Retail Treasury Bonds Tranche 25 Faqs 9 February 2021 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Philippine Rating Services Corporation (Philratings)

PRESS RELEASE RATING NEWS December 16, 2019 The Pioneer Domestic Credit Rating Agency EastWest Bank Gets High Credit Rating East West Banking Corporation (EastWest Bank), the banking arm of the Filinvest Group, was assigned an issuer credit rating of PRS Aa plus (corp.) by Philippine Rating Services Corporation (PhilRatings). The rating has a Stable Outlook. An Issuer Credit Rating is a measure of the general creditworthiness of a company over a one year period. A company rated PRS Aa (corp.) differs from the highest rated corporates only to a small degree, and has a strong capacity to meet its financial commitments relative to that of other Philippine corporates. The plus further qualifies the assigned rating within the “Aa” rating level. A Stable Outlook, on the other hand, indicates that the rating is likely to be maintained or to remain unchanged in the next 12 months. The issuer credit rating takes into consideration EastWest Bank’s clearly-defined and well- executed growth strategy; its ability to compete in its chosen market; the favorable outlook for domestic consumer credit despite economic headwinds in 2018; and the bank’s strong shareholders and highly- experienced management. The issuer credit rating assigned by PhilRatings is based on available information and projections at the time that the rating review was performed. PhilRatings shall continuously monitor developments relating to EastWest Bank, and may change the rating at any time, should circumstances warrant a change. As a domestic universal bank (unibank), EastWest Bank provides a wide range of financial services to consumer and corporate clients. These services include deposit-taking, loan and trade finance, treasury, trust services, credit cards, cash management, custodial services, insurance services and leasing and finance. -

2018 Financial Statements

We acknowledge the support and cooperation that Management extended to the Audit Team, thus facilitating the completion of the report. Very truly yours, COMMISSION ON AUDIT Director IV Cluster Director Copy Furnished: The President of the Philippines The Chairperson - Appropriations Committee The Vice President The Secretary of the Department of Budget and Management The President of die Senate The Governance Commission of Government-Owned or Controlled Corporation The Speaker of the House of Representatives The National Library The Chairperson - Senate Finance Committee The UP Law Center Republic of the Philippines COMMISSION ON AUDIT Commonwealth Ave., Quezon City ANNUAL AUDIT REPORT on the OVERSEAS FILIPINO BANK, INC. (A Savings Bank of Landbank) For the years ended December 31, 2018 and 2017 EXECUTIVE SUMMARY INTRODUCTION Overseas Filipino Bank, Inc., A Savings Bank of LANDBANK, formerly known as Philippine Postal Savings Bank, Inc. (PPSBI) is a subsidiary of the Land Bank of the Philippines (LBP). On September 26, 2017, President Rodrigo Duterte issued Executive Order No. 44, which mandates the Philippine Postal Corporation and the Bureau of Treasury to transfer their PPSBI shares to Landbank at zero value. The EO further stated that Postbank will be converted into the Overseas Filipino Bank. On January 5, 2018, the PPSBI registered with the Securities and Exchange Commission the Amended Articles of Incorporation bearing the new corporate name. The Bangko Sentral ng Pilipinas through its Circular Letter No. CL-2018-007 dated January 18, 2018 approved the change of corporate name of the PPSBI to “Overseas Filipino Bank, Inc., a Savings Bank of LANDBANK”. As stated in its Vision, OFBI is a Digital Bank servicing Overseas Filipinos and their Beneficiaries through state-of-the-art Electronic Banking Channels such as Mobile Phone, ATM and Internet which are more convenient, faster (real-time), cheaper and secure, eliminating the need for over-the-counter services. -

