2015 Scorecard.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NGPF's 2021 State of Financial Education Report

11 ++ 2020-2021 $$ xx %% NGPF’s 2021 State of Financial == Education Report ¢¢ Who Has Access to Financial Education in America Today? In the 2020-2021 school year, nearly 7 out of 10 students across U.S. high schools had access to a standalone Personal Finance course. 2.4M (1 in 5 U.S. high school students) were guaranteed to take the course prior to graduation. GOLD STANDARD GOLD STANDARD (NATIONWIDE) (OUTSIDE GUARANTEE STATES)* In public U.S. high schools, In public U.S. high schools, 1 IN 5 1 IN 9 $$ students were guaranteed to take a students were guaranteed to take a W-4 standalone Personal Finance course standalone Personal Finance course W-4 prior to graduation. prior to graduation. STATE POLICY IMPACTS NATIONWIDE ACCESS (GOLD + SILVER STANDARD) Currently, In public U.S. high schools, = 7 IN = 7 10 states have or are implementing statewide guarantees for a standalone students have access to or are ¢ guaranteed to take a standalone ¢ Personal Finance course for all high school students. North Carolina and Mississippi Personal Finance course prior are currently implementing. to graduation. How states are guaranteeing Personal Finance for their students: In 2018, the Mississippi Department of Education Signed in 2018, North Carolina’s legislation echoes created a 1-year College & Career Readiness (CCR) neighboring state Virginia’s, by which all students take Course for the entering freshman class of the one semester of Economics and one semester of 2018-2019 school year. The course combines Personal Finance. All North Carolina high school one semester of career exploration and college students, beginning with the graduating class of 2024, transition preparation with one semester of will take a 1-year Economics and Personal Finance Personal Finance. -

News Release

NEWS RELEASE Contact: Kim Marggraf Background: www.KohlEducation.org mailto:[email protected] For Immediate Release: Thursday, Feb. 25, 2021 920-457-1727 office 920-946-3640 mobile 2021 Herb Kohl Foundation Excellence Scholarship, Initiative Scholarship, Fellowship, Leadership Award Recipients Announced Organization has impacted more than 8,300 people, 3,100 schools since 1990 MILWAUKEE — The selection committee for the Herb Kohl Educational Foundation Student Scholarship, Teacher Fellowship and Principal Leadership program has announced recipients of the 317 Herb Kohl Foundation awards for Wisconsin students, teachers and principals. Awards in the amount of $6,000 are being made to 101 teachers, 16 principals, and their schools, and $10,000 scholarships will be given to 200 graduating high school students. Excellence Scholarship recipients have demonstrated excellence in the academic arena and high motivation to achieve, have displayed a broad range of activity and leadership outside the academic setting, and have shown strong promise for succeeding in college and beyond. Fellowship recipients are educators who have been chosen for their superior ability to inspire a love of learning in their students, their ability to motivate others, and their leadership and service within and outside the classroom. Leadership Award recipients are school principals who are being recognized for setting high standards for instruction, achievement and character, and creating a climate to best serve students, families, staff and community. Excellence Scholarship, Fellowship and Leadership Award recipients are selected by a statewide committee composed of civic leaders, and representatives of education-related associations and the program’s co-sponsors: The Wisconsin Newspaper Association Foundation, Wisconsin Department of Public Instruction, Wisconsin Council of Religious and Independent Schools (WCRIS), regional Cooperative Educational Service Agencies (CESA), the Association of Wisconsin School Administrators, and the Wisconsin Homeschool Parents Association. -

Herb Kohl to Honor Area Students, Teachers, and Principals on April 17

NEWS RELEASE For Immediate Release Contact: Kim Marggraf Thursday, April 14, 2016 920-946-3640 mobile, 920-457-1727 office [email protected] www.kohleducation.org Herb Kohl to Honor Area Students, Teachers, and Principals on April 17 Awards luncheon to be held at West De Pere High School MILWAUKEE — The Herb Kohl Educational Foundation will sponsor an awards luncheon Sunday, April 17, to honor the achievements of northeast and northcentral Wisconsin students, teachers, and principals who are receiving foundation awards. The event begins with a reception at noon at West De Pere High School with the awards program following at 1 p.m. According to Kim Marggraf, spokesperson for the foundation, Herb Kohl will be making formal award presentations to the recipients at the luncheon. “Education is the key to the future of Wisconsin and our nation. I am very proud of the accomplishments of these students, teachers, and principals, and look forward to the great contributions they will make in the future,” Kohl said. Northeast and northcentral Wisconsin’s 19 Excellence Scholarship recipients and 19 Initiative Scholarship recipients will each receive $5,000 grants to the postsecondary institution that the student will attend. The scholarship amount was increased from $3,000 to $5,000 in a surprise announcement earlier this month at the first awards luncheon in Chippewa Falls. The 18 teachers and five principals from northeast and northcentral Wisconsin will each receive a $3,000 Fellowship or Leadership grant and an additional $3,000 will be awarded to the teachers’ and principals’ schools for use in innovative educational projects. -

