Report No.4 of 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unclaimed & Unpaid Dividend For

First Name Middle name Last Name Address Country State Dist. Pin code Folio No. Investment type Amount Due (in Rs.) Proposed Date of Transfer to IEPF RAVINDER NATH SHARMA 3382 DELHI GATE DELHI 110002 INDIA DELHI CENTRAL DELHI 110002 0000157 Amount for unclaimed and 300.00 23-OCT-2016 unpaid dividend HARISH KUMAR BISHT C/O NATIONAL INS. COM. LTD. EMCA HOUSE D.O.XX INDIA DELHI CENTRAL DELHI 110002 0008581 Amount for unclaimed and 30.00 23-OCT-2016 23/23B, ANSARI ROAD, DARYA GANJ DELHI 110002 unpaid dividend RAJINDER KUMAR SHARMA 1/2892 RAM NAGAR LONI ROAD SHAHDRA DELHI INDIA DELHI EAST DELHI 110032 0008669 Amount for unclaimed and 30.00 23-OCT-2016 110032 unpaid dividend SURESH KUMAR SHARMA 1/2892 RAM NAGAR LONI ROAD SHAHDRA DELHI INDIA DELHI EAST DELHI 110032 0008670 Amount for unclaimed and 30.00 23-OCT-2016 110032 unpaid dividend RAJESH SHARMA 1/2892 RAM NAGAR LONI ROAD SHAHDRA DELHI INDIA DELHI EAST DELHI 110032 0008671 Amount for unclaimed and 30.00 23-OCT-2016 110032 unpaid dividend PUSHPA GUPTA GP 13 MAURYA ENCLAVE PITAMPURA DELHI 110034 INDIA DELHI CENTRAL DELHI 110034 0001466 Amount for unclaimed and 30.00 23-OCT-2016 unpaid dividend PUSHPA JAIN 147 RISHAB VIHAR VIKAS MARG EXTENTION DELHI INDIA DELHI EAST DELHI 110092 0002395 Amount for unclaimed and 60.00 23-OCT-2016 DELHI 110092 unpaid dividend AMAN SHARMA H NO 7/607 ANIL NAGAR MAHAVIR COLONY INDIA HARYANA KARNAL 131001 0002953 Amount for unclaimed and 30.00 23-OCT-2016 SONEPAT HARYANA HARYANA 131001 unpaid dividend KOMAL JAIN HOUSE NO. -

Dist. Rohtas, Bihar Usari Gidha

83°15'0"E 83°30'0"E 83°45'0"E 84°0'0"E 84°15'0"E 84°30'0"E MEDANI PUR SAISER JAMSONA SEMARI ITWAN BISIKALA BHARA SARA Koath (NP) © D A W A TT H BHUI SAHI NAUN BABHNAUL GIDHA DIST. ROHTAS, BIHAR USARI GIDHA DERGAUN GARA BHANPUR LILWACH GUNSEJ DAWATH GOSAL DIH SIOBAHAR AGRER KALA NARWAR 30 S U R Y A P U R A JAM RODH 0 S U R Y A P U R A KARANJ .H KUCHHILA N SURAJ PURA MOHINI N HARIBANS PUR SURAJ PURA N " " 0 BALIHAR 0 ' KUSUMHRA MORAUNA ' 5 CHITAWN 5 NAUWAN AKODHA D II N A R A 1 SARAYA 30 1 ° N.H 0 JAMORI ° 5 DINARA TENUAJ 5 2 KOCHAS CHITAWN 2 MAHARODH NONHAR SHIWPUR KHAIRA BHUDHAR MORAUNA CHITTAINI K O C H A S RAJPUR B IIK R A M G A N JJ Bikramganj (NP) LAHERI KANJAR MUNJI SAMHUTI GHUSIYA-KALAN I2 MANPUR BIKRAMGANJ BALATHARI CHANDI ENGLISH KATHRAI CHILHAR;UWA BALIA GHUSIYAI2 KHURD INDEX MAP REDIA SARAWAN JONHI KARAKAT PACHIM CHAMPAR* KAPASIYA GHUSIYAKALA CHIKSIL SAKLA KARMAINI AGARSI DIHRA ± AKODHI MOTHA SONBARSA ARANG KHAIRA SAHMAL MANI JAI SHREE DANWAR MANJHAULI GHUSIYAKALA KIRHI SHIWAN KARAHANSI MANJHAULI AMONA PURBI CHAMPARAN BAKSARA GARURA SITAMARHI BARAHRI KARUP SEMARI K A R A K A TT SHEOHAR DHARAMPURA I2 GOPALGANJ BENSAGAR MADHUBANI DHANHARA S A N JJH A U LL IISANJHAULI KAITHI AMARTHA KISHANGANJ AMAITHI SUPAUL KARGAHAR SOTWA GAMHARIYA ARARIA ARARUWA SENDUWAR UDAI PUR GORARI SIWAN MUZAFFARPUR BHOKHARI NONSARI BURHAWAL DARBHANGA RUPAITHA DEO SAMARDIHA KHIRIYANW K A R G A H A R Nokha (NP) BARNA SARAN SHIYAWAK SAMASTIPUR BARADIH SAHARSAMADHEPURA PURNIA GHUSIA CHATTONA VAISHALI I2 ) BASDIHA NOKHA PARARIYA PARASIYA THORSON MANGRAWAN HATHINI -