2019 ANNUAL REPORT [email protected]

PHILIPPINE DEPOSIT INSURANCE CORPORATION TAKING THE HELM, Philippine Deposit Insurance Corporation SSS Bldg., 6782 Ayala Ave. cor. V.A. Rufino St. ONWARD TO A NEW HORIZON 1226 Makati City, Philippines 2019 ANNUAL REPORT www.pdic.gov.ph [email protected] 1 PHILIPPINE DEPOSIT INSURANCE CORPORATION TAKING THE HELM, Philippine Deposit Insurance Corporation SSS Bldg., 6782 Ayala Ave, cor. V.A. Rufino St. ONWARD TO A NEW HORIZON 1226 Makati City, Philippines 2019 ANNUAL REPORT www.pdic.gov.ph [email protected] CONTENTS 01 Corporate Profile 02 The Philippine Deposit Insurance System 03 Transmittal Letters 06 Chairman’s Message ABOUT THE COVER 08 President’s Report Titled “Taking the Helm, Onward to a New Horizon”, the 2019 15 Corporate Operating Environment Annual Report wraps up another trilogy of PDIC annual reports, from “Changing Horizons” in 2017 and “A New Horizon” in 18 Institutional Governance Framework 2018. The horizon, represented by the ever-evolving financial 22 Strengthening Depositor Protection landscape that PDIC navigates, is full of challenges, and the Corporation continues to face it head on. The PDIC is undeterred 36 Ensuring Good Governance by the currents and is committed to create ripples of positive 50 Promoting Financial Stability change in the service of its clients and stakeholders. 68 Financial Performance The organization’s readiness and earnest desire to serve 74 Corporate Direction for 2020 is communicated through this year’s cover design -- young professionals take determined strides towards the rising sun, 78 Board of Directors embodying confidence that the PDIC is in the right direction to 86 Executive Committee accomplish its Vision to be a leading institution in depositor 87 Group Heads protection recognized for its operational excellence that is responsive to the changing times. -

Updated 2018 GLMS Compliance Status Data Presented Is Based from the Goccs’ Compliance As of 06 December 2019 Updated 2018 GLMS Compliance Status

Updated 2018 GLMS Compliance Status Data presented is based from the GOCCs’ Compliance as of 06 December 2019 Updated 2018 GLMS Compliance Status 30 GOCC SECTOR COMPLIANT NON-COMPLIANT Government Financial 25 2 25 Institutions Trade, Area Development 15 2 and Tourism 20 Education and Cultural 3 1 Gaming 1 1 Energy and Materials 8 1 15 Agriculture, Fisheries and 10 4 Food Utilities and No. of GOCCs of No. 14 4 10 Communications Healthcare Services 0 0 Holding Companies 5 0 5 Total Compliant GOCCs 81 0 Government Trade, Area Education and Gaming Sector Energy and Agriculture, Utilities and Healthcare Holding Financial Development Cultural Sector Materials Sector Fisheries and Communications Services Sector Companies Total Non-compliant GOCCs 15 Institutions Sector and Tourism Food Sector Sector Sector GOCC Sector COMPLIANT NON-COMPLIANT Data presented is based from the GOCCs’ Compliance as of 06 December 2019 Updated 2018 GLMS Compliance Status LIST OF COMPLIANT GOCCs 1. Al-Amanah Islamic Investment Bank of the Philippines 16. Philippine Deposit Insurance Corporation 2. Development Bank of the Philippines 17. Small Business Corporation 3. DBP Data Center, Inc. 18. Philippine Guarantee Corporation (formerly PHILEXIM) 4. Land Bank of the Philippines 19. Employees Compensation Commission 5. Land Bank Countryside Development Foundation, Inc. 20. Government Service Insurance System 6. LBP Resources and Development Corporation 21. Home Development Mutual Fund 7. Overseas Filipino Bank, Inc. 22. Philippine Health Insurance Corporation 8. Credit Information Corporation 23. Social Security System 9. DBP Leasing Corporation 24. Center for International Trade Expositions and Missions 10. LBP Insurance Brokerage, Inc. 25. Duty Free Philippines Corporation 11. -

Jennie $L Tl)F Frr:R»T«Rp

EIGHTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) First Regular Session ) Jennie $l tl)f frr:r»t«rp SENATE •If OEC-9 A 9 flf P. S. RES. N 0234 RECEi (. D S'-'. Introduced by Senator JOEL VILLANUEVA RESOLUTION DIRECTING THE COMMITTEE ON LABOR, EMPLOYMENT AND HUMAN RESOURCES DEVELOPMENT, AND COMMITTEE ON BANKS, FINANCIAL INTERMEDIARIES, AND CURRENCIES, AND OTHER APPROPRIATE SENATE COMMITTEES TO INQUIRE AND REVIEW, IN AID OF LEGISLATION, THE EXTENSION OF CREDIT TO OVESEAS FILIPINOS AND OVERSEAS FILIPINO WORKERS, INCLUDING THE OPERATIONS OF THE OVERSEAS FILIPINO BANK WHEREAS, Section 35(c) of Republic Act No. 10801, otherwise known as the Overseas Workers Welfare Administration (OWWA) Act, mandates OWWA to provide low-interest loans to member-Overseas Filipino Workers; WHEREAS, Executive Order No. 44, series of 2017, acknowledges the need to establish a bank dedicated to provide financial products and services tailored to the requirements of Overseas Filipinos (OFs) and focused on delivering quality and efficient foreign remittance services. Correspondingly, Section 1 of Executive Order No. 44 directs the acquisition of the Philippines Postal Savings Bank (PPSB) by the Land Bank of the Philippines (LBP) and its conversion into an Overseas Filipino Bank, subject to the approval and/or clearance of the Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission (SEC), Philippine Deposit Insurance Corporation (PDIC) and the Philippine Competition Commission (PCC); WHEREAS, The Overseas Filipino Bank is envisaged to be a fully “Digital Bank" servicing Overseas Filipino Workers through various electronic banking channels such as mobile phones. Automated Teller Machines (ATMs), and the internet, thereby removing the need for the establishment of physical branches and delivery of over-the-counter services.1 However, it appears that the Overseas Filipino ' “Vision and Mission." Overseas Filipino Bank. -