WI Act 28) Report on Remedial Education Fall 2015 Immediate New Freshmen from Wisconsin High Schools

University of Wisconsin System (WI Act 28) Report on Remedial Education Fall 2015 Immediate New Freshmen from Wisconsin High Schools New Math Rem Math Rem English Rem English Rem High School District High School Name Freshmen Required (#) Required (%) Required (#) Required (%) Adams-Friendship Area Sch Dist Adams-Friendship High School 31 11 35.5% * * Antigo Sch Dist Antigo High School 47 7 14.9% * * Appleton Area Sch Dist Appleton High School East 124 17 13.7% 8 6.5% Appleton Area Sch Dist Appleton North High School 135 17 12.6% * * Appleton Area Sch Dist Appleton West High School 83 10 12.0% * * Appleton Area Sch Dist Xavier High School ^ 56 12 21.4% * * Arrowhead UHS Sch Dist Arrowhead High School 257 28 10.9% 15 5.8% Ashland Sch Dist Ashland High School 32 8 25.0% * * Auburndale Sch Dist Auburndale High School 27 9 33.3% * * Baraboo Sch Dist Baraboo High School 81 9 11.1% 8 9.9% Barron Area Sch Dist Barron Area Senior High School 26 10 38.5% 9 34.6% Beaver Dam Sch Dist Beaver Dam High School 71 13 18.3% * * Belleville Sch Dist Belleville High School 18 7 38.9% * * Beloit Sch Dist Beloit Memorial High School 97 46 47.4% 12 12.4% Beloit Turner Sch Dist F J Turner High School 40 7 17.5% * * Berlin Area Sch Dist Berlin Senior High School 39 7 17.9% * * Black River Falls Sch Dist Black River Falls High School 35 11 31.4% * * Brodhead Sch Dist Brodhead Senior High School 33 9 27.3% * * Brown Deer Sch Dist Brown Deer High School 49 21 42.9% 9 18.4% Burlington Area Sch Dist Burlington High School 105 26 24.8% 7 6.7% Campbellsport Sch Dist -

2016 Herb Kohl Foundation Excellence Scholarship, Initiative Scholarship, Fellowship, and New Leadership Award Recipients Announced

NEWS RELEASE For Immediate Release Contact: Kim Marggraf Monday, March 21, 2016 920-946-3640 mobile; 920-457-1727 office [email protected] www.kohleducation.org 2016 HERB KOHL FOUNDATION EXCELLENCE SCHOLARSHIP, INITIATIVE SCHOLARSHIP, FELLOWSHIP, AND NEW LEADERSHIP AWARD RECIPIENTS ANNOUNCED MILWAUKEE — The selection committee for the Herb Kohl Educational Foundation Scholarship, Fellowship, and Leadership Program has announced recipients of the 2016 Herb Kohl Foundation awards for students, teachers, and principals. The $3,000 awards are being made to 100 teachers, 16 principals and their schools, and 184 graduating high school students. This year marks the first Kohl principal awards that recognize school leadership across the state. Excellence Scholarship recipients have demonstrated excellence in the academic arena and high motivation to achieve, have displayed a broad range of activity and leadership outside the academic setting, and have shown strong promise for succeeding in college and beyond. Fellowship recipients are educators who have been chosen for their superior ability to inspire a love of learning in their students, their ability to motivate others, and their leadership and service within and outside the classroom. Recipients of the new Leadership Award are school principals who are being recognized for setting high standards for instruction, achievement, and character and for creating a climate to best serve students, families, staff, and community. Excellence Scholarship, Fellowship and Leadership Award recipients are selected by a statewide committee composed of civic leaders and representatives of education-related associations and the program’s co-sponsors: The Wisconsin Newspaper Association Foundation, Wisconsin Department of Public Instruction, Wisconsin Council of Religious and Independent Schools (WCRIS), regional Cooperative Educational Service Agencies (CESA), and the Association of Wisconsin School Administrators. -

