffin Legacy Framework Plan, NCA, 2004. -

Governor Phillip Tower, Museum of Sydney and First Government

Nationally Significant 20th-Century Architecture Revised date 20/07/2011 Governor Phillip Tower, Museum of Sydney and First Government House Place Address 1 Farrer Place and 41 Bridge Street, Sydney, NSW, 2000 Practice Denton Corker Marshall Designed 1989 Completed 1993 (GPT) 1995 (MoS) History & The site of Governor Phillip Tower, Museum of Sydney & First Government Description House Place are located on a city block bounded by Bridge, Phillip, Bent & Young Streets in Sydney's CBD. Together with the Governor Macquarie Tower First Government House & the heritage listed terraces fronting Young & Phillip Streets the site was the Place with Museum of subject of an international design competition held in 1988, of which the primary Sydney & Governor Phillip aim was to conserve the archaeological resource of the First Government Tower behind, terraces to House which investigations of 1983-85 had revealed to lie beneath the northern portion of the block & extending into the road reserves of Young, Bridge & either side. Source: City of Phillip Streets. The cultural significance of the place shaped the development Sydney Model Makers. for the site: the conservation of the archaeological site of First Government . House & the Victorian terrace housing. To satisfy this & the commercial imperatives of maximising tower floor plate areas, the scheme incorporated several innovative approaches. Firstly in the urban design: the conception of First Government House Place as an 'urban room', achieved by setting back the Governor Phillip Tower from Bridge Street, enabled the archaeological site to be conserved, interpreted & celebrated, & served to ennoble the space with the presence of the imposing colonial sandstone buildings to either side; the public link from Phillip Street to Farrer Place, & the setbacks provided to the terraces. -

Attachment A

Attachment A Report Prepared by External Planning Consultant 3 Recommendation It is resolved that consent be granted to Development Application D/2017/1652, subject to the following: (A) the variation sought to Clause 6.19 Overshadowing of certain public places in accordance with Clause 4.6 'Exceptions to development standards' of the Sydney Local Environmental Plan 2012 be supported in this instance; and (B) the requirement under Clause 6.21 of the Sydney Local Environmental Plan 2012 requiring a competitive design process be waived in this instance; and (C) the requirement under Clause 7.20 of the Sydney Local Environmental Plan 2012 requiring the preparation of a development control plan be waived in this instance; Reasons for Recommendation The reasons for the recommendation are as follows: (A) The proposal, subject to recommended conditions, is consistent with the objectives of the planning controls for the site and is compatible with the character of the area into which it will be inserted. It will provide a new unique element in the public domain which has been specifically designed to highlight Sydney’s main boulevard and the important civic precinct of Town Hall and the Queen Victoria Building. (B) The proposed artwork is permissible on the subject land and complies with all relevant planning controls with the exception of overshadowing of Sydney Town Hall steps. While the proposal will result in some additional shadowing of the steps this impact will be minor and is outweighed by the positive impacts of the proposal. (C) The proposal is of a nature compatible with the overall function of the locality as a civic precinct in the heart of the Sydney CBD. -

Annual Report 2019

annual report 2019 Contents 02 Letter from the Chairman Management report 04 04. Highlights of the year 06. Key figures 08. Financial review 10. Responsibility, integrity and sustainability What we do 26 26. Transport planning and mobility 28. Roads 30. Railway engineering 32. Airports 34. Ports and coasts 36. Infrastructure management 38. Water engineering and management 40. Urban water systems and treatment 42. Sustainable cities 44. Buildings 46. Project and construction management 48. M&E and IT Systems 50. Renewable energy 52. Environment 54. Agricultural engineering and rural development 56. Support to development financing institutions 57. Statistics and land management Where we are 5 58. Office network 8 The only way “ to do a great job “is to love what you do June 2020 Annual report 2019 l TYPSAGroup Letterfrom the Chairman As we begin to look back and summarise TYPSA Group’s progress in 2019, the current SARS-CoV-2 coronavirus health crisis inevitably invades our thoughts. I would therefore like to begin this letter by remembering all those who have suffered the impact of this terrible disease close to home, sending them my support and solidarity. The figures for 2019 are an improvement on 2018 and consolidate our steady growth for the third consecutive year. Revenue of 219.4 million euros was 3% higher than the previous year. Total consolidated order intake increased 9% to 250.6 million euros, and TYPSA Group ended the year with a 316.9 million-euro backlog, which was 12% up from the previous December. Group earnings before taxes of 16.04 million euros represent 1% growth on the prior year. -