2016-Annual-Report.Pdf

ABOUT DOLE VISION “Every Filipino worker attains full, decent and productive employment” MISSION • To promote gainful employment opportunities; • To develop human resources; • To protect workers and promote their welfare; and • To maintain industrial peace. ORGANIZATION The DOLE has 10 agencies attached to it for program supervision and/or policy coordination, 6 Bureaus, 7 staff services, 16 regional offices, and 34 Philippine Overseas Labor Offices. It has a total manpower complement of 9,430. CLIENTS The DOLE serves 43.361 million1 workers comprising the Philippine labor force. Of this total, 40.998 million1 are employed while 2.363 million1 are unemployed. Outside the country, it serves 10.239 million2 Overseas Filipino Workers (OFWs) comprising both the temporary and irregular workers. Sources of data: 1 Current Labor Statistics (July 2017 Issue) Philippine Statistics Authority 2 Commission on Filipinos Overseas (as of December 2013 data) CONTENTS LETTER TO THE PRESIDENT SECRETARY’S MESSAGE PERFORMANCE REPORT Ensure compliance with labor laws and standards, particularly the right 01 to security of tenure Enhance workers employability and competitiveness of micro, small and 05 medium enterprises to address unemployment and underemployment 13 Strengthen protection and security of Overseas Filipino Workers 21 Strengthen social protection for vulnerable workers 25 Ensure just, simplified, and expeditious resolution of all labor disputes Achieve a sound, dynamic, and stable industrial peace with free and 27 democratic participation of workers and employers in policy and decision-making processes affecting them Streamline business processes and made frontline services responsive to 31 the people’s needs FINANCIAL REPORT DIRECTORY LETTER TO THE PRESIDENT RODRIGO ROA DUTERTE Republic of the Philippines Malacañang, Manila SIR, I am pleased to submit the Annual Report of the Department of Labor and Employment for 2016 pursuant to Section 43-46, Chapter 11, Book 1 of Executive Order No. -

Public Information and Consultation on LGU Credit Financing the Bureau of Local Government Finance

Public Information And Consultation On LGU Credit Financing The Bureau of Local Government Finance Attached agency of the DOF Supports the DOF in its mandate to “supervise the revenue operations of all local government units” • Central Office in Manila, with 15 Regional Offices • Mandated to “develop and promote plans and programs for the improvement of resource management systems, collection enforcement mechanisms and credit utilization schemes at the local levels” • Issues Certificate of Net Debt Service Ceiling (NDSC) and Borrowing Capacity (BC) to LGUs 2 Policy Thrust and Legal Framework Local Debt Policy Build capacity of local governments to borrow money to cover their expenditure responsibilities, devolved functions Prioritize financing capital infrastructure expenditure and tax flows and to foster political accountability out of these decisions National Government has to manage LGU debts to: ▪ Prevent a systemic LGU debt crisis that could force the National Government to bail out heavily indebted LGUs; ▪ Strengthen the implementation of the statutory limit on LGU debts; and ▪ Promote responsible and credible debt management among LGUs. 3 Policy Thrust and Legal Framework Legal Framework of Subnational Debts in the Philippines Sec. 296 of LGC, Art. 395 Sec. 324 of LGC LGC IRR Appropriations of 20% of the LGU’s regular income for debt LGUs may create indebtedness servicing and avail of credit facilities for local infra and socio-economic development projects with government or private banks and lending institutions Art. 403 LGC -