Town Wise Revised Action Plan for Polluted River Stretches in the State of Bihar Original Application No: 200/2014 (Matter : M.C

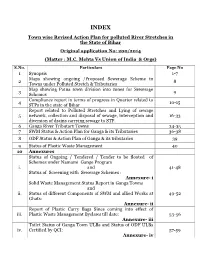

INDEX Town wise Revised Action Plan for polluted River Stretches in the State of Bihar Original application No: 200/2014 (Matter : M.C. Mehta Vs Union of India & Orgs) S.No. Particulars Page No 1 Synopsis 1-7 Maps showing ongoing /Proposed Sewerage Scheme in 2 8 Towns under Polluted Stretch & Tributaries Map showing Patna town division into zones for Sewerage 3 9 Schemes Compliance report in terms of progress in Quarter related to 4 10-15 STPs in the state of Bihar Report related to Polluted Stretches and Lying of sewage 5 network, collection and disposal of sewage, interception and 16-33 diversion of drains carrying sewage to STP. 6 Ganga River Tributary Towns 34-35 7 SWM Status & Action Plan for Ganga & its Tributaries 36-38 8 ODF Status & Action Plan of Ganga & its tributaries 39 9 Status of Plastic Waste Management 40 10 Annexures Status of Ongoing / Tendered / Tender to be floated of Schemes under Namami Gange Program i. and 41-48 Status of Screening with Sewerage Schemes : Annexure- i Solid Waste Management Status Report in Ganga Towns and ii. Status of different Components of SWM and allied Works at 49-52 Ghats: Annexure- ii Report of Plastic Carry Bags Since coming into effect of iii. Plastic Waste Management Byelaws till date: 53-56 Annexure- iii Toilet Status of Ganga Town ULBs and Status of ODF ULBs iv. Certified by QCI: 57-59 Annexure- iv 60-68 and 69 11 Status on Utilization of treated sewage (Column- 1) 12 Flood Plain regulation 69 (Column-2) 13 E Flow in river Ganga & tributaries 70 (Column-4) 14 Assessment of E Flow 70 (Column-5) 70 (Column- 3) 15 Adopting good irrigation practices to Conserve water and 71-76 16 Details of Inundated area along Ganga river with Maps 77-90 17 Rain water harvesting system in river Ganga & tributaries 91-96 18 Letter related to regulation of Ground water 97 Compliance report to the prohibit dumping of bio-medical 19 98-99 waste Securing compliance to ensuring that water quality at every 20 100 (Column- 5) point meets the standards. -

TACR: India: Preparing the Bihar State Highways II Project

Technical Assistance Consultant’s Report Project Number: 41629 October 2010 India: Preparing the Bihar State Highways II Project Prepared by Sheladia Associates, Inc. Maryland, USA For Road Construction Department Government of Bihar This consultant’s report does not necessarily reflect the views of ADB or the Government concerned, and ADB and the Government cannot be held liable for its contents. (For project preparatory technical assistance: All the views expressed herein may not be incorporated into the proposed project’s design. TA No. 7198-INDIA: Preparing the Bihar State Highways II Project Final Report TTTAAABBBLLLEEE OOOFFF CCCOOONNNTTTEEENNNTTTSSS 1 INTRODUCTION .............................................................................................................................. 8 1.1 INTRODUCTION .............................................................................................................................. 8 1.2 PROJECT APPRECIATION............................................................................................................. 8 1.2.1 Project Location and Details 9 1.2.2 Road Network of Bihar 11 1.3 PERFORMANCE OF THE STUDY ................................................................................................ 14 1.3.1 Staff Mobilization 14 1.3.2 Work Shop 14 1.4 STRUCTURE OF THE FINAL REPORT ....................................................................................... 14 2 SOCIO ECONOMIC PROFILE OF PROJECT AREA .................................................................. -