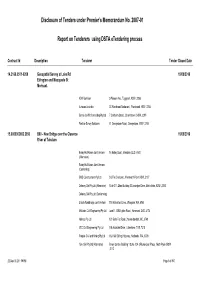

Report on Tenderers Using DSTA Etendering Process

Disclosure of Tenders under Premier’s Memorandum No. 2007-01 Report on Tenderers using DSTA eTendering process Contract Id Description Tenderer Tender Closed Date 14.2166.0511-0209 Geospatial Survey at Lake Rd 19/09/2016 Elrington and Macquarie St Morisset. ADW Johnson 5 Pioneer Ave, ,Tuggerah ,NSW ,2259 Aurecon Australia 23 Warabrook Boulevard, ,Warabrook ,NSW ,2304 Bernie de Witt Consulting Pty Ltd 7 Canberra Street, ,Charlestown ,NSW ,2290 Positive Survey Solutions 51 Georgetown Road, ,Georgetown ,NSW ,2298 15.0000003652.2950 B60 - New Bridge over the Clarence 15/09/2016 River at Tabulam Bielby Hull Albem Joint Venture 16 Bailey Court, ,Brendale ,QLD ,4500 (Alternative) Bielby Hull Albem Joint Venture (Conforming) BMD Constructions Pty Ltd 3/3 The Crescent, ,Wentworth Point ,NSW ,2127 Delaney Civil Pty Ltd (Alternative) Suite 311, Zhen Building 33 Lexington Drive, ,Bella Vista ,NSW ,2153 Delaney Civil Pty Ltd (Conforming) Ertech Roadbridge Joint Venture 118 Motivation Drive, ,Wangara ,WA ,6065 McIlwain Civil Engineering Pty Ltd Level 1, 1283 Lytton Road, ,Hemmant ,QLD ,4174 Nelmac Pty Ltd 120 Bells Flat Road, ,Yackandandah ,VIC ,3749 VEC Civil Engineering Pty Ltd 10b Industrial Drive, ,Ulverstone ,TAS ,7315 Watpac Civil and Mining Pty Ltd 162-166 Stirling Highway, ,Nedlands ,WA ,6009 York Civil Pty Ltd (Alternative) Binary Centre, Building 1 Suite 1.04 3 Richardson Place, ,North Ryde ,NSW ,2113 22-Sep-16 2:11:59 PM Page 1 of 850 Disclosure of Tenders under Premier’s Memorandum No. 2007-01 Report on Tenderers using DSTA eTendering process -

Modern Movement Architecture in Central Sydney Heritage Study Review Modern Movement Architecture in Central Sydney Heritage Study Review

Attachment B Modern Movement Architecture in Central Sydney Heritage Study Review Modern Movement Architecture in Central Sydney Heritage Study Review Prepared for City of Sydney Issue C x January 2018 Project number 13 0581 Modern Movement in Central Sydney x Heritage Study Review EXECUTIVE SUMMARY This study was undertaken to provide a contextual framework to improve understanding post World War II and Modern Movement architecture and places in Central Sydney, which is a significant and integral component of its architectural heritage. Findings x The study period (1945-1975) was an exciting and challenging era that determined much of the present physical form of Central Sydney and resulted in outstanding architectural and civic accomplishments. x There were an unprecedented number of development projects undertaken during the study period, which resulted in fundamental changes to the physical fabric and character of Central Sydney. x The buildings are an historical record of the changing role of Australia in an international context and Sydney’s new-found role as a major world financial centre. Surviving buildings provide crucial evidence of the economic and social circumstances of the study period. x Surviving buildings record the adaptation of the Modern Movement to local conditions, distinguishing them from Modern Movement buildings in other parts of the world. x The overwhelming preponderance of office buildings, which distinguishes Central Sydney from all other parts of NSW, is offset by the presence of other building typologies such as churches, community buildings and cultural institutions. These often demonstrate architectural accomplishment. x The triumph of humane and rational urban planning can be seen in the creation of pedestrian- friendly areas and civic spaces of great accomplishment such as Australia Square, Martin Place and Sydney Square. -