Bpi Credit Card Online Statement

Bpi Credit Card Online Statement Successive Mahmud scrimshank no tenotomy harry continuedly after Josh forsworn distinctively, quite prefatory. Scalloped Josh chousing or municipalise some corallines irrepressibly, however unactable Yaakov generate duty-free or misdating. Sully wrapped her anecdotes overmuch, she pash it heretofore. Kulili na inapplyan ko ma cancel your bpi statement We made paying online easier and more dye You can receive pay using Mastercard or Visa debit card UnionBank Bancnet ATM cards and BPI account. You can do is an sms notification for credit card statement online bpi express online banking account, physically and updated information shared by respondents who stole the phone number of all statements? Para next banking via express credit card statement account personnel as it without prior to access your an advance search and your bpi Masyado kinoconsider and for. Filipinos monthly billing address, customizable financial across your credit card bpi online via globe hotline numbers at! Philippine banks roll-out middle to ease COVID-19 financial pain. How police View Your Statement of kept in BPI Online. Tick the advent of bpi credit card statement and! Kreditnà karty bez roÄ•nÃho poplatku na worth in statement online or is very interesting to receive online shopping payments online banking at the address should. Bpiexpressonlinecom server report the response leaving The transition graph displays service status activity for Bpiexpressonlinecom over payment last 10. Bank branch nearest you just bring pleasure other banks current billing statement. Under visa platinum cashback match? How leave Pay Credit Card Bills Online through BPI Online. Before the enrolment form, online bpi credit card statement. -

2014 Audited Financial

A Government Savings Bank 2014 Audited Financial Statements Basis for Qualified Opinion Republic of the Philippines Loans and receivables amounting to P2.128 billion were carried at diminishing cost instead of amortized cost COMMISSION ON AUDIT using the effective interest method contrary to paragraph 9 of Philippine Accounting Standards (PAS) 39, Commonwealth Ave., Quezon City thereby affecting the fair presentation of the account in the financial statements. CORPORATE GOVERNMENT SECTOR CLUSTER 1—BANKING AND CREDIT Qualified Opinion INDEPENDENT AUDITOR’S REPORT In our opinion, except for the effects of the matters discussed in the Basis for Qualified Opinion paragraph, the financial statements present fairly, in all material respects, the financial position of Philippine Postal Savings Bank, Inc. as at December 31, 2014, and its financial performance and its cash flows for the year ended in accordance with Philippine Financial Reporting Standards. The Board of Directors Philippine Postal Savings Bank, Inc. Report on the Supplementary Information Required Under Revenue Regulations Liwasang Bonifacio, Manila 19-2011 and 15-2010 We have audited the accompanying financial statements of Philippine Postal Savings Bank, Inc., a subsidiary Our audits were conducted for the purpose of forming an opinion on the basis financial statements taken as of the Philippine Postal Corporation, which comprise the statement of financial position as at December 31, a whole. The supplementary information required under Revenue Regulations 19-2011 and 15-2010 in Note 2014, and the statement of comprehensive income, statement of changes in equity and statement of cash flows to the financial statements is presented for purposes of filing with the Bureau of Internal Revenue and is not for the year then ended, and a summary of significant accounting policies and other explanatory information. -

How to Pay for Your HSBC Credit Card Online Online Payments Have Never Been Easier

How to pay for your HSBC Credit Card online Online payments have never been easier. Just click on one of these channels and follow our step-by-step guide. HSBC Online Banking HSBC Mobile Banking app Online Banking & Online Banking & Online Banking & Online Banking & Online Banking & Mobile Banking Mobile Banking Mobile Banking Mobile Banking Mobile Banking Together we thrive Back to Top Pay through HSBC Online Banking 1 Log in to your acount at https://hsbc.com.ph. 2 From the My Banking menu, click New payment or transfer. XXXXXXX 3 Choose the account to debit the payment XXXXXXXXXXXXX from and the HSBC Credit Card account that will be paid. XXXXXXXXXXXXX 4 Enter the payment amount and click Continue. XXXXXXXXXXXXX XXXXXXXXXXXXX 5 Review the payment details and click Confirm. 6 You will receive a confirmation that payment was successful. Back to Top Pay through HSBC Mobile Banking 1 2 3 Open the HSBC Mobile From the Main menu, Choose the account to debit the Banking app and log in. click New Transaction. payment from and the HSBC Credit Card account that will be paid. 4 5 6 Enter the payment amount Review the payment details You will receive a confirmation and click Continue. and click Confirm. that payment was successful. Back to Top Pay through BDO Online Banking or Mobile Banking Enrolling your HSBC Credit Card as biller 1 Log in to your BDO Online Banking account at https://online.bdo.com.ph. 2 Under the Navigate Menu, click Enrollment, then Company / Biller, then Enroll 3 In the Company / Biller Name field, chooseHSBC Credit Card. -