Ldc Final Merit

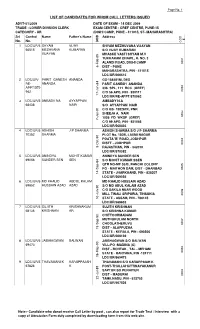

Page No. 1 LIST OF CANDIDATES FOR WHOM CALL LETTERS ISSUED ADVT-01/2009 DATE OF EXAM - 14 DEC 2009 TRADE : LOWER DIVISION CLERK EXAM CENTRE - GREF CENTRE, PUNE-15 CATEGORY - UR (DIGHI CAMP, PUNE - 411015, ST- MAHARASHTRA) Srl Control Name Father's Name Address E DOB No. No. COD 1 LDC/UR/5 SHYAM VIJAY SHYAM MEZHUVANA VIJAYAN 66515 MEZHVANA KUMARAN S/O VIJAY KUMARAN VIJAYAN MHASKE VASTI SHYAM M.V TUKKARAM CHAWL, R. NO. 3 ALANDI ROAD, DIGHI CAMP 0001 6-Feb-89 DIST - PUNE MAHARASHTRA, PIN - 411015 LDC/UR/566515 2 LDC/UR/ PARIT GANESH ANANDA GS-188481M, DES RE- ANANDA PARIT GANESH ANANDA APPT/570 336 SPL, 111 RCC (GREF) 962 C/O 56 APO, PIN - 930111 0002 17-Jun-84 LDC/UR/RE-APPT/570962 3 LDC/UR/5 ANBADV NA AYYAPPAN AMBADY N.A 68436 NAIR S/O AYYAPPAN NAIR C/O GS- 188267K, PNR SHEEJA A. NAIR 1056 FD WKSP (GREF) 0003 7-Jan-91 C/O 99 APO, PIN - 931056 LDC/UR/568436 4 LDC/UR/5 ASHISH J P SHARMA ASHISH SHARMA S/O J P SHARMA 70382 SHARMA PLOT No. 180B, LAXMI NAGAR POATA 'B' ROAD, JODHPUR DISTT - JODHPUR 0004 5-Oct-90 RAJASTHAN, PIN - 342010 LDC/UR/570382 5 LDC/UR/5 ANINDYA MOHIT KUMAR ANINDYA SUNDER SEN 69056 SUNDER SEN SEN S/O MOHIT KUMAR SSEN QTR NO-MF 53/B, RANCHI COLONY PO - MAITHON DAM, DIST - DHANBAD 0005 14-Sep-84 STATE - JHARKHAND, PIN - 828207 LDC/UR/569056 6 LDC/UR/5 MD KHALID ABDUL KALAM MD KHALID HUSSAIN AZAD 69652 HUSSAIN AZAD AZAD S/O MD ABUL KALAM AZAD C/O SAKILA NEAR WOOD MILL TINALI SRIPURIA, TINSUKIA 0006 10-Jun-90 STATE - ASSAM, PIN - 786145 LDC/UR/569652 7 LDC/UR/5 SUJITH KRISHNAKUM SUJITH KRISHNAN 68136 KRISHNAN AR S/O KRISHNA -