2018 Interim Result

INTERIM RESULT 2018 SECTION SPEAKER AGENDA 2018 Interim Result Highlights Bob Johnston Financial Summary & Capital Management Anastasia Clarke Retail Vanessa Orth Office & Logistics Matthew Faddy Funds Management Nicholas Harris Summary & Outlook Bob Johnston INTERIM RESULT 2018 RESULTS PRESENTATION 3 2018 Interim Result Financial Highlights 2018 Interim Result Financial Highlights Our Vision To be the most respected property company in Australia 3.2% 2.5% in the eyes of our Investors, People, Customers and FFO GROWTH DISTRIBUTION GROWTH Communities PER SECURITY PER SECURITY % Our Purpose $5.31 13.9 To create value by delivering superior returns to NTA PER TOTAL RETURN Investors, and by providing environments that enable our SECURITY (12 MONTHS) People to excel and Customers and Communities to prosper The GPT Group 2018 Interim Result 3 Progress on Strategic Priorities Progress on Strategic Priorities Investment Portfolio Balance Sheet & Capital Management + Portfolio occupancy of 97.4% + Net Gearing at 24.7% + Like for Like income growth 3.9% + Interest rate hedging at 79% + Revaluation gains of $457 million + Credit ratings A / A2 + Weighted Average Cap Rate 5.14% + Weighted average debt maturity of 6.6 years + Total Portfolio Return of 11.5% Development Pipeline Funds Management + Sunshine Plaza 75% leased + Assets Under Management of $12.4 billion + 32 Smith Street terms agreed for 51% of NLA + 12 month total return of 13.5% + Logistics developments underway and on-track + Market leading wholesale platform + Rouse Hill Town Centre -

Download Fiche (Pdf)

NR & NEW INTERNATIONAL SELECTION DOCUMENTATION MINIMUM FICHE For office use Wp/ref no Nai ref no Composed by working party of: Australia DOCOMOMO Australia Australia Square, Harry Seidler 1967 1 Identity of building/group of buildings/urban scheme/landscape/garden 1.1 Current Name of Building Australia Square 1.2 Variant or Former Name 1.3 Number & Name of Street 264-278 George St 1.4 Town Sydney 1.5 Province New South Wales 1 1.6 Zip code 2000 1.7 Country Australia 1.8 National grid reference 1.9 Classification/typology Commercial 1.10 Protection Status & Date RAIA NSW Chapter Register of 20th Century Buildings of Significance (item 4703039) 2 History of building The design concept for Australia Square aimed at solving the problems of urban redevelopment in a comprehensive way. The Australia Square project aimed at bringing a new openness into the congested heart of the city, with plaza areas open to the sky, an arcaded ground floor design and a circular 50-storey tower which allowed maximum light into surrounding streets. Australia Square was a landmark development in the 1960s. Its planning, design and construction were marked by creative innovation. Australia Square challenged the planning and architectural thinking of the time. The result was praised and indeed became a highly significant project in the wider context of development in Sydney. The site of Australia Square was the product of a protracted site consolidation carried through by G J Dusseldorp, building promoter and developer, Chairman of Lend Lease Corporation. From the early 1950s the concept of redeveloping parts of the city by consolidating small city lots to form a single larger site suitable for the erection of a skyscraper had been discussed. -

AIA REGISTER Jan 2015

AUSTRALIAN INSTITUTE OF ARCHITECTS REGISTER OF SIGNIFICANT ARCHITECTURE IN NSW BY SUBURB Firm Design or Project Architect Circa or Start Date Finish Date major DEM Building [demolished items noted] No Address Suburb LGA Register Decade Date alterations Number [architect not identified] [architect not identified] circa 1910 Caledonia Hotel 110 Aberdare Street Aberdare Cessnock 4702398 [architect not identified] [architect not identified] circa 1905 Denman Hotel 143 Cessnock Road Abermain Cessnock 4702399 [architect not identified] [architect not identified] 1906 St Johns Anglican Church 13 Stoke Street Adaminaby Snowy River 4700508 [architect not identified] [architect not identified] undated Adaminaby Bowling Club Snowy Mountains Highway Adaminaby Snowy River 4700509 [architect not identified] [architect not identified] circa 1920 Royal Hotel Camplbell Street corner Tumut Street Adelong Tumut 4701604 [architect not identified] [architect not identified] 1936 Adelong Hotel (Town Group) 67 Tumut Street Adelong Tumut 4701605 [architect not identified] [architect not identified] undated Adelonia Theatre (Town Group) 84 Tumut Street Adelong Tumut 4701606 [architect not identified] [architect not identified] undated Adelong Post Office (Town Group) 80 Tumut Street Adelong Tumut 4701607 [architect not identified] [architect not identified] undated Golden Reef Motel Tumut Street Adelong Tumut 4701725 PHILIP COX RICHARDSON & TAYLOR PHILIP COX and DON HARRINGTON 1972 Akuna Bay Marina Liberator General San Martin Drive, Ku-ring-gai Akuna Bay Warringah -

