India- Ahmedabad- Retail Q4 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Organizing Existing Para Transit to Work As Feeder for Janmarg - Brts Ahmedabad

th 04 December, 2010 ORGANIZING EXISTING PARA TRANSIT TO WORK AS FEEDER FOR JANMARG - BRTS AHMEDABAD A project under JnNURM An initiative of: A H M E D A B A D M U N I C I P A L C O R P O R A T I O N Operations : A H M E D A B A D J A N M A R G L T D. Technical support : CEPT University, Ahmedabad Ahmedabad today • Area- 466 sq kms. Population-60 lakh, By 2031 >1 Crore • 22 lakh vehicles. 2 wheelers-73 percent, 8 Lakh Bicycles, 70000 3-wheelers • Addition of 400 vehicles every day • Bus trips 10 lakh per day • Ahmedabad has 6 ring roads and 17 well developed radials. Mixed Land uses • Avg. Trip Length is about 5.5 kms in Ahmedabad (Bangalore–11 kms, Hyderabad–8 kms) • Low Road Fatalities (Ahmedabad 224, Surat-267, Bangalore - 700, Hyderbad-424, Delhi>2000) • CNG Introduced AHMEDABAD INITIATIVES • Suburban Rail Transit System (Ahmedabad-Kalol, Naroda, Mehemdabad) • Metro Rail System • A Bus Rapid Transit System to cater to major mobility needs of the city, • A regular Bus System to support BRTS, namely feeder systems, • 20 Railover bridge/underpass, Flyovers • 2 River Bridges 20 Railover bridge/underpass, Flyovers 2 River Bridges Pedestrian and NMV Facilities along the BRTS corridor Area Traffic Control System (93 Junctions) LENGTH 38 Kms. THE PROPOSED REGIONAL RAIL CORRIDOR INITIAL PROPOSAL ADDITIONAL LENGTH 32 Kms. GANDHINAGAR GIFT A M A AD RM NA KALOL NARMADA MAIN CANAL AHMEDABAD THE PROPOSED METRO CORRIDOR TOTAL LENGTH 82 Kms. -

Institutions and Colleges in Ahmedabad and Gandhinagar

INSTITUTIONS AND COLLEGES IN AHMEDABAD AND GANDHINAGAR 1 AES POST GRADUATE INSTITUTE OF Phone : (O) 26442451 (R) 26609731 BUSINESS MANAGEMENT Activities : Teaching Plot No 16/1, Vikram Sarabhai Marg, Vastrapur Subjects : Education Ahmedabad – 15 Director : Dr. A. H. Karlo 5 A. P. ARTS AND N. P. PATEL COMMERCE Phone No : 26300048 COLLEGE Librarian : Sangita S. Purohit Nr.Narayan Nagar,Naroda, Ahmedabad 382325 Phone No : (O) 2630048 (R) 26929977 (M) Phone : 55451910-11 9426365969 Principal : Shri J B Patel Email : [email protected] Phone :55451905 Subject : Management Librarian : Shri Prashant Patel Activities : Teaching 2 ALL INDIA DISASTER MITIGATION Subjects : Commerce, Arts INSTITUTE 411, Sakar-5, B/H, Natraj Cinema, Ashram Road, 6 ACHARYA SRI KAILAS SAGARSURI Ahmedabad GYANMANDIR Phone No : 079-26586234, 26583607 Sri Mahavir Jain Aradhana Kendra Koba,Gandhinagar Director : Shri Mihir R. Bhatt 382009 Phone No : (O) 26586234, 26583607 EPABX : 23276205/ 23276204/ 23276252 Email : [email protected] Fax : 23276249 URL : www.southasiadisasters.net E-mail : [email protected] Librarian : Shri Bhargavi Mistry URL : kobatirth.org Phone No : (O) 26586234, 26583607 Associate Director : Shri Manoj R Jain & Email : [email protected] Mr. J. P. Sanghani Subject :Disaster, Disaster mitigation, Preparedness Phone : (O) 23276252 (R) 27413002 (M) 9426044511 Activities : Disaster Management Librarian : Shri Ramprakash Jha Activities : Research in Jainology & Indology. 3 ALL INDIA INSTITUTE OF LOCAL SELF Library is computerized and has a GOVERNMENT huge museum. Barfiwala Bhavan, Nr. Bhavan’s College, Khanpur, Subjects : Jainology, Indology, Museology Ahmedabad 380001 EPABX : 25601296/ 25601835 7 AHMEDABAD ART & COMMERCE Fax : 25601835 COLLEGE E-mail : [email protected] Opp. Sandesh Building, Vasana, Tel. -