Sch Code School Name Dist Name 11001 Zila School

BIHAR SCHOOL EXAMINATION BOARD PATNA DISTRICTWISE SCHOOL LIST 2013(CLASS X) SCH_CODE SCHOOL_NAME DIST_NAME 11001 ZILA SCHOOL PURNEA PURNEA 11002 URSULINE CONVENT GIRLS HIGH SCHOOL PURNEA PURNEA 11003 B B M HIGH SCHOOL PURNEA PURNEA 11004 GOVT GIRLS HIGH SCHOOL PURNEA PURNEA 11005 MAA KALI HIGH SCHOOL MADHUBANI PURNEA 11006 JLNS HIGH SCHOOL GULAB BAGH PURNEA 11007 PARWATI MANDAL HIGH SCHOOL HARDA PURNEA 11008 ANCHIT SAH HIGH SCHOOL BELOURI PURNEA 11009 HIGH SCHOOL CHANDI RAZIGANJ PURNEA 11010 GOVT HIGH SCHOOL SHRI NAGAR PURNEA 11011 SIYA MOHAN HIGH SCHOOL SAHARA PURNEA 11012 R P C HIGH SCHOOL PURNEA CITY PURNEA 11013 HIGH SCHOOL KASBA PURNEA 11014 K D GIRLS HIGH SCHOOL KASBA PURNEA 11015 PROJECT GIRLS HIGH SCHOOL RANI PATRA PURNEA 11016 K G P H/S BHOGA BHATGAMA PURNEA 11017 N D RUNGTA H/S JALAL GARH PURNEA 11018 KALA NAND H/S GARH BANAILI PURNEA 11019 B N H/S JAGNICHAMPA NAGAR PURNEA 11020 PROJECT GIRLS HIGH SCHOOL GOKUL PUR PURNEA 11021 ST THOMAS H S MUNSHIBARI PURNEA PURNEA 11023 PURNEA H S RAMBAGH,PURNEA PURNEA 11024 HIGH SCHOOL HAFANIA PURNEA 11025 HIGH SCHOOL KANHARIA PURNEA 11026 KANAK LAL H/S SOURA PURNEA 11027 ABUL KALAM HIGH SCHOOL ICHALO PURNEA 11028 PROJECT GIRLS HIGH SCHOOL AMOUR PURNEA 11029 HIGH SCHOOL RAUTA PURNEA 11030 HIGH SCHOOL AMOUR PURNEA 11031 HIGH SCHOOL BAISI PURNEA 11032 HIGH SCHOOL JHOWARI PURNEA 11033 JANTA HIGH SCHOOL BISHNUPUR PURNEA 11034 T N HIGH SCHOOL PIYAZI PURNEA 11035 HIGH SCHOOL KANJIA PURNEA 11036 PROJECT KANYA H S BAISI PURNEA 11037 UGRA NARAYAN H/S VIDYAPURI PURNEA 11038 BALDEVA H/S BHAWANIPUR RAJDHAM -

Private School Total Data up to Date

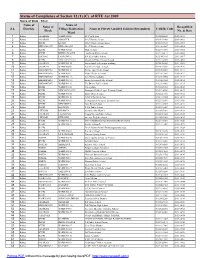

Status of Compliance of Section 12 (1) (C) of RTE Act 2009 Name of State : Bihar Name of Name of Name of Recognition S.L Districts Village/Habitation/ Name of Private Unaided Schools (Recognised) U-DISE Code Block No. & Date Ward 1 Rohtas SASARAM WARD NO-09 ST. Paul School 10320126603 2013-14/01 2 Rohtas SASARAM ADMAPUR D.A.V.Public School 10320101002 2013-14/02 3 Rohtas DEHRI KATAR D.A.V Public School, Katar 10321107102 2013-14/03 4 Rohtas BIKRAMGANJ BIKRAMGANJ D.A.V.Public School 10321000907 2013-14/04 5 Rohtas DEHRI WARD NO-28 Model School 10321117501 2013-14/05 6 Rohtas DEHRI DEHRI ON SONE Sun Beam Public School 10321100111 2013-14/06 7 Rohtas KOCHAS PARSATHUA S.N.Ideal Public School 10321843105 2013-14/07 8 Rohtas DEHRI NEW GANGAULI Damyanti Public Primary School 10321114703 2013-14/08 9 Rohtas SASARAM WARD NO-12 Isavarchand vidhyasagar acadamy 10320126903 2013-14/09 10 Rohtas SASARAM WARD NO-09 Bal Bharati Public School 10320126602 2013-14/10 11 Rohtas BIKRAMGANJ WARD NO-13 Devine light Public School 10321018201 2013-14/11 12 Rohtas BIKRAMGANJ WARD NO-9 Model Children School 10321017801 2013-14/12 13 Rohtas BIKRAMGANJ WARD NO- 16 Sant Merry Acadamy 10321018502 2013-14/13 14 Rohtas BIKRAMGANJ WARD NO- 16 Krisna Sudarsan Public School 10321018504 2013-14/14 15 Rohtas BIKRAMGANJ WARD NO-11 The Devine Public school 10321018001 2013-14/15 16 Rohtas DEHRI WARD NO-16 G.L acadmy 10321116301 2013-14/16 17 Rohtas DEHRI NEW GANGAULI Damayanti Public Upper Primary School 10321114703 2013-14/17 18 Rohtas DEHRI WARD NO-26 Happy Days Acadmy 10321117301 -