Students Attending the Following High Schools Are Eligible to Apply for the Deprey-Skyline Family Information Technology Scholarship Through Collegeready

Students attending the following high schools are eligible to apply for the Deprey-Skyline Family Information Technology Scholarship through CollegeReady County Brown Schools Ashwaubenon High School Green Bay Preble High School Pulaski High School Bay Port High School Green Bay Southwest High School West De Pere High School De Pere High School Green Bay West High School Wrightstown High School Denmark High School NEW Lutheran High School Green Bay East High School Notre Dame Academy County Calumet Schools Brillion High School Hilbert High School Stockbridge High School Chilton High School New Holstein High School County Door Schools Gibraltar High School Southern Door High School Washington Island High School Sevastopol High School Sturgeon Bay High School County Florence Schools Florence High School County Fond du Lac Schools Campbellsport High School Laconia High School St. Mary's Springs Academy Fond du Lac Christian School Oakfield High School Trinity Baptist School Fond du Lac High School Ripon High School Winnebago Lutheran Academy Horace Mann High School St. Lawrence Seminary County Green Lake Schools Berlin High Schol Markesan High School Princeton Public School Green Lake High School County Kewaunee Schools Algoma High School Kewaunee High School Luxemburg-Casco High School County Manitowoc Schools Kiel High School Mishicot High School Two Rivers High School Lincoln High School Reedsville High School Valders High School Manitowoc Lutheran High School Roncalli Catholic High School County Marinette Schools Coleman High School Marinette -

Organization City La Follette High School Madison Westosha High

Organization City La Follette High School Madison Westosha High School Riverside University HS Milwaukee Nicolet High School Glendale Whitefish Bay High School Whitefish Bay Marquette University High School Milwaukee Big Foot Union High School Walworth Arroyo Valley High School San Bernadino Central High School La Crosse Rufus King High School Milwaukee Watertown High School Watertown West De Pere High School De Pere Neillsville Middle/High School Neillsville Columbus Catholic HS Columbus Shorewood High School Shorewood New London High School New London Messmer High School Milwaukee West Bend West High School West Bend Laona School District Laona Pulaski High School Milwaukee Franklin High School Franklin Middleton High School Middleton Divine Savior Holy Angels High SchoolMilwaukee University School of Milwaukee Milwaukee Hmong American Peace Academy Milwaukee West Bend East High School West Bend Oak Creek High School Oak Creek Kaukauna High School Kaukauna Appleton East High School Appleton Hamilton High School Sussex Brown Deer Middle/High School Brown Deer Osseo-Fairchild High School Osseo Randolph School District Randolph Onalaska High School Onalaska Cedarburg High School Cedarburg Brookfield Academy Brookfield Ozaukee High School Fredonia Brookfield Central High School Brookfield Xavier High School Appleton New Lisbon High School New Lisbon Casimir Pulaski High School Milwaukee Bay Port High School Green Bay St. John's Northwestern Military AcademyDelafield Parkview School District Orfordville White Bera Lake Area High School Clintonville High School Clintonville Washington High School of IT Milwaukee West De Pere HS De Pere Central High School Burlington Alexander Hamilton High School Milwaukee Appleton North High School Appleton Valders High School Valders Edgewood High School Madison Waunakee High School Waunakee St. -

Herb Kohl to Honor Students, Teachers, and Principals at Award Luncheon on April 28 in Denmark