Gls University Celebrates Research Day

GUJARAT LAW SOCIETY Date of publication : 7th of every month. News for GLS students, staff, alumni and friends Gujarat Law Society, Opp Law Garden, Ellisbridge, Ahmedabad 380006 ■ Ph 079 26440532, 079 26468513 ■ email: [email protected] ■ Price Rs.2/- INSIDE Volume 9 Issue 2 Editor: Dr. Bhalchandra H Joshi FEBRUARY 2017 GLS UNIVERSITY CELEBRATES RESEARCH DAY Pg : 2 NATIONAL MOOT COURT COMPETITION Pg : 4 CELEBRATION OF REPUBLIC DAY CONTENDERS FOR THE VARIOUS CATEGORIES OF AWARDS WITH DIGNITARIES FOR THE DAY LS University celebrated its maiden Research GDay on the 19th January, 2017 at the GLS Campus, Ahmedabad. The research day was celebrated to encourage faculty members and PG students to undertake research in their areas of specialisation and to recognise excellence in research. The research day Pg : 6-7 PRESIDENT OF GLS UNIVERSITY FROM L-R DR. B H JOSHI (PRO-VOST, GLS UNIVERSITY), PROF. ABHIJIT GLS UNIVERSITY’S 2ND YOUTH celebration and the awards were SHRI SUDHIR NANAVATI SEN (S. CHANDRASEKHAR CHAIR EMERITUS PROFESSOR, INSTITUTE FOR given to commemorate late Shri ADDRESSING THE AUDIENCE PLASMA RESEARCH) AND SHRI SUDHIR NANAVATI (PRESIDENT, GLS FESTIVAL ASMITA 2017 I.M. Nanavati, Pioneer Member UNIVERSITY) of Gujarat Law Society. Shri. Sudhir Nanavati, the facilities to encourage gathering. Dr. Hitesh Ruparel, delivered by Prof. Abhijit Sen, President, GLS University research by the faculty and Director General of GLS S. Chandrasekhar Chair delivered the presidential students. University explained the vision Emeritus Professor, Institute for address. He promised a Dr. B. H. Joshi, Provost, of the University in research. Plasma Research, Gandhinagar, congenial atmosphere and all GLS University welcomed the The key note address was CONTINUED ON PAGE-2 GLS University’S 2ND YOUTH Festival - ASMita 2017 Pg : 9 SOCIAL RESPONSIBILITY he 2nd Youth Festival of they recognize and take pride in INITIATIVES AT GLS ICT GLS University was held what is their own ¥çS}¢¼¢. -

Thaltej Village: an Incremental Approach to Urban Encroachment

Thaltej Village: An Incremental Approach to Urban Encroachment Thaltej Village: An Incremental Approach to Urban Encroachment Emily Brown Allison Buchwach Ryan Hagerty Mary Richardson Laura Schultz Bin Yan Under the advisement of Professor Michael Dobbins Georgia Institute of Technology April 27, 2012 Acknowlegements This report was produced with help from faculty and students at CEPT University in Ahmdebad, as well as many other generous folks both here and abroad that have helped us immeasurably with their advice, insight and feedback along the way. To all, we extend our heartfelt gratitude. Contents 1 INTRODUCTION ............................................................................................................................................. 1 2 INDIAN NATIONAL CONTEXT ......................................................................................................................... 3 2.1 INDIA’S URBANIZATION AND ITS IMPACT ON SLUMS AND THE ENVIRONMENT ................................................................ 3 2.2 IMPACT OF URBANIZATION: ENVIRONMENTAL DEGRADATION .................................................................................... 5 2.3 POLICY RESPONSES ............................................................................................................................................ 6 2.4 POLICY RESPONSES ............................................................................................................................................ 8 2.4.1 Slum Clearance (1956) ............................................................................................................................ -