(AMDA) in India 1 | Page List of Municipal Councils and Municipalitie

Association of Municipalities and Development Authorities (AMDA) in India List of Municipal Councils and Municipalities in India S. No State Contact person, Address, Phone Website Name of Municipal Name of Municipality/Town and Email Id Council/Boards /Municipal Committees 1 Andhra Commissioner & Director of https://cdma.ap.gov.i 1. Adoni (M) 1. Addanki Pradesh Municipal Administration n/ulb-lists-0 2. Bhimavaram (M) 2. Allagadda Padmini Enclave, 5th lane, 4/7, 3. Chilakaluripet (M) 3. Amalapuram Mahatma Gandhi Inner Ring Rd, 4. Dharmavaram (M) 4. Amudalavalasa Annapura Nagar, Guntur, Andhra 5. Gudivada (M) 5. Atmakurknl Pradesh 522034 6. Guntakal (M) 6. Atmakurnlr Phone: 0866-2456708 7. Hindupur (M) 7. Bapatla Email: [email protected] 8. Madanapalle (M) 8. Bobbili 9. Nandyal (M) 9. Budwel 10. Narasaraopet (M) 10. Cheemakurthy 11. Proddatur (M) 11. Chirala 12. Tadepalligudem (M) 12. Dhone 13. Tadpatri (M) 13. Giddalur 14. Tenali (M) 14. Gollaprolu 15. Vizianagaram (M) 15. Gooty 16. Gudur-Kurnool 17. Gudur-SPR NELLORE 18. Ichapuram 19. Jaggaiahpet 20. Jammalamadugu 21. Jangareddygudem 22. Kavali 23. Kadiri 24. Kalyanadurgam 25. Kandukur 26. Kanigiri 27. Kovvur 28. Macherla 29. Madakasira 30. Mandapet 31. Mangalagiri 1 | P a g e Association of Municipalities and Development Authorities (AMDA) in India S. No State Contact person, Address, Phone Website Name of Municipal Name of Municipality/Town and Email Id Council/Boards /Municipal Committees 32. Markapur 33. Mummidivaram 34. Mydukur 35. Nagari 36. Naidupet 37. Nandigama 38. Nandikotkur 39. Narasapur 40. Narsipatnam 41. Nellimarla 42. Nidadavole 43. Nuzividu 44. Palakol 45. Palakonda 46. Palamaner 47. Palasakasibugga 48. -

Lekgj.Kky;&Y[Khljk;