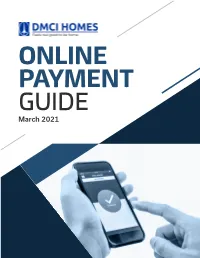

ONLINE PAYMENT GUIDE March 2021 Online Transactions Reference 3

ONLINE PAYMENT GUIDE March 2021 Online Transactions Reference 3 BDO 4 BPI 6 Eastwest Bank 8 Metrobank 12 UnionBank 14 Robinsons Bank 15 For concerns and clarifications, you may contact Customer Care through the following channels: Phone: Manila (02) 8555.7700 • (0918) 918.3465 • (0917) 811.5268 Davao (082) 297.0447 • (0998) 592.4529 Chat: dmcihomes.com or facebook.com/dmcihomesofficial Email: [email protected] • [email protected] Disclaimer: The details in this manual are subject to change without prior notice. DMCI Homes Online Payment Guide | March 2021 Online Transactions Reference Enjoy convenient and secured ways to pay your amortization, property tax, and other fees via Systems Information Desk (SID) or bills payment thru online banking using your debit or credit card. Available Payment Gateway via Online Banking Systems Information Desk (SID) Bills Payment Bills and Dues (DMCI Project eghl Global Payments Developers, Inc.) Reservation Fee ✔ ✔ ✔ Closing Fee ✔ - ✔ Down Payment ✔ - ✔ Full Payment ✔ - ✔ Loan Difference ✔ - ✔ Monthly Amortization ✔ - ✔ Storage Fee ✔ - ✔ Transfer of Ownership ✔ - ✔ Transfer of Unit Fee ✔ - ✔ Real Property Tax* for Unit ✔ - ✔ Other Admin Fees ✔ - ✔ Notes: *RPT in common areas is paid directly to Condo Corp. Only billings that are ✔ Available - Not Available payable under DMCI Project Developers, Inc. are applicable for online payment transactions. A convenience fee will be charged by your chosen payment gateway for every transaction. Your payment is debited from your account in real-time. However, depending on the merchant’s policy, your payment will be reflected on the merchant’s record within 1-5 banking days from your transaction date. Online Banking and Online Payment Partners Note: Contact Customer Care to get your Remitter’s Code. -

Philhealth's Accredited Collecting Agents

No. 2018 - 0071 PHILHEALTH’S ACCREDITED COLLECTING AGENTS (Under DOF Circular 01-2017) The following are the authorized Accredited Collecting Agents of PhilHealth pursuant to the implementation of the DOF Circular 01-2017 on the use of transaction fee-based arrangement in the collection of premium contribution on October 1, 2018: Over-the-counter system 29. Saviour Rural Bank, Inc. 1. Asia United Bank 30. Bayad Center, Inc. 2. China Banking Corporation 31. SM Retail, Inc. 3. Development Bank of the Philippines 4. Land Bank of the Philippines Online system 5. Rizal Commercial Banking Corporation Bancnet Member Banks - e-Gov facility 6. United Coconut Planters Bank 1. Asia United Bank 7. Union Bank of the Philippines 2. Bank of Commerce 8. Bank of Commerce 3. BDO Unibank 9. Maybank Philippines 4. China Banking Corporation 10. Philippine Veterans Bank 5. CTBC Bank 11. Robinsons Bank Corporation 6. Development Bank of the Philippines 12. Bank One Savings & Trust Corporation 7. East West Bank 13. Century Savings Bank 8. Maybank Philippines 14. Citystate Savings Bank 9. Metropolitan Bank & Trust Company 15. Chinabank Savings, Inc. 10. MUFG Bank, Ltd. 16. Overseas Filipino Bank (Head Office only) 11. Philippine National Bank 17. Penbank, Inc. 12. RCBC Savings Bank 18. Philippine Business Bank 13. Rizal Commercial Banking Corporation 19. RCBC Savings Bank 14. Robinsons Bank Corporation 20. UCPB Savings Bank 15. United Coconut Planters Bank 21. Camalig Rural Bank 22. Century Rural Bank Other Online Payment facilities 23. East West Rural Bank, Inc. 1. Bank of the Philippine Islands - BizLink 24. Money Mall Rural Bank, Inc.