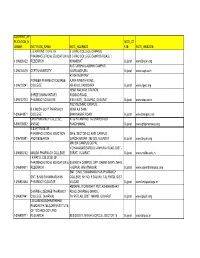

Ahmedabad Municipal Corporation Councillor List (Term 2021-2026)

Ahmedabad Municipal Corporation Councillor List (term 2021-2026) Ward No. Sr. Mu. Councillor Address Mobile No. Name No. 1 1-Gota ARATIBEN KAMLESHBHAI CHAVDA 266, SHIVNAGAR (SHIV PARK) , 7990933048 VASANTNAGAR TOWNSHIP, GOTA, AHMEDABAD‐380060 2 PARULBEN ARVINDBHAI PATEL 291/1, PATEL VAS, GOTA VILLAGE, 7819870501 AHMEDABAD‐382481 3 KETANKUMAR BABULAL PATEL B‐14, DEV BHUMI APPARTMENT, 9924136339 SATTADHAR CROSS ROAD, SOLA ROAD, GHATLODIA, AHMEDABAD‐380061 4 AJAY SHAMBHUBHAI DESAI 15, SARASVATINAGAR, OPP. JANTA 9825020193 NAGAR, GHATLODIA, AHMEDABAD‐ 380061 5 2-Chandlodia RAJESHRIBEN BHAVESHBHAI PATEL H/14, SHAYONA CITY PART‐4, NR. R.C. 9687250254, 8487832057 TECHNICAL ROAD, CHANDLODIA‐ GHATLODIA, AHMDABAD‐380061 6 RAJESHWARIBEN RAMESHKUMAR 54, VINAYAK PARK, NR. TIRUPATI 7819870503, PANCHAL SCHOOL, CHANDLODIA, AHMEDABAD‐ 9327909986 382481 7 HIRABHAI VALABHAI PARMAR 2, PICKERS KARKHANA ,NR. 9106598270, CHAMUDNAGAR,CHANDLODIYA,AHME 9913424915 DABAD‐382481 8 BHARATBHAI KESHAVLAL PATEL A‐46, UMABHAVANI SOCIETY, TRAGAD 7819870505 ROAD, TRAGAD GAM, AHMEDABAD‐ 382470 9 3- PRATIMA BHANUPRASAD SAXENA BUNGLOW NO. 320/1900, Vacant due to Chandkheda SUBHASNAGAR, GUJ. HO.BOARD, resignation of Muni. CHANDKHEDA, AHMEDABAD‐382424 Councillor 10 RAJSHRI VIJAYKUMAR KESARI 2,SHYAM BANGLOWS‐1,I.O.C. ROAD, 7567300538 CHANDKHEDA, AHEMDABAD‐382424 11 RAKESHKUMAR ARVINDLAL 20, AUTAMNAGAR SOC., NR. D CABIN 9898142523 BRAHMBHATT FATAK, D CABIN SABARMATI, AHMEDABAD‐380019 12 ARUNSINGH RAMNYANSINGH A‐27,GOPAL NAGAR , CHANDKHEDA, 9328784511 RAJPUT AHEMDABAD‐382424 E:\BOARDDATA\2021‐2026\WEBSITE UPDATE INFORMATION\MUNICIPAL COUNCILLOR LIST IN ENGLISH 2021‐2026 TERM.DOC [ 1 ] Ahmedabad Municipal Corporation Councillor List (term 2021-2026) Ward No. Sr. Mu. Councillor Address Mobile No. Name No. 13 4-Sabarmati ANJUBEN ALPESHKUMAR SHAH C/O. BABULAL JAVANMAL SHAH , 88/A 079- 27500176, SHASHVAT MAHALAXMI SOCIETY, RAMNAGAR, SABARMATI, 9023481708 AHMEDABAD‐380005 14 HIRAL BHARATBHAI BHAVSAR C‐202, SANGATH‐2, NR. -