lekgj.kky;&y[khljk; ¼ftyk LFkkiuk 'kk[kk½ lkekU; ¼iq:"k½ Matric Sl.No Application ID App Name Father Name DOB Mobile No Corr Address Marks AT-BIHARI PO-JAMUI PS-JAMUI DIST- 1 EXA/227008952 ROSHAN SINGH RAJNITI SINGH 25/01/1999 99 7992400545 JAMUI VILL PO BISHNUPUR BAGHNAGRI PS 2 EXA/227000097 TAPAN KUMAR ANKUR MANOJ KUMAR MISHRA 06/04/1996 95 8873761073 SAKRA DIST MUZAFFARPUR BIHAR Vill-sahoor post-sahoor dist-lakhisarai ps- 3 EXA/227017359 PRASHANT KUMAR GEETA PANDEY 02/12/1998 95 7323859735 suryagadha state-bihar 4 EXA/227008102 Raj kumar Murari prasad singh 05/08/1998 95 8789338845 Vill+po-Rampur,ps-suryagada,dist-lakhisarai VILL-PITWANS, P.O- PITWANS,P.S- 5 EXA/227015647 ABHISHEK KUMAR SANJAY KUMAR 18/05/1997 95 8434850611 NAUBATPUR,DIST-PATNA C/o-krishna kumar singh,Baba 6 EXA/227008292 CHANDAN KUMAR RAJ KRISHNA KUMAR SINGH 03/01/1996 95 7004000925 market,station market,Hisua,Nawada C/O Ramanuj singh Pankaj hardware store , 7 EXA/227001448 MANISH RANJAN RAMANUJ SINGH 21/11/1996 95 8298329372 Barauni chowk BARAUNI Vill-MANO PO-MANO DISTT- 8 EXA/227002918 AMARENDRA KUMAR RAMANUJ PRASAD SINGH 15/12/1993 93.4 9454953945 LAKHISARAI MOHAMMAD SHAREEF Village-Chopra Post-Sadipur butha Block- 9 EXA/227010572 SHAMSEER RAZA 07/06/1993 93.2 8806957652 ALAM BaisiDisst.-Purnia, Bihar 10 EXA/227017786 VIDUR JEE SAHJA NAND SINGH 17/04/1998 93 8210821729 VILL + PO - PAWAI PS- SURAJGARHA CO SANJIV KUMAR VILL HIRDANBIGHA WARD 8 PO PS 11 EXA/227008456 ASHUTOSH KUMAR SANJIV KUMAR 25/07/1998 93 8709272277 BARAHIYA DIST LAKHISARAI STATE BIHAR AT-SINGARPUR -

Doctor's Current Posting Details, Doh

Doctor's Current Posting Details, DoH, GoB -- (Source: HRIS Portal) -- As on 10.01.2018 Posting Details - 1 DISCLAIMER: Every effort has been made to ensure accuracy of Health Employees Data. However these need to be verified by and supplemented with documents issued finally by the concerned authorities. Department of Health, Govt. of Bihar/State Health Society, Bihar will not be responsible for any decision or claim that is based on the basis of displayed data. This Disclaimer is valid for all records/pages on website of Department of Health, Govt. of Bihar/State Health Society, Bihar. iHRIS Manage Version: 4.1.12.0 Current Position Current Posting From Reason for Sr.No. HRIS-Person Id Name Current Designation Position Current Posting Facility Job Classification Gender Designation 1 Facility 1 District 1 To Date Type District Date Change Start Date RBSK (School Contractual- 1 person|1499335 Majid Ali Unani Medical Officer-RBSK 09-06-15 Block Dehri PHC Rohtas Health Male NHM Programme) RBSK (School Contractual- 2 person|1498349 Md Mobin Alam Unani Medical Officer-RBSK 10-05-15 Block Karakat PHC Rohtas Health Male NHM Programme) RBSK (School Contractual- 3 person|1747159 Md Yaqub Unani Medical Officer-RBSK Block Rajpur PHC Rohtas Health Male NHM Programme) RBSK (School Contractual- 4 person|1499115 Shakil Ahmad Unani Medical Officer-RBSK 09-06-15 Block Rohtas PHC Rohtas Health Male NHM Programme) RBSK (School Contractual- 5 person|1498122 Md Sahid Hussain Unani Medical Officer-RBSK 12-06-15 Block Sanjhauli PHC Rohtas Health Male NHM Programme) -