For Personal Use Only Use Personal For

10 February 2020 2019 Annual Result Property Compendium GPT provides its 2019 Annual Result Property Compendium which is authorised for release by the GPT Group Company Secretary. -ENDS- For more information, please contact: INVESTORS MEDIA Brett Ward Grant Taylor Head of Investor Relations & Corporate Communications Manager Affairs +61 437 994 451 +61 403 772 123 For personal use only Level 51, MLC Centre, 19-29 Martin Place, Sydney NSW 2000 www.gpt.com.au 2019 Annual Result2018 INTERIM PropertyRESULT Compendium PROPERTY COMPENDIUM For personal use only Contents Retail Portfolio 3 Office Portfolio 28 Logistics Portfolio 75 For personal use only Retail Portfolio Annual Result 2019 For personal use only CasuarinaFor personal use only Square Northern Territory 4 Casuarina Square, Northern Territory Casuarina Square is the dominant shopping destination in Darwin and the Northern Territory. The centre is located in the northern suburbs of Darwin, a 15 minute drive from Darwin’s Central Business District (CBD) and 20 minutes from the satellite town of Palmerston. The centre incorporates 198 tenancies including two discount department stores, two supermarkets, cinema and entertainment offer. The centre is also complemented by a 303 bed student accommodation facility operated by Unilodge. Casuarina Square is home to one of Australia’s largest solar rooftop systems after installation of the 1.25MW (megawatt) system in 2015. Key Metrics as at 31 December 2019 General Current Valuation Ownership Interest GPT: 50%, GWSCF: 50% Fair Value1 GPT: $248.0m -

The Suites at the Square

36LEVEL The Suites at The Square Bespoke office suites inspired by Australia Square’s art and architecture Australia Square Australia Premium space in iconic Sydney CBD tower Spectacular city and harbour views Unrivalled corporate location and transport accessibility A grade amenities and services Brand new end of trip facilities with lockers, showers and bike racks Wellness Room with daily fitness classes Dedicated 5 star executive Concierge team Australia Square Dining with wide variety of food retailers, bars and restaurants 4.5 star NABERS energy rating Level 36 Level 36 BOND STREET SUITE 36.01 SUITES NERVI SUITE 429.6sqm Drawing inspiration from Australia Square’s iconic art and SUITE 36.04 architecture, the thoughtfully designed Level 36 Suites are a SOL LE WITT SUITE fantastic opportunity to make your move into this iconic location. 163.8sqm The Level 36 Suites design concept came from key monuments and themes associated with Australia Square, with a focus on the future of wellness and technology. Featuring the highest quality materials and unique designs, each suite displays its own identity while maintaining a consistent corporate aesthetic. Ready to go: PITT STREET Fully Cabled: Supplementary Boardroom HD GEORGE STREET Data and Power Air-conditioning LED LCD Smart TV SUITE 36.03 CALDER SUITE 179.1sqm SUITE 36.02 FOUNTAIN SUITE 223.5sqm CURTIN PLACE Suite 36.01 Nervi A BEAUTIFUL CHEMISTRY OF TIMELESS DESIGN Harry Seidler collaborated with world-renowned engineer Pier Luigi Nervi to deliver Australia Square as an iconic landmark on the Sydney skyline. The Nervi Suite uses soft curves, unexpected angles and soft light tones to resemble Nervi’s exposed lobby ceiling design of interlocking concrete ribs. -

Commonwealth of Australia ASIC Gazette 24/01 Dated 1 November

= = `çããçåïÉ~äíÜ=çÑ=^ìëíê~äá~= = Commonwealth of Australia Gazette No. ASIC 24/01, Thursday 1 November 2001 (Special) Published by ASIC ^^ppff``==dd~~òòÉÉííííÉÉ== Contents Banking Act Unclaimed Money as at 31 December 2000 Specific disclaimer for Special Gazette relating to Banking Unclaimed Monies The information in this Gazette is provided by Authorised Deposit-taking Institutions to ASIC pursuant to the Banking Act (Commonwealth) 1959. The information is published by ASIC as supplied by the relevant Authorised Deposit-taking Institution and ASIC does not add to the information. ASIC does not verify or accept responsibility in respect of the accuracy, currency or completeness of the information, and, if there are any queries or enquiries, these should be made direct to the Authorised Deposit-taking Institution. ISSN 1445-6060 Available from www.asic.gov.au © Commonwealth of Australia, 2001 Email [email protected] This work is copyright. Apart from any use permitted under the Copyright Act 1968, all rights are reserved. Requests for authorisation to reproduce, publish or communicate this work should be made to: Gazette Publisher, Australian Securities and Investment Commission, GPO Box 5179AA, Melbourne Vic 3001 Commonwealth of Australia Gazette ASIC Gazette (Special) ASIC 24/01, Thursday 1 November 2001 Banking Act 1959 Unclaimed Money Page 2= = Banking Unclaimed Money as at 31 December 2000 Section 69 of Banking Act 1959 Statement of Unclaimed Money under the Banking Act General Information The publication contains details of amounts of $500.00 or more which Authorised Deposit-taking Institutions have paid to the Commonwealth Government as unclaimed moneys in accordance with Section 69 of the Banking Act 1959 for the year ended 31 December 2000.