State Zone Commissionerate Name Division Name Range Name

Commissionerate State Zone Division Name Range Name Range Jurisdiction Name Gujarat Ahmedabad Ahmedabad South Rakhial Range I On the northern side the jurisdiction extends upto and inclusive of Ajaji-ni-Canal, Khodani Muvadi, Ringlu-ni-Muvadi and Badodara Village of Daskroi Taluka. It extends Undrel, Bhavda, Bakrol-Bujrang, Susserny, Ketrod, Vastral, Vadod of Daskroi Taluka and including the area to the south of Ahmedabad-Zalod Highway. On southern side it extends upto Gomtipur Jhulta Minars, Rasta Amraiwadi road from its intersection with Narol-Naroda Highway towards east. On the western side it extend upto Gomtipur road, Sukhramnagar road except Gomtipur area including textile mills viz. Ahmedabad New Cotton Mills, Mihir Textiles, Ashima Denims & Bharat Suryodaya(closed). Gujarat Ahmedabad Ahmedabad South Rakhial Range II On the northern side of this range extends upto the road from Udyognagar Post Office to Viratnagar (excluding Viratnagar) Narol-Naroda Highway (Soni ni Chawl) upto Mehta Petrol Pump at Rakhial Odhav Road. From Malaksaban Stadium and railway crossing Lal Bahadur Shashtri Marg upto Mehta Petrol Pump on Rakhial-Odhav. On the eastern side it extends from Mehta Petrol Pump to opposite of Sukhramnagar at Khandubhai Desai Marg. On Southern side it excludes upto Narol-Naroda Highway from its crossing by Odhav Road to Rajdeep Society. On the southern side it extends upto kulcha road from Rajdeep Society to Nagarvel Hanuman upto Gomtipur Road(excluding Gomtipur Village) from opposite side of Khandubhai Marg. Jurisdiction of this range including seven Mills viz. Anil Synthetics, New Rajpur Mills, Monogram Mills, Vivekananda Mill, Soma Textile Mills, Ajit Mills and Marsdan Spinning Mills. -

AMDHY Fact Sheet

NEAR VASTRAPUR LAKE, VASTRAPUR Ahmedabad, Gujarat 380015 India T + (9179) 6160 1234 F + (9179) 6160 1235 [email protected] ahmedabad.hyatthotels.hyatt.com you’re more than welcome 2013.02 Accommodations Services & Facilities • 178 rooms including 10 suites • 24-hour in-room dining • Size of the rooms range from 26 to 111.48 square metres • Airport limousine / limousine for hire (280 to 1,200 square feet) • Car rental • Choice of smoking and non-smoking rooms • 24-hour Assistant Manager / Concierge • Ergonomically designed beds • Car parking with valet parking facilities • Range of comfort pillows • Doctor on call • Bedside electronic controls • Currency exchange • Spacious bathroom with a walk-in shower cubicle • Executive Lounge for Executive room and Suite room guests (bath tub facility in Hyatt executive Suite only) • Bathroom amenities and hairdryer Conferences & Banquets • Tea- and coffee- making facilities • State-of-the-art conference and banquet facilities ideal for • Stocked minibar (optional health minibar) board meetings, closed door discussion, break away functions, • Individually controlled air-conditioning and lighting weddings and banquets are available at lobby level with • Large bay windows 1,068.39 square metres (11,500 square feet) of space • 32-inch LCD television with international channels • A pre-function area and two separate meeting rooms (40-inch LCD television in Suite Rooms) • Broadband data port / wired and wireless Internet accommodating smaller meetings • Iron / ironing board on request • Meeting areas are equipped with the latest software, Wi- • In-room electronic safes conferencing capabilities Recreational Facilities Restaurant, Bar & Lounge • Spa — featuring seven beautifully appointed rooms with • Collage — designed to be an uplifting yet informal experience, interconnecting shower cubicles, including a salon. -