NEWS RELEASE Contact: Kim Marggraf Background: www.kohleducation.org 920-946-3640 mobile, 920-457-1727 office [email protected] For Immediate Release: Tuesday, April 24, 2018 Herb Kohl to honor students, teachers, and principals at award luncheon on April 28 in Denmark MILWAUKEE — A luncheon and awards program sponsored by the Herb Kohl Educational Foundation to honor the achievements of northeast and east central Wisconsin students, teachers, and principals will be held Saturday, April 28, at Denmark High School. On March 20, the Herb Kohl Educational Foundation announced the 2018 recipients of Initiative Scholarships, Excellence Scholarships, teacher Fellowships, and principal Leadership Awards. The April 28 luncheon will recognize the accomplishments of the area’s outstanding students, educators, and administrators. Twenty-one teacher Fellowship recipients, 26 Excellence Scholarship recipients, 21 Initiative Scholarship recipients, and one principal Leadership Award recipient will be honored. Kim Marggraf, spokesperson for the Herb Kohl Foundation, said that Herb Kohl, representatives of co-sponsoring organizations — the Wisconsin Department of Public Instruction, Wisconsin Council of Religious and Independent Schools, Wisconsin Cooperative Educational Service Agencies (CESAs), Wisconsin Newspaper Association Foundation, Wisconsin Parents Association, Association of Wisconsin School Administrators — and the families and friends of award recipients will be part of this program. The Herb Kohl Foundation Excellence Scholarship was established by Herb Kohl to provide scholarships to graduating Wisconsin high school students who have demonstrated academic excellence, outstanding leadership, citizenship, community service, integrity, and other special talents. In addition to the 20 Excellence Scholars from CESAs 7, 8, and 9, six students from CESAs 5 and 6 will attend the recognition program. -

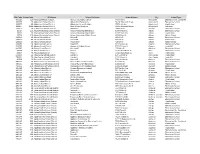

WI Ag Ed Instructor Directory

Wisconsin Agricultural Education Directory 2021-22 School Year Updated September 14, 2021 Updates to this directory will be posted on our website at: http://dpi.wi.gov/ag/#wis-ag-directory Distributed by: Career and Technical Education Team Department of Public Instruction PO Box 7841 Madison, WI 53707-7841 608-267-9251 2021-22 Wisconsin Agricultural Education State Leadership Department of Public Instruction Wisconsin Association of Agricultural Educators (WAAE) Agricultural Education PO Box 87 125 South Webster St., PO Box 7841 Sauk City, WI 53583 Madison, WI 53707-7841 https://wisconsinaged.org http://www.dpi.wi.gov/ag/ KATHY HARTMANN-BREUNIG, Executive Director SHARON WENDT, Agriculture & Natural Resources [email protected] (608) 354-6450 Consultant (Interim), ROGER KING, President Wisconsin Association of FFA State Advisor (Interim) [email protected] [email protected] (608) 267-9251 KELLEY FANNING, Office Operations Associate [email protected] (608) 267-9235 Wisconsin Technical College System Board 4622 University Ave., PO Box 7874 Madison, WI 53707-7874 Wisconsin FFA Center FAX: (608) 266-1690 S3222 Casey Ave., PO Box 110 http://www.wtcsystem.edu/ Spencer, WI 54479 BETSY LEONARD, Education Director FAX: (715) 659-5865 Ag. & Natural Resources https://wisconsinaged.org/ [email protected] CHERYL ZIMMERMAN, Executive Director [email protected] (715) 659-4807 TERRY BERNICK, Executive Assistant University of Wisconsin-Platteville [email protected] (715) 659-4807 Agricultural Education 1 University Plaza Platteville, WI 53818 Wisconsin FFA Foundation, Inc. FAX: (608) 342-1395 1241 John Q. Hammons Dr., Ste 200 DR. MARK ZIDON Madison, WI 53717 [email protected] (608) 342-1391 https://wisconsinaged.org/ JOHN HROMYAK, Executive Director University of Wisconsin-River Falls [email protected] (608) 831-5058 x3 Agricultural Education Department CAROLYN ROZELL, Operations Manager 410 S. -