DGT Notification in Respect of Applications Prior to 2015-16

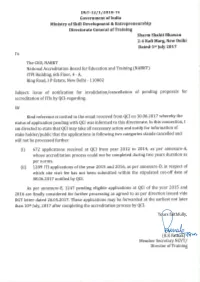

Annexure-A_Applications_Pending_for_more_than_2_years Sl. No. Application No. Name of the ITI and Address indicating town & District Name of State 1 App001123 SANMATI PRIVATE I T I, NEAR DALLU DAWTA SHAMLI Uttar Pradesh ROAD KHANJAHAPUR , DISTRICT: MUZAFFARNAGAR, STATE: UTTAR PRADESH, PIN CODE: 251002 2 App001125 GOVT. I.T.I. JHANSI., GWALIOR ROAD JHANSI. , DISTRICT: Uttar Pradesh JHANSI, STATE: UTTAR PRADESH, PIN CODE: 284003 3 App001126 CHAMPABEN BHAGAT EDU-COLLEGE OF FIRE Gujarat TECHNOLOGY, 86,VILL.KHODA,SANAND VIRAMGAM HIGHWAY , DISTRICT: AHMEDABAD, STATE: GUJARAT, PIN 4 App001128 GOVT. I.T.I., SUJROO CHUNGI , DISTRICT: Uttar Pradesh MUZAFFARNAGAR, STATE: UTTAR PRADESH, PIN CODE: 5 App001129 GITI ETAWAH, MAINPURI ROAD ETAWAH , DISTRICT: Uttar Pradesh ETAWAH, STATE: UTTAR PRADESH, PIN CODE: 206002 6 App001131 GOVERNMENT INDUSTRIAL TRAINING INSTITUTE BASTI, Uttar Pradesh KATARA BASTI , DISTRICT: BASTI, STATE: UTTAR PRADESH, 7 App001133 GOVERNMENT INDUSTRIAL TRAINING INSTITUTE, KHANTH Uttar Pradesh ROAD , DISTRICT: MORADABAD, STATE: UTTAR PRADESH, 8 App001136 GOVERNMENT INDUSTRIAL TRAINING INSTITUTE, Uttar Pradesh KARAUNDI, VARANASI , DISTRICT: VARANASI, STATE: UTTAR PRADESH, PIN CODE: 221005 9 App001140 GOVT. I.T.I. RAMPUR, GOVT. I.T.I. QILA CAMPUS RAMPUR , Uttar Pradesh DISTRICT: RAMPUR, STATE: UTTAR PRADESH, PIN CODE: 10 App001145 IJK PRIVATE ITI, PLOT NO 313 BISS FUTTA ROAD PREM Uttar Pradesh NAGAR LONI , DISTRICT: GHAZIABAD, STATE: UTTAR 11 App001146 GOVERNMENT INDUSTRIAL TRAINING INSTITUTE BALLIA, Uttar Pradesh RAMPUR UDYBHAN -

Contact Details of Commissioners and Mayors of AMRUT Cities Size

CONTACT DETAILS OF COMMISSIONERS AND MAYORS OF AMRUT CITIES Updated: as on end of September 2015 Sl. Phone Mobile State Name City Name Status Name of the Head Designation Email Address No. (STD Code-Number) (10 digit number) 03192-232576 / Dr. AJAY KUMAR SINGLA Secretary/CEO [email protected] 9434260726 Mohanpura, Port Blair, Andaman & 234508 1 Port Blair (M Cl) Andaman and Nicobar Nicobar Shri Arumugam M Chair Person [email protected] 03192-232576 9933202608 Islands 744101 [email protected], S.Pradeep Kumar Commissioner 08512-253121 98499 05859 Adoni Municipal Office, 1 Adoni (M) [email protected] Adoni, Kurnool, AP K. Sarojamma Chairman 9440253841 -- -- 2 Amravati -- -- P. Nagaveni Commissioner [email protected] 08554-274716 9849905852 Anantapur Municipal 3 Anantapur (M Corp.) Madamanchi swaroopa Mayor 9949703463 Corporation Office, B.R. Satyanarayana Commissioner [email protected] 08816-234284 98499 05813 Bhimavaram Municipal 4 Bhimavaram (M) Kotikalapudi Govinda Rao Chairman 9848553399 Office, Bhimavaram, West N. Kanaka Rao Commissioner [email protected] 08647-253994 9849907278 Chilakaluripet Municipal 5 Chilakaluripet (M) Ganji Chenchu Kumari Chairman 9704158686 Office, Chilakaluripet, G. Srinivasa Rao Commissioner [email protected] 08572-232314 98499 05864 Chittoor Municipal Office, 6 Chittoor (M) Katari Anuradha Mayor 9030159422 Chittoor, AP B. Rama Mohan, Asst Commr dharmavarammunicipality@rediffma Dharmavaram Municipal Commissioner 08559-223018 98499 05856 7 Dharmavaram (M) (FAC) il.com Office, Dharmavaram, Beere Gopalakrishna Chairman 9440553569 Anantapur, AP. Y. Sai Sreekanth Commissioner [email protected] 08812-230026 9849908154 Eluru Municipal Corporation 8 Eluru (M Corp.) Shaik Noorjahan Mayor 9440188786 Office, Eluru, West Godavari, M Seshagiri Commissioner [email protected] 08674-245053 98499 05821 Gudivada Municipal Office, 9 Gudivada (M) Yalavarthi Srinivasa Rao Chairman 9848153333 Gudivada, Krishna, AP.