Special Report on Ahmedabad City, Part XA

PRG. 32A(N) Ordy. 700 CENSUS OF INDIA 1961 VOLUME V GUJARAT PAR T X-A (i) SPECIAL REPORT ON AHMEDABAD CITY R. K. TRIVEDI Superintendent of Census Operations, Gujarat PRICE Rs. 9.75 P. or 22 Sh. 9 d. or $ U.S. 3.51 CENSUS OF INDIA 1961 LIST OF PUBLICATIONS CENTRAL GOVERNMENT PUBLICATIONS Census of India, 1961 Volume V-Gujarat is being published in the following parts: * I-A(i) General Report * I-A(ii)a " * I-A(ii)b " * I-A(iii) General Report-Economic Trends and Projections :\< I-B Report on Vital Statistics and Fertility Survey .\< I-C Subsidiary Tables -'" II-A General Population Tables * II-B(l) General Economic Tables (Tables B-1 to B-IV-C) * II-B(2) General Economic Tables (Tables B-V to B-IX) * II-C Cultural and Migration Tables :l< III Household Economic Tables (Tables B-X to B-XVII) * IV-A Report on Housing and Establishments * IV-B Housing and Establishment Tables :\< V-A Tables on Scheduled Castes and Scheduled Tribes V-B Ethnographic Notes on Scheduled Castes and Scheduled Tribes (including reprints) ** VI Village Survey Monographs (25 Monographs) VII-A Selected Crafts of Gujarat * VII-B Fairs and Festivals * VIII-A Administration Report-Enumeration " ~ N ~r£br Sale - :,:. _ _/ * VIII-B Administration Report-Tabulation ) :\' IX Atlas Volume X-A Special Report on Cities * X-B Special Tables on Cities and Block Directory '" X-C Special Migrant Tables for Ahmedabad City STATE GOVERNMENT PUBLICATIONS * 17 District Census Handbooks in English * 17 District Census Handbooks in Gl~arati " Published ** Village Survey Monographs for SC\-Cu villages, Pachhatardi, Magdalla, Bhirandiara, Bamanbore, Tavadia, Isanpur and Ghclllvi published ~ Monographs on Agate Industry of Cam bay, Wood-carving of Gujarat, Patara Making at Bhavnagar, Ivory work of i\1ahllva, Padlock .i\Iaking at Sarva, Seellc l\hking of S,v,,,-kundb, Perfumery at Palanpur and Crochet work of Jamnagar published - ------------------- -_-- PRINTED BY JIVANJI D. -

Bharatiya Janata Party – Gujarat State

BHARATIYA JANATA PARTY – GUJARAT STATE STATE DEPARTMENTS (ç±|¢¢x¢) - 2017 SR. DEPARTMENT NAMES MOBILE NO. NO. NAMES 9898000098 SHRI KAUSHIKBHAI PATEL [email protected] 9978405844 DEPARTMENT FOR 9427306026 GOOD GOVERNANCE, SHRI I. K. JADEJA [email protected] 1 9978405808 AND CENTER - STATE 9825005335 SHRI JAYNARAYANBHAI VYAS [email protected] COORDINATION 9978405316 [email protected], SHRI NARHARIBHAI AMIN 9825006667 [email protected] 9824212033 SHRI KAMLESHBHAI JOSHIPURA [email protected] 9978407041 [email protected], DEPARTMENT FOR SHRI KANUBHAI MAVANI 9825144801 [email protected] 2 POLICY RESEARCH [email protected], SHRI PRAKASHBHAI SONI 9825215092 [email protected] SHRI DR. JIGISHABEN SHETH (VADODARA 9825802410 [email protected] CITY) SHRI DR. HARSHAD PATEL 9426015397 [email protected] [email protected], SHRI RAJUBHAI DHRUV 9426719555 [email protected] 3 MEDIA DEPARTMENT [email protected], SHRI DR. HEMANTBHAI BHATT 9825010940 [email protected] 9033455797 [email protected], SHRI VINODBHAI JAIN (SURAT CITY) 9925118094 [email protected] MEDIA RELATIONS SHRI BHUPENDRASINH CHUDASMA 9909018303 [email protected] 4 DEPARTMENT SHRI BHARATBHAI PANDYA 9825010329 [email protected] [email protected], SHRI BHARGAVBHAI BHATT 9825802229 [email protected] TRAINING SHRI K. C. PATEL 9824063260 [email protected] 5 DEPARTMENT [email protected], SHRI RAJESHBHAI PATEL 9426500757 [email protected] SHRI PRADIPBHAI -