WIAA BULLETIN • Vol

WIAA Vol. 84 Issue Number 9 BULLETIN Charter Official Publication of the ___M_e_m__b_er___ National Wisconsin Interscholastic Athletic Association Federation of State HS Stevens Point, WI April 11, 2008 Associations WIAA Winter Team Tournament Sportsmanship Awards Announced STEVENS POINT, Wis. – The Wis - vision 2 this year, following a 36-22 over Regis in the semifinals and its 70- semifinal. It’s the first time the Mosinee consin Interscholastic Athletic Associa - dual defeat to Lodi in the championship 51 loss to Aquinas in the Division 3 title co-op has won the award. Northland tion, in cooperation with Rural Insur - match. They advanced to the finals with championship game. It’s the second Pines and Chippewa Falls/McDonell ance, has selected the team Sports - a 33-28 victory over Luxemburg-Casco WIAA/Rural Insurance Sportsmanship Central was also given consideration for manship Awards for the 2008 winter in the semifinals. Arrowhead, Clear Award presented to the Thunderbirds. the award. State Tournaments. Lake, Franklin, Kaukauna, Milton, Pe - They also received the recognition in The WIAA/Rural Insurance Sports - The winners of the prestigious award waukee, Random Lake and Tomah re - football in 2000. Dominican, Eau Claire manship Award is presented to one are Antigo in gymnastics, Ellsworth in ceived honorable mention for the North, Monroe, Oshkosh West, Ply - school and community in each of the team wrestling, Oostburg in girls bas - award. mouth and Randolph received honor - State team tournaments. The award ketball, Iola-Scandinavia in boys bas - Division 3 champion Oostburg topped able mention. winners are determined by the conduct ketball, Superior in boys ice hockey and the list of schools and communities Superior was chosen as the winner of and sportsmanship displayed by ath - the Mosinee co-op in girls ice hockey. -

Wolf River Wednesday

WOLF RIVER WEDNESDAY SHAWANO LEADER WWW.NEWMEDIA-WI.COM Wednesday, September 25, 2019 Volume 138, Issue 138 $1 Man killed in logging accident Incident in town of Richmond claims life of 54-year-old. PAGE 3 Legion honors 100 years of service, sacrifice American Legion Post 117 celebrated its 100th anniversary this weekend. PAGE 20 Welcome back, class of 1949 Shawano High School alumni celebrate their 70th anniversary. SENIOR LIFESTYLE Kickoff starts early this week Get ready for game day with a special early Packers preview. FOUR INJURED IN EXPLOSION, FIRE GREEN & GOLD EXPRESS Four people were injured on Monday in an explosion at about 4 p.m. in the town of Grant. Numerous fire department and emergency services personnel and three medical helicopters were dispatched to N4011 Verg Road in the town of Grant just west of Caroline after reports of an explosion and fire. Eagle III, Spirit, and Theda Star, pictured above, were at the scene. A fourth victim was taken by helicopter from ThedaCare Medical Center-Shawano, according to a Shawano County Sheriff’s Department deputy at the scene. The address is the location of V & S Builders, Tigerton. The names of the four victims were not released as of the deadline. As information is available it will be posted on www.newmedia-wi.com. CAROL RYCZEK | NEW MEDIA PAGE 40 • NEW MEDIA • www.newmedia-wi.com • WEDNESDAY, SEPTEMBER 25, 2019 A link to high school Clintonville High School holds Link Crew activities for all freshmen on the first day of school Sept. 3. Link Crew is a high school transition program that welcomes freshmen and makes them feel comfort- able throughout the first year of their high school experience. -

School Code List for Public and Private

SFA Code School Code SFA Name School Site Name Street Address City School Type 403619 315 Millwaukee Public Schools Miw Co Youth Educ Center 949 N 9th St Milwaukee Elementary/Sec Combined 100007 20 Abbotsford School District Abbotsford Elementary 514 W. Hemloch Street Abbotsford Elementary School 100007 40 Abbotsford School District Abbotsford Jr. and Sr. High 307 N. 4th Ave Abbotsford High School 100007 9100 Abbotsford School District Rural Virtual Academy 510 W. Hemlock Street Abbotsford Unknown 424074 20 Oconto Falls School District Abrams El 3000 Elm St. Abrams Elementary School 10014 130 Adams-Friendship School District Adams-Friendship Elementary 500 N Pierce St Adams Elementary School 10014 40 Adams-Friendship School District Adams-Friendship High School 1109 E North St Adams High School 10014 210 Adams-Friendship School District Adams-Friendship Middle School 420 N Main St Adams Middle School 230063 20 Albany School District Albany El 400 5th St Albany Elementary School 230063 40 Albany School District Albany Hi 400 5th St Albany High School 230063 60 Albany School District Albany Mid 400 5th St Albany Middle School 310070 20 Algoma School District Algoma El 514 Fremont St Algoma Elementary School 310070 40 Algoma School District Algoma Jr/Sr High School 1715 Division St Algoma Junior H.S 665390 10 Slinger School District Allenton El 228 Weis St Allenton Elementary School 60084 20 Alma School District Alma El S1618 State Road 35 Alma Elementary School 60084 40 Alma School District Alma Hi S1618 State Road 35 Alma High School 270091