Linking Urban Lakes

LINKING URBAN LAKES: Assessment of Water Quality and its Environmental Impacts AKSHAY ANAND February, 2014 SUPERVISORS: Ir. M.J.G. Mark Brussel Ms. M. Kuffer LINKING URBAN LAKES: Assessment of Water Quality and its Environmental Impacts AKSHAY ANAND Enschede, The Netherlands, [February, 2014] Thesis submitted to the Faculty of Geo-Information Science and Earth Observation of the University of Twente in partial fulfilment of the requirements for the degree of Master of Science in Geo-information Science and Earth Observation. Specialization: Urban Planning and Management SUPERVISORS: Ir. M.J.G. Mark Brussel Ms. M. Kuffer THESIS ASSESSMENT BOARD: Ms. Prof. dr. ing. P.Y. Georgiadou Dr. ir. C.M.M. Mannaerts [ University of Twente ] DISCLAIMER This document describes work undertaken as part of a programme of study at the Faculty of Geo-Information Science and Earth Observation of the University of Twente. All views and opinions expressed therein remain the sole responsibility of the author, and do not necessarily represent those of the Faculty. ABSTRACT Lakes in urban and peri-urban areas are an important interface between planning and ecology, which demands environmentally responsive strategies, acknowledging problems like flooding, water pollution, and water quality with their complexities in design and engineering. The present study attempts to investigate the impacts of hydrological planning interventions on lake ecosystems. The research highlights the issues in experimental projects like ‘lake linking project’ carried out by Ahmedabad Urban Development Authority (AUDA). The integration of storm water infrastructure and lake ecosystem creates adverse pressure on lake water quality which is subsequently also transferred to other connected lakes. -

Name of Regional Directorate of NSS- Ahmedabad State-Gujarat

Name of Regional Directorate of NSS- Ahmedabad State-Gujarat Regional Director Name Address Email ID Telephone/Mobile/Landline Number Sh. GirdharUpadhyay Regional Directorate of NSS, [email protected] 079-26565988 2ndfloor,PatnagarYojnaBhavan, 7999894816 Ellis bridge ,Ahmedabad-380006 Secretary, dealing with NSS Name Address E Mail ID Telephone/Mobile Number Shri S.J. Haider , IAS Block No.-5, [email protected] 079-23251301/303 Principle Secretary 7th,Floor Fax 07923251325 Education Department Sachivalaya, Government of Gujarat Gandhinagar,Gujarat State NSS Officer/Officer acting as SNO Name Address E Mail ID Telephone/Mobile Number ShriYashwant Kumar HPatel Commissionerate of Higher Education [email protected] 9427685870 State NSS Officer Govt. of Gujarat, Old Sachivalaya 079-23253993 Block No.12/2,Dr. Jivraj Mehta Bhavan, Gandhinagar ,Gujarat Programme Coordinator, NSS Name Address E Mail ID Telephone/Mobile Number 1 Dr Shreedhar Nimavat Veer Narmad South Gujarat [email protected], 0261-2203039 Programme co-ordinator, NSS University, [email protected] 8780077566 Veer Narmad South Gujarat University Campus, University, Surat UdhnaMagdalla Road, Surat-395007 2 Dr. J. D. Damor Hemchandracharya [email protected] 02766-230743,Ext.316 Hemchandrcharya North North Gujarat University, 9925046204, 7573010065 Gujarat University, Patan Raj Mahal Road, P.B. No. 21 Patan-384265 3 Dr. N. K. Dobariya Saurashtra University, [email protected] 02812578501 Saurashtra University, Rajkot Kalavad Road, 9687692940 Rajkot-360 005 4 Dr. JagrutiSuvera Sardar Patel University, [email protected] 02692-226823 Sardar Patel University, VallabhVidyanagar, [email protected] 9408507810 VallabhVidyanagar,Anand Dist : Anand- 388120 5 Dr. Arunbhai Gandhi, Gujarat Vidyapith, [email protected] 079-4001630 Gujarat Vidyapeeth, Ashram Road, 9428214260 Ahmedabad Ahmedabad-380014 6 Dr. -

Current Ap Plication Umber N Institute Name Insti Address Insti St Ate Insti Website 1-396085422 L B Rao Institute of Pharmac

CURRENT_AP PLICATION_N INSTI_ST UMBER INSTITUTE_NAME INSTI_ADDRESS ATE INSTI_WEBSITE L B RAO INSTITUTE OF B D RAO COLLEGE CAMPUS, PHARMACEUTICAL EDUCATION & B D RAO COLLEGE CAMPUS ROAD, 1-396085422 RESEARCH KHAMBHAT Gujarat www.lbriper.org KASTURBHAI LALBHAI CAMPUS 1-396100415 CEPT UNIVERSITY NAVRANGPURA Gujarat www.cept.ac.in AT-SAYAJIPYRA PIONEER PHARMACY DEGREE AJWA-NIMETA ROAD 1-396103241 COLLEGE NR-N.H.8, VADODARA Gujarat www.ogect.org NEAR RAILWAY STATION, SHREE DHANVANTARY KUDSAD ROAD 1-396137213 PHARMACY COLLEGE KIM (EAST), TA-OLPAD, DI-SURAT Gujarat www.sdpc.co.in POLYTECHNIC CAMPUS, B.K.MODY GOVT.PHARMACY NEAR AJI DAM 1-396649871 COLLEGE BHAVNAGAR ROAD Gujarat www.bkmgpc.com GHB PHARMACY COLLEGE, AT & PO-ANIYAD,,, TA-SHAHERA,DI- 1-396708382 ANIYAD PANCHMAHAL Gujarat www.ghbpharmacy.org K.B.INTITUTE OF PHARMACEUTICAL EDUCTION GH/6, SECTOR-23, KADI CAMPUS, 1-396780981 AND RESEARCH GANDHINAGAR- 382 023, GUJARAT Gujarat www.kbiper.org MALIBA CAMPUS,GOPAL VIDYANAGAR,BARDOLI-MAHUVA ROAD, DIST - 1-396882142 MALIBA PHARMACY COLLEGE SURAT, GUJARAT Gujarat www.maliba.edu.in I.K.PATEL COLLEGE OF PHARMACEUTICAL EDUCATION & SAMARTH CAMPUS, OPP. SABAR DAIRY, NH-8, 1-396899501 RESEARCH HAJIPUR, HIMATNAGAR Gujarat www.samarthcampus.com SMT. B.N.B. SWAMINARAYAN PHARMACY SMT. B.N.B SWAMINARAYAN COLLEGE, NH NO. 8 SALVAV, TAL PARDI, DIST 1-396901664 PHARMACY COLLEGE VALSAD Gujarat www.bnbspcollege.in AMRAPALI TOWNSHIP, PETLAD-KHAMBHAT DHARMAJ DEGREE PHARMACY ROAD, DHARMAJ-388430 1-396907441 COLLEGE, DHARMAJ TA: PETLAD, DIST: ANAND, GUJARAT Gujarat www.ipcprc.org LEELABEN DASHRATHBHAI RAMDAS PATEL(LDRP)INSTITUTE OF TECHNOLOGY AND 1-396908711 RESEARCH BESIDES ITI, NR KH 5 CIRCLE, SECTOR 15 Gujarat www.ldrp.ac.in KRISHNA KAMPUS, BECHRAJI-SHANKHALPUR SHREE KRISHNA INSTITUTE OF ROAD, TALUKA-BECHRAJI, DIST-MEHSANA, 1-396910173 PHARMACY GUJARAT Gujarat www.skip.org.in MEHSANA - VISNAGAR HIGHWAY, AT